An employee's salary certificate refers to an official document issued by the management of an institution to confirm the amount of income of an employed person. Such a form can be requested from the personnel department or the accounting department of the company where the employee is employed.

It should be noted that today there is no approved unified form for such a form. Therefore, often, when drawing up this document, various inaccuracies are made, which complicate the procedure for obtaining preferential funds.

In what case is the form drawn up?

Content:

An income certificate is issued to be submitted to the social protection department in order to find out reliable information about the real income of the citizen who has applied for help, since only low-income citizens have the right to state financial assistance and benefits to reduce household burdens.

A citizen’s income certificate is submitted to the social security department at the following points:

- When applying for maternity benefits. The document can be issued to an employee in connection with pregnancy or for a baby under the age of 1.5 years. The certificate is drawn up on income for 2 years and in some cases is required for calculating child benefits SZN, based on income at the place of work (for example, upon dismissal due to the liquidation of an institution).

- When a family is recognized as low-income. In this option, a certificate can be issued to receive subsidies and is drawn up based on income for 3 months. Such data must be confirmed by the employed person every year.

- In a number of circumstances, it is required to provide a certificate of income for the last 6 or 12 months:

- For example, 6 months of income may be required by social security to calculate certain types of subsidies.

- Banks usually request a salary certificate for 12 months when taking out a loan.

Rules for issuing a certificate

This document does not have a unified template that is mandatory for use, so it can be drawn up in free form or according to a template specially developed and approved by the company. The main thing is that the certificate contains the following information:

- Business name,

- information about the employee,

- average monthly salary,

- the amount of salary actually accrued and received by the employee for a certain period of time.

The amount of deductions for taxes and insurance contributions to extra-budgetary funds does not need to be written, provided that the certificate indicates a “net” salary. In addition, it is advisable to indicate the amount of debt the organization owes to the employee as of the date of issue of the certificate, if any.

All data entered into the income certificate must be reliable, and there should be no errors or corrections in the document. For providing incorrect information (which today can be easily verified by supervisory authorities), the administration of the enterprise, represented by the chief accountant and manager, may be punished with a large fine.

The certificate can be written either on a regular A4 sheet or on the company’s letterhead; the law allows both printed and handwritten versions. There can be as many copies of the certificate as the employee requests in his application. The document must be signed by the chief accountant of the enterprise and the director.

If the document is issued by a commercial organization, then the stamp may not be affixed, since individual entrepreneurs and legal entities (since 2020) are not required to use seals and stamps in their activities (but it is worth keeping in mind that sometimes representatives of government and credit institutions may require a stamp on the document).

Instructions for filling out an income certificate

A certificate for social protection structures is required to display data on the salary received by the employee for the last 3 months.

The purpose of such a document is to confirm the legality of a person’s employment, as well as to confirm the amount of income when the employee applies for benefits. The issuance of such a document is carried out by the personnel department or accounting department of the institution where the employee works. The certificate must be issued no later than 3 days after the employee’s application. The structure of the form and its form depends on the following factors:

- Purposes of obtaining the document.

- Reasons for requesting the form.

- Grounds for drawing up a certificate.

The listed points are required to avoid errors when filling out the form. To correctly fill out such a certificate, a HR specialist must understand what it is:

- Minimum salary.

- 2-NDFL.

- Financial compensation.

- Material aid.

Salary is the payment given to an officially employed person in an institution. The amount of an employee’s income is directly related to his level of professionalism and job responsibilities. The amount of income and job obligations are established by the employment contract concluded by the citizen upon employment.

Note. Concluding an employment contract is a prerequisite.

Remuneration is considered the basis for determining the size of a future pension and compensated payments by the employment center in circumstances where a person is unable to fulfill official obligations. The income cannot be less than the minimum salary. The management of the institution may decide to accrue additional remuneration and compensated payments to the employee in the amount established by intradepartmental agreements. Such payments are not displayed in statistical reports, but are taken into account in the issued certificate confirming the amount of the applicant’s income.

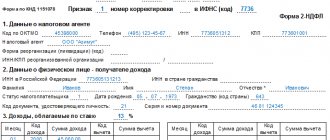

Form “2-NDFL” is a standard form for an institution to report to the Federal Tax Service on wages paid to employees and tax withholdings, on the basis of which a salary certificate is drawn up. Thanks to the “2-NDFL” form, you can easily determine the amount of an employee’s salary for the required period. Despite this, the social service department may request a certificate showing the amount of income on a separate form.

The certificate is drawn up on A4 sheet or on letterhead. When filling out this form, you must display:

- Company details including postal address and telephone number.

- The name of the form, for example, “Certificate of average salary for the last 3 months”

- FULL NAME. and the vacancy occupied by the employee.

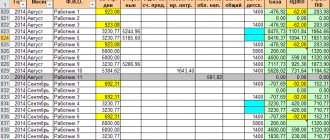

- The amount of the salary issued, displayed monthly in the table. The above income is filled in based on the institution’s personal account.

- Signature of the chief and chief. accountant, as well as the seal of the institution that issued the document.

The presentation of such certificates is necessary to perform income indexation in the Pension Fund. When filling out such a form, you must take into account insurance transfers. If the institution on the territory of which the citizen worked is liquidated, a certificate to the social protection department from the place of work is issued by the above-mentioned body.

2-NDFL: filling out online 2020 - online services and facilities

2-NDFL online is a new service provided to organizations and entrepreneurs that do not have their own accounting service. This service allows you to fill out a 2-NDFL certificate free of charge online. Let's figure out what these services are and whether you can use them.

In what form should the calculation be submitted?

According to paragraph 1 of Art. 230 of the Tax Code of the Russian Federation, tax agents keep records of income received by employees, including under civil law contracts. It is also the responsibility of the tax agent to record all benefits provided to the employee.

Clause 2 art. 230 of the Tax Code of the Russian Federation states that information on accrued income and tax withheld and paid to the budget system must be submitted to the tax office at the place of registration no later than April 1 of the year following the reporting year.

At the same time, organizations providing information for less than 10 (and from 2020 - 25) people can submit it on paper, and the Federal Tax Service is obliged to accept it.

If the number of citizens who received income from a tax agent during the reporting period is 10 (from 2020 - 25) or more people, then the information is transmitted only electronically. There is no information in the Tax Code of the Russian Federation about who has the right to transmit information through communication channels - the tax agent himself or the organization with which the agent has a contractual relationship for the use of communication channels.

How to calculate and fill out 2-NDFL online for free

If, for various reasons, it is impossible to use special software that allows you to fill out and print 2-NDFL certificates, you can resort to the service of filling out 2-NDFL online.

The majority of services offering the opportunity to fill out 2-NDFL online in 2015–2016 were developed taking into account all legal requirements regarding 2-NDFL. When choosing such a service, it would be useful to pay attention to whether income and deductions are calculated automatically or whether some calculations will have to be made manually.

The service, which respects the user, is necessarily supplemented with an online 2-NDFL calculator, designed to save him from the routine work of summing up the income paid to the employee, the tax subject to withholding, and tax benefits provided by the tax agent at the request of the employee or other recipient of the income.

Despite the fact that the services allow you to generate and fill out a 2-NDFL certificate online for free, most of them do not implement the function of generating a register of certificates, which must be submitted to the Federal Tax Service. Consequently, the register will have to be created somewhere else, and most services are only suitable for creating a certificate that is handed to the employee.

Online calculator

Such a calculator is available on many services. Simply fill out the “Salary Amount” column and select the appropriate rate. The calculator can take into account the following deductions: expenses for your own education and education of children, for charity, treatment, including expensive ones, pension payments and purchase costs or interest on a real estate loan.

The only thing that may make it difficult to use the calculator is outdated rates (you should pay attention to this before using it). In any case, using an online calculator presupposes an understanding of the essence of personal income tax calculation.

Is it possible to submit 2-NDFL online in 2015–2016?

Possible. But the organization, whether it is the tax agent himself, transmitting information from the accounting program, or a third-party organization acting under a power of attorney issued to the tax agent, must first obtain an enhanced qualified electronic signature, which gives the right to certify documents in the absence of a regular signature.

Responsibility for failure to submit

Regardless of how and by whom the 2-NDFL certificate was filled out (online or using software), as well as how the enterprise is obliged to submit reports (on paper or electronically), responsibility for its failure or late submission is assigned ( in accordance with Article 126 of the Tax Code of the Russian Federation) for a tax agent.

Since 2020, the list of sanctions has been supplemented by Art. 126.1 of the Tax Code of the Russian Federation, which provides for liability for the unreliability of information submitted by a tax agent to the Federal Tax Service.

Source: “nalog-nalog.ru”

Certificate of income for 3 months

The following services have the right to request a salary form for the last 3 months:

- Employment Center - when registering a dismissed person and calculating unemployment benefits.

- Social Protection Department - to establish the fact of a low-income family, with the subsequent registration of a number of benefits and subsidies. This may include preferential payment for kindergarten, meals at a school institution, travel, payment of utility bills, etc.

To obtain such a certificate, an employed person must submit a petition to the head of his institution, in which he must state a request for the issuance of salary data for the last 3 calendar months.

Management, after registering such a request, is obliged to instruct an employee of the human resources department or an accountant to prepare the requested certificate and issue it to the applicant no later than 3 days.

The completed certificate must be signed by the head of the institution, Ch. an accountant and certified by a seal. If necessary, the form can be sent by registered mail.

Sample of filling out a certificate of income in 2020

Income certificate form

New form 2-NDFL

In 2020, accountants must fill out a new form of certificate 2-NDFL for 2020. If you submit the old one, it will not be accepted. The new form and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11/ [email protected]

The new form has two forms:

- For submission to the Federal Tax Service (looks like a declaration)

- For handing over to the employee

Comparison of changes in old and new forms (for the Federal Tax Service) according to criteria

Number of sheets to fill:

- Old form - One sheet - “Certificate of income and tax amounts of an individual”

- New form - Two sheets, of which:

- first – “Certificate of income and tax amounts of an individual”

- the second is the appendix “Information on income and corresponding deductions by month of the tax period”

Sign:

- Old form:

- “1” - if personal income tax is paid

- “2” - if it is impossible to transfer personal income tax

- New form:

- “1” - when paying personal income tax by a tax agent

- “2” - if it is impossible to withhold tax in a normal situation

- “3” - if personal income tax is withheld, but the report is submitted by the legal successor of the tax agent

- “4” - if personal income tax was not withheld and the form is submitted by the legal successor of the tax agent

The procedure for indicating the notification data on the provision of social and property deductions:

- Old form - Separate lines are provided for such data

- New form - Availability of notification code:

- “1” - notification for the provision of a property deduction

- “2” - notification for the provision of social deductions

- “3” - notification of a reduction in the tax base by the amount of the patent

Location in the income and deductions certificate with explanation:

- Old Form - Section 3

- New form - In the appendix to the help

Location in the certificate of the tax base and personal income tax amount:

- Old Form - Section 5

- New Form - Section 2

Location in the certificate of child and social deductions:

- Old Form - Section 4

- New Form - Section 3

There have been global changes in form since the 2020 report.

Now it is not one form, but two. One is given to the employee and is similar to the old one, and the second is completely new, it must be submitted to the Federal Tax Service, its title page is similar to the title of tax returns. The Simplified 24/7 program has updated the electronic version of the certificate taking into account the new order. See how to prepare and print your new form. Please note that there are now two forms.

If you filled out an old form and want to quickly convert it to a new one, use the free service.

Due dates

Certificates must be provided to tax inspectors no later than April 1, 2020 (Clause 2 of Article 230 of the Tax Code of the Russian Federation).

If it is impossible to withhold income tax, you must notify the inspectors. This must be done in writing. The deadline is no later than March 1, 2020 (clause 5 of Article 226 of the Tax Code of the Russian Federation). Don’t forget to also notify the employee - he needs to be given a copy of the certificate no later than March 1.

https://youtu.be/2H1kBHzWNlc

At the same time, submitting a certificate on March 1 does not exempt you from submitting a certificate on April 1. Since these certificates are filled out differently. Workers are given a uniform within 3 working days upon their request.

Form for handing over to employees

The Tax Code obliges employers to issue their employees with certificates of income and withheld personal income tax, provided that the employee has written an application requesting such data (Clause 3 of Article 230 of the Tax Code of the Russian Federation).

If previously Form 2-NDFL for the tax office and the employee were the same, now the forms are different (Order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11 / [email protected] ). The form was made simpler: the certificate attribute, information about its number, tax office code, correction number, etc. were removed.

Source: “26-2.ru”

Where can I get a certificate of income for 3 months?

Having found out what the average salary certificate is, you can move on to the topic of where you can purchase such a form.

To purchase a salary document for the required period, you will need to apply to the institution where the person works. Usually, an employee applies for such a certificate orally, but if management ignores his request, then a written request must be submitted. The legislation provides that after registering an application, the management of the institution is obliged to issue such a form to the applicant no later than 3 days from the date of application.

This certificate is issued either in the personnel department of the institution, or in its absence in the accounting department, and is certified by the head and chief. accountant who are responsible, in accordance with the existing legislative norms of the Russian Federation, for the accuracy of the information provided.

If you refuse to issue such a document, which relates to an offense, the management of the institution may have problems with the Federal Tax Service.

The received certificate does not have a validity period. Even years later, the document will be valid and can be presented, for example, to the Pension Fund for calculating a pension or to other government agencies. However, the social security administration requires the applicant’s income data for the last 3 months, therefore, the validity period of such a form for acquiring the right to benefits is until the end of the current month. If you miss this deadline, social. the service will require new confirmation of salary level.

To purchase child benefits, the applicant will need to provide information on income for the last 3 months, since child benefits are intended only for families who really need them. And the benefit will be assigned only if the total family income per month is less than the approved level.

How to obtain a 2-NDFL certificate through State Services -

For individuals in 2020 There are several options for obtaining an income tax certificate, there are only two options.

1. Contact the accounting department at your place of work

2.Order in person through the tax office online

The government services portal does not provide the opportunity to do this through their services.

| pros | Minuses |

| 1. efficiency of the information provided | 1.opportunity to obtain a certificate only for the last year and previous ones |

| 2. there is no need to contact the accounting department and distract an accountant | 2.despite the fact that the seal is enhanced, for individual organizations an original with a wet seal of the organization is still required |

| 3. if the organization has been liquidated and there is nowhere to turn, then the electronic version of the certificate is just right | 3. if you receive a certificate at your workplace, you can immediately ask the questions you are interested in; when applying online, there is no one to ask; in any case, you will have to go to an accountant |

| 4. obtaining a certificate on the website of the Federal Tax Service is the only legal way, other than contacting an accountant; no other website provides such a service |

The tax system (TS) of Russia is based on a three-level TS, consisting of local, regional and federal duties. Today, the main legislative act is the Tax Code of the Russian Federation, consisting of general and special parts. It contains general principles for constructing the system and describes the interaction between taxpayers and the state. On January 1, 1999, the 1st part came into force, the rest - in 2001.

The work of the Russian tax system is built on 4 principles of taxation accepted throughout the world. They are the principles of justice, certainty, convenience and economy. The first rule assumes equal taxation in accordance with income level. The second is that the amount payable to the taxpayer must be known in advance.

The Tax Code also provides for special regimes. He also forms the procedure for their establishment, which describes individual cases when the duty is not charged. Information about this can be found in articles 13-15 of the Tax Code.

Article 18 includes such special regimes such as a single agricultural tax, a simplified taxation system, a taxation system in the form of a single tax on imputed income for certain types of activities and in the implementation of a production sharing agreement.

Structure of the National Assembly of Russia

Initially, only the employer could find and provide the employee with the necessary information within three days. Now there is an option where you can order an income certificate remotely, without contacting your boss or chief accountant.

Previously, the extract was prepared by an accountant at the enterprise.

This is especially true for people who have already quit or employees of liquidated enterprises, or those who have moved to live in another city. The State Services service operates around the clock and is free. This became possible after a program was introduced to systematize information about taxpayers.

In the accounting department of the enterprise, after three days the document will be certified with the seal and signature of the chief accountant or manager. The ordered certificate on the public services portal is certified using an electronic digital signature. This certificate will have the same legal force as the one issued by management.

Today, a certificate can be ordered through the online service portal

The public services portal is not provided for ordering a 2-NDFL certificate similar to the one issued by the employer. Government services cannot replace a tax agent. Therefore, such information is obtained remotely on the website of the Federal Tax Service in your personal account.

Another difficult point is the electronic form of the document. Not everyone is comfortable with this format, since it is quite difficult to convert it into a standard format for printing. For example, when submitting documents to a bank for loan approval, you cannot provide some documents in printed form and some electronically. You will need scanned originals of your passport, work book and 2NDFL certificate.

The required documents are: passport, work book, certificate

Thus, the online service is a convenient structure, however, for banks, courts and visa applications, it is better to contact the manager directly.

To obtain a certificate of income from the tax service, you must contact the department at the place of registration of the former manager. Because this is where data on income paid to employees was sent. You need to take your passport and application with you.

Organizations submit tax reports, including 2-NDFL, once a year, before the first of April following the reporting year. Therefore, until this date, you may not receive certificates for the previous year from the tax office.

Those organizations that are undergoing the process of liquidation or reorganization submit documentation ahead of schedule. The employer is required to submit 2-NDFL tax certificates before being excluded from the register of individual entrepreneurs or legal entities.

In order not to waste time waiting for the necessary information, an individual has the right to order paper electronically through the State Services portal.

2-NDFL is a document of a unified form containing information about:

- an individual’s income for a specified period of time (usually a year), divided into types by code;

- tax deductions due to him;

- the amount of personal income tax transferred to the budget.

To obtain 2-personal income tax, you can contact the accounting department of the employing company. The document must be issued within three days, it will be certified by a seal and the signature of the responsible person (director or chief accountant).

A more modern way of issuing certificates is remotely, using your personal account on the Federal Tax Service website. Login to it is available through an account on the State Services portal. 2-NDFL, provided in this way, is certified by an electronic digital signature.

Individuals need help to resolve a wide range of issues. This includes obtaining government subsidies, obtaining visas to other countries, confirming financial solvency to obtain bank loans, litigation regarding the amount of alimony, compensation for harm caused, etc.

Modern people are very economical with their time, so most likely you, not wanting to waste it on going to various authorities and waiting, want to know how to get a 2nd personal income tax certificate through State Services.

Basic moments

There are several situations when an individual entrepreneur is required to confirm income for a certain period:

- Obtaining a loan from a bank or other financial institution.

- Obtaining permission to visit another country.

- Receiving subsidies.

- Obtaining child benefits, low-income family status, and more.

There is no regulatory document establishing a specific form of income certificate for individual entrepreneurs, so instead a tax return in form 3-NDFL is presented. In addition, this form should be an attachment to the certificate when it is required.

There is no regulatory document establishing a specific form of income certificate for individual entrepreneurs, so instead a tax return in form 3-NDFL is presented.

To avoid problems with confirming income in the future, individual entrepreneurs should regularly register 3 copies of the declaration with the fiscal service. There is no additional charge for such a service; it is required to be provided by the Federal Tax Service. It will not be possible to take an income certificate directly from the tax office, since there is no established form, but you can certify documents there (including re-certification) with a written application.

Many institutions, in particular banks, provide their own forms for drawing up certificates (see a sample here), thanks to which the entrepreneur will only have to fill out the proposed template and certify with a personal signature. The application can be not only a declaration, but also primary documents confirming income (relevant for individual entrepreneurs on UTII and PSN). Remember that concealment of cash proceeds is subject to criminal liability under Art. 199.2 of the Criminal Code of the Russian Federation.

The most common errors

The most popular mistakes include:

- spelling errors, punctuation;

- incorrect codes and details;

- typo errors;

- incorrect calculations of the amount of income.

Such mistakes cannot be made. The responsibility for compilation lies with the accountant or other important person. A document with errors will simply not be accepted in place of the requirements and that’s all. Therefore, before submitting the paper for signature, you must check it for errors, correctness of codes, details, accuracy of filling, etc.

https://youtu.be/FT48DhrK0TM

It is worth consulting with an accountant in advance so that he can also check everything and clarify the purpose of filling it out. Certificates can be asked for at any institution, so you should not delay filling it out.

How to get Putin's child benefits

Why do you need a salary certificate for social security? How to get a job locally? On what form is it drawn up? Here is an example from 2020.

In 2020, a certificate of average earnings can be submitted to social security for the following purposes:

- Registration of benefits and benefits (for example, benefits for utility bills).

- Recognition of a low-income family and receipt of subsidies and benefits.

Where to get it?

The certificate is issued to the employee at his place of work no later than 3 working days from the date of application (Article 62 of the Labor Code of the Russian Federation).

What form?

The form (form) of the income certificate for social security is not defined. Therefore, the certificate is issued in any form. It is logical that the following information should be indicated in the income certificate:

- details of the organization (name or full name of individual entrepreneur, INN, KPP, OGRN or OGRNIP, address, telephone);

- name of the document, its registration number and date of execution;

- details of the employee (name and position) to whom the certificate is issued;

- signatures of authorized representatives of the organization (IP) - manager, chief accountant, who signed the document with full names and indications of their positions;

- the amount of the employee’s income for the last three months preceding the month of applying for the certificate.

In the event of the birth of a child in 2020 (first, second and subsequent ones), you can count not only on the usual one-time and monthly maternity benefits, but also on additional (Putin) and regional ones as assistance to parents, as well as maternity capital. Everything about payments at the birth of a child in 2020 is in this material.

Most families in Russia, upon the birth of a child, have the right to receive a lump sum allowance for the birth of a child, a monthly allowance for child care up to 1.5 years, and monthly compensation for child care up to 3 years. Also, starting from 2020, you can count on a new type of payment for children. More about this below.

From January 1, 2020, families whose first or second child was born can apply for an additional monthly payment for children. New payments were introduced by law dated December 28, 2017 No. 418-FZ. In essence, they are not benefits, but only serve as additional material support for those who need it.

On November 28, 2017, at a meeting of the Coordination Council for the Implementation of the National Strategy for Children, President Vladimir Putin proposed implementing the developed measures to support young families in need of additional material support. One of these measures is the introduction of cash payments for the first and second children.

The new law spells out in detail who has the right to receive additional payment, the amount and procedure for receiving it. The document came into force on January 1, 2020. Let's look at the key points in detail.

https://youtu.be/QDRudlGn-aM

First of all, it should be noted that the new payment is targeted. Vladimir Putin stated the need to support only young and needy families. The program is designed for three years – from January 1, 2018 to December 31, 2020.

To receive monthly payments for the first (second) child in 2019, several conditions must be met (Article 1 of Law No. 418-FZ).

- Birth (adoption) of a baby after January 1, 2020;

- Citizenship of the Russian Federation for the recipient of the benefit and his permanent residence in Russia.

- Citizenship of the Russian Federation for a born (adopted) child;

- The income of each family member is ≤ 1.5 times the minimum subsistence level for the working-age population, established in the region for the 2nd quarter of the year preceding the year of application for additional benefits.

- The child must be no more than 1.5 years old at the time of submitting documents

- For the second child - after receiving a certificate for maternity capital.

The payment is not assigned to persons whose children are fully supported by the state, as well as to those who are deprived of parental rights or have limited such rights.

We invite you to familiarize yourself with the penalties for petty hooliganism

A monthly payment upon the birth (adoption) of the first child can be received by:

- a woman who gave birth (adopted) her first baby;

- father or adoptive parent;

- guardian in the event of the death of a woman, father (adoptive parent), declaring them dead, deprivation of their parental rights, as well as in the event of cancellation of the adoption of a child.

The owner of the maternity capital certificate can receive a payment for the second child.

The payment stops being paid in the following cases:

- The baby’s age is 1.5 years – from the day following the day he turns 1.5 years old;

- Change of residence of the recipient - from the 1st day of the month following the month in which social security or the fund became aware of the change;

- Refusal to receive – from the 1st day of the month following the month in which the corresponding application was received;

- Death of an infant - from the day following the day of death;

- Death of the recipient, recognition of him as missing, deprivation of parental rights - from the 1st day of the month following the month in which the corresponding event occurred.

- Full use of maternity capital funds;

- Receipt of an application for refusal to receive.

This depends on the family income and the minimum cost of living established in a particular region.

Average per capita income is calculated taking into account a newborn. That is, you need to take into account the income of at least three people - mother, father and child.

Family income = (the cost of living for the working population for the 2nd quarter of 2020 x 1.5) x 3 people.

Income for assigning payments to the first (second) child. Table

| Accountable | remuneration for the performance of labor or other duties (salary, compensation payments, bonuses, etc.); pensions, benefits, scholarships, etc.; payments to successors of deceased insured persons; compensation paid for the performance of state or public duties; monetary allowances for military personnel, employees of internal affairs bodies, institutions and bodies of the penal system, and customs authorities. |

| Not taken into account | one-time financial assistance paid in connection with a natural disaster, emergency circumstances, terrorist act |

All amounts are taken into account in the month of their actual receipt, which falls within the billing period. For other periods of calculation and payment of income, the amount of income received must be divided by the number of months for which it was accrued and taken into account in the family income for those months that fall within the billing period.

Income from civil contracts, from business and other activities is divided by the number of months for which they were accrued (received) and taken into account in income for the months of the billing period.

Until now, it was not clear whether to take into account the length of service days that were not included in full months when working for different employers. The Social Insurance Fund has decided on the procedure for calculating length of service for sick leave and maternity benefits.

Income is recorded before taxes. Income in foreign currency is converted into rubles at the Central Bank exchange rate on the date of actual receipt of these incomes.

To do this, divide 1/12 of the income of all family members for the billing period by the number of family members. If information on the amount of income of family members is presented for a period of less than 12 calendar months, the average per capita income is calculated in proportion to the period for which information is available.

When calculating the average per capita family income, the family composition does not include:

- persons serving a sentence of imprisonment, in custody, undergoing compulsory treatment by court decision, deprived of parental rights or limited in parental rights;

- persons who are fully supported by the state.

Example 1

The Petrov family (mother and father under the age of 35) lives in the Altai Territory. On January 5, 2020, the family’s first child was born. The total family income at the time of the child’s birth is RUB 40,500.00. per month.

From January 2020 to July 5, 2020, the family was assigned a payment for the first-born child, since the average per capita family income does not exceed 1.5 times the subsistence level for the working-age population established in the region (9,906 x 1.5 x 3 = 44,577.00 rubles. ).

The monthly payment for the first child will be

https://youtu.be/QXes-RSlCXU

RUB 9,811.00 Total additional volume payments for 18 months – RUB 176,598.00. (RUB 9,811.00 x 18 months).

Example 2

The young mother is a student, lives and studies in St. Petersburg, does not officially work. On March 15, 2020, her first baby was born.

ALL PAYMENTS AND BENEFITS AT THE BIRTH OF A CHILD IN 2020

The situation with the birth rate in the country before the introduction of compensation payments was terrible: not only was there a high mortality rate in the country, but also a number of compatriots left for permanent residence in other countries, changing citizenship. The government tried in every possible way to stimulate the natural growth of the population, since the main reason was that many families, due to financial instability in the country, did not risk having children.

More often than not, people either put it off or limited themselves to just one child. Deciding that financial means could partially correct the situation, the state decided to make payments to citizens after the birth of children. By the way, there are quite a lot of them: such incentives are not limited only to maternal capital.

All payments that parents are entitled to upon replenishment can be divided into several main classes:

- A one-time payment upon the birth of a child. This category, as the name suggests, is paid only once, most often at the birth of a child.

- Monthly payments. The state will pay them every month until the child reaches a certain age.

- Privileges. This includes various subsidies from the state that the child’s parents may receive.

- Certification payments. These include payments provided to parents in the form of a certificate, which they can spend only on specific purposes.

https://youtu.be/qrwlk7_GF9g

Nuances

[ads-pc-4] [ads-mob-4]

When accepting an application from an employee for the payment of wages, it is also recommended to obtain from him consent to the disclosure of his personal data, which indicates specifically what information he allows to be disclosed and to whom.

In practice, it is the employee’s relatives who come to receive a salary certificate, not the employee himself. In this case, it is necessary that the request be submitted only by him, and his representatives have a correctly executed power of attorney when receiving the certificate. The certificate is issued on the basis of a corresponding application.

Also, each employer must issue a certificate upon dismissal in the form approved in Appendix No. 1 to the Order of the Ministry of Labor, approved on April 30, 2013 under number 182n (Certificate 182n). It is necessary in order to calculate sick leave for the employee’s new place of work. The help can be supplemented with lines or, if necessary, the font can be enlarged so that all the necessary information can fit in it.

https://youtu.be/kM0uvGA5e9c

Features of individual income confirmation

https://youtu.be/29jXkYZ5G7A

When preparing statements, it is important to remember the difference between the terms “revenue” and “net profit”. Representatives of government agencies regularly try to erase the line, which leads to unreasonably inflated deductions or refusals to subsidize. Competent calculations will help eliminate such situations. In certificates and calculations it is necessary to reflect costs as a separate line.

The legislator has not created a unified mechanism for confirming the income of merchants. However, positive practice is emerging in the regions. Business representatives contact the inspectorate at their place of registration with a request to issue information. The regulatory authorities meet halfway and issue written confirmations. The period for consideration of applications does not exceed 30 days.