How to fill out field 107 when paying personal income tax: recommendation from the Ministry of Finance

Field 107 of the payment order is the tax period. This indicator is used to indicate the frequency or specific date of tax payment established by law.

Find out what values field 107 can take here.

As the Ministry of Finance explains, for personal income tax, in this field you need to indicate the month for which it is paid (see letter dated June 11, 2019 No. 21-08-11/42596). The Federal Tax Service previously provided similar explanations.

Example

When paying personal income tax on employees’ salaries for September 2020, in detail 107 you must indicate “MS.09.2019”.

We indicate the tax period in the payment order - 2020 - 2020

The tax period in the payment order for 2019-2020 is filled in when transferring taxes and contributions (advance payments thereon). How to correctly fill out field 107 “Tax period”? What to do if you made a mistake when filling out this field? You can find answers to these questions and examples of filling out a payment order in our article.

What is a payment order

Procedure for filling out a payment order

Field 107 “Tax period” in the payment order for 2019–2020

Examples of filling out field 107

Consequences of incorrectly filling out field 107

Results

What is a payment order

A payment order is an order drawn up in a document of a certain form from the account owner to the bank servicing this account to write off a specific amount of money to the recipient’s account opened with the same bank or other financial institution. The payment order form is approved by Bank of Russia Regulation No. 383-P dated June 19, 2012. It is used to transfer funds:

- for delivered (performed, rendered) goods (work, services);

- to budgets of all levels, as well as the social insurance fund;

- for the purpose of returning/placing credits (loans), deposits and paying interest on them;

- for other purposes provided for by law or agreement.

The payment order form and a sample of how to fill it out can be found here.

Procedure for filling out a payment order

payment order and its form must comply with the requirements provided for by law. The document regulating the procedure for filling out the fields of payment orders is Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107n, which describes in detail the algorithm for filling out each field.

For information about which details are basic for a payment order, read the article “Basic details of a payment order”. And how the list of details to fill out depends on who the transferred funds are intended for, read here.

You can find samples of filling out payment forms for different types of taxes in the Ready-made solution from ConsultantPlus.

If you still have questions about filling out payment forms, ask them on our forum. For example, you can find out how to fill out a payment order for a fine on the thread.

Field 107 “Tax period” in the payment order for 2019–2020

Let us consider in detail the rules for filling out the tax period in a payment order (field 107 “Tax period”) in 2019–2020. This field is filled in when generating payment orders for the payment of taxes and contributions:

- To indicate the period for which the tax (contribution) is paid.

- To indicate a specific payment date - in exceptional cases established by law.

Field 107 has 10 characters, 8 of them are indicated in a specific order, and the remaining 2 are used for separation and are filled with periods. Signs 1 and 2 indicate the frequency of tax (contribution) payment, which can take the following values:

- menstruation (MS);

- quarterly (QW);

- semi-annual (PL);

- annual (AH).

The 4th and 5th digits of the indicator correspond to the number of the selected period:

- for monthly payments, the number of the month of the reporting period is indicated - such a number can take a value from 01 to 12 according to the number of months in the year;

- for quarterly payments, the quarter number is given - the number takes a value from 01 to 04 according to the number of quarters;

- for a half-year, the half-year number is indicated, it has 2 values: 01 and 02;

- for payments made once a year, zeros are entered.

The 3rd and 6th characters correspond to the “dot” symbol and are separating characters.

Characters 7 to 10 are reserved for indicating the reporting year. If the law specifies the exact date for tax payment, then this date is indicated in the “Tax period” field of the payment order.

The “Tax period” field can be filled in for payments not only of the current year, but also of past periods, if the taxpayer himself has discovered errors in the reports already submitted and independently pays additional tax (contribution). In this case, field 107 should reflect the tax period in which the changes were made.

There are a number of situations in which a specific date is indicated in the “Tax period” field . This occurs when the associated Payment Basis field 106 has a specific encoding. A specific date in such situations means for the basis of payment:

- TP - payment deadline established by the tax authority;

- RS - date of payment of part of the installment tax amount, based on the existing installment schedule;

- FROM - the date when the deferred payment ends;

- RT - date of payment of part of the restructured debt based on the existing restructuring schedule;

- PB - the end date of the procedure that is applied in a bankruptcy case;

- PR—end date of suspension of collection;

- IN - date of payment of part of the investment tax credit.

In the event that payment is made for a debt identified during a tax audit or according to a writ of execution, a zero value is indicated in the “Tax period” field.

In case of advance payment of tax, field 107 indicates the tax period for which payment is made.

NOTE! When making payments to customs, field 107 is filled in completely differently .

Personal income tax: if there is a date in field 107

But it turns out that not everyone acts as the Ministry of Finance recommends. Some accountants enter the date in field 107 - the deadline for transferring taxes. We remind you that payroll tax must be paid no later than the next working day after the money is issued and personal income tax is withheld.

Read more about the deadline for transferring personal income tax in this article.

Example

Salaries for September were issued on Friday, October 4th. In the payment slip, the accountant indicated “10/07/2019” (postponement of the payment deadline from Saturday, October 5).

Is this a mistake? In general, no. There are no specific requirements for filling out field 107 for personal income tax, which means that no legal regulations are violated in this case. The bank will accept such a payment and send the money to the required details. The tax authorities will credit it as intended. It is not difficult for them to understand for which month the tax was received; just look at the purpose of the payment. And it usually states that this is a transfer of personal income tax from wages for such and such a month.

So if until now you have indicated the date in field 107 for personal income tax, there is no need to worry. But for the future it is better to change the approach.

What to pay attention to

Initially, it is necessary to pay attention to the fact that a payment order means administrative documentation, which is considered the basis for Sberbank or another financial institution.

Please note that Sberbank employees accept payment orders submitted by:

- in paper form;

- on electronic media;

- or generated through the Sberbank online service.

The payment order must be completed in strict accordance with the norms of Russian legislation.

At the same time, field 107 is considered to be an integral part of any type of payment order, which must be generated with the corresponding data without fail.

In addition, it is necessary to pay attention to the fact that thanks to the generated payment order, it is possible to:

| Transfer money to direct counterparties | For purchased products or services received |

| Make payments to the budget and various extra-budgetary departments | Including the ability to remit taxes and insurance premiums |

| Initiate the procedure for replenishing deposits from a specific current account | Or repay the debt under the loan agreement |

| Pay for Internet, mobile communications, utilities and digital television in particular | — |

At the same time, you should remember that the corresponding billing period code includes 10 characters when transferring funds for taxes, and:

| 8 of them | Display tax time itself |

| Remaining 2 | The so-called points for delimiting points |

Thanks to the first few characters, payers can easily display data regarding the frequency of payment, in particular:

| MS | Indicates monthly payment |

| HF | Indicates quarterly payment |

| PL | Displays payment at semi-annual intervals |

| GD | Transfers are made once a year |

The main option of the next few characters displays the numbering of the number of the corresponding declared period, in particular:

| In the case of monthly periods | Digital designations from 01 to 12 (directly depends on the month itself) |

| In the case of a quarter | The digital designation is indicated from 01 to 04 |

| For semi-annual transfers | The value is indicated as 01 or 02 |

| For annual transfers | You need to enter 00 |

The remaining four characters are intended to indicate the current reporting calendar year.

Payment orders in the case of customs and tax transfers have some differences among themselves when forming section 107.

When transferring taxes, it is extremely important to indicate the tax reporting period for which a specific payment is made, and in the case of customs duties, the established code of the customs authority.

Field 107: Personal income tax on vacation pay

For vacation pay, the deadline for transferring personal income tax is set differently than for salary. This is the last day of the month in which vacation pay took place.

For more details, see the article “Deadline for transferring personal income tax from vacation pay.”

How to fill out field 107 for personal income tax in this case? Does this mean you need to date it? Not at all. When paying personal income tax on vacation pay, the month must also be indicated in this detail. By the way, you need to do the same with the sick leave tax.

For more details, see: “Is sick leave (sick leave) subject to personal income tax?”

How to fill?

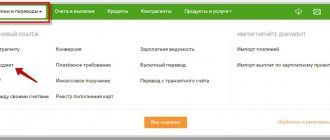

So, you decided to use Sberbank’s online service to make a payment. To do this, you need:

- 1. Enter your login and password in your Sberbank Online personal account.

- 2. Open the “Transfers and Payments” tab, then click Didn't find a suitable section, but do you know the details?

(this item is at the very bottom).

- 3. Fill in the required fields (make sure all data is entered correctly).

- 4. Request a code via SMS, enter it in the appropriate field.

- 5. Check the payment status.

If all actions are completed correctly, your payment will be transferred and credited to the bank account of the relevant government agency. When paying again, field “107” will be filled in automatically.

Now let’s figure out what to do with the “Tax period 107” field in Sberbank Online. To determine the order of payments, click Create

. To confirm, you must specify a code that should be sent via SMS. The format for the code is NN.NN.NNNN (two letters, six numbers and two separating dots). The first two characters in the code indicate the frequency of payment.

Decoding frequency codes:

- MS – monthly payment (used to pay personal income tax, excise tax, etc.);

- CV - quarterly payments (made once every three months - when paying taxes VAT, UTII, etc.);

- PL – mandatory money transfers with a frequency of six months (UST);

- GD – annual payment (for example, property tax, transport tax and others like them).

After the separating dot there are two numeric characters indicating the number of the period when the payment is made:

- MS – months (01 – January, 02 – February and so on);

- KV – quarters (01 – January-March, 02 – April-June, 03 – June-September, 04 – October-December);

- PL – half a year (indicate 01 if the payment time falls in the period from January to June, and 02 if in the period from July to December);

- 00 – indicated if the payment is made annually.

The remaining four characters indicate the year for which the payment is made.

Error in field 107 in a personal income tax payment order: what to do

An error in field 107 of a payment slip for any tax can be corrected by submitting an application to clarify the payment. It is written in free form (we have a sample on our website). If the tax office has already accrued penalties to you, they will be written off after the payment is confirmed.

For more information about this, see our publication “What to do if the tax office has wrongfully accrued penalties.”

Sources: Letter of the Ministry of Finance of Russia dated June 11, 2019 No. 21-08-11/42596

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Registration

Other taxes

10/06/2016 Print Be careful, this magazine material is relevant as of 10/06/2016

From January 1, 2020, different deadlines for paying personal income tax withheld from different types of payments have been established. But in the Rules for indicating information in the details of orders for the transfer of funds for payment of payments to the budget system of the Russian Federation (approved by order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n) there is no clear answer to the question of how to fill out field 107 in payment orders when paying personal income tax. Therefore, accountants have disagreements. Let us remind you in what cases and what specifically to indicate in this field.

In field 107 of the payment order you must indicate the tax period for which the tax or contribution is paid. From the contents of field 107 it should be clear for what period the tax is paid. Also, a specific date can be indicated in field 107.

The procedure and timing for payment of personal income tax by tax agents is regulated by Article 226 of the Tax Code. Tax legislation establishes several payment deadlines, and for each of these deadlines there is a specific payment date. For example, for salaries this is the last day of the month for which money is issued (Article 223 of the Tax Code of the Russian Federation).

If the legislation on taxes and fees provides for more than one deadline for payment of tax payments and specific dates for payment of taxes (fees) are established for each deadline, then it is necessary to generate separate settlement documents with different indicators of the tax period (letter of the Federal Tax Service of Russia dated July 12, 2020 No. ZN-4- 1/ [email protected] ) .

The deadline for transferring tax depends on the type of income - dividends, salary, financial benefits, sick leave. Tax agents are required to transfer personal income tax to the budget no later than the day following the day of payment of income to the taxpayer (clause 6 of Article 226 of the Tax Code of the Russian Federation). The only exception is for vacation and sick leave. For these payments, payment can be transferred no later than the last day of the month in which these payments were made (clause 6 of Article 226 of the Tax Code). Therefore, personal income tax from your salary must be sent in one payment and in field 107 indicate, for example, “MS.09.2016”. To pay personal income tax on vacation pay, you need to draw up a separate payment order. In it, in field 107, indicate the specific date (payment day). It will not be a mistake if you indicate the month in which the payment day falls.

Note!

The error in field 107 is not a critical error and does not affect the transfer of tax to the required account. This means that the money will reach the inspectorate, and personal income tax will be considered paid (clause 4 of article 45 of the Tax Code of the Russian Federation).

If you have generated a single payment order for the payment of personal income tax from different types of payments, this will not be considered an error, but may lead to distortion of the calculation data in Form 6-NDFL. To avoid possible controversial issues, draw up explanations and attach them to the calculation using Form 6-NDFL.

In the event that an error in filling out an order to transfer a tax did not result in the non-transfer of this tax to the budget system of the Russian Federation to the appropriate account of the Federal Treasury, then to correct the error it is enough to submit an application to clarify the payment.

Examples of filling out payment orders

When transferring wages

When transferring wages, the date of actual receipt of income is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). Therefore, in field 107 you can enter the number of the month for which the salary was accrued. Let's assume that an accountant prepares a personal income tax payment from wages for August. Then in field 107 he will indicate “MS.08.2016”. Even though the payment is drawn up in September.

Recipient ──────┴── ─┬──┴──┬────────┴───┬─────

1821010201011000110 │47345000 │ │MS.08.2016 │ │ │

────────────────────┴───────────┴────┴────────────┴─────┴────────────┴─────

Personal income tax withheld by the tax agent from income

employees for August 2020

When transferring vacation pay

Vacation pay is recognized as income on the last day of the month in which it was paid (clause 6 of Article 223 of the Tax Code of the Russian Federation). For example, if you pay vacation pay to an employee in September, then in field 107 of the income tax payment slip, enter “MS.09.2016” or you can indicate the date of payment of vacation pay (09/30/2016). This is also acceptable if the vacation “shifts” to October.

Recipient ──────┴── ─┬──┴──┬────────┴───┬─────

1821010201011000110 │47345000 │ │MS.09.2016 │ │ │

────────────────────┴───────────┴────┴────────────┴─────┴────────────┴─────

Personal income tax withheld by the tax agent from vacation pay paid in September 2020

Paying off debts: field 107

Tax agents are also required to fill out field 107 in situations where personal income tax debts are being repaid. If the organization repays the debt on its own initiative (voluntarily), then in field 107 indicate the month for which the debt is repaid. And in field 106 put the PO code. This code will mean that this is not a current payment, but a debt repayment. Let’s say, if you are paying off your personal income tax debt for April 2020, then make up your payment order like this: