What are insurance premiums

Insurance contributions are mandatory payments for pension, medical and social insurance of employees and individual entrepreneurs. Since 2020, control over the calculation and payment of contributions has again been transferred to the Federal Tax Service, which until 2010 was already collecting such payments under the name Unified Social Tax (UST).

A new Chapter 34 has been introduced into the Tax Code, which regulates the calculation and payment of contributions for:

- compulsory pension insurance;

- compulsory health insurance;

- social insurance in case of temporary disability and maternity.

These types of contributions must no longer be paid to the funds, but to your tax office. Contributions for injuries for workers remained in the introduction of the Social Insurance Fund; nothing has changed regarding them.

Among the payers of insurance premiums listed in Chapter 34 of the Tax Code of the Russian Federation, individual entrepreneurs are also named. An individual entrepreneur has a dual status - as an individual and as a business entity. An individual entrepreneur is his own employer, so the responsibility to provide himself with a pension and health insurance falls on him.

Payment of contributions to the Social Insurance Fund

Individual entrepreneurs' insurance premiums for employees in 2020 to the Social Insurance Fund are divided into 2 types:

1. From accidents at work (and from occupational diseases). 2. In case of temporary disability (and in connection with maternity).

The amount of insurance premiums in case of temporary disability is 2.9% of wages. The amount of the contribution may vary depending on the preferential tariff.

The amount of insurance premiums for accidents at work is from 0.2 to 8.5%. It depends on the class of professional risk to which the type of activity of the employee belongs.

In 2020, the budget classification code for transferring insurance contributions to the Social Insurance Fund remained unchanged:

- KBK 393 10200 160 (in case of temporary disability);

- KBK 393 10200 160 (from industrial accidents).

The remaining details can be found in the territorial office of the Social Insurance Fund.

Starting from January 1, 2020 (this rule is true for 2019 and 2020 ), when transferring insurance contributions to the Social Insurance Fund, the amount payable in rubles and kopecks is indicated.

An individual entrepreneur submits reports quarterly to the Social Insurance Fund in the form of “Calculation of accrued and paid insurance premiums (according to Form 4-FSS).”

In 2020, electronic reporting is submitted to the Social Insurance Fund no later than the 25th day of the month following the reporting quarter. On paper - no later than the 20th day of the month following the reporting quarter.

Employers with an average number of employees of more than 25 people in 2020 submit reports only in electronic form (with an enhanced qualified electronic signature of UKEP).

Who should pay insurance premiums

The procedure for calculating and paying mandatory insurance premiums causes a lot of controversy. Entrepreneurs who do not conduct business or do not receive profit from it believe that paying mandatory insurance premiums in such situations is not justified. The state proceeds from the fact that a person who continues to be listed in the state register of individual entrepreneurs, despite the lack of activity or profit from it, has his own reasons for this. Relatively speaking, no one is stopping him, due to lack of income, from stopping his business activities, deregistration, and, if necessary, re-registering.

We recommend: Registration of individual entrepreneurs online

Courts, including higher ones, always indicate that the obligation to pay insurance premiums arises for an individual entrepreneur from the moment he acquires such status and is not related to the actual implementation of activities and receipt of income.

Calculation of insurance premiums for individual entrepreneurs for themselves

An individual entrepreneur is obliged to pay insurance premiums for himself as long as he has the status of a business entity, with the exception of grace periods for non-payment.

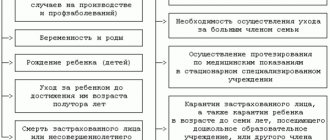

Article 430 of the Tax Code of the Russian Federation allows individual entrepreneurs not to pay insurance premiums for compulsory pension and health insurance if they are temporarily not operating in the following cases:

- military service under conscription, caring for a child under one and a half years old, a disabled child, a disabled person of the 1st group, elderly people over 80 years old;

- living with a spouse who is a contract military serviceman in the absence of employment opportunities for a total of up to five years;

- living abroad with a spouse sent to diplomatic missions and consulates of the Russian Federation (also no more than five years).

The absence of activity during such periods must be documented, and the suspension of payment of contributions must be reported to your Federal Tax Service.

If an individual entrepreneur has the right to a benefit, but continues to receive income from business activities, then he must pay insurance premiums on a general basis.

And now the most important thing - what amounts of mandatory individual entrepreneur contributions are we talking about? In 2020, an individual entrepreneur must transfer payments for himself only to compulsory pension and health insurance. The transfer of social insurance contributions for sick leave and maternity benefits is made by individual entrepreneurs on a voluntary basis.

Insurance premiums for individual entrepreneurs in 2020 no longer depend on the size of the minimum wage (minimum wage), but are fixed amounts approved by the Government:

- Contributions for compulsory health insurance (CHI) - 6,884 rubles per year.

- Contributions to compulsory pension insurance (OPI) are partially differentiated and consist of a fixed amount of 29,354 rubles and an additional contribution.

- An additional contribution is paid if the income of an individual entrepreneur is more than 300 thousand rubles per year. It is calculated as 1% of the amount of income exceeding this limit.

Insurance premium calculator for 2020:

It is necessary to pay insurance premiums in the amount of: - r.

The payment consists of:

| Purpose of payment | Sum | Payment date |

| Fixed contributions for compulsory pension insurance | - R. | Pay by December 31, 2020 |

| Additional contributions for compulsory pension insurance | - R. | Pay by July 1, 2021 |

| Fixed contributions for compulsory health insurance | - R. | Pay by December 31, 2020 |

✐ Example ▼

Let’s assume that an entrepreneur received income in the amount of 1,200,000 rubles in 2020. Let's calculate the amount of insurance premiums payable by individual entrepreneurs:

- Pension insurance contributions will be calculated as follows: 29,354 + ((1,200,000 – 300,000) * 1%) = 38,354 rubles.

- Health insurance premiums will remain at the same level and amount to 6,884 rubles at any income level.

Total: the total amount of insurance premiums for yourself in this example is 45,238 rubles.

An upper limit on the amount of contributions to compulsory pension insurance has also been introduced - in 2019, this amount cannot exceed 234,832 rubles.

The above formulas showed the calculation of the cost of a full insurance year, but if the entrepreneur was not registered at the beginning of the year or ceased activity before its end, then all calculated amounts are proportionally reduced. In these cases, it is necessary to take into account only full months and calendar days (if the month is incomplete) in which the person had the status of an entrepreneur.

Let's summarize:

- In 2020, individual entrepreneurs’ contributions for themselves with an annual income not exceeding 300 thousand rubles, including in the absence of activity or profit from it, will amount to 36,238 rubles, based on: 29,354 rubles of contributions to compulsory health insurance plus 6,884 rubles of contributions to compulsory medical insurance .

- If the amount of income exceeds 300 thousand rubles, then the amount payable will be 36,238 rubles plus 1% of income exceeding 300 thousand rubles.

Penalties on insurance premiums in 2020

In 2020, fines for violations of payment of contributions will be calculated, according to the Tax Code of the Russian Federation, according to the following rules:

- for violation of the deadline for submitting calculations for insurance premiums, the fine will be 5% of the unpaid amount for each month, but not more than 30% of this amount;

- the minimum fine will be 1,000 rubles (Article 119 of the Tax Code of the Russian Federation);

- for each document on contributions not submitted, the fine will be 200 rubles (Article 126 of the Tax Code of the Russian Federation);

- for deliberate underestimation of the contribution base, the fine will be 40% of the underpaid contribution amount.

The material has been edited in accordance with changes in the legislation of the Russian Federation, relevant as of 10/11/2019

What is considered income when calculating insurance premiums?

Determining income for calculating individual entrepreneur contributions depends on the chosen taxation system:

- in a simplified form - income from sales and non-operating income without taking into account expenses, including when applying the simplified tax system “Income minus expenses”;

In our service you can prepare a notification about the transition to the simplified tax system for individual entrepreneurs absolutely free of charge (relevant for 2020):

Create an application for the simplified tax system for free

- for UTII - imputed income, calculated taking into account basic profitability, physical indicators and coefficients;

- in the patent taxation system, the potential annual income on the basis of which the cost of the patent is calculated;

- on the unified agricultural tax - income taken into account for tax purposes, without deducting expenses;

- on OSNO - income received from business activities, minus professional deductions.

If an individual entrepreneur combines tax regimes, then income from different regimes is summed up.

To choose the most profitable tax system specifically for your business, we recommend taking free advice from professionals who will help you choose a regime with minimal payments.

Free tax consultation

Deadlines for payment of insurance premiums for individual entrepreneurs

The entrepreneur must pay insurance premiums for himself in terms of income not exceeding 300 thousand rubles (i.e. the amount of 36,238 rubles) by December 31 of the current year. At the same time, it is worth taking the opportunity to reduce, in some cases, the amount of accrued taxes by paying insurance contributions quarterly, which will be discussed in more detail in the examples.

Please note: there is no such thing as “insurance premiums of individual entrepreneurs for the quarter.” The main thing is to pay the entire amount of 36,238 rubles before December 31 of the current year in any installments and at any time. The division of the indicated amount into four equal parts is used only for conditional examples.

For example, if you don’t expect to have income in the first and (or) second quarter using the simplified tax system, then there is no point in rushing to pay your contributions. It may be more profitable for you to pay 3/4 or even the entire annual amount in the third or fourth quarter, when significant income is expected. And vice versa - if the main income is expected only at the beginning or middle of the year, then the main amount of contributions must be paid in the same quarter.

The essence of the opportunity to reduce the accrued single tax is that in the quarter in which a significant advance tax payment is expected, you can take into account the amount of insurance premiums paid in the same quarter. In this case, contributions must be transferred before you calculate the amount of single tax payable.

As for UTII, there is no concept of zero declarations for imputed tax. If you are a payer of this tax, then lack of income will not be a reason for non-payment. You will still have to pay the imputed tax, calculated using a special formula, at the end of the quarter based on the quarterly declaration. For UTII it would be reasonable to pay insurance premiums every quarter in equal installments if the quarterly amounts of imputed income do not change.

An additional amount equal to 1% of annual income exceeding 300 thousand rubles must be transferred before July 1, 2020 (previously the deadline was April 1 of the year following the reporting year). But if the limit is exceeded already at the beginning or middle of the year, then these additional contributions can be made earlier, because they can also be taken into account when calculating taxes. The same rule applies here - tax reduction due to contributions paid in the same quarter before the tax payable is calculated.

Using the Sberbank business online system for payment

Each company is required to make contributions by December 31 of each year. As soon as an entrepreneur has become a member of the Sberbank Business online , the first service he receives is registering his own personal account for managing finances and accounts. In order to make a payment for insurance needs, you will first need to log in. To do this, enter your login and password, and the action is confirmed by the code that came via SMS. Then the sequence of actions when paying insurance premiums through Sberbank business online is as follows:

Generate a payment document. To do this, you need to go to the payment and transfers section and select the “Payment to the budget ” category there. In the window that appears, you must fill out the form correctly so that no problems arise payment

In the field for specifying the contribution amount, you will need to enter the payment . However, it may differ for each payment;

Select the account number in the financial institution from which the amount for making the mandatory deposit payment through ;

Next, you need to fill in the field to enter the details of the insurance company;

Save the template if you plan to pay such fees in the future.

Using the Sberbank business online , payment transactions to the tax service are carried out using the same instructions. For this purpose, the tab with payments to the budget is also selected. Just enter the details of the tax department. through a system from a financial institution, since the forms already have fields that need to be filled out. If the user makes a mistake, no payment is made. And only after making adjustments to the document, payments go through.

Filling example:

And it is also worth remembering that in order for the payment through Sberbank Business to be completed, you must enter the code sent to the user via SMS into a special field. Also, the payment order is signed using an electronic signature. A significant amount of time is saved while using the system. After all, you don’t need to allocate it to go to the nearest bank branch and fill out all the documents manually. The online service will automatically select a form to fill out, and it will exactly meet the requirements of the government agency where the money is transferred.

Insurance premiums for individual entrepreneurs and employees

Having become an employer, in addition to contributions for himself, the entrepreneur must pay insurance premiums for his employees.

Read more: How can an individual entrepreneur organize accounting?

In general, the amount of insurance premiums for employees under employment contracts amounts to 30% of all payments in their favor (except for those that are not subject to taxation for these purposes) and consists of:

- contributions to compulsory pension insurance for employees of public pension insurance companies – 22%;

- contributions to compulsory social insurance OSS – 2.9%;

- contributions for compulsory health insurance compulsory medical insurance – 5.1%.

Additionally, a contribution is paid to the Social Insurance Fund for compulsory insurance against industrial accidents and occupational diseases - from 0.2% to 8.5%. Under civil contracts, remuneration to the contractor is subject to mandatory insurance contributions for compulsory health insurance (22%) and compulsory medical insurance (5.1%), and the need for social insurance contributions must be provided for in the contractual terms.

After the amount paid to the employee since the beginning of the year exceeds the maximum base for calculating insurance premiums (in 2020 this is 1,150,000 rubles), payment rates for compulsory insurance are reduced to 10%. The maximum base for calculating insurance premiums for OSS in 2020 is 865,000 rubles, after which contributions for sick leave and maternity leave are not accrued.

Unlike individual entrepreneurs’ contributions for themselves, insurance premiums for employees must be paid monthly, no later than the 15th day of the month following the billing month.

If you need help in selecting types of activities that require the lowest insurance premiums for workers, we advise you to take advantage of a free consultation with our specialists.

Free selection of OKVED

It is interesting that an entrepreneur has the right to be an employee of another individual entrepreneur, but cannot issue a work book for himself. At the same time, insurance premiums paid for him as an employee do not exempt the individual entrepreneur from paying contributions for himself.

Contributions paid by individual entrepreneurs for employees in 2020

Tariffs for paying insurance premiums to funds in 2020 are as follows:

- Pension insurance - 22%. From the amount exceeding the established limit value of the base - 10%;

- Insurance in connection with temporary disability and maternity - 2.9% (excluding contributions from accidents), and 1.8% from payments to temporarily staying foreigners;

- Health insurance - 5.1%.

Some individual entrepreneurs have the right to pay insurance premiums at reduced (preferential) rates. Data on these individual entrepreneurs are presented in tables at the end of the article.

The basis for calculating insurance premiums is all payments and rewards received by an individual and subject to contributions for medical pension insurance, injury insurance, temporary disability insurance and maternity insurance. As soon as the annual income of an individual reaches the limit approved by the Government of the Russian Federation, a regressive scale comes into effect. Such income will be taxed at a reduced tariff rate or even exempt from taxation.

From January 1, 2020, the maximum values of the base for calculating insurance premiums are set in the following amounts:

- for contributions to pension insurance - 1,150,000 rubles (if exceeded, contributions are calculated at a rate of 10%);

- for insurance premiums in connection with temporary disability and maternity – 865,000 rubles;

- There is no limit for health insurance contributions.

For 2020, the maximum values of the base for calculating insurance premiums are set in the following amounts:

- for contributions to pension insurance - 1,292,000 rubles (if exceeded, contributions are calculated at a rate of 10%);

- for insurance premiums in connection with temporary disability and maternity – 912,000 rubles;

- There is no limit for health insurance contributions.

Individual entrepreneurs' insurance premiums for employees in 2020 for all types of compulsory insurance (pension, medical, injury, disability, maternity) must be paid by individual entrepreneurs no later than the 15th (next month). Do not forget that if the last day for payment of contributions falls on a weekend (holiday), then the final due date for payment of contributions is postponed to the nearest working day.

How to reduce the amount of taxes payable through insurance premiums

One of the advantages when choosing the legal form of an individual entrepreneur, in comparison with an LLC, is the ability to reduce the accrued tax on transferred insurance premiums. The amount of possible tax reduction payable will vary depending on the tax regime chosen and the availability of employees.

Important: the amounts of individual entrepreneur insurance premiums themselves, calculated above, cannot be reduced, but in some cases, due to the contributions paid, the amounts of taxes themselves can be reduced.

The accrued tax itself can be reduced only using the simplified tax system “Income” and UTII, and the tax base can be reduced, i.e. the amount from which the tax will be calculated can be used on the simplified tax system “Income minus expenses”, unified agricultural tax and on OSNO. Entrepreneurs working only on the patent system, without combining modes, cannot reduce the cost of a patent by the amount of insurance premiums. This applies to individual entrepreneurs’ contributions both for themselves and for their employees.

Our specialists can help you choose the most favorable tax regime and tell you how to properly reduce your insurance premiums.

Contributions of individual entrepreneurs to the simplified tax system with the object of taxation “Income”

Entrepreneurs in this regime who do not have employees have the right to reduce the accrued single tax by the entire amount of contributions paid (Article 346.21 of the Tax Code of the Russian Federation). There is no need to notify the tax authorities about this, but the paid contributions must be reflected in the Book of Income and Expenses and in the annual tax return under the simplified tax system. Let's look at a few simplified examples.

✐Example ▼

1. An individual entrepreneur using the simplified tax system “Income” and working independently received an annual income in the amount of 380,000 rubles. The calculated tax was 22,800 rubles. (380,000 * 6%). During the year, 36,238 rubles were paid. insurance premiums, i.e. only a fixed amount (an additional contribution of 1% of income over 300,000 rubles will be transferred by the individual entrepreneur until July 1 of the next year). The entire amount of the single tax can be reduced by the contributions paid, so there will be no tax payable at the end of the year at all (22,800 - 36,238<0).

2. The same entrepreneur received annual income in the amount of 700,000 rubles. The accrued single tax amounted to 42,000 rubles (700,000 * 6%), and contributions paid quarterly during the year - 40,238 rubles, based on (36,238 + 4,000 ((700,000 - 300,000) * 1%) The amount of tax payable will be only (42,000 – 40,238) = 1,762 rubles.

3. If an entrepreneur uses hired labor in this mode, then he has the right to reduce the accrued single tax at the expense of the amounts of contributions paid (contributions for himself and for employees are taken into account) by no more than 50%.

The individual entrepreneur discussed above with an annual income of 700,000 rubles. has two employees and paid 80,000 rubles as contributions for himself and for them. The accrued single tax will be 42,000 rubles. (700,000 * 6%), however, if there are employees, it can only be reduced by 50%, i.e. for 21,000 rub. The remaining 21,000 rubles. the single tax must be transferred to the budget.

Contributions of individual entrepreneurs using UTII

Individual entrepreneurs on UTII without employees can reduce the tax by the entire amount of contributions paid in the same quarter (Article 346.32 of the Tax Code of the Russian Federation). If hired labor is used, then until 2020 it was allowed to take into account only contributions paid for employees, and in an amount of no more than 50% of the tax. But in 2020, the procedure for reducing the quarterly tax on UTII through contributions is exactly the same as on the simplified tax system Income, i.e. Individual entrepreneurs have the right to take into account contributions paid for themselves.

When using taxation in the form of UTII, the tax is calculated for each quarter separately. In the quarter in which hired labor was not used, the tax can be reduced to 100%. And in the quarter when hired workers were hired, the tax is reduced only to 50%. Thus, an important condition for reducing the tax payable on the simplified tax system “Income” and UTII is the transfer of contributions quarterly and before the tax itself is paid.

Individual entrepreneur contributions when combining simplified taxation system and UTII

When combining such regimes, you need to pay attention to the workers engaged in these types of activities. If there are no employees in the “simplified” activity, but in the “imputed” activity they are hired, then the simplified tax system tax can be reduced by individual entrepreneurs’ contributions for themselves, and the UTII tax can only be reduced to 50% by the amount of contributions transferred for employees (letter of the Ministry of Finance no. 03-11-11/130 dated 04/03/2013).

And, conversely, in the absence of employees on UTII, individual entrepreneurs’ contributions for themselves can be attributed to the reduction of “imputed” tax, and the “simplified” tax can be reduced to 50% by the amount of contributions for employees (clarification of the Ministry of Finance No. 03-11-11/15001 dated 04/29/2013).

According to Art. 346.18 of the Tax Code, when combining special regimes, taxpayers must keep separate records of income and expenses, which can be quite complicated and require contacting specialists.

Free tax consultation

Individual entrepreneur contributions when combining the simplified tax system and a patent

It was already mentioned above that entrepreneurs on the patent tax system cannot reduce its value by the amount of contributions. In the case of combining the simplified tax system and a patent, an entrepreneur who does not have employees can reduce the amount of the single tax for activities on a simplified basis by the entire amount of insurance premiums paid for himself (letter of the Federal Tax Service of Russia dated February 28, 2014 No. GD-4-3 / [email protected] ).

Individual entrepreneur on the simplified tax system “Income minus expenses”

Entrepreneurs in this mode take into account paid contributions in expenses, thereby reducing the tax base for calculating the single tax. Expenses can include both individual entrepreneurs’ contributions for themselves and contributions for employees. They cannot reduce the tax payable itself, so the amounts saved will be less than under the simplified tax system “Income”.

Individual entrepreneur on the general taxation system

These entrepreneurs include paid contributions in their expenses and thus reduce the amount of income on which personal income tax will be charged.

What are insurance premiums and who pays them?

Insurance premiums are targeted mandatory fees paid by Russian citizens in order to accumulate a pension or health insurance. These payments are not taxes, but their timely payment is strictly controlled by law. Employers or individual entrepreneurs themselves (when they pay for themselves) are responsible for the timing and volume.

The purpose of such fees is the formation of funds for payment of pensions, sick leave, benefits for the birth of a child, as well as payment for medical services. Since citizens pay these contributions throughout virtually their entire lives, calling pensions “state” and medicine “free” is not entirely correct.

Payers of insurance premiums are named in Article 419 of the Tax Code of the Russian Federation. Please note that despite the fact that payments to the Social Insurance Fund, Compulsory Medical Insurance Fund and pensions are not considered taxes, they are regulated by the Tax Code. Payers in fact include all citizens:

- citizens of Russia - individuals;

- individual entrepreneurs;

- organizations;

- persons making payments to other citizens.

Contributions to the Pension Fund, Compulsory Medical Insurance Fund and Social Insurance Fund are made by the employer for the employee, and individual entrepreneurs pay for themselves.

Citizens working under an employment contract do not pay contributions on their own. The employer does this for them, using their own funds or their own (opinions differ on this issue). Simply put, it deducts or spends part of your earnings from your possible payment. Unemployed people don't pay. Insurance contributions from employers are also mandatory, like taxes, because they are strategically important for the state.

Rates

Insurance payments for individual entrepreneurs and individuals differ. Individual entrepreneurs pay fixed amounts, and citizens pay a percentage of income. The amount of contributions to the pension fund differs according to a similar principle: for workers it is a percentage of their salary, for entrepreneurs - the same amount + an additional contribution. The founders of the LLC are not payers of insurance premiums.

Where and how much do individual entrepreneurs pay:

- in the Pension Fund of the Russian Federation - 26,545 rubles per year + 1% of income over 300 thousand;

- for health insurance - 5,840 rubles per year;

- contributions to the Social Insurance Fund are voluntary.

What citizens pay:

- savings in the Pension Fund - 22% of salary monthly;

- contributions to the Compulsory Medical Insurance Fund - 5.1% of salary monthly;

- contributions to the Social Insurance Fund - 2.9% of salary, monthly.

For citizens, contributions to the social insurance fund are mandatory, since they are used to generate benefits for certificates of incapacity for work and for maternity leave and child care. An individual entrepreneur has the right not to pay to the Social Insurance Fund for himself, but must definitely contribute money for each of his employees.

Certain categories of taxpayers have benefits when calculating pension and insurance payments. In particular, 20% in the Pension Fund and 0% in the Compulsory Medical Insurance Fund and the Social Insurance Fund pay:

- organizations and entrepreneurs subject to simplified taxation (in certain areas of activity approved by the regional authorities);

- pharmacies on UTII;

- entrepreneurs subject to patent taxation (except for trade, catering and rental);

- non-profit organizations under a simplified tax regime.

Amounts not subject to taxation

Taxation of insurance premiums concerns the income of citizens and entrepreneurs. In this case, income is salaries and business profits. Not every amount a citizen receives is subject to insurance premiums. Such payments are not subject to:

- government benefits;

- compensation for health damage;

- compensation for expenses for training or professional retraining;

- financial assistance after natural disasters and emergencies;

- financial assistance from the employer, up to 4 thousand per year.

In total, 30% of a citizen’s salary is spent on insurance payments

Individual entrepreneur reporting on insurance premiums

An individual entrepreneur who does not have employees does not have to submit reports on the payment of insurance premiums for himself. In 2020, the individual entrepreneur must submit the following reports, reflecting the amount of contributions transferred for his employees:

- to the Pension Fund of the Russian Federation monthly, according to the SZV-M form - no later than the 15th day of the month following the reporting month;

- to the Social Insurance Fund quarterly in form 4-FSS - no later than the 20th day of the month following the reporting quarter;

- to the Federal Tax Service on a quarterly basis in form 6-NDFL - no later than the end of the next month after the end of the reporting quarter;

- to the Federal Tax Service on a quarterly basis in the form of a single calculation - no later than the 30th day of the next month after the end of the reporting quarter;

- to the Federal Tax Service once a year in form 2-NDFL - no later than April 1 for the previous year.

Payment of insurance premiums for individual entrepreneurs for employees in 2020

Let us remind you that from January 1, 2020, the functions of tax administration of insurance premiums are assigned to the Federal Tax Service. At the same time, the procedure for monitoring the payment of insurance premiums for temporary disability and in connection with maternity changed.

Since 2020, the tax inspectorate has been charged with the following duties:

- control the payment of insurance premiums in accordance with the provisions of the Tax Code of the Russian Federation;

- collect debt on insurance premiums, including those incurred before January 1, 2020;

- accept calculations of insurance premiums for the reporting period from the 1st quarter of 2020.

In 2020, the Social Insurance Fund remains responsible for contributions for temporary disability and in connection with maternity:

- accept calculations for insurance premiums for 2010-2016.

- carry out control measures on insurance premiums for 2010-2016.

- make a decision on the return of overpaid (collected) insurance premiums for 2010-2016.

- carry out verification of expenses for sick leave and maternity and reimbursement of social insurance expenses.

Contributions for injuries remain administered by the Social Insurance Fund.

The deadlines for paying insurance premiums in 2020 will remain the same as in previous years - no later than the 15th day of the month following the month for which they were accrued. But contributions in 2020 must be transferred to the tax office, and not to the Pension Fund or Social Insurance Fund.

In 2020, individual entrepreneurs must submit reports on paid contributions to the Federal Tax Service.

Reporting on insurance premiums in 2020

In 2020, a new report to the Federal Tax Service will continue to be in effect - a unified calculation of insurance premiums. Let us remind you that this report replaced the following reports: 4-FSS, RSV-1, RSV-2 and RV-3. The form for calculating insurance premiums was approved by Order of the Federal Tax Service of Russia dated October 10, 2016 N ММВ-7-11/ [email protected]

Entrepreneurs-employers must submit calculations for insurance premiums within the following deadlines:

- for the 1st quarter of 2020 until 05/03/2019.

- for the first half of 2020 until July 30, 2019.

- for 9 months of 2020 until October 30, 2019.

- for 2020 until January 30, 2020

For the periods of 2020, the following reporting deadlines have been established:

- for the 1st quarter of 2020 until 05/03/2020.

- for the first half of 2020 until July 30, 2020.

- for 9 months of 2020 until October 30, 2020.

- for 2020 until January 30, 2021

To date, a new form for calculating insurance premiums has been prepared, which will presumably need to be submitted for the periods of 2020. The new form, as usual, will take into account changes in legislation. The new 2020 DAM form must be submitted from the 1st quarter of 2020. The 2020 DAM form was approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] and officially published on October 8, 2020.

The changes in the new form are minor, in particular:

- the sheet with information about an individual who is not an individual entrepreneur was excluded;

- the line “Amount of insurance premiums payable for the billing (reporting) period” has been removed from section 1; the amounts of contributions will be indicated only for the last three months of the billing (reporting) period;

- A line has been added to Appendix 1 for deducting expenses when calculating contributions from income under copyright contracts and other contracts specified in clause 2 of Article 421 of the Tax Code.

For 2020, the 2019 DAM form, approved, is relevant for submission to the Federal Tax Service. by order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551.

The SZV-M report continues to be submitted in 2020. SZV-M must be submitted to the Pension Fund by the 15th day of the month following the reporting month.

The report Information on the length of service of insured persons is submitted, starting in 2017, annually before March 1 of the year following the reporting year.

Form 4-FSS in 2020 is submitted to the FSS within the same time frame as in previous years. This form consists of section 2 of the previously valid form 4-FSS. It must also be submitted to the territorial offices of the Social Insurance Fund.

Let us remind you of the deadline for submitting 4-FSS in 2020:

- on paper no later than the 20th day of the month following the reporting period;

- in the form of an electronic document no later than the 25th day of the month following the reporting period.

For individual entrepreneurs who do not employ hired workers, there is no need to submit reports on insurance contributions to the Federal Tax Service, Pension Fund or Social Insurance Fund in 2020.