As the deadline for pension payments approaches, many future pensioners are concerned about the issue of calculating length of service, which affects the size of the pension. This article will be a useful information resource that will help improve the competence of citizens of the Russian Federation in the matter of calculating and confirming length of service. The period of insurance coverage, in addition to the size of the pension, affects and is used to calculate sick leave and when calculating the employee’s vacation. In this article we will look at the rules for calculating and confirming the length of service of employees in 2020.

What is the difference between work experience and insurance experience?

According to the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation” (Article 2), length of service is the total duration of periods of work and other activities taken into account when determining the right to certain types of pensions under state pension provision, which are counted towards the insurance period for receiving a pension provided by Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

In accordance with the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” (Article 3), the insurance period is the total duration of periods of work and (or) other activities taken into account when determining the right to an insurance pension and its amount, for which insurance contributions were accrued and paid to the Pension Fund of the Russian Federation, as well as other periods counted towards the insurance period.

Thus, from the definitions it follows:

| Seniority | Insurance experience |

| seniority is the length of periods of work; length of service is taken into account when determining the right to certain types of pensions; The length of service is counted towards the insurance period for receiving a pension. | insurance period – duration of periods of work; the insurance period is taken into account when determining the right to an insurance pension and its amount; During the insurance period, insurance contributions are calculated and paid to the Pension Fund of the Russian Federation. |

Definition and legislation

The insurance period is regulated by the Federal Law “On Insurance Pensions” dated December 28, 2013 N 400-FZ. This section regulates all issues regarding the determination, timing of appointment, payment of the required amounts to categories of citizens, and the right to receive this type of pension.

The law on pension insurance is discussed in detail in this material.

An insurance pension is a monthly payment to disabled citizens who have retired due to old age and disability, based on accumulated contributions during their working life under official employment contracts.

Starting from 2020, a mandatory contribution of 22% of monthly earnings is divided into 3 components: 6% for a fixed payment, 10% for the insurance part of the pension, 6% for a funded one. This distribution makes it possible to receive a one-time payment of the funded part, when the insurance and fixed part will be paid until the death of the pensioner.

Advantages of the new pension system

How is an employee's length of service calculated?

When calculating the insurance period, the calendar order is taken into account.

It should be noted that when calculating the insurance period for citizens of the Russian Federation, periods when the laws of other states influenced the establishment of pensions are not taken into account.

When calculating the insurance period, periods of work and other activities, information about the insured person posted in the Pension Fund of the Russian Federation in accordance with the Federal Law “On individual (personalized) accounting in the compulsory pension insurance system” is used.

In accordance with the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions,” to calculate the length of service, it is necessary to take the information entered in the work book as a basis.

The employer is required to make entries in the work book taking into account the Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 (as amended on October 31, 2016) “On approval of the Instructions for filling out work books” (Registered with the Ministry of Justice of Russia on November 11, 2003 No. 5219).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Confirmation of experience with witness testimony

Witness testimony can be a good help for citizens who need to confirm their work experience if, for some reason, other documents are missing. To do this, the employee should write an application to the personnel department of the enterprise, where personalized accounting is carried out.

The application must be accompanied by the following documents:

-A document that confirms with facts the circumstances as a result of which the work book was damaged or lost. For example, confirmation from the fire inspection service about a fire at the facility, indicating the date of the event.

-Certificate of loss of the book signed by the employer indicating the reasons.

-Certificate from the archive about the absence of data on the requested periods of work.

If the loss of documents occurred as a result of careless storage or intentional destruction, but the employee is not to blame for this, then the testimony of 1-2 witnesses can be used as confirmation of work experience. They must be the employee’s colleagues, that is, work at the same enterprise. According to their testimony, the duration of work should not be longer than that established by law when assigning a pension.

It is permissible for a witness to provide his testimony in writing if he is unable to testify for objective reasons, for example, in case of illness.

Important! In a situation where the Pension Fund decides not to take into account length of service based on testimony, then citizens can resolve this issue through the court.

Confirmation of length of service if there is no entry in the work book

For citizens whose work experience began before the application of individual (personalized) accounting in the compulsory pension insurance system, information about work experience can be provided by submitting the following documents containing information about work experience (Resolution of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval Rules for calculating and confirming the insurance period for establishing insurance pensions"):

- a written employment contract drawn up in accordance with labor legislation;

- a written contract of a civil law nature;

- collective farmer's work book;

- a certificate issued by the employer or the relevant state (municipal) body;

- extract from the order;

- personal account;

- salary slip.

Thus, if there is no entry in the work book, the employee can provide information about his work experience by presenting the documents specified in the normative act.

Based on the data available to the body providing pensions, the amount of the insurance pension is determined.

Calculation without a work book

When you have a work book in hand, the insurance period is calculated based on the dates of admission and dismissal.

Much more problems arise if the work book is lost. When there is only one place of work and the organization has not ceased its activities, then it is enough to contact the personnel department of the institution and get a certificate about the date of employment and dismissal. Such a document, certified by the seal of the enterprise, has legal force and can be presented to the Pension Fund for calculating a pension. Valorization of pensions: what is it?

If there were several places of work, then the procedure for visiting HR departments will have to be done multiple times. It will be somewhat more difficult for those individuals whose organizations or enterprises have been completely disbanded and ceased their activities. This was especially the case in the 90s, when not only small institutions closed, but also large industrial enterprises with thousands of employees went bankrupt. As a rule, all documentation of state enterprises is transferred to the archive for storage.

Old-age pension law: all articles and regulations

In some cases, work data can be confirmed by extracts from organizational orders and copies of payroll statements.

Access to the archive

First, you need to clarify which archival department you should contact to obtain information on the issue of interest. Since the document is necessary for calculating a pension, information on where to apply can be found at the Pension Fund. The law does not establish a specific form for a request to the archive, so the application is written independently in free form, but indicating the required details.

What subsidies and benefits can Russian pensioners count on?

The full name of the institution to which the application is being sent is written in the header of the application. Then the following data is indicated:

- surname, name, patronymic of the applicant;

- date of birth, address and all contacts;

- Business name;

- department and position;

- approximate period of work;

- for what purpose is the certificate required;

- date, personal signature.

Sample request to the archive for restoration of a work book

If the surname has been changed, then the old and new surnames must be indicated. The purpose of obtaining a certificate is the requirement of the Pension Fund related to the registration of a pension. The archival document required for pension accrual is issued free of charge within 30 days from the date of registration of the application.

There are often cases when a future retiree changes his region of residence. In this case, there is no need to personally contact your former place of work. The request application should be sent by registered mail with acknowledgment of receipt, having previously specified the address of the organization.

Lack of archival confirmation

The situation is much more complicated when not only the work book is missing, but also archival documents for a specific institution. In the 90s, there were many cases when employers disappeared along with all financial documentation, depriving their former employees of the opportunity to confirm their experience in this organization.

It makes sense to start looking for certificates to confirm your experience only if a “white” salary, that is, an official salary, was paid during the required period. If the money was paid “in an envelope,” this means that the employer did not pay contributions for its employees, and this period of professional activity is not included in the insurance period.

If an organization or enterprise has been liquidated, but there is a legal successor, then providing the necessary documents becomes his responsibility. You can find out about the presence of a legal successor in the tax service of the region where the liquidated organization was located. If there is no successor, then you should find out the level of subordination of the organization. With federal subordination, documents are located in the federal archive, with municipal or regional subordination - in the appropriate archives.

Interviewing witnesses

If no traces of activity, as well as documentation of the disbanded organization, could be found, then the only evidence of activity in this institution may be testimony.

Moreover, there must be at least two witnesses. They must submit certificates of employment in this institution at the same time as the person whose period of work they confirm. In this case, an application is written to the Pension Fund at the place of permanent residence, which sets out a request to establish a period of work, taking into account the testimony of witnesses. The application must include their names and addresses. The application must be accompanied by a certificate from the archive, which indicates that among the storage units there are no documents for the enterprise where the applicant worked.

If there is no work book, there are no supporting documents in the archives, and no witnesses have been found, then this period is not suitable for calculating a pension.

What periods of an employee’s activity are taken into account when calculating length of service?

In Art. 20 of Federal Law No. 166-FZ states that if the assignment of a pension requires work experience of a certain duration, it includes periods of work and other socially useful activities that are counted in the insurance period required to receive a labor pension.

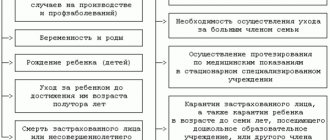

In accordance with Art. 11 and art. 12 of Federal Law No. 400-FZ of December 28, 2013, the insurance period includes the following periods:

- work periods;

- the period of military service, as well as other service equivalent to it;

- the period of receiving compulsory social insurance benefits during the period of temporary disability;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total;

- period of receiving unemployment benefits;

- period of participation in paid public works;

- the period of relocation or resettlement in the direction of the state employment service to another area for employment;

- the period of detention of persons unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total;

- the period counted towards the insurance period in accordance with Federal Law of August 12, 1995 N 144-FZ “On Operational Investigative Activities”;

- the period during which persons who were unjustifiably brought to criminal liability and subsequently rehabilitated were temporarily suspended from office (work) in the manner established by the criminal procedural legislation of the Russian Federation.

Rules for calculating and confirming work experience

As the deadline for pension payments approaches, many future pensioners are concerned about the issue of calculating length of service, which affects the size of the pension. This article will be a useful information resource that will help improve the competence of citizens of the Russian Federation in the matter of calculating and confirming length of service. The period of insurance coverage, in addition to the size of the pension, affects and is used to calculate sick leave and when calculating the employee’s vacation. In this article we will look at the rules for calculating and confirming the length of service of employees in 2020.

What is the difference between work experience and insurance experience?

According to the Federal Law of December 15, 2001 No. 166-FZ “On State Pension Provision in the Russian Federation” (Article 2), length of service is the total duration of periods of work and other activities taken into account when determining the right to certain types of pensions under state pension provision, which are counted towards the insurance period for receiving a pension provided by Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions”.

In accordance with the Federal Law of December 28, 2013 No. 400-FZ “On Insurance Pensions” (Article 3), the insurance period is the total duration of periods of work and (or) other activities taken into account when determining the right to an insurance pension and its amount, for which insurance contributions were accrued and paid to the Pension Fund of the Russian Federation, as well as other periods counted towards the insurance period.

Thus, from the definitions it follows:

seniority is the length of periods of work;

length of service is taken into account when determining the right to certain types of pensions;

The length of service is counted towards the insurance period for receiving a pension.

insurance period – duration of periods of work;

the insurance period is taken into account when determining the right to an insurance pension and its amount;

During the insurance period, insurance contributions are calculated and paid to the Pension Fund of the Russian Federation.

How is an employee's length of service calculated?

When calculating the insurance period, the calendar order is taken into account.

It should be noted that when calculating the insurance period for citizens of the Russian Federation, periods when the laws of other states influenced the establishment of pensions are not taken into account.

When calculating the insurance period, periods of work and other activities, information about the insured person posted in the Pension Fund of the Russian Federation in accordance with the Federal Law “On individual (personalized) accounting in the compulsory pension insurance system” is used.

In accordance with the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions,” to calculate the length of service, it is necessary to take the information entered in the work book as a basis.

The employer is required to make entries in the work book taking into account the Resolution of the Ministry of Labor of Russia dated October 10, 2003 No. 69 (as amended on October 31, 2016) “On approval of the Instructions for filling out work books” (Registered with the Ministry of Justice of Russia on November 11, 2003 No. 5219).

| Seniority | Insurance experience |

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Confirmation of length of service if there is no entry in the work book

For citizens whose work experience began before the application of individual (personalized) accounting in the compulsory pension insurance system, information about work experience can be provided by submitting the following documents containing information about work experience (Resolution of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval Rules for calculating and confirming the insurance period for establishing insurance pensions"):

- a written employment contract drawn up in accordance with labor legislation;

- a written contract of a civil law nature;

- collective farmer's work book;

- a certificate issued by the employer or the relevant state (municipal) body;

- extract from the order;

- personal account;

- salary slip.

Thus, if there is no entry in the work book, the employee can provide information about his work experience by presenting the documents specified in the normative act.

Based on the data available to the body providing pensions, the amount of the insurance pension is determined.

What periods of an employee’s activity are taken into account when calculating length of service?

In Art. 20 of Federal Law No. 166-FZ states that if the assignment of a pension requires work experience of a certain duration, it includes periods of work and other socially useful activities that are counted in the insurance period required to receive a labor pension.

In accordance with Art. 11 and art. 12 of Federal Law No. 400-FZ of December 28, 2013, the insurance period includes the following periods:

- work periods;

- the period of military service, as well as other service equivalent to it;

- the period of receiving compulsory social insurance benefits during the period of temporary disability;

- the period of care of one of the parents for each child until he reaches the age of one and a half years, but not more than six years in total;

- period of receiving unemployment benefits;

- period of participation in paid public works;

- the period of relocation or resettlement in the direction of the state employment service to another area for employment;

- the period of detention of persons unjustifiably prosecuted, unjustifiably repressed and subsequently rehabilitated, and the period of serving their sentences in places of imprisonment and exile;

- the period of care provided by an able-bodied person for a group I disabled person, a disabled child or a person who has reached the age of 80 years;

- the period of residence of spouses of military personnel serving under contract with their spouses in areas where they could not work due to lack of employment opportunities, but not more than five years in total;

- the period of residence abroad of spouses of employees sent to diplomatic missions and consular offices of the Russian Federation, permanent missions of the Russian Federation to international organizations, trade missions of the Russian Federation in foreign countries, representative offices of federal executive authorities, state bodies under federal executive authorities or as representatives these bodies abroad, as well as to representative offices of state institutions of the Russian Federation (state bodies and state institutions of the USSR) abroad and international organizations, the list of which is approved by the Government of the Russian Federation, but not more than five years in total;

- the period counted towards the insurance period in accordance with Federal Law of August 12, 1995 N 144-FZ “On Operational Investigative Activities”;

- the period during which persons who were unjustifiably brought to criminal liability and subsequently rehabilitated were temporarily suspended from office (work) in the manner established by the criminal procedural legislation of the Russian Federation.

Rules for calculating the insurance period for assigning an insurance pension

Calculation and confirmation of insurance experience is based on the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming insurance experience for the establishment of insurance pensions” (with amendments and additions).

According to this document, the calculation of the duration of periods of work, including on the basis of witness testimony, and (or) other activities and other periods is carried out on a calendar basis based on a full year (12 months). In this case, every 30 days of periods of work and (or) other activities and other periods are converted into months, and every 12 months of these periods are converted into full years (clause 47).

Thus, when calculating length of service, all days worked are taken into account, which are gradually converted into months worked, which, in turn, are converted into years worked:

30 days = 1 month

12 months = 1 year

“Special” periods when calculating length of service

When calculating the insurance period, it is necessary to pay attention to “special” periods:

| Periods | Inclusion/non-inclusion in the insurance period |

| Periods taken into account when establishing a pension in accordance with the legislation of a foreign state | |

| Periods of activity of persons who independently provide themselves with work, heads and members of peasant (farm) households, members of family (tribal) communities of indigenous peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors, periods of work for individuals (groups of individuals ) according to contracts | Included in the insurance period subject to payment of insurance premiums |

| Period of childcare by both parents | Each parent’s insurance record includes no more than 6 years of care, if they do not coincide in time or care is provided for different children. |

| The period of receiving compulsory social insurance benefits during temporary disability | Included in the insurance period regardless of the payment of mandatory payments for this period |

Rules for calculating the insurance period for assigning an insurance pension

Calculation and confirmation of insurance experience is based on the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming insurance experience for the establishment of insurance pensions” (with amendments and additions).

According to this document, the calculation of the duration of periods of work, including on the basis of witness testimony, and (or) other activities and other periods is carried out on a calendar basis based on a full year (12 months). In this case, every 30 days of periods of work and (or) other activities and other periods are converted into months, and every 12 months of these periods are converted into full years (clause 47).

Thus, when calculating length of service, all days worked are taken into account, which are gradually converted into months worked, which, in turn, are converted into years worked:

30 days = 1 month

12 months = 1 year

“Special” periods when calculating length of service

When calculating the insurance period, it is necessary to pay attention to “special” periods:

| Periods | Inclusion/non-inclusion in the insurance period |

| Periods taken into account when establishing a pension in accordance with the legislation of a foreign state | Do not turn on |

| Periods of activity of persons who independently provide themselves with work, heads and members of peasant (farm) households, members of family (tribal) communities of indigenous peoples of the North, Siberia and the Far East of the Russian Federation, engaged in traditional economic sectors, periods of work for individuals (groups of individuals ) according to contracts | Included in the insurance period subject to payment of insurance premiums |

| Period of childcare by both parents | Each parent’s insurance record includes no more than 6 years of care, if they do not coincide in time or care is provided for different children. |

| The period of receiving compulsory social insurance benefits during temporary disability | Included in the insurance period regardless of the payment of mandatory payments for this period |

To quickly calculate your length of service, use: → “Calculator for calculating work experience in Excel.”

Counting Rules

The algorithm for calculating this indicator is based on the following rules:

- To determine the time of continuous work in one place, it is necessary to subtract the date of entry to the place of employment from the date of dismissal.

- The total length of service will be the sum of all periods specified in the previous paragraph.

- When calculating, each month is rounded to thirty days.

- If the number of individual days is more than thirty, they are combined into a month.

- All calculations are carried out in calendar order.

When making calculations, periods suitable for the purposes under study include:

- activities under contracts of various nature;

- different types of civil service;

- completing military duty;

- duration of illness;

- time spent caring for children, the elderly and disabled;

- staying registered in case of unemployment;

- periods of arrest if proven innocent;

- the time when the individual himself transferred mandatory contributions to the funds;

- living in a marriage with a military man in places where it is impossible to find work.

Related article: Is military service included in the insurance period?

IMPORTANT! This time will only be taken into account if the person had periods of official employment before or after it began.

To independently calculate the value in question, you can use online calculators located on Internet portals. They will calculate the total amount of experience when entering the requested information.

How to calculate the insurance period and why it needs to be calculated can be found here.

Common Questions Answered

Question No. 1. I was on maternity leave for a total of 7 years and 5 months. Is it really possible that the entire period of childcare will not be included in the insurance period?

Answer: According to the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for establishing insurance pensions” (with amendments and additions), no more than 6 years of care are counted in the insurance period of each parent, if they do not coincide in time or care is provided for different children. Moreover, it is worth noting that the insurance period includes leave to care for a child until he reaches the age of 1.5 years, but in total no more than 6 years. Thus, 6 years of care will be included in the insurance period, 1 year 5 months will not.

Question No. 2. I have an entry in my work book that I was a member of a collective farm from 1992 to 1995. The Pension Fund told me that this period is not included in the length of service. Clarify please.

Answer: The fact is that having membership in a collective farm does not mean having work experience. To calculate work experience, it is necessary to have work activity, because in accordance with clause 66 of the Decree of the Government of the Russian Federation of October 2, 2014 No. 1015 “On approval of the Rules for calculating and confirming the insurance period for the establishment of insurance pensions” (with amendments and additions), the calendar years indicated in the collective farmer’s work book, in which there were no not a single exit to work are excluded from the count.

Features of document confirmation of experience

The method of confirming work experience on the basis of other official papers, in addition to the work book, is a fairly common occurrence upon retirement, therefore the legislation provides for various categories of labor activity, where the work book may be absent:

1. Carrying out work under a civil contract. The length of service in this case is calculated from the moment the agreement is concluded until the day of termination.

2. Individual entrepreneurship of citizens who have a document confirming their registration as an individual entrepreneur and have paid taxes, which is confirmed by a document from the tax service or the Pension Fund, depending on the form of taxation.

3. Farmers who regularly paid taxes, as evidenced by a certificate from the Pension Fund or the tax office.

4. Workers of family communities of indigenous peoples of the North who are registered as entrepreneurs engaged in traditional crafts.

5. Employees of creative teams who are not on staff, but performed work in these organizations and received remuneration for their work.

6. Detectives, notaries, lawyers who are engaged in private activities.

7. Military personnel, as well as equivalent employees of the Ministry of Internal Affairs and the penal system. These employees confirm their length of service with certificates from military registration and enlistment offices, military IDs, and other documents that indicate the length of service.

The law also regulates a list of special cases when citizens need to confirm various periods that can be counted into the insurance period: detention of unjustly repressed and then rehabilitated citizens, care for the disabled by decision of social protection authorities, care for elderly relatives over 80 years of age and others. Each case must be confirmed by official documents.

In a court

On January 1, 1997, Federal Law 27 of April 1, 1996 “On Individual...” came into force in all regions of the Russian Federation (from January 1, 1996 - on the territory of only 5 subjects of the Russian Federation).

Thus, work or other activities carried out after the specified date do not need to be confirmed - all the data is already in the Pension Fund.

An appeal to the court will be required, for example, if a citizen worked before 1997, and the employer did not pay insurance contributions for it.

After all, the Pension Fund is authorized to take into account periods of activity (regardless of the confirmation method - work book, contract, etc.) only if contributions were paid for it (activity). Therefore, the applicant will have to resolve the issue with the unscrupulous employer only through the court.

What's included

Above we cited other periods of activity counted in the SS. In addition to others, there are also the main ones, specified in paragraph 2 of the Resolution:

- periods of work that was performed on the territory of the Russian Federation and for which the employer paid insurance premiums in accordance with the established Federal Law No. 167 of December 15, 2001 “On Mandatory...”;

- periods of work performed by the insured citizen outside of Russia, if this is provided for by an international agreement;

- periods of payment of contributions by persons for other persons;

- periods of payment of contributions by the self-employed population “for themselves”.