The procedure for liquidation of individual entrepreneurs

The procedure for liquidating an individual entrepreneur is provided for in the Civil Code of the Russian Federation and Federal Law No. 129. These regulations establish that closure can occur voluntarily and compulsorily. In the first case, the individual entrepreneur himself makes a decision to terminate his activities, in the second, the corresponding verdict is issued by government agencies.

Important! Only a court can make a decision to forcibly close an individual entrepreneur. The legislator limits the range of grounds for making such a verdict. Changes to the Unified State Register of Individual Entrepreneurs are made after a court verdict is issued.

If an entrepreneur voluntarily wants to close an individual entrepreneur, he submits the application to the tax service at the place of registration. After 5 days, he is provided with a certificate and changes are made to the Unified State Register of Individual Entrepreneurs. Then the businessman pays off the debt on tax payments and contributions to extra-budgetary funds. The fact that he has hired employees is not a reason to refuse liquidation.

https://youtu.be/rhHdBHMEFLQ

Basic moments

The organization process is established by legislative norms. However, there are many nuances directly related to this.

It is mandatory to register at the state level.

An individual entrepreneur, like a legal entity, has the right to hire employees. In the event of liquidation, it will be necessary to terminate the employment contract.

The dismissal of employees during the liquidation of an individual entrepreneur must be carried out in a special way, with prior notice. At the same time, it is also necessary to carry out documentation.

Otherwise, certain questions may arise from the labor inspectorate. Also, violation of the algorithm can lead to fines and the employee himself going to court.

The main issues, preliminary consideration of which will avoid many difficulties, include:

- What it is?

- Who does it apply to?

- Where to contact?

What it is

Today, individual entrepreneur is one of the organizational forms of conducting commercial activities. It is understood that an individual is engaged in business, but a legal entity is not formed.

This makes sense with a small turnover of funds, in a small business.

There are many features of doing business this way. One of the most significant is that an individual entrepreneur has the right to hire workers.

Moreover, labor relations are regulated in a standard way - the Labor Code of the Russian Federation.

That is why, in the event of termination of employment or liquidation, it will be necessary to dismiss employees according to the standard scheme.

It is especially important to pay attention to advance notice. Failure to comply with the relevant requirements leads to quite significant difficulties.

“Liquidation” is a term that is incorrect to use when closing an individual enterprise. It is correct to use the term “closure”. This does not only mean the actual cessation of activity.

But also exclusion from the special state register of individual entrepreneurs. There are many different nuances associated with this. This algorithm is again regulated.

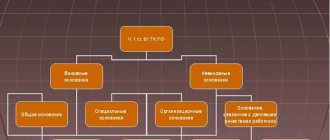

The liquidation process itself can be implemented for a number of different reasons.

The main ones include:

| Indicators | Description |

| The wish of the entrepreneur himself | this basis is sufficient to terminate the activities of an individual entrepreneur |

| Judgment | if there are any serious violations of the law, such as non-payment of taxes |

| Actual termination of activity | — |

| Liquidation due to the death of an entrepreneur | or being declared missing |

| No profit | During a long time |

| Bankruptcy | Recently, the possibility of carrying out the process of closing an individual entrepreneur even with debts was enshrined in law |

Who does it apply to?

An individual entrepreneur is responsible for the process of dismissing employees.

But often this procedure is carried out:

- Chief Accountant;

- HR employee;

- another person.

Often the authority to carry out all necessary operations is transferred to someone else.

But regardless of who exactly carries out all the actual procedures, the individual entrepreneur will be responsible for their results.

This process involves complexities and peculiarities. If any specific errors or violations occur, the individual entrepreneur will definitely have to bear responsibility for this.

Also today, the liquidation process can be organized as follows:

- Through a trusted person.

- Through a special commercial institution.

The procedure for dismissing employees, as well as the liquidation of the individual entrepreneur itself, must be carried out directly by the entrepreneur himself.

But in some cases it is not possible to carry out this procedure for some reason. In this case, a convenient solution would be to draw up a special power of attorney, certified by a notary.

Based on it, the authorized representative can not only fire employees, but also carry out the process of closing the individual entrepreneur itself.

Today there are many different commercial companies that carry out the procedure for registering or closing an individual entrepreneur.

In this case, a special power of attorney is again issued. On the basis of it, legal representatives carry out all necessary operations.

This process involves many different nuances. In this case, a special commercial company draws up all the necessary documents, including liquidation and other procedures.

It is only important to remember that there are quite a lot of different scammers in this area. That is why, before contacting any specific company, it is worth reading reviews about it.

It often happens that funds are taken to complete the necessary procedures - after which the performer, along with the money, simply disappears. In this matter you need to be as careful as possible.

Where to contact

The algorithm for liquidating individual entrepreneurs involves contacting a fairly large number of different institutions.

The list of these today includes:

- Federal Tax Service - at the place of registration of the individual entrepreneur himself, where he conducts his activities;

- Pension Fund of the Russian Federation;

- Social Insurance Fund.

You will need to contact the tax service directly to liquidate the individual entrepreneur itself. A special application is prepared on the basis of which this procedure is carried out.

You will also need to submit tax reports to the Federal Tax Service. There is a wide range of nuances associated with this procedure.

An individual entrepreneur must also make appropriate contributions to the Pension Fund and the Social Insurance Fund. In the event that a liquidation procedure is carried out, it will be necessary to notify the relevant funds.

Otherwise, they will accrue debts by default. The procedure for applying to them is standard; you just need to make a special application.

When dismissing employees, there is no need to apply anywhere else. It will only be enough to notify the employee at least 2 months before the dismissal.

In some cases, the period given is even shorter than that indicated above. Lately, less often, but it still happens that the liquidation process, for a variety of reasons, is not carried out in accordance with special regulations.

In such a situation, the optimal solution for the illegally dismissed employee would be to contact the relevant authorities to protect his rights.

These are:

| Indicators | Description |

| Labour Inspectorate | — |

| Court | at the place of registration of the individual entrepreneur |

If a violation of legal norms is obvious and no additional investigations are required, then you should contact the labor inspectorate. The alternative is to go to court.

But it is important to remember that you should only contact it if there is an attempt to resolve the issue out of court. Otherwise, the statement of claim will not even be accepted by the court.

Dismissal procedure when closing an individual entrepreneur

Ideally, the dismissal procedure when closing an individual entrepreneur is as follows:

- Two months before liquidation, employees are notified in writing of their impending dismissal.

- Two weeks notice of the closure of the individual entrepreneur is sent to the employment service.

- Personalized reporting must be submitted to the Pension Fund and payments for employees must be made within 15 days.

- Final settlement with employees, official dismissal and deregistration with the Social Insurance Fund.

By following these step-by-step instructions, an entrepreneur can be sure that no claims will be brought against him. Violation of employee rights during the dismissal process may give rise to claims. After the liquidation of the individual entrepreneur, he will appear in court as a private person.

Be sure to warn employees

In any case (dismissal due to the termination of the entrepreneur’s activities or due to a reduction in the number or staff), employees are warned of the upcoming dismissal by the employer personally and signed at least two months before the dismissal (Article 180 of the Labor Code of the Russian Federation).

The employer, with the written consent of the employee, has the right to terminate the employment contract with him before the expiration of a two-month period, paying him additional compensation in the amount of average earnings, calculated in proportion to the time remaining before the expiration of the notice of dismissal.

Notification to IP employees

Let's look at how things work out in practice.

Labor legislation stipulates that employees are notified of liquidation 2 months in advance. A different period is provided for employees working under a fixed-term employment contract. The employer is obliged to give them notice of the impending termination of employment at least 3 days in advance. Employees engaged in seasonal work are notified by signature one week in advance.

The notice form has not been ratified at the federal level. Each employer develops it independently. The notice indicates the reason for canceling the employment relationship and the period for carrying out these actions. The fact of familiarization with the notice is certified by the employee’s signature.

The employer and his employee may decide to terminate the employment agreement early. The person gives his permission in writing and is compensated according to the average wage for the period remaining before the expiration of the period established by law.

Having received consent, the employer has the right to formalize the termination of the employment relationship on other grounds (at his own request, transfer to another company, etc.). This will allow the individual entrepreneur not to pay severance pay.

Unscrupulous employees may refuse to provide written certification of receipt of the notice. In this case, the employer can send it by mail. The employee’s refusal is documented in a special act. These actions will prevent a situation where an employee files a lawsuit against the employer to declare the dismissal unlawful.

Analyzing the norm, it can be noted that it is more applicable for organizations than for an entrepreneur. Regarding individual entrepreneurs, the law does not use the wording “liquidation”. We are talking only about the completion of economic activity. In practice, individual entrepreneurs often terminate their activities forcibly. In this case, there is no way to notify employees in advance.

If an entrepreneur decides to close, it is better to immediately notify employees. Moreover, he will need some time to carry out actions for legal dismissal, etc.

Important! A special situation arises when an individual entrepreneur is closed due to bankruptcy. In this case, employees must receive notice in advance. Typically, the notice reaches the addressee at the time of initiation of bankruptcy proceedings in court.

If a private enterprise closes, how do employees quit?

If an individual entrepreneur decides to close his business, he must make an appropriate decision. If there are no debts to the budget or counterparties, the closing procedure follows a simplified procedure. After five days from the date of filing the application, the tax office issues a certificate stating that the individual is no longer an entrepreneur.

In the event that an entrepreneur’s license has not been renewed, or his permits for certain types of activities have expired, then the individual entrepreneur itself is also subject to closure. Such an individual entrepreneur can fire all of his employees without waiting for them to return to work.

And in this case, he will not break the law.

First of all, employees must be warned about the termination of their employment relationship due to the fact that the individual entrepreneur ceases its activities. The norms of the Labor Code of the Russian Federation establish that a warning about dismissal during liquidation must be sent to the employee in writing two months before dismissal.

But, this clause refers to the procedure for a legal entity to completely cease its business activities. That is, it does not apply to entrepreneurs. After all, he does not always know in advance about his liquidation, and, most often, the termination of an individual entrepreneur occurs by a court decision forcibly.

Article 81 of the Labor Code of the Russian Federation provides for the dismissal of an employee due to the liquidation of an enterprise or individual entrepreneur. That is, the employment relationship is terminated at the initiative of the employer. In this case, you can formalize them by issuing an order and making an entry in the labor record, even when the employee is on vacation or sick.

And although the requirement to notify staff of upcoming layoffs at least two months in advance applies to organizations and not individuals, a certain period of time for terminating employment contracts with employees and paying them wages and vacation pay is still necessary .

In addition, those laid off must be provided with all payments required by law: compensation for unused vacations, and all existing wage arrears must also be paid.

The Labor Code of the Russian Federation also establishes the procedure for concluding and terminating an employment contract between an employee and an individual registered as an entrepreneur. In accordance with Art. 307 of the Code, the legislator gives the parties freedom of choice in establishing, at the discretion of the employer:

- terms of notice of dismissal;

- possibility of paying severance pay.

That is, the entrepreneur-employer himself determines what amount of severance pay and other compensation is due to employees dismissed due to liquidation.

The law provides for strict requirements to pay severance pay upon dismissal in the event of termination of activity only for organizations and enterprises of all forms of ownership. In this case, individual entrepreneurs are free from obligations unless they specify a specific amount in the employment contract.

Go to How to dismiss an employee for absenteeism

The dismissal of an employee during the liquidation of a company and an entrepreneur are significantly different. In principle, like the procedure for ending the activity itself. For example, if an entrepreneur is liquidated by a court decision and forcibly, then termination of employment contracts can occur upon the entry into force of the decision.

During legal proceedings regarding the bankruptcy of an enterprise, employees must be warned about dismissal in advance, before the moment of liquidation. Most often, notice of dismissal due to bankruptcy arrives at the employee’s address after the court has issued a ruling on the commencement of the procedure.

How to fire an employee if an individual entrepreneur ceases activity. As such, the concept of “liquidation of an individual entrepreneur” does not exist in legislation and law enforcement practice.

An individual entrepreneur ceases his business activities, about which the corresponding notes are made in the registers.

After five days from the date of filing the application, the tax office issues a certificate stating that the individual is no longer an entrepreneur. Unfortunately, neither the tax service nor the employment service has the right to refuse to close his individual entrepreneur just because he has hired employees whom he did not warn in advance about his decision.

But he will no longer be responsible for them as a business entity. He will have to cover all debts to the budget and to employees as a private individual. The guarantees established by the Code for temporary workers during the liquidation of the employer also mainly apply only to organizations.

This includes the obligation to notify in advance of dismissal, at least a week in advance, as well as to pay severance pay upon termination of the employment contract within the established minimum (if the term of their employment contract exceeds two months).

Based on this, only the individual entrepreneur decides whether to pay his employees or not, since there are no specific instructions in the law regarding these business entities. But it is worth considering that all these conditions must be specified in a standard contract with an employee when hiring.

Therefore, having prescribed such guarantees and compensation, as well as their amount, the employer, even without being a legal entity, is obliged to fulfill such obligations assumed.

The Labor Code of the Russian Federation assumes that an entrepreneur does not have the right to start the process of liquidating an enterprise while at least one of his employees is on annual leave or undergoing treatment, however, there are regulations that allow for the impossibility of notifying an employee about the dismissal in advance.

Go How to restore a divorce and divorce certificate

In practice, it will still take some time to make final payments for wages, bonuses, unused vacations, etc., so employees will be aware that they will soon lose their jobs.

Let's consider what an entrepreneur who decides to close his business needs to do.

He can turn to various law firms offering their services to help prepare documents for the liquidation of individual entrepreneurs.

The issue will be resolved quite quickly and without unnecessary trips to the authorities, but specialists price their services quite expensively.

Moreover, this does not pose any particular difficulties.

1. An application is written in the prescribed form (p26001) on behalf of the owner of the individual entrepreneur.

According to the third paragraph of Article 25 of the Civil Code, in the Russian Federation an individual entrepreneur can work both himself and has the right to hire employees under the terms of concluding employment contracts.

Also, the current civil code considers in detail the issues of liquidation of individual entrepreneurs for various reasons, both from the desire of the owner himself, and under duress by judicial authorities, in cases of bankruptcy or on orders from supervisory authorities for gross violations of business activities.

At the same time, when an enterprise is closed and liquidated, it goes without saying that labor agreements are terminated and employees are released.

Let's consider the procedure for dismissing employees of individual entrepreneurs.

The very procedure for dismissing employees working for an individual entrepreneur is not much different from the termination of employment relationships at enterprises, no matter what type of property they belong to.

In the case of individual entrepreneurs, the law is more loyal and makes it possible to set at one’s discretion the period in which people must be notified of the upcoming dismissal; the amount of compensation payments is also set at the discretion of the owner.

We suggest you read: Is it possible to get a separate bus for transporting children to kindergarten?

The procedure for liquidating an individual entrepreneur is prescribed by law. Dismissal during the liquidation of an individual entrepreneur is an integral part of the process of terminating the activities of an entrepreneur.

All employment contracts concluded by him must be terminated, and employees must be given work books and pay in hand. At the same time, the law establishes compensation for dismissal from a liquidating enterprise.

Do employees need to be paid severance pay? How many days in advance must an employee be notified of an upcoming dismissal? In order to answer all these questions, it is necessary to analyze the norms of the current labor and civil legislation.

There are HR rules that guide individual entrepreneurs when dismissing employees. They established the publication of an internal order explaining the reasons why employees are dismissed and the enterprise is closed.

Labor relations can be terminated only on the basis of an order, which is issued separately for each employee of the organization. He must sign, thereby confirming familiarization with the document. If the employee refuses to read the dismissal order, the individual entrepreneur draws up a certificate of refusal.

Employment service notification

The Labor Code of the Russian Federation determines that making a decision to close an individual entrepreneur is the basis for notifying the employment service. Notification is sent in writing in the following cases:

- Liquidation of a market entity if it employs more than 15 people.

- Staff reduction by 50 (within 1 month) or 200 people (within 2 months).

- Dismissal of employees in an amount of more than 1% in regions with a total number of working citizens of less than 5 thousand.

These figures may vary depending on the specific region.

Order.

An order to dismiss an employee can be drawn up by an individual entrepreneur in any form. The entrepreneur also has the right to draw it up on the T-8 form.

The order must contain information such as:

- FULL NAME. entrepreneur;

- Date and serial number of the document;

- Date of dismissal;

- Full name, employee position;

- Grounds for dismissal.

The order must be signed by the individual entrepreneur, as well as by the dismissed employee, upon familiarization with this document. If the employee refuses to sign the order, the employer must make a note about this on the order itself, or issue a separate act recording this information. Such an act is drawn up in writing in any form.

The order is issued in one copy. But at the request of the employee, the employer is obliged to provide him with a copy of this document.

Worker's compensation

When closing an individual entrepreneur, the employee receives the following payments:

- wages for hours worked;

- compensation for unused vacations;

- severance pay.

Severance pay is accrued for the time during which employees must find a new job. Labor legislation regulates the process of its compensation in the Labor Code of the Russian Federation.

It consists of the following components:

- Monthly earnings.

- Maintaining the average salary for up to 2 months (for regions of the Far North it increases to 3 months).

- According to the verdict of the employment service authority, the average monthly salary is also reimbursed for the third month (for regions of the Far North this period is up to 6 months).

The Labor Code of the Russian Federation establishes that for the third month an employee is accrued severance pay if he manages to notify the employment service of his dismissal no later than 14 days later. For persons working in the Far North region, this period is 1 month.

Attention! Payment of funds to the employee is made on the final day of work. If he was ill or for other reasons could not receive the amount of money due to him, then he can purchase it the next day after sending a request to his former employer for payment.

Is it possible to fire a maternity leaver?

According to Russian laws, women released from work duties due to the birth of a child have the right to take one of the following leaves:

- for pregnancy and childbirth - regulated by Article No. 255 of the Labor Code of the Russian Federation, which indicates the duration of the incapacitated period;

- for the care of minors - Article No. 256 of the Labor Code of the Russian Federation outlines guarantees for women on maternity leave for the period of their absence from organizations, but only with official employment (maintenance of position and remuneration for the performance of labor duties).

Russian legislators have protected the interests of women on maternity leave; they cannot be fired without obtaining their consent. The only exception is the liquidation of the company. Only during this process can the employment relationship with them be officially terminated. In this case, you must comply with all legal requirements:

- Article 261 of the Labor Code of the Russian Federation. It states that pregnant workers and women on maternity leave cannot be dismissed at the request of management, except in cases of liquidation.

- Article 140 of the Labor Code of the Russian Federation. The document obliges the employer to pay accrued wages and additional money to the employee on the day of her dismissal. If she is absent from the enterprise, then no later than the next day after her demands for the payment of the entire amount due.

Attention

The management of a closed company must pay maternity workers, in addition to accrued earnings, severance pay. In the future, social benefits are transferred to children by social security. If an employee does not have time to take maternity leave, she must visit the local branch of the Social Insurance Fund to receive a lump sum payment before giving birth.

Registration of dismissal

Termination of labor relations at the initiative of the employer is regulated by Art. 81 Labor Code of the Russian Federation. According to the norms of this codified act, the entrepreneur formalizes the cancellation of the employment relationship with the employee by issuing an order in Form N T-8. It was developed and officially certified by Resolution of the State Statistics Committee of Russia dated January 5, 2004 N 1. The person must be notified of the issuance of the order in writing. When filling out a work book, the employer indicates a certain paragraph of Article 81 of the Labor Code of the Russian Federation. This is ratified in Resolution of the Ministry of Labor of Russia dated October 10, 2003 N 69. The work book records information that the cancellation of an employment agreement is a consequence of the termination of the activities of an individual entrepreneur.

When dismissing, the fact that the employee is on maternity leave or vacation does not play a role (Part 6, Article 81 of the Labor Code of the Russian Federation).

The procedure for annulment of labor relations during the liquidation of an individual entrepreneur has its own peculiarities. Thus, they are associated with the need to notify employees and the employment service in advance about the upcoming dismissal. When making a final settlement with an employee, the employer is obliged to transfer severance pay to him.

Previous article: The procedure for using the BSO accounting book Next article: Is it possible to sell or re-register an individual entrepreneur to another person

Dismissal by agreement of the parties.

The initiator of the termination of the labor relationship by agreement of the parties can be either an individual entrepreneur who has decided to terminate his activities, or an employee who has learned about such a decision.

In order to terminate an employment contract, the parties must sign a bilateral additional agreement.

Such an agreement must contain:

- Information about the parties (employer and employee);

- Information about the employment contract;

- Date of conclusion of the agreement;

- Date of termination of the contract concluded between the individual entrepreneur and the employee;

- Signatures of the parties.

Natalia

Labor expert

In addition, the agreement may include a condition for the payment of severance pay to the employee, if such a condition was provided for in an employment or collective agreement, a local act, or the parties reached such an agreement by mutual agreement.

Let's turn to the legislation

According to clause 1, part 1 of Art. 81 of the Labor Code of the Russian Federation, an employment contract can be terminated on such grounds. In this case, employment contracts are terminated with absolutely all employees, including pregnant women, single mothers, veterans and representatives of other groups enjoying additional labor guarantees. The procedure for terminating employment relations with employees in the event of liquidation of an enterprise consists of several steps, which we will consider below. That is, dismissal due to liquidation applies to absolutely every staff member of the enterprise. What are the rights of an employee during the liquidation of an organization? We will discuss this in detail below; the law establishes that employees must be warned, firstly, about the termination of the contract, and secondly, they have the right to appropriate payments and compensation.

Compensation (severance pay).

An individual entrepreneur is obliged to pay the employee monetary compensation (severance pay) upon dismissal, if such a condition was provided for in the employment or collective agreement.

At the same time, he is obliged to make payments in strict accordance with the terms of the amount, timing and procedure for making payments provided for by these documents.

Thus, the dismissal of employees in connection with the closure of an individual entrepreneur, as well as the dismissal of employees for any other reasons, must be carried out in strict accordance with the Labor Code of the Russian Federation and in compliance with its rules and procedures established by this document. Any violation of an employee’s rights resulting from illegal or unjustified dismissal can be appealed by him to the court, the labor inspectorate (LIT) or the prosecutor’s office.

Calculation.

The employer is obliged to pay the resigning employee in full on his last day of work. Such an employee should be given not only the salary due to him, but also compensation for all unused vacation.

If the employee was absent from work that day, or refused to receive the money, the employer should, if possible, send him the funds by bank transfer. If he does not have such an opportunity, the funds must be paid to the employee no later than the next day after he makes the corresponding demand.