What documents may remain after liquidation?

The list of documents that remain after the termination of the company’s activities depends on many factors: how long the company existed, whether it had employees, what type of business the company was engaged in, etc.

Most often, after liquidation, all that remains is:

- personnel documents;

- agreements with counterparties;

- correspondence;

- reporting to government agencies (tax, statistical);

- constituent documents, etc.

The legislation places responsibility for storing documents after the liquidation of an LLC on the liquidation commission (liquidator). It is they (he) who are entrusted with the responsibility for preparing all documentation and transferring it for storage to the appropriate organization (institution).

Documents upon liquidation of an organization

For HR employees, the liquidation of an organization means not only formalizing the dismissal of all its employees, but also a lot of work with all the personnel documents that have accumulated in the company during its existence.

The future pension of all employees, including management, depends on how competently their maintenance and subsequent transfer for further storage of personnel documents during the liquidation of the organization were organized. Therefore, all processes related to this documentation must be given the closest attention.

It would seem that the simplest answer to such a question is to destroy.

After all, the company no longer exists, therefore there is no need for its documents either. But such an answer can only be given by an extremely incompetent person.

Data on the employee’s work activity, position and salary received is important and must be preserved.

What to follow?

What documents need to be kept and for how long can be found out from the following acts:

- List of documents for government agencies (approved by Order of the Ministry of Culture of the Russian Federation dated August 25, 2010 N 558);

- List of documents in the production and scientific-technical activities of organizations (approved by Order of the Ministry of Culture of the Russian Federation dated July 31, 2007 N 1182);

- List of documents for government agencies (approved by the Main Archive of the USSR on August 15, 1988);

- For joint-stock companies, storage periods are determined in the Regulations, approved. Resolution of the Federal Commission for the Securities Market of the Russian Federation dated July 16, 2003 N 03-33/ps.

Why do they hand over documents to the archive?

After completing the liquidation procedure of a legal entity, when the entrepreneur already has a Certificate confirming the fact of closure, he destroys the seal and deposits all important documents (legal and financial) in the archives. This must be done because the information recorded in these documents may be needed later. For example:

- a former employee needs information about what salary he received;

- the former owner needs to document the fact that he has repaid all debts to creditors;

- Employees of the tax inspectorate or extra-budgetary funds may have questions regarding the activities of a liquidated legal entity, and they will also find answers in archival documents.

Where are documents stored after the liquidation of an organization?

First, you need to find out whether the company that was liquidated had an agreement with the state archival service. If there was such an agreement, then the documents are transferred to the archive.

If the company has not entered into an agreement with the state archive, then the archive is obliged to accept for storage only those documents that relate to the personnel of the organization’s employees.

The chairman of the liquidation commission (liquidator) or, if the LLC is liquidated through bankruptcy, the bankruptcy trustee must determine the location of storage of documents.

For example, documents (which are not subject to mandatory transfer to the archive) can be transferred for storage under an act to one of the company’s participants.

It is advisable to store documents for which storage periods have not been established and not transferred to the archive for 3 years (since such a period is established for the limitation period). Other documents that do not contain any valuable information and whose storage period has come to an end may be destroyed by decision of the liquidator.

Where to look for the archive of a liquidated enterprise

The issue of creating a state archive specializing in receiving documents on personnel has been worked out in the City Hall Committees since 1993, and later in the Administration of St. Petersburg. The decision was made only a few years later. In March 1999, the Order of the Governor of St. Petersburg was issued (No. 244-r dated March 11.

St. Petersburg State Treasury Institution "Central State Archive of Documents on the Personnel of Liquidated State Enterprises, Institutions, Organizations of St. Petersburg" (TSGALS SPb) Central State Archive of Documents on the Personnel of Liquidated State Enterprises, Institutions, Organizations of St. Petersburg (TSGALS SPb) created by order of the Governor of St. Petersburg on March 11, 1999.

? The archives of St. Petersburg contain millions of documents (including documents from liquidated enterprises) from the pre-revolutionary period to the present day, so the probability of obtaining the information you are looking for from the archive, although not 100%, is quite high. Archives provide the results of information searches in the form of archival certificates.

According to the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs,” managers/HR officers of a liquidated enterprise are required to notify the employment service of their locality about the mass layoff of employees. They must do this no later than two months before the upcoming dismissal and send there personal information about each of the employees: their profession, specialty, qualifications, as well as the amount of their remuneration.

We suggest you familiarize yourself with: Tax Code gift agreement

What requests are fulfilled by archives free of charge? Requests related to the social protection of citizens, providing for their pension provision, as well as receiving benefits and compensation in accordance with the legislation of the Russian Federation and the international obligations of the Russian Federation (requests of a social and legal nature) are fulfilled by the archive free of charge. 2.

Which archive stores documents on the personnel of liquidated enterprises? Documents on the personnel of liquidated institutions, organizations, enterprises, incl. during bankruptcy, documents for social and legal protection of citizens are deposited in the State Treasury Institution State Archive of the Nizhny Novgorod Region at the address: st. Balkhashskaya, 13, Nizhny Novgorod, 603089, e-mail: , tel.

Simply put, a person went to work in July of the year, which means he will have to provide a salary certificate for the period from July to July of the year. Since this year, the Pension Fund of Ukraine has been keeping personalized records of pension insurance contributions paid by every legally working resident of Ukraine.

Retention period for documents after LLC liquidation

LLC documents can be divided into categories depending on the established retention period:

- permanent storage;

- long-term (more than 50 years);

- temporary (less than 10 years).

The first category includes documents that may be related to the economic activities of the organization.

The second group includes historical information about the LLC and documentation on personnel.

Documents whose shelf life varies from 1 to 10 years include documents that do not contain important information.

How long a specific document should be stored must be determined by a specialist. For example, you can create a commission, in which you can involve an employee from the archives to determine the exact storage period for the remaining documents.

Archival storage of documents in the organization

Submitting documents to the archive is one of the key stages of office work.

We are talking about the internal archive of the organization. The most difficult issues are the time period and rules for storing archival documents, since the requirements and regulations are scattered across different legal acts. Any organization has documentation (management, personnel, accounting), which is filed annually in a single file and must be stored. A complete methodological list of standard management documentation and storage periods for each of these case files are given in Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558 (as amended on February 16, 2016). The Labor Code (everything related to the investigation of an industrial accident - 45 years) and Law No. 125-FZ “On Archival Files in the Russian Federation” (on personnel, any file created before 2003, must be kept for 75 years, any later file - 50 years). The procedure for working with accounting and tax documents is determined by the Tax Code, Law No. 402-FZ “On Accounting” and a number of by-laws.

Organizations constantly operate expert commissions, whose activities include the assessment and examination of the enterprise’s production documentation in the process of office work and transfer to the archive, as well as setting storage periods. Every year, this service decides which documents are to be kept and which can be destroyed.

Submission of documents to the archive upon liquidation of an enterprise

In accordance with Part 10 of Art. 23 of Law No. 125-FZ of October 22, 2004, the following documents must be transferred to the state archive:

- related to the Archival Fund of the Russian Federation;

- the storage period of which has not yet expired;

- by personnel.

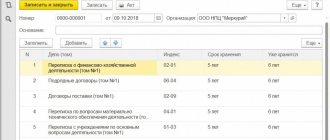

Before submitting documents to the archive, they need to be prepared. All documents must be divided by storage period and placed in folders. When creating folders, it is recommended to use the nomenclature of the company’s affairs. Each case should not exceed 250 sheets.

Documents are filed in a single copy. The papers are filed in chronological order.

So, in order to submit documents, they must be:

- structured (according to shelf life and chronology);

- hemmed;

- numbered;

- with internal inventory;

- with a cover in the prescribed form.

Submission of documents to the archive during liquidation

According to clause 10 of article 23 of the Federal Law of October 22. 2004 No. 125-F3 “On archival affairs of the Russian Federation”, upon liquidation of an enterprise or institution, all documents on personnel, as well as documents whose storage periods have not expired, are subject to mandatory transfer for storage to the State or Municipal Archives. Preparation of documents before submitting to the archive includes: • examination (assessment) of the scientific and practical value of documents; • registration of cases; • description of documents of permanent and long-term storage; • ensuring their safety; • delivery of documents to the archive of the institution;

№

| Name of types of work and services | Unit | Cost per unit in rubles (with VAT 20%) | |

| 1 | Comprehensive preparation and transfer of documents, taking into account all necessary work for State storage (up to 30 employees) - Over 30 employees, the cost is negotiated individually | 1 service | 90 000 |

| 2 | An archivist’s visit for a preliminary inspection of the Customer’s archive is provided free of charge | — | — |

Useful

Transfer of files to the archive upon liquidation of an organization

Hello, in this article we will try to answer the question “Transferring files to the archive during the liquidation of an organization.” You can also consult with lawyers online for free directly on the website.

professionally provides all services for processing, storing and transferring documents to the archive during bankruptcy and liquidation of an organization. Our expertise in resolving these issues is consistently highly sought after by our clients.

Where to send documents after liquidation of a company or individual entrepreneur? This question comes up very often. Any organization undergoing the process of self-liquidation faces a large number of problems, ranging from paying off debts or reconciling tax reports to competently preparing company documentation, as well as determining the location of its storage.

Today, in Russia, the procedure for dealing with documents upon cancellation of a company is regulated, in addition to the Civil Code, by the following legislative acts:

- “Basic rules for the work of archives of organizations”;

- “On archiving in the Russian Federation”;

- “On limited liability companies”;

- “Regulations on the procedure and terms of storage of documents of joint-stock companies.”

Where to submit personnel documents upon liquidation?

When preparing documents for the archive during the liquidation of a Limited Liability Company or individual entrepreneur, owners often ask the question: what to do with personnel files? The answer is simple: they must also be submitted to the state archive, adhering to the following rules:

- documents must be properly executed and provided in full (set);

- an examination of the value must be carried out, according to the results of which all documents must be formed into files, numbered, described and bound in archival binding;

- prefaces to inventories and historical information are prepared;

- The quality of the archival processing carried out is agreed upon with the archive representative.

For personnel files, it is necessary to draw up an inventory in three copies, on which a stamp and a mark of the state archivist on its approval are affixed. Partial or incomplete submission of files for the personnel of the enterprise is unacceptable.

Post-liquidation transfer of documents to the archive

However, it should be noted that such archives or centers have not yet been created everywhere in our country. In the absence of such a center, the functions of archives of personnel documents are assigned to the corresponding state (municipal) archives.

These services are paid. Expenses are borne by the founders (participants) of the legal entity and are made at the expense of the property or at the expense of the participants themselves (Clause 2 of Article 62 of the Civil Code of the Russian Federation). It should be remembered that state archives may refuse to accept some papers with a short shelf life.

The stages of liquidation of an enterprise are discussed in detail in the article. Subsequent details Inventory Drawing up an internal inventory of cases is an optional procedure.

At the same time, sources of government recruitment, which most often are large departmental enterprises, are not required to conclude an agreement. To find out whether a company has such status, you should contact the appropriate archival affairs management body.

Target

Completion of a business requires the transfer of all documents of important legal and financial significance to the archive for the purpose of subsequent storage. The procedure for storing transferred archival documentation is determined by the Federal Law “On Archival Affairs. The responsibility for transferring files to the archive rests with both state-owned enterprises and organizations created on the basis of private financial investments.

The reason for the transfer of documentation is the possibility of a need to raise any document that occurs during the functioning of the liquidated enterprise.

The reason for this may be the loss of a work book by a former employee and his need to restore the information data that was recorded in it. Only by contacting the archive will an employee be able to obtain documents confirming the fact of his employment, calculation and payment of wages.

On approval of the Regulations on the procedure and periods for storing JSC documents

The need for access to information of a liquidated enterprise may also arise from its management team. The reason for this need may be the presence of controversial issues that have arisen regarding the repayment of accounts payable.

Accounting documentation relating to this issue, as well as payment of payments to tax authorities and extra-budgetary funds, must be transferred to the archive and stored there.

Transfer of documents of the liquidated LLC to the archive

If the organization has neither a successor nor a higher organization, the papers should be transferred to one of the specialized archives (centers) of personnel documents. They were created in some constituent entities of the Russian Federation. For example, in Moscow, such archives operate on the basis of Moscow Government Decree No. 81 dated 02/01/2000 “On the creation of archives of administrative districts.”

In addition, temporary storage documents that continue to be valid must be transferred to the state archive, because this information may be significant from a legal or economic point of view.

In any case, if there is no reliable information, then you will have to confirm the amount of earnings with indirect evidence. The court will provide you with the necessary assistance in this regard. For example, at the request of the court, it is possible to analyze documents related to the calculation of mandatory contributions to the Pension Fund of the Russian Federation for a specified period, or to identify information about the payment of taxes (including income tax) by the organization.

The cost of archival processing of documents depends on their type and storage period. As a rule, documents are divided into temporary storage (up to 5 years), for example, financial documents, and long-term storage (75 years), for example, personnel files.

Archival legislation on the transfer of documents during liquidation of enterprises

Document fragment. Clause 9.7 of the Basic Rules for the Operation of Organizational Archives

9.7. When an organization is liquidated, its documents are subject to transfer to the organization that is its legal successor.

9.7.1. When an organization that is the source of acquisition of the state archive is liquidated without a legal successor, documents with a permanent shelf life and documents on personnel are transferred to the archive of a higher organization. If it is impossible to transfer documents to a higher organization, by decision of the commission formed for the transfer of affairs and property (liquidation commission), agreed upon with the relevant archival management body, these documents are transferred to the state archive.

9.7.2. Documents on the personnel of a liquidated organization, in the absence of a legal successor and a higher organization, are transferred for temporary storage to a specialized archive (center) of documents on personnel, and in its absence - to the state archive.

9.7.3. The destruction of documents with unexpired temporary storage periods of organizations liquidated without a legal successor is carried out only by decision of the relevant executive authority of a constituent entity of the Russian Federation or municipal entity and is documented in an act with an inventory of the documents being destroyed.

9.7.4. Documents of an organization being liquidated without a legal successor, the storage period of which has expired at the time of liquidation, are destroyed in the manner established in clauses 2.4.1 - 2.4.7 of these Rules.

9.7.5. The organization of organizing the documents of the liquidated organization, transferring them for storage or destruction is carried out by the liquidation commission. These basic provisions given in Sect. 9 of the Basic Rules are the basis for the procedure for transferring cases. From the content of clause 9.7 of the Basic Rules, we conclude that if another organization is created on the basis of a liquidated organization, the archive of the liquidated organization goes to this new organization, which is its legal successor. Let's consider a situation where a liquidated enterprise does not have a legal successor. In this case, we must be guided by clause 9.7.1 of the Basic Rules. In this case, first of all, we must determine whether our liquidated enterprise is a source of acquisition of the state archive. This can be obtained from the relevant archival authority.

Typically, the state archive is formed by large enterprises operating within the system of federal ministries or departments. The basic rules for liquidated organizations that do not have a legal successor offer two algorithms of action:

— the first option is to transfer the archive of the liquidated enterprise to a higher organization;

- the second option is to transfer such an archive to the appropriate state archive. If the organization has neither a successor nor a higher organization, the papers should be transferred to one of the specialized archives (centers) of personnel documents. They were created in some constituent entities of the Russian Federation. For example, in Moscow, such archives operate on the basis of Moscow Government Decree No. 81 dated 02/01/2000 “On the creation of archives of administrative districts.”

But it should be noted that such archives or centers have not yet been created everywhere in our country. In the absence of such an archive, the functions of personnel archives are assigned to the corresponding state archives.

So, the most common situation is when an enterprise is liquidated, which has never previously been a source of acquisition of the state archive. At the same time, there is no legal successor of the liquidated enterprise (let’s say its owner simply officially decided to close his business). Naturally, there is no higher organization. The author of this article would like to dwell on this most common case in more detail.

What documents are transferred to the archive upon liquidation of an organization?

NA No. 12'2010 The storage periods for documents are determined in accordance with the List of standard management archival documents generated in the process of activities of state bodies, local governments and organizations, indicating storage periods, approved. by order of the Ministry of Culture of Russia dated August 25, 2010 No. 558 (hereinafter referred to as the List).

Furthermore, in accordance with Art. 264 of the Civil Procedure Code of the Russian Federation, the court establishes any facts on which the emergence, change, or termination of personal or property rights of citizens (in your case, pension rights) depends. If the organization was indeed liquidated in accordance with the established procedure, then it was obliged to transfer the most important documents to the archive. You can try to clarify how, when and who carried out the liquidation of the organization in order to clarify the issue of the location of the documents. It is possible that they were given to the legal successor or the documents were taken for storage by a higher structure.

And many companies have original requirements for submitted materials. If any item is missed or performed incorrectly, the entire array will have to be processed again.

Features of filing documents in the archive during the liquidation of an enterprise

Reading time: 3 minute(s) The process of winding up a company to begin its activities in a new format with other founders or as part of another organization after dividing into two companies is called liquidation. In the event of a successful closure procedure, which took place in accordance with all rules and regulations, the tax service ceases its activities to control the actions of the company, including internal papers. Therefore, after liquidation, part of the documentation must be transferred to state archives for preservation.

In order for the transfer procedure to be successful, it is important for the head of the company and those responsible for performing this task to understand what papers and under what conditions need to be transferred, as well as to carefully read some legislative acts.

Today we will talk about the rules for filing documents in the archive during the liquidation of an enterprise.

What to do with documents after the liquidation of an LLC: do they need to be archived?

The procedure for handling documents during the liquidation of an organization is regulated by the laws of the Russian Federation, in particular, this procedure is discussed in the archival legislation of the Russian Federation.

Before starting liquidation, it is necessary to familiarize yourself not only with the specific issues of transfer for archival preservation, but with the provisions of Article 57 of the Federal Law of 02/08/1998 No. 14-FZ “On Limited Liability Companies.” Thus, the Law on LLC obliges to carry out preservation in accordance with current legislative acts from the moment of registration of the organization. In accordance with this act, non-governmental organizations that are being liquidated must transfer archival data for preservation to a municipal or state archive. This responsibility rests with the liquidation commission.

Archival documents include documents that have not yet expired for temporary storage at the time of liquidation of the company and data on personnel. After submitting this type of paper, the chairman of the liquidation commission independently determines the location of the remaining documents.

To carry out the transfer procedure, the liquidation commission or liquidator must enter into an agreement with the archive. Responsibility for failure to submit documents to the archive during liquidation is regulated by Article 13 of the Code of Administrative Offenses of the Russian Federation. If documents that are subject to transfer to the archive are destroyed, under Article 325 of the Criminal Code of the Russian Federation, the responsible person faces a fine of up to 200,000 rubles or imprisonment for up to one year.

The deadlines for transferring documents to the archive are not established by law, however, most often this procedure is carried out after making the appropriate entry on the liquidation of the enterprise in the Unified State Register of Legal Entities.

What documents belong to the transfer?

Papers of permanent storage, documents on personnel and temporary storage periods (up to 10 years), the storage periods of which have not yet expired, are sent to state or municipal archives.

To determine such deadlines, the responsible person can use the new list of standard management archival documents generated in the course of the activities of state bodies, local governments and organizations, indicating retention periods, approved by the Ministry of Culture of Russia dated August 25, 2010 No. 558.

How to prepare papers correctly?

If proper attention was not paid to maintaining documentation during the operation of the organization, then organizing all the forms and certificates before transferring them to the archive will be quite problematic. Typically, the result of such negligence is that all shortcomings and mistakes in organizing the work of the enterprise archive are revealed precisely during the liquidation procedure. In such cases, the company can use the services of specialized companies involved in the preparation of documentation for transfer to the archive and archival processing.

Labor-intensive preparation consists of the following stages:

- conducting an examination of valuables (page by page review of cases);

- registration of cases - filing, binding, numbering;

- drawing up an internal inventory of files (drawing up an inventory of permanent storage files, personnel files, temporary storage files and scientific reference apparatus for them);

- design of case covers.

Where to submit documentation: to which archive?

According to Federal Law No. 125 of October 22, 2004, “On archiving in the Russian Federation,” the liquidation commission of a liquidated enterprise is obliged to enter into an agreement with an organization that takes documentation into a municipal or state archive for preservation. Most often, information about the location of the archive can be found on the website of the local administration.

It is worth noting that documentation related to the storage group for up to 10 years can be transferred to a private company engaged in storing archival data. In addition, in the event of liquidation of an LLC with a successor company or parent organization, the papers are transferred to it.

How to deposit documents of an organization for storage: step-by-step instructions

After careful preparation by the liquidation commission of all archival data for their transfer to the state or municipal archive for storage, the following stages must be completed.

Stage 1 . Contacting the appropriate local archival authorities. Meeting with the archivist, identifying all requirements for storing papers from archival employees.

Stage 2. Conclusion of an agreement with the state or municipal archive.

Stage 3. Drawing up a transfer and acceptance agreement, which fixes the obligations of the parties, the composition of the transferred papers, and the procedure for depositing documents. The act is drawn up in two copies and certified by the signature of the chairman of the liquidation commission.

How long are documents stored?

Retention periods by law are established by a list of standard management archival documents, which states that the storage of LLC documents after liquidation should be carried out taking into account their classification:

- Papers of permanent storage related to the economic activities of the organization.

- Long-lasting papers. Includes documentation on personnel (personnel documents) and historical information. Can be stored for 75 years.

- Temporary storage papers for up to 10 years: orders, primary accounting documents, waybills.

Documents with an expired storage period are not used for business needs. Such papers are disposed of - for this purpose, a special commission is assembled, which draws up an act with an inventory of the documentation to be destroyed.

Thus, preserving the papers after the liquidation of the organization allows us to resolve all controversial issues that may arise in the future. In addition, these documents can help employees of the organization avoid problems with receiving the pension they are entitled to. That is why the company must approach the issue of transferring documentation to the archive with full responsibility, taking into account its interests and the interests of its employees.

Did this article help you? We would be grateful for your rating:

0 0

Archivist, accountant, personnel officer

In the event of the official liquidation of a legal entity, as well as in the event of a change of legal address to another subject of the Russian Federation, or a change of owner, personnel documents must be transferred to state storage. These documents are of particular value to the state, since on their basis the labor pension of employees who worked at the liquidated enterprise is calculated.

Upon liquidation of a company, documents must be transferred for storage to the state archive. This requirement is not discussed for either commercial or government organizations. It doesn’t matter whether your company worked for the prosperity of the Russian state or purely for the benefit of private individuals: some of the documents will certainly end up at the disposal of the state or municipal archive.

Important and useful information in the article: “Where to find the archive after the liquidation of an organization.” The article examines the topic from various points of view, which allows us to draw the right conclusions. For any questions, you can contact our specialist on duty.

Upon liquidation of a company, documents must be transferred for storage to the state archive. This requirement is not discussed for either commercial or government organizations. It doesn’t matter whether your company worked for the prosperity of the Russian state or purely for the benefit of private individuals: some of the documents will certainly end up at the disposal of the state or municipal archive.

Answer: Unfortunately, the situation you described is typical. It was in the period 1986 to 1995. documents on the length of service and earnings of workers most often did not reach the archives. It is necessary to admit with bitterness that at present the situation with the safety of documents is also not in the best way, especially in commercial organizations.

At the request of the archival repository, the company must transfer a package of necessary papers, for example, the originals of constituent documents, including the charter.

An exception is the inventory of personal files. Each individual case must have a blank sheet at the beginning, and at the end a witness drawn up in a generally accepted form. This sheet must contain a numerical value of the number of sheets in the case that are numbered.

For example, collective agreements, personal files of the organization’s leaders, lists of members of the organization’s governing and executive bodies must be stored permanently.

Federal Law “On Archival Affairs in the Russian Federation”, Law of the City of Moscow dated November 28, 2001 No. 67 “On the Moscow Archival Fund and Archives”.

I think it’s no secret to anyone that this process is extremely complex, in many ways even painful: fixed assets are transferred, debts are paid to suppliers and contractors, final settlements are made with personnel for wages, as well as other payments provided for by law; reconciliation of reports with the tax authority, etc. and so on.

What to do with documents when liquidating a company

https://youtu.be/0Yz3ya82pks

Source: The decision has been made: the company is being liquidated. But, unfortunately, this is not the end. Ahead of you lies the painful process of parting with her rich past: from paying off debts to reconciling reports with the tax authorities.

However, this is not the finish line yet. Documents are the main inheritance of a liquidated company, which must be dealt with wisely.

Otherwise, you will not be able to escape the dissatisfaction of future retirees. What to do with documents during liquidation and to which archive should you transfer your paper treasure? Upon liquidation of a company, documents must be transferred for storage to the state archive. This requirement is not discussed for either commercial or government organizations.

It doesn’t matter whether your company worked for the prosperity of the Russian state or purely for the benefit of private individuals: some of the documents will certainly end up at the disposal of the state or municipal archive.

Retention period for documents after LLC liquidation

The destruction of documents with unexpired temporary storage periods of organizations liquidated without a legal successor is carried out only by decision of the relevant executive authority of a constituent entity of the Russian Federation or municipal entity and is documented in an act with an inventory of the documents being destroyed.

Unlike documents with a permanent storage period and documents on personnel, which after liquidation must be stored in the state archive, the state has the right to refuse to store documents with a temporary storage period (if, for example, there was no free space in the archive at the time of application).

It states the obligations of the parties and lists the documents to be submitted, indicating the procedure and time frame for their transfer. Points of payment, possibilities for organizing and conditions for subsequent destruction of materials with an expired shelf life must be specified.

The question of submitting documentation to the archive service always arises in the process of liquidating an enterprise. Documents are archived, as a rule, after issues with the tax office and pension fund have been resolved, after which they are transferred for storage to the archive.

How long should documents be kept after the liquidation of an LLC?

https://youtu.be/I_eAXaJ4-Lg

Business companies use a wide range of documents in the course of their activities. Most of them have a statutory shelf life. What can it be like when a company is liquidated?

Documents must then be stored in accordance with the deadlines established by Order of the Ministry of Culture of Russia dated August 25, 2010 No. 558 (its jurisdiction also extends to private organizations) and other regulations, such as, for example:

- Law “On Accounting” No. 402-FZ;

- Decree of the Government of the Russian Federation No. 1137, establishing the procedure for using various documents for VAT payers.

In this case, it does not matter whether the LLC is operating or being liquidated, from the point of view of the company’s obligation to comply with the requirements of the specified rules of law.

How is the storage of documents ensured during the liquidation of an LLC?

Law of the Russian Federation on the transfer of documents to the archive during the liquidation of a company

This responsibility rests with the liquidation commission in case of voluntary liquidation or with the bankruptcy trustee in case of bankruptcy. In this case, an agreement is concluded between these persons and the archival organization.

The pressing question when liquidating an organization is where to put the documents. After all, the company has closed and there is nowhere to store documents.

When a company is liquidated, the successor company or a superior enterprise in relation to the liquidated organization has the primary right to receive documentation. If, according to the law, there are no such institutions, the liquidation commission is obliged to contact a specialized center, whose responsibilities include the temporary storage of documents on personnel.

People often have a question about what to do with documents that have not been accepted into the state or municipal archives. After all, the document storage period has not expired, and the legal entity has stopped working.

Who is responsible for transferring documents during liquidation?

The legislation clearly states that the delivery of documents to the archive is carried out in accordance with paragraph 10 of Art. 23 of the Federal Law of October 22, 2004 N 125-FZ “On Archival Affairs in the Russian Federation.” When liquidating non-governmental organizations, including as a result of bankruptcy, archival documents, documents on personnel, as well as archival documents whose temporary storage periods have not expired and included in the Archival Fund of the Russian Federation, which were formed during their activities and included in the Archive Fund, must be handed over to the liquidation commission ( liquidator) or bankruptcy trustee in an orderly state for storage in the appropriate state or commercial archive. In this case, the liquidation commission (liquidator) or bankruptcy trustee organizes the delivery of documents to the archives of the liquidated organization, including an organization liquidated as a result of bankruptcy on its own.

Unforeseen difficulties

Unfortunately, the delivery of archive documents during liquidation is not always completed properly, especially in enterprises liquidated due to their insolvency (bankruptcy). Officials of an enterprise undergoing liquidation should be prepared for the difficulties that arise in the process of submitting documents to the archive. The presence or absence of claims when submitting documents to the archive will depend on the competent decision of the responsible persons.

What documents are submitted to the archives during bankruptcy and liquidation?

All documents of a liquidated enterprise for labor and wage accounting and settlements with personnel (orders, personal cards, personal payroll accounts or payroll statements) are submitted to the state or municipal archive at the legal address of the organization. The acceptance of documents into the archive is recorded by an act of acceptance and transfer. Let us remind you that the storage period for documentation related to the calculation of length of service, earnings, etc. issued before 2003 is 75 years. Similar documents created after 2003 are stored for 50 years. This gives interested parties the right to contact the archive for clarification of information when calculating, for example, work experience.

What to do with documents that are not accepted into state archives

People often have a question about what to do with documents that have not been accepted into the state or municipal archives. After all, the document storage period has not expired, and the legal entity has stopped working.

Option 1. Find a place at home and store until the shelf life expires. Please note that the storage period for most documents does not change during liquidation and is at least 5 years.

Option 2 . Systematize and process documents with the preparation of an appropriate inventory. Then transfer it for depository storage on a paid basis to any archive that provides such services.

Services for submitting documents to the archive during liquidation

Our company professionally provides all services for processing, storing and transferring documents to the archive during bankruptcy and liquidation of an organization. Our expertise in resolving these issues is consistently highly sought after by our clients. Submitting documents to the archive is an important procedure with the need to comply with many requirements imposed on this event by current legislation.

What documents do you receive after submitting documents to the state archive?

Firstly, the procedure for dealing with documents during the liquidation of an organization is regulated by the archival legislation of the Russian Federation. In this case, we are talking about the Basic Rules for the Operation of Archives of Organizations, approved by the Federal Archive on February 6, 2002, and Federal Law No. 125-FZ of October 22, 2004 “On Archiving in the Russian Federation.”

The extensive experience of our company’s archivists, including thanks to established contacts in departmental and municipal archives, allows us to deposit documents in the archive promptly and on conditions favorable to our clients!

To close a legal entity, it will be necessary to implement a certain algorithm of actions.

The transfer of documentation begins after the completion of the company’s liquidation procedure in the form of amendments to the Unified State Register of Legal Entities. The procedure for holding the event is established by the above rules.

How to submit documents to the archive?

How to submit documents to the archive for storage in compliance with all existing requirements, without wasting valuable time and thus avoiding economic damage to the enterprise?

Contact the Archival Expert. Our company’s specialists are perfectly familiar with the procedure for transferring documents for storage. We will carry out all necessary actions in strict accordance with current legislation quickly and, importantly, inexpensively. We have extensive experience and are able to resolve all issues related to organizing the delivery of documents to the archive during liquidation and reorganization.

You can find out about current prices, discounts and special offers for services for submitting documents to the archive by phone or [email protected]

Responsibility for failure to meet deadlines for transfer of documents

Unfortunately, the delivery of archive documents during liquidation is not always completed properly, especially in enterprises liquidated due to their insolvency (bankruptcy). Officials of an enterprise undergoing liquidation should be prepared for the difficulties that arise in the process of submitting documents to the archive.

The Moscow Government adopted Resolution No. 1123-PP, which, in order to improve the conditions of preservation and enhance the use of documents on the labor activity of employees of city organizations, created a Central Archive of Documents on the Labor Activities of Citizens within the structure of the Main Archival Department of Moscow on the basis of the archives of personnel documentation of administrative districts Moscow.

The organization of organizing the documents of the liquidated organization, transferring them for storage or destruction is carried out by the liquidation commission.

The liquidation procedure for an enterprise begins with a meeting of shareholders, who must decide on the start of this kind of process.

If the company does not have a higher organization or legal successor, then the papers are sent to the archival storage of personnel documentation. To obtain the necessary information, a representative of the enterprise must contact the archival authority operating within the region. Before meeting with an archivist, you should decide on the following points:

- determine the deadlines that will form the company’s archive fund;

- calculate the number of files to be transferred to the storage facility separately for each group: for permanent storage for a period of 10 years and for temporary storage - up to 10 years , as well as papers for personnel.

Fourthly, if the liquidation process takes place in a joint-stock company, then in order to resolve the issue of ensuring the safety of documents, it is necessary to study the Regulations on the procedure and periods for storing documents of joint-stock companies, approved by Resolution of the Federal Commission for the Securities Market of Russia dated July 16, 2003 No. 03-33/ps.

Where is the archive of documentation of liquidated enterprises located?

How to find the archives of the organization in which you previously worked is a question that newly minted retirees are often puzzled by. Now the era of modernization of personnel document flow is just beginning, and in the future, certificates will no longer be needed to apply for a pension. In the meantime, personnel documentation must be stored in accordance with the deadlines established by the Federal Labor Service.

Closing of companies occurs infrequently, so the founders may not know what to do with documents when liquidating the organization. However, in case of forced or voluntary cessation of the existence of an institution, it is imperative to keep the documentation compiled during its activities.

We invite you to read: Paid leave must be provided to the employee

stored If the enterprise is liquidated, the archives are stored either in a higher body or in the territorial state archive: The paper archive of liquidated Where in Moscow, which has a temporary storage period and is not subject to destruction, must be stored by the former manager personally or in an independent archival company.

What documents are transferred to the archive upon liquidation of an organization?

In the event of liquidation or “bankruptcy” of a company, it is necessary to transfer documents to the state archive. If you want to understand how to prepare documents in such a way as to please the archive workers the first time, read our article.

Most government archives provide document organizing services. Find out from the archive to which you plan to transfer documents, the cost of the service and how long it will take to process the documents. If the queue for archival processing is scheduled for several months in advance, and there is no time to wait, ask the archive workers if they would agree to prepare your documents under a contract, for example. Do not want? Then we can handle it ourselves: there’s nothing complicated here.

We collect documents for transfer to the archive: - documents on the creation of an enterprise (decision on creation, all editions of the Charter with amendments and additions, constituent agreement, copy of the state registration certificate);

— documents on the liquidation of the enterprise: minutes of the meeting of founders / decision of the founder, liquidation balance sheet;

— annual balance sheets and explanatory notes thereto;

— annual statistical reports on the main areas of activity (except for forms “1-insurance (Belgosstrakh)” and “4-fund (Ministry of Labor and Social Protection)”);

— minutes of meetings of founders or decisions of the founder;

— orders for core activities;

— orders for personnel (on admission, transfer, dismissal, long-term (more than a month) business trips outside the Republic of Belarus, bonuses, provision of parental leave, changes in official salaries, provision of leaves without pay, establishment of bonuses, changes in surnames);

— personal payroll accounts/payroll payslips/payroll payslips/payroll book;

— personal cards of dismissed employees (must be completed in full);

— personal files of dismissed employees;

— unclaimed work books (only completed ones).

The documents will most likely be mixed up. Statistical reports are often kept together with accounting reports, personal cards are often kept in personal files. We divide everything according to the above diagram.

Now we arrange the documents by year. Let's not touch personal matters yet! We place orders for 2017 in one folder, for 2018 in another, etc.

We arrange documents inside folders. The early ones should be at the beginning of things, the late ones at the end. That is, the case should begin with the order dated January 1, 2017 No. 1, and end with the order dated December 31, 2017 No. 99.

We systematize personal accounts alphabetically: Avoskin, Burakov, […], Yukhnovich, Yaroshkin.

With a simple pencil. In the upper right corner. By hand. A most exciting activity. Better with music or TV series☺.

At the end of each case we put a certification sheet. It looks like this:

Inside the personal files, we arrange the documents in the following order: addition to the personal personnel record sheet, personal personnel record sheet, autobiography, copies of educational documents (certificates, diplomas, certificates, etc.), application for employment, copy of the order about hiring. The following is chronological. The last document in the personal file should be a copy of the dismissal order. If it is not there, find the original, make a copy and put it in the case.

Copies of orders for granting labor leave, passports, work records, military ID cards, etc. can be thrown away. Although among experienced Belarusian archivists there is an opinion that it is better not to do this: “Once the personnel officer has decided it, then it is necessary.” It's up to you here. We are throwing...

Sheets of personal files are numbered in the same way as in other files: with a simple pencil. In the upper right corner. By hand.

Don't forget about the certification sheets.

Now you need to create an internal inventory of your personal file. In theory, it should be filled out by the employee responsible for behind-the-scenes office work. But most often, personnel officers give up this task after entering data on the documents that are drawn up when applying for a job. Further - empty. The inventory may include data on documents that should not be in the file (copies of passports, military IDs, etc.). You will have to enter additional information and make notes about the documents that you decide to throw away. Do you need it? If not, then we cross out the existing internal inventory, place it at the end of the personal file and draw up a new one. Believe me, it will be faster this way.

The internal inventory of a personal file looks like this:

Submission of documents to the archive during liquidation - Where to go, what to follow, what to transfer

During the period of its liquidation, in order to resolve the issue of transferring archival documents, the enterprise must contact the appropriate archival management body operating on the territory of its constituent entity of the Russian Federation. The local administration usually has information about its location. Currently, almost every administration has its own website on the Internet, searching for relevant information on which will significantly speed up obtaining the necessary information.

For the initial conversation with archivists, you need to prepare: - set the deadlines for documents that form the archival fund of your enterprise and - calculate the number of files to be transferred for archival storage, separately for each category (permanent storage, temporary (over 10 years) storage, temporary ( up to 10 years) storage and personnel). When starting to transfer personnel documents to the state archive, it is necessary to take into account the requirements of the corresponding state archive to which they will be transferred. The Basic Rules state that they are binding on all non-governmental organizations. But if a particular archive has its own special requirements, which, as a rule, are always due to compelling reasons, you should treat them with respect and take them into account and fulfill them. The category of documents on personnel includes documents generated in the activities of personnel services (orders on personnel, personal files, personal cards of employees, etc.) and accounting (personal accounts for wages). When liquidating an enterprise, to select documents to be transferred for archival storage, we are guided by paragraphs. 8.1 section 8 List of standard management documents generated in the activities of organizations, indicating storage periods.

Here is an approximate list of documents on personnel that may exist at an enterprise: - orders on personnel (or orders, notes, etc.); — job descriptions; — personal files of dismissed employees; — employment contracts; — personal cards of dismissed employees, including temporary ones (form T-2); — characteristics of employees; — documents (extracts from minutes, lists of works, reports) of the competition commission for filling vacant positions, electing persons (employees) to positions; — minutes of meetings of the commission to establish length of service for the payment of bonuses for length of service; — lists of employees; — pointers to orders for personnel; — books (magazines, cards) recording the reception, movement (transfer), dismissal of employees; — books (magazines, cards) for recording personal files, personal cards, employment agreements (contracts), employment agreements; — books (magazines, cards) recording the issuance of work books and inserts for them; — unclaimed personal documents (work books/labor lists, diplomas, certificates, certificates, etc.); — personal accounts for employee salaries (or, in the absence of such, documents that replace them: pay slips, tax cards); - accident reports.

At the request of the receiving party, the enterprise must transfer a number of additional documents, for example, constituent documents (originals or copies of certificates of registration, re-registration, liquidation, charters, constituent agreements, etc.).

How documents are submitted to the archive during liquidation

The procedure for transferring documents to the archive is relevant for any organization, regardless of the type of its property, areas of business and the stage at which it is located.

Documents that are created in the process of entrepreneurship accumulate. Even if they have already been executed and cannot affect the future activities of the company, they must be stored. Some records are retained for a long period of time, while others are retained for a short period of time.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

+7 (Saint Petersburg)

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

Among the main cases of transferring company documents to the archive, we can note its liquidation, reorganization or lack of storage space.

The legislation defines the mandatory transfer to the archive of the documentation that the liquidated enterprise has.

The organization of the archiving process can be carried out either by the liquidated enterprise itself or by involving third-party companies.

Completion of a business requires the transfer of all documents of important legal and financial significance to the archive for the purpose of subsequent storage. The procedure for storing transferred archival documentation is determined by the Federal Law “On Archival Affairs. The responsibility for transferring files to the archive rests with both state-owned enterprises and organizations created on the basis of private financial investments.

The reason for the transfer of documentation is the possibility of a need to raise any document that occurs during the functioning of the liquidated enterprise.

The reason for this may be the loss of a work book by a former employee and his need to restore the information data that was recorded in it. Only by contacting the archive will an employee be able to obtain documents confirming the fact of his employment, calculation and payment of wages.

The need for access to information of a liquidated enterprise may also arise from its management team. The reason for this need may be the presence of controversial issues that have arisen regarding the repayment of accounts payable.

Accounting documentation relating to this issue, as well as payment of payments to tax authorities and extra-budgetary funds, must be transferred to the archive and stored there.

The process of submitting documents to the archive

The process of depositing into the archive is multi-stage, and the order in which the archive is transferred must be strictly observed (in other words, the alternation of stages). First of all, an examination of the practical and scientific value of the transferred documents is carried out, after which the selected cases are included in the so-called delivery inventory.

List of documents

The opinion that such an inventory can have an arbitrary form is deeply erroneous: its form is determined at the legislative level and must be strictly observed. There are also specific requirements for the cover form of a long-term storage case. They are contained in the relevant rules, which are called “Cover of long-term storage files. Types, sections, technical requirements." We must not forget that in case of improper execution of documents, the receiving party has grounds not to accept the documents for storage. The procedure for submitting documents to the archive also implies the creation of a scientific reference apparatus for the transferred archive.

What practice shows

So, we see that the procedure for transferring documents to the archive is very complex and requires taking into account many features. Practical experience shows that attempts by enterprise management to carry out relevant activities using their employees most often lead to significant losses of working time and are not always effective.

Basic steps

The liquidated enterprise is obliged to transfer its documents for archival storage.

Submission of enterprise documents to the archive during liquidation involves the preparation and transfer of the following documents:

- constituent documents (certificate of registration, as well as documentation on the creation of the company; its charter or regulations on it; liquidation documents; orders and other instructions on the basis of which the company was renamed, the form of business was changed);

- certificate establishing the fact of liquidation;

- the decision on the basis of which the liquidation was carried out;

- orders or other administrative documents within the framework of which employment, dismissal, transfer were carried out, official salaries were established, and leave was issued;

- employment contracts, contracts, agreements;

- personal cards established by the T-2 form, including cards issued for temporarily hired workers;

- personal files of dismissed persons, which contain their statements, autobiographies, orders, personal documents, etc.;

- personal accounts of employees or statements with accrual of remuneration for labor;

- decoding of codes by types of payroll and deductions made;

- unclaimed personal documents (originals);

- reports of accidents that occurred;

- staffing schedules;

- log books of work books and other documents relating to the employment of workers, remuneration for their work, benefits, changes in social and legal status;

- report cards and orders issued to employees employed in hazardous professions;

- a list of hazardous professions, a description of the technological process of such work (if available).

In addition to the above documentation, for transfer to the archive you will need an inventory of transferred cases in 3 copies on paper and electronically, as well as one historical certificate

How to prepare

Submission of documents to the archive during liquidation is the responsibility of the business entity. Non-governmental organizations can enter into an agreement to transfer their own documentation to the Federal Archive Service.

The absence of such an agreement gives the right to transfer for archival storage only those documents that relate to the personnel of employees.

The liquidation commission is obliged to determine the place of storage of other documentation. The procedure for transferring documentation for storage includes the registration of cases.

Each of them should be:

- correctly grouped;

- bound or stitched;

- numbered;

- have a certification sheet;

- have an internal inventory (if necessary);

- accompanied by the exact name of the organization, its registration index, the deadlines of the case and its title.

That part of the files that requires temporary storage (not exceeding 10 years) requires partial registration, which allows:

- do not organize documents;

- do not number the case sheets;

- do not issue a certification letter;

- do not bind.

Archival processing will be carried out correctly. This is required so that the documents transferred to the archive correspond to the case title, nomenclature, location, chronology and other characteristics.

The general archiving rule allows for 250 sheets in one archival file. If there are more sheets, the case is divided into several volumes, each of which is numbered.

The archival worker who prepares files for transfer checks the files according to the criteria of correct formation, execution, and their quantity. Detection of the absence of a case requires the preparation of an appropriate certificate.

Documents after liquidation

All documents for which storage periods have been established are subject to submission to the archives, and these deadlines have not expired. The following must be stored:

- personnel records: for labor accounting, for wages, for settlements with personnel (their storage period is 75 years for documents created before 2003, and 50 years for documents created after 2003;

- accounting (primary accounting documents, accounting policies, inventory cards, etc.; their shelf life is at least five years);

- constituent.

As we can see, documents after liquidation constitute a fairly voluminous mass, especially if the legal entity had a large staff of employees, carried out permanent activities and was liquidated according to the procedure provided for by law.

These regulations should be used as a guide when answering the question (when the liquidation of the enterprise has already been completed) what documents to prepare.

Documents are transferred to the archive during liquidation, as a rule, after receiving certificates from the Pension Fund of the Russian Federation and extra-budgetary funds confirming the deregistration of a legal entity. Before the stage of destroying seals and stamps, work with the archive takes place.

The legislation does not clearly answer the question of whether there is an obligation to transfer documentation for storage after the termination of the activities of an individual entrepreneur. On the one hand, when describing the procedure, the law refers only to organizations, and on the other hand, the individual entrepreneur is also obliged to store, for example, documents on personnel.

The final document of liquidation of an enterprise is a notice of exclusion of a legal entity from the Unified State Register of Legal Entities. It is issued after all documentation has been transferred for storage.

After the liquidation of the company, the persons responsible for this procedure (members of the liquidation commission, bankruptcy trustee or founder) must perform two main actions:

- Close the current account. The procedure involves submitting two documents to the bank: a client’s application and a certificate of exclusion of the organization from the Unified State Register of Legal Entities. After the current account is closed, the applicant, in accordance with Article 859 of the Civil Code of the Russian Federation, notifies the funds and the tax service within 7 days.

- Transfer documents to the archive for storage. This procedure is determined by Federal Law No. 125. In particular, what documents are subject to this transfer can be found out from Regulation No. 03-33/ps. The key is the method of closing the LLC.

In case of voluntary liquidation and bankruptcy, if the organization during the period of its activity entered into an agreement with the Archive Fund of the Russian Federation (example of agreement), all documents necessary for storage are transferred to the archive. In this case, the members of the LLC completely relieve themselves of the obligations associated with them. Otherwise, only documents with information about the company’s personnel are transferred to the archive.

During reorganization, the responsibility for storing documents is assumed by the newly formed company. If we are talking about division, then it will be an organization with a large authorized capital.

The contract also specifies the conditions for the destruction of documents upon expiration of the storage period, and stipulates the associated costs (sample contract). When transferring documents, a corresponding act of the following type is drawn up.

We invite you to read: How to invalidate a car purchase and sale agreement

According to the law, there are three types of documents related to the activities of the organization:

- Documents of permanent storage.

- Long-term storage documents. They contain information on employees of the liquidated organization and must remain untouched for 75 years.

- Temporary storage documents. Their term is no more than 10 years.

The first group includes documents containing information about the receipt of profit and entrepreneurial activities of the LLC. They are transferred to the Archive in processed form. These include:

- Orders related to the activities of the company, a journal of their registration.

- LLC structure, work schedule.

- Documents on pricing.

- Acts of destruction of documents.

- Internal accounting of the organization: reports, declarations, etc.

- Agreements for the provision of services, performance of work, and transactions.

- Charter

1. Personnel files in three copies on paper and one electronic version.

These documents include:

- Orders on dismissal, hiring and transfer of employees of the organization.

- Personal files for each employee, document form T2.

- Employment contracts, labor record books.

- Document on wages, schedule, overtime and other staffing issues.

- Statements of receipt of payment by employees and their income.

- Acts on accidents and injuries sustained at work.

2. Historical information.

There are certain rules for preparing historical information. It allows the use of only direct word order in a sentence (to avoid ambiguity in interpretation); its design is carried out on the title page of the organization, if available.

The historical information must reflect the following information:

- Name, legal address and contact details of the LLC.

- Date of creation of the organization, numbers of documents and resolutions or deeds of transfer that accompanied the opening (purchase) of the LLC.

- Structural changes that took place during business activities, with reference to documents.

- List of all management members and founders of the company. Dates of their employment or ownership of shares, numbers of orders for enrollment, dismissal, entry and exit from the LLC.

- Clauses of the charter that speak about the type of activity of the organization, the purposes of its creation, and mission.

- Structural organization of a limited liability company: number of employees, subordination among different departments.

- Current account number, availability of loans, debts.

- Full name of the person responsible for conducting business, status of documents. Numbers of the order on his appointment to the position, job description.

This group includes:

- Orders on business trips, vacations, time off, administrative and overtime work.

- Documents with information on the purchase of materials for the needs of the organization.

- Acceptance certificates for completed work.

- Other documents that do not contain essential, important information.

If you need to use the information contained in the documents transferred for storage, you can contact the Archives or their representative offices. Legal certificates are issued upon request. It is also possible to obtain copies of resolutions, orders and regulations of the liquidated organization.

After completing the entire liquidation operation, the organization is obliged to submit information about its employees: documents on personnel, including personal cards, personal accounts of all employees, calculations for the calculation and payment of wages, etc., and to the city archive.

The delivery of documents for storage to the state archive during the liquidation of non-governmental organizations, as well as as a result of bankruptcy, is the main activity of our company. The extensive experience of our company’s archivists, including thanks to established contacts in departmental and municipal archives, allows us to deposit documents in the archive promptly and on conditions favorable to our clients!

The cost of submitting documents of a liquidated organization to the state archive upon liquidation of an organization is calculated based on the period of existence of the organization, the number of employees, the level of staff turnover at the liquidated enterprise, and the scope of activity of the liquidated organization.

According to the agreement with the Central State Technical University of Moscow, the cost of accepting for storage documents on personnel from liquidated non-governmental organizations is 310 rubles per 1 item. storage (1 case).

Specialist in submitting documents to the archive: Ivan Vladimirovich Penkovoy, tel., 8-926-604-22-08

Special conditions for bankruptcy trustees, call!

1. Call us to determine the cost of services for submitting documents to the archive.

2. Conclude an agreement with us for the delivery of documents to the archive.

3. Determine the start date and time of work.

1. Agreement for the provision of work on archival processing and delivery of documents for state storage in the archive.

2. Agreement with the state archive on the acceptance and transfer of documents for state storage.

3. Act on the acceptance and transfer of documents to the archive for state storage (the act is issued by the state archive that accepted the documents for storage).

4. A document confirming payment of the state fee for accepting documents for storage.

5. Certificate of completed work.

1. Constituent documents (certificate of registration or documents of creation, charter or regulations, document of liquidation, orders and / or instructions on creation, renaming, documents of liquidation); 2. Signature of the organization’s leaders or the chairman of the liquidation commission; 3. Certificate of liquidation of the organization; 4.

The organization's decision to liquidate; 5. Orders and/or instructions on hiring, dismissal, transfer, setting official salaries, vacations (if the enterprise used professions in hazardous work). 6. Employment contracts, contracts, agreements, work contracts. 7. Personal cards of the T-2 form (including temporary workers). 8.

Personal files of dismissed persons (applications, autobiographies, copies of orders and extracts from them, copies of personal documents, characteristics, personnel records sheets, questionnaires, etc.). 9. Personal accounts of employees or payroll statements. Note: in the absence of personal accounts - statements for the issuance of wages, documents for the issuance of benefits, fees, financial assistance and other payments. 10.

Decoding codes for types of payroll and deductions (when calculating codes on payslips); 11. Unclaimed personal documents (work books, diplomas, education certificates, etc.). 12. Acts on accidents. 13. Staffing schedules. 14. Journals of the movement of work books, lists of personnel, alphabetical books, other documents confirming work experience, remuneration, education, property and preferential rights, changes in position and social and legal status of citizens. 15.

Agreement with the fund

Owners of companies who transfer documents for archival storage continue to remain the owners of this documentation. Violation of storage rules by employees of the institution may become the basis for the transfer of the most important documents to the storage of the owner. This procedure is carried out exclusively within the framework of legal proceedings.

The rights arising during the storage process can be exercised through an agreement concluded with the relevant archival institution belonging to the federal structure of archives.

The main provisions of such an agreement are the period and procedure for carrying out actions to store the transferred documentation. The archival institution and the liquidated enterprise must necessarily enter into an agreement on the storage of documents relating to personnel. The liquidation commission will act as the customer for the storage service.

You can also send documentation to a private archive for storage. This will also require the conclusion of a storage agreement. As a rule, the terms of such an agreement provide for the owner’s obligation to prepare documents and destroy them at the end of the storage period at his own expense.

The procedure for paying for the services of an archival institution is determined by the liquidator even before the transfer of documents. The funds required for this purpose are established in a separate expense item of the liquidation balance sheet.

The stages of liquidation of an enterprise are discussed in detail in the article.

Deadline for submitting documents to the archives of liquidated companies

The work of the liquidation commission ends with the entry of the closure of the company into the Unified State Register of Legal Entities. Since this body is responsible for transferring all necessary papers to archivists for storage, in practice the procedure is carried out before the actual liquidation of the enterprise. Although the law of the Russian Federation does not establish specific deadlines within which the state archive must accept documents for storage. In practice, the transfer process can take from two to six months from the moment the documents are submitted for streamlining.

Subsequent details

Drawing up an internal inventory of cases is an optional procedure. An exception is the inventory of personal files.

Each individual case must have a blank sheet at the beginning, and at the end a witness drawn up in a generally accepted form.

This sheet must contain a numerical value of the number of sheets in the case that are numbered. This number must also be indicated in words. It reflects missing and lettered numbers.

The certification cannot be made on the reverse side of the last document or on the cover of the case.

An examination of the value of the transferred documents and their organization was carried out, which allows us to draw up an inventory of cases that require permanent storage, prepare an inventory of personnel files that are stored for 75 years, an inventory of cases subject to temporary storage and an act on the formation of cases for destruction.

The expert verification commission reviews the inventory of cases and the act of upcoming destruction, coordinates and approves them.

Recycling is documented with acceptance notes containing information about the date of the procedure and the weight of the papers.

Responsibility for storing documents during liquidation

Documents that are created in the process of entrepreneurship accumulate. Even if they have already been executed and cannot affect the future activities of the company, they must be stored. Some records are retained for a long period of time, while others are retained for a short period of time.

Among the main cases of transferring company documents to the archive, we can note its liquidation, reorganization or lack of storage space.

The legislation defines the mandatory transfer to the archive of the documentation that the liquidated enterprise has.

The organization of the archiving process can be carried out either by the liquidated enterprise itself or by involving third-party companies.