Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 05/22/2020

Reading time: 6 min

0

118

Based on the Civil Code, upon liquidation of a company, it completely ceases its activities without succession. Therefore, the employer is obliged to first dismiss all employees and pay them the money they earned.

- What payments are due to an employee upon liquidation of an enterprise and the procedure for receiving them

- Are there any special conditions for calculating payments?

- Deadlines

- What to do if you are in arrears

- How to collect wage arrears

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

The procedure for liquidating an organization, dismissing employees

In modern times, the economic situation is unstable, so many organizations, for one reason or another, are forced to cease their activities and fire employees. Legal entities cannot continue their activities if there are no credit resources and its partners do not pay owed funds. Therefore, the founders decide to liquidate the organization. If the enterprise is liquidated, then labor relations with employees will also be terminated.

In accordance with Part 1 of Art. 81 of the Labor Code of the Russian Federation, the basis for termination of employment contracts at the initiative of the employer is the liquidation of the organization.

When terminating employment contracts, enterprises are obliged not to violate the rights of employees, to correctly draw up documents for dismissal and to make all payments upon liquidation in the form of compensation, benefits, wages, observing the order established by law.

When the participants decide to liquidate the organization and stop this business, a liquidation commission is formed. It is to her that the powers to manage the enterprise are transferred, including the dismissal of employees. According to Part 6 of Art. 22 of the Federal Law “On State Registration of Legal Entities and Individual Entrepreneurs”, the enterprise will be liquidated when an entry is made in the Unified State Register of Legal Entities.

One point should be noted. If liquidation does not occur, then all dismissed employees can be reinstated to their previous jobs by court decision. That is, on the basis of Part 1 of Art. 81 of the Labor Code of the Russian Federation, the dismissal of personnel is lawful if only the participants of the liquidated legal entity actually made a decision to terminate its activities without succession to third parties.

Liquidation should not be confused with a change in the jurisdiction of an organization, reorganization and a change in the owner of its property.

The liquidated enterprise has no legal successors, so all employees must be fired, including pregnant women, single mothers, minors, employees with children under three years of age, and also employees who took sick leave or vacation.

Absolutely all legal entities that no longer operate are required to comply with the sequence and timing of activities related to the termination of employment contracts. This helps to avoid conflicts with some employees, material costs in the form of legal fees, etc.

Paperwork

When an enterprise is liquidated on the basis of a dismissal order, an entry is made in the work book of each employee. It must contain a reference to legislation, namely clause 1, article 81 of the Labor Code.

The work book must be issued on the employee’s last day of work, or within 24 hours after he applies for it.

Also, on the last working day, the employee must receive a copy of the dismissal order. Upon request, any personnel documents (for example, a salary certificate or information about insurance contributions) must be issued.

The employer's procedure for liquidation in relation to employees

The following notification procedure is provided: first, the employment service is informed about the liquidation of the organization, then the trade union and, finally, the workers themselves.

No later than two months before liquidation, the employer is obliged to notify the employment service in writing. The notification must indicate the position, profession, specialty, qualification requirements for workers and employees, and their remuneration.

If it is determined that the decision to liquidate will contribute to mass layoffs, then notice must be provided no later than three months. In accordance with Art. 82 of the Labor Code of the Russian Federation, the criteria for such dismissal are defined in territorial and industry agreements. If there are no such agreements, then the rules contained in the Regulations on the organization of work to promote employment in conditions of mass release are taken as a basis. This provision provides notification forms that are used in the event of mass layoffs.

In accordance with Article 19.7 of the Code of Administrative Offenses of the Russian Federation, the employer is held administratively liable for late submission or failure to provide information. The fine for officials ranges from 300 to 500 rubles, for an organization – from 3,000 to 5,000 rubles.

Article 82 of the Labor Code of the Russian Federation, which provides for the mandatory participation of the trade union in the consideration of issues related to the termination of employment contracts at the initiative of the employer, does not provide for cases of dismissal due to the liquidation of the organization. At the same time, the dismissal of employees is carried out after prior written notification (at least 3 months in advance) of the elected trade union body. The notification procedure is established by labor legislation.

So, the trade union body must be informed in writing about the mass dismissal of workers during the liquidation of a legal entity three months before the dismissal.

The notification can be drawn up in any form. A notification of the same form can be sent to the employment authority.

Notification to employees

Employees are notified of dismissal due to liquidation of the organization at least two months in advance, against signature and indicating the date of familiarization. Employees working under employment contracts that are concluded for up to two months are notified at least three calendar days in advance. For workers who are engaged in seasonal work - no less than seven days.

If a bankruptcy procedure has been introduced against an organization, the bankruptcy trustee informs the employees of the dismissal. Notification is made no later than one month from the date of commencement of bankruptcy proceedings.

Also in accordance with Art. 180 of the Labor Code of the Russian Federation, an employer may terminate an employment contract with the written consent of the employee before the expiration of two months. In this case, additional compensation is paid equal to the amount of average earnings.

The notification to employees is drawn up in any form, but in two copies. One is given to the employee, and the other, where he signed, remains in the organization.

The employee has the right not to sign the notice. In this case, a corresponding act is drawn up, which records the transmission of the notification and the date. This document is also drawn up in any form in the presence of two or more witnesses and sealed with their signatures.

Witnesses can be members of the liquidation commission and any other employees of the legal entity.

If the employee is on a business trip, he must be recalled from there and given a notice against signature.

Orders to terminate employment contracts with employees are issued after the expiration of a two-month period. The employer must familiarize each dismissed employee with them against signature. In case of refusal or impossibility of familiarization, appropriate notes are made.

Next, entries about the termination of the employment contract are made in the employees’ work books in strict accordance with the wording of the Labor Code of the Russian Federation with reference to the articles.

The employee is paid all compensation upon liquidation of the organization established by law, and is given a completed work book on the day of dismissal.

Severance pay upon liquidation of an organization

In connection with the termination of the employment contract, the employer must provide the employee with the following payments:

- wages for the time worked in the month of dismissal;

- compensation for unused vacation for all previous years without any limitation;

- additional compensation for early termination of an employment contract. Compensation is equal to average earnings. It is calculated in proportion to the time remaining before the expiration of the notice period for dismissal due to the liquidation of the organization;

- severance pay equal to the average monthly salary. On a general basis, severance pay is paid to part-time workers;

- average earnings during employment, when no more than two months have passed since the date of dismissal (taking into account the severance pay paid);

- If the employee provides a certificate from the employment authority, then the average salary for the third month from the date of dismissal is paid. Such a certificate is issued to an employee if he applied to this body within two weeks from the date of dismissal and was not employed by him.

When dismissing an employee with whom an employment contract has been concluded for up to two months, severance pay is not paid. A seasonal worker is entitled to severance pay equal to two weeks' average earnings.

Payment of compensation for unused vacations

According to Art. 127 of the Labor Code of the Russian Federation, in addition to the salary for the time worked in the month of dismissal, the employee is also paid monetary compensation for unused vacations. The amount of this compensation is calculated as follows. The calculated average earnings for one day are multiplied by the number of days of vacation that were not used.

In accordance with Art. 115 of the Labor Code of the Russian Federation, the duration of annual paid leave is 28 calendar days. That is, if an employee has worked for a whole year without vacation, then the employer pays him compensation for all 28 days.

If the working year has not been fully worked out, then vacation days should be calculated in proportion to the months worked.

Upon liquidation of a legal entity, full compensation for unused vacation is paid only to those employees who worked at least five and a half months in the working year.

The organization has the right to round the number of calendar days of payment of this compensation in favor of the employee.

Article 238 of the Tax Code of the Russian Federation provides that payment for unused vacation is not included in the tax base for calculating contributions to compulsory pension insurance and the unified social tax base. Contributions for compulsory insurance against occupational diseases and accidents at work are not charged for this payment.

The employer withholds personal income tax from the compensation amount.

Severance pay and average salary for the period of employment

Severance pay is payment for the first month after dismissal. Its payment is made to all dismissed employees, without taking into account the fact whether they found a new job or not.

The average salary is also paid for the second month of non-employment of the employee. Payment is made by the employer on the basis of a written application from the employee and upon presentation of his work book, which does not contain a record of hiring a new job.

If suddenly an employee gets a new job during the second month after dismissal, then he is also entitled to payments for the days of the second month when he was not employed anywhere.

In addition, the law provides for the payment of average earnings for the third month of non-employment of the employee. This is possible with the permission of the employment center and upon presentation of the work book (original).

Such a permit is issued if the former employee, within 14 calendar days after dismissal, registered with the employment center at his place of residence and was not employed by him.

To register at the employment center, the following documents are required:

- passport;

- education document;

- employment history;

- certificate of salary for the last three months. It is issued by the former employer and is needed to establish unemployment benefits.

A dismissed employee can apply for payment of the average salary at any time, unless the organization is expelled from the Unified State Register of Legal Entities due to its liquidation. The payment period is not defined by law, but usually it is made immediately after the application or on the day the salary is issued.

Article 236 of the Labor Code of the Russian Federation provides for financial liability for delay in payment of the amount due to the employee. An employer who fails to pay the employee the specified amount on time is obliged to pay it back with interest. The interest rate is calculated using the refinancing rate of the Bank of Russia.

Maternity benefits

If an employee expecting a child is fired during the liquidation period and is far from going on vacation, then such a woman is entitled to standard payments from the employer. This will require mandatory registration of the pregnant woman at the Employment Center. Other benefits are issued on the basis of an application at the Social Protection Center at the place of registration.

If a woman goes on maternity leave during the liquidation period, the employer will pay her part of the funds. This will be standard severance pay and compensation for 3 months. Next, such a woman will need to submit an application for continued maternity payments to the local branch of the Social Insurance Fund.

She needs to submit the following package of documents:

- General passport.

- Certificate from the antenatal clinic.

- Work record book (an additional copy is required).

- Birth certificate of the child, if he has already been born.

- Certificate of non-receipt of compensation (provided by the Employment Center).

- Bank details for transferring funds.

To protect the interests of citizens in the event of liquidation of the company for which they worked, an entire system of providing payments has been developed. In particular, severance pay. Failure to comply with its norms entails punishment for those responsible.

about the author

Valery Isaev

Valery Isaev graduated from the Moscow State Law Institute. Over the years of work in the legal profession, he has conducted many successful civil and criminal cases in courts of various jurisdictions. Extensive experience in legal assistance to citizens in various fields.

Calculation of compensation for dismissal during liquidation of an organization

The calculation of the average salary for the period of employment and severance pay is made in accordance with Art. 139 of the Labor Code of the Russian Federation and the Regulations on the specifics of the procedure for calculating average wages, approved by the Government of the Russian Federation No. 922 of December 24, 2007.

The calculation of the average salary includes all payments that are provided for by the remuneration system and are applied by a particular employer, regardless of their sources.

In any work mode, average earnings are calculated based on the accrued salary and time worked for the 12 months preceding the month of dismissal. This is called the billing period.

In accordance with Art. 139 of the Labor Code of the Russian Federation, a calendar month is the period from the 1st to the 30th or 31st day of the corresponding month, inclusive.

If the employment contract is terminated on the last day of the month, then this month is included in the calculation period. If the dismissal occurred on another day of the month, then the calculation period includes 12 calendar months before the month in which the employee was dismissed.

The employer has the right to terminate employment contracts before the expiration of a two-month period. In this case, the organization is obliged to make settlements with employees, pay severance pay, average earnings and additional compensation.

Based on Art. 255 of the Tax Code of the Russian Federation, the taxpayer has the right to take into account the amounts of all payments provided for upon dismissal of employees in labor costs when calculating income tax.

These payments are not taxed:

- unified social tax;

- personal income tax;

- insurance premiums against occupational diseases and accidents;

- contributions to pension insurance.

Payment calculation algorithm

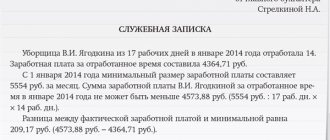

Based on Regulation No. 922, payments are calculated in the following way:

- Calculation of severance pay: VP=RD*SDZvp.

- Calculation of average salary: SDZvp=ZP/OD.

Where:

- SDZvp – average daily earnings for calculating severance pay;

- Salary – wages for days actually worked, including bonuses and rewards;

- OD – number of days worked;

- RD – the number of working days in a period of time that the organization must pay.

When calculating severance pay, weekends and holidays are not paid. Only working days are subject to payment.

After calculating severance pay, you need to determine what taxes and fees need to be calculated. If the employer makes all payments within the framework of labor legislation, then insurance premiums are not charged.

If a legal entity pays severance pay on its own initiative or is calculated at an increased rate, then insurance premiums are charged on the amount of the payment or on the excess amount.