05/20/2019 liquidation, tax, reporting, Pension Fund of Russia, deregistration, TRADE, Federal Tax Service

From the moment the sole owner or co-founders make a decision to liquidate the enterprise, the appointed liquidator or the commission created by them starts the liquidation process. Liquidation of an LLC provides for the obligation of the enterprise to repay all its debts to counterparties through available financial resources or by dividing property.

A business entity is abolished in two ways:

- voluntarily based on the decision of the co-founders;

- forced by a court decision.

These are legal methods of liquidating an enterprise, as a result of which a legal entity finally ceases conducting business activities, that is, its rights and obligations are not transferred to third parties, as in the case of alternative options for the abolition of legal entities (reorganization, resale through a change of general director). The Liquidation Commission, created upon the decision to terminate the economic activities of the enterprise, is responsible for the entire liquidation process, including the distribution of LLC property.

Property to be distributed

the formation of an authorized capital for each LLC and the distribution of shares between participants in proportion to the contribution of each of them to this fund. In addition, the company may acquire additional property in the course of its activities. Based on the above, it can be noted that in the event of liquidation, the following property of the company should be distributed

- tangible assets - buildings, structures, equipment, supplies, materials;

- intangible assets - shares, copyrights, art, deposits;

- the company's profit in monetary terms, credited to the company's current account or cash register.

The shares of the participants are not distributed, since they are exclusively under their control. The distribution of the LLC's property is carried out in turn among all persons who filed claims within a month after the official notification of the LLC's liquidation.

Attention, promotion! Get a free consultation right now by calling our hotlines!

- For Moscow and Moscow region:

The fate of the organization’s material assets during liquidation

Issues related to the division of company property between the founders and the liquidation procedure of the enterprise are regulated in accordance with the norms of the following legislative acts:

- Civil Code, section 4, art. 92 – regulation of the procedure for reorganization and liquidation of the company; paragraph 2 of section 4 of the Civil Code of the Russian Federation - provisions on partnerships, including limited liability companies.

- Federal Law No. 14-FZ of February 8, 1998 (hereinafter referred to as Law 14-FZ), Art. 57, 58 – liquidation of the LLC and division of the company’s property between its members.

The norms of the above legislative acts can be specified in the charter of the enterprise (statutory documents), which will also be used to resolve the issue of division of property between members of the company.

According to Art. 58 of Law 14-FZ, the founders can begin the process of distributing shares after satisfying the claims of creditors. This procedure is carried out during the period established for filing claims.

The liquidation of an organization is associated with the cessation of the operation of the enterprise, which means that the participants have the right to receive their share, which was invested when the company was formed. Also, a member of the organization has the right to receive more than the initial contribution if, during its existence, the organization has succeeded in its activities and replenished its assets.

The procedure for distributing property between members of the enterprise is carried out in a clear sequence. There are two key rules for separating assets :

- The first payments are made from the organization's income that has not yet been distributed among the participants.

- Next, the residues are divided. In this case, the proportions corresponding to the size of the share in the authorized capital are taken into account.

The distribution of shares is made after an independent assessment of the value of the company's property. The liquidation procedure is often accompanied by a tax audit and is always associated with the payment of taxes.

Possibility and procedure for distribution of property

As an analysis of the provisions of Article 63 of the Civil Code of the Russian Federation shows, the possibility of dividing property after the liquidation of a legal entity between participants and the procedure for its implementation depend on 2 main factors:

- method of liquidation of the organization;

- its organizational form.

Speaking about methods of liquidation, it is important to emphasize that Article 63 of the Civil Code describes the procedure for voluntary termination of a company’s activities, while in practice forced termination is also possible - within the framework of bankruptcy or by court decision, as well as in the case when the organization does not actually conduct business activities, according to the provisions Article 64.2 of the Civil Code of the Russian Federation.

Bankruptcy

If insufficient property is discovered during liquidation, the liquidation commission, by virtue of paragraph 4 of Article 63 of the Civil Code, is obliged to apply to the court to declare the organization bankrupt. Moreover, according to Article 3 of the Law “On Insolvency...” dated October 26, 2002 No. 127-FZ, an operating organization can also be declared bankrupt by claims of creditors, employees or tax authorities if it is unable to repay the debt within 3 months. This allows us to conclude that the fact that there is insufficient property to pay off accounts payable already indicates the absence of property that can be distributed among its participants.

Forced liquidation by court decision

In case of liquidation of a company on the basis of a court decision (in the absence of a license, violations during registration, conduct of illegal activities and on other grounds specified in paragraph 3 of Article 61 of the Civil Code), the court, in view of the provisions of paragraph 5 of Article 61 of the Civil Code, obliges the founders to fulfill the requirements provided for in Article 63 Civil Code procedures provided for voluntary liquidation. In this situation, the distribution of the property remaining after liquidation will be carried out in accordance with the general procedure, in accordance with paragraph 8 of Article 63 of the Civil Code.

If the founders evade the liquidation procedure, then the court appoints an arbitration manager to liquidate the company, who will act according to the general rules of Article 63 of the Civil Code of the Russian Federation. If there is insufficient property to pay for the manager’s services and finance other expenses related to the liquidation, the difference, by virtue of paragraph 5 of Article 61 of the Civil Code, is subject to recovery from the company’s participants.

Briefly about liquidation

The procedure algorithm is fixed in Art. 63 Civil Code of the Russian Federation. Closing a company takes place in several stages:

- Participants must decide to liquidate the LLC, notify the government agency and appoint members of the LC.

- The LC or liquidator must identify all obligations to creditors, inform them about the termination of activities, and also send a message to the media for publication. Next, it calculates the interim liquidation balance.

- Settlements are made with creditors and a liquidation balance sheet is drawn up.

- If a company or enterprise has property left, it must be distributed among the former founders of the legal entity.

The company will be considered liquidated after information about the termination of its existence is entered into the Unified State Register of Legal Entities.

The Supreme Court told what to do with the property of the company after its liquidation by the tax authority

If third parties do not declare their claims to the property, then the founder has the right to demand recognition of the ownership of this property for himself.

The company received a loan from the company. The fulfillment of obligations under the loan agreement was secured by the pledge of real estate. Later, the tax office excluded the company from the Unified State Register of Legal Entities as inactive. And two months later the society also ceased its activities.

The sole founder of the company asked to remove the encumbrance on the real estate. Rosreestr refused because he was not a mortgagor. The founder appealed to the court with a demand to recognize the ownership of the property as his own.

How to return money if the debtor has been excluded from the Unified State Register of Legal EntitiesNew rules

The first instance sided with the plaintiff. The court indicated that the founder owns 100% of the share in the company, therefore, from the moment of making an entry about the termination of the company’s activities, he is the owner of the property that belonged to him. The appeal considered otherwise. The founder did not indicate on what basis, after the company was excluded from the Unified State Register of Legal Entities, he acquired ownership of the property. The fact of exclusion of a company from the Unified State Register of Legal Entities is not provided for by the Civil Code of the Russian Federation as a basis for the founder’s right of ownership to the property of a legal entity.

The Supreme Court sent the dispute back for reconsideration on appeal. The court explained that, according to paragraph 7 of Art. 63 of the Civil Code of the Russian Federation as amended, which was in force at the time of termination of the company’s activities, after liquidation and settlements with creditors, the remaining property is transferred to the founders. However, in this case, the company was liquidated by decision of the Federal Tax Service, and not by the founder. In this connection, the plaintiff was deprived of the opportunity to assert his rights. In this case, filing a claim for recognition of property rights remains the only way to obtain it. In addition, the creditor (company) also ceased its activities and the statute of limitations for filing claims of interested parties against the company has expired. This confirms that there are no legal claims of third parties to the company’s property.

Source: determination of the RF Armed Forces dated July 18, 2017 No. 78-KG 17-46

Property upon liquidation of LLC

In particular, special attention is paid to the following nuances:

- All property is subject to distribution if the legal entity has no obligations to creditors. In this case, compliance with two basic conditions is mandatory. Firstly, the period for receiving claims from creditors is two months. The period must be counted from the date of publication of the liquidation record in the Bulletin. Secondly, the compiled interim liquidation balance sheet must reflect all settlements with creditors.

- Only the part of the property remaining after full settlement of debts will be distributed. The remaining funds must be entered into the liquidation balance sheet.

- The property is not distributed or transferred to the company's participants, since it is not available after settlements with creditors.

Distribution of property upon liquidation of LLC

Sending the liquidation balance sheet to the tax authority and making an entry in the Unified State Register of Legal Entities is the final stage of liquidation and allows us to proceed to the procedure for distributing the remaining property between its participants.

Distribution of property between the participants of the LLC The remaining property of the company, according to the liquidation balance sheet, must be distributed among its participants in accordance with Article 58 of the already mentioned Federal Law No. 14.

If the company has 1 participant, then all remaining property is transferred to him individually.

Distribution of LLC property during liquidation

Liquidation balance There are two types of liquidation balance: unprofitable or profitable.

A balance sheet is considered unprofitable when the organization’s debts are covered from the authorized capital.

The balance sheet must contain: assets, liabilities, cash, non-current assets, retained earnings and authorized capital. How to calculate the proportionate share of the property of an LLC participant Shares purchased by the LLC are not subject to distribution upon liquidation.

An LLC participant can count on receiving a portion of the property in the amount of the nominal value of his share (as a percentage or fraction) in the authorized capital of the organization.

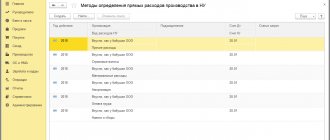

Taxation on property received during the liquidation of an LLC The procedure for taxation on profits received during the liquidation of an LLC is determined by Art. 277 of the Tax Code of the Russian Federation.

How to transfer property to the founder during liquidation of an LLC?

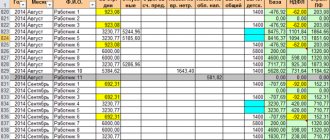

Work of the accounting department The entire process of distribution of property within the framework of the liquidation of an LLC is carried out strictly through the accounting department, since we are talking about the material interests of the participants and the liquidated Company itself.

Fulfilling the company’s material obligations involves calculating tax payments and completing the necessary documents.

Taxation Since, when distributing property, the question arises of transferring to participants their shares in profits, the question arises of how taxes such as VAT and personal income tax apply to this amount.

Value added tax (VAT) is not imposed on the shares of profit of participants if they turn out to be less than their initial contribution to the authorized capital. The tax rate is 18%.

How is property distributed upon liquidation of an LLC?

The Civil Code of the Russian Federation states that the liquidation commission (or liquidator) must independently determine the timing and procedure for the liquidation process of an LLC, including such responsibilities of the organization as the division of property. The liquidation commission is the authorized representative of the organization on any legal issues, for example, representation in court.

- A complete inventory of property owned by the organization.

- Draw up a report on the availability and condition of the enterprise’s assets. Record in the documentation the quantity, liquidity and other qualitative characteristics of assets.

- Collect information on the size of the company's accounts payable and draw up a repayment plan based on the principle of consistency. Those.

Transfer of real estate to a single participant upon liquidation of an LLC

Algorithm for distribution of LLC property during liquidation The civil legislation of the Russian Federation strictly defines the order of repayment of the obligations of a liquidated LLC to its creditors - individuals and legal entities to whom, due to certain circumstances, the Company found itself in debt.

These include:

- employees of the company who have an employment contract with it;

- partners who have entered into business agreements with the Company;

- state budget and other funds;

- founders and investors of the company.

It is worth noting that only those assets that belong directly to the LLC are included in the distribution. Liability does not extend to the property of the founders, since all participants who created the LLC risk only within the limits of their contribution.

How is property distributed during the liquidation of an LLC?

Society on the right of ownership.

- Creditors of the LLC must assert their claims to the company's property within 3 months from the date of sending the notifications.

- The liquidation commission includes all creditors of the company who reported their claims on time in the list of persons among whom the property of the LLC will be divided.

- If creditors did not manage to declare their claims on time, then the company will pay them on a residual basis: after the claims of other parties are satisfied and only if the Company has funds remaining before that time.

- It should be noted that during the liquidation process, an LLC distributes its property not only between banks and partners - this extensive list also includes company employees, government agencies, and persons who suffered damage during the company’s activities.

Source: https://rusblank.ru/imushhestvo-pri-likvidatsii-ooo/

How is the distribution of LLC profits determined?

The founder can refuse to participate in the activities of the LLC on his own initiative by sending an application addressed to the head of the company. The procedure for leaving an LLC on your own initiative.

Before drawing it up, the founder carefully considers his actions, because after transferring the appeal, all powers of the company manager are removed from the applicant.

This procedure must be provided for by the company's Charter. If a participant has outstanding obligations, then the necessary amounts must be paid before writing a letter of resignation from the founders.

Further actions related to document management are assigned to the current administration of the company.

This option is more common in the practical activities of Russian companies, but there are other reasons for leaving an LLC:

- death of the founder - the share passes to the legal heirs of the first priority (children, spouses, parents) or to the persons specified in the will;

- coercion by judicial authorities - co-owners (share of the authorized capital of more than 10%) have the right to submit a petition for the exclusion of a participant through the court.

The reasons for the members of the company to go to court may be the inaction of the founder, failure to achieve the set goals and unprofitability of the enterprise, the occurrence of severe economic consequences as a result of signing an unfavorable contract, or seizure of the property of the enterprise.

To recognize the validity of the participants’ demands for the withdrawal of one of them from the LLC, it is necessary to provide a complete evidence base confirming the need for a positive verdict.

If guilty, the defendant bears all the costs of the proceedings and may be denied compensation for his share.

If the LLC includes only 1 participant or all participants decided to leave the company at the same time, then this method is not allowed.

To break the relationship, a decision is made to liquidate the enterprise or sell the share to third parties.

In each permissible option for a participant to withdraw from the LLC membership, all changes in the composition of the founders are formalized after an extraordinary meeting of the founders, and a protocol is drawn up.

How to divide property - main stages

Key points regarding the transfer of property are discussed in the Civil Code of the Russian Federation (Article 62, part three). As soon as the decision to liquidate a legal entity is made, a commission is formed whose task is to conduct the liquidation procedure. In parallel with this, members of the commission participate in the process of distributing property among the current participants of the company.

The main attention is paid to the current debt of the LLC. If the company was active in the market and worked in various directions, the presence of debts is quite possible. This is why the first step in the process of winding up a company is to pay them off. Only after the debt is covered is it possible to transfer the property to the founder or divide it between the participants.

During the liquidation process, it is not immediately possible to identify existing creditors. To do this, an advertisement is placed in the State Registration Bulletin, after which you must wait for 60 days. During this period, creditors must appear and put forward claims against the LLC, which is in the process of liquidation. Once the allocated two months have passed, the commission prepares a balance sheet and adds a number of data to it, namely:

- Composition of the liquidated enterprise.

- List of demands made by creditors.

- Results according to the requirements.

- Court decisions on the satisfaction of creditors' applications.

Once the LLC's debts are paid off, the remaining property can be transferred to the founders. Below we will look at how to do it correctly.

The fate of the organization’s material assets during liquidation

Issues related to the division of company property between the founders and the liquidation procedure of the enterprise are regulated in accordance with the norms of the following legislative acts:

- Civil Code, section 4, art. 92 – regulation of the procedure for reorganization and liquidation of the company; paragraph 2 of section 4 of the Civil Code of the Russian Federation - provisions on partnerships, including limited liability companies.

- Federal Law No. 14-FZ of February 8, 1998 (hereinafter referred to as Law 14-FZ), Art. 57, 58 – liquidation of the LLC and division of the company’s property between its members.

The norms of the above legislative acts can be specified in the charter of the enterprise (statutory documents), which will also be used to resolve the issue of division of property between members of the company.

The liquidation of an organization is associated with the cessation of the operation of the enterprise, which means that the participants have the right to receive their share, which was invested when the company was formed. Also, a member of the organization has the right to receive more than the initial contribution if, during its existence, the organization has succeeded in its activities and replenished its assets.

The procedure for distributing property between members of the enterprise is carried out in a clear sequence. There are two key rules for separating assets :

- The first payments are made from the organization's income that has not yet been distributed among the participants.

- Next, the residues are divided. In this case, the proportions corresponding to the size of the share in the authorized capital are taken into account.

The distribution of shares is made after an independent assessment of the value of the company's property. The liquidation procedure is often accompanied by a tax audit and is always associated with the payment of taxes.