The benefit assigned in connection with pregnancy and upcoming childbirth is included in the group of payments made through the employer by the Social Insurance Fund. In regions where it is implemented pilot project in 2020, FSS directly transfers funds to maternity leavers. And in the constituent entities of the Russian Federation, where there is a scheme for paying social benefits by employers, reimbursement of the Social Insurance Fund for pregnancy and childbirth and for sick leave is practiced. Let's look at how this happens in 2020.

Also see:

- Application form for compensation from the Social Insurance Fund

- Sample application for reimbursement of hospital benefits from the Social Insurance Fund

How long does it take for the Social Insurance Fund to compensate the employer for maternity benefits?

Amounts due to employees in connection with the birth of children and their care are processed through the employer. Women receive payments in connection with registration in the early stages of pregnancy and maternity benefits.

The program for indexing social payments in favor of the population is being implemented at the federal, regional and local levels. Therefore, the amount of benefits may change every year and even more often - by half-year or quarter.

At the same time, there is a situation where the company itself refuses to pay the employee adequate funds during maternity leave.

Also, women who did not give birth to a child themselves, but are adopting one, can apply for paid leave under the BiR.

Thus, in general, maternity leave and payment of insurance are not a financial blow to the organization. If your boss for some reason tries to avoid paying you benefits, you need to find out the reason or simply contact the guardianship authorities. There are often cases when unscrupulous organizations try to appropriate your financial assistance illegally.

As a general rule, child care benefits for children up to 1.5 years old are calculated once, namely on the start date of parental leave. Therefore, if the benefit was assigned in 2020, then you should not recalculate the benefit for those months of vacation that fall in 2020. In 2020, you must pay monthly the amount of benefits that was calculated in 2020.

The procedure for calculating benefits for mothers with children and pregnant women

When an insured event occurs, the insured person (his authorized representative) contacts the policyholder at his place of work (service, other activity) with an application for payment of benefits and documents

necessary for this.

After this, the policyholder no later than 5 calendar days

sends information to the territorial body of the fund for the assignment and payment of benefits (in the form of an electronic register).

READ ON THE TOPIC:

Amount of monthly child care benefit in 2020.

Examples of calculations To an insured who has not provided information in full, the fund body sends a notice within 5 working days about the provision of the missing information.

The missing documents or information are also submitted by the policyholder within 5 working days from the date of receipt of the notice. Benefits are paid from the Social Insurance Fund by transfer to the bank account of the insured person

, specified in the application or in the register of information, or through the federal postal service organization, or another organization at the request of the insured person (his authorized representative)

within 10 calendar days

from the date of receipt of the application and documents or information that are necessary for the assignment and payment of the corresponding type benefits.

The initial payment of the monthly child care benefit is made in the manner and terms specified above. Subsequent payment of such benefits is made from the 1st to the 15th day of the month following the month for which such benefits are paid.

Insurers whose average number of individuals in whose favor payments are made exceeds 25 people submit the above information in electronic form. Others also have the right to use the electronic form, but can also submit information on paper.

In the event of termination of activities by the insured, the insured person (his authorized representative) has the right to independently submit to the territorial body of the fund at the place of registration of the employer an application and documents necessary for the assignment and payment of benefits.

Who has the right to count on maternity payments?

At the beginning of the third trimester, women expecting a baby or babies prepare to go on long-awaited and necessary maternity leave.

Typically this takes less than two weeks. Where can I turn if my rights have been violated? There are several options: if problems arise specifically with the employer, who refuses to transfer money because he claims that he did not receive it from the Social Insurance Fund, you can go directly to the fund with the problem.

Persons who have a job in 2020 will receive such a benefit in the amount of 40% of the average monthly earnings for the last two years when they worked, but not more than 26 thousand 152 rubles.

Who Pays Maternity Benefits in 2020? Social Insurance Fund or Employer

The maximum and minimum maternity payments for the year have changed. Find out what benefits are available when applying for maternity leave, taking into account the procedure and changes in legislation. Expectant mothers who take maternity leave this year have the right to apply for financial assistance from the state and employer. The types and amounts of compensation you can receive depend on a number of factors. Let's talk about them in detail. What is maternity leave?

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

Social Insurance Fund: maternity benefits

The maximum and minimum maternity payments for the year have changed. Find out what benefits are available when applying for maternity leave, taking into account the procedure and changes in legislation. Expectant mothers who take maternity leave this year have the right to apply for financial assistance from the state and employer.

The types and amounts of compensation you can receive depend on a number of factors. Let's talk about them in detail. What is maternity leave? This is maternity leave lasting from up to days, depending on the characteristics of pregnancy and childbirth, and subsequent maternity leave for up to 1.

According to the law, in case of registration of such leaves, the following maternity payments are provided for the year: According to the new law, maternity benefits are indexed in the year from February 1. The indexation coefficient was 1. Employers must calculate four payments in a new way: benefits at birth, for early registration and the minimum amount of benefits for child care up to 18 months.

In the year, benefits are calculated from the employee’s earnings in and years. The amount of compensation is increased by regional coefficients. The main document for calculating maternity benefits is a sick leave certificate. The bulletin is issued by the medical institution where the expectant mother is registered.

At the same time, the duration of sick leave is different for all women in labor. The number of days of incapacity for work depends on the characteristics of labor and the number of expected children. Until now, it was not clear whether to take into account the days that were not included in the full months when working for different employers. The Social Insurance Fund has decided on the procedure for calculating length of service for sick leave and maternity benefits. How to calculate length of service for benefits.

Maternity leave this year is calculated differently compared to last year. Because to calculate average earnings you need to take the last two years, that is, years. In these years, the maximum average daily earnings is:. Allowance for registration in the early stages of pregnancy. If the expectant mother registered before 12 weeks of pregnancy, she has the right to apply for additional social assistance. This right is secured to her by Article 9 of the Federal Law dated In the year, the compensation was .47 rubles; in the year, taking into account indexation, the amount was higher - .48 rubles.

The same categories of women who receive maternity benefits can take advantage of the right to payment. Money can be obtained both from the Social Insurance Fund and from the employer. Secondly, the expectant mother will need to bring an application for payment and a certificate from a medical organization to the accounting department. A one-time payment at the birth of a baby. Regardless of what kind of child the parents are expecting, they have the right to claim a one-time payment at the birth of the baby in the amount of 16.09 rubles during the period from. That is, it does not matter whether it is the first-born, second, third, or fourth child.

Moreover, such payments do not depend on whether the child’s parents work or not. Compensation is provided in the same amount to absolutely everyone. If the baby’s mother and father are employed, they can receive payment from their employer. Only unemployed people can apply for payment to the Social Insurance Fund at their place of residence. The receipt procedure for single parents is a little simpler, since you do not need a certificate from the second parent’s place of work stating that he did not receive money.

Local authorities of the constituent entities can also approve other social protection measures for future parents. For example, at the birth of a second or third child. Maternity payments for child care up to 1. Any of the baby's parents - mom or dad - can receive it. But the amount cannot be lower than the minimum wage.

Unemployed parents may also receive a payment. But in this case, they will receive payments from the Social Insurance Fund and in the minimum amount, see below.

For employed parents, there are minimum and maximum thresholds for child care benefits. The maximum payment is limited to the coverage years for which employers contribute. The maximum that employed parents can count on is 26.33 rubles. Calculate child care benefits up to 1. Child benefits per year up to 3 years. Mothers or other family members can receive it until the baby is three years old, decree of the President of the Russian Federation from the size is only 50 rubles.

Payments are made from the budget through the Social Insurance Fund. But the money can be received directly through the employer; to do this, you need to submit an application for benefits to him. If the mother is a student, then the application is submitted to the rector of the university. To do this, you will need documents: a copy of the work record, the child’s birth certificate, a certificate from the father that he did not receive benefits, etc.

An application for benefits can be written within 6 months from the moment the baby turns 1.5 years old. By law, money must be paid for the entire period.

Maternity capital for a second child. At the birth of their second child, parents have the right to receive maternity capital. In a year the payment will be RUB. It has not changed over the year. In recent years, maternity capital has already shown its effectiveness in terms of the birth rate in the country.

After all, this is a good start for purchasing housing, for example, with a mortgage. Banks offer reduced loans for such families. Parents also have the right to set aside maternity capital for their child’s education or for the funded part of their pension. Payments to large families for the third child under 3 years old. Now workers with many children choose their own vacation time.

Leave at any time is a new guarantee for employees with family responsibilities Art. How to properly grant leave. At the birth of the third baby in a year, parents have the right to receive additional payments under the program “On measures to implement the demographic policy of the Russian Federation” approved. By decree of the President of the Russian Federation dated If during the years only regions with a fertility rate below the national average of 1 participated in the program, for the year, in the year the program included regions with a coefficient of 2.

This is important to know: Temporary disability benefits: is it subject to personal income tax or not?

In total, there are 60 regions of the Russian Federation on the list, instead of the previous ones. Regional authorities themselves set the amount of payments for a third child under three years of age; to find out the amount, contact the territorial department of social protection. But the family must meet the following criteria: Benefit for the birth of the first and second child of the year. Benefits for the first and second child can be received by families whose average per capita income does not exceed 1.

The average payment amount per year will be 10 rubles. The standard period at which a woman can go on maternity leave is 30 weeks in a normal singleton pregnancy. But in some cases: The application can be made in any form addressed to the manager.

It must indicate the requested period according to the certificate of incapacity for work. If the expectant mother has changed her place of work and one of the periods falls at her previous place of work, a certificate of earnings in the form NUTV is required to process payments. There may be a situation where it is not possible to provide a certificate. In this case, the employer calculates the benefit based on the available information during the work period. Two years ago, a new girl got a job in the accounting department.

According to the work book, the experience was only two years in some LLC. But the certificate of earnings from the previous job showed a decent amount - it came with a salary three times less.

Literally a month later, the new girl announced that she was pregnant. The company, as expected, calculated the benefits. The employee received the money. A month later, the company submitted documents for reimbursement, but the FSS waived expenses for children. It turned out that the salary certificate from the previous place of work was fake. As it turned out, such a company did not exist and no one paid the fees. The company agreed with the Social Insurance Fund and removed benefits from the reporting. The director called the employee and demanded an explanation.

She admitted that she had falsified the papers to get more. She returned the money voluntarily, so the case did not go to trial.

Application to the Social Insurance Fund for payment of maternity benefits

Not all regions of the country yet support direct payment programs.

- Therefore, initially the funds are paid by the employer himself.

- Then the offset is made:

- first, the company makes transfers to women on maternity leave;

- the Social Insurance Fund then reimburses the costs.

Algorithm of actions:

- The employee writes an application to the HR or accounting department to receive payments.

- The accountant makes the accruals.

- Funds are transferred to the card or issued in person. Transfers are made according to the procedure approved by the company.

- The accountant prepares the necessary documents and reports.

- An application is submitted to social security to receive compensation.

- The inspector checks the correctness of the documents.

- A conclusion is given on whether to reimburse the benefit or not.

The inspector monitors the correctness of the assignments. For example, checks documents for overstatement of wages.

Social insurance fully compensates for costs from the first day to the last.

The Ministry of Health and Social Development has approved what documents will be needed to receive compensation. Order No. 951n is dated December 2012.

To reimburse costs, 4 documents are needed:

- Application signed by the head of the enterprise. It states:

- name of company;

- company registration codes;

- request for a refund.

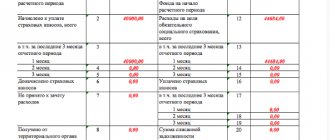

- Two copies of form 4-FSS.

- Register of expenses. The document contains a detailed breakdown of information about who was accrued and how much.

- Photocopy of documentation justifying the legality of costs:

- sick leave;

- calculations of transfer amounts;

- employment orders;

- photocopies of the work book.

If the maternity worker worked part-time, it is necessary to attach an employment contract.

Unfortunately, the Direct Payments program is not yet operational in all regions. Therefore, as usual, the B&R benefit is paid by the employer from his own funds. Because of this, there is a mutual offset relationship between the enterprise and the Social Insurance Fund, according to which the enterprise has the right to apply to the Social Insurance Fund for reimbursement of benefits paid from its own benefit budget (not only for Birth and Reconciliation, but also for child care, early registration pregnancy and any other).

We suggest you read: Where and how to complain about a teacher at school

For 2020, for regions where “Direct Payments” do not apply, the following sequence of actions is provided:

- The applicant applies to the employer for labor and maternity leave.

- Accounting accrues money.

- The benefit is transferred by postal order to a bank card and issued to the applicant at the cash desk.

- The employer applies for reimbursement of the funds paid from the Social Insurance Fund. To do this, submit an application, the necessary documents and reports.

- The FSS inspector checks documents for violations (for example, inflating wages before going on maternity leave) and decides whether to provide compensation or not.

Attention

But the amount of maternity payments is quite large - usually more than the insurance premiums of a small employer for all employees for one month. Payment for sick leave in connection with BiR is reimbursed from the Social Insurance Fund from the first to the last day.

The list of documents that the policyholder must provide to the Social Insurance Fund for reimbursement of benefits is presented in Order of the Ministry of Health and Social Development No. 951n dated December 4, 2009. It includes:

- written statement from the policyholder;

- Form 4-FSS in the original in 2 copies - it represents a calculation of insurance premiums accrued and transferred to the FSS;

- a register of expenses for paid insurance benefits (with a breakdown of the amount, indicating the full names of recipients and other data) and the total amount for compensation;

- certified copies of documents confirming the legality of expenses.

You can confirm expenses for the B&R benefit with the following documents:

- sick leave for pregnancy and childbirth;

- calculation of the payment amount;

- if a woman has been working at the enterprise for less than 6 months. and the benefit is assigned to her based on the minimum wage - an order for employment, a copy of the work book;

- for part-time jobs - an employment contract and other documents.

The application for compensation must contain:

- name of the enterprise (or full name of an individual entrepreneur), legal address;

- registration number;

- request to return funds to pay insurance coverage;

- indication of the refund amount.

From January 1, 2020, all employers are required to pay maternity benefits in new amounts

What will be the amount of maternity leave per year? Are employers required to recalculate maternity benefits and pay extra? What are the new minimum and maximum sizes? Let's talk about it.

Who calculates and pays maternity benefits to a working person. In what cases are maternity payments received directly from the Social Insurance Fund? To understand who – the state or the employer – pays maternity benefits, let’s find out where the funds for their payment are generated and how they are used. Maternity benefits are among the social benefits financed from the state extra-budgetary Social Insurance Fund FSS. Funds in the Social Insurance Fund are formed from insurance contributions paid by employers from the income of employees without fail and by other persons voluntarily.

Going to court before applying for benefits from the Social Insurance Fund

Women whose employers are unable to pay BIR benefits have to file a claim in court. This is the only way to prove your case and confirm your right to receive funds.

If your region of residence does not belong to the “pilot” project, you must:

- File a claim in court, attaching the required list of documents.

- Wait for a positive court decision.

- Submit documents for benefits to the Social Insurance Fund.

When filing a claim in court, a woman must attach documents proving the employer’s inability to pay benefits or the creation of a conflict situation. If the decision is positive, the Social Insurance Fund will independently make a request to the Pension Fund to receive income for the previous two years of work in order to calculate payments.

Maternity leave in 2020: new law, payments

Most women in this situation are unable to continue working as usual and take maternity leave, and financial assistance for pregnancy and childbirth plays the role of compensation for this period of temporary disability. Unfortunately, there are situations when the manager does not want to put an employee on maternity leave and pay her financial assistance. In addition to permanent employees of organizations, they receive financial assistance from the state: In fact, financial assistance to expectant mothers is provided by the state budget, namely the Social Insurance Fund. However, if in the above cases payments are made according to a very simple scheme; the expectant mother receives funds from social care authorities directly, then an employed woman receives financial assistance from her boss. Therefore, you should not allow it to be overshadowed by unpleasant surprises when paying for the entire period of forced disability. At the thirtieth week, the gynecologist issues a certificate of incapacity for work for 70 days before and 70 after childbirth. In case of any complications, an additional sick leave is issued for 16 days. Unlike maternity leave, which is used directly by the expectant mother, leave to care for a baby up to one and a half years old can be used by any other family member. The beginning of this type of maternity leave will be considered the day immediately following the end of the sick leave period according to Bi R. Maternity and childbirth benefits are entitled to receive: And if only a woman - a future mother - can apply for payment for the period of pregnancy and subsequent childbirth, then other benefits for the birth of a baby and the baby’s daddy can also receive monthly care.

Who, according to the law, pays maternity benefits - the employer or the state?

Let’s figure out who is entitled to maternity pay and in what amount, what the duration is and the specifics of receiving it. It is important to understand that only women can count on maternity benefits, unlike child care benefits. All categories of recipients of maternity benefits in the year are listed in the Federal Law dated These include women:.

For happy parents who have no problems receiving maternity benefits, information about who pays maternity benefits - the employer or the state - is interesting insofar as. But there are situations when information about the payer of maternity benefits is almost vital. However, the Social Insurance Fund of the Russian Federation then returns the funds spent by the employer on paying benefits to women on maternity leave.

Maternity benefit in 2020

Pay for maternity leave per year taking into account the new indicators. We will tell you how maternity leave is calculated in a year, how to transfer payments and benefits, taking into account new rules and laws. The same rules for calculating maternity leave apply this year as before, since no new law has been adopted. However, when calculating maternity benefits, take into account changes in indicators, in particular:.

Who is entitled to payments?

In a number of regions, a pilot project has been launched since January 2012, payments for which are immediately transferred from the Social Insurance Fund. Since the woman receives the benefit amount directly from Social Insurance to her personal bank account or by mail. There is simply nothing to compensate the employer.

We suggest you read: Register for improvement of living conditions: where to apply

In all other cases, the Social Insurance Fund is obligated to reimburse the funds paid by the employer as a B&R benefit, provided that the company pays insurance premiums regularly and in good faith.

If a woman has the right to apply to the Social Insurance Fund for payment on her own, she must report this in the application form. That is, fill out and submit the application. It can be submitted in person, through a representative, by mail or electronically. There is no state fee for applying to the FSS.

The following documents are submitted along with the application:

- applicant's passport;

- sick leave from the antenatal clinic;

- a court decision that the woman really does not have the opportunity to apply for benefits from the employer;

- salary certificate for two years (if it is not possible to provide it, then you need to fill out an application to request data on income from the Pension Fund).

The unified form “Application for payment of benefits (vacation pay)” for social insurance was approved by order of the Federal Social Insurance Fund of the Russian Federation No. 335 dated September 17, 2012. It is filled out on a standard form, where on three pages you need to indicate information about the applicant, the documents she provided, and the method of receiving benefits and other data.

Application for payment of maternity benefits

On the first page, in the paragraph “Please (...) assign and pay”, it is important to check the box next to the required type of insurance coverage - maternity benefit.

Only women can receive funds. This is different from child care benefits. The entire list of recipients is listed in Law No. 81-FZ.

You can receive funds:

- working women;

- unemployed expectant mothers;

- female students studying full-time;

- contract employees in military service.

Important!

Not only the birth of your child gives you the right to financial assistance. If you adopt a baby under three months of age, you can also receive benefits. There is one important nuance. Two benefits are not transferred at the same time. An employee can choose what benefit to receive for the birth of a baby or care for up to one and a half years.

2 nuances related to the payment of benefits:

- Transfers are made by the Social Insurance Fund. If the employee was fired due to the liquidation of the staff, then the payer will be social security of the population. You should contact the branch staff at your place of registration.

- Two employers are required to make payments if the employee worked simultaneously in two companies.

Thus, part-time workers receive higher payments than regular employees.

As a general rule, to receive benefits in 2020, you must write applications addressed to the head of the company.

Some regions introduce a different procedure. To receive payment, you can contact the Social Insurance Fund directly.

It is planned that the practice of “direct payments” will further spread throughout the Russian Federation. For example, the project is already operating in the Kaliningrad, Kaluga, and Ulyanovsk regions. As of 2020, the program has already been implemented in twenty regions of the country.

Important! When you have the right to independently apply to the Social Insurance Fund, you must submit an application. You can do this in person or fill out the form and then send it by post.

A representative acting under a power of attorney can also submit documents.

The form to be filled out was approved by FSS order No. 335, dated September 2012.

The form contains three pages for filling out information about the applicant.

Tips for filling out the form:

- Check the box next to the B&R manual on the first page.

- Please indicate your preferred payment method.

Advice! The form must be filled out carefully. The slightest inaccuracies lead to errors in the assignment of benefits.

Who pays maternity benefits in 2020?

Maternity payments per year are usually limited to maximum and minimum amounts. The article contains current benefit limits, free reference books and useful links. Calculating payments to hired employees is one of the most time-consuming operations for an accountant. Even if there are not very many employees working for an organization or an entrepreneur, nevertheless, they all receive a salary, the majority receive bonuses, and they may also receive increased wages, allowances, additional payments, and compensation. In addition, if employees go on business trips, they are entitled to average earnings for business trips, as well as reimbursement of expenses associated with staying away from their place of residence, per diem, reimbursement of travel, accommodation, and reimbursement of other expenses that are agreed upon with the employer. As for women, many of them take maternity leave and are on leave to care for their small children.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!

What will be the amount of maternity leave per year?

Social Insurance Fund: maternity benefits

Download the order for maternity leave. Indicators for calculating maternity benefits changed this year. The new law increased the maximum amount of payments taken into account for the billing period and the minimum wage, and shifted the billing period for calculating benefits. Let us immediately remind you at what period of maternity leave per year. A certificate of incapacity for work for pregnancy and childbirth is issued to a woman by doctors at 30 weeks of pregnancy at a time for 70 calendar days before giving birth and 70 calendar days after the birth of the baby.

How many weeks a year do people go on maternity leave and for what period? Read on. Billing period. Companies calculate benefits from the actual number of days and earnings for the two calendar years preceding the year of the insured event. Accordingly, if an employee went on maternity leave in a year, then the benefit is determined from earnings and the number of days for and years. Periods of temporary disability, maternity leave, parental leave.

The period of release of an employee from work with full or partial retention of wages, if insurance premiums were not calculated from wages. If during the billing period the employee was on maternity leave or child care leave, she can replace the corresponding calendar years from the billing period with the previous calendar years by submitting an appropriate application. Provided that this will lead to an increase in the benefit amount. The calculation period can only be replaced by those years or the year that immediately precedes the occurrence of the insured event.

This is important to know: Additional payment to the pension for length of service for state civil servants in 2020

The employee has the right to change the year of the billing period in which maternity leave or parental leave fell. In any case, the full year in which the vacation days fell can be changed to the previous year. You need to take exactly the previous ones; you cannot change them arbitrarily. Limit amount of income taken into account. By law, the amount of earnings for calculating maternity benefits per year for each year is limited, as is the base for insurance premiums. In a year the limit is:. How to determine the average daily earnings.

If the employee has less than six months of insurance coverage, the total benefit amount cannot be more than the minimum wage for a full calendar month. From January 1, the minimum wage increased to 11 rubles. The minimum benefit amount has increased accordingly.

The benefit is paid in one amount for the entire period of maternity leave. All days are taken into account: working days, weekends and holidays. In the table we have given the maximum duration of leave for six cases. The duration of maternity leave is calendar days.

To calculate the average earnings, you need to divide payments to the employee, subject to contributions to the Federal Social Insurance Fund of the Russian Federation, by the number of days of the billing period. In this case, certain days must be excluded from the calculation period. The list of excluded periods is given in paragraph 3. Secretary E. Ivanova was hired by the organization on October 1 of the year. In February of this year she goes on maternity leave. The billing period is years.

Number of calendar days in the period - The employee did not have any calendar days excluded from the payroll period. Ivanova presented a certificate from her previous place of work about her earnings for the period from January 1 to September 30 of the year.

Her income from the previous employer, from whom insurance premiums were calculated for the year, amounted to rubles. Compulsory social insurance contributions are charged on the entire amount of earnings for two years.

Ivanova’s earnings in the billing period did not exceed the maximum values, so the accountant took it into account in full:. See examples of calculations if a woman works in two organizations at the start of maternity leave:. The maximum average daily earnings cannot be more than the maximum base for calculating contributions for two years, divided by. In a year it is equal to 2.68 rubles.

If the employee earned more over the previous two years, calculate the benefit from the new average earnings. For example, the maximum amount of maternity benefits per year for a normal birth is .20 rubles. If the mother is expecting twins, triplets, etc. Before starting work, she did not have any insurance experience.

The billing period was completed completely. The actual salary of the employee in the billing period:. There is also a minimum limit on average daily earnings for calculating maternity benefits.

Use it if the employee has no earnings during the billing period or is less than the minimum wage as of the start date of maternity leave. That is, for maternity leave that began on January 1 of the year, the minimum wage is 11 rubles. Use the federal minimum wage, do not take regional ones into account.

Compare the minimum average daily earnings with the average daily actual earnings of the employee. The minimum average daily earnings from January 1 of the year is equal to .85 rubles. Accordingly, the minimum amount of benefit, for example, for normal childbirth is 51 rubles. Next, we’ll look at how to pay maternity benefits if the employee’s work experience is more or less than 6 months. Memo: how to calculate maternity benefits. If by the time the vacation starts, the employee’s insurance coverage is six months or more, then calculate the maternity benefit for the year as follows.

For further calculation, take the smaller value of the compared ones. Calculate your average daily earnings. To calculate benefits, take the smaller of the compared values. Compare the average daily earnings with the minimum allowable amount of 85 rubles.

To calculate benefits, take the larger of the values. Step 2. Calculate the benefit amount. To do this, multiply the resulting average daily earnings by the number of vacation days.

Is it necessary to recalculate maternity benefits if maternity leave began in the year and continues throughout the year? If at the start of the vacation the employee’s length of service is less than six months, then calculate maternity benefits as follows.

Determine the daily allowance based on the minimum wage for each calendar month of maternity leave. To do this, divide the minimum wage by the number of calendar days in a month and multiply by the number of vacation days in that month. Step 3. Ivanova goes on maternity leave. At the time of going on maternity leave, her work experience was less than six months.

The company is located in the city of Inta, Komi Republic, where the regional coefficient is set at 1.5. Ivanova works full time. The employee goes on maternity leave from July 3 to November 19 of the year inclusive.

The minimum amount of daily earnings is .85 rubles. But since the length of service is less than six months, the amount of the benefit cannot be more than 16 rubles. Let's calculate the benefit for each full month during which maternity leave falls:. The amount of the benefit will exceed the minimum wage, increased by the regional coefficient, in those months that have 31 days - in July, August and October.

This means that for the full months of August and October you need to pay 16 rubles. And for incomplete July, make a calculation in proportion to the days of maternity leave: The total amount of maternity benefits that the employee will receive will be:.

The program takes into account the requirements of the Labor Code of the Russian Federation and the Federal Law of To receive leave and maternity benefits, the employee must submit to the employer:. The fact is that sick leave gives the employee the right to leave.

However, when to exercise this right, the employee decides for herself. After all, the basis for leave is the employee’s statement.

Until she writes it, she can continue to work for some time after receiving sick leave. For these days, the employer must pay wages on a general basis. If an employee was hired this year and she goes on vacation, maternity payments for the year are calculated according to the general rules. After all, she hasn’t been registered with you yet. And what should I do? It is necessary to take into account earnings from previous jobs, if any in the billing period.

Having received all the necessary documents from the employee, the employer issues an order to grant her maternity leave and grant benefits. In any case, the form that you will use is approved by the manager.

Calculation of maternity benefits in 2020 for the Social Insurance Fund

The procedure for calculating the B&R benefit for the Social Insurance Fund both within the framework of the direct payments project and by court decision is absolutely identical to that used in the enterprise. The country has adopted a unified payment calculation method. The benefit amount is equal to 100% of the woman’s average monthly earnings for the previous two years. If no errors occurred during the calculation, then the amount calculated at the enterprise will be equal to the amount calculated by the Social Insurance Fund employee.

The benefit is calculated as follows:

- The average earnings are found for each day of work in the billing period (during the two calendar years preceding going on maternity leave, that is, for 2014-2015 when going on leave under the BiR in 2016). To do this, the total earnings for 2 years are divided by the number of days actually worked.

- The amount of the benefit is determined directly. To do this, the average daily earnings are multiplied by the number of days of maternity leave (in the simplest case, 140).

A peculiarity of calculating benefits in the Social Insurance Fund is that the necessary data is transmitted by the accounting department of the enterprise where the woman works, or is requested from the Pension Fund (PFR). These include:

- monthly earnings data;

- the number of days in the billing period used for sick leave and other needs (for these days no transfers are made from earnings in social security).

Attention

The general procedure for calculating benefits for BiR is set out in Art. 14 of Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity.” It has not changed since 2009 and in 2020 the payment is calculated in the same way as in previous years.

We suggest you read: What to do if your employer forces you to resign at your own request

Let's consider the example of a woman going on maternity leave from July 4, 2016, who had worked at the same enterprise for the two previous years. The FSS received data that for 2014-2015. she earned a total of 718,000 rubles. In 2020, the woman used 39 days of sick leave. The duration of maternity leave is 140 days. How will an accountant from the Social Insurance Fund calculate benefits?

- The total number of calendar days in the billing period was 730 days (none of the billing years were leap years).

- The number of days based on which benefits are calculated is determined. From the calculation period we subtract the period of sick leave (730 – 39 = 691 days).

- The average daily earnings of a woman are: 718,000 rubles. / 691 days = 1,039.07 rubles.

- The amount received is compared with the minimum established in 2016:

- The minimum wage from July 1, 2016 is 7,500 rubles;

- the minimum average daily benefit will then be 7,500 rubles. × 24 months / 730 days = 246.58 rubles;

- the calculated amount is greater than the minimum, therefore it is accepted for further calculation.

- A comparison is made with the maximum allowable amount of payment based on the amount of the insurance base in 2014-2015:

- (624,000 rub. 711,000 rub.) / 730 = 1,828.77 rub.;

- the calculated amount is less than the maximum, therefore it is accepted finally for calculating the benefit.

- The amount of maternity benefits payable from the Social Insurance Fund will be RUB 1,039.07. × 140 days = RUB 145,469.80

The FSS website contains a calculator that any woman can use to independently calculate the amount of sick pay she is entitled to. To do this, you first need to enter the dates of the certificate of incapacity for work and select its type - “Pregnancy and childbirth”. Next, to receive the payment amount, you need to enter the following data:

- check the box if there is a need to replace the calculation years (allowed only if the woman was on maternity leave for part of the time in 2014-2015);

- go to the “Calculation Conditions” tab and fill in all the required fields;

- Click “Calculate” and see the result in the “Calculation” tab.

Social Insurance Fund calculator for calculating maternity benefits

Attention

The calculation uses exactly the same data on the basis of which the Social Insurance Fund employee calculates the benefit. If they are entered correctly, then the payment amount will be as close as possible to the one that will be transferred to the woman’s account after the application is reviewed by the Social Insurance Fund employees.

Maternity payments in 2020

FSS pilot regions Penalty for late submission of reports to the FSS. Limit amount for calculating insurance premiums Confirmation of the type of economic activity Amount of child benefits per year.

Download the order for maternity leave. Indicators for calculating maternity benefits changed this year. The new law increased the maximum amount of payments taken into account for the billing period and the minimum wage, and shifted the billing period for calculating benefits. Let us immediately remind you at what period of maternity leave per year. A certificate of incapacity for work for pregnancy and childbirth is issued to a woman by doctors at 30 weeks of pregnancy at a time for 70 calendar days before giving birth and 70 calendar days after the birth of the baby. How many weeks a year do people go on maternity leave and for what period? Read on. Billing period.

Let’s figure out who is entitled to maternity pay and in what amount, what the duration is and the specifics of receiving it. It is important to understand that only women can count on maternity benefits, unlike child care benefits. All categories of recipients of maternity benefits per year are listed in the Federal Law dated

Documents for reimbursement

Documents for reimbursement of the insurer's expenses are determined by order of the Ministry of Health and Social Development. First, we will look at the general documents that are needed to reimburse any benefit, and below we will look at what needs to be collected additionally for each benefit.

The entrepreneur prepares general documents for all benefits. At Button we do this for clients. Documents must be signed with full name and dated and stamped by the organization.

What you need to prepare for reimbursement of any benefit:

- Application for the return of funds spent on social security in 2 copies - one will be returned with a mark of acceptance.

- Help-calculation. The calculation certificate does not have an approved form, but it must contain information about insurance premiums and expenses made by the policyholder, expenses accepted and not accepted for offset, and amounts owed.

- Breakdown of Social Security Expenses. All these 3 documents can be downloaded from 1C.

- Calculation of insurance premiums for the previous quarter, this is the DAM report.

- Confirmation of submission of this report.

- A copy of the employee’s work record book - have each page certified, and write on the last page “currently working.”

- Documents confirming the payment of benefits - a payment slip signed by the employee or a payment order with a bank mark.

Additional documents for benefits are required in the form of copies. Certify each document as a “true copy”, indicate the position, signature with transcript, date and seal of the organization.

What you need to collect for maternity benefits and early registration benefits:

- certificate of incapacity for work;

- benefit calculation;

- applications for maternity leave and benefits;

- application for a benefit for registration in the early stages of pregnancy;

- order on granting maternity leave and granting benefits;

- certificate 182-n about the amount of earnings for the previous 2 years, if the employee worked somewhere else besides you during this time;

- a certificate from a medical institution that registered a woman in the early stages of pregnancy.

What you need for childbirth benefits:

- application for benefits;

- child's birth certificate;

- child's birth certificate;

- certificate of non-payment of benefits to the second parent;

- if the second parent does not work - a certificate from social security about non-receipt of monthly benefits.

What you need for a monthly child care allowance:

- applications for parental leave to care for a child up to 1.5 years and payment of benefits;

- order on granting parental leave;

- calculation of average earnings during parental leave;

- child's birth certificate;

- child's birth certificate;

- if this is not the first maternity leave, birth certificates of previous children;

- a certificate from work about non-receipt of benefits from the second parent;

- if the second parent does not work - a certificate from social security about non-receipt of monthly benefits;

- certificate 182-n about the amount of earnings for the previous 2 years, if the employee worked somewhere else besides you during this time.

Documents are submitted to the Social Insurance Fund exclusively on paper by the director or representative by proxy.