What is known about the cash receipt?

This is a document that reflects the fact of transfer of the subject of the loan (money or other things defined by generic characteristics) from one person to another. The legislator does not give a clear definition of this document, but only mentions it in passing in Part 2 of Art. 808 of the Civil Code of the Russian Federation.

A receipt is very often an additional document to the loan agreement, which is concluded in simple written form if the loan amount exceeds 10,000 rubles. Such a barrier is established by the Civil Code of the Russian Federation. Simply put, a loan agreement is concluded separately and upon transfer of money, the borrower draws up a promissory note confirming receipt of money from the lender. Very often, after borrowing money, the lender only has a receipt in his hands.

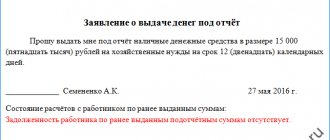

Drawing up a receipt

Receipt for receipt of money for construction work performed. There is no specific procedure for compiling this receipt.

The law stipulates such a rule that if the amount that is transferred from hand to hand is more than 1000 rubles or 10 times the minimum wage, then in this case it is necessary to draw up a receipt.

However, the law does not require that the receipt must be notarized, however, if we are talking about a sufficiently large amount of money, then you can use a receipt with subsequent certification by a notary. However, this can be done for your own safety net. Having certified by a notary, you once again confirm the fact of transfer of money.

There is no specific form for the receipt. But we must not forget about some components of the document that can be called mandatory:

- Last name and initials of the seller, and information from his passport;

- Last name and initials of the buyer, and information from his passport;

- The amount of money that is composed of both numbers and words;

- The place where this document was written, as well as the signatures of the parties.

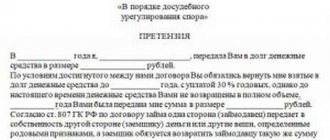

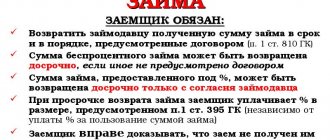

What is the difference between a loan agreement and a receipt for receiving money?

The loan agreement is drawn up by both Parties to the agreement, it specifies all aspects of the transaction and states the rights and obligations of the Parties. A loan agreement can be concluded both upon the transfer of money, and before the transfer, which will take place in the future. The agreement is usually drawn up in two copies - one for each of the parties.

A receipt is a document confirming the fact of transfer of money, a kind of acceptance certificate for the main agreement. It is not made up by both parties, but only by the borrower on his own behalf. Usually it is drawn up in one copy and transferred for storage to the lender until the funds borrowed by him are returned. After this, it is either destroyed or returned to the borrower.

Another important feature of the receipt is that it is a universal document and is a working tool not only for the loan agreement, but also for other agreements and non-contractual relations. It can record the transfer of a monthly payment under a rental agreement for a premises or vehicle, the transfer of money under a purchase and sale agreement, a contract, etc. However, such receipts are not promissory notes.

As for the receipt and loan, the “debt” characteristic is exactly applicable here. Of course, in this case it is more correct to draw up both the contract itself and a receipt as an appendix to it. But increasingly, this rule is neglected and only a receipt is drawn up.

The courts got used to this state of affairs and began to accept applications for collection based solely on one piece of evidence - a receipt. Nowadays, judicial practice is replete with examples of collection of funds only by receipt without a loan agreement, so this state of affairs has long been the norm. In addition, this category of cases is generally considered one of the simplest.

But at the same time, when drawing up this document, it is necessary to comply with a number of mandatory and desirable conditions, on which the outcome of the case will depend if the case goes to court.

Required conditions for receipt:

- The receipt is drawn up on behalf of the borrower. In it, he reflects the fact of transfer of funds;

- Accordingly, the document indicates the surname, name and patronymic of the borrower according to the passport. In addition, it is also necessary to indicate his passport details, date and place of birth, his registered address, so that in the event of a trial, the court can identify the borrower’s identity without any doubt. In addition to the place of registration, it is also a good idea to indicate the borrower’s residential address if they differ from each other;

- Last name, first name and patronymic of the lender. This is necessary so that a specific person - the lender - has the right to demand the return of funds, including through the court;

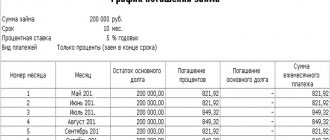

- The amount transferred under the loan agreement. It is best to indicate it in rubles. If money is transferred in foreign currency, this can be reflected in the document, but the equivalent of the monetary amount in rubles, current as of the date of its preparation at the exchange rate of the Central Bank of the Russian Federation, must also be written down in the receipt;

- Refund period. The parties to the agreement must clearly indicate such a period in the loan agreement, and if it does not exist, and there is only a receipt, this must be reflected precisely in it; If the Parties cannot yet determine the repayment period, the text of the receipt reflects this approximately as follows: “I undertake to return the funds upon the borrower’s first request.” In this case, the return period is not set by a specific date, but is determined by an event that will occur in the future. Thus, after an official demand for the return of funds, the lender will have the right to go to court on this issue. The official requirement in this case will be a written demand that the lender will present to the borrower, from the text of which it clearly follows that it is time to return the money (here it is necessary to strictly adhere to the official writing style, since this document will have to be presented to the court). You can submit a demand on purpose (but you will need to keep a copy of the request with a note from the borrower about its receipt), or by using the services of the Russian Post, and here the letter must be sent to the borrower’s registration address, preferably by registered mail with registered notification. If the text also contains the borrower’s residential address, such a letter will need to be duplicated at this address.

- If the parties have established interest for the use of the loan subject, this must also be reflected in the text of the receipt. Moreover, the algorithm for calculating interest must be clearly stated. However, you should not expect that exorbitant interest can be indicated - the court in this case will reduce its amount “to the amount of interest usually charged under comparable circumstances.” If the receipt does not talk about interest, it will be possible to use the algorithm for calculating it, which was kindly provided by the legislator in Art. 809 of the Civil Code of the Russian Federation;

- Date of receipt;

- Borrower’s signature with transcript;

What is better: a receipt for money or a loan agreement?

To record the debtor's obligation to you to return the amount of money received, it will be sufficient to draw up a regular receipt for receipt of funds. To be more confident that the debtor will not later say that it is not his signature and that he did not take any money, it is advisable to have one or two witnesses (relatives or friends) when transferring funds.

The notarized form of a receipt for the transfer of money is not required by law. It is usually used when the loan amount is large, or when the lender wants, in the event of the debtor’s refusal to return the money, to collect it from him in a quick way, bypassing a lengthy legal battle.

Notarization gives the document stronger legal force. However, for such a notarial sample you have to pay a decent state fee, which is not always justified.

In addition, a legal dispute over an ordinary non-notary receipt is not particularly difficult and should not be feared.

How to correctly write a receipt for receiving money yourself?

As a rule, it is written in his own hand by the person receiving the money, that is, the debtor. The text of such a document can be completely arbitrary.

In order for the contract paper to be valid and complete evidence that your debtor has received money, it must indicate:

- Last name, first name, patronymic, date of birth of the citizen both receiving and transferring money.

- Passport details of both parties.

- Write down the exact amount of money transferred to the debtor (be sure to duplicate it in capital text).

- Write the date the document was drawn up and the place where it was done (locality).

- Be sure to write the exact date of the refund.

- If money is given at interest, indicate its amount.

- The debtor must sign the document. If it is drawn up in front of witnesses, their signatures are also required. It is better to make two samples - for the debtor and the creditor.

READ Judicial practice on land disputes: is it necessary to register a court decision on the procedure for using a land plot, redistribution of land plots in Rosreestr

What to do if the debtor does not return the money?

If you lent money, recorded the fact of the loan with a correctly drawn up receipt or loan agreement, but the debtor does not want or cannot return the money received, then in this situation you have the right to file a claim in court and demand a forced return of the money loaned.

Important nuances when writing a receipt

The chance of getting your money back from an unscrupulous borrower will increase if the receipt is written in the borrower’s own handwriting. Of course, you can take advantage of the convenience that modernity offers us and print the text of the receipt on a printer; this will not be a mistake. But as practice shows, courts prefer handwritten documents of this kind. And in such cases, it is easier for the lender to prove that the borrower was well aware of all the terms of the loan agreement at the time of its conclusion, and there will be practically no point in saying that this document was signed by him by mistake, by accident, or that the borrower did not see part of the text signed them document.

You should carefully check the promissory note for errors. Each of them may become a reason for refusing to satisfy demands for the collection of funds from the borrower. It is also undesirable to scribble or blot out the receipt, since after all, this is a document with which you may have to go to court.

Sample receipt for receipt of money

It is necessary to take responsibility for drawing up a receipt for receipt of money, because it is he who will help to return funds from an unscrupulous borrower. And if large sums are involved and the case is already approaching court, it is always better to contact a qualified lawyer, this way you can save both your time and, of course, your nerves.

Application of receipt

Despite its long history, humanity has not yet come up with anything simpler and more practical than a receipt. That is why this document is still used in legal practice. However, as practice shows, receipts are also disputed quite often. And all because not enough attention is paid to the preparation of this paper. Since this document is considered by many to be too simple and insignificant, which is what attackers invariably take advantage of.

It is not known for certain whether you will deal with receipts, however, in order to avoid troubles in the future, it is better to take care to correctly draw up this document.

It is very difficult to list all the cases in which it is necessary to draw up a receipt. However, there is always someone who transmits something and someone who accepts something, and along with this acceptance, he takes on some obligations. A receipt is a good tool of influence; the presence of a receipt for this document cannot be ignored. Whatever the receipt, in any case it must be a written document, because the law does not recognize the legal force of oral agreements. It can be in simple written form or it can be certified by a notary. The second option is not required, of course, but will increase the significance of the document. However, due to the high cost of certification by a notary, as well as the significant investment of time required for this procedure, it is used extremely rarely in practice.

More often they use a template for a receipt for receiving money, but the truth is that such paper can be considered universal, so it can be easily adjusted to other documents. For example, a receipt for receiving money as a loan can be converted into a document for a compensated transaction, and a document for a gratuitous transaction and other types of papers.

The basic principle of the receipt is that one party transfers funds, and the other accepts them, which means the text of the document confirms the fact of transfer of money, and it also comes into force only from the moment the funds are transferred.