Why do you need a receipt for a loan?

In order to avoid unforeseen circumstances, the lender insures itself in this way. To avoid controversial issues, you need to correctly draw up documents in accordance with Article 708 of the Civil Code of the Russian Federation. If the issuance of funds exceeds 10 minimum wages, the execution and signing of an agreement is considered a mandatory condition. The state does not require the lender to notarize documents, but it is better to do this in order to avoid gross errors or omissions. Doubtful data can negatively affect the judges' decision.

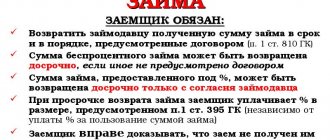

Repayment of borrowed funds

The lender and debtor can agree in advance on how the repayment will take place. In any case, confirmation that the funds have been received back should be a receipt of money. It contains personal information about the debtor and lender and the clause: “received in payment of debt.” If we are talking about a one-time return of borrowed funds, you can simply put the amount and signature on the old receipt. After this, the lender returns the paper to the counterparty.

How to draw up a marriage contract? Read here.

Unscrupulous borrowers can delay the return of money in every possible way. There is no need to rush to go to court. Perhaps the debtor is temporarily experiencing financial difficulties, and he really intends to fulfill his obligations a little later. The first step towards debt repayment is submitting a claim. Its text contains the main points of the transaction for the transfer of funds, the loan amount, as well as the requirement for repayment and a description of the negative consequences of violating the terms of the contract. The letter can be sent not only to the debtor’s place of residence, but also to his employer. Often this is enough to get your money back.

If requests for debt repayment have no effect, you can resort to claiming it by order. To do this, they apply to the court. The loan receipt serves as confirmation. After receiving a copy of the order, they contact the bailiff service with it. It is its employees who will be involved in the execution of the judge’s decision. If it was not possible to return the money by order, all that remains is to file a claim in court. Its form and content are determined by Art. 131 Civil Code.

What information should be on the promissory note?

So, the mandatory points contained in the document:

- All the data that is in the passport

- The debtor's residential address, indicate the actual address if it does not correspond to the place of registration

- Data on the amount of debt and repayment period

- Payment schedule, including interest

- A clause of penalties if the borrower does not pay the debt on time, in accordance with Article 29 of the Code of Civil Procedure of the Russian Federation.

- Date of execution of the document, signature of the creditor at the end of the receipt.

An important point is to invite witnesses if you need to protect the interests of the creditor. It is necessary to collect their signatures - this will increase the likelihood of a positive outcome and decision of the judges in case of controversial situations.

Can a receipt protect against non-payment of debt?

A receipt for a loan of money between individuals is not always a guarantee of repayment of the debt. The document will not be able to help if it was drafted incorrectly.

Below are a few examples of improperly drafted promissory notes:

- The document is limited to indicating only the full name of the borrower; passport data is not indicated. Example:

“I, Konstantin Petrovich Ivanov, give a receipt that I received a loan from Pyotr Ivanovich Konstantinov in the amount of 10,000 rubles.”

With such a receipt, it is very difficult to prove that Konstantin Petrovich Ivanov is the same person who borrowed money from P.I. Konstantinov. To confirm the document, a whole range of measures will be required, including a handwriting examination.

- Some receipts do not contain information about the lender. Example:

“I, Petr Konstantinovich Ivanov, born 02/05/1967, passport series 1234 number 567890, issued by the department of the Federal Migration Service of Russia for the XXXXXXX district of the city YYYYYYY, date of issue 05/01/2012, registered at the address YYYYYYY, st. xxxx, 11, apt. 14, I give a receipt that I received a loan on 02/01/2014 in the amount of 10,000 rubles with a repayment period of 05/02/2014.”

Since a loan receipt between individuals is a confirmation of the loan agreement, the borrower can submit to the court a completely different agreement, which will contain all the same information, but one of his friends or relatives will be indicated as the lender. In this case, the borrower may claim that he has lost the receipt for the provided agreement and attract several false witnesses.

- Another version of an incorrectly drawn up receipt looks like this:

“I, Petr Konstantinovich Ivanov, date of birth, passport details, registration address, give this receipt that on 01/01/2014 I agreed with Ivan Petrovich Konstantinov, date of birth, passport details, registration address, to borrow an amount of 40,000 rubles "

The difficulty for the lender is that the receipt states the loan agreement, but does not say anything about the transfer of money. That is, an unscrupulous borrower may claim that he did not receive any funds.

The Civil Code has Article 812, according to which a loan agreement can be challenged. If the borrower proves that he did not receive the money, and the court accepts this position, the lender’s demands for repayment of the debt will not be satisfied.

- The receipt may not indicate the purpose of the transfer of money, nor does it indicate the return period. Example:

“I, Konstantin Petrovich Ivanov, date of birth, passport details, registration address, received on 01/01/2014 from Ivan Konstantinovich Petrov, date of birth, passport details, registration address, the amount of 2000 rubles.”

In the future, the borrower can safely claim that he received the specified money not as a loan, but just like that - as a gift, for example. If the lender does not provide any evidence, he is unlikely to be able to return the money.

- The loan receipt between individuals does not contain information about the period for repayment of the debt, and additional conditions are not indicated. For example, a lender may lend money and then receive a larger amount from the borrower. In this case, this must be stated or indicated at what interest the loan was issued.

According to the current legislation (Article 809 of the Civil Code of the Russian Federation), a loan is recognized as interest-free when the loan is transferred in an amount not exceeding 50 times the minimum wage.

- Sometimes money is lent for specific purposes. Such loans are called “targeted”. If the receipt does not say anything about the purpose of receiving the funds, you cannot demand early repayment of the debt when the borrower uses the funds for other purposes.

- If the receipt does not contain information regarding the timing of repayment, the borrower is obliged to return the money within 30 days from the date of presentation of such a demand by the lender (the norm is enshrined in Article 810 of the Civil Code of the Russian Federation).

- Quite often difficulties arise with receipts printed on a computer. If the case goes to court, the borrower may begin to claim that his signature was forged. In this case, it is impossible to do without an examination to determine whether the handwriting matches.

If the borrower’s signature resembles more of a “squiggle”, the expert may write in the conclusion that it is not possible to establish the degree of authenticity of the signature.

- It is not allowed to have any deletions or corrections in the loan receipt between individuals, especially if they relate to the amount, terms, etc. All this casts doubt on the reliability of such corrections.

Repayment of a loan to an individual from a legal entity occurs in the ways described in the article: return of a loan to an individual. Read the interest-free loan agreement between an individual and an individual entrepreneur here.

What errors are an obstacle to loan repayment?

A promissory note can serve as the only evidence confirming the transfer of money. If this sample is missing any important points, this may become the basis for court hearings on the issue that has arisen.

Appeal to the court is possible if controversial issues arise, as mentioned above. It is necessary to verify all the information in the document - all points, including passport data. And the situation can be complicated by the fact that money is provided to close relatives who regard the preparation of these documents as a mere formality.

An unscrupulous borrower can appeal the fact of receiving funds, because the receipt (sample) does not indicate the disbursement of money. Mistakes made when filling out papers lead to sad results.

It is imperative that the loan requirement be included in the document. It should be determined that the funds were needed for specific purposes. Don't forget to indicate the interest rate! What happens if the act does not indicate the period for the return of funds? Let us turn to Article 314 of the Civil Code of the Russian Federation. The debtor must return the entire amount after 7 days after submitting a request from the borrower.

A situation may arise when a person does not make contact with the creditor. And the situation is heating up due to incorrect filling out of documents. And the period for receiving money may be delayed for an unknown period due to errors or incorrect data. According to Article 331 of the Civil Code of the Russian Federation, the lender does not have the right to demand payment of interest in a situation of delay in repayment, if the sample does not contain information about the penalty.

A debt receipt of an individual (sample) may be the only evidence that confirms the fact of transfer of money to a stranger. It is worth mentioning that the promissory note can also be issued in any form. There are no clear requirements regarding design rules. But it is important to take into account basic information, without which the document loses its validity. Because errors and inaccuracies complicate the process of returning money. It's easier to fill out the sample by hand. If there are corrections, they must be confirmed by the borrower's signature.

Important! Corrections may lead to refusal to consider the promissory note in court. The agreement can be printed on a computer. However, lawyers do not recommend using this method, since it will be more difficult for specialists to conduct a graphological examination.

How to correctly draw up a receipt for receiving money under a loan agreement?

Almost everyone borrows and lends money, at least occasionally, although there are those who under no circumstances accept going into debt or those who adhere to the principle “if you want to lose a friend, lend him a loan.” The article will discuss how to borrow correctly, while drawing up a receipt.

We are talking not only about the surnames, first names and patronymics of the parties. Legally illiterate citizens draw up a receipt simply indicating their full name, the amount of the debt and the period for its repayment. This plays into the hands of unscrupulous borrowers, because in court they boldly say that there are millions of Ivanov Nikolaevich Petrovs in Russia, and thus evade responsibility.

- The interest rate for using the loan is 6 (six) percent per month for the entire loan amount and begins to accrue on October 1, 2020 (October 1, two thousand and seventeen).

- I undertake to repay the entire loan, as well as interest on the use of credit funds within 4 (four) months.

- The last date for repayment of the contract is February 1, 2020 (February 1, two thousand and eighteen).

- Always write your receipt by hand.

- Always include the lender's and borrower's initials in full.

- Please write dates of birth and registration addresses accurately.

- The borrower must write a receipt. In another case, he may claim that he did not write the document.

- All signatures must be decrypted.

- A joint decision between the lender and the borrower.

- When the loan amount is ten times the minimum wage, notarization will be a good reason for legal action if the borrower does not comply with the terms of the agreement. (Federal Law dated June 19, 2000 N 82-FZ).

A promissory note is a written document that confirms the transfer of funds as a loan to another person. In other words, this is official proof of the loan. According to civil law (clause 1 of Article 807 of the Civil Code of the Russian Federation): the lender transfers the right of ownership of funds or other valuables.

When concluding an agreement between individuals, it is important to adhere to the basic rules that guarantee the authenticity of the document in the event of litigation:

- the receipt is written only by hand;

- the body of the document contains complete information about the parties to the transaction, including passport data;

- it is the borrower who writes the receipt;

- transcripts (full full name) are required near the paintings;

- the transaction amount is written down in numbers and in words, indicating the currency;

- you need to indicate the exact terms of repayment of the debt;

- to conclude an agreement that involves a large amount, it is better to involve witnesses (in the agreement, also indicate their personal and passport details);

- if the transaction involves the accrual of interest for using the loan, this must be reflected in the document, indicating the amount of charges.

Even if there were no witnesses, but the borrower’s signature is on the receipt stating that the money was received in full, the document is considered legal.

However, witnesses may be needed to testify in court that the process of transferring money was carried out with mutual voluntary consent and the receipt was not signed by the borrower under duress.

So, in order to protect yourself in the courtroom from deception on the part of an unscrupulous debtor, if he suddenly declares that he signed the receipt through threats, but actually did not receive the money, take reliable people as witnesses who can refute this.

There is no legislative definition of the term “receipt”, but Article 808 of the Civil Code of Russia states that a receipt, along with other documents, proves the fact of transfer of money from one person to another, and regardless of the form in which the loan contract is drawn up (oral, written or certified legally).

The receipt is worth filling out, no matter what. Still, this document is mandatory from a legal point of view and gives the borrower the right to claim. For most borrowers, the receipt is valid, and, as a rule, a possible dispute is resolved by the parties out of court.

The main purpose of the receipt is its legal force before the court. Therefore, before drawing up this document, you should know some rules for filling out the paper.

| It is best to fill out the document by hand | Despite the fact that the law allows you to print out the form and put only a signature on it manually, priority is given to a document that is completely handwritten. The fact is that during court proceedings, handwriting examination will take place. And it is impossible to accurately determine authenticity from one signature. Therefore, the court may not take this document for consideration in the case, which will reduce the chances of winning |

| Evidence of the transaction | When signing a receipt, you should ensure that there are at least two witnesses. Although this procedure does not have to be carried out in every case of a loan, it is still recommended to use this opportunity. After all, this is another way to give the receipt greater legal force |

| Agreement details | Since the promissory note is intended, first of all, to protect the parties to the transaction from fraud, it is worth making sure that this document contains as many details about the transaction as possible. So, it is important to indicate the loan amount, loan term, debt repayment algorithm, etc. |

Subject to these simple rules, you can achieve the greatest degree of legal force of the receipt. Therefore, you should carefully prepare the sample, and only after that start filling it out and concluding the deal.

Loans for individuals and legal entities are provided by different organizations. Most often, such loans are issued by private individuals.

For a sample of a loan receipt between individuals, see the article:

loan receipt between individuals

.

How to get a loan on a card without refusal with a bad credit history, read here.

To find the most suitable option in terms of borrower requirements and lending conditions, you should compare different lenders. This can be done using different services.

Various private investors post their advertisements on special Internet platforms. The search is carried out using a special form. The required amount is entered into it and the program displays a list of the most suitable lender options.

Is it possible to do without witnesses when drawing up a promissory note?

The lender has the right to require the borrower to include information about the people present during the execution of the document. And thus, there must be a signature of those people who were at that moment when drawing up the promissory note.

There is no need to look for a specific correct form to fill out, because as stated above, the document can be drawn up in any form on plain paper. The lender can also make a computer printout. But this form makes it difficult to perform a graphological examination. And we conclude that the best option is to use the handwritten method.

Important points contained in the text of the receipt:

- Full name of the person who took the money

- Passport details and residential address of the borrower (both addresses: actual and place of registration)

- It is necessary to write the amount in words, and not just in numbers. This is important because scammers can forge a document

- When issuing money in foreign currency, you must indicate the exchange rate at the time of issue - this will allow you to avoid controversial situations in the future

- It is important to indicate the loan repayment period

- Payment schedule

Controversial and unpleasant moments can often arise if the document is not notarized. And then, in order to prove that you are right, you need to conduct a handwriting examination. But this process may not be necessary if the document is certified by a notary. If necessary, a receipt can be provided in court. With this, the lender will protect himself from various kinds of troubles and surprises.

Sample loan receipt for interest

The header of the document indicates its full name, the name of the locality and the date of preparation. The text of the receipt follows: “I, Ivanishin Ivan Sidorovich, date of birth 10/12/1976, native of the city of Navashino (passport details) received from gr. Svitchenkov Sergei Stanislavovich (identity card details and address of the lender) a sum of money (in numbers and in words) in the form of an urgent reimbursable loan. Passport data must contain complete information, including series, number, information about the organization that issued the document, date of issue and place of registration.

I undertake to repay the borrowed funds together with interest amounting to 15% (in words) per annum in a lump sum before December fifteenth, 2020. I have been notified that the place of debt repayment is the lender's residential address. If deadlines are violated, I guarantee payment of a penalty amounting to 0.1% of the total amount for each day of delay. I agree that territorial jurisdiction in the event of a dispute is determined by the place of residence of the lender. This receipt was made by me personally. I am fully aware of the legal consequences of signing the document, which I confirm in front of witnesses.”

Next, you must provide complete information about the persons present during the transfer of money, put the date and signatures with a transcript. The given example of drafting, as you already understood, refers to the independent writing of the contract. If you use the services of a notary, he will provide a sample receipt for borrowing money and help you draw up the document correctly.

Receipt for the return of money in case of purchase of real estate

A fairly common situation is when a citizen, together with his family or individually, plans to purchase an apartment or house in installments or taking into account the interest rate. There are quite a few sellers who are ready to sell real estate, waiting a certain period of time for payment of the full amount of money.

This option is considered positively, generally interest rates are not taken into account, and the installment amount is only part of the total payment (the remaining funds are transferred immediately after the execution of the agreement governing aspects of the acquisition and sale), since the seller is interested in prompt settlement with his client.

In most cases, the cash payment clause is included in the title document evidencing the acquisition of residential premises (agreement), without reflecting it in a separate receipt. Only if the amount is returned in full, the seller can sign the agreement that he has received the money in full, or draw up a separate document indicating the implementation of this action. In most situations, lawyers recommend issuing such a receipt separately, as written information filled out by the seller personally.

Do not forget that a mandatory element of the document being drawn up is the obligation to transfer ownership of the property to the buyer after he pays the remaining amount in installments.

Rules for drawing up a receipt not certified by a notary

The promissory note is written directly by the borrower. It will be valid if the requirements of Art. 808 of the Civil Code of the Russian Federation.

Provide reliable passport data and details if you have a passport. The date is in full format, since the document is valid for three years. Amount in written and Arabic format.

Penalties should be provided for in case of failure to comply with the conditions on the part of the borrower. Only if all conditions are met when writing the document, it comes into legal force.

Receipt for payment of money for the provision of services

One of the common phenomena today is the partial payment of cash for the provision of services and the arrangement of installment plans for the remaining portion of the payment. Such cases are practiced in the field of healthcare, law, social services on a private basis and other areas of work related to helping people.

This state of affairs is due to the high level of prices for medical services, medicines, procedures, and legal services. Situations that encourage issuing a receipt after receiving a certain type of service indicate the client’s reliability and the stability of his financial situation.

In the text of such a receipt, it is advisable to indicate the type of services provided to the citizen, how much money he must pay, the frequency of contributions, and deadlines. In case of failure to fulfill the obligations of one of the parties, as a measure to resolve the conflict, an appeal to the judicial authority for the purpose of debt collection is taken.

If the decision is positive, this issue is dealt with by bailiffs, who are called upon to ensure the feasibility of court decisions. They use methods to resolve the issue of debt collection.

Emergence of legal relations

If a person needs money, he can apply to the bank for a loan. But in the absence of collateral, the bank may refuse him a loan. Therefore, receiving money in this way may not be suitable for everyone.

An easier way may be to receive money from your friends or relatives. But the creditor wants to be sure that he can get his money back in the same amount and within the prescribed period. For this purpose, it is possible to conclude one of the following documents:

- receipts;

- loan agreement.

Important! Both the first and second variants of the relationship are regulated by the Civil Code of the Russian Federation. The simplest option would be the first one, since it is less troublesome than concluding an agreement.

What must be on the receipt?

When planning to borrow or lend money, it is worth studying what the receipt should include.

Although the receipt does not have to have any particular form, it must meet a number of requirements. If you miss any seemingly unimportant details, you may later face the fact that the court will not consider it convincing evidence.

So, let’s look at what must be included in the receipt:

- The name of the locality in which the transaction takes place (city, urban settlement, village).

- Date of transfer of money (date of origin of the loan relationship between individuals).

- Last name, first name and patronymic of the borrower and occupier. Date of birth, residential address (preferably) and passport details of the borrower.

- The exact amount being loaned. If this is agreed upon, interest accrued on the amount of debt during the period of use.

- Date of planned refund.

- The borrower's signature confirming that he received the money.

All data must be provided as completely, accurately and legibly as possible. The amounts of money, as well as the dates of the transaction and the return of money must be written in numbers and in words.

Why are witnesses needed?

Some lenders prudently enlist the support of witnesses when transferring money. They may be uninterested persons, information about whom is also required to be included in the receipt (their full name, passport details and address of residence).

With their signatures, they confirm the fact that the money was transferred exactly in the amount stated in the receipt and on the conditions indicated in it.

In fact, in some way the witnesses perform the function of a notary.

For what amounts is a loan receipt required?

Actually, the law does not prohibit issuing promissory notes for any, even minimal, amounts of money.

However, according to the Civil Code of the Russian Federation, from a certain level of borrowed amounts, written documentation of the loan is required. Article 808 of the Civil Code of the Russian Federation states that a loan agreement must be drawn up if the amount borrowed is at least 10 times greater than the minimum wage (minimum wage).

For smaller amounts of borrowed funds, according to the legislation of the Russian Federation, an oral agreement between individuals entering into debt relationships is sufficient.

The loan agreement regulates the rights and obligations of the parties involved in debt relations. It may or may not be notarized. In any case, the agreement is not evidence of the transfer of a loan between individuals.

To record this fact, a loan receipt is required.

Rules for implementing the procedure for issuing receipts

In addition to the correct content of the text, it is necessary to meet the requirements for document formatting:

- obligation to pay money drawn up in several copies, it is generally accepted that there should be 2 of them (one for each participant in the transaction);

- the transaction can be carried out in the presence of witnesses, so that in the event of a trial for late payment, the plaintiff or defendant can invite a citizen who was previously present during this procedure to confirm the data (the signature of the witness is recorded in the receipt, confirming the reality of the transaction);

- a receipt for the repayment of the debt not in printed form, but in handwritten form, since when examining handwriting, specialists are not always able to identify a person only by his signature; this requires a sample of a longer fragment written in the handwriting of the parties to the transaction;

- It is important not to forget to indicate the end date, which qualifies as the debt repayment limit. It is with this in mind that the beginning of the limitation period is determined, which is valid for only 3 years;

- if funds are to be transferred and returned not in rubles, but in another currency, this point must be recorded in the receipt.

A correctly drawn up document is a guarantee of a successful resolution of the issue of debt repayment.