Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 05/22/2020

Reading time: 6 min

5

130

Debt obligations of legal entities to each other are determined by the terms of transactions concluded between them. The grounds for termination of obligations are:

- high-quality performance (that is, debt repayment);

- government decision or court order;

- replacement of obligations with new ones by agreement of the parties;

- objective impossibility of execution (Article 416 of the Civil Code of the Russian Federation);

- debt forgiveness agreement.

- Concept and regulation of debt forgiveness

- Methods of registration Bilateral agreement

- Unilateral order (notification)

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

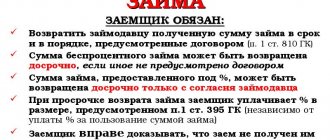

Debt forgiveness under a loan agreement: basic provisions

One of the possible ways to terminate obligations under a loan agreement is the forgiveness of the debt by the lender-creditor to the borrower-debtor. The parties to these legal relations are both legal entities and individuals. The procedure is regulated by the provisions of Art. 415 of the Civil Code of the Russian Federation.

For other possible ways to terminate obligations, read the ready-made solution ConsultantPlus. If you do not yet have access to the ConsultantPlus system, you can obtain it free of charge for 2 days.

In accordance with this article, the debt can be canceled either completely or partially, subject to certain conditions:

- there are no objections from the debtor;

- the rights of other persons related to the creditor’s property are respected.

Since forgiveness of a loan debt frees the borrower from property obligations to the lender, such an expression of the latter’s will can be qualified as a type of donation if:

- it is performed free of charge (Article 572 of the Civil Code of the Russian Federation);

- the court determined that the lender intends to release the borrower from paying the debt as a gift (clause 3 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation “Review of the practice of application ...” dated December 21, 2005 No. 104).

Important! Donations between businesses are not permitted. An exception is gifts worth no more than 3,000 rubles. (Subclause 4, Clause 1, Article 575 of the Civil Code of the Russian Federation).

In order for debt forgiveness to be distinguished from a gift, the lender, when carrying out such an action, must indicate that he has no intention of giving a gift to the debtor. This can be done by justifying the feasibility of writing off the debt, for example:

- to return part of the money without legal proceedings;

- in order to continue cooperation with the debtor (resolution of the FAS ZSO dated December 12, 2011 in case No. A46-5477/2011), etc.

Purpose of compilation

The founder of the organization is the owner of a significant share of the assets and has the right to dispose of them at his own discretion. At the same time, the founder can replenish the working capital of the legal entity from his own financial resources. Regardless of the size of equity participation in the company, the investor provides a loan of unlimited size for any period. The borrower can take out a loan at the initiative of the manager with a priority number of shares and votes.

Borrowed capital is necessary for the enterprise to restore solvency, develop the production and material base, and introduce new technologies. Lending from the founder is the most profitable option for attracting third-party assets. First of all, the lender knows perfectly well the internal state of affairs of the borrower and will not require additional information or supporting documents. In addition, the owner is personally interested in the well-being of the organization, so he will not tighten lending conditions.

The creditor has the right to claim the debt within the terms established by the contract or to completely waive the loan amount and interest in favor of the debtor. For the borrower, at the time of forgiveness of the debt arrears, tax obligations arise, the need to reflect profits and pay taxes to the state budget. In addition, the event is accompanied by certain nuances and subtleties.

So, debt forgiveness is a procedure for completely terminating the existence of obligations by the decision of one party, namely the lender. The most important consequence of such actions is a complete refusal to make claims in the future. The creditor will no longer be able to return his own money or go to court after signing the relevant agreement.

Debt resulting from the borrower’s failure to fulfill its obligations under the loan agreement may be forgiven by the lender

Legality of the transaction

The main legal act regulating the procedure for terminating obligations through forgiveness is the Civil Code of the Russian Federation, Article 415. Both legal entities and citizens can act as lenders. The borrower is exclusively the organization. The debt is canceled in whole or in part by agreement of the parties to the relationship. It is worth considering that the agreement should not violate the rights of others.

Due to legislative subtleties, in 2020 forgiveness can be qualified as a gift if the transaction is gratuitous. Counterparties should not forget that the practice of giving gifts between companies is prohibited by law (Article 575 of the Civil Code of the Russian Federation) if the value of the gift exceeds three thousand rubles.

To eliminate the possibility of disputes and the risk of recognizing the transaction as fictitious or reclassified as another type, the parties to the agreement must confirm the absence of signs of a gift. For example, the creditor forgives part of the debt so that the debtor can repay the remaining amount within the period established by the contract. Mutual cooperation in the future will also serve as a rationale.

The most important stage of debt repayment is the procedure for assessing potential risks. The lender is obliged to analyze his own financial situation, assess the size of existing obligations and debts. If there is the slightest chance that any person may protest the agreement, the debt cannot be forgiven. Since the controversial transaction will be protested in court and annulled. Interested parties may include spouses, children, creditors, and a bank.

A separate issue is the situation with the founder being declared bankrupt. In a difficult financial situation, the lender should not take risks. The arbitration manager studies in detail all the latest transactions related to the alienation of property and money. The employee has the right to initiate legal proceedings and seek termination of the agreement. The only exceptions will be transactions that have undergone preliminary approval from the manager.

Debt forgiveness is a legal procedure

https://youtu.be/4Fy1Kd82oHg

Registration of debt forgiveness

Before formalizing debt forgiveness under a loan agreement, the lender must make sure that his actions do not violate the rights of persons related to his property (clause 1 of Article 415 of the Civil Code of the Russian Federation). Such persons may be the lender's spouse, co-founders, or in some cases counterparties to other transactions. Also, you should not forgive debts in anticipation of the upcoming bankruptcy (Article 61.2 of Law No. 127-FZ of October 26, 2002).

As stated in paragraph 2 of Art. 415 of the Civil Code of the Russian Federation, debt forgiveness requires mandatory notification of the debtor. Although the legislator does not impose specific requirements for this document, it is advisable to include information in it:

- about the initial agreement (in our case, the loan agreement);

- the amount of existing debt;

- intention to write off the debt in full or in a certain part;

- conditions or purpose of performing this action.

Note! The notification can be sent in any way that makes it possible to reliably establish from whom it comes and to whom it is addressed (clause 65 of the resolution of the Plenum of the Armed Forces of the Russian Federation “On the application ..." of June 23, 2015 No. 25).

If the debtor does not present his objections within a reasonable time, then according to paragraph 2 of Art. 415 of the Civil Code of the Russian Federation, the obligation terminates from the date of receipt of the document. To determine the response time, it seems permissible to use the provisions of paragraph 2 of Art. 314 Civil Code of the Russian Federation.

If the debtor has any objections or clarifications after their approval, the debt write-off should be formalized by an additional agreement to the current loan agreement or a separate agreement.

The legislative framework

Art. 415 of the Federal Civil Code:

- The creditor may release the debtor from property obligations, but only if this does not affect the rights of third parties in relation to this property.

- All debt obligations can be considered extinguished as soon as the debtor receives the appropriate document within the established time frame - a notarized receipt, or a simple oral notice of termination of the debt obligation.

The law stipulates that debt forgiveness, like any other form of donation, can be carried out exclusively free of charge. The debt holder does not acquire any material benefit, and the debtor is not subject to any obligations. However, a debt forgiveness agreement deprives the creditor of any opportunity to make demands on the debtor to fulfill the original obligations established in the agreement, including demanding this in court. An exception may be the adoption of such an agreement as void for ten years from the date of signing.

Contract (agreement) on debt forgiveness

Based on the provisions of Art. 415 of the Civil Code of the Russian Federation, to forgive a debt, the will of the lender, expressed by notifying the borrower of complete or partial cancellation of the debt, is sufficient. However, in practice, they often draw up an additional agreement to the existing loan agreement.

The parties to the agreement can be both individuals and legal entities.

When making a decision to cancel a debt, it is advisable for the creditor to have an act of reconciliation of mutual settlements with the debtor. Next, you need to define and record the terms of the agreement:

- The clearly expressed intention of the creditor to cancel existing debt obligations (clause 1 of Article 415 of the Civil Code of the Russian Federation).

- Information about the obligation (name, number, date and parties) terminated as a result of this action. In the absence of the specified information, the court may recognize the debt forgiveness agreement as not concluded (Resolution 2 of the AAS dated May 19, 2010 in case No. A31-4521/2009).

- The amount of debt forgiven (resolution of the Federal Antimonopoly Service of the Eastern Military District dated September 10, 2009 in case No. A39-1176/2009).

- Conditions for forgiveness (if any).

Debt cancellation can be completed, as mentioned above, by concluding a separate agreement. An example of this document is presented here: Debt forgiveness agreement under a loan agreement - sample.

Writing off a debt to an individual can also be formalized through a gift agreement.

When an employer cancels a debt to its employee, it is permissible to issue an order or instruction.

Tax consequences for legal entities

It should be noted that when drawing up an agreement, the borrower must be prepared that not only positive aspects await him. According to accounting, he will have to display this amount as unrealized income.

These standards are prescribed in. Paragraph 18 of this article states that the amount of money specified in the forgiveness agreement is indicated.

Entering an amount into this category of the balance sheet results in tax consequences.

A debt forgiveness agreement is one of the legal tools that allows you to resolve a controversial situation with a legal entity that, due to circumstances, cannot pay the debt.

Its registration occurs only with the consent of the lender and implies a paid release of obligations from the borrower.

Taxation of a debtor - an individual

According to the provisions of tax legislation, in the case of forgiveness of a debt under a loan agreement to an individual, the latter will receive income - economic benefit (clause 1 of Article 41 of the Tax Code of the Russian Federation) in the amount of the loan written off and interest (when issuing a loan with interest). This amount is subject to personal income tax at a rate of 13% (clause 1 of Article 210, clause 1 of Article 224 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated October 17, 2016 No. 03-04-07/60359).

When writing off a debt on an interest-free loan, taxable income in the form of material benefits from saving on interest does not arise for the payer (letter of the Ministry of Finance of Russia dated October 28, 2014 No. 03-04-06/54626).

The creditor organization, being a tax agent, is obliged to make all relevant transfers to the budget.

If the creditor is the debtor’s employer, the amount of personal income tax due to be paid to the budget can be withheld from the money paid to the employee (clause 4 of Article 226 of the Tax Code of the Russian Federation).

If it is impossible to make the specified transfers, the tax agent is obliged to inform the payer and the tax authority at the place of his registration (clause 5 of Article 226 of the Tax Code of the Russian Federation, order of the Federal Tax Service of Russia dated October 2, 2018 No. ММВ-7-11 / [email protected] ).

In this case, individuals pay personal income tax on the specified income on the basis of a notification from the tax authority (clause 6 of article 228 of the Tax Code of the Russian Federation).

Important! If the amount of the forgiven debt is equal to or less than RUB 4,000. or the debt is forgiven as a gift, there is no need to pay tax on the forgiven amount (Clause 28, Article 217 of the Tax Code of the Russian Federation).

Contributions to state extra-budgetary funds

As a general rule, amounts transferred to an individual under civil contracts (in our case, a loan agreement), the subject of which is the transfer of ownership of property (including money), are not subject to insurance contributions to state extra-budgetary funds (clause 4 Article 420 of the Tax Code of the Russian Federation).

This is consistent with the position of the judiciary. According to the judges, a debt under a loan agreement forgiven by an employer to his employee is not subject to insurance premiums if these relations are not related to the employee’s work responsibilities, and the debt write-off is formalized by a gift agreement (see resolution of the AS PO dated 05/07/2015 No. F06-22195/ 2013 in case No. A12-30165/2014, decision of the Supreme Court of the Russian Federation dated August 18, 2015 No. 306-KG15-8237).

A similar position is presented in the letter of the Federal Tax Service of Russia dated April 26, 2017 No. BS-4-11/8019.

However, as noted in the same document, if such non-repayable loans are issued by the employer to its employees systematically, this may mean that the employer is hiding labor benefits under the loans.

Issues of calculating corporate income tax when forgiving loan debt

According to Art. 247–252 of the Tax Code of the Russian Federation, the object of taxation for profit tax is the company’s income (including non-operating), reduced by the amount of expenses incurred (including non-operating).

For the debtor, the amount of the forgiven loan and interest on the loan is non-operating income that increases the tax base (clause 18 of Article 250 of the Tax Code of the Russian Federation).

For the creditor, the issue of including the written-off debt as part of non-operating expenses that reduce taxable profit is not resolved so clearly:

- According to the judges, the creditor has the right to include a partially forgiven debt in non-operating expenses, since partial write-off is aimed at generating income, but in a smaller amount (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 15, 2010 No. 2833/10 in case No. A82-7247/2008- 99).

- The Russian Ministry of Finance, on the contrary, believes that the amount of forgiven debt, including partially forgiven, cannot be taken into account as part of such expenses, since it is not a justified expense in the sense of Art. 252 of the Tax Code of the Russian Federation (see letter of the Ministry of Finance of Russia dated April 4, 2012 No. 03-03-06/2/34).

- The Federal Tax Service of Russia, taking into account the opinion of the judges, in a letter dated August 12, 2011 No. SA-4-7/13193, confirmed that the creditor has the right to include the written-off debt as part of non-operating expenses if it took measures to collect it in court and mutual claims were settled by a settlement agreement . Then these expenses will meet the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation. If there are no attempts to collect the debt, it can be written off only when the statute of limitations expires (subclause 2, clause 2, article 265 of the Tax Code of the Russian Federation).

Informing participants

Forgiveness of the founding loan occurs subject to mandatory notification of the debtor. The notification form can be developed in any form. It is advisable to include the following information in the document:

- Information about the previous agreement.

- Size and structure of the debt obligation at the date of forgiveness.

- A detailed statement of intentions regarding the amount of obligations that will terminate on a specified date.

- A summary of the purposes for entering into the agreement.

The creditor sends notification in any available way: by mail, via courier service, electronic communication channels. It is important that the debtor correctly identifies the addressee and makes the appropriate entries in accounting and tax accounting. The correctness of the formation of the borrower’s tax base for income tax will depend on the conditions of information. If the declaration is submitted with errors, the payer of the budget fee will face penalties.

Based on the norms of Art. 314 of the Civil Code of the Russian Federation, we can say that the agreement comes into force after seven days from the date of delivery to the debtor of a correctly executed notice. For example, the creditor sent a letter by registered mail. Confirmation of the moment of delivery of the form will be a mark on the postal notification form.

To reduce waiting times and minimize controversial situations, the founder invites the loan recipient to draw up a bilateral agreement. In this situation, there is no need to write letters to notify the debtor. He confirms with his own signature and seal the fact of complete unconditional consent with the actions being taken.