Who has the right and is deprived of it to receive a deduction?

To receive a deduction, you must fulfill the conditions for documenting and confirming costs. Additionally, general requirements for the recipient of the benefit have been established.

| Condition | Emergence of the right to benefit | No right to benefit |

| Person status | Resident | Non-resident |

| Availability of taxable income | Available | None |

| Payment of personal income tax to the budget | Produced | Not produced |

| Expenses eligible for deduction | Actually produced and documented | No expenses or paperwork |

| Submitting documents for deduction to the Federal Tax Service | Produced | Not produced |

| Submitting an application for deduction | Implemented | Application not submitted |

Payment for temporary disability due to pregnancy and childbirth

Before wondering whether maternity leave is subject to personal income tax in 2018, it would be good to know exactly how maternity leave payments are calculated and calculated in 2020. In total, payment for this period is made in the same way as payment for the most ordinary annual calendar leave, only it is called an allowance and is issued from the Social Insurance Fund.

This happens because, although maternity leave is a vacation, it is documented as a period of temporary disability - and this is the sphere of activity and responsibility of the Social Insurance Fund. Calculations, as having complete information, are made by employers and provide only the final result to the Fund. Therefore, they are required to figure out whether maternity leave is taxed, even though, according to the new legal requirements, a calculation sheet is provided along with the final figure, on which all calculations are fully described.

Back to contents

Payment order

Just like regular calendar paid rest from work, the period of release from work duties for pregnancy and childbirth is paid according to the average daily earnings - you need to know this before calculating taxes on maternity leave.

In the same way, all payments subject to taxes and contributions during the billing period are summed up and divided by the number of days worked over the last two years. The calculation period does not include all time periods when the employee received partial earnings or full earnings, but not subject to taxes and insurance contributions.

If in the previous two years the employee worked at a different company from which she is going on maternity leave, she must bring a certificate of income for calculations. By the way, if an employee is registered and works at several enterprises, she can apply for benefits at all places of her work. Of course, the question of whether personal income tax is charged on maternity leave will then have to be decided by all its employers.

Back to contents

Who provides the tax benefit?

Control over the receipt of tax deductions lies with the Federal Tax Service. When receiving a benefit from an employer, control is carried out either before it is provided or during an on-site tax audit. You can get a tax deduction:

- Directly to the Federal Tax Service by submitting a declaration, application, package of documents. The benefit is provided after a year of receipt of income and expenses.

- From the employer on the basis of a notification issued by the Federal Tax Service after checking documents confirming the right to a property or social benefit.

- From the employer on the basis of an application for a standard deduction without additional permission from the Federal Tax Service. Depending on the type of deduction, the package of documents differs.

What are tax deductions and what are they?

A tax deduction is the portion of your income that the government allows you to avoid paying tax on.

This kind of support from the state that you can get if you have children or spent money on something useful. Costs for purchasing housing, treating yourself and your relatives, and training are considered “useful.” You can receive deductions from your employer or on your tax return. In the first case, 13% of the deduction amount due to you will be transferred by the employer not to the state budget, but to you as a salary increase. If you file a return, you will be refunded the due amount from the taxes you already paid last year.

https://www.youtube.com/watch?v=ha4jcfumwTE

Let's look at different types of deductions in the context of a “maternity” situation.

Composition of documents for obtaining a deduction

When applying for a benefit, the list of documents must include supporting documents confirming:

- When receiving a property deduction - a purchase and sale agreement, title documents, and, if necessary, a transfer deed. To claim a deduction for interest - a mortgage agreement, an account statement.

- When applying for a social deduction for training or treatment - an agreement, a license, an act of services performed. When purchasing medications - a doctor’s prescription, a prescription. To apply the benefit to a relative, a document confirming the relationship is provided.

- When applying for a standard deduction - a birth certificate, if necessary - a certificate from the registry office about making a voluntary record of paternity, an agreement on the adoption of a child into the family, a certificate of guardianship or trusteeship, disability. To receive a deduction for a child under 24 years of age studying full-time, a certificate from the dean’s office of the educational institution is required.

Additionally, payment documents certifying the fact of incurring expenses are submitted. Documents must be submitted with a current validity period, in original or copy, depending on the requirements of the Federal Tax Service.

Taxation of employee income

Let's remember, before we find out whether income tax is paid on maternity leave, what kind of taxes an ordinary employee of an ordinary organization pays. According to the law, each tax resident pays from the income received:

- personal income tax;

- insurance contributions to the Social Insurance Fund;

- contributions to the Pension Fund;

- insurance premiums against occupational diseases or accidents at work.

It is from insurance payments that a fund is formed, from which temporary disability is then paid, including the period of time during pregnancy and childbirth.

Features of claiming deductions when using different methods

Depending on the chosen method of claiming a deduction, there are differences in design.

| Method of receiving a deduction | To the Federal Tax Service in person | To the Federal Tax Service by contacting the government services website | From the employer (tax agent) |

| Filing a 3-NDFL declaration | Required, on paper | Required, electronically | On required |

| Statement | Required, included in the package of documents | Required, generated after verification | Required by the Federal Tax Service to receive notification and to the employer |

| Desk inspection | Carried out, period limited to 3 months | Carried out, period limited to 3 months | Not carried out, document verification is carried out within 1 month |

| Deadline for receiving the deduction | The amount of overpaid tax is transferred to the account within a month after verification if an application is submitted | The amount is transferred to the person within a month after verification and generation of the application in electronic form | The deduction is provided in the current period of income receipt |

The declaration for obtaining the deduction is submitted at any time after the end of the annual tax period . Within 3 years, you can apply for a recalculation of the tax base and a refund of overpaid tax. After 3 years there is no tax refund.

Registration procedure

Personal income tax is paid upon receipt of the notice, but in most cases this responsibility is assumed by the employer's accounting department. Transfers are made from the company's account, which are later deducted from the employees' salaries.

You can receive a property deduction either through the tax authority or through your employer. More often, individuals apply to the Federal Tax Service on their own, because this way the process happens much faster. There is no statute of limitations for tax deductions for purchased housing, so a person himself determines when it is more profitable for him to apply for its registration.

To return taxable personal income tax, you must submit documents in accordance with the requirements of the tax authority and the specific situation. The declaration indicates the amount of income received during the year and taxes paid. Based on the results of the audit, a notification about the decision of the Federal Tax Service is issued within 30 days, and after another 10 days the money is transferred to the taxpayer’s account.

Limits on deductions provided to taxpayers

The legislation establishes the amount of restrictions provided for each type of benefit. Limit values are set:

- For a property deduction when purchasing residential real estate - 2 million rubles in the amount of expenses and 3 million rubles for the interest paid on the loan agreement.

- For property deduction when selling residential real estate - 1 million and 250 thousand when selling other property.

- For social deductions for treatment (your own or relatives), treatment according to the list - 120 thousand rubles, education for children - 50 thousand rubles. The benefit applicant must choose the type of expenses to be claimed, the total amount of which is 120 thousand rubles, with the exception of education for children and payment for expensive treatment.

- For the standard deduction - 1,400 for the first and second child and 3,000 for the third.

The amount of deduction is further limited by the amount of income received and expenses incurred.

An example of applying a benefit at a maximum value

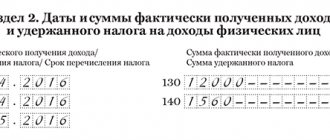

Citizen N. claimed a deduction for 2020 for treatment, the total amount of which was 150 thousand rubles. In 2020, N. was on maternity leave and child care, but received income from renting out an apartment in the amount of 90 thousand rubles. A tax of 11,700 rubles was included in the budget. After contacting the Federal Tax Service, the inspector:

- Determined whether N. has the right to a deduction.

- Set the maximum deduction amount at 120 thousand rubles.

- I recalculated the base: B = 90,000 – 120,000 = (30,000) rubles.

- Determined the amount of tax to be refunded in full: 11,700 rubles.

- Conclusion: due to the lack of a tax base, after applying the deduction, the tax must be refunded in full.

Tip #2: Plan your shopping time

In the year of maternity leave

If the purchase of real estate was made in the same calendar year as going on maternity leave, then the woman can receive a deduction in the amount of the tax paid on wages for that year.

The right to claim a tax refund arises after the end of the year in which the purchase of real estate was made (Clause 7, Article 220 of the Tax Code of the Russian Federation). An exception is receiving a deduction from the employer in accordance with clause 8 of Art. 220 of the Tax Code of the Russian Federation - it can be declared immediately after purchase.

But this exception is rarely relevant for those going on maternity leave. A deduction from the employer is a transfer of the entire salary to the applicant without deducting personal income tax from it. Since wages are usually not paid during maternity leave, this method becomes irrelevant.

After maternity leave

If the tax deduction was not used immediately, the right to claim it remains in subsequent years. This is true if there was no income during maternity leave. You can apply for it after leaving maternity leave.

There is no time limit for applying for a property tax deduction. A number of sources mention a 3-year limit. However, as follows from the practice of courts and other government bodies, the 3-year limitation does not apply to the taxpayer’s right to apply for a personal income tax refund in connection with the purchase of an apartment on the basis of Art. 220 Tax Code of the Russian Federation.

In accordance with the Cassation Ruling of the Supreme Court of the Russian Federation dated February 27, 2020 No. 5-KG18-308, the law does not establish a deadline for applying for a property tax deduction in connection with the acquisition of residential real estate. The Russian Ministry of Finance came to the same conclusions in letter dated September 30, 2020 No. 03-04-05/74665. In these clarifications, government authorities considered situations where an application for a tax refund was filed in relation to apartments purchased more than 3 years ago. The applicants' eligibility to receive funds has been confirmed.

Possible changes in tax laws should not affect your tax refund in the future. As a rule, the rules that were in force at the time the right to it arose are applied to relations for receiving a deduction. In any case, the law prohibits worsening the taxpayer’s position in comparison with the previously existing regulation.

The only risk that remains if the deduction is postponed “for later” is a change in the above-described point of view of government agencies that the right to apply for it is not limited to a certain period.

Therefore, it is better not to delay applying for a tax refund. The application must be submitted immediately after maternity leave, when income subject to personal income tax appears.

Is it possible to get a deduction for previous years before maternity leave?

The transfer of tax deductions to previous periods (before the acquisition of real estate) is not provided for women on maternity leave. Only pensioners have this right in accordance with paragraph 10 of Art. 220 Tax Code of the Russian Federation.

Possibility of combining several types of deductions

The legislation does not prohibit the use of several types of benefits at the same time, subject to the provision of proof of the right to deduction.

Example of combining deductions

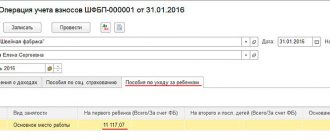

Enterprise employee S. took maternity leave from September 15, 2015. S.’s salary in 2020 was 210,000 rubles. Tax in the amount of 27,300 rubles was calculated and withheld from the amount of income. In 2020, S. spent 70,000 rubles on treatment, and is entitled to the balance of the property deduction that arose when purchasing an apartment in 2014 in the amount of 1,700,000 rubles. After submitting the declaration to the Federal Tax Service, the inspector:

- Determined the person’s right to a social deduction and the balance of the property deduction.

- Calculated the tax base for personal income tax: B = 210,000 – 70,000 – 1,700,000 = (1,560,000) rubles.

- Determined the amount of refundable tax in the amount of 27,300 rubles.

- Established the balance of the property deduction transferred to future periods in the amount of 1,560,000 rubles.

- Conclusion: due to the use of the deduction, S. has no tax base for 2015, which made it possible to return the full amount of previously paid tax.

What is maternity leave

According to labor law, a pregnant employee has the right not to go to work seventy days before giving birth and another seventy days after it. During her stay at home, she will receive an allowance, and this period of time is called maternity leave or maternity leave, in official terms.

It goes without saying that when making calculations, enterprise managers are interested in whether personal income tax is withheld from maternity leave, as well as other taxes and contributions. The same question, of course, worries employees who are going on vacation - after all, it is much more pleasant to receive the entire accrued amount in your hands in full, without any deductions.

Back to contents

Probable reasons for refusal to receive a deduction

Violation of the document flow procedure or lack of evidence of expenses leads to a refusal to provide a deduction. Common cases include:

- Application for benefits in the absence of taxable income during the year.

- Lack of originals provided to the Federal Tax Service upon request during the inspection period.

- Submitting an application to refuse to apply a deduction in favor of a spouse if the absence of the right to a deduction is documented, for example, in the presence of a separation agreement or when inheriting property. Knowledge of legal regulations guarantees the prevention of denial of deductions.

Results

To the question of whether income tax is taken from maternity leave, there is only one answer - negative. Unlike payments for regular sick leave, maternity benefits should not be subject to personal income tax. This is clearly indicated in paragraph 1 of Art. 217 Tax Code of the Russian Federation.

Almost all income of legal entities and individuals in the Russian Federation is subject to taxation. Ultimately, tax payments reduce the amount of cash an employee receives.

It is not surprising that the question of whether so-called maternity benefits are subject to tax withholding worries new mothers.

This article talks about typical ways to resolve the issue, but each case is unique. If you want to find out how to solve your particular problem, call:

Yulia Simanovskaya, Director of the Department of Legal Support of Transactions at Tekta Group, answers:

Since ownership of the apartment arose in 2020, the right to deduction arises from 2020. Therefore, you can file a return for 2020 and receive part of the tax deduction. The deduction amount will be calculated based on the period of work and, accordingly, taxes paid to the budget until mid-2020. During the period while maternity leave is taken out, due to the lack of taxable income, it is impossible to receive a deduction.

After returning to work, you must resume filing returns and receive the remaining tax deduction. Current legislation does not provide for a statute of limitations for applying for a tax deduction.

Where to contact

You can receive a tax deduction from the Federal Tax Service or through an employer whose employee is on maternity leave. It is necessary to fill out an application indicating the details for crediting funds, and fill out the 3-NDFL declaration. Attach to these papers copies of documents confirming the period of work for which the woman received taxable income.

We suggest you read: Forced leave without pay

When contacting an employer, he takes upon himself the issuance of a 2-NDFL certificate. At the same time, you should attach: copies of the Taxpayer Identification Number (TIN) and passport, purchase and sale agreement, mortgage with payment schedule, checks and receipts confirming expenses, title documents. If a taxpayer claims a different type of deduction, the list will change.

After the documents are received by the Federal Tax Service, the verification process takes about three months, and then the funds are credited to the account for another month. To summarize, it should be noted that women on maternity leave do not have to worry, since they will be able to receive a tax deduction, in particular a property one, even after returning to work. And if they work for some time, the benefits will be more obvious.