Before talking about whether it is possible to apply for leave retroactively, you should understand what leave is, as well as what types of leave are available that an employee can take advantage of in accordance with labor law. Vacation is the release of an employee from performing his job duties for a certain period of time in order to ensure annual rest or social purposes. At the same time, for such a period, the employee retains the workplace or position held, and in cases directly provided for by the Labor Code, the average salary.

There are several types of work release. These are:

- paid annual leave, which is the main one;

- additional leave;

- special;

- leave without pay.

These types of leaves can be either paid or unpaid. It should be noted that most holidays are paid.

Unpaid leave includes leave during which wages are not retained. They are provided to employees only upon their written application. It should be borne in mind that there is a certain category of employees who have the legal right to additional unpaid leave.

Required by law

Legislative regulation of vacations is provided for by Chapter 19 of the Labor Code of the Russian Federation. The issue of registering leave not in the manner prescribed by law, but retroactively, in most cases arises in relation to unpaid leave. This type of release from work is provided for in Article 128 of the Labor Code. Its essence is that the employee and the employer enter into an agreement. However, in some cases, only necessity forces one to apply for such leave. For example:

- an employee’s close relative has died and he needs to leave urgently;

- the employee has given birth to a child and needs additional time;

- the employee registers the marriage;

- the employee is an old-age pensioner and needs additional time to rest;

- the employee is disabled and also needs additional rest;

- the employee is a WWII veteran or participant in combat operations;

- the employee is a victim of Chernobyl and other radiation disasters.

The given list of reasons is not exhaustive. However, in the presence of such circumstances, days of additional, unpaid leave are subject to inclusion in both insurance and seniority. While such an employee is on vacation, he retains his job, and the employer does not have the right to dismiss him on his own initiative.

Procedure for provision

The provision of annual leave with payment of the average daily rate is regulated by Article 122 of the Labor Code. As a general rule, in order to go on vacation, an employee must work in a new place for at least six months. However, if the employee belongs to the following categories, then he can exercise his right earlier. This:

- women - before going on maternity leave or after leaving it;

- employees who have not yet turned 18 years of age;

- employees who adopted a child under three months of age.

Other categories of workers may be defined at the legislative level.

If there are family circumstances or for other reasons specified in Article 128 of the Labor Code, the employee has the right to take unpaid leave by agreement with the employer. To do this, you must submit a written application and justify your request, preferably documented. These may be certificates, telegrams, and other official documents.

Benefit amount

The amount of benefits is affected by the minimum wage at the time of the start of maternity leave or parental leave.

Maternity benefits are paid to the insured woman in total for the entire period of maternity leave in the amount of 100% of average earnings:

- 140 calendar days: 70 days before and 70 days after childbirth;

- 156 days - for complicated childbirth;

- 194 days - for multiple pregnancy.

The average earnings for female entrepreneurs are taken as the minimum wage, that is, 11,280 rubles. (from January 1, 2019).

As mentioned above, insured entrepreneurs can count on receiving other benefits (benefits for registering with medical institutions in the early stages of pregnancy, benefits for the birth of a child and child care benefits until they reach 1.5 years of age) .

To receive them, an individual entrepreneur needs to contact the FSS branch at the place of registration. To do this, it is necessary to prepare a written application in any form and another list of documents specified in Order of the Ministry of Health and Social Development of the Russian Federation dated December 4, 2009 N 951N.

If a woman entrepreneur has not paid insurance premiums, then she can only count on minimum payments:

- allowance for registration before the 12th week of pregnancy - 655.49 rubles.

- child birth benefit - 17,479.73 rubles.

- child care allowance until he reaches 1.5 years of age - 3,277.45 rubles. (for the first child)

To receive the minimum payments, you need to contact the social security authorities.

Now let's see how different the amount of benefits will be if the woman paid insurance premiums.

Retroactive leave

It is not always possible for an employee to foresee the need to notify the employer in advance of the need to provide leave. The following should be taken into account:

- According to the requirements of Article 136 of the Labor Code, vacation pay must be issued to an employee no later than three days before going on vacation. Thus, it is impossible to retroactively issue paid leave, since the employer will be held administratively liable. Thus, Article 5.27 of the Code of Administrative Offenses of the Russian Federation establishes punishment for violation of legislation regulating labor law standards. The sanction in this article provides for an administrative fine in the amount of 30 to 50 thousand rubles for a legal entity and from 1 to 5 thousand rubles for a manager.

- Providing any leave requires the issuance of an order in Form No. T-6, which the employee must familiarize himself with. Therefore, issuing an order retroactively carries the risk of an administrative fine, both for the enterprise and for its manager. What to do depends on the manager and the labor discipline that he has established.

However, since there is no direct legislative prohibition on such a procedure, the employer can, at his own peril and risk, apply for planned or unscheduled leave retroactively.

Retrospective sick leave: how to apply legally?

Citizens perceive issuing a sick leave certificate as a kind of formality and a simple way to confirm legal absence from work. Therefore, many workers believe that it is possible to receive a sick leave certificate for the days that have passed before going to the hospital, that is, retroactively.

How true is this opinion, in what cases is retroactive registration of sick leave allowed and what is the possible liability for violations identified in this case - all this will be discussed in detail below.

Situation one: suddenly on vacation

Let's start with a situation that does not happen often, but when it does, it can fray the nerves of both the manager and the accountant. We are talking about cases when an employee first does not come to work, and then asks to register his absence as paid leave. The employer, agreeing with this approach, must take into account that in this situation it will not be possible to formalize the relationship legally flawlessly*.

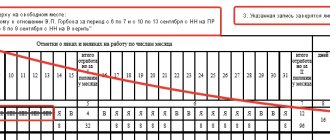

The matter is further aggravated by the fact that the employer must decide whether to consider this absence as a vacation immediately - after all, it is necessary to fill out the Time Sheet. Therefore, of course, the ideal option, if you have already decided to meet the employee halfway, is to receive a vacation application from him on the same day. Let it not be the original application, but a copy sent by fax, or scanned and sent by email. Even such a document is better than nothing.

Based on such a statement from the employee, the head of the organization must issue an order granting leave on the same day. At the same time, it will be necessary to issue an order to amend the Vacation Schedule, and also instruct the accounting department to calculate vacation pay and accrue it to the employee on the same day. At the same time, if settlements with the employee occur by transferring the amounts due to him to a bank (card) account, then on the same day the amount of vacation pay must be transferred. And if not, the employee must be notified on the same day of the opportunity to receive vacation pay.

However, as we have already said, there is no legally impeccable design option in this case. Therefore, the “ideal option” proposed above also contains a “wormhole”. Formally, in this case, the employer violates the rules of Article 136 of the Labor Code of the Russian Federation that payment for vacation must be made no later than three days before its start. And also the rules of Article 123 of the Labor Code of the Russian Federation that the employee must be notified of the date of the vacation by signature two weeks before it begins.

Simply put, “if something happens” the labor inspector will have something to complain about. Therefore, in order to reduce possible risks, it is necessary for the employee to indicate in his leave application the reason (a valid reason) why he so urgently and suddenly needed leave. And of course, there should be such a statement. Without it, the chance of getting a fine increases significantly.

Situation two: vacation for a new employee

The next situation is simpler, but also capable of baffling accounting workers who have not yet become skilled in personnel matters. When engaged in personnel accounting, accountants, as a rule, know that, by law, vacation is granted on the basis of the Vacation Schedule. And this schedule is drawn up at the end of the year (more precisely, no later than two weeks before the end of the year).

However, at the beginning of the year, many organizations start new businesses, projects, open new branches, divisions, directions, etc. As a result, the staff is expanded and new employees are recruited. It is clear that if a person joined the company, for example, in January, then he is not taken into account in the Vacation Schedule (after all, the Schedule was drawn up back in December). But after just six months, this person can apply for vacation. And it is quite possible that he will want to realize this opportunity. How to be?

In fact, everything is solved quite simply. As soon as a newly hired employee becomes eligible for vacation (usually after six months of work), it must be entered into the Vacation Schedule. This can be done in two ways: by supplementing the existing Schedule or by approving it in a new edition. Naturally, changes to the Vacation Schedule need to be made only if the employee actually plans to take vacation this year. If he does not rest, then he will be included in the Vacation Schedule for the next year and there will be no violation here.

What payments are due to an individual entrepreneur on maternity leave?

To obtain information about benefits, you must calculate the duration of your maternity leave in advance. Payment amounts depend on the following factors:

- Minimum wage size;

- Individual entrepreneur's insurance experience;

- Average salary;

- Features of the region in which the individual entrepreneur is registered.

As it was clarified above, the main action that a woman individual entrepreneur must perform in order to receive payments from the state is paying contributions to the Social Insurance Fund. In case of full payment to the Social Insurance Fund, the individual entrepreneur claims:

- maternity benefits, that is, payment for maternity leave. In connection with the change in the minimum wage in 2020, an individual entrepreneur will receive 51,918.90 rubles in 140 days (70 days before giving birth and 70 after);

- a one-time amount if registered with the residential complex before the twelfth week, 655.49 rubles.

In addition to these payments, there are others, which depend on the number of children the individual entrepreneur has, the status of a large family and the family of a military personnel. An individual entrepreneur applies for these benefits even if he does not pay contributions to the Social Insurance Fund.

If the insurance contract is concluded in the same year in which the individual entrepreneur plans to go on maternity leave, then payments will be accrued the following year, after submitting all relevant documents, but no later than six months after the sick leave expires.

Situation three: vacation not as scheduled

Let's consider a similar situation. When drawing up the Vacation Schedule, the employee indicated one date as his desired date, but actually wants to rest at another time. It should be borne in mind that in this case the employer has no obligation to fulfill the employee’s wishes. After all, the Vacation Schedule is a document mandatory not only for the employer, but also for the employee (Article 123 of the Labor Code of the Russian Federation). However, if you decide to accommodate the employee halfway, you will have to formalize a change in the Vacation Schedule. This is done by order or instruction of the manager based on a written application from the employee.

Situation four: vacation for one day

Go ahead. In many companies, employees do not have the opportunity to use all their vacation at once. But since you still need to rest, vacation is “chosen” in small parts, sometimes even one day at a time. The accounting department, naturally, has the question of arranging such “mini-vacations”.

The first thing to consider in this regard is that the legislation does allow the employee to “split” his vacation. But only if two conditions are met: the employer agrees to divide the vacation, and one of the parts of the vacation is at least 14 calendar days (Article 125 of the Labor Code of the Russian Federation). By introducing this rule, the legislator assumed that the “fragmentation” of vacation would be planned and would be reflected in the Vacation Schedule even when it was drawn up. This is confirmed by the absence of any peculiarities in filling out the Vacation Schedule in the case of granting vacation in parts. This means that the proper design of “mini-vacations” will depend on when such an idea arose.

If these “mini-vacations” are planned by the employee in advance and included in the Vacation Schedule, then they are issued in the same way as regular vacation: two weeks’ notice, payment of vacation pay three days in advance, an order to grant vacation. If we are talking about unscheduled, that is, “mini-vacations” not included in the Schedule, then a rule must be established: the employee warns the employer about such “mini-vacations” at least two weeks in advance. In this case, the employer will have time to make changes to the Vacation Schedule and promptly notify the employee about the vacation.

Payments to an employed woman

Having work experience and a permanent place of work, a “maternity leaver” can receive a number of monthly and one-time benefits if she provides the following documents:

- In case of official employment, the following conditions for granting leave apply: if the woman is in normal condition and gives birth on time, leave is given for 140 days, from the date of sick leave. In case of complications during childbirth, the leave is extended to 154 days. When more than one child is born, the number of days increases to 194.

- The amount of assistance is the amount of the average salary for the previous 6 months. If such a period is not worked by the employee, the payment will correspond to the minimum wage, which from 2020 is 11,280 rubles.

- Simultaneously with the previous payment, a pregnant employee will receive 655.49 rubles, if she provides a certificate from the housing complex confirming her timely registration;

- One-time assistance is paid next. The amount of assistance is 17,479.73 rubles from February 1, 2020. The amount paid will increase depending on the number of children born

- And the last help from the state is a monthly payment. This amount depends on the minimum wage; from January 1, 2020, the minimum wage is 11,280.00 rubles, thus

Monthly amount per child = 11,280.00 * 0.4 (40%) = 4,512.00 rub.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Situation five: from sick leave to vacation

And finally, consider this situation: a few days before a planned vacation, an employee falls ill. What should I do? The answer to this question depends on when exactly the employee fell ill. If this happened before you warned him about the vacation, that is, more than two weeks before the planned date of vacation, then this issue must be resolved together with the employee. If, despite illness, he does not want to change the time of vacation, then the procedure remains unchanged - notification of the date of vacation, payment of vacation pay, order of vacation. At the same time, the annual vacation itself will be extended for those days of sick leave that fall during the vacation (Article 124 of the Labor Code of the Russian Federation). If the employee says that due to illness he would like to postpone the vacation, and the employer does not object, then, taking into account the employee’s wishes, we determine a new vacation date and make appropriate changes to the Schedule.

We act differently in cases where an employee falls ill after he was warned about vacation or even after receiving vacation pay. Here the employer has the right not to take any action at all - the vacation will automatically be extended for the duration of the sick leave. No amendments to the Vacation Schedule are required.

The situation will not be complicated by the fact that the employee fell ill without having time to apply for leave. The fact is that, according to the Labor Code, such a statement need not be drawn up. We have already mentioned that vacation is provided on the basis of the Vacation Schedule, which is mandatory for both the employee and the employer (Article 123 of the Labor Code of the Russian Federation). So the order for granting leave is drawn up on the basis of the Leave Schedule and no application is needed here.

At the same time, if an employee asks to reschedule his leave due to illness, then the employer has the right (but not the obligation!) to accommodate him (Article 124 of the Labor Code of the Russian Federation). Accordingly, in this case, a new vacation date is determined and changes are made to the Schedule.

* In this case, we do not consider the option of processing all vacation documents “retrospectively”. At first glance, this is an ideal option. However, it must be taken into account that signing such documents is a matter of goodwill not only of the employer, but also of the employee. This means that there is always a risk that he will back down and not sign the documents. In addition, organically integrating several documents retroactively into the document flow is not an easy task.

Vacation at your own expense: learning from other people's mistakes

Summer is a period when personnel officers are literally overwhelmed with work on processing vacations, including vacations without pay. This does not come without legal difficulties. Indeed, according to the law, in some cases the employer is obliged to provide the employee with free days, and in others he has the right to act at his own discretion. In the article, we will analyze readers’ questions regarding leaves without pay, look at what mistakes are made in practice, and give recommendations on how to “resolve” this or that problematic situation.

The General Director informed us that in September of this year, for financial reasons, the work of production workshop No. 3 would be temporarily “frozen.” In this regard, he instructed the personnel service to issue leave to employees without pay. Tell me, how far in advance should I notify the staff that they are being granted leave?

Natalya Shakhvorostova, senior HR manager, Tver

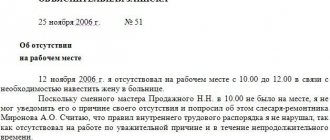

The question is posed fundamentally incorrectly. The fact is that it is impossible to “forcibly” send an employee on leave without pay, even for operational reasons. Here the initiative should come only from the employee himself. At the same time, it is important that the application be formulated in such a way that it is clear to everyone (including the state labor inspectorate) that the reasons that prompted the employee to contact the employer are of a purely personal nature (see Example 1).

Example 1 CollapseShow

It should be noted that the forced sending of employees on leave without pay is a serious violation of labor legislation, for which the Code of Administrative Offenses of the Russian Federation provides for both a fine (for legal entities up to 50,000 rubles) and, taking into account repetition, suspension of the employer’s activities (for up to 90 days).

Note CollapseShow

The minimum wage from June 1, 2011 was 4,611 rubles. (see Federal Law No. 106-FZ dated June 1, 2011 “On Amendments to Article 1 of the Federal Law “On the Minimum Wage”).

In a situation of downtime, which is exactly what is happening in your company, you need to act as follows. First of all, issue an order recognizing the fact of a temporary suspension of work, determining the start and end time of the downtime (if the exact date is known), and specifying how much the staff will be paid for the time of forced inactivity. In addition, it is important to convey to subordinates that during downtime they are required to be at their workplaces. The fact is that downtime takes place during working hours, during which the employee must obey the internal labor regulations (Article 56 of the Labor Code of the Russian Federation) and, in particular, be at his workplace. In some cases, the law allows the employee to be transferred to another job for up to one month during this period. And without even asking his consent, if the upcoming work requires qualifications of the same level. We are talking about emergency situations. For example, about a production accident or industrial accident (part two of Article 72.2 of the Labor Code of the Russian Federation).

Note CollapseShow

The law defines downtime as a temporary suspension of work for reasons of an economic, technological, technical or organizational nature (Article 72.2 of the Labor Code of the Russian Federation). Such suspension is paid depending on the absence or presence of fault of the employee or employer. So, if the incident is not the fault of any of the parties to the employment contract, downtime is paid in the amount of less than 2/3 of the tariff rate, the employee’s salary, calculated in proportion to the downtime time. And if the downtime was due to the fault of the employer, then in the amount of at least 2/3 of the employee’s average salary. Suspension of work due to the fault of the employee is not paid at all (Article 157 of the Labor Code of the Russian Federation).

We had a conflict at work. That's the essence of it. The employee asked for a few days of leave at her own expense and said that her adoptive father had died. The director did not sign the statement: in the summer we have a large influx of clients, and there was no one to replace her. In addition, N. is a well-known “dreamer,” so they thought that this was just a reason to take a break from work. The woman left anyway, and we decided to punish her. When N. returned three days later, they handed her a work book with a record of dismissal for absenteeism. Now she threatens to sue, produces a death certificate and says that we had to let her go. Is this so? After all, her father is not her own.

Olga Vladimirovna Solomatina, head of HR department, Perm

There is a general rule according to which the employer independently decides whether to satisfy the employee’s request for leave at his own expense or not. Moreover, in case of refusal, the manager should not give any explanations regarding his decision.

Fragment of the document Collapse Show Part one of Article 128 of the Labor Code of the Russian Federation “Leave without pay”

For family reasons and other valid reasons, an employee, upon his written application, may be granted leave without pay, the duration of which is determined by agreement between the employee and the employer.

However, there are exceptions to every rule. There are certain categories of employees to whom the employer, at their request, is obliged to provide leave without pay. They are listed both in articles of the Labor Code and in other Federal laws1.

Thus, the employer is obliged to provide the employee with leave of up to five calendar days in the event of the birth of a child, registration of marriage, or in connection with the death of close relatives (Article 128 of the Labor Code of the Russian Federation). The latter is exactly your situation. And the manager, of course, had to satisfy the employee’s request. The fact that the deceased is not the woman’s natural father, but an adopted one, does not matter at all. The law, in particular the Family Code of the Russian Federation, does not distinguish between biological and adoptive parents (Article 2).

Thus, without understanding the situation, you made two mistakes. The first is that you did not give the employee the required vacation. The second is that they fired for absenteeism without sufficient grounds, while ignoring the dismissal procedure itself. After all, before applying a disciplinary sanction, the employer must request a written explanation from the employee (if after two working days the employee does not provide an explanation, draw up an appropriate report). And only if the reason for absence from work is considered unjustified, can the mechanism of dismissal for absenteeism be launched (Article 193 of the Labor Code of the Russian Federation). With that said, the court will most likely reinstate your employee.

The general director came to our HR department and asked for the maximum period for which an employee can be sent on vacation at his own expense. To my shame, I could not answer him. Please help me “rehabilitate myself.”

N.S. Kolyvanov, senior HR inspector, Moscow

There are no maximum periods beyond which the employer is not entitled to provide the employee with leave at his own expense. Everything depends on the agreements of the parties. If an organization has the opportunity to give an employee the number of free days that he asks for, no one will judge it for this.

Moreover, the law in some cases establishes a minimum period of vacation at one’s own expense. We are talking about cases where the employer is obliged to provide leave without pay to certain categories of employees. For example, parents and wives of military personnel who died as a result of injuries received in military service, and old-age pensioners. These categories of workers should be provided, upon their written request, with up to 14 calendar days a year (Article 128 of the Labor Code of the Russian Federation). And for municipal and state civil servants - up to one year (Federal Law No. 25-FZ and Federal Law No. 79-FZ).

The employee did not show up for work for three days. They called him at home - he didn’t answer. When he showed up, he put a retroactive application for leave at his own expense on my desk. He says that he was sick and took advantage of his right to a short vacation. Is the employee right? I can’t understand what kind of vacation he meant?

Sofya Nikolaevna Kudryashova, head of the administrative department, Kineshma

No, your employee is wrong. The vacation he had in mind is not currently provided for by law. This benefit is a thing of the past. Previously, in case of illness, an employee had the right to three days of leave without pay during the year. These days were provided to him upon personal application. In this case, no other document from the doctor (neither a sick leave certificate nor a certificate) was required. However, after 01.01.2005, that is, after changes to the Fundamentals of the Legislation of the Russian Federation on the protection of the health of citizens2 came into force, this provision lost force.

We are a small business. The employees are mostly young women. Many have children. The previous leader established such a procedure that every mother with two or more children under the age of 14 enjoyed the right to short-term unpaid leave in the summer. The list of beneficiaries was even on the director’s desk. Now a new boss has come and abolished this practice. The employees are outraged and believe that their rights have been violated. Is it so?

Mikhail Sokolovsky, HR inspector, Ulyanovsk

It’s great that your company cared so much about working mothers. This practice is a good means of motivating staff. It's a pity that this tradition is a thing of the past. However, in order to answer the question about the violation of the rights of working mothers, you need to know whether the leave benefit was properly formalized (this does not follow from the letter). The fact is that employees with two or more children under the age of 14 (as well as employees with a disabled child under the age of 18, single mothers and fathers raising a child under the age of 14) have the right to demand leave without preservation of wages only if this provision is expressly enshrined in the collective agreement. No other local act, including the Vacation Regulations in force in the organization, in this case can replace this document (Article 263 of the Labor Code of the Russian Federation). Thus, the answer to your question depends on whether the organization has a collective agreement or not, and if so, whether such a benefit is reflected in it.

We remind you: if the organization has undertaken to provide unpaid leave to the employees listed in Art. 263 of the Labor Code, then such leave (upon a written application from the employee) can be added to the annual paid leave or used separately (in whole or in parts). Transferring the specified vacation to the next working year is not allowed.

I know that if an employee falls ill during the next paid leave, such leave is extended or postponed. What if an employee gets sick while on vacation at his own expense? Is the employer obliged to move it or agree with the employee on rescheduling it to another time? How is sick leave paid in this case?3

Nadezhda Chelnakova, HR specialist, Ufa

Indeed, Art. 124 of the Labor Code obliges the employer (taking into account the wishes of the employee) to extend or postpone the annual basic paid leave to another date. The law says nothing regarding unpaid leave (including when providing such leave is the responsibility of the employer). Thus, when superimposing leave at your own expense with a period of illness, no “progress” occurs. At the same time, the employee is not paid for sick leave. Federal Law No. 255-FZ of December 29, 2006 “On compulsory social insurance in case of temporary disability and in connection with maternity” states that temporary disability benefits for the period of release of an employee from work without pay are not assigned (Article 9). If temporary disability occurs during a period of unpaid leave (if the illness continues), a certificate of incapacity for work is issued from the day the specified leave ends (Order of the Ministry of Health and Social Development of the Russian Federation dated August 1, 2007 No. 514).

For example, an employee was on leave without pay during the period from June 1 to June 28, 2011. On June 21, he fell ill and did not return to work until July 5. Consequently, a certificate of incapacity for work will be issued to him from June 29 to July 4 (inclusive) 2011.

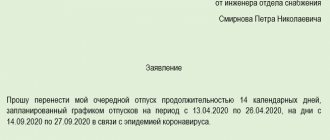

The employee, an economist in the planning department, took a vacation at her own expense and went to the country. And the manager had questions about her work. He said that the subordinate should be urgently recalled from vacation and a corresponding order should be prepared. Tell me how to formulate it? Due to production needs?

Svetlana Rodionova, office secretary, Moscow

The Labor Code does not directly address the issue of recalling an employee from leave without pay. Although in practice such a need, naturally, may arise. How can we be here? In our opinion, one should act by analogy and be guided by the norms of Art. 125 of the Labor Code. It follows from the norm that the employer can recall an employee from annual paid leave with his written consent.

Therefore, do not rush into issuing an order. First, get the employee’s consent to leave the vacation early. Such consent may be provided in a separate application. Although the woman’s signature on the tear-off part of the notice (which contains a proposal to interrupt the vacation) is quite enough. The wording of the order in this case is not important. You can also write “due to production needs” or “due to the need to perform unforeseen work,” etc. It all depends on the real situation that dictated such a decision.

Example 2 CollapseShow

During the working year, the employee (group 3 disabled) took leave without pay several times. The total duration of all vacations is 40 calendar days. How many days should be excluded from the calculation when determining the length of service for the next vacation?

Let's start with the fact that the length of service that gives an employee the right to annual basic paid leave includes not only the time of actual work, but also other periods. For example, vacation time without pay, not exceeding 14 calendar days during the working year (Article 121 of the Labor Code of the Russian Federation)4. Anything that exceeds this period is not taken into account. For example, an employee started work on July 20, 2010. From 07/01/2011 to 07/20/2011 I was on leave without pay. This means that by July 20, 2011, he had not yet “earned” his right to basic annual paid leave. He will receive this right only on July 26, since the working year has shifted by 6 calendar days.

Note CollapseShow

The right to use annual paid leave for the first year of work arises for an employee after six months of continuous work with a given employer. At the same time, he is entitled to rest in full (at least 28 calendar days), and not in the amount of days calculated in proportion to the time worked, as some personnel officers mistakenly believe. By agreement of the parties, paid leave can be provided earlier than six months. Also, before the expiration of the specified period, women before maternity leave or immediately after it, and employees under the age of eighteen have the right to go on leave.

In practice, the question arises as to whether it is necessary to include vacation for the first year of work, provided in advance, in the vacation schedule? In Art. 122 of the Labor Code says nothing on this matter. It only says that the order must be observed when granting leave for the second and subsequent years.

In our opinion, the new employee should be included in the company’s “vacation plans”. And not only if he started working immediately before drawing up the schedule for the next year5, but also if he was hired into the organization later. Firstly, by doing so we will fulfill the requirements of Art. 123 of the Labor Code, which states that all annual paid leave must be covered by the schedule, with no exception made for leave for the first year of work provided in advance. Secondly, it will be much more convenient for the company’s management to organize work if the rest of all employees without exception, both new and “old” employees, is planned in advance.

If an employee was on unpaid leave several times during the working year and the total duration of these leaves was more than 14 calendar days (for example, in your case - 40), then only 14 calendar days are also taken into account.

When calculating length of service giving the right to annual leave, it does not matter that the employee is disabled. Article 121 of the Labor Code establishes in this case uniform rules for all categories of employees, including those to whom the employer (at their written request) is obliged to provide leave without pay. For example, participants of the Great Patriotic War, working disabled people or people with disabilities.

Duration of unpaid leave established by the Labor Code for certain categories of workers CollapseShow