Going on maternity leave: basic rules

Facts relevant for expectant mothers:

- A woman can go on maternity leave only after reaching 30 weeks of pregnancy. If more than one child is expected, the period increases.

- Leave is taken on sick leave, which is issued for 140 days. This period covers the time before and after childbirth.

- Sometimes the period of maternity leave is extended to 160 days. Typically, such relief is given to women who experience complications during pregnancy or childbirth.

You can receive payments from the state not only during preparation for childbirth and a short period after it, but also for several months while caring for a child. It is permissible to apply for maternity leave not only for a woman, but also for her husband. The maximum period of maternity leave is 36 months, but you can only receive significant payments from the state for 18 months.

All women, without exception, including unemployed people, have the opportunity to receive benefits. The only condition in order to be able to submit the appropriate application is to pay contributions to the Social Insurance Fund in advance. People working in enterprises do not have to worry about this stage, since deductions are written off automatically. For individual entrepreneurs, this procedure is optional and is performed on a voluntary basis.

Important! If a female individual entrepreneur decided to go on maternity leave, but did not pay her contribution to the Social Insurance Fund, she is not entitled to benefits. In order not to encounter difficulties, but to have stable financial assistance until the child turns 3 years old, it is necessary to pay contributions in advance. The total amount will be more than 2000 rubles. in year. A woman has the opportunity to repay the amount monthly or pay it immediately.

https://youtu.be/H4YQO-pQ5Qk

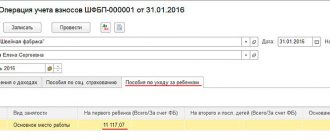

The procedure for registration of VHI in the Social Insurance Fund and the amount of contributions

To conclude a VHI agreement, an individual entrepreneur must present to the Social Insurance Fund at the place of permanent registration, in accordance with Order of the Ministry of Labor of Russia dated February 25, 2014 N 108n (as amended on November 27, 2017) a certain list of papers:

- Application in the prescribed form.

- Original or copy of an identity document certified by a notary.

If the applicant provides the FSS with an original passport, in accordance with Chapter II, paragraph 13 of the above order, fund employees can certify it themselves.

The requirement to provide other documents (certificate of registration of individual entrepreneurs or USRIP) is illegal. FSS officials must request them themselves from the relevant government agencies.

After three working days after the application (clause 10 of Chapter II of Order No. 108N), the fund is obliged to issue the applicant a certificate of registration under the VHI agreement in the established manner. If the entrepreneur changes place of residence, the registration period increases to five days.

After completing the registration procedure, the individual entrepreneur must deposit insurance amounts into the Social Insurance Fund in the following order [Resolution of the Government of the Russian Federation dated October 2, 2009 N 790 (as amended on May 27, 2016)]:

- in parts or at a time, but no later than December 31 of the current year;

- by postal transfer, direct deposit of funds or by bank transfer.

The amount of insurance payments does not depend on the income of the individual entrepreneur, it is fixed and is calculated according to the following rule: by multiplying the minimum wage in force at that moment by the rate of insurance premiums and by the number of months in the year.

It follows that the amount of funds paid depends only on the minimum wage established at that time, since the maximum TSV in 2020 was determined to be 2.9%. The minimum wage depends on the place of residence of the insured and is established by law.

How to register with the Social Insurance Fund

To go on maternity leave, you need to collect a package of documents in advance to submit to the Social Insurance Fund:

- passport or other identification document;

- registration certificate issued by the tax authorities;

- OGRN.

If the documents are submitted on time, the woman will be registered. In order to continue to receive maternity benefits, you must pay contributions every month and also submit reports annually.

Important! Women individual entrepreneurs do not have to pay contributions to the Pension Fund if they do not continue to engage in professional activities during maternity leave. The time a woman took while on maternity leave will be deducted from her length of service if she fails to pay contributions to the Pension Fund.

What you need to know

Financial stability is a concern for any woman planning a pregnancy. If the expectant mother is an employee, then the employer will take care of calculating benefits.

The recipient of the payments will only need to find out from the accounting department about the list of necessary documents and provide them in a timely manner.

It’s another matter when a woman comes – you have to take care of receiving payments yourself.

First of all, you should know that all payments related to pregnancy are divided into two types. Some are only available to working women, while others are entitled to any mother.

Regardless of the fact of employment, expectant mothers are entitled to a lump sum payment for the birth of a baby.

In addition, you can receive child care benefits until the age of one and a half years. These social support measures are issued through the social protection authorities directly at the place of registration.

But during pregnancy and childbirth, working women are entitled to paid leave. But as an individual entrepreneur, such leave is not always paid.

Basic Concepts

Maternity benefits are compensation for the temporary disability of a working woman. A pregnant employee is granted leave for a total duration of 140 days.

In case of multiple pregnancy, rest increases by 56 days. Complications during childbirth make it possible to increase the rest period after the birth of the baby by 16 days.

Maternity leave is calculated cumulatively, that is, a woman can use the allotted period in full, regardless of the time of maternity leave.

All vacation days are subject to payment in the amount of average earnings. The payment is calculated by the employer, but is paid at the expense of the Social Insurance Fund.

Compulsory insurance for employed citizens provides for contributions such as compensation for temporary disability, including those related to maternity.

That is, a woman receives B&R benefits from the social fund. Being pregnant, a woman can also qualify for this benefit. But only if there are certain reasons.

Who should

Benefits from the Social Insurance Fund in connection with pregnancy and childbirth are provided to the following categories of persons:

- working under an employment contract;

- employees of state and municipal institutions.

Simply put, the Social Insurance Fund pays benefits to insured persons. Individual entrepreneurs are not included in the list, but this does not mean that entrepreneurs are not entitled to benefits for accounting and economics.

This is due to the fact that individual entrepreneurs are not required to pay contributions to the Social Insurance Fund.

However, a woman entrepreneur has the right to register with the Social Insurance Fund by concluding a social insurance agreement and pay fixed payments.

If for the year preceding maternity leave the individual entrepreneur pays the contribution in full, then she is assigned a minimum wage allowance based on the minimum wage.

Legal regulation

In accordance with clause 5 of Article 14 of Federal Law No. 212 of July 24, 2009, entrepreneurs do not pay insurance payments for themselves to the Social Insurance Fund in case of temporary disability.

But clause 2, part 1, article 5 of this Law states that individual entrepreneurs can enter into legal relations under compulsory social insurance at their own request.

That is, paying contributions to the Fund gives a woman individual entrepreneur the right to receive maternity benefits.

This is also stated in paragraph 14 of Federal Law No. 212, namely, the B&R benefit is accrued and paid to voluntarily insured persons, but only if they pay insurance premiums for at least six months.

Exact time of maternity leave

The final decision in this matter is made by the gynecologist. In order to avoid mistakes when determining the duration of pregnancy, it is necessary, when the first symptoms of their presence occur, to come for an examination to a gynecologist and register. This action must also be performed in order to regularly monitor the progress of pregnancy.

In standard cases, a woman has the opportunity to go on maternity leave at 30 weeks of pregnancy. If the doctor determines the presence of complications that may negatively affect the birth process, as well as in the case of pregnancy with more than one child, a sick leave certificate is issued a little earlier, at 28 weeks. It is up to the doctor to determine the duration of maternity leave. If no complications arise, leave is granted for exactly 70 days before and after delivery. In the presence of complicating factors, the time in most cases increases.

If a woman has taken care of the timely payment of contributions to the Social Insurance Fund, there are no obstacles to the successful registration of maternity benefits. You need to do the following:

- Apply.

- Prepare a certificate confirming the fact of pregnancy registration.

- Go through the process of applying for sick leave.

- After the birth of the child, submit a separate application for maternity leave to care for him.

- Attach a copy of your birth certificate.

Women who are officially married must also provide a certificate from their spouse’s place of work.

Benefit amount

Having registered with the fund, what payments does the mother of an individual entrepreneur receive upon the birth of a child in 2020? For businessmen, there are two types of benefits from the Social Insurance Fund budget:

- For pregnancy and childbirth, which is called maternity benefits. The amount is 51,918.90 rubles for 140 days of vacation. If two or more babies are born at once, the amount increases.

- Benefit paid for early registration with gynecology. Its value is limited to 649.84 rubles.

Note! If a woman is both an entrepreneur and works under an employment contract, then she has the right to apply to her employer for assignment of payments. In this case, the amount is determined based on the employee’s salary level.

On the Internet you can find a calculator for calculating maternity payments for a convenient and quick calculation of benefits.

What additional payments are due to women running a business?

Some social benefits paid by the state are accrued not only to those who paid contributions to the insurance fund, but to all women. Subject to timely registration at the antenatal clinic (up to 12 months of pregnancy), the woman will be paid a one-time benefit in the amount of 632 rubles.

Payments are also made after the birth of the child. The benefit amount is more than 16,000 rubles. The percentage of payments of one-time benefits to women individual entrepreneurs does not differ from unemployed women and those who have an employment contract with the company.

If a woman is not pregnant with her first child, it is possible to receive additional financial benefits.

In many cases, various benefits are provided; if necessary, you can obtain special conditions when taking out or recalculating a loan.

When a child turns one and a half years old and until he reaches 3 years old, a monthly allowance of 50 rubles is paid. To obtain it, you must submit a package of documents. Many women do not apply for this benefit due to the small amount.

The main and most significant payment is maternity benefits. Its amount is more than 35,850 rubles. If more than one child is born, or complications arise during pregnancy or childbirth, the duration of maternity leave increases, which affects the amount of benefits.

Parents with many children need to pay attention to regional and federal benefits. To receive them, you must submit an appropriate application if there are suitable programs. To find out if you are currently eligible for additional benefits, you need to check the availability of programs in your area.

Is it possible to receive maternity benefits if you have not previously paid contributions to the Social Insurance Fund?

If the insurance contract was concluded in the same year when registration with the Social Insurance Fund took place, you can hope to receive maternity benefits. In this case, you should pay the entire amount for the current year, and apply for payments next year. This activity must be completed no later than six months after the end of the sick leave period.

Voluntary insurance rules for entrepreneurs

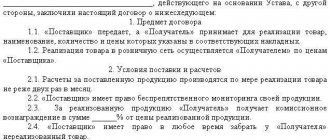

What is voluntary insurance?

Voluntary insurance is an agreement between a person and the insurer company, according to which an individual. the person pays monthly contributions to the insurance fund, and the insurance organization pays compensation upon the occurrence of an insured event. To receive maternity benefits, pregnancy and childbirth must occur.

Such an agreement is concluded solely voluntarily. To do this, the individual entrepreneur must independently contact the Social Insurance Fund to obtain insurance. It has a certain period, which is negotiated by the parties. At the end of the agreement, the contract period can be extended.

The amount of insurance premiums is also set by the parties. They must be paid every month, quarter or year at the entrepreneur’s choice.

Where to go?

To conclude a voluntary insurance contract, you need to visit the Social Insurance Fund. An application should be submitted to this authority and a list of required papers should be attached to it.

Required documents

To apply for voluntary insurance, you will need to collect the following documents:

- Russian passport.

- TIN certificate.

- Paper confirming tax registration.

- Certificates certifying the registration of individual entrepreneurs.

The last two papers are presented at the request of the entrepreneur. Government employees authorities usually make the request themselves in order to speed up the procedure for drawing up the contract.

Work experience: features

When a woman goes on maternity leave, the time spent caring for the child is counted as work experience. In order not to lose these years, you must present a sick leave certificate, which is also necessary for calculating child care benefits. This rule is relevant for all women, with the exception of individual entrepreneurs. In order not to interrupt her work experience, a businesswoman must pay a contribution to the Pension Fund during her entire maternity leave. Otherwise, the time spent on maternity leave will not be counted when calculating your pension.

In order to easily receive all the payments required by law when going on maternity leave, you need to prepare a package of documents, take care of registering with the Social Insurance Fund and paying contributions in advance, and register with the antenatal clinic in a timely manner. All women receive part of the payments, regardless of compliance with certain requirements and labor status. Other benefits can be received only if the listed rules are followed.

What can an individual entrepreneur expect?

Women who are registered as individual entrepreneurs are often concerned about the payments they are entitled to from the state. This is especially true for maternity benefits and how to obtain maternity individual entrepreneurs.

The answer to this question is extremely simple. If an entrepreneur pays contributions to the Social Insurance Fund, he can count on assistance from the state in certain cases. This also includes those situations when a woman goes on maternity leave to care for her baby until he reaches 1.5 years old.

There is no rule in Russian legislation that would oblige individual businessmen to pay contributions to the Social Insurance Fund for themselves. Everything happens entirely on a voluntary basis, but insurance provides many advantages, so experts recommend not to refuse it. There are many compensation options for individual entrepreneurs. If an entrepreneur has paid contributions to the Social Insurance Fund, he is entitled to payments due to temporary disability, compensation for pregnancy and childbirth, as well as maternity benefits. For this reason, it is especially recommended for business women to pay insurance premiums.