From January 1, 2020, the minimum wage remained at 7,500 rubles. However, despite this, from January 1 there have been changes in the calculation of some “children’s” benefits. How to calculate “children’s” benefits from January 1, 2017? What is the amount of benefits from January 1, 2020? Has the amount of child care benefit changed? How much will the Social Insurance Fund reimburse for “children’s” benefits from January 1? You will find answers to these and other questions related to children's benefits, as well as a table with new sizes in this article.

Types of "children's" benefits

“Children’s” benefits usually include payments related to the birth of children. The list of “children’s” benefits is given in Federal Law No. 81-FZ dated May 19, 1995 “On state benefits for citizens with children.” Let’s consider how the amounts of the most frequently paid “children’s” benefits will change from January 1, 2020, namely:

- benefits for registration in the early stages of pregnancy;

- lump sum benefit for the birth of a child;

- monthly child care allowance up to 1.5 years;

- maternity benefits.

These benefits are paid by the employer. However, we note that in certain regions of the Russian Federation a pilot experiment is being conducted to pay benefits directly from the Social Insurance Fund budget. FSS units in the experimental regions themselves calculate and pay “children’s” benefits to employees. See “Participants in the FSS pilot project.”

If an organization or individual entrepreneur has employees to whom he is obliged to pay child benefits, then the employer should know the amount of child benefits from January 1, 2020.

Indexation from February 1, 2020

From February 1, 2020, child benefits were indexed by a factor of 1.054. Therefore, do not get confused: in January there will be one benefit amount, and from February 1 there will be another. After reading this article, we recommend that you familiarize yourself with the materials “Children’s benefits from February 1, 2020: new amounts and features of payments”, “Children’s benefits are indexed from February 1, 2020”.

Social payments 2020

In the middle of the term, all pregnant women begin to think about what guarantees they will receive from the state at the birth of their baby. How to feed and raise a baby during maternity leave, when a young mother does not have many opportunities to do this adequately, because she needs to raise her child. Before we look at existing social benefits for 2020, it is worth noting what types all benefits can be divided into.

Additional payments for your baby can be paid once for the entire vacation period (let’s say one-time) and those that are paid once a month (naturally, up to a certain age of the baby).

It is also worth noting that, in addition to support expressed in monetary terms, the state provides support to new parents in the form of certificates (maternity capital, birth certificate (issued at the place of registration, at seven months of pregnancy), certificate for the purchase of real estate) , and the state provides various benefits. In addition to the fact that there are benefits at the federal level that apply to all citizens, there is also a category of benefits of regional significance, that is, those that citizens of certain regions of our country can receive. Regarding the payments we are interested in, it should be noted that these payments can only be received by pregnant women who work under a work book or independently contribute money to the Social Insurance Fund.

So, let's look at the social benefits that a woman can count on when going on a long-awaited vacation:

- Maternity benefit;

- Allowance for early registration;

- One-time benefit for the birth of a child;

- Monthly allowance for child care up to 1.5 years old.

Now we will analyze each payment in more detail, but before that, I will clarify at what stage of pregnancy women’s long-awaited maternity leave begins: At 30 weeks, if you have a standard pregnancy (you are carrying one baby).

If you are doubly or triple lucky (you are carrying several babies), then your long-awaited vacation begins at 28 weeks of pregnancy.

I would also like to note that there are other social benefits for individual citizens, for example, military personnel or low-income people:

- Monthly allowance for the second child;

- Federal maternity capital for the third child;

- Monthly payment for the 3rd and subsequent children;

- Regional maternity capital (for large families);

- Allowance for foster children and those under guardianship;

- Payments for disabled children and cash benefits.

Maternity benefit

In 2020, a pregnant woman receives maternity benefits at her place of work, or at the Social Insurance Fund closest to her place of residence, if she was fired due to the closure of the organization. The amount of payment depends on the pregnant woman’s work experience and her average income.

The smallest amount of maternity benefits in 2017 is 34,521 rubles (depending on the minimum wage: as of January 1, 2020, the minimum wage was 7,500 rubles); the maximum value is 266,191 rubles.

I would like to draw special attention to expectant mothers that if you decide to continue working until the birth, please calculate in advance how it will be more profitable for you: leaving immediately at 7 months of pregnancy or just before giving birth. First of all, maternity leave is provided precisely at this stage of pregnancy, and if you don’t take it right away, it means you’re missing it and you have no choice but to work and earn money for the birth of the baby and subsequent leave, since immediately The employer does not have the right to accrue two accrual formats (benefits and salary).

We recommend reading: Melon during pregnancy, Cocoa during pregnancy, Urine culture tank during pregnancy

And also, it is important to remember that during pregnancy, expectant mothers should lead a calm lifestyle: a positive charge of emotions, but no physical activity. At work, you are unlikely to rest or work at full strength; the baby is already making itself known with its numerous pushes. Therefore, before making a decision, compare all the pros and cons of your further actions.

We also recommend reading: Second pregnancy after 30 years: mother again

Early pregnancy benefit in 2020

A payment of 613 rubles is received by those pregnant women who are registered for up to 12 weeks. At 30 weeks, you will be given a certificate with a sick leave certificate indicating that you were registered early. It is this certificate that will become the basis for payment of benefits by the employer.

One-time benefit for the birth of a child in 2020

Women receive this benefit at the birth of a child in the amount of 16,350 rubles. You can receive this payment along with maternity benefits at your place of work or at the Social Insurance Fund at your place of residence, but on the condition that these mothers are unemployed or work unofficially.

Monthly allowance for child care up to 1.5 years old

The amount of this payment is calculated based on the average earnings of one of the parents over the past two years. In the amount of 40%. It is worth noting that both a young mother and a young father can receive this benefit (unless, of course, the mother has already received it).

For leave and benefits to care for a child up to one and a half years old, you must provide the following documents:

- Passport;

- Child’s birth certificate, a copy will be taken by the HR department;

- Bank card number for transfer;

- Statement. Documents for obtaining maternity leave (sick leave for pregnancy and childbirth)

However, the mere fact that you are pregnant is not a reason to let you go on the desired vacation. In order to go on maternity leave, you must bring the following documents to the HR department:

- Sick leave for pregnancy and childbirth (be sure to check that everything is indicated correctly, because the process of issuing a duplicate sick leave is quite tedious);

- A certificate stating that you are registered in the early stages (this document is issued at the antenatal clinic at 30 weeks of pregnancy); Application for leave, indicating the period indicated on the certificate of incapacity for work. The standard period for sick leave for pregnancy and childbirth is 140 days. If you had a Caesarean section or any other complication during childbirth, then your sick leave will be extended by 16 days, but if you have more than one “belly”, that is, you are so lucky that you have twins or triplets, then your sick leave will also be extended and will be equal to 194 days. A sick leave certificate is also issued when adopting children, provided that at the time of adoption your children are less than 3 months old. The validity period of the sick leave in this case will be 70 days. If you have adopted several children, then the sick leave can be extended to 110 days;

- Passport;

- Certificate of income for the last 2 years of work;

- Bank card number for transferring benefits.

It also happens that an expectant mother often changes jobs, including over the past 2 years, then to calculate maternity benefits in 2020 she will need to bring a certificate of income or, in other words, “the amount of wages” from previous jobs. If suddenly it is not possible to provide such a certificate, then the employer calculates sick leave based on the data available to him, without breaking the law at all. Please note that for you, as young mothers, this calculation is not entirely profitable, so try to provide this certificate to your employer.

There are also unscrupulous expectant mothers who, for their own benefit, are ready to forge documents, including a certificate “about the amount of wages.” Therefore, dear employers, when hiring an employee or as soon as you have been provided with the appropriate certificate, check its authenticity through the Russian Pension Fund by writing a corresponding application. In any case, if this happened, in accordance with our legislation, the employer would be right if it withheld the amount of undeserved payments from the salary of the pregnant employee.

The employer pays sick leave only when it has a complete package of documents. This payment is assigned by order, which must be approved within 10 working days. You should not wait long for the payment of benefits, because payment for a wonderful vacation will be made on the nearest date of your advance or salary following the issuance of the order.

We also recommend reading: At what stage does hCG indicate pregnancy?

Indexation of benefits from January 1, 2017

There will be no indexation of “children’s” benefits from January 1, 2020, since legislators have not provided for such an indexation coefficient. However, payments for children will be indexed from February 1, 2017, taking into account the consumer price index for 2020. In this regard, from January 1 to February 1, 2020, “children’s” benefits should be paid in the same amounts as in 2020. Let us summarize the amounts of “children’s” benefits in the table from January 2020. These dimensions have not changed in any way.

| Type of benefit | Benefit amount in January 2020 |

| Benefit for registration in early pregnancy | RUB 581.73 |

| One-time benefit for the birth of a child | RUB 15,512.65 |

| Minimum monthly allowance for child care up to 1.5 years | Care for the first child - 3,000 rubles; Care for the second child RUB 5,817.24. |

However, some changes in the amount of benefits from January 1, 2017 will still occur. We'll talk about them further.

Documents for benefits for the birth of a child in 2020

Depending on the situation, other documents or copies thereof may be needed (see Table 2). Until the employee brings all the documents, the lump sum benefit is not paid.

Table 2. Documents for assigning a lump sum benefit to an employee upon the birth of a child

The child was born in Russia

Certificate of birth of a child

The child was born outside of Russia

A document (or a copy thereof) confirming the fact of the birth of a child abroad

An external part-time worker applied for benefits

Certificate from the main place of work stating that the employee did not receive benefits there

The child's parents are married and the other parent works

Certificate from the other parent’s place of work stating that he did not receive benefits

The child's parents are married and the other parent does not work

Certificate from the social security authority at the place of residence of the other parent stating that no benefits were assigned

The marriage between the parents is dissolved, the child lives with the parent who is asking for benefits.

A copy of the divorce certificate, a document confirming the child’s cohabitation with one of the parents in Russia

The application for benefits is submitted by the guardian

Extract from the decision on establishing guardianship

The application for benefits is submitted by the adoptive parent

A copy of the court decision on adoption

The foster parent submits an application for benefits.

A copy of the agreement on the transfer of the child to a foster family

Also, no benefit is awarded if the employee missed the deadline - six months from the date of birth of the child.

After you have accepted the employee’s application and documents, give him a receipt-notification in any form.

The period for preparing the receipt is five calendar days. Then the manager issues an order to assign and pay benefits.

Sample 1. Application for a one-time benefit at the birth of a child

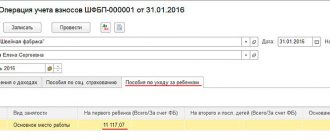

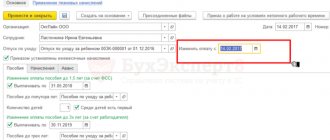

When child care benefits up to 1.5 years old need to be recalculated

Some accountants may have a question about whether, from January 1, 2020, it is necessary to recalculate already assigned child care benefits up to 1.5 years. The answer is no. There is no need to revise anything. The fact is that, as a general rule, child care benefits for children up to 1.5 years old are counted once - on the start date of parental leave. Therefore, if the benefit was assigned in 2020, then the benefit for those months of vacation that fall in 2017 should not be reviewed. That is, in 2020, you need to pay monthly the amount of benefits that was calculated in 2016.

However, keep in mind that there may be a situation where you may need to change the amount of the benefit determined in 2020. This can happen if a person interrupts parental leave for up to 1.5 years, and in 2020 takes the same leave again. And then the amount of child care benefits will need to be calculated based on the new values. The fact is that child care benefits are also calculated from average earnings calculated for the two calendar years preceding the year the parental leave began (Part 1, Article 14 of Law No. 255-FZ). Therefore, if a new vacation is issued in 2017, the new pay period should be taken into account: 2015 and 2020 (unless the employee exercises the right to transfer the pay period). As a result, the benefit amount may differ from what was previously paid. Let's give an example.

From one and a half to 3 years

Now families with children have the right to receive monthly payments for the first and second child under 3 years of age. Such payments are established for children born from January 1, 2020. Payments are made in the amount of 1 times the regional subsistence minimum for children.

Moreover, only those families whose income for each member does not exceed 2 times the regional subsistence level can receive payments.

Wealthier families cannot count on receiving these payments. Moreover, even if the family income exceeded the limit by only a few rubles.

Payments for the first child are made from the federal budget, and for the second - from maternity capital.

An application for a monthly payment may be submitted at any time within 3 years from the date of birth of the child. Once the child reaches 3 years of age, the right to payment is lost. But not for everyone.

Recently, it was decided to extend monthly cash payments to children aged 3 to 7 years inclusive.

Maternity benefit from January 1, 2020

Maternity benefits paid by employers are not indexed annually. However, the maximum benefit will increase from 1 January 2020 as the accountant will need to take into account the new maximum average daily earnings when calculating benefits.

Let us remind you that maternity benefits are paid in a lump sum and in total for the entire period of maternity leave, which is (Part 1, Article 10 of Law No. 255-FZ):

- 140 days (in general);

- 194 days (with multiple pregnancies);

- 156 days (for complicated births).

Maximum benefit amount

To calculate the maximum amount of maternity benefit from January 2017, you need to take into account the maximum average daily earnings. It is calculated using the same formula as when calculating child care benefits for children up to 1.5 years old (Part 3.3 of Article 14 of Law No. 255-FZ). That is, in 2020 it will also be 1901.37 rubles (670,000 rubles + 718,000 rubles) / 730.

Thus, in 2020, the maximum amounts of maternity benefits reimbursed from the Social Insurance Fund will change and amount to:

- RUB 266,191.8 (RUB 1,901.37 × 140 days) - in the general case;

- 368,865.78 rubles (1901.37 rubles × 194 days) - for multiple pregnancies;

- 296,613.72 rubles (1901.37 rubles × 156 days) - for complicated births.

Benefit amounts from January 1, 2020: table

In the table we present the new benefit amounts from January 1, 2020 and compare the changed values with 2020. New values in the table are highlighted.

| Benefit | 2016 | from January 1, 2020 |

| Benefit for registration in early pregnancy | RUB 581.73 | 581.73 rub. |

| One-time benefit for the birth of a child | RUB 15,512.65 | RUB 15,512.65 |

| Minimum monthly allowance for child care up to 1.5 years | • care for the first child - 3,000 rubles; • care for the second child RUB 5,817.24. | • care for the first child - 3,000 rubles; • care for the second child RUB 5,817.24. |

| Maximum monthly allowance for child care up to 1.5 years | RUB 21,554.82 | RUB 23,120.66 |

| Minimum amount of maternity benefit | • RUB 34,521.20 - in general; • 47,835.62 rub. - during multiple pregnancy; • 38,465.75 rub. - during complicated childbirth. | • RUB 34,521.20 - in the general case; • 47,835.62 rub. - during multiple pregnancy; • 38,465.75 rub. - during complicated childbirth. |

| Maximum amount of maternity benefit | • RUB 248,164. - in general; • 343,884.4 rub. - during multiple pregnancy; • 276,525.6 rub. - during complicated childbirth. | • RUB 266,191.8 - in the general case; • RUB 368,865.78. - during multiple pregnancy; • RUB 296,613.72. - during complicated childbirth. |

If you find an error, please select a piece of text and press Ctrl+Enter.