Unified forms of primary accounting documents - what does this mean?

For many years, until 2013, only documents compiled according to specially approved forms could be used as primary documents for accounting and tax accounting purposes. These forms are called unified. It was allowed to draw up in free form only those documents for which there was no unified form.

With the entry into force of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, economic entities received the right to develop document forms independently, subject to compliance with certain requirements for them.

After this, most of the unified forms of primary documents became recommended, but some remained mandatory. We will talk about them further.

Methods for organizing primary personnel records

As a result, when carrying out personnel accounting, organizations can:

- or keep records using standardized forms, which greatly facilitates the process of maintaining it, especially in small organizations that often do not have a personnel specialist;

- or develop your own forms of primary accounting documentation, which is a rather complex and time-consuming process;

- or modify unified forms taking into account specific needs and characteristics of the activity, which allows you to achieve maximum results while saving resources.

Finished works on a similar topic

- Coursework Primary personnel records 440 rub.

- Abstract Primary personnel records 280 rub.

- Test work Primary personnel records 200 rub.

Receive completed work or specialist advice on your educational project Find out the cost

Choosing each of the listed methods requires certain actions.

In the first case, the use of unified forms of primary accounting personnel documents should be secured by a separate order of the manager, if in general the use of unified accounting forms is not provided for in the accounting policy of the organization.

The second case is the most labor-intensive and requires special attention.

Note 2

The composition of the primary documentation for personnel records does not change, even if unified forms are abandoned; changes can only concern the content of the documents.

The absence of certain documents on the primary accounting of personnel can lead to administrative liability or tax disputes when certain expenses are not taken into account due to improper documentation.

When developing your own forms of primary documentation for personnel accounting, it is necessary to strictly comply with the requirements of the Federal Law “On Accounting” in terms of the availability of mandatory details (names, dates of compilation, name of the organization, characteristics of the content of the fact of economic activity, its natural or monetary measure, names of positions and signatures persons responsible for drawing up the document).

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

The absence of mandatory details may become the basis for recognizing personnel records as not meeting legal requirements, which again can lead to administrative liability.

In the third case, modified forms of primary documentation for personnel records should also be secured by order of the manager, even if minor changes are made.

What unified forms of primary accounting documentation are mandatory?

Forms of primary documentation established by authorized bodies in accordance with and on the basis of other federal laws continue to be mandatory (see letter of the Ministry of Finance of Russia dated March 6, 2013 No. 03-03-06/1/6700). For example this:

- Cash documents from the album of unified forms, approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88 (information of the Ministry of Finance of Russia No. PZ-10/2012, letter of the Ministry of Finance of Russia dated February 28, 2013 No. 03-03-06/1/5971).

- Consignment note in the form from Appendix 4 to the Rules for the transportation of goods by road, approved by Decree of the Government of the Russian Federation dated 04/15/2011 No. 272 (this follows from letters of the Ministry of Finance of Russia dated 09/06/2016 No. 03-03-06/1/52112, dated 07/20/2015 No. 03-03-06/1/41407, Federal Tax Service of the Russian Federation dated May 17, 2016 No. AS-4-15/ [email protected] )..

Thus, the mandatory use of unified forms applies not only to cash documents, but also to the waybill.

You can find a transport bill of lading in the article “Confirmation of transport costs - with what documents?” or in the material “Transportation costs are confirmed by only one document.”

Order of the Ministry of Finance of the Republic of Kazakhstan on approval of forms of primary accounting documents

The most significant of them is the lack of mandatory document details (Part 2 of Article 9 of Law No. 402-FZ, GOST R 6.30-2003)2.

Advice

Do not forget to include in the form of each primary accounting document the required details: name, date of publication, name of the organization, description of the event, magnitude and units of measurement of the event, position and signature with a transcript of the person who issued the document, otherwise the document will not have legal force (Part 2 Article 9 of Law No. 402-FZ)

We remove obviously unnecessary columns from unified forms

If you are developing forms of primary accounting documents based on the forms of the State Statistics Committee of Russia, then first of all remove unnecessary columns and lines from them.

In primary accounting documents it is better to use the name “order” rather than “order (instruction)”. From the order form, exclude codes for OKUD and OKPO. In the upper right corner of the form, make a link to the order approving the primary accounting documents of the head of the organization (sample below).

The expert shares important information about the order to create a brigade in the material at the link.

How to issue an order for approval of forms of primary accounting documents for labor accounting and payment

When the HR department has decided which forms to use and has compiled their samples, the development of a draft order for their approval begins.

What does “album of unified forms of primary accounting documentation” mean (examples)

An album of unified forms is usually called the so-called thematic selection of document forms. So, there are accounting albums:

- personnel, working hours and settlements with personnel for wages;

- cash transactions;

- trading operations;

- fixed assets and intangible assets;

- materials;

- products, inventory items in storage areas;

- inventory results;

- works in capital construction and repair and construction work, etc.

Unified forms of personnel documents (timesheets, statements, etc.)

Unified forms of personnel documents were approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. Conventionally, they can be divided into 2 groups:

- Documents directly related to personnel records - from hiring to dismissal:

- order (instruction) on hiring;

Cm. .

- employee personal card;

See “Unified form No. T-2 - form and sample filling” .

- staffing schedule;

See “Unified Form No. T-3 - Staffing (form)” .

- order (instruction) on granting leave to the employee;

Cm. .

- vacation schedule;

See "Unified Form No. T-7 - Vacation Schedule" .

- dismissal order, etc.

See “Unified form No. T-8 - form and sample filling” .

- Documents reflecting data for settlements with personnel:

- time sheets according to forms No. T-12 and T-13;

See “Unified Form No. T-12 - Form and Sample” and “Unified Form No. T-13 - Form and Sample” .

- salary slips: payroll, settlement and payroll;

See “Unified Form No. T-49 - Form and Sample” , “Unified Form No. T-51 - Calculation Sheet” and .

- personal account, etc.

See “Unified Form No. T-54 - Personal Account” .

GLAVBUKH-INFO

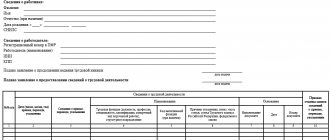

The movement of employees of an organization may include the following main stages: hiring, transfer to another job, being on vacation, being on a business trip, dismissing an employee.Documentation of all stages of the movement of the organization’s employees is carried out in accordance with the approved unified forms of primary accounting documentation for labor accounting and payment:

Form No.

| Form name | |

| T-1 | Order (instruction) on hiring an employee |

| T-1 a | Order (instruction) on hiring employees |

| T-2 | Employee personal card |

| T-3 | Staffing table |

| T-4 | Registration card of a scientific, scientific and pedagogical worker |

| T-5 | Order (instruction) to transfer an employee to another job |

| T-5a | Order (instruction) on transfer of employees to another job |

| T-6 | Order (instruction) on granting leave to an employee |

| T-6a | Order (instruction) on granting leave to employees |

| T-7 | Vacation schedule |

| T-8 | Order (instruction) on termination (termination) of an employment contract with an employee (dismissal) |

| T-8a | Order (instruction) on termination (termination) of an employment contract with employees (dismissal) |

| T-9 | Order (instruction) on sending an employee on a business trip |

| T-9a | Order (instruction) on sending employees on a business trip |

| T-10 | Travel certificate |

| T-10a | Official assignment of the day of assignment on a business trip and a report on its implementation |

| T-11 | Order (instruction) to encourage an employee |

| T-11a | Order (instruction) on incentives for employees |

As a rule, all of the above forms are compiled by personnel department employees. One copy of all personnel records documents must be sent to the organization’s accounting department. Based on the documents received, the accounting department makes various calculations: for wages of employees, for vacation pay, etc.

Employees are hired into the organization, as a rule, in accordance with the approved staffing schedule.

To formalize the structure, staffing and staffing levels of an organization in accordance with its Charter, a unified form No. T-3 “Staffing table” is used.

The staffing table contains a list of structural units, positions, information on the number of staff units, official salaries, allowances and monthly payroll. The staffing table is approved by order (instruction) of the head of the organization or a person authorized by him.

Changes to the staffing table are made in accordance with the order (instruction) of the head of the organization or his authorized person.

Hiring is formalized by an order (instruction) of the employer, issued on the basis of a concluded employment contract. The content of the order (instruction) of the employer must comply with the terms of the concluded employment contract.

An order (instruction) on hiring an employee (Form No. 9 T-1) or an order (instruction) on hiring employees (Form No. T-1 a) are used to register and record persons newly hired under an employment contract ( contract). These forms are prepared by the person responsible for hiring for all persons hired by the organization.

When completing these forms, the name of the structural unit, the position (specialty, profession) of the employee, and the probationary period (if the employee is subject to a test upon hiring) are indicated.

In addition, the conditions for employment and the nature of the upcoming work are indicated (part-time, in the order of transfer from another organization, to replace a temporarily absent employee, to perform certain work, etc.).

The order (instruction) signed by the head of the organization or an authorized person is announced to the accepted employees against signature within three days from the date of signing the employment contract.

When hiring, the employer is obliged to familiarize the employee with the internal labor regulations in force in the organization, other local regulations related to the employee’s labor function, and the collective agreement.

Based on the order, a record of hiring is made in the work book, a personal card is filled out (form No. T-2), and an employee’s personal account is opened in the accounting department (form No. T-54 or No. T-54a).

The work book is the main document about the employee’s work activity and length of service.

On January 1, 2004, by Decree of the Government of the Russian Federation dated April 16, 2003 No. 225, new forms of work books and inserts for them were introduced, and the procedure for maintaining and storing work books was established. At the same time, the previously established work books that employees have remain valid and cannot be exchanged.

The instructions for filling out work books were approved by Decree of the Ministry of Labor of Russia dated October 10, 2003 No. 69 and can be used for further filling out old-style work books.

The employee’s personal card (form No. T-2) is filled out on the basis of an order (instruction) for employment (form No. T-1 or No. T-1a), work record book, passport, military ID, document on graduation from an educational institution, insurance certificate state pension insurance, certificate of registration with the tax authority and other documents required by law, as well as information provided by the employee.

Work experience (general, continuous, giving the right to a bonus for length of service, giving the right to other benefits established in the organization, etc.) is calculated on the basis of entries in the work book and/or other documents confirming the relevant length of service. When information about an employee changes, the corresponding data is entered into his personal card, which is certified by the signature of a personnel service employee.

To register scientific and scientific-pedagogical workers, scientific, research, design, educational and other institutions and organizations operating in the field of education, science and technology, in addition to the personal card, fill out a registration card of a scientific, scientific and pedagogical worker (form No. T- 4).

This form is filled out on the basis of relevant documents (Doctor of Science and Candidate of Science diplomas, certificates of associate professor and professor, etc.), as well as information provided by the employee.

While working in an organization, an employee or employees may be transferred to another job, for example, from one structural unit to another.

Transfer to another job is a permanent or temporary change in the labor function of an employee and/or the structural unit in which the employee works (if the structural unit was specified in the employment contract), while continuing to work for the same employer, as well as transfer to work in another location together with the employer.

In accordance with Art. 72 of the Labor Code of the Russian Federation, transfer to another permanent job in the same organization at the initiative of the employer is permitted with the written consent of the employee.

By agreement of the parties, concluded in writing, the employee may be temporarily transferred to another job with the same employer for a period of up to one year.

In the case when such a transfer is carried out to replace a temporarily absent employee, whose place of work, in accordance with the law, is retained until this employee returns to work.

If, at the end of the transfer period, the employee’s previous job is not provided, and he did not demand its provision and continues to work, then the condition of the agreement on the temporary nature of the transfer loses force and the transfer is considered permanent.

The employee’s consent is not required to move him from the same employer to another workplace, to another structural unit located in the same area, or to assign him work on another mechanism or unit, unless this entails a change in the terms of the employment contract determined by the parties.

In case of production necessity, the employer has the right to transfer the employee without his consent for a period of up to one month to a job not stipulated by the employment contract in the same organization.

Such a transfer is permitted to prevent a catastrophe, industrial accident or eliminate the consequences of a catastrophe, accident or natural disaster; to prevent accidents, downtime (temporary suspension of work for reasons of economic, technological, technical or organizational nature), destruction or damage to property.

In this case, transfer to a job requiring lower qualifications is permitted only with the written consent of the employee.

With such transfers, the employee is paid according to the work performed, but not lower than the average earnings for the previous job.

In all cases, an employee cannot be transferred to a job that is contraindicated for him due to health reasons.

To document the transfer of employees to another job in the organization, an order (instruction) on the transfer of an employee to another job (Form No. T-5) or an order (instruction) on the transfer of employees to another job (Form No. T-5a) is used.

The forms are filled out by a HR employee, signed by the head of the organization or a person authorized by him, and announced to employees against signature.

Based on the order (instruction) on transfer to another job, notes are made in the personal card (form No. 2 T-2), personal account (form No. T-54 or No. T-54a) and an entry is made in the work book.

To register and record leaves granted to employees in accordance with the law, collective agreements, local regulations of the organization and employment contracts, an order (instruction) on granting leave to an employee (form No. T-6) or an order (instruction) on granting leave to employees (form No. T-6a).

These orders are drawn up by a personnel service employee or an authorized person, signed by the head of the organization or his authorized person and announced to the employee against signature.

Based on the order (instruction) to grant leave, marks are made in the personal card (form No. T-2), personal account (form No. T-54 or No. T-54a) and the wages due for leave are calculated according to form No. T -60 “Note-calculation on granting leave to an employee.”

Vacations are provided to employees, as a rule, in accordance with the approved vacation schedule.

To reflect information about the time of distribution of annual paid leaves of employees of all structural divisions of the organization for the calendar year by month, the unified form No. 8 T-7 “Vacation Schedule” is used.

When drawing up a vacation schedule, current legislation, the specifics of the organization’s activities and the wishes of employees must be taken into account.

The vacation schedule is endorsed by the heads of the personnel service and structural divisions, agreed with the elected trade union body (if there is one) and approved by the head of the organization or his authorized person.

When the vacation period is postponed to another time, with the consent of the employee and the head of the structural unit, appropriate changes are made to the vacation schedule.

To register and record the dismissal of employees, an order (instruction) on termination (termination) of an employment contract with an employee (dismissal) (Form No. 9 T-8) or an order (instruction) on termination (termination) of an employment contract with employees (dismissal) (form No. 9 T-8a).

These forms are filled out by a HR employee, signed by the head of the organization or a person authorized by him, and announced to employees against signature. Based on these orders, entries are made in personal cards (Form No. T-2), personal accounts (Forms No. T-54 or No. T-54a), work book, and settlements are made with the employee using Form No. T-61 “Note-settlement for termination (termination) of an employment contract with an employee (dismissal).”

To register and record the sending of employees on business trips, an order (instruction) on sending an employee on a business trip (Form No. 9 T-9) or an order (instruction) on sending employees on a business trip (Form No. T-9a) is used.

These forms are filled out by a human resources employee and signed by the head of the organization or his authorized representative. The order for sending on a business trip indicates the surname and initials, structural unit, profession (position) of the worker being sent, as well as the purpose, time and place of the business trip.

If necessary, the sources of payment for travel expenses and other conditions for sending on a business trip are indicated.

A document certifying the time spent on a business trip (time of arrival at the destination and time of departure from it) is a travel certificate (form No. T-10).

At each destination, notes are made on the time of arrival and departure, which are certified by the signature of the responsible official and seal.

The travel certificate is issued in one copy by an employee of the personnel service on the basis of an order (instruction) on sending on a business trip (forms No. T-9, No. T-9a).

After returning from a business trip to the organization, the employee (accountable person) draws up an advance report with attached documents confirming the expenses incurred.

To prepare and record a work assignment for sending on a business trip, as well as a report on its implementation, the unified form No. 9 T-10a “Office task for sending on a business trip and a report on its implementation” is used.

The official assignment is signed by the head of the structural unit in which the posted employee works, approved by the head of the organization or a person authorized by him and submitted to the personnel service for issuing an order (instruction) on sending on a business trip (form No. T-9 or No. T-9a).

A person arriving from a business trip draws up a brief report on the work performed during the business trip, which is agreed upon with the head of the structural unit and submitted to the accounting department along with a travel certificate and an advance report.

The advance report must be drawn up according to the unified form No. 9 AO-1.

This form is used to account for funds issued to accountable persons for administrative and business expenses (including business trips), and is drawn up in one copy by the accountable person and an accounting employee.

The advance report can be prepared on paper and computer media. On the reverse side of the form, the reporting person writes down a list of documents confirming the expenses incurred (travel certificate, receipts, transport documents, cash register receipts, sales receipts and other supporting documents), and the amount of expenses for them. The documents attached to the advance report are numbered by the accountable person in the order in which they are recorded in the report.

The accounting department checks the intended use of funds, the presence of supporting documents confirming the expenses incurred, the correctness of their execution and calculation of amounts, and also the amounts of expenses accepted for accounting are indicated on the reverse side of the form.

Details related to foreign currency are filled in only if funds in foreign currency are issued to an accountable person in accordance with the established procedure and the current legislation of the Russian Federation.

The verified expense report is approved by the manager or an authorized person and accepted for accounting.

The balance of the unused advance is handed over by the accountable person to the organization's cash desk using a cash receipt order in the prescribed manner. Overexpenditure on the advance report is issued to the accountable person according to the cash receipt order.

Based on the data of the approved advance report, the accounting department writes off accountable amounts in the prescribed manner.

To register and record incentives for employees for success at work, an order (instruction) on rewarding an employee (Form No. T-11) or an order (instruction) on rewarding employees (Form No. 8 T-11a) is used.

These forms are drawn up on the basis of a proposal from the head of the structural unit of the organization in which the employee works, signed by the head of the organization or a person authorized by him and announced to the employees against signature. Based on the order (instruction), a corresponding entry is made in the employee’s work book.

| < Previous | Next > |

Unified documentation for recording cash transactions

Again, these forms are required. This means that you are required to draw up cash documents strictly according to the forms that are present in the album approved by Decree of the State Statistics Committee of the Russian Federation dated August 18, 1998 No. 88. These are well-known to everyone:

- cash receipt order;

See “Unified form No. KO-1 - cash receipt order” .

- account cash warrant;

See "Unified Form No. KO-2 - Cash Order" .

- cash book, etc.

See “Unified Form No. KO-4 - Cash Book”

Look for other documents on the cash register on our website in the section “Online cash registers KKT KKM”.

And you will find the main forms of primary accounting documentation for other areas and objects in the section “Accounting > Accounting Documents”.

NOTE! On our website there are completed samples for all documents, which can not only be viewed on the website, but also downloaded in Word or Excel formats.

Order of the Minister of Finance of the Republic of Kazakhstan on approval of forms of primary accounting documents

But best practices show that orders for administrative and economic (administrative and organizational) activities, which are administrative documents of operational validity and have a 5-year shelf life, are more suitable for this purpose (Example 3).

When preparing a draft order, its text must provide for:

- when the approved forms are put into effect: immediately or the IT department will need time to set up these forms in the information system;

- which unit or official will be entrusted with the function of methodological guidance in the application of these forms (not only primary accounting documents, but also all unified forms);

- identification of approved forms, for example, using indexes that have already been assigned to standard forms at the national level, or using codes according to a classifier of document forms that the organization develops independently.

Example 3

Order on approval of the forms of primary accounting documents used in the organization

In Example 3, note the approved form codes. They are assigned according to the Document Form Classifier

, for the development and maintenance of which the office management service is responsible.

Results

The organization has a choice: to independently develop primary documents or use their unified forms. But there is an exception: when carrying out operations involving the transportation of goods by road or the acceptance/issuance of funds, it is still necessary to use the form of the bill of lading approved in the regulatory documents and documents for processing cash transactions (receipt/expenditure cash orders, cash book).

Sources: Law “On Accounting” dated December 6, 2011 No. 402-FZ

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.