What are fixed assets

Fixed assets include any property of an enterprise used to carry out its activities: these can be materials, machinery, instruments, equipment, etc., in other words, everything that is involved in the labor process.

It should be noted that any inventory items acquired by an organization for work must be listed on its balance sheet. Once materials, equipment or machinery become unusable, they must be written off.

https://youtu.be/ia4OS4VoO_w

Procedure

In order to write off fixed assets, it is necessary to first establish their unsuitability for further use. For this purpose, the company creates a special commission, the main task of which is to certify the fact of a defect, wear, etc.

The commission must include at least three people, including the financially responsible person.

Most often, only full-time employees of the enterprise are included in the commission, but in some cases, these may also be third-party experts who have the necessary knowledge and skills to determine irreparable failure, for example, of particularly complex equipment.

After the property is declared completely faulty, the commission draws up a special act, on the basis of which the organization writes an order to write off fixed assets. This order, in turn, serves as the basis for drawing up a write-off act.

Who fills it out and when?

The unified form is filled out only after the issuance of a special order or instruction to write off a fixed asset from the balance sheet of the enterprise. Moreover, such a document must be signed by the chairman and members of the commission, which is created precisely for this purpose.

After drawing up the paper, it is signed by the chief accountant of the enterprise, who is not a member of the commission, and approved by the manager, indicating his position and the transcript of the signature.

It should be noted that the act is created in two original copies , one of them is sent to the accounting department for reflection in the accounting accounts, and the second is sent to the financially responsible person for transfer to the warehouse of any parts, materials or spare parts remaining as a result of the write-off of the object.

You will find a classifier of fixed assets by depreciation groups in this material. Read about how to fill out an inventory card for recording fixed assets here.

How to draw up an act correctly

Today, the act of writing off fixed assets can be written in any form, however, most enterprise employees, in the old fashioned way, prefer to use previously generally applicable mandatory forms in their work. Their advantage is obvious: there is no need to rack your brains over the structure and content of the document, since all the necessary positions are indicated in it. Such unified forms also include form OS-4. This act can be filled out both when writing off one object or several at once.

What it is?

The act of writing off a fixed asset is a document required to be filled out when withdrawing any fixed asset from the organization’s balance sheet .

It should be borne in mind that this document does not write off motor vehicles - another form of “primary registration” is intended for them. As a rule, the form is used to exempt assets from accounting that have become unusable due to any physical reasons or material obsolescence.

You can find out all the information about the procedure for writing off this property from the following video:

https://youtu.be/3v5ue8PkhC8

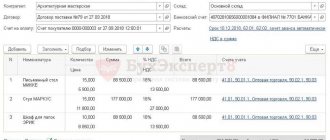

Sample of filling out the OS-4 form

- At the beginning of the document, on its front side, the following is indicated:

- name of company,

- her TIN,

- checkpoint,

- the structural unit to which the written-off fixed asset belongs.

- Next, the basis for the write-off is written - here you need to put a link to some supporting document (usually an order from the manager) and the financially responsible person (only the employee’s full name is written here).

- On the right side of the form enter:

- OKPO code of the company (can be found in the constituent documents),

- date of write-off of fixed assets from accounting,

- number and date of issue of the document that became the basis for write-off,

- personnel number of the financially responsible employee.

- Below is the document number, the date it was compiled, and the reason for the write-off.

- On the right is a place for approval of the act by the director of the enterprise.

The next part is presented in the form of a table and relates directly to the property being written off:

- in the first column,

- in the second and third - inventory and serial numbers, respectively,

- on the fourth or fifth date of release of the product and the date of its acceptance onto the balance sheet of the organization.

- in the sixth column (i.e., the time that the property was actively used in work),

- in the seventh - the cost of the object at the time of its acceptance for accounting,

- in the eighth - the amount of accrued depreciation,

- in the ninth - residual value (the value in the last paragraph is the difference in indicators from the two previous columns).

Instructions for filling

Here certain rules must be followed. Like any other accounting document, this form contains basic and specific data. In these two groups the following information can be distinguished:

- Basic data . This category includes information that reflects general data, including the name of the organization and structural unit in which the object was registered, as well as the position and full name of the materially responsible person. In addition, this block indicates the basis for drawing up this document, that is, an order or order for write-off, as well as the serial number and date of the act.

- Specific data . This group includes all information that is directly related to the write-off object, including the reason for this event. Information about the condition of the fixed asset as of the write-off date is indicated: name of the object, inventory and serial numbers, date of issue and registration, actual period of use, initial and residual value, as well as the amount of depreciation accrued over the entire period. Information related to the individual characteristics of the object may be indicated - the number of units written off and the content of any precious metals or stones (if present) with their name and quantity in natural units of measurement. On the reverse side, the chief accountant enters information about what costs were incurred during the dismantling of the facility, what material assets or spare parts were received as a result of this, indicating the amounts for all operations and indicating the corresponding accounts. After this, data on sales revenue is entered if the remaining material assets were sold.

Here you can download the document form and a sample of how to fill it out for free.

In the final part, a note is made about the conclusion the commission came to - that the object cannot be used in the future due to its deterioration or deterioration. The act is signed by the commission with the obligatory indication of positions and full names.

Sample of filling out the reverse side of the OS-4 form

The reverse side of the act also contains two tables. The first contains individual parameters that serve as part of the characteristics of the object, including information about the content of precious metals.

Below the table there are several lines in which the commission taking part in the write-off of fixed assets makes its conclusion (in this case, on the write-off).

If necessary, a list of additional documents accompanying this act is indicated.

Then the commission puts its signatures next to the indicated positions with their full names.

The last table includes information about:

- expenses incurred for write-off of fixed assets,

- remaining inventory items suitable for further use,

- funds proceeds from the sale of written-off property.

Finally, the act is certified by the signature of the organization’s chief accountant.

How to correctly draw up an act of write-off of fixed assets in the OS-4 form

The act can be filled out manually or on a computer.

There is only one important condition: it must contain the original signatures of the head of the enterprise, as well as members of the write-off commission.

There is no strict need to certify the form with a seal - as of 2020, legal entities are exempted by law from the obligation to use various types of cliches and stamps in their work.

The act is drawn up in at least two copies :

- one of which is transferred to the accounting department of the enterprise, so that in the future, on its basis, the accountant can reflect the write-off of the property specified in the act,

- the second remains with the financially responsible person, who then gives it to the warehouse in order to either dispose of the fixed asset or sell it.

If necessary, additional copies of the act can be created.

Unified form OS-4 (form)

The unified form OS-4 is an act of write-off of fixed assets (OS). The form (you can download it on our website) and instructions for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7.

Let us remind you that at present the use of unified forms is optional. If you wish, you can independently develop and approve the form of the act for writing off the fixed assets.

How to fill out form OS-4a

Form OS-4a was approved by the State Statistics Committee (Resolution No. 7 of January 21, 2003), but is not mandatory for use (like most unified forms) and can be replaced by another document of similar content.

When filled out, the OS-4a form is quite clear in terms of the meaning of its sections:

- The header part reflects information about the owner of the object, the number and date of the document being drawn up, information about the car being written off and the financially responsible person.

- The 1st section is devoted to a description of the technical condition of the object.

- Section 2 provides data on its residual value.

- The 3rd section contains information about the passport, engine and chassis numbers, digital characteristics of the car’s dimensions and information about the precious metals in it. It also contains the conclusion of the commission, to which it is advisable to attach the conclusion of third-party technical experts confirming its conclusions.

- The 4th section is devoted to data on parts removed from the car that are suitable for further use.

- Section 5 provides data on the costs of dismantling, information on material assets entered into the warehouse and the financial result of write-off.

About the features of tax accounting for the disposal of incompletely depreciated property, read the material “How to take into account the costs of liquidation of underdepreciated fixed assets in tax accounting?”

Features of drawing up the OS-4 form

The act of writing off a fixed asset is drawn up by the employee responsible for accounting for fixed assets in the organization, based on the manager’s order to write off (liquidate) the fixed asset and the commission’s report on the impossibility of its further operation.

Form OS-4 is drawn up in 2 copies:

- the first is transferred to the accounting department (on its basis, accounting reflects the disposal of the fixed asset and its write-off from account 01);

- the second remains with the person responsible for the safety of fixed assets, and is the basis for the delivery to the warehouse and sale of material assets and scrap metal remaining as a result of dismantling the object.

Rules for drawing up an OS write-off act

The write-off report is filled out by the employee responsible for the operating system.

Sample of filling out the act according to the OS-4 form.

An act is drawn up in 2 copies:

- The first is necessary for accounting in order to reflect the disposal of property from circulation;

- The second is kept by the financially responsible person and is the basis for transferring property to the warehouse.

Sections of the form are arranged in the form of tables on 2 sheets:

- The document header or title section contains all the necessary details and information about the persons drawing up the document, as well as the approval of the manager;

- Section 1 consists of 9 columns of the table, column 7 in this section is filled out only in the case of previously carried out restoration work;

- Section 2 is filled out only if the object contains precious metals and precious stones;

- Section 3 is a carrier of information about the costs of dismantling equipment - the “Total” line contains the full cost of costs minus the cost of parts that can be used in the future, and the total cost of the decommissioned object is displayed.

Important: the act is filled out only in case of liquidation of the object, if it was transferred to free use by another enterprise or was sold; other forms of disposal of fixed assets are filled out.

An example of filling out an OS write-off act.

How to avoid mistakes

The entire process of writing off fixed assets must be carried out according to well-established stages that fully comply with legal requirements.

To avoid errors when filling out documentation, you must:

- Assemble an authorized commission based on the order of the head. How to draw up an order to write off fixed assets - read the link.

- Draw up an act in 2 copies and hand them over to the appropriate persons.

- In this case, the document must be formatted correctly:

- First, fill out the header, indicating all the required details, dates, numbers;

- You should not forget to indicate the person responsible, the date and reason for decommissioning the object.

- To fill out the tables you need to prepare:

- Technical documentation;

- Inventory card;

- Turnover balance sheets.

- Next, you should indicate all the data from the object’s passport - year of manufacture, name, brand, etc. Here you will learn how to correctly draw up an act for writing off materials that have become unusable.

- To fill out columns 6 and 7, you must use accounts 01 and 02 SALT.

- After which the manager will study the documentation and approve it.

Nuances of filling out the act of writing off the operating system

The act consists of 3 sections.

Section 1 reflects information about the condition of the object as of the date of write-off, including:

- initial (replacement) cost;

- the amount of depreciation accrued from the beginning of operation of the facility;

- residual value of the operating system.

If the object has been revalued, column 7 indicates the replacement cost based on the results of the last revaluation. For non-revalued objects, their original cost is indicated on the date of acceptance for accounting.

About the revaluation of fixed assets and its role for different types of accounting, read the article “Why is the revaluation of fixed assets (fixed assets) necessary?”

Section 2 provides a brief individual description of the OS (devices, accessories, content of precious metals), and also provides the commission’s conclusion on the condition of the object and the possibility (impossibility) of its further operation.

Section 3 contains information about the costs associated with the write-off of fixed assets and the remaining usable inventory items after write-off.

You can view a sample of filling out the unified form OS-4 on our website.

Download a sample of filling out the unified form OS-4

Write-off of fixed assets in 2019

The procedure is carried out on the basis of the norms enshrined in Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91N. According to the Methodological Recommendations approved by this document, the disposal of an asset is recognized on the date of termination of the provisions of its acceptance for accounting.

Procedure and rules of procedure

If an object has fallen into disrepair or is outdated, it is written off based on the standards established by the Methodological Guidelines for Accounting for Assets, Letter of the Ministry of Finance of the Russian Federation dated December 25, 2015 N 07-01-06_76480 and PBU 6/01.

Reasons

The reason for putting a mark on the disposal of an asset on the OS-6 inventory card is an act approved by the head of the enterprise.

For a fully depreciated item, the procedure does not change.

In cases where dismantling takes a long period, early write-off can be carried out. To do this, you will need an order from the director, drawn up in any form.

According to Letter of the Ministry of Finance of the Russian Federation dated June 13, 2013 N 03-05-05-01_21929, the document must contain a resolution on decommissioning the OS or on stopping its use and beginning dismantling.

Step-by-step instruction

In order to correctly write off a fixed asset that has fallen into disrepair, you must adhere to the following algorithm:

- by order of the manager, a group of people is formed that will determine the suitability of the OS for further operation, consider the likelihood and profitability of repairs, and draw up the necessary paperwork;

- the commission draws up a write-off act in the OS-4 form;

- The accountant records the capitalization of units and materials suitable for further use;

- a mark of disposal is placed on the inventory card;

- the financial results of the write-off are credited to the profit and loss account and reflected in the accounting records.

Actions and composition of the commission

According to Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91N, write-off of fixed assets is carried out by decision of a special body created by order of the head of the organization.

The following officials are invited to participate in the work:

- accountant;

- technical specialists;

- employees ensuring the safety of the asset.

An authorized group conducts an examination of fixed assets for write-off.

The procedure consists of the following steps:

- OS inspection;

- establishing causes;

- identifying the perpetrators;

- determining the possibility of further use of the object or its components, assessing their market value;

- control of removal of parts;

- drawing up an act for writing off a fixed asset.

Sample order for the creation of a commission for writing off a fixed asset

For OS worth up to 40,000 rubles

According to clause 5 of PBU 6/01, low-value fixed assets are written off as expenses when they are put into operation.

If a small enterprise has the right to keep simplified accounting, then it can attribute such property to expenses for ordinary activities at the time of acquisition in the following cases:

- the object is intended for management needs;

- the organization is a micro-enterprise (numbers up to 15 people, income up to 120 million rubles per year);

- the balances of inventories are insignificant, that is, information about their availability is not capable of influencing the decisions of users of the statements.

With residual value

If an object is written off before the expiration of its useful life, then the costs of liquidation can be taken into account as part of non-operating expenses.

The decision must be formalized by order of the manager. The cost of an asset that could not be depreciated reduces income tax.

From off balance

In a situation where it is necessary to take into account the disposal of fixed assets that are leased or leased, the tenant (lessee) makes entries to account 001.

Morally obsolete

If an asset is no longer capable of generating economic benefit, it must be removed from the balance sheet. To do this, you will need to verify the appropriateness of the decision made, draw up the appropriate document establishing the event, and fill out an inventory card.

Below is an example of the reason for writing off fixed assets in the act for the situation under consideration:

The computer system unit is subject to write-off due to obsolescence by selling it for recycling. In this case, the residual value is recognized as another expense, and the obligation to restore VAT is not provided for in accordance with clause 3 of Art. 170 Tax Code of the Russian Federation.

At the expense of the perpetrators

If an employee is identified as a result of whose actions the OS failed, write-off is carried out as follows:

| Debit | Credit | |

| 01 | 01 | The book value of the disposed asset is written off. |

| 02 | 01 | Accumulated depreciation is reflected. |

| 94 | 01 | The residual value has been written off. |

Is there a write-off limit?

According to clause 5 of PBU 6/01, a specific value limit for classifying an asset into a particular category of fixed assets is established in the accounting policy.

Documenting

In order for the write-off of a group of fixed assets to take place in accordance with current legislation, it is first of all important to correctly fill out the necessary paperwork.

Position (sample)

To consolidate the procedure for disposal of fixed assets, many organizations issue special regulations that contain the following information:

- cases in which write-offs are made and the nuances of registration;

- rules of the commission and how to create it;

- document forms.

Regulations on the procedure for receipt, accounting and disposal of fixed assets

Service memo/petition (sample)

To officially notify the manager of the need to write off the operating system, you will need to draw up a report in free form.

For example, it might look like this:

Service memo about the need to write off the OS

Inspection report (sample)

The form of such a document is not established by law, so it needs to be developed independently and fixed in the accounting policy.

The information that must be included is listed below:

- main characteristics of the object;

- examination results;

- commission resolution.

Report on identified defects (inspection)

Defective statement (sample)

To confirm the need to dispose of an asset due to the discovery of flaws that make further operation impossible, the following document must be drawn up:

Defective statement (example)

Defective statement (example 2)

The statement is certified by the signatures of authorized persons and the responsible employee.

Is there a penalty for paying wages ahead of schedule?

Who should keep the time sheet? Find out .

How much rest should there be between shifts with a shift work schedule? Read.

Technical report (sample)

To determine the performance of the equipment and the causes of failure, contact specialists.

The results of the procedures performed can be formalized as a technical examination report, which includes the following information:

- type, model, year of manufacture of the object;

- examination results;

- conclusions about the presence and causes of malfunctions, the scope of required repairs and their cost;

- degree of wear;

- final recommendations on decommissioning and suitability for further use.

Certificate of technical condition of equipment

Commission protocol (sample)

To determine the feasibility of disposal of the fixed assets in question, a meeting is held, the result of which is a document containing the data presented below:

- initial cost of the object;

- wear pattern;

- suitability for further use;

- resolution authorizing write-off.

Minutes of the commission meeting

Order/instruction (form and completed sample)

The legislation does not establish a special form for the resolution on the disposal of fixed assets.

Therefore, the document can be filled out in free form.

For example:

Sample order for write-off of fixed assets

Write-off act (filling sample)

The final document is drawn up according to the OS-4 form.

It contains information about the retiring OS:

- date of acceptance for accounting;

- year of issue;

- commissioning period;

- SPI;

- initial cost;

- accrued depreciation;

- revaluations carried out;

- repairs;

- reasons for write-off;

- condition of the main parts.

The form for the act of writing off fixed assets can be downloaded for free on the website of the Federal State Statistics Service or on our website:

Form of act OS-4

Accounting entries

There are three reasons for the disposal of an asset, and in each case the correspondence of accounts will have its own characteristics.

When an item is liquidated, the transaction table looks like this:

| D | TO | Operation | |

| 91 | 70 (69, 10) | Expenses include | cost of dismantling work performed by company employees |

| 91 | 60 | liquidation costs carried out by the contractor | |

| 02 | 01 | Write-off of accrued depreciation | |

| 91 | 01 | Inclusion of the residual value of fixed assets into expenses | |

| 10 | 91 | The received inventories are accepted for accounting | |

If the object is transferred to the authorized capital, the contribution is taken into account in account 58 (Financial investments). Upon transfer of ownership, the sale price is reflected in other expenses.

Write-off of residual value

The difference between the original price of the item and the accrued depreciation is classified as other expenses (account 91).

Fully customized OS

The disposal of an item that has depreciation equal to 100% is reflected in the accounting accounts as follows:

| Operation | D | TO |

| Write-off of original cost | 01 | 01 |

| Write-off of accrued depreciation | 02 | 01 |

| Capitalization of units suitable for further use | 10 | 91 |

| Capitalization of scrap metal | 10 | 91 |

| Salaries of workers who performed dismantling | 91 | 70 |

| Deduction of mandatory contributions | 91 | 69 |

| Financial results | ||

| Profit | 91 | 99 |

| Lesion | 99 | 91 |

Depreciation on the simplified tax system

If the cost of the acquired fixed assets was included in expenses, then in the event of the sale of the object, a recalculation of the tax base will be required (Chapter 26.2 of the Tax Code of the Russian Federation).

To do this, previously taken into account costs are changed to the amount of depreciation accrued during operation during the period of application of the simplified system. In the situation under consideration, the sale price of the fixed assets is included in income, but nothing is written off as expenses.

OS to an off-balance sheet account

Depending on where the asset will be listed - on the balance sheet of the lessee or the lessor, entries are made to account 001 or 011, respectively.

For example:

| D | 001 | Item received for temporary use |

| TO | 001 | Property returned |

Receipt of scrap metal from write-off

In accordance with Order of the Ministry of Finance 91N, metal remains of products are taken into account at the market price. To summarize information, account 10 “Materials” is intended, and the presence and movement are reflected on sub-account 10-6.

How to cancel?

To return an OS item by the buyer, the following entries must be made:

| D | TO | Operation |

| 62 | 91 | Value of the returned asset |

| 91 | 01 | Residual value |

How to reflect in 1s?

To stop accounting for a particular fixed asset on balance sheet accounts, you need to adhere to the algorithm presented below:

- At the top of the toolbar, select the button “Fixed assets of intangible assets, legal acts”;

- in the menu that opens, find the “disposal” item;

- select the section that corresponds to the situation, for example, “Write-off of fixed assets, intangible assets, legal acts” if the office desk is retired;

- Next, you need to create a document using the button of the same name located in the upper left corner of the window that opens;

- in the form that appears, from the drop-down menu you need to select the appropriate type of write-off, in this case it is “Write-off of your own fixed assets on the balance sheet (101, 102, 103);

- in the “General Information” tab indicate the storage location, division and details of the basis document;

- in the next section, select the asset to be disposed of;

- to determine the book value, a special button is provided - “Calculate”;

- further indicate the reason for the write-off;

- the commission can be selected from the list of permanent bodies or filled out manually;

- from “Typical transactions” select the item corresponding to the reason for the write-off;

- additional details are filled in automatically; KPI and other expenses are entered manually;

- then click the “swipe and close” button;

- The accounting transaction has been completed.

Tax accounting

The procedure for reflecting income and expenses from write-off of fixed assets when calculating mandatory contributions depends on the reasons for disposal.

A decoding of LIFO and FIFO is presented in our article.

How often is the organization's accounting policy developed? Find out .

Rules for filling out an act for writing off fixed assets - download the form and sample form OS-4

When fixed assets (hereinafter referred to as fixed assets) of a company become unusable or their useful life is approaching, they need to be written off.

When carrying out this procedure, a special document is drawn up. In this block, we will analyze the rules for drawing up the act of writing off the unified form OS-4, and whether it is necessary to use it.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

When is the unified form OS-4 issued?

The form refers to the primary documentation detailing the process of cancellation of the OS. According to information from the act:

- entries are made in the inventory card;

- Certain accounting entries are generated.

OSes are written off when there is documentary evidence of their unsuitability or the end of their useful life.

The director of the organization approves the order for write-off and gives orders to form a commission that controls the process and signs the corresponding act.

The main reason for deregistration of an asset is its unsuitability for various reasons. For example, there was a fire in the organization and the equipment was damaged.

Sample act of write-off of fixed assets OS-4

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

The need to write off an asset arises when an object becomes unusable due to its physical or moral properties. In this case, the head of the enterprise issues a corresponding order for write-off and a commission is created that controls this process and signs the completed act. The head of the enterprise also signs the document. Data on the disposal of an object are entered into the inventory card.

The OS-4 form consists of three tables:

- The first table is filled out on the basis of the existing acceptance certificate of the object, which was drawn up when the fixed assets arrived at the enterprise; this table contains general information about the object, service life and accrued depreciation.

- The second table reflects the features of the object, the content of precious metals in it, this information can also be gleaned from the acceptance and transfer certificate OS-1, OS-1a, OS-1b.

- The third table lists the costs incurred in connection with the write-off of a fixed asset and its dismantling, while materials suitable for further use often remain, which are included as inventory items; the cost of these inventory items is also reflected in the third table along with the corresponding accounting entries.

Who fills it out?

Before decommissioning an object, it is inspected, upon which an inspection report is drawn up.

When the OS is confirmed to be unsuitable for use, the write-off process is launched and a corresponding report is issued.

It is also compiled by the commission that conducted the property survey.

The commission for writing off assets must include at least 3 people.

This may include heads of various departments and third-party experts.

The document is issued only after a thorough inspection of the written-off fixed asset. All commission members must affix their visas to the document.

If one of them does not want to sign, a special note is made about this.

Filling procedure

The act can be filled out in any form or in the form approved by the company. But, most companies use the unified OS-4 form.

Such an act can be filled out for one or several objects at once.

Basic rules for filling out the OS-4 form:

The top of the form includes the following information:

- Company name;

- form code;

- grounds for drawing up the paper;

- the write-off date is indicated;

- FULL NAME. mat. responsible person;

- Director's visa and signature date.

The main part of the form should consist of 3 tables. Before each of them you need to write down the reason for writing off the object.

Let’s say: the fixed asset is outdated, incorrect operation of the equipment, damage as a result of an accident, etc. The contents of the tables should be as follows: