Home / Taxes / What is VAT and when does it increase to 20 percent? / Book of purchases and sales

Back

Published: 05/22/2020

Reading time: 4 min

0

184

The purpose of maintaining a purchase ledger is to determine the amount of VAT that is subject to deduction. In it, buyers must register invoices issued by sellers, received on paper and electronic media.

- Transaction type code in the purchase book

- How to reflect the advance refund

- Filling out the declaration

Dear readers! To solve your problem, call hotline 8 or ask a question on the website. It's free.

Ask a Question

It contains primary invoices, as well as adjustment and corrected invoices.

Section 8. Information from the purchase book on transactions reflected for the expired tax period

- Comments and clarifications

Section 8 of the declaration is filled out by organizations and individual entrepreneurs (including tax agents) in cases where the right to tax deductions for the past tax period arises. An exception is made for tax agents authorized to sell confiscated, ownerless and other similar property, as well as those carrying out business activities involving participation in settlements based on agency agreements, commission agreements or agency agreements with foreign persons who are not registered with the tax authorities as taxpayers.

Attention! When submitting an updated declaration to the tax authority, the “Adjustment” field must be filled in . Previously submitted information"

.

“no correction required”

sign is selected if the previously submitted information in this section is reflected correctly and does not require correction.

“needs to be corrected”

sign is indicated if the previously submitted information was reflected with errors or was not provided at all.

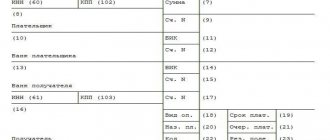

Next in the section you need to fill in information for each invoice registered in the purchase book, namely, indicate the transaction code, number and date of the seller’s invoice, INN and KPP of the seller, the date of registration of goods (work, services), the cost of purchases this invoice (including VAT) and the amount of VAT on the invoice.

This section also provides for the reflection of such additional information as: number and date of correction of the seller's invoice, number and date of the seller's adjustment invoice, number and date of correction of the adjustment invoice, number of the customs declaration, currency code in accordance with the all-Russian classifier currencies, as well as the number and date of the payment document confirming the advance payment.

The total amounts of the cost of purchases and tax according to the purchase book are calculated in section 8 automatically.

Offset of advance payment in the book of purchases and sales: code, invoice, reflection, filling

The basic rule that taxpayers should follow when accepting payments as an advance payment for goods or services is the obligation to issue an invoice.

Simultaneously with issuing the primary document, accountants need to display the transaction in the purchase book and sales book (KPP). The procedure for conducting business transactions is usually duplicated in contracts between entities. Simultaneously with the acceptance of advance payments for accounting, it is necessary to register the departure of the products for which the advance payment was made. At the same time, value added tax (VAT) must be calculated and paid.

Recording the advance in the purchase and sales ledger

A new entry appears in the accounting register after shipment. What it contains:

- Number in order;

- Code for each operation;

- Temporary details for the account itself, the preparation of adjustments and the actual document on which the tax was transferred;

- Information that will allow you to identify the seller;

- Vedomosti, in case of participation of intermediaries in the transaction;

- Data taken from the customs declaration;

- The total amount of value added tax for all documents.

Registration of the invoice in the target register will allow previously paid taxes to be deducted. According to tax legislation, information on accepted advances must be reflected no later than 5 days from the moment the amounts are credited to the supplier’s bank account. The same deadlines must be observed when shipping products that are shipped after prepayment.

Advances received and issued, deduction and restoration of VAT - all this is discussed in the video below:

Invoice for advance payment

By issuing an invoice, the company has the opportunity to record the fact of a transaction with its counterparties. The main purpose of the invoice continues to be tax accounting.

According to Article 171 of the Tax Code, the buyer retains the right to apply a withholding rate on transactions with the seller. The sales book, in turn, is a register in which all invoices are reflected without exception.

At the same time, you can always look at other documents in the case:

Its return

Often in the practice of business entities there is a need to resolve controversial situations by terminating a contract.

Proper registration of the action on the part of the taxpayer will avoid not only difficulties with the counterparty, but also not getting into trouble with the tax service.

Usually, in order to return the advance payment, the payer sends a letter to the supplier with a request (demand) to return the previously paid amount against a future delivery. He can do this only in two cases.

- The first situation is associated with failure to deliver products in the required quantity and quality on time.

- In the second case, a claim can be filed if obligations to the initiator were not fulfilled in full.

After the prepayment has been returned, both the supplier and the buyer are required to register the corresponding entries in their registers. In 2020, the transaction code for such transactions is 22 (02).

The receivables are accrued in favor of the main executor for the obligations and the value added tax previously accrued on the advance amount is deducted - this is how the prepayment is reflected.

After the return, the receivables are subject to repayment, a reverse entry is made for VAT, according to which the tax can be reduced.

In this case, the supplier will need to repay the existing accounts payable, which arose after the prepayment, while simultaneously reversing the amount of accrued payments to the budget. The VAT amount is restored.

This video will tell you why, even if the advance is offset, the amount on account 76AB may not be deductible:

Restoration of VAT advances

Due to the fact that tax deductions must be reflected in the acquisition journal, reverse transactions should be formed in the same register. To restore advance payments, the following conditions must be met:

- Previously, the company had a transaction, during which the acquisition of inventory items or services took place;

- For the registered transaction, an invoice was generated by the supplier for acceptance by the buyer;

- Based on the tax document, clarifications were made on the taxable base.

And so, circumstances have arisen that make it necessary to restore the previously reduced VAT. Invoices that were issued earlier can be considered void. To do this, on a blank page of the book, you need to list the invoices that become invalid, put a mark on their retirement from accounting and make an entry indicating the reason for such changes.

When they don't make it into the book

Tax documents should not be reflected in the register accounting for company purchases in the following situations:

- When transferring valuables free of charge;

- Upon receipt of products for subsequent resale;

- At the time of acquisition of securities and other similar assets;

- When the supplier issues an invoice for the difference in amounts;

- In the event that the company has received funds to pay for goods to fulfill a commission agreement.

In all other cases, invoices must be entered into the sales (purchases) ledger.

The video below will tell you how to reflect advances from buyers and VAT on advances in 1C 8.2:

Source: https://uriston.com/kommercheskoe-pravo/dokumentatsiya/kniga-pokupok-i-prodazh/zachet-avansa.html

What transaction codes can be indicated in section 8 of the VAT return?

In order to correctly indicate transaction codes in sections 8-11 of the declaration, the tax authorities prepared Examples of reflecting entries on invoices in the purchase book and sales book, indicating the CVO.

In accordance with these Examples and letters from the Federal Tax Service (dated 01/16/2018 No. SD-4-3/ [email protected] , dated 01/09/2018 No. SD-4-3/ [email protected] ), the following transaction codes can be indicated in section 8:

| No. | Operation type code | Name of the type of operation |

| 1 | 01 | Shipment (purchase) of goods (works, services) |

| 2 | 02 | Receiving (transferring) advance payments |

| 3 | 06 | Operations performed by tax agents (Article 161 of the Tax Code) |

| 4 | 13 | Contracting work for capital construction |

| 5 | 15 | Registration by the intermediary of his own goods and the goods of the consignor in one invoice |

| 6 | 16 | Return of goods from a buyer who does not pay VAT |

| 7 | 17 | Return of goods from a buyer - an individual |

| 8 | 18 | Adjustment of sales of goods (works, services) downwards |

| 9 | 19 | Import of goods from the EAEU |

| 10 | 20 | Import of goods from countries other than the EAEU |

| 11 | 22 | Deduction of VAT from a previously received advance or upon return of an advance |

| 12 | 23 | Purchase of services issued by BSO (clause 7 of Article 171 of the Tax Code) |

| 13 | 24 | VAT deduction on export transactions (paragraph 2, paragraph 9, article 165, paragraph 10, article 171 of the Tax Code) |

| 14 | 25 | Reinstatement of VAT when using goods in transactions taxed at 0% |

| 15 | 26 | Sale of goods (receipt of advances) to buyers who do not pay VAT, incl. individuals |

| 16 | 27 | Preparation by an intermediary of a consolidated invoice for the sale (purchase) of goods |

| 17 | 28 | Preparation by an intermediary of a consolidated invoice for the advance payment |

| 18 | 32 | Acceptance for deduction of VAT on goods imported into the territory of the Kaliningrad SEZ (clause 14 of Article 171 of the Tax Code) |

| 19 | 34 | Downward adjustment of the cost of shipments of raw hides and scrap |

| 20 | 36 | Deduction of VAT on goods for which compensation was paid to a foreigner (tax free system) |

| 21 | 41 | Deduction of VAT when transferring an advance payment for the supply of raw hides and scrap (“as for the buyer”) |

| 22 | 42 | VAT deduction on shipment of raw hides and scrap (“as per buyer”), incl. with increasing shipping costs |

| 23 | 43 | Deduction of VAT on advance payment after shipment of raw hides and scrap (“as for the seller”) |

| 24 | 44 | VAT deduction when reducing the cost of shipments of raw hides and scrap (“as for the seller”) |

Transaction type code in the purchase book

The purchase book is maintained quarterly and filled out by the taxpayer for each tax period. When filling it out, it is necessary to take into account Government Decree No. 1137 of 2011.

When returning an advance to a buyer, the seller must record this transaction in the purchase book and make all necessary adjustments in accounting and management reporting related to the return. This fact is reflected in column 7 of the purchase book. Here are the details of the document that confirms the return of this prepayment.

When maintaining a purchase book, you need to use the codes established by the Federal Tax Service for different types of transactions. When returning an advance, the seller indicates in the purchase book the details of the issued invoice for the advance received and puts the transaction code “22” in the second column (according to paragraphs e, clause 6, 22 of the Rules for maintaining the purchase book).

The seller is obliged to register the invoice in the purchase book no later than one year after the buyer refuses to supply. This is indicated in paragraph. 2 clause 22 of Appendix 4 to Government Decree No. 1137.

Additionally, the taxpayer should confirm the right to receive a deduction using documents that indicate termination of the contract (for example, an additional agreement or unilateral refusal to fulfill the contract) and the return of money to the buyer.

Sales book

The sales book is intended for registering invoices, as well as cash register control tapes, strict reporting forms for the sale of goods, works and services.

The sales book records all issued invoices in cases where the obligation to calculate VAT arises, including:

- when shipping goods, performing work, providing services, transferring property rights;

- upon receipt of an advance;

- when receiving funds that increase the tax base;

- when performing construction and installation work for own consumption;

- when transferring goods, performing work, providing services for one’s own needs;

- when returning goods accepted for registration;

- when performing the duties of tax agents;

- when carrying out transactions that are not subject to taxation (exempt from taxation).

Invoices issued by sellers for cash sales are subject to registration in the sales book. In this case, the readings of the control tapes of cash register equipment are recorded in the sales book without taking into account the amounts indicated in the corresponding invoices.

If it is necessary to make changes to the sales book, an additional sheet of the sales book is generated in which the changed invoice is registered. An additional sheet is generated for the period in which the invoice was registered before corrections were made to it.

When restoring VAT amounts accepted by the taxpayer for deduction, invoices on the basis of which tax amounts were accepted for deduction are subject to registration in the sales book for the amount of tax subject to restoration.

In order to restore tax amounts, in the sales book in the last month of the calendar year, starting from 2006, the amount of VAT to be restored and paid to the federal budget for the current calendar year is indicated.

Registration of invoices in the sales book is carried out in chronological order in the tax period in which the tax liability arises.

When receiving advance amounts from the buyer, sellers record in the sales ledger invoices issued to the buyer for the advance amount received.

Sellers who perform work and provide paid services directly to the public without the use of cash register equipment, but with the issuance of strict reporting documents, register in the sales book, instead of invoices, strict reporting documents issued to customers, or the summary data of strict reporting documents based on an inventory compiled based on sales results for the calendar month.

The sales book must be bound, and its pages numbered and sealed. Control over the correctness of maintaining the sales book is carried out by the head of the organization or his authorized person.

The sales ledger is retained by the supplier for a full 5 years from the date of the last entry.

Issuing an invoice for shipment to the buyer

An invoice for shipped goods is issued using the Issue invoice , located at the bottom of the Sales document (act, invoice) .

The Invoice document issued is automatically filled with data from the Sales document (act, invoice) .

Find out more about VAT calculation when selling goods in wholesale trade

Filling out column 11 of the sales book

In what cases, when maintaining sales books, should you fill out column 11 “Number and date of document confirming payment”?

The form of the sales book used in VAT calculations and the Rules for its maintenance are approved by Decree of the Government of the Russian Federation of December 26, 2011 N 1137 (shown in Appendix 5 to this document). Column 11 “Number and date of the document confirming payment” in the sales book appeared thanks to the Decree of the Government of the Russian Federation dated July 30, 2014 N 735, the norms of which have been applied since October 1, 2014 (Letter of the Ministry of Finance of Russia dated September 18, 2014 N 03-07-15/46850) . In accordance with the Rules for maintaining the sales book, column 11 indicates the number and date of the document confirming payment of the invoice, in cases established by the legislation of the Russian Federation. The sales book does not specify exactly which cases we are talking about.

However, let us remember the main rule for filling out the sales book: this book records compiled and issued invoices (including adjustment ones) in all cases when the obligation to calculate VAT arises in accordance with the Tax Code (clause 3 of the Rules for maintaining the sales book applied in calculations for value added tax). (In addition to invoices (including adjustment ones), CCP control tapes and strict reporting forms for the sale of goods, performance of work, and provision of services to the public are also recorded in the sales book.) In this regard, we believe that column 11 is filled out in the case when the occurrence of the obligation to calculate VAT depends on the fact of receipt (transfer) of amounts that are recorded in the invoice. By the way, in the invoice itself there is line 5 “To the payment document __ dated ____.”

Nuances of calculating advance VAT during the transition period 2018-2019

From January 1, 2019, the VAT rate increased from 18% to 20%, and the estimated tax rate also changed from 18/118 to 20/120 and from 15.25 to 16.67% (Law No. 303-FZ dated August 3, 2018). Business operations were not interrupted in connection with such innovations: in 2020, suppliers received advances from buyers for shipments that occurred or were yet to occur in 2020. But this did not in any way affect the design of purchase and sales books and the codes of transaction types in them. The codes should be the same as in 2020.

How to cope with the nuances of the transition period was explained by the Federal Tax Service of Russia in a letter dated October 23, 2018 No. SD-4-3 / [email protected] The procedure for the buyer and seller according to the tax service’s methodology is presented in the figure below:

Let us explain the procedure proposed by the Federal Tax Service using an example.

In November 2020, the office furniture supplier Mebelshchik LLC received an advance payment in the amount of RUB 276,000 from the buyer Service Center PJSC. From this amount, Mebelshchik LLC calculated VAT:

276,000 × 18/118 = 42,101.69 rubles.

In January 2020, furniture was shipped to PJSC Service Center in the amount of RUB 233,898.31. The supplier charged VAT on this transaction at a rate of 20%:

233,898.31 × 20% = 46,779.66 rubles.

VAT accrued on prepayment in November 2020 was accepted for deduction in the amount of RUB 42,101.69.

Transactions with VAT from the buyer PJSC "Service Center":

- after the prepayment is transferred, VAT in the amount of RUB 42,101.69 is accepted for deduction;

- after receiving the furniture, tax in the amount of RUB 46,779.66. accepted for deduction with the simultaneous restoration of VAT in the amount of 42,101.69 rubles. with prepayment.

Find out what a taxpayer should do if an additional 2% VAT is paid due to an increase in the tax rate from this publication.

Preparation of consolidated invoices

In practice, it often happens that an intermediary purchases goods for a commission agent from several suppliers or sells his goods to several buyers. In this case, consolidated invoices may apply. Next, we will consider their application in specific situations.

The intermediary sells the consignor's goods to several buyers

In this case, the intermediary issues a separate invoice to each buyer. The intermediary must register these documents in Part 1 of his Journal with code 27. After this, the data of all issued invoices is transferred to the principal, and he issues a consolidated invoice based on them. The principal must register this document in his sales book with code 27, listing information about all buyers in the appropriate columns, separated by commas. The intermediary reflects it in part 2 of his Journal, also indicating code 27. Information about each buyer must be indicated in separate lines in the columns that are intended for intermediary activities (10, 11 and 12).

The intermediary purchases goods for the principal from several suppliers

In this case, each individual invoice that the intermediary receives from the supplier is recorded in the second part of the Journal with code 27. Then, based on this data, the intermediary issues a consolidated invoice to the principal for the total amount of purchases. This document must be recorded in Part 1 of the Intermediary's Journal, and code 27 must also be indicated. Information about each supplier must be indicated in the appropriate columns of the Journal (10, 11 and 12).

The principal registers the received invoice in the purchase book with code 27. In the appropriate columns, you must indicate information about all suppliers, listing them separated by commas.