To compare information from the reports of taxpayers, suppliers and buyers, the Federal Tax Service uses various software systems, for example, ASK VAT-2. When detecting inconsistencies, the program automatically generates and sends a notification to the taxpayer. He, in turn, must provide explanations to the tax office within five days. If the taxpayer does not provide the Federal Tax Service with a receipt for the receipt of the request and a response to the request within the prescribed period, his accounts may be frozen.

The program records 2 types of discrepancies:

- mismatch of amount - if the transaction is reflected in the declarations of both counterparties, but the tax amounts indicated are different;

- gap - if the transaction is not reflected by one of the counterparties (he submitted a zero declaration, did not submit reports at all, or is not in the Unified State Register of Legal Entities).

To help taxpayers, the Ministry of Finance of the Russian Federation together with the Federal Tax Service issued Information Letter dated December 3, 2020 N ED-4-15/ [email protected] The text of the letter states that from 2020, the requirements of the Federal Tax Service, among other things, will indicate a possible error code. The letter contains error codes and their interpretation. There are nine of them in total.

Error code "8"

This means that sections 8 - 12 of the VAT tax return incorrectly indicate the transaction type code provided for by Order of the Federal Tax Service of Russia dated March 14, 2020 N ММВ-7-3/ [email protected] “On approval of the list of transaction type codes indicated in the purchase book , used in calculations for value added tax, an additional sheet to it, a sales book used in calculations for value added tax, an additional sheet to it, as well as codes for the types of transactions for value added tax necessary for maintaining a log of received and issued invoices."

What is an error code and how to find it

Tax authorities “run” all electronic VAT returns through the specialized software package ASK VAT-2.

Both the relationships between sections within the declaration and information received from counterparties are checked. If discrepancies are identified, the taxpayer is sent a VAT request for explanations.

The regulations used by tax authorities include typical types of errors. Each of them has its own digital code. You can find out all types of errors and their codes valid in 2020 from the joint letter of the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation dated December 3, 2018 No. ED-4-15 / [email protected]

Error code "9"

Means that errors were made when canceling entries in section 9 “Information from the sales book” (Appendix 1 to section 9 “Information from additional sheets of the sales book”) of the tax return:

- the VAT amount indicated with a negative value exceeds the VAT amount indicated in the entry on the invoice subject to cancellation;

- There is no invoice entry to be cancelled.

The use of error codes should make it easier for taxpayers to identify reporting errors.

Error codes in the VAT return

The list of codes contains nine positions indicating a possible error, discrepancy or inconsistency in data:

- Error code 1 in the VAT return is recorded if the entry in the declaration about the business transaction carried out is not confirmed by the partner’s declaration, or errors made when filling out did not allow the system to identify the entry about the SF and compare it with the information in the counterparty’s declaration. That is, code 1 indicates the presence of a gap between the data of counterparties’ declarations. There may be several reasons for the data discrepancy - the counterparty did not submit a declaration to the Federal Tax Service for the same period, it has zero indicators;

- Error code 2 in the VAT return is indicated by the program if inconsistencies in information about transactions are detected between sections No. 8 and No. 9 (according to the purchase and sales books), i.e. we are talking about discrepancies in reporting within the company. If VAT, for example, when refunding VAT on previously calculated advance invoices, is first accrued and then reimbursed, then one invoice is recorded in the purchase and sales books, therefore, the amount of transactions should not diverge. If there are discrepancies in this information, the Federal Tax Service generates an error using code 2;

- error code 3 in the VAT return is indicated by the Federal Tax Service if there is a discrepancy between the information in sections No. 10 (for the invoice issued) and No. 11 (for the invoice received), for example, when recording transactions on intermediary transactions;

- error 4 in the VAT return means an assumption of an inaccuracy in a certain column. Its number is usually indicated in parentheses. For example, error 4 (19) in the VAT return will indicate a possible discrepancy in the data from the purchase book, or the discrepancy is contained in the partner’s declaration, since cross-checks are being carried out between the interacting parties to the transaction. To ensure that the data is correct, the declarant should check the information from the invoices issued, and, if he is confident that the amount is correct, contact the counterparty and ask him what information he has declared;

- error code 5 in the VAT return indicates that sections No. 8-12 do not indicate the date of the tax return, or the date is indicated, but goes beyond the reporting period of the submitted declaration;

- error code in the VAT return 6 means that the declarant (according to section.

declared a VAT deduction outside the permissible period within 3 years;

declared a VAT deduction outside the permissible period within 3 years; - code 7 indicates that (according to section,

a VAT refund has been declared for the Federation Council, issued before the date of state registration;

a VAT refund has been declared for the Federation Council, issued before the date of state registration; - error code 8 indicates an incorrect reflection of transaction type codes in sections from 8 to 12 in accordance with Federal Tax Service Regulation No. MMV-7-3/136 dated March 14, 2016;

- error code in the VAT return 9 records an error when canceling entries in section 9. Declarations. For example, VAT indicated in a negative value is higher than the tax amount subject to cancellation in the Federation Council. The same code reflects the absence of an entry under the Federation Council, which must be cancelled.

The company receives such a requirement electronically.

When does the taxpayer become aware of errors?

When sending the initial VAT return to the tax office, the taxpayer may not even suspect that inspectors will find errors in it. Moreover, these errors can arise not only through the fault of the taxpayer himself (due to inaccurate filling, technical errors, etc.), but also in connection with any actions/inactions of his counterparties.

For example, the partner will not reflect the invoice issued to you in the sales book. As a result, he will not only underestimate the amount of sales and VAT in his declaration, but will also cause a lot of trouble for you, the recipient of the invoice:

- You will be forced to give explanations to the controllers.

- There is an increased risk of denial of VAT deductions on an invoice reflected in your purchase book and not recorded in the sales book of your counterparty.

How will you know that your counterparty did not reflect the invoice in the sales book or the data was distorted? It's simple: you will receive a request from the tax authorities to provide explanations in connection with the discrepancies identified during the audit of the declaration. The annex to the request will list the errors and their codes. We'll talk about this in more detail below.

What should the taxpayer do?

Receipts

First of all, send an electronic receipt to the tax office, which indicates that you have received a request for clarification.

Error checking

The request will indicate all possible error codes for which contradictions and inconsistencies were found. It is necessary to find out exactly which reflected transactions the inspection found inconsistencies in. It is important to reconcile the invoice records with those shown in the statements. Pay attention to the completed details, especially for any inconsistencies identified: date, number, amounts, calculation of the VAT amount at the correct tax rate and the cost of purchases or sales.

Explanations or subtle declaration

Send explanations if previously discovered errors did not change the VAT amount. Also provide explanations if you have not identified any errors and there are no grounds for correction.

Possible response format to the tax office:

“In response to the request from DT.MM.YYYY No. XX, I inform you that I have not identified any grounds for entering other data into the XXX declaration for the reporting period ... the declaration was drawn up correctly.”

If a self-check shows that you made a mistake (for example, a technical error in the digit of a certain code):

“In response to the request from DT.MM.YYYY No. XX, I inform you that when checking the XXX declaration for the reporting period... an error was discovered in the reflection... The updated declaration is attached.”

After re-checking, submit it to the tax inspector at your location, reflecting the new correct tax calculation indicators (if errors were found that underestimated the amount of tax payable to the state budget).

Changes in tax calculations

Elimination of errors in the calculation of the VAT amount in the updated declaration occurs in the direction of its decrease or increase.

If you have submitted clarifications in order to reduce the VAT payable, such reporting will be followed by a desk audit or an on-site audit, if one has not been carried out for a long time. If the audit confirms the fact of a tax reduction, an overpayment will be created on the company’s personal account: return it to your current account, or use it to offset other taxes. You also need to write an application addressed to the head of the Federal Tax Service inspection for a refund or offset.

If you have submitted clarifications for an increase in tax, which means an additional payment, first pay the amount of the underpayment, and then submit the adjustment declaration. This will help you avoid penalties for non-payment of taxes.

The tax office may impose penalties on the amount of non-payment, which must also be paid before submitting the clarification. If the additional payment amount has already been transferred, you can submit the declaration on that day, but it is usually submitted on the next business day.

A private easement is established by agreement of the parties. How to properly purchase a plot of land and avoid problems? Find out about this by reading our article. When should land tax be paid? You will find the answer here.

Has the Federal Tax Service deciphered the error codes and explained what to do when receiving a Request?

The tax authority may send such a Request to the taxpayer if it discovers contradictions and inconsistencies between the information about transactions contained in the VAT return, information about these transactions submitted to the tax authority by another taxpayer, or in the journal of received and issued invoices. The appendix to the tax authority's request (for reference) indicates a possible error code. There are 4 error codes in total.

For each transaction, only one of four error codes can be indicated, namely: - error code “1” is indicated if the transaction entry is missing in the counterparty’s declaration, or the counterparty did not submit a VAT return for the same reporting period, or the counterparty submitted a declaration with zero indicators, or errors made do not allow identifying the invoice record and, accordingly, comparing it with the counterparty; — error code “2” is indicated if the transaction data between section 8 “Information from the purchase book” (Appendix 1 to section 8 “Information from additional sheets of the purchase book”) and section 9 “Information from the sales book” ( Appendix 1 to Section 9 “Information from additional sheets of the sales book”) of the taxpayer’s declaration (for example, when deducting the amount of VAT on previously calculated advance invoices). - if code “3” is specified, the data on the transaction between section 10 “Information from the journal for recording issued invoices” and section 11 “Information from the journal for recording invoices received” do not correspond to the taxpayer’s declaration (for example, reflection of intermediary transactions); — error code “4” means that there may be an error in some column. In this case, the number of the column with a possible error is indicated in brackets.

After receiving a request from the tax authority in electronic form via telecommunication channels through an electronic document management operator, the taxpayer must: 1. Submit to the tax authority a receipt of receipt of the Requirement in electronic form via telecommunication channels through an electronic document management operator within six days from the date of its sending by the tax authority ; 2. With regard to the entries specified in the Request, check the correctness of filling out the tax return, check the entry reflected in the tax return with the invoice, pay attention to the correctness of filling in the details of the entries for which discrepancies have been established: dates, numbers, amounts, correctness of calculation of the amount VAT depending on the tax rate and the cost of purchases (sales). If an invoice was accepted for deduction in parts (several times), it is also necessary to check the total amount of VAT accepted for deduction for all entries in such an invoice, including taking into account previous tax periods; 3. Submit to the tax authority an updated tax return with correct information if an error is identified in the submitted VAT return that leads to an understatement of the amount of tax payable; 4. If an error in the declaration did not affect the VAT amount, provide an explanation indicating the correct data. It is also recommended to submit an amended tax return. Explanations can be presented in free form on paper or in formalized form via telecommunication channels through an electronic document management operator. To send explanations in a formalized form, it is necessary to clarify the availability of such an opportunity with the developer (supplier) of the taxpayer’s accounting system or the electronic document management operator; 5. If, after checking the correctness of filling out the declaration, no errors are identified, the tax authority must be notified about this by providing explanations. These clarifications are provided by the Federal Tax Service of Russia for the Oryol Region (conveyed by letter of the Federal Tax Service of Russia dated November 6, 2015 No. ED-4-15/ [email protected] ).

Share with your friends:

Electronic registers are a new step in the development of electronic document flow

Schedule of online meetings for December with Federal Tax Service experts

To the list of news

License

Any tariff for the “Reporting via the Internet” service.

VLSI 2.4

VLSI 2.5

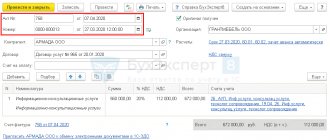

- Click "Generate response."

- Make sure that in the “Base Document” field the name of the file of the VAT document about which the NI has questions is indicated.

VLSI will fill in the file name automatically if the system has a VAT tax return report with the period specified in the request and the adjustment number for which a notification of entry or a notification of clarification was received. If there are several suitable declarations, select the one you need from the list or specify the file name manually. - The requirement contains control ratios and invoices for which discrepancies were found. Open the folder to generate a response.

In addition to the main requirement, NI can attach invoices with the “Information Details” type. There is no need to formulate a response to such entries.

- Make corrections depending on the type of discrepancy:

- What should I do if, when submitting for signature, the message “In the section... there is raw data” appears?

In addition to the main answer, you can write a letter with explanations.

Attention!

In response to a request, you cannot send only a letter, otherwise the Federal Tax Service may impose a fine. If a taxpayer submits VAT documents electronically, then he must respond to the requirement in the Federal Tax Service format .

Explanation of information not included in the sales book

The procedure for responding to requirements of this type has not been officially approved, so we have included expert recommendations in this table.

| Explanation type | Explanation of information not included in the sales book |

| In what case will the demand come? | When the buyer reflects transactions with the seller in the declaration, but the seller does not do this in his sales book |

| When will it come | Theoretically, such requests can be received within three months of verification, but it is more likely that the demand will arrive within two weeks from the date of sending the declaration |

| In what format will it come? | |

| What it contains | Name, INN and KPP of the buyer who reflected the transaction data, as well as invoice numbers and dates |

| What to include in an email response | The data should fall into different tables in response to the requirement depending on the conditions given below. — The transaction is confirmed, that is, there is an invoice in the declaration, but with data different from the buyer’s data. The invoice then goes into a table that explains the discrepancies. In the table, it is enough to indicate the number, date and TIN of the counterparty; additional information is not necessary. — The transaction is not confirmed, that is, the seller did not issue this invoice to the buyer. The invoice is included in a table containing data on unconfirmed transactions. The following information must be reflected in the table: – invoice number; – invoice date; – Buyer’s TIN. — The payer has the invoice mentioned in the request, but he forgot to reflect it in the sales book. In this case, we advise you to include the invoice in an additional sheet of the sales book and send an updated declaration. Five working days are given for this after sending the receipt of acceptance of the request |

Code 000000002: looking for our mistakes

Error code 0000000002 in a VAT return means that there is a discrepancy between the purchase and sales ledger of the reporting company for the same transaction. Here we are not talking about inconsistencies between the declarations of the seller and the buyer, but about discrepancies within the reporting of the company (or individual entrepreneur) itself.

If tax is first assessed and then deducted, the same invoice is recorded in the purchase and sales ledger. How does this happen in practice?

Example 1

Almira LLC (supplier) received an advance payment from Sigma Lux LLC (buyer) and charged VAT on the amount. When shipping products, the supplier declared a deduction of accrued advance VAT (clause 6 of Article 172 of the Tax Code of the Russian Federation). These two operations will compare the VAT ASK.

If there is a deduction in the declaration, but the tax is not charged, the system will generate a request with error code 0000000002. Having received an inspection request with this error code, Almira LLC:

- checks whether the advance invoice is registered in the sales ledger;

- Having identified an advance invoice not reflected in the sales book, he draws up an additional list for the sales book (for the period of receiving the advance payment), pays additional tax and penalties, and also submits an updated declaration.

Almira LLC will receive the same error code if it calculates advance VAT and accepts it for deduction, but at the same time makes errors when registering the invoice in the book of purchases and sales.

Example 2

PJSC KeramzitStroy leases municipal property and acts as a tax agent for VAT. The company issues a monthly invoice and registers it in the sales book, and also pays VAT to the budget. Then PJSC KeramzitStroy declares a deduction for the same amount in the purchase book.

If KeramzitStroy PJSC makes a mistake when reflecting an invoice in the book of purchases and sales, when checking the declaration, the system will indicate an error with code 0000000002. After receiving a request for clarification, the company must follow the algorithm described in example 1.

declared a VAT deduction outside the permissible period within 3 years;

declared a VAT deduction outside the permissible period within 3 years;