Bookmarked: 0

What is a reward? Description and definition of the term

Remuneration is the monetary payment of employees in the form of wages and bonus payments, depending on the quantity and quality of work. When remunerating sales workers on commission, wages depend on cash turnover, on cash proceeds from the sale of goods. Agency fee - payment for agency intermediary services for the sale, advertising or purchase of goods. Depressive remuneration is a system that provides for a reduction in the amount of remuneration to the intermediary depending on the volume of sales. Linear remuneration is a system in which the intermediary receives a certain percentage of turnover without any changes depending on the sales volume. Progressive remuneration - in which the percentage of remuneration increases with increasing sales volume.

Remuneration – expressed in monetary form, is the payment of employees. Remuneration is presented in the form of basic salary, as well as bonuses paid based on performance results. For sales employees, a commission system may apply, where the amount of payment received depends on revenue and turnover. There is also the concept of agency fees - payment for the services of an intermediary for the sale or purchase of goods, as well as advertising of goods. Linear remuneration means a payment system in which an employee acting as an intermediary receives the same percentage of product turnover, regardless of how sales volumes change. Unlike linear remuneration, with progressive remuneration the amount of payment increases as sales volume increases.

Reward and its necessity

Let us consider in more detail what the term remuneration means.

Need for reward:

- Attracting the best personnel to the organization. Firms compete in the labor market, trying to attract the best specialists (including through effective motivation).

- Retaining the best employees in the organization. When an organization's compensation does not match what the job market offers, employees may begin to quit. To prevent this (after all, money is spent on training and development of employees), management must provide a competitive motivation system.

- Stimulating productive behavior. Remuneration should focus employees on the actions necessary for the organization: productivity, creativity, initiative, dedication to the company.

- Control of labor costs. If the remuneration is low, workers will quit; if the remuneration is unreasonably high, the company may go bankrupt.

To motivate employees to be more effective, managers use two main types of rewards —intrinsic and extrinsic.

Intrinsic rewards provide (or do not provide) job content. Its components are the following:

- feeling of achievement;

- a sense of content and significance of the work performed, self-esteem;

- friendship and communication that arise in the process of work;

- acceptable working conditions and precise task definition.

Extrinsic rewards do not come from the work itself, but are given by the organization. It can take the following forms:

- salary increase;

- promotion;

- providing symbols of official status and prestige;

- praise and recognition from management;

- additional payments.

Incentive payments (bonuses) as a form of payment for work

The current labor legislation (Article 129 of the Labor Code of the Russian Federation) allows the employer to establish a wage system consisting of several parts:

- payments for work performed in accordance with job duties;

- compensatory payments taking into account the conditions in which work is carried out;

- additional incentive payments designed to increase employee interest in work.

By adopting such a remuneration system, the employer has the opportunity to:

- influence the employee’s interest in the results of his activities;

- regulate the amount of labor costs taken into account when calculating the income tax base.

The types of bonuses and remunerations used as additional incentive payments are reflected in the internal regulations developed by the employer (Article 135 of the Labor Code of the Russian Federation). This act establishes:

- list of types of incentives used;

- conditions and frequency of their accrual;

- the circle of persons to whom each type of incentive applies;

- a list of indicators that allow an employee to qualify for appropriate remuneration and deprive him of such an opportunity;

- a system for assessing indicators giving the right to remuneration, the result of processing of which will be the monetary value of the remuneration;

- procedure for reviewing assessment results and challenging its results.

However, incentive additional payments, when included in the remuneration system, become mandatory for the employer if all conditions for applying the incentive are met.

Reward as motivation

One obvious answer to the question of motivation is that employees may be motivated to take power by achieving organizational goals, specific management that gives them financial rewards, promotion and recognition. Such fees are, of course, stimulating, but their impact is only satisfactory if certain conditions are met. The main condition is that the employee's contribution to the organization's goals must be measured with a reasonable degree of accuracy. Salespeople, for example, are often compensated (at least in part) on a commission basis. Workers are sometimes rewarded on a piece-rate production basis, although in a growing number of situations. Controls, and sometimes others, receive bonuses that are supposed to be related to their contribution to profits.

But such bonus systems are only effective when success can be accurately correlated with individual contribution. If the symbols used to measure the effects are inappropriate, either because the variables are not measured correctly, or because individual contributions are not correctly identified, while the premium system as a whole is ineffective or even has the opposite effect. When assessing a number of issues, without due attention to quality, as well as incentive payments of bonuses, this will lead to a decrease in the cost of increasing the quality of products. When it is not possible to assess the compliance of company policies that lead to certain actions, they will be ignored or violated. Salespeople may misrepresent product information, workers may ignore safety rules, and managers may leak problems to other departments.

In general, it is more difficult to determine the contributions of individual members of an organization in achieving their goals than to determine the relationships between them. But of course, strong interdependence makes for a better organization of people, as an alternative to depending solely on market transactions. Measuring the difficulties arising in connection with individual contribution is a reward for it, not superficial, they arise due to the nature of the organization, its rationality.

Many large American corporations after World War II attempted to respond to this problem by dividing their organizations into relatively autonomous components. The independent balances would then be combined for each department and used to evaluate performance and pay bonuses.

Of course, division is only successful when the departments are truly autonomous. If one department operates primarily as a supplier of parts to other departments, then the course of action should be limited to setting the prices at which goods are sold to other departments, or determining the conditions under which the department can leave the company to buy products at a lower price. . For these and similar reasons, the division may be slightly different from the typical corporate structure, and solves the problem of attributing results to specific individuals only at higher levels, if overall.

Although economic bonus plays an important role in ensuring the realization of organizational goals and managerial commitment, it is limited in its effectiveness. Organizations will be much more ineffective than they actually are if such rewards are the only means, or even the main means of real incentives. In practice, organizational behavior monitoring has revealed other important motives that encourage employees to accept organizational goals and authority as the basis for their actions. Let us turn to the most important of these mechanisms: organizational identification (identification).

What kind of bonuses are there and how else can employee incentives be expressed?

Incentives that serve the purpose of stimulating employees are divided into 2 main types:

- material (monetary or in kind), representing various types of additional payments;

- intangible, which can be expressed in a declaration of gratitude, placement on the honor board, assignment of an honorary title, awarding a diploma, medal or memorial sign.

Among material incentives, the leading role is given to bonuses. But there may also be other types of cash payments, expressed, for example:

- in bonuses to the salary or tariff rate established for a certain period;

- additional payments for length of service.

Among bonuses in relation to the regularity of their payment, there are 2 main groups:

- Regular (systematic), accrued and paid at a certain frequency (month, quarter, year). All issues related to such bonuses are regulated by the employer’s internal regulations on incentive payments. Special instructions (decisions) for calculating such bonuses are not needed. If the conditions stipulated by the internal regulations on bonuses are met, they must be accrued without fail.

- Irregular (one-time), which can be named in the internal regulatory act on bonuses as included in the remuneration system, but their accrual requires additional information on indicators essential for bonuses. Therefore, for such bonuses it is necessary to draw up a separate document justifying the employee’s right to receive a bonus, and to make a separate decision on this document by the head of the organization.

According to the sources through which bonuses are calculated, they can be divided:

- included in expenses that reduce the income tax base - this will include bonuses related to the employee’s labor achievements, both included in the remuneration system and not included in this system;

- attributable to net profit - such attribution applies to bonuses for non-production purposes, paid not for labor achievements (letter of the Ministry of Finance of Russia dated April 24, 2013 No. 03-03-06/1/14283).

Reward as a way to satisfy needs

The key element in motivation theory is needs. Need is a feeling of human physiological, psychological or social discomfort, lack or need for something. Requirements are divided into primary and secondary.

Primary requirements are physiological in nature and, as a rule, innate (for example, the need for food, water, the need to breathe, sleep, etc.). Secondary needs are psychological in nature (for example, the need for success, respect, power, love and necessarily belonging to someone or something).

The basic requirements are set out genetically, and the secondary ones are usually realized with experience. Because different people have gained experience, secondary requirements differ to a greater extent than primary ones.

Understanding the needs of private people of a different nature causes the emergence of interest as a form of knowledge and an opportunity for learning to meet the needs that arise in an individual at a certain stage of life and development. Based on the interests of employees about the possibilities of meeting their needs, incentives were used.

Incentives are designed to ensure a person's goal-directed behavior by limiting or expanding his potential to meet the needs of the present and future.

Purpose and essence

The purpose and essence of the award follow from the concept.

A bonus should be understood as a monetary payment for additional or improved results of work, which is paid regularly from the same sources as wages.

Bonuses are used as a factor in moral and material incentives for employees to achieve higher levels of quantity or quality of activity.

They are often used to attract or retain qualified or conscientious employees and improve their morale.

The assignment of bonuses to employees is considered a voluntary decision of the organization's management.

And if management decides to give bonuses to people, then this must be done thoughtfully from both a managerial and legal point of view in the form of appropriate orders, regulations and instructions.

Some aspects of the appointment, including bonus provisions, will be discussed below.

Chapter 2. Remuneration for hired work [p.16]

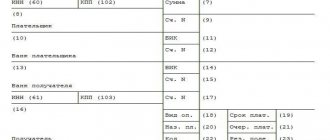

The payroll sheet is used by individual entrepreneurs using the labor of hired workers, as well as by legal entities maintaining accounting records based on the ledger of business transactions. The payroll is intended to record settlements with employees for wages, as well as to determine the amounts of mandatory contributions and deductions to the State Social Insurance Fund, the Mandatory Medical Insurance Fund, the Employment Promotion Fund, the State Center for the Payment of Pensions, etc. in accordance with the established procedure from the amounts of remuneration of employees. The payslip is also a payment document and is intended for processing the payment of wages to employees of a small business entity. In the column “Accrued wages” the amounts accrued to employees for wages for work performed are reflected and at the same time deductions are made from the accrued amounts for wages (personal income tax, mandatory pension contributions and others in accordance with the legislation of the Republic of Kazakhstan) in the column “Withholding from wages." [p.92]

Cash savings include profit in the amount of the total balance sheet profit of enterprises and organizations of all sectors of the national economy. The turnover tax is determined in amounts received by the state budget. The net income of collective farms is defined as the difference between the gross income and wages of collective farmers, hired and hired persons, as well as contributions to the centralized union funds for social security and social insurance of collective farmers. Contributions to state social insurance are taken into account in the amount of amounts actually transferred to social insurance bodies. Deductions for research and geological exploration are reflected in the amounts included by enterprises and organizations in the cost of production or expenses. At the same time, such deductions for research work are not made by enterprises of ministries and departments that form from profits a single fund for the development of science and technology, from which expenses on science are financed. Income from foreign trade is included in amounts received by the state budget when carrying out export and import operations, minus budget expenses incurred for these purposes. Other cash savings include expenses not listed above that go to the state budget, as well as contributions from enterprises and organizations that are included in the cost or expenses, but are their net income. [p.346]

One of the cost components of gross value added is the payment of wages to employees. It represents the remuneration in cash or in kind that must be paid by the employer to the employee for work performed during the period under review. [p.569]

In Germany, for example, a special law has been adopted, according to which employees have the opportunity to influence management decisions affecting their interests. In enterprises with more than 5 employees, they have the right to discuss and participate in decision-making. There are two forms of participation - through supervisory and production councils. For example, the functions of the latter include monitoring compliance with laws, regulations, safety regulations, tariff agreements and collective agreements regulating working conditions. The production council has the right to participate in decision-making on all issues of the use of working time, dismissal and hiring of employees, the introduction of technical means designed to monitor the behavior and productivity of workers, the use of new forms of remuneration, the distribution and vacancy of factory apartments, etc. [ p.536]

Wages as an economic category are a modification and specification of the price of labor (labor power). There is a close relationship between the categories of wages and labor prices, but these are not identical categories. The price of labor is a category of the labor market (labor force). It is formed, as already emphasized above, in the labor market, and its level depends on the relationship between the demand for labor and the supply of labor. Wages are a category primarily of production. It is formed in the production process, its level depends not only on the market price of labor, but also on factors such as the complexity of labor, working conditions, the social significance of the labor function, labor efficiency, its productivity and results. The price of labor is determined before the production process begins and expresses the cost of labor of a certain quality. Wages are paid after completing certain work, depending on its quantity, quality and results. The price of labor characterizes the level of wages on average for certain professionally qualified groups of workers. Wages are a specific category; they take an individualized form and reflect the results of the labor of a particular employee. Thus, wages can be characterized as remuneration for work, the amount of money that an employer pays an employee for work performed in accordance with its quantity, quality and results. [p.384]

However, despite all the positive aspects of such an organizational structure, a psychological barrier on the part of the initiator remains. In fact, with the chosen scheme for organizing and implementing a venture project, the owners of the technology being created become a consulting firm, an industrial partner, and a venture fund, since they financed the project at the initial and intermediate stages. The developer himself, or a group of managers, are performers who will receive compensation for their work in the form of royalties. After completion of the work, they may find themselves without a job, but with a guaranteed receipt of a certain amount for the use of intellectual property. The technology developer, as is customary in most countries, is a normal employee who receives payment for his work. [p.197]

The item Compensation of employees on the left side of the income generation account serves to reflect accrued amounts of remuneration in cash and in kind that must be paid by employers (resident institutional units) to employees (residents and non-residents) for work performed in the current period (before deduction taxes and other deductions in accordance with the law). Remuneration of employees according to the SNA methodology consists of the following components [p.392]

COMPENSATION OF LABOR (wages) - remuneration in cash or in kind that must be paid by the employer to the employee for work, without deducting taxes and other deductions. In world practice, various forms and methods of O.T. are accepted. hourly or time-based wages of workers, monthly or annual salaries of employees, one-time remuneration of administrative managers, participation in income, participation in profits, payment for qualifications and titles, etc. [p.207]

Wage rates vary by type of activity and job. This is because there are many separate markets for specific types of labor services, and in each of them, specific conditions of supply and demand determine the level of wages. Wage rates are sensitive to the quality of working conditions, degree of risk, and location of work. In most cases, finding people willing to work in worse conditions and with increased risk is only possible by providing a compensation supplement. In addition to wages, employees receive other types of income, such as social and medical services, provided through contributions from employers. The share of these types of income varies across countries and is just over 5% in the US, and about 8% in the UK. Nevertheless, the overall share of income from employment in the countries under consideration is approximately at the same level. [p.195]

Gross profit and gross mixed income are profits and income that represent that part of the added value that remains with producers after deducting expenses associated with the payment of employees and net taxes on production and imports. This measures the profit (or loss) generated from production before property income is taken into account. For unincorporated businesses owned by households, this type of income contains basic remuneration for work, which cannot be separated from the income of the owner or entrepreneur. In this case it is called mixed income. [p.167]

Let's look at this in more detail. The initial factors for organizing wages are production tasks, the contingent of workers and the available means of production. Production objectives determine the indicators and conditions of remuneration. The attitude of workers to the means of production essentially predetermines the form of payment; we are talking about payment for hired labor or the income of the owner (here, as before, we mean the entrepreneur directly involved in production). Market relations and trade unions operate in opposite directions. The former, by incentivizing the owner to extract the greatest profit by reducing any costs, including wages, influence wages in order to ensure its rational minimum. The latter, protecting the interests of hired workers, see their duty in the maximum possible increase in wages. The result of the functioning of the wage mechanism, in our opinion, is the level of average wages (not the value of the fund, but the level of wages of an individual employee) and the final results of the enterprise, the general indicator of which is the profit received. [p.51]

The introduction of new, higher tariff rates made it possible to apply higher labor standards. This made it possible, without reducing the average wage, to reduce the share of piece workers whose labor was paid at increased piece rates for work according to standards that were more intense than those in force at that time. For a similar reason, the share of time workers, whose wages were paid at increased tariff rates, decreased. The previous excess labor at the new tariff rates became a higher norm, as a result of which the number of workers who received additional payments also sharply decreased. In the new economic conditions, labor standardization faces the difficult task of determining labor efficiency taking into account market relations. And if experience has already been accumulated in terms of remuneration of labor according to its costs, then in the matter of determining the amount of remuneration for hired labor depending on the overall results of the enterprise, the cost of labor, and the income received, it is virgin soil. [p.88]

The new, or added, value v + m is divided into two parts, the first -v is a value equal to the cost of labor power that the capitalist paid, and the second -m - is created in excess of the value of labor power and is appropriated by the capitalist as a market reward for his social useful entrepreneurial work. In this, the entrepreneurial social division of labor is economically realized. All entrepreneurial work on allocating capital, collecting information, determining the feasibility of labor and its organization is undertaken by the owner of the capital, and it does not matter whether he performs it himself or delegates part of it to workers and managers from the selected administration, who become participants in the appropriation surplus value. Professionally, technological work on the production of goods associated with labor costs is performed by hired workers. This relationship between capitalists and hired workers is the main relationship of capitalist production, in which the work of organizing production is undertaken by the owner of capital - the entrepreneur, and technological work - by the hired worker. [p.182]

Compensation of employees is remuneration in cash or in kind paid by an employer to an employee for work performed during the reporting period. [p.114]

Remuneration of employees is determined by the sum of all remunerations in cash or in kind paid by the enterprise to the employee for work performed during the reporting period. Remuneration of employees is taken into account on the basis of accrued amounts and includes actual contributions to social insurance (contributions to the state pension fund, employment fund, social insurance fund, compulsory health insurance fund), income taxes and other payments that are payable by employees , even if they are actually retained by employers for administrative purposes or for other reasons and are paid directly to social insurance authorities, tax authorities on behalf of the employee. [p.158]

When analyzing the data obtained, it turned out that in Japan, differences in the size of companies and the gender and age structure of employees are much more important in explaining inequality in earnings. The observed age-earnings curves showed that the influence of these three factors is greater than all others. Growth in earnings occurs more gradually and peaks earlier as company size decreases. For small firms, the real level of wages directly depends on their ability to generally pay their employees for their work. Even in large firms, wages are falling sharply due to the effect of strict assessment of the achievements of older workers (over 50 years old). Moreover, there is virtually no increase in women's earnings as they age, especially in smaller firms. [p.62]

Wage-earners. This group includes persons performing work for remuneration in accordance with a concluded employment agreement (contract, oral agreement) on working conditions and payment with a company (enterprise) as a legal entity or with an individual. At the same time, the basic remuneration guaranteed by the concluded agreement does not directly depend on the income received by the organization. All persons elected or appointed to a paid position, including managers who manage the organization's activities on behalf of the owner, are considered employees. These also include ministers of religious cults, persons serving in the Armed Forces, internal troops, and state security agencies. [p.48]

In the conditions of privatization of property for workers, when hiring them, the state can guarantee only the minimum wage for professions and positions, taking into account qualifications. Therefore, the observance of the principle of equal pay for equal wage work should be monitored to a greater extent by trade unions [p.48]

The main importance for public sector employees and employees in the private sector of the economy is remuneration in various forms. In accordance with the system of national accounts, it includes (1) accrued wages at piece rates, tariff rates and official salaries (2) payments for work under special conditions (3) additional payments for overtime work and work at night, on weekends and holidays days (4) bonuses and one-time incentive payments (5) long service pay (6) annual and additional vacation pay (7) profit-sharing income (for example, stock dividends) (8) travel and lifting expenses (9) cost issued special clothing, special footwear and special food, etc. Part of the employee’s income received in the form of wages is necessary for him directly to perform his official duties; the other part, which is the main one, goes to the maintenance of the household, including family members. [p.489]

The workers were paid monthly and daily (“the purchase price of two working days” in the employment contract) [210, p. 109]. Payment was recorded in the allowance lists. The exact days of payment are not known, but by the beginning of the month workers were receiving it. Payment for labor was usually made in bread and beer. Construction workers received “wages” in food - bread, fish, fried meat, vegetables, including onions and garlic, which were the most favorite. We received linen clothes twice a month. The hired men were paid both in “money” in the form of wire and in grain. This is not to say that the content is sparse. In Ramesses III’s address to the “dexterous, skillful, hand-picked” stonemasons, we read: “For you I will fill the warehouses with everything you need: food, meat, sweet dough, sandals, clothes to protect your bodies, many ointments so that you anoint your heads every ten days, I will give you clothing for a whole year, so that your feet will stand firmly on the ground every day and so that none of you sighs in your sleep because of need... Rowing ships are moving from Upper Egypt to Lower Egypt for you, from Lower Egypt in Verkhny with barley, grain, wheat, salt, beans in unlimited quantities. And they do this so that you would work for me with an obedient heart” [29, p. 58]. [p.50]

The socialist system influenced people through basic life guarantees and satisfaction of needs. Labor was seen as a human responsibility in exchange for social guarantees. It was important to instill in a person a sense of duty to society for the guarantees provided. The capitalist system acted through the stimulation of desires to increase consumption. Human life was perceived as divided into two parts: work and leisure. The main impact was directed towards leisure. Work is like payment for leisure. The individual was offered an increasingly varied number of pleasures that he could receive in exchange for his work. The amount of wages de facto was directly dependent on the amount of leisure offers. The quality of leisure could not be related to the quality of work. This connection is too abstract for people and cannot be perceived by them as reality. I produce more, I work more to get more different benefits - this is the main moral value that was the basis for self-motivation in the capitalist system. The quality of work was determined by a set of requirements that the employer set for employees, the fulfillment of which was stimulated by possible punishments, dismissals and very artificial reward systems. The entrepreneur's self-motivation was aimed only at increasing income; the quality of the goods and services he offered was considered by him as inevitable losses that must be incurred in order to sell, in modern jargon - insert, a product or service to the consumer. [p.228]

Personnel records according to these characteristics were kept in lists by name and group by work party, in which notes were made about cases of illness (“days of separation”) and death of workers. The lists of the dead were summarized over several months, distributed by month, and their payments were returned to the warehouse, which required a counter-check of documents on the issuance of products from the warehouse, numbers, time sheets and the actual use of funds. Probably, part of the income and expense accounts represents the results of such control. It is known from the documents that the financial responsibility of officials for the funds received was established, which is confirmed by the indication of their names. However, control over the labor process was ensured not only by scrupulous current accounting, but also by reporting. Moreover, some of the indicators were calculated in general. Such a report provides a set of indicators for the content and volume of work, the average production rate per day, purely days worked, found by dividing the volume of work by the daily production rate [192, p. 273-286]. The number of person-days worked was summed up by category of workers, highlighting hired workers. “Days open” were taken into account when summing up the results. Obviously, the time worked in man-days was compared with the calendar fund to determine the efficiency of using working time. [p.92]

The Japanese type of occupational labor protection is based on the employee’s personal data, that is, based on age, gender, educational level, work experience and form of hiring labor. The specifics of developing a tariff system for paying permanent workers in Japan are largely determined by the traditional system of lifetime employment. The dominant role here is played by graphical methods (employee maturity profile methods, job career curves, individual wage curves, etc.). These methods are used for general labor protection in Japan in relation to all categories of employees. In this case, the starting point is not the year of graduation, but the year of entry into work. The essence of graphical methods of OPP is to identify a certain dependence of the level of wages on work experience. It is believed that as the age and length of service of an employee increases, the efficiency of his work increases, which should be compensated by an increase in the wages he receives. Revealing- [p.269]

JJpry raM, a person has found a job that matches his capabilities, knowledge and salary requirements. Having signed the employment documents, he temporarily leaves the labor market, but not the sphere of economic relations. Only the nature of the employer’s problems is changing; now the main problem is how to ensure that a person works with the highest productivity and quality, and for the hired employee, how to get more for his work within the framework of the current wage system. [p.151]

Labor successes in the volunteer’s personal record book

Members of youth public associations and volunteer organizations, volunteer teams of higher and secondary educational institutions, individual volunteers can keep records of their achievements - for this they need to issue a personal volunteer book. In it, the organizers of the events enter information about the volunteer’s “work experience” - participation in events, number of hours of work, incentives, additional training. All experience is taken into account in further volunteer activities and more. Some universities add additional points for volunteer experience (confirmed) to the applicant’s Unified State Exam scores upon admission.

Over time, more and more employers, when hiring, began to pay attention to the volunteer activities of the candidate, which allows him to gain an advantage over other applicants for the vacancy.