VAT on export for organizations using the simplified tax system

Organizations included in the simplified tax system are not VAT payers, with the exception of VAT payable when importing goods into the customs territory of the Russian Federation and when operating under certain agreements (clause 2 of article 346.11 of the Tax Code of the Russian Federation).

The remaining operations are carried out by the “simplified” ones without issuing invoices and without highlighting VAT in the primary documents. Consequently, when exporting goods, as well as when selling goods to Russian counterparties, there is no need to pay VAT or file a declaration on it. The rationale for this position is given below in the materials of the Glavbukh System

1. Article: Simplified companies do not confirm exports

As a general rule, when selling goods from Russia to countries participating in the Customs Union (Belarus and Kazakhstan), VAT must be calculated at a zero rate, and the right to it must be confirmed. This is stated in paragraph 1 of Article 1 of the Protocol (ratified by Federal Law dated May 19, 2010 No. 98-FZ). But simplified companies do not pay VAT (clause 2 of Article 346.11 of the Tax Code of the Russian Federation). This means that sales to a counterparty from Belarus are not subject to tax. Accordingly, there is no need to issue invoices or confirm the zero rate*.

Magazine “Accounting. Taxes. Law" No. 27, July 2014

2. Article: Simplified companies are not required to pay export VAT

Simplified companies are not exempt from paying VAT when importing goods from the countries of the Customs Union. This follows from paragraph 2 of Article 2 of the Protocol (ratified by Federal Law dated May 19, 2010 No. 98-FZ). But your company exports, not imports, goods. This means there is no need to pay VAT. There is also no obligation to confirm the zero VAT rate*.

In turn, your buyer pays VAT when importing goods into Belarus. To do this, he fills out an import application and sends two copies with an inspection mark to you. This document is necessary for companies to confirm the zero VAT rate. You do not confirm the zero rate because you are not a taxpayer. At the same time, it is safer to save documents. After all, they may be needed in case the company loses the right to simplification.

Non-taxable goods are exported to Belarus with zero VAT

We trade goods that are not subject to VAT. We would like to conclude a foreign trade contract with a buyer from the Republic of Belarus. Will this export supply also not be subject to VAT at all?

No, you will have to include the export of goods to Belarus in transactions subject to VAT, but you will only apply a 0% rate. The fact that, according to Russian tax legislation, the sale of goods is not subject to VAT (Article 149 of the Tax Code of the Russian Federation) does not play a role. After all, the CU Agreement has priority over the Tax Code of the Russian Federation (Article 7 of the Tax Code of the Russian Federation). And neither the CU Agreement nor the Protocol on Goods provides for the possibility of exemption from VAT when exporting certain goods to Belarus (Articles 1, 2 of the CU Agreement; clause 1, article 1 of the Protocol on Goods; Letter of the Ministry of Finance of Russia dated 05.10.2010 N 03- 07-08/277; clause 4 of Letter of the Ministry of Finance of Russia dated 06.10.2010 N 03-07-15/131). True, in addition to the obligation to apply a zero rate, you also have the right to tax deductions (Clause 1, Article 1 of the Protocol on Goods; clause 2, Article 171, clause 3, Article 172 of the Tax Code of the Russian Federation). Moreover, despite the fact that according to the Tax Code of the Russian Federation the sale of your goods is not subject to VAT, the Ministry of Finance believes that if you do not submit documents in time to justify the zero rate, you will have to pay VAT for the period of shipment of goods (Clause 3 of Article 1 of the Protocol on Goods ).

From authoritative sources Anna Nikolaevna Lozovaya, Advisor to the Indirect Taxes Department of the Department of Tax and Customs Tariff Policy of the Ministry of Finance of Russia “When exporting goods, the sale of which is not subject to VAT on the basis of Art. 149 of the Tax Code of the Russian Federation, a 0% VAT rate must be applied to the territory of the member countries of the Customs Union (Article 7 of the Tax Code of the Russian Federation; clause 1 of Article 1 of the Protocol on Goods). If the exporter does not confirm this rate, he will have to charge VAT on the date of shipment at a rate of 18% (Clause 3 of Article 164 of the Tax Code of the Russian Federation). In this case, input tax can be deducted (Clause 2 of Article 171, paragraph 3 of Article 172 of the Tax Code of the Russian Federation). Such an operation will need to be reflected in Section. 6 of the VAT return, and not in section. 7".

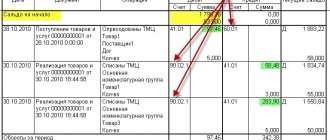

Step-by-step instructions for accounting for VAT when exporting goods to the countries of the Customs Union.

First, a little about the legislative framework. The general procedure regulating export operations is established by Federal Law dated November 27, 2010 No. 311-FZ “On customs regulation in the Russian Federation.” The procedure for paying VAT on exports or imports between countries that are members of the Customs Union (hereinafter referred to as the CU) is regulated by:

- Protocol on Goods (Protocol dated December 11, 2009 “On the procedure for collecting indirect taxes and the mechanism for monitoring their payment when exporting and importing goods in the Customs Union” (hereinafter referred to as the Protocol on Goods);

- Minutes of December 11, 2009 “On the exchange of information in electronic form between the tax authorities of the CU member states on the paid amounts of indirect taxes.”

- Decision of the Interstate Council of the Eurasian Economic Community dated May 21, 2010 No. 36 “On the entry into force of international treaties that form the legal framework of the Customs Union”;

- Agreement between the Government of the Russian Federation, the Government of the Republic of Belarus and the Government of the Republic of Kazakhstan dated January 25, 2008 “On the principles of levying indirect taxes on the export and import of goods, performance of work, provision of services in the Customs Union” (hereinafter referred to as the CU Agreement).

The participants of the Customs Union (CU) united into a single customs territory are three countries:

- Republic of Belarus;

- The Republic of Kazakhstan;

- Russian Federation.

When selling goods within the Customs Union, a special procedure is in effect, regulated by the above legislative acts. According to Article 2 of the CU Agreement, when selling goods within the CU, subject to documentary confirmation, a zero VAT rate is applied. General rules for applying the zero VAT rate when exporting within the Customs Union

Let's look at the export procedure itself using an example.

The goods are shipped to Belarus or Kazakhstan

When shipping goods to the Republic of Belarus or Kazakhstan, a delivery note and an invoice are drawn up, indicating the VAT rate of 0%. There is no need to mark these documents with the tax office. However, at your request, they can mark it. If you previously set off VAT on the shipped goods, it must be restored. You can deduct the VAT amount or submit a VAT refund only after you confirm the fact of export.

- In order to confirm export, collect a complete package of documents for export shipment.

The package of documents should be collected no later than 180 calendar days from the date of shipment. The date of shipment is the date the document is issued to the buyer or carrier. You will need to collect the following documents:

- Agreement (contract) on the basis of which the goods were shipped;

- Application for the import of goods and payment of indirect taxes in the approved form;

- Transport and shipping documents confirming the export of goods.

Previously, the list of required documents included a bank statement. From 01.10.2011, due to amendments made to the Tax Code, it is no longer necessary to provide a bank statement.

- We fill out a tax return.

For this operation, Section 4 or 6 of the VAT declaration is completed. When filling out, you should indicate the export transaction code:

- if exported goods within the country are subject to VAT at a rate of 18% - 1010406;

- if exported goods within the country are taxed at a rate of 10% - 1010404.

If a complete package of documents is collected within the allotted time

Fill out your VAT return. Enter your export data in section 4 of the declaration. The declaration is drawn up for the quarter in which the package of documents was collected.

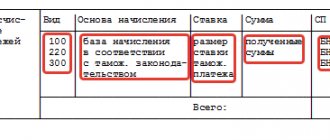

Filling out section 4 of the VAT return In column 1, indicate the transaction codes, according to Appendix No. 1 to the Procedure for filling out the VAT return:

- Code 1010401 – code of goods not specified in clause 2 of Art. 164 of the Tax Code of the Russian Federation, i.e. which in Russia are subject to a VAT rate of 18%;

- Code 1010402 – code of goods specified in paragraph 2 of Article 164, i.e. which in Russia are taxed at a rate of 10%;

- Code 1010403 – code of goods not specified in paragraph 2 of Article 164, which are subject to taxation;

- Code 1010404 – code of goods specified in paragraph 2 of Article 164, which are subject to taxation.

- Next, fill in all other fields in accordance with each operation code.

In column 2, indicate the tax base for the tax period for which you are preparing the declaration. In column 3, reflect the amount of tax deductions for the sale of goods, which include:

- the amount of tax that is indicated in the invoice that you received from the Russian supplier when purchasing the goods;

- the amount of tax that you paid when importing goods to Russian customs, if the goods are imported;

- the amount of tax paid by the buyer, who is a tax agent;

- and so on.

In column 4, indicate the amount of tax for which you did not collect a package of documents earlier and included them in column 3 of section 6 of the declaration in previous tax periods. In column 5, indicate the amount of tax that was previously accepted for deduction, but did not have time to collect documents to confirm the zero VAT rate. Previously, you included this amount in column 4 of section 6 of the declaration. Now you must pay this amount to the budget. In line 10, add the values of columns 3 and 4, and reduce it by the amount of column 5, you should get the amount of tax that you can deduct for a given tax period. Fill in only those columns for which you have had relevant transactions.

Now, submit your declaration with a package of documents to the tax office. First, in a special program that can be found on the tax authority’s website, reflect all the data on the export operation and submit it on a magnetic medium to your inspection along with other documents. Print out the application in four copies; the tax office will return three copies to you with its mark upon completion of the audit. So, take the following documents to the tax office:

- VAT return with completed section 4 – 2 copies;

- Statement on the import of goods and payment of indirect taxes (Appendix 1 to the Protocol on Goods) – 4 copies; (enter data on export operations into a special program - TS-exchange (tconp));

- Covering letter for the package of documents listing the documents to be provided;

- Contract with a counterparty - an organization of the Republic of Belarus or Kazakhstan;

- Contact attachments;

- Packing list;

- Invoice with zero VAT rate;

- Customs declaration with a mark from the customs authority;

- Shipping and transport documents with marks from customs authorities;

- Agreement with the transport company with attachments;

- Application;

After the check, the tax office returns 3 copies of the Import Application to you with its marks - you keep 1 copy for yourself, 2 give it to the foreign counterparty.

Section 5 of the declaration is completed if, in previous tax periods, documents to confirm a zero certificate:

- Collected;

- Not collected;

But the right to apply the deduction arose only in this period. Therefore, fill out the fifth section only if you have grounds for deductions. This happens in the following cases:

- If you collected the documents on time, but did not fulfill the conditions for applying deductions.

- They did not have time to collect all the documents in previous periods, and then they submitted an updated declaration with the sixth section completed. But the deductions were not declared in that period, because... did not fulfill the conditions for applying VAT deductions.

- Fill in the “Reporting year” or “Tax period” columns according to the data of the declaration in which you previously reflected the transactions for which the documents were collected.

- In column 1, as in section 4, indicate the amounts for the corresponding codes. And then fill in all the columns for each operation code.

- In column 2, indicate the tax base for each transaction subject to a zero VAT rate, for which all documents were collected, and the validity of the application was confirmed in the period indicated in the columns “Reporting year” and “Tax period”.

- In column 3, indicate the amount of tax based on the tax bases indicated in column 2.

- In column 4, reflect the tax bases for those transactions for which the validity of applying the zero rate was not documented in the period specified in the columns “Reporting year” and “Tax period”.

- In column 5, reflect the tax amounts according to the tax bases indicated in column 4.

- Section 5 should be completed separately for each tax period, i.e. quarter, information about which was indicated in the “Reporting year” and “Tax period” columns of this section.

If you did not manage to collect a complete package of documents within the allotted time

Please fill out Section 6 if you have not collected a package of documents. You should draw up an updated VAT return for the period (quarter) in which the goods were shipped to the buyer. Calculate the amount of VAT on the date of shipment on the cost of the shipped goods, at the appropriate rate of 10 or 18 percent, depending on the rate at which the goods are taxed. If in the next tax periods you collect all supporting documents, then fill out the declaration for the period in which you collected the full package, and enter the data in the fourth section of the declaration, according to the previously specified method.

Now fill out the sixth section as follows:

- In column 1, in the same way as when filling out sections 4 and 5, reflect the transaction codes.

Fill in all other columns according to each code for which you had transactions.

- In column 2, indicate the tax bases for the relevant transactions separately for each VAT rate.

- In column 3, reflect the amount of tax, separately in accordance with the VAT rate, the validity of applying a zero rate for which has not been documented. Calculate the tax amount for each transaction code as follows: multiply the amount reflected in column 2 by the tax rate (10 or 18) and divide by 100.

- In column 4, reflect tax deductions for those transactions for which the validity of applying the zero rate has not been confirmed, i.e. did not collect a complete package of documents.

- Line 010 indicates the total amount of columns 2-4.

- If the amount in column 3 on line 010 is higher than the amount in column 4 on line 010, reflect the difference obtained as a result of subtraction on line 020 of section 6.

- If the total of column 3 on line 010 is less than the total amount of column 4 on line 010, then indicate the difference in line 030 of this section.

So, we have examined the general procedure for tax accounting for VAT, the documents that need to be collected to confirm the legality of applying VAT at a rate of 0%, and also examined the procedure for filling out a VAT return in different cases.

Completion of the export transaction

After the Federal Tax Service confirms the right to a zero VAT rate, it is necessary to register the invoice in the sales book. This should be done on the last date of the quarter in which the shipment was documented. In this case, it is necessary to register incoming invoices for goods and services that were involved in the export transaction in the purchase book. When preparing a tax return, do not forget to indicate in the section the export code to Belarus 1010403. We reflect the proceeds received in rubles from the sale of goods as well as the amount of VAT deductions. The deal can be considered completed. However, it is possible that during a desk audit, Federal Tax Service inspectors will want to take another look at the documentation.

If the necessary documents could not be collected within 180 days, then already on the 181st day from the date of shipment of the goods, the buyer must issue a sales invoice and indicate VAT at the usual rate of 18%. This is provided for in Article 167 of the Tax Code of the Russian Federation. All invoices from suppliers of goods that give rise to a VAT deduction are reflected in an additional sheet to the purchase book for the delivery period. Next, you will have to fill out an updated VAT return, in which additional tax must be calculated. This amount, along with penalties, should be transferred to the budget before sending the declaration to the Federal Tax Service. If this is not done, the tax service will also impose a fine of double the tax amount.

But even in this case, not all is lost. The exporting organization has another 3 years to restore its right to an export deduction and return the overpaid VAT. If you fail to collect the documents within this period, then it will no longer be possible to return the tax, but its amount can be taken into account as part of expenses that reduce income tax. This is provided for in the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 9, 2013 No. 15047 /12.

Summarizing all of the above, it can be noted that the collection of documents to confirm the right to a zero VAT rate is the most important stage of an export transaction with a counterparty from the Republic of Belarus. Therefore, it is very important that the partner organization not only promptly pays for the goods received under the contract, but also submits the necessary documents on time. Therefore, penalties for delays in documents can be specified in the supply agreement. In this way, possible losses from VAT restoration can be at least minimally compensated. The reliability of a partner from Belarus can also be checked in advance by sending a request to the Belarusian register of legal entities and entrepreneurs. You will learn how this can be done from the continuation of articles about business with the Republic of Belarus, dedicated to the import of goods from this country to Russia.

What future awaits the export of goods to Kazakhstan?

Before talking about the export of goods to Kazakhstan from the Russian Federation, it is worth providing some statistical information. What volumes do exports of goods to Kazakhstan reach today? For the first two quarters of 2020, the amount was an impressive $4.55 billion. The leading positions among exporting countries today are occupied by the Netherlands (11%) and China (11%). Kazakhstan is in ninth place for the Russian Federation (3.3%), but it is second among the CIS countries, second only to Belarus (5.2%).

Export of goods to Kazakhstan is a fairly important item in the Russian economy. For comparison, European countries such as France or Poland have comparable positions. It is even more significant that Kazakhstan is already ahead of Spain, India, Finland, Belgium and the UK.

The export of goods from Russia is very significant for the economy of Kazakhstan itself, because our country is its main partner in the international arena, and only then – China and Germany.

The export of goods to Kazakhstan has been developing since the Customs Union was organized, because it was it that made it possible to bypass all political obstacles to trade between our states. Of course, everything is far from perfect regarding the export of goods to Kazakhstan from Russia. Today trade volumes are falling, but this is not caused by a deterioration in partnerships, but by the crisis.

The international economy significantly influences the situation with the export of goods to Kazakhstan, because it has long been established that international trade is conducted in dollars. It goes without saying that any financial problems also affect trade between our countries. The devaluation of national currencies has led to the fact that current statistical data give a very conditional picture of the objective situation. Currently the situation is as follows. Exports to Kazakhstan increased by 10.7%, imports from Kazakhstan decreased by 7.4%. It is important to pay attention to the fact that if you calculate in rubles, then the volume of trade between our states increased by 22.3%. This is a very impressive amount, because it amounts to 705.2 billion rubles. When converted to rubles, it becomes clear that the total share of mutual settlements between Russia, Belarus and Kazakhstan has reached 70%, which is much more than the 23.8% that is obtained when calculated in dollars.

Exports from Russia and exports from Kazakhstan are completely different goods. Russia supplies mainly products from the mechanical engineering sector, while Kazakhstan's exports are metals, ores and various minerals. Let's look at the statistics again. For example, in the second quarter of 2020, exports of goods to Kazakhstan had the following ratio:

- 22.6% - transport, machinery and other equipment (mainly nuclear reactors, mechanical devices, boilers, slightly less - electrical equipment, and even less - cars);

- 16% – mineral products (fuel that Kazakhstan is not able to produce independently on the required scale);

- 15.9% metals and products made from them;

- 12% – food;

- 5.2% – wood, pulp and paper products, etc.;

- 2.6% – textiles, textile products, shoes.

Exporting goods to Kazakhstan is a natural process, because there are close, long-term relationships between our states. It could not be otherwise with such an extended common border. Over the years, trade routes, transport connections, etc. have been established. It is not surprising that most of the exports to Kazakhstan are transported from other countries through Russia - this is the most rational and economical route. Moreover, many of these goods (fuel, energy resources, etc.) are very important for Kazakhstan. The nuances of the relationship between the two states were established by the agreement of June 7, 2002.

An important issue in trade relations between Russia and Kazakhstan is the oil pipeline, because every year simply colossal volumes of oil are transported through it (15.5 million tons via the Atyrau-Samara oil pipeline and 5.5 million tons via the Makhachkala-Tikhoretsk-Novorossiysk oil pipeline).

It should be noted here that Kazakh oil is exported through the CPC (Caspian Pipeline Consortium) oil pipeline, which is jointly owned by the governments of Russia and Kazakhstan. In 2002, a joint venture between the Russian Gazprom and KazMunayGas (Kazakhstan) - KazRosGaz - was created. It supplies gas from the Karachaganak field to the Orenburg gas processing plant.

Another important point in the economic relations between Russia and Kazakhstan is the issue of uranium processing. The fact is that its reserves in Kazakhstan are so large that they are inferior in volume to only one country - Australia. However, Kazakhstan does not have its own nuclear power industry, so Russia and Kazakhstan organized a joint uranium mining project, which is being implemented by the Kazakh-Russian-Kyrgyz enterprise, Zarechnoye CJSC.

Of course, the export of goods to Kazakhstan, as well as other trade and economic interactions between the Russian Federation and Kazakhstan today, needs to be improved. Each country has impressive resources and economic potential, which have not yet been used to their full potential. But activities in this direction are underway. And it has great prospects. The bets are placed on import substitution programs in the Russian Federation and the industrialization of Kazakhstan, in particular on cross-border production chains in mechanical engineering and manufacturing. According to experts, this will have a positive impact on trade and economic relations between the countries, and therefore will increase the export of goods to Kazakhstan from the Russian Federation.

Read the article: Export risks: how to anticipate and reduce them

How to register the export of goods to Kazakhstan

Among the states participating in the Eurasian Economic Union, uniform requirements regarding documents for the export of goods have been established. Kazakhstan is no exception in this case.

To export goods to Kazakhstan, you will need the following documents:

- An agreement on the basis of which goods are exported to Kazakhstan. It is very important that the papers are correctly and legibly formatted. Any inaccuracies or ambiguities may delay goods at the border with Kazakhstan and generally raise the question of the impossibility of exporting them.

- Application for export of goods and payment of VAT on import by the buyer. It is important that the tax office puts the appropriate mark on this document. It is required that VAT on the export of goods to Kazakhstan be paid by the buyer by the twentieth day of the following month. In addition, the exporter is also required to have a copy of this document.

- Transport documentation. There are possible options: a waybill or UPD, which must be signed by the driver, and there must also be a license plate number of the vehicle that transported the products to the territory of Kazakhstan. It should be taken into account that not all organizations that carry out transportation are able to fill out the paperwork correctly. This leads to problems when exporting goods to Kazakhstan.

- Other documentation required by law. For example, if the amount under the contract is more than fifty thousand dollars, a transaction passport is required.

VAT for the export of goods to the territory of Kazakhstan is returned after a declaration is submitted to the tax office. But this is far from the only condition. For example, if the documents are not completed on time or if the VAT for the export of goods to Kazakhstan, which the supplier should have paid, is not paid, you should not count on a VAT refund.

It is noteworthy that 9/10 of goods intended for export to Kazakhstan are dual-use goods. In such cases, it is usually necessary to carry out an examination, which should confirm that the product does not require a license for export to Kazakhstan. Of course, an examination is not a mandatory procedure when confirming a zero rate, but in the absence of such a conclusion, problems may arise, in particular, a very serious fine from the FSTEC.

It is also worth considering that in some situations, export to Kazakhstan requires a phytosanitary or veterinary certificate.

If all the documentation is filled out correctly and the desk tax audit shows positive results, after 5-8 months from the date of shipment you will be refunded 18% of the VAT that was paid for the goods.

Read the article: Structure of Russian exports

What documents are required for export to Belarus?

To register export to Belarus you will need a large package of documents. It is similar for all CIS countries:

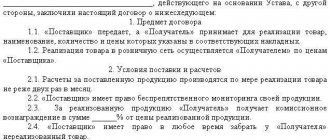

- A contract concluded between the parties.

- Transaction passport if the contract size exceeds $50 thousand. A copy certified by the seal of the exporting company.

- An invoice containing data regarding the cost of products, terms of delivery, contract number and details of the parties. Certified with a seal.

- Bill of lading, act of loading and unloading, documents for the car.

- An invoice indicating the weight and packaging of each type of product.

- Certificates, licenses certifying the possibility of selling a product and its safety.

- Documents of title for the goods.

- A passport explaining the origin and composition of the product.

- Documents describing the path of the product to the exporter, if he is not the manufacturer.

- Justification of the price of the goods (receipts, invoices, accounting documents).

When exporting goods to Kazakhstan, VAT can be easily returned

Thus, whatever we try to implement in the states that are members of the EAEU, it will (for a VAT payer from Russia) be taxed at a zero rate.

It should be noted that the procedure for deducting VAT does not currently require taking into account “input” VAT for goods that are exported. This greatly simplifies the procedure. The only exception is raw materials. This way, an invoice will be required and you won't have to worry about the "input tax" costs.

How to return VAT when exporting goods to Kazakhstan? There are two options: do it yourself or contact specialists who provide such services.

The first option for returning VAT when exporting goods to Kazakhstan contains the following algorithm of actions:

- Preparation and submission of declarations and other necessary documentation to the tax office.

- Desk check.

- If, as a result of a desk audit, the tax inspectorate makes a positive decision, then the applicant is refunded VAT for the export of goods to Kazakhstan.

The duration of these three stages in total will be from three to five months.

But there are situations when the money needs to be returned immediately, and there is no desire to contact the tax office, there is no time to collect documents. Then it is advisable to seek help from specialists who will help you quickly return VAT for exporting goods to Kazakhstan.

What else is important to know when returning VAT for exporting goods to Kazakhstan? First of all, it is important to take into account that a strictly established period is given for collecting documents - 180 days from the moment the goods were shipped. If during this time the entire package is not submitted to the Federal Tax Service, VAT will need to be paid at a rate of 10 or 18%. It is calculated based on the period of the operation itself. From the 181st day a penalty is charged.

But it happens that documents are collected, albeit late. VAT can also be returned, as stated in Article 78 of the Tax Code of the Russian Federation.

Even if you were unable to take advantage of the zero rate, there is a way out. VAT for the export of goods to Kazakhstan, which had to be paid, can be attributed to income tax expenses. This is explained simply: the supplier himself paid the tax, which means the prohibition from clause 19 of Art. 270 of the Tax Code does not apply.

Export of goods to Kazakhstan, as an operation to the EAEU countries, must be reflected in the fourth section of the declaration. Applications include documentation that can confirm the zero rate. Otherwise, an updated declaration must be submitted for the shipment period.

Read the article: Russian goods for export: past and present

VAT on exports 2020

VAT deductions from July 2016

Changes to the Tax Code of the Russian Federation, introduced by Law No. 150-FZ of May 30, 2020, are aimed at eliminating the unsuccessful legal structure described above.

The period that has passed since May 2020 has confirmed our position - the new edition of Articles 165 and 172 of the code did not simplify, but complicated the position of exporting taxpayers: the accounting services of exporters have increased work and legal uncertainty.

In addition, exporters cannot properly calculate VAT, since the calculation now depends on the by-law of the Government of the Russian Federation, which as of February 14, 2020 has not been adopted.

VAT deductions from July 2020. The procedure for applying deductions of “input” VAT on exports for exporters depends on the category of the exported product. Now exporters will have to determine whether the exported goods are classified as raw materials or not, and, depending on the category, apply VAT on export sales.

Law No. 150-FZ, paragraph 3 of Article 172 of the Code, on the procedure for applying deductions for sales transactions at a tax rate of zero percent, is supplemented by paragraph 3 with the following content:

The provisions of this paragraph do not apply to operations for the sale of goods specified in subparagraph 1 (except for raw materials) and subparagraph 6 of paragraph 1 of Article 164 of this Code.

That is, from July 2020, if non-raw materials , tax deductions for “input” VAT are applied in the same manner as for domestic sales - after the goods are accepted for accounting. From July 2020, it is no longer necessary to confirm the right to deduct “input VAT” on exports, as was the case before Law 150-FZ.

This unification with internal implementation corresponds to the change in paragraph 1 of Article 165 of the Code, according to which, from July 2020, the documents listed in the article confirm only the right to apply the VAT tax rate of zero percent , but not the right to apply VAT deductions.

With such a legal structure, it is logical that there is no obligation for the exporter to restore the “input” VAT previously accepted for deduction in the case of exporting goods and applying a VAT tax rate of zero percent.

Exporters are upset by the lack of a real opportunity to apply the “simplified” procedure for applying deductions for non-commodity exports, since until now (February 2020) the Government has not approved the corresponding list of foreign trade codes.

Deductions of “input” VAT on exports are allowed for raw materials

When carrying out export transactions with raw materials , the previously existing (since January 2015) procedure for applying tax deductions for “input” VAT is retained. What are “commodity goods” for calculating VAT, you will read below, and read more about the list of raw materials in a special publication on our website.

As before, for raw materials, deductions can be claimed only at the time of determining the tax base according to the rules of Article 167 of the Code, that is, not earlier than the last day of the quarter in which the full package of documents provided for in Article 165 of the Tax Code is collected.

If export confirmation is not confirmed (absence of supporting documents) within 180 days from the date of shipment of the goods for export, the zero percent VAT tax rate is not applied to the sale transaction; the sale of export goods is subject to VAT at regular rates.

Reimbursement for unconfirmed exports

From July 2020, subsequent documentary confirmation of the right to apply a tax rate of 0 percent provides the exporter with the opportunity to deduct the paid VAT (on unconfirmed exports) in accordance with paragraph 3 of Article 171 of the Tax Code, and not reimburse it, as was previously the case in accordance with Article 176.

From July 2020, the described procedure for calculating VAT applies only to sales of raw materials for export.

Export of goods to Kazakhstan under the simplified tax system

All states that are members of the Eurasian Economic Union comply with the same rules for taxation of exports and imports of goods. When it comes to exporting goods from Russia to Belarus, Armenia, Kazakhstan and Kyrgyzstan, these requirements only apply to VAT. As for the remaining taxes on such a transaction, they must be paid in the same manner as when selling goods to counterparties from Russia.

If we take the point of view of tax policy as a basis, then there is no significant difference between exports to any state from the EAEU and other countries. This means that in any case a zero rate will apply and this must be confirmed by submitting the appropriate documentation to the tax office.

It should be understood that when exporting goods to Kazakhstan, these rules apply to persons/organizations that operate under the general taxation system - OSNO. As for the simplified tax system, organizations that work on the “simplified” system practically do not experience any difficulties when entering the markets of other countries. This happens because VAT on exports is not included in the list of exceptions for persons using the simplified tax system (Article 346.11 of the Tax Code of the Russian Federation). This means they don’t have to worry about collecting documentation, “zero” invoices, statements, special declarations, etc. Everything is as if the goods were sold to Russia.

Enterprises using the simplified tax system are not recognized as VAT payers, with the exception of certain situations (export is not included). This means that zero VAT does not need to be charged and there is no need to report on it either. There is no need for statements either. The tax office also does not check these transactions. You will not have to expect any tax audits when exporting goods to Kazakhstan. Of course, the counterparty can request an invoice. This document can be drawn up with a note indicating the absence of VAT. When exporting goods to Kazakhstan, it happens that the Kazakh tax services require clarification of the VAT situation. Here it is enough to draw up a written explanation that you work according to the simplified tax system and do not pay VAT.

It is important to consider that the transition between OSNO and simplified tax system may cause some complaints from the tax authorities. The fact is that persons who pay the simplified tax system are not recognized as VAT payers, and therefore do not have the right to a refund. You can read more about this in the letter of the Federal Tax Service of the Russian Federation for Moscow dated August 12, 2011 No. 16-15/079549. But here a lot depends on for which quarter the VAT is required to be returned for the export of goods to Kazakhstan.

Usually the determining factor is which system was used on the last day of the quarter. If it was completely subject to the OSNO, and the transition to the simplified tax system was carried out in the next quarter, then VAT for the export of goods to Kazakhstan should be refunded. You can read more about this in letter dated November 11, 2009 No. 03-07-08/233.

The Presidium of the Supreme Arbitration Court of the Russian Federation put an end to this issue (see Resolution No. 6759/12 of September 9, 2012). According to the court decision, even if a person has switched to the simplified tax system, this does not deprive him of the right to a VAT refund at a zero rate. At the same time, it was indicated that the Tax Code of the Russian Federation does not limit the taxpayer’s right to provide a full package of documents to prove an export transaction after 180 days.

Read the article: World exports of goods

The moment of determining the tax base: according to the Protocol, but with an eye to the Tax Code of the Russian Federation

For the first time we exported goods to Belarus. In July, we collected a package of supporting documents and took it to the tax office. But they were not accepted, they said, bring them in October, when the third quarter ends. But 180 days from the date of shipment of goods will expire in September. If we submit documents in October, will we be required to pay VAT due to late export confirmation?

No, if, of course, all the documents are in order. The Protocol on Goods states that documents confirming the zero VAT rate must be submitted, on the one hand, within 180 calendar days from the date of shipment (transfer) of goods, and on the other hand, simultaneously with the tax return (Clause 2 of Article 1 of the Protocol on Goods ). Considering that the VAT return is submitted no later than the 20th day of the month following the expired quarter (Article 163, paragraph 5 of Article 174 of the Tax Code of the Russian Federation), tax authorities do not see anything reprehensible in the fact that a timely prepared package of documents will be submitted along with declaration for the quarter in which you collected it. After all, the Federal Tax Service believes that if the full package of export documents is collected, then the moment of determining the tax base for exports to the Customs Union countries is the last day of the quarter in which this happened (Letter of the Federal Tax Service of Russia dated May 13, 2011 N KE-4-3 / [email protected] ). As with regular exports (Clause 9 of Article 167 of the Tax Code of the Russian Federation; Letter of the Ministry of Finance of Russia dated 04/01/2008 N 03-07-08/81). Experts from the Ministry of Finance agree with this.

From authoritative sources Lozovaya A.N., Ministry of Finance of Russia “Since the moment of determining the tax base for VAT when exporting goods to Belarus and Kazakhstan is not established by the Protocol on Goods, this issue is regulated by the norms of the Tax Code of the Russian Federation. Thus, with confirmed exports to CU member states, the moment of determining the tax base is the last day of the quarter in which the full package of documents is collected (Clause 9 of Article 167 of the Tax Code of the Russian Federation). This means that if the deadline for collecting documents when selling goods for export to Belarus (Kazakhstan) expires, for example, in September, and the documents are collected already in July, then the VAT declaration along with the documents is submitted within the period from October 1 to October 20.”

Features of export of dual-use goods

It is difficult to export goods to Kazakhstan if these goods can be used for military purposes. But even if there is no such intention, it should be borne in mind that some exporters do not even suspect that their goods may fall into this category. For example, who would have thought that optical lenses or green adhesive tape could be dual-use goods. In this section, we will examine in detail whether there is a list of such goods and what to do in order to still obtain permission to export goods to Kazakhstan.

What are dual-use goods? This is the name for products that are used for civilian purposes, but can be used to create a wide variety of weapons. This could be equipment, various materials, raw materials. In addition, this list also includes some information of a scientific and technical nature that may be applicable when creating:

- various military equipment and weapons;

- nuclear and missile weapons;

- chemical and bacteriological weapons.

All dual-use goods must undergo export control, which is a system for protecting the country’s interests during the conversion of the defense industry, while expanding foreign economic activity and following international obligations on the non-proliferation of weapons of mass destruction. The export control system is implemented by the Export Control Commission under the Russian government.

In 2010, the Customs Union between the former countries of the USSR, Kazakhstan, Belarus and Russia not only began to function, but also established a Unified List of goods that are subject to licensing when exported to Kazakhstan and other countries of the union. Each country has its own authorities that issue licenses to goods. For example, in Russia such activities are carried out by the Ministry of Industry and Trade.

The application of this agreement in practice has shown that most often the Ministry of Industry and Trade is asked to apply for licenses for high-frequency and radio-electronic equipment and precursors.

At customs, each product is assigned certain HS codes, which coincide with a similar code of the product that is subject to export control. The person carrying out cargo transportation must provide documentation that would indicate that a license for these goods is not needed, or, conversely, is necessary. There are general and specific characteristics of dual-use and military goods, which determine the need to issue a license for them: the CIS HS code and some values of the product characteristics. If only general characteristics coincide, a license is not required.

For example, a product may be classified as a dual-use product according to the code, but at the same time have characteristics that do not correspond to the real level of threat. For example, binoculars may be considered a dual-use product because they can be used for military purposes. But if in reality such binoculars zoom in quite poorly, then a license for this product is not needed.

It should be noted that certain organizations, in accordance with Resolution No. 477 of June 21, 2011 “On the system of independent identification examination of goods and technologies carried out for the purposes of export control,” have permission to carry out examination of controlled goods and technologies.

As for goods that may become problematic when exported to Kazakhstan, unfortunately, such a complete list does not exist. There are various resolutions and orders, but no one has done any work to consolidate them into a single register. Thus, there is only a HS code, on which a decision is made by customs authorities on the spot, based on the characteristics of the goods.

Dual-use goods are listed in Presidential Decree No. 1661 of December 17, 2011. This list is quite voluminous: five sections include nine categories of goods.

For example, if you export a numerically controlled lathe to Kazakhstan, it will be included in the list of dual-use products. If, when comparing its technical description with the characteristics given in the decree, coincidences are identified, then it will be necessary to obtain a license for its export or an order not to classify this machine as an object of export control. Typically, such orders are issued within two to four weeks.

The personal factor cannot be ignored, since the customs inspector is responsible for the release of goods for export. For example, he may insist on carrying out export controls on a technically complex product, since he himself is not competent enough in technical matters. But the export of complex equipment to Kazakhstan from Russia is a relatively rare phenomenon, since there are much more imports than exports.

Customs may prohibit the export of any product to Kazakhstan if there are doubts about the possibilities of its use. In addition, the lack of any documentation will also be a valid reason for refusal. Therefore, it is so important to have in hand a license or some other documents (technical documentation, FSTEC conclusion) that can confirm that this product, after export to Kazakhstan, will not be used for military purposes.

As already mentioned, binoculars become a frequent subject of disputes when exporting goods to Kazakhstan. Of course, there are clearly defined criteria for optical instruments that cannot be transported across the border, but it should be understood that customs officials are the same people, and they can make mistakes or simply, due to some suspicions, prohibit the export of a certain product to Kazakhstan.

When exported to Kazakhstan, electro-optical converters having the following characteristics can be classified as dual-use goods:

1. In the wave range 400–1050 nm they have maximum spectral sensitivity.

2. Use in electronic image enhancement:

- microchannel plate having a center-to-center distance of up to 12 μm, no more;

- electronic sensitive element with a pitch of non-binned pixels up to 500 microns, no more. However, it must be designed or modified in such a way that charge multiplication is achieved differently than in a microchannel plate.

3. Photocathodes of these types:

- multi-alkaline (for example, S-20 or S-25), having an integral sensitivity of over 700 μA/lm;

- GaAs or GalnAs photocathodes;

- other semiconductors made on the basis of compounds III – V;

There are many nuances in the field of exporting goods from Russia, which cannot be described in one material. It is always safer and smarter, before you start exporting goods to Kazakhstan or another country, to consult with an expert, or even better, to entrust him with the entire customs procedure. The participation of a specialist will save time and save you from additional expenses.

When preparing goods for export to Kazakhstan, it is necessary to study a large amount of special information, which the enterprise often does not have. Information and analytical specialists offer their clients customs statistics from around the world, in particular Kazakhstan. Our company has 19 years of experience in providing product market statistics as information for strategic decisions, identifying market demand.

Quality in our business is, first of all, the accuracy and completeness of information. When you make a decision based on data that is, to put it mildly, incorrect, how much will your loss be worth? When making important strategic decisions, it is necessary to rely only on reliable statistical information. But how can you be sure that this information is reliable? You can check this! And we will provide you with this opportunity.

You can clarify all the details by calling 8 (800) 555-34-20.

Request a call back

Fresh materials

- Certificate of non-admission to the apartment, sample EVERYTHING THAT CONCERNES THE COMPANY BURMISTR.RU CRM system APARTMENT.BURMISTR.RU SERVICE FOR REQUESTING EXTRACTS FROM ROSSREESTR AND CONDUCTING…

- Balance sheet of JSC Accounting (financial) statements of enterprises 39,149.84 billion rubles — JSC VTB CAPITAL 4,892.93 billion…

- Tax planning Tax planning in an organization Tax planning can significantly affect the formation of the financial results of an organization,…

- Exemption from VAT Notification of the use of the right to exemption from VAT Notification of the use of the right to exemption from VAT...

Preparation of invoices for export to the EAEU

According to the Tax Code of the Russian Federation, invoices are the basis for accepting tax amounts presented to the buyer by the seller for deduction when the requirements established by paragraphs 5, 5.1 and 6 of this article are met. (Clause 2 of Article 169 of the Tax Code of the Russian Federation). Issuing invoices is the responsibility of the supplier.

Since July 2020, paragraph 5 of Article 169 of the Code has been supplemented with subparagraph 15, according to which invoices issued by Russian entrepreneurs and organizations must have new details:

code of the type of product in accordance with the unified Commodity Nomenclature for Foreign Economic Activity of the Eurasian Economic Union. The information provided for in this subparagraph is indicated in relation to goods exported outside the territory of the Russian Federation to the territory of a member state of the Eurasian Economic Union.

In our opinion, the absence of a new invoice detail can be considered by the tax authority as a basis for refusing a deduction, since it does not allow identifying the goods, and therefore, taking into account Law No. 150-FZ, and the procedure for applying deductions when exporting goods.

In addition, the preparation of invoices when exporting to the EAEU has other features.