Entrepreneurship in Russia is a fairly common phenomenon. Today there is a huge number of different enterprises; citizens become individual entrepreneurs or form legal entities. All this, of course, does not happen without control. The legislation establishes a number of requirements for persons running a business. The rules also provide for the consequences of illegal business. Their type depends on the nature of the violations. Let us further consider what the penalties for illegal entrepreneurship are.

No license

For some types of activities, it is mandatory to obtain a permit. This document is issued by authorized regulatory authorities. The fine for illegal business of individuals in this case will be 2-2.5 thousand rubles. In this case, products, production tools, and raw materials may be confiscated. For officials for illegal business, the Code of Administrative Offenses provides for a monetary penalty of 4 to 5 thousand rubles. An additional penalty may be confiscation of goods, means of production or materials. Similar sanctions have been established for organizations. The difference is that the monetary penalty for them has been increased. The fine can be 40-50 thousand rubles.

Characteristics and forms

The fact of carrying out a prohibited business is revealed after checking the following points:

- Is it carried out independently?

- Is it aimed at making profit?

- Is it carried out regularly?

- Is the entrepreneur registered?

These actions of the subject become illegal if:

- a legal entity or individual has not been registered with government agencies;

- false information was provided during the registration process;

- the types of work that the businessman is engaged in were not licensed, or the established requirements were violated.

There are several types of prohibited business, differing in the norm that was violated. There are 4 situations.

Without registration with accounting authorities

We are talking about a situation where a citizen is engaged in business, but was not registered as an individual entrepreneur or legal entity. Officially, it is registered at the moment when the corresponding entry is made in the state register.

It is considered a violation to start work without notifying the competent regulatory authorities. To do this, submit a document of the established form to the authority responsible for supervising this type of business. These include Rospotrebnadzor, Rostekhnadzor, Rostrud, etc.

Actual activities do not correspond to those declared during registration

This category includes both cases of discrepancies between the specified types of work and those that are carried out in fact, as well as deliberate silence about other actions.

Therefore, an entrepreneur needs to provide only reliable information about the registered business.

Without a license

Some types of business require not only registration, but also obtaining permits. Situations are considered a violation when:

- The business owner did not apply to the government agency to obtain permission for the planned types of employment.

- An application for a license has been submitted, but has not been approved, and work is ongoing before the permit is issued.

- If the license has expired (or the permit has been revoked), but the activity has not been stopped.

Business licensing conditions were violated

A number of conditions apply to licensed works. If they are not followed, the organizer may be held accountable.

Violations include the following situations:

- The product does not comply with the conditions established by law (for example, it does not indicate the date of manufacture).

- The business is carried out outside the territory and addresses specified in the license. If it is planned to expand production points or move to a new location, then the permit must be issued again.

- Technical requirements relating to specific activities are not met (for example, sanitary and hygienic conditions in production are violated).

Afterwards, the trial will begin, following which a protocol will be drawn up. Next, the authority transfers the case to the court, which will analyze the available evidence and take appropriate measures to punish the violators.

Violation of requirements

Upon receipt of a license, the subject undertakes to comply with the conditions established in it. Violation of these requirements is recognized as illegal business. The Code of Administrative Offenses in this case provides for monetary penalties in relation to:

- Citizens - 500-2000 rub.

- Officials - 3-4 thousand rubles.

- Organizations – 30-40 thousand rubles.

If an economic entity has committed a gross violation of the requirements, the sanctions will become more stringent. For such illegal business, the Code of Administrative Offenses establishes monetary penalties for:

- Citizens - 4-8 thousand rubles.

- Employees - 5-10 thousand rubles.

- Organizations – 100-200 t.r.

In this case, the work of an enterprise or individual entrepreneur may be suspended for a period of up to three months. These sanctions are established in Art. 14.1 Code of Administrative Offenses of the Russian Federation.

Responsibility for illegal business activities

According to government estimates, about 20 million working-age Russians do not declare the sources of their income. About half of them run their own, often small, illegal businesses. What fine will they face for illegal business activities in 2020?

What is entrepreneurial activity

But first, what is entrepreneurship anyway? How does it differ from employment? And why is illegal business prosecuted by law?

The concept of entrepreneurship is established in Article 2 of the Civil Code. This is an independent, risky activity aimed at systematically generating profit. At the same time, the entrepreneur receives income not from the performance of labor duties, but from the sale of goods, performance of work, provision of services, and use of property. If you compare an entrepreneur with an employee, you can identify a number of differences.

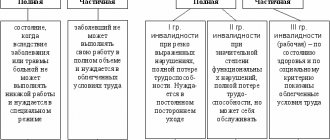

| Entrepreneur | Employee |

| Independently establishes relationships with the consumer, performing the entire cycle from finding an order for a product or service to receiving payment for it. | Works under the control of the employer, often performing only one function in the customer service cycle. Receives payment from the employer. |

| He risks not receiving payment for his goods and services, but if successful, he disposes of business income at his own discretion. | Protected by labor legislation, receives a salary, regardless of personal results. In this case, the employer pays the employee only part of the profit he earned. |

| He independently provides his pension and health insurance, pays taxes on income received from business. | The employer pays for the employee’s pension, social and health insurance, and he also withholds and transfers personal income tax from the salary. |

If a business is conducted without registration, then the state does not receive anything from such a commercial entity. But at the same time, an illegal entrepreneur enjoys all the rights of a citizen, plus he can count on free medical care and a social pension. And this happens at the expense of law-abiding businesses and their employees, who pay taxes and fees.

The state is trying to return shadow business to the legal field in various ways, including by establishing administrative, tax and criminal sanctions.

Administrative sanctions

The current norms of Article 14.1 of the Code of Administrative Offenses of the Russian Federation establish a fine for illegal business activities in 2020 in the amount of 500 to 2,000 rubles. If a citizen is illegally engaged in activities that require a license (which is issued only to registered entities), then the fine here is slightly higher - from 2,000 to 2,500 rubles.

These are, indeed, too insignificant amounts that do not motivate illegal businesses to register with the Federal Tax Service. After all, the state registration fee alone is 800 rubles for an individual entrepreneur and 4,000 rubles for a company.

In addition, a registered organization or individual entrepreneur receives the status of commercial entities and is required to comply with numerous legal regulations. This, at a minimum, includes timely submission of reports, payment of taxes and contributions, fulfillment of employer duties, and use of a cash register.

At the same time, for violation of the legislation regulating business, fines are imposed on legal merchants, and often these are very significant amounts. For example, for placing advertising without the consent of the local administration, a legal entity can be fined up to 1 million rubles.

Thus, if we talk about administrative responsibility for illegal business, the sanctions currently applied do not have any stimulating function. Moreover, this situation provokes even law-abiding citizens who cannot compete with illegal businesses to go into the shadows.

Tax penalties

Tax legislation does not establish liability for illegal business, but imposes fines for non-payment of tax or failure to register.

If it is proven that income has been received from an illegal business on which tax has not been paid, then a fine will be collected under Article 122 of the Tax Code of the Russian Federation. This is 20% of the tax amount, and for intentional evasion of payment - 40%. The tax itself and penalties on it will also have to be paid.

If an entrepreneur conducts real activities for more than 30 days without registering and registering with the Federal Tax Service, then this threatens with a fine of 10,000 rubles under Article 116 of the Tax Code of the Russian Federation.

Criminal liability

A fine for illegal business activities in 2020 may also be imposed as part of criminal prosecution. The amounts here are significant - up to 300 thousand rubles or the income of the convicted person for a period of up to two years.

However, criminal prosecution can be carried out if proven income from an illegal business was received on a large scale, and this is more than 2.25 million rubles. Anything below falls under administrative jurisdiction, i.e. subject to fines from 500 to 2500 rubles.

If the criminal income was received by an organized group, or its amount is recognized as particularly large (more than 9 million rubles), then the fine increases to 500 thousand rubles or up to three years’ income of the convicted person. Criminal liability for illegal business also provides for real terms of restriction of freedom - from six months to five years.

Illegal business activity (punishment for an individual)

from 20% of unpaid tax;

10,000 rubles for failure to register

| Types of liability | Sanction amount |

| Administrative | from 500 to 2500 rubles |

| Tax | |

| Criminal | fine from 100 to 500 thousand or withdrawal of average income for up to three years; imprisonment up to 5 years |

Why register a business

As can be seen from the size of the sanctions, and judging by the number of illegal businessmen, the established responsibility for illegal business activities does not fulfill its motivating function.

However, every year it becomes more and more difficult to operate without registration, and the reason here is not at all due to state control. The choice in favor of registered business entities is made by consumers themselves.

If a product or service is obtained from an illegal businessman, then the consumer is not protected in any way. He cannot receive a document confirming payment, apply for warranty repairs, replace defective goods, or demand high-quality performance of work or services.

If we talk about the b2b segment, then it is more difficult for an entrepreneur without registration to find a business partner. The efforts of tax authorities to control the execution of business transactions are bearing fruit. To avoid being accused of tax evasion, counterparties conduct a thorough analysis of their future partner before concluding transactions. And the first point of this analysis is the presence of registration in the state register of individual entrepreneurs or legal entities.

New form of business activity

Usually, when talking about registering a business, they mean an individual entrepreneur or an LLC. But although these organizational and legal forms are very popular, they have a lot of disadvantages. This is a fairly high tax burden, and the complexity of management, and the need to constantly submit difficult reports, and the use of a cash register, etc.

For several years now, the state has been trying to create a new form of entrepreneurial activity - self-employed persons. Essentially, this category includes all small sellers and performers who have little income and do not employ workers in their business.

Of course, they could register as an individual entrepreneur, but the following nuances stop them:

- irregular nature of business;

- the need to pay insurance premiums (in 2020 this is at least 36,238 rubles), even if the activity does not bring any profit;

- the obligation to use a cash register, the purchase and annual maintenance of which exceeds 25 thousand rubles;

- complex reporting, for which you have to pay an accountant.

A mechanism was needed that would allow these individuals to work legally, but would simplify the accounting of their income and the payment of taxes.

However, the first experiment aimed at bringing illegal entrepreneurs out of the shadows failed. The self-employed included a very narrow circle of performers: tutors, domestic staff, nannies and caregivers. Moreover, they do not pay taxes and contributions for two years, but simply register with the Federal Tax Service.

The unregulated status of the self-employed, as well as the need for subsequent registration as individual entrepreneurs, did not bring results. Across Russia, just over 1,000 people are registered in this capacity, which is not comparable to the millions of illegal entrepreneurs.

But at the end of June 2020, the Federal Tax Service came up with a completely new initiative that could really radically resolve the situation. It is proposed to classify as self-employed individuals who independently sell goods and provide services in various areas of business.

Moreover, the tax rate depends on the consumer of the product or service. If this is an ordinary individual, then the self-employed person will pay only 3% tax on the income received. If the buyer or customer is a legal entity, then the tax rate will be 6%.

And most importantly, the tax payment system has been simplified as much as possible. Confirmation of payment for the buyer is issued through the mobile application, i.e. without a cash register. Self-employed people will register in their personal account on the Federal Tax Service website, where the income they receive is reflected. You must pay tax on each such transaction. If there is no income, then you will not have to pay taxes or contributions.

The implementation of this option in practice will make it possible to bring the majority of small businesses out of the shadows, and they will no longer have to be subject to fines and other sanctions.

If insurance premiums were not enormous, but for example 15 thousand rubles. - the state would have more taxes than it does now... everyone calmly opened individual entrepreneurs and worked for the Glory of the Motherland and themselves...

Notes

The concept of “gross violation” used in Art. 14.1 of the Code of Administrative Offenses of the Russian Federation, is determined by the Government in relation to the specific licensed type of work. The Code provides for the possibility of exempting business entities from punishment. This is allowed when the facts provided for in Art. 14.1, as well as 15.3-15.6, 15.1, 15.25, 15.11, if they are declarants or information about them is present in a special declaration provided in the manner established by Federal Law No. 140. In this case, the relevant violations must be related to the acquisition (formation of sources for purchase), disposal, use of property by controlled foreign companies, transactions with currency, crediting funds to an account, information about which is contained in the specified document.

Arbitrage practice

The main question in the trial is what the crime is. It depends on which authority will consider the case - an arbitration court or a general jurisdiction.

The fines established by law for violating the rules of doing business are floating. The final size is determined by the judge himself. This is proven by judicial practice, when in two practically identical cases and circumstances a decision is made to pay different amounts.

Art. 14.1 part 1 of the Code of Administrative Offenses of the Russian Federation: clarifications

The object of the violation is the relationships that arise when doing business. Regulation of interactions that are established between entrepreneurs or carried out with their participation is carried out on the basis of civil legislation. This takes into account the fact that business is an area associated with constant risks. Entrepreneurship is an independent activity aimed at systematically generating income from the use of property, sales of products, provision of services or performance of work. Business entities must comply with the requirements established for them by law. The first of these is state registration of an individual entrepreneur or organization. It is a specific procedure, the order of which is strictly regulated.

Conceptual apparatus

What is illegal business?

Entrepreneurial activity is the actions of a citizen aimed at regularly generating profit.

Entrepreneurship is not considered a one-time provision of a service or sale of a product.

In other words, if a person sold an old TV or helped a neighbor assemble furniture for a small fee, he is not considered an entrepreneur and is not of interest to the inspection authorities.

However, the systematic sale of old household appliances or furniture assembly services is considered a business activity.

For the tax inspectorate, three confirmed transactions are enough to impose a penalty.

Thus, illegal entrepreneurship is considered to be the activity of a citizen, as a result of which he receives regular profit , but carries out this activity without appropriate documentary registration or in violation of registration.

Illegal entrepreneurship - more details in the video:

What are the penalties for illegally selling alcohol? Find out the answer right now.

Signs

It is often difficult for the Tax Inspectorate to obtain evidence of a citizen’s illegal acts. Business may be recognized as illegal under the following conditions:

- A citizen places advertising information on social networks, at the point of sale, on the Internet.

- A person makes a wholesale purchase of goods.

- Concludes a commercial real estate lease agreement in his name.

- Provides receipts for receipt of funds for products sold or services performed.

- Regularly receives funds into his account from various counterparties.

In addition, testimony from buyers, service recipients, and employees can confirm illegal activities.

If an entrepreneur is found to have a warehouse with goods, an operating retail outlet, notebooks and activity books, then this will also be indisputable evidence of entrepreneurial activity.

Forms

Doing business is considered illegal not only when operating without registration, but also in violation of the rules of business activity. The law defines the following forms of such activity:

- Doing business without registering with the tax authorities.

- Carrying out business activities without a license or certificates in types of business that are licensed.

- Providing information to the tax inspectorate about the economic activities of the entity that contains knowingly false or incomplete information.

- Conducting business before the issuance of a certificate of registration. This applies to citizens who applied to register a company, but began their activities before the tax authorities issued them the appropriate permit.

What happens if you sell alcohol to a minor? Find out about this from our article.

Kinds

Not all activities without registration of an individual entrepreneur or LLC fall under the concept of illegal entrepreneurship. Illegal types of business include :

- Providing household services without appropriate tax registration.

- Carrying out passenger and cargo transportation without a license.

- Providing medical, veterinary and other services without a license.

- Trade in industrial and food products on the market.

- Production of goods without certification.

- Carrying out business activities that do not correspond to those specified in the application for registration.

It should be noted that renting out residential premises by an individual is not an illegal business.

At the end of the year, a citizen must submit an income tax return and pay personal income tax in the amount of 13% of the profit received . Also, resale of housing is not a business if it is of a one-time nature.

Street trading has a separate line in the law.

Do I need to register as an individual entrepreneur in order to sell on the street ?

A citizen’s entrepreneurial activity is not considered in two cases:

- if he sells flowers, vegetables, herbs grown in his garden;

- if he sells products made with his own hands at a fair.

For such trade, permission from the administration of the economic entity that owns the area is required.

Such fairs are regularly held so that people can sell their own products. The activities of such fairs are also strictly regulated by law.

In the case when a citizen sells goods of his own production in places not designated for the fair (near the metro, near shops, on the station square), his activity falls under the category of illegal.

What are the consequences of illegal business? Find out from the video:

https://youtu.be/liuswBjGkXo

Registration

State registration of an individual entrepreneur or organization is an act of the authorized executive body. It is carried out by entering into special registers information on the creation, liquidation, reorganization of business entities, acquisition of individual entrepreneur status, termination of work by citizens, as well as other information provided for by Federal Law No. 129. Until recently, registration was within the competence of the Ministry of Duties and Taxes. The corresponding regulation is present in the government decree of 2002. According to the Presidential Decree of 2004, after the approval and entry into force of the relevant Federal Law, the ministry was transformed into the Federal Tax Service. Thus, in order to avoid punishment under Art. 14.1 part 1 of the Code of Administrative Offenses of the Russian Federation, the subject is obliged to contact the territorial division of the tax service. Requirements for the preparation of documentation used for registration are approved by the Government Resolution of 2002.

Responsibility of persons working for an illegal entrepreneur

Regardless of the damage caused by illegal business activities, the following are not entitled to criminal punishment:

- Persons working with the perpetrators in accordance with the concluded employment contract.

- Owners of real estate that is rented out to unregistered entrepreneurs.

If it is proven that employees deliberately worked without registration, and property owners tried to hide their income, they will also be brought to trial for violating the norms of the Civil Code, Labor Code and Tax Code of the Russian Federation.

Part 3 art. 14.1 Code of Administrative Offenses of the Russian Federation: commentary

As Article 49 of the Civil Code indicates, in order to carry out certain types of work, the subject must obtain a special permit - a license. The need for this, however, does not negate the obligation to undergo state registration. The basic rules for licensing are established by Federal Law No. 128. The provisions of the Law are specified in other regulations. For example, lists of types of services for which a license is required are enshrined in the Federal Law “On Education”.

Specific qualifications

When assessing the actions of an entity that is not registered with the Federal Tax Service as an entrepreneur, it should be taken into account that they do not constitute a violation if the fact is proven that the number of products, their assortment, the volume of work performed, services provided and other circumstances do not indicate that that the activity is aimed at systematically generating income. The corresponding explanation is present in the plenary resolution of the Supreme Court of 2006. Information received from persons who paid for services, products, work, receipts for accepting funds or statements from the account of the entity charged with responsibility can be used as evidence confirming the fact of doing business. At the same time, it should follow from the specified documents and information that the amounts were received for the sale of goods, advertising, display of samples, purchase of materials, conclusion of agreements, etc. When considering violations, it should also be taken into account that the presence of profit does not affect qualifications. This is due to the fact that generating income is the goal of entrepreneurship, and not its obligatory result.

Responsibility for illegal business activities

Almost every adult has sold something at least once in his life, but no one would think of calling the sale of grandma’s furniture entrepreneurship.

But what if a person begins to purposefully search for old furniture around the city, buy it and sell it to new owners? Such activities already have the character of a business, which means that you need to register and pay taxes so that you do not have to pay a fine for illegal business activities. You should not rely on the fact that the tax authorities turn a blind eye to an illegal business if it brings in relatively small income. To hold a person accountable for illegal business activities, even proof of income is not required. It is enough to convict him that by his actions he pursued the goal of making a profit - for example, he advertised in a newspaper or purchased goods in bulk.

What is illegal business activity

There is an opinion that the tax authorities will be interested in an entrepreneur only if he earns a serious amount. In reality this is not the case. Even if a person sends out homemade jewelry from time to time, receiving payment by cash on delivery, he must be prepared for personal attention from the tax office. It is possible to be punished for illegal business activities even with a meager income. The severity of the punishment depends on the amount of income: upon reaching a certain amount, administrative liability for illegal business develops into criminal liability.

To understand what constitutes illegal business activity, you need to understand the concept of “business activity.” The Civil Code interprets it as an activity aimed at systematically generating profit. Theoretically, two transactions of the same type in a year are enough to discern such a direction in a person’s actions.

Among the signs of entrepreneurial activity it is worth highlighting:

- testimony of clients - persons who paid for services or goods;

- advertising of goods and services;

- display of product samples;

- wholesale purchases;

- availability of receipts for receiving money;

- established relationships with counterparties;

- concluding lease agreements for commercial space;

- accounting of business transactions.

If any of the above is characteristic of a person’s activities, it is useless to focus on the lack of profit. Illegal entrepreneurship is an activity that is aimed at making a profit, but does not necessarily bring it.

Those who rent out housing may not register an individual entrepreneur: in order not to be held responsible for illegal business, you need to draw up an agreement with the tenant, file a tax return on time and pay personal income tax. The same applies to persons who have entered into a one-time sale transaction for a decent amount: by filing a declaration, the seller will save himself from proceedings with the tax authorities.

If your activity relates to the service sector, but you don’t want to register an individual entrepreneur or LLC, you can provide services on the basis of civil law contracts. This does not qualify as illegal business, but such cooperation has obvious disadvantages:

- You cannot advertise your services;

- tax authorities may consider such a business relationship to be an employment relationship, which will lead to problems for the customer of the services;

- all other things being equal, the customer will prefer to cooperate with an individual entrepreneur or a company, since it will be more profitable for him.

Please note: from 2020, persons who independently provide services in Moscow, the Moscow and Kaluga regions and Tatarstan can legalize their activities as self-employed.

To engage in business fully, you need to register properly. This is very easy to do with the help of our free document preparation service: the procedure itself will take little time, and a certificate of state registration will be issued within three working days.

If you continue to conduct illegal business activities, the consequences can be very unpleasant - from fines to imprisonment.

Punishment for illegal business activities

Illegal business carries tax, administrative and criminal liability. Employees of the tax inspectorate, police, prosecutor's office, antimonopoly authorities, and consumer market supervisory authorities are authorized to expose illegal business activities. The reason for the inspection will be a signal from vigilant citizens: for example, a client of an illegal taxi driver will be dissatisfied with the service and will file a complaint.

Tax officials in court are seeking compensation from the owner of an illegal business for taxes that, due to the latter’s fault, the state did not receive. Punishment for an individual for illegal business activities will involve payment of personal income tax in the amount of proven income and late fees. In addition, there are penalties for tax evasion:

- 10% of the amount of income derived from illegal business activities, but at least 20 thousand rubles, constitutes a fine for an entrepreneur who has not submitted an application to the Federal Tax Service to register his own business;

- 20% of the income, but at least 40 thousand rubles, will be paid by an entrepreneur who has been conducting an illegal business for more than 90 days;

- Entrepreneurs are fined 5 thousand rubles for delaying business registration. This is a situation where an individual has submitted documents to register an individual entrepreneur or LLC, but the fact of receiving revenue earlier has been revealed. If registration is delayed for more than 90 days, the fine doubles - 10 thousand rubles.

The Code of Administrative Offenses of the Russian Federation provides for penalties. For illegal business, the fine in 2020 will be at least 500 rubles.

- The fine for illegal business without registering an individual entrepreneur or LLC is from 500 to 2000 rubles;

- Carrying out licensed activities by an individual without a license entails a fine of 2,000 to 2,500 rubles. Products and means of production may be confiscated.

A decision in a case of illegal business is made by a judge at the place of residence of the accused or the place of activity. The case is considered within two months from the date of drawing up the protocol on the violation, otherwise the case is not allowed to proceed.

Criminal liability for illegal business

If an illegal business causes damage to the state or citizens, the entrepreneur risks incurring criminal liability for illegal business. The articles of the Criminal Code cover the extraction of illegal income in a large amount (1.5 million rubles or more) or an especially large amount (6 million rubles or more). Prosecution in such cases is the task of the police and the prosecutor's office.

For illegal business activities, the Criminal Code of the Russian Federation provides the following penalties:

- for causing damage on a large scale - a fine of up to 300 thousand rubles or in the amount of the offender’s earnings for two years; Also, the punishment for an individual for illegal business activities can be 180-240 hours of compulsory labor or imprisonment for a period of 4-6 months.

- for causing damage on an especially large scale - a fine of up to 500 thousand rubles or in the amount of the offender’s earnings for three years; imprisonment for a term of up to five years, coupled with a fine of up to 80 thousand rubles or in the amount of six months’ income.

The fine for illegal business activities may be supplemented by sanctions for related offenses: illegal use of someone else’s trademarks in business, deception of the buyer, trade in counterfeit goods.

Set of articles

In some cases, when qualifying the actions of a business entity, signs of violations provided for by other norms of the Code are discovered. In such situations, all the articles under which the offense falls are applied in their entirety. For example, if illegal entrepreneurship is accompanied by storage, transportation, or purchase of unlabeled products for subsequent sale, additional sanctions will be imposed under Art. 15.12 (part 2). If, among other things, the entity sells goods the sale of which is restricted or prohibited, Article 14.2 of the Code also applies. If an economic entity conducting illegal business activities violates sanitary standards or provides products, services, or work of inadequate quality, additional sanctions will be imposed on it under Art. 14.4. If the regulations governing the sale of certain types of products are not observed, Article 14.15 additionally applies.

Features of bringing to responsibility

In order for the violator to be punished, it is necessary to prove the fact of the offense.

Supervisory authorities can do this. But if a law-abiding citizen finds out about this, he also has the right to notify the authorities, which, having considered his request, will begin proceedings. According to various sources, up to 30% of entrepreneurs work in the “dark” sector. However, despite the massive scale of violations, government agencies prefer to first hold accountable those who carry out illegal activities that can harm the health of citizens. For example, medicine, cosmetology, transportation and cargo transportation, construction work, etc.

Therefore, if a person finds out about a full-fledged business operating without registration and permits within a residential premises, he has the right to file a complaint. It can be sent to the following authorities:

- Economic Security Department.

- Federal Tax Service (sorts out situations with entrepreneurs hiding significant income).

- The prosecutor's office (will consider the citizen's appeal and redirect it to the appropriate authority).

- Police department (here they investigate complaints regarding street trading and operating without a license - production and sale of alcohol, cigarettes, etc.).

- Bodies issuing licenses.

In the appeal, the applicant indicates:

- information available about the offender;

- types of work performed and the subject of the offense;

- evidence confirming the correctness (for example, if there are copies of sales receipts, service agreements).

The following authorities are held accountable:

- Law enforcement agencies and prosecutors.

- Tax, fire, labor inspection, FAS.

- Rospotrebnadzor and related regulatory authorities.

How to bring to justice for illegal business? The answer to the question is in the video.

https://youtu.be/EYAiHest6_0

Licensing specifics

When assessing the actions of an economic entity within the framework of part two of Art. 14.1, it is necessary to take into account a number of nuances. First of all, you need to take into account that licensing is an event related to the issuance of a permit, re-issuance and cancellation, confirmation of its availability, suspension, renewal, termination of its validity or the activity of a person violating the established requirements. In addition, the procedures include control by authorized bodies over business entities. It involves checking compliance with the requirements stipulated by the license, maintaining registers, and providing interested parties with the necessary information in the prescribed manner. The list of structures whose competence includes these activities is determined by the Government. It approves the Regulations on licensing of certain types of work and services. If signs of violations provided for in part two of Art. 14.1, it is necessary to be guided by the provisions of the Civil Code. In particular, Article 49 of the Code (clause 1, paragraph 3) is important. As the norm indicates, the right to conduct activities, the implementation of which requires obtaining a license, arises at the time of issuance of such a permit or within the period specified in it, and terminates upon expiration of the validity period, cancellation or suspension of the document, unless otherwise provided by law.

What is not entrepreneurship

Income can be derived from three types of business:

- Use of property.

- Selling any items.

- Provision of paid services.

Conducting a business is a process in which legal relations are built between citizens, legal entities and government agencies. The law stipulates that an entrepreneur is a person whose activities have the following characteristics:

- Conducted by an individual or legal entity independently and voluntarily. The business owner bears all the risks.

- Aimed at regular (rather than one-time) income generation.

- Carried out for commercial purposes, for which various property is used, goods or services are sold.

Therefore, if a person once provided a service to a friend for money (for example, a haircut), this is not yet entrepreneurship, since profits are not made regularly. But if a separate salon is opened, and the owner has systematic income from his actions, then he needs to register with the tax office.

By selling goods at a price less than or equal to what it was at the time of purchase, a citizen does not become an entrepreneur. In fact, he makes no profit. Therefore, the business must generate systematic income.

Example

The Licensing Chamber appealed to the arbitration court with a statement to bring the port organization to administrative responsibility for the procurement, processing and sale of scrap ferrous metal without a license. The control body drew up a corresponding protocol during the inspection. As the legislation indicates, the obligation to obtain a license for the procurement, collection, storage, processing and sale of scrap is provided for enterprises conducting such activities as their main activity and which includes cutting, pressing, grinding, extraction, briquetting, cutting, remelting. The number of operations should also include the sale/transfer of raw materials free of charge or for a fee. For the port, this activity was not the main one and was not carried out as such. The organization carried out loading and unloading in accordance with the contract for the provision of services. Provided by the agreement, the provision of sites for warehousing and storage of raw materials to the business entity involved the accumulation of the required consignment of cargo for subsequent loading onto a ship and transportation outside the country. Based on this, the placement of scrap on the port territory must be considered as an element of the main type of activity for which a license was obtained.

Responsibility

Punishment for illegal entrepreneurs is assigned depending on the severity of the offense.

They can get off with a fine as part of an administrative penalty or receive a prison sentence.

Activities without a license are punished much more severely than running a business without registering an individual entrepreneur or LLC. For violating the law, a citizen faces tax, administrative and criminal liability.

Tax

Tax liability is borne by entrepreneurs who carried out activities before the registration of the enterprise. In addition to the fine, the citizen will have to pay a percentage of the profits obtained illegally. Fines are calculated as follows :

- when conducting an illegal business for less than 30 days - 5000 rubles + profit tax;

- when doing business from 30 to 90 days - 10,000 rubles or 10% of the income received;

- when carrying out activities longer than 90 days - 20,000 rubles or 20% of income.

The court may reduce or increase the amount in accordance with the evidence presented.

The amount is calculated taking into account payments to the pension, insurance fund and regional taxes. The citizen will be required to make payments after the court decision enters into legal force.

Administrative

Administrative liability for illegal business is defined in Article 14.1 of the Administrative Code.

Punishment is applied to citizens carrying out business activities without registration , if the profit received does not exceed 250,000 rubles.

This is punishable by an administrative fine in the amount of 500 to 2000 rubles. In this case, there is no trial; the tax inspectorate appeals to the World Court.

The citizen may not even be present in person at the court hearing; the judge will issue a court order against him.

There are penalties for doing business without a license :

- for individuals - from 2 to 3 thousand rubles with confiscation of products;

- legal entities - from 40 to 50 thousand rubles with confiscation.

If the terms of the license are violated repeatedly, the entrepreneur faces suspension of activities for up to 90 days.

Important point

When considering the actions of an economic entity within the framework of part three of Art. 14.1 of the Code, it is necessary to take into account the provisions of Federal Law No. 128. In particular, we are talking about article 2 of the normative act. As its provisions indicate, entrepreneurship in violation of the requirements established by a license (permit) should be understood as the performance of certain work by a person who has the specified document, but does not fulfill the conditions established by the legislation governing this area. For the correct application of the rules, the Supreme Court in plenary Resolution No. 18 (dated October 24, 2008) provided some clarifications. In particular, it was indicated that in situations where administrative liability for illegal entrepreneurship, in addition to the article of the Code discussed above, is also provided for by its other provisions, the actions of an economic entity must be qualified according to a special norm. An example would be the provision of health care services. Engagement in private pharmaceutical or medical practice by a person who has not received a license is punishable under Art. 6.2 of the Code (part one). If the requirements of the permit are violated as part of the performance of certain types of work in the field of industrial safety of hazardous production facilities, it falls under the provisions of Article 9.1 (Part 1).

Administrative fines

Administrative liability may occur in parallel with tax liability. These two forms of punishment are not mutually exclusive. Administrative liability involves the imposition of a fine on an individual in accordance with the norms of the Administrative Code. Penalties are imposed both for lack of registration and for operating without the required license.

According to Art. 14.1 of the Administrative Code, the fine for failure to register an individual as an entrepreneur is 500-2000 rubles. Its value is influenced by the scale of illegal activity and other circumstances. Thus, on this basis, the administrative fine is quite small, it is even less than the state duty for registering an individual entrepreneur.

If an individual was engaged in an activity that falls under licensing, then he will additionally face a fine under clause 3 of Art. 14.1 of the Administrative Code in the amount of 1500-2000 rubles. for violation of licensing requirements.

The fine for illegal business for individuals in certain categories is:

- For illegal trade in medicines under Art. 6.28 Code of Administrative Offenses of the Russian Federation – 1500-3000 rubles.

- For illegal gambling outside the gambling zones under Art. 14.1.1 Code of Administrative Offences, Art. 171.2 of the Criminal Code – 700 thousand rubles. – 1 million rub.

- For illegal games in special gaming zones under clause 4 of Art. 14.1.1 Code of Administrative Offenses – 5000 rub.

- For the sale of products restricted in civil circulation or withdrawn from it under Art. 14.2 Code of Administrative Offenses – 1500-2000 rub.

- For illegal activities in the transport sector under Art. 14.1.2 Code of Administrative Offenses – 2000-4000 rubles.

Penalties against a person in a case of illegal business are imposed by the judge at the place of residence of the accused or at the place where he conducts his illegal business. The case is considered within 2 months after the protocol on violations was drawn up, otherwise the statute of limitations is considered missed.

If, as a result of the entrepreneur’s activities, the state suffered major damage in the amount of 2.25 million rubles. or more (as of 2020) or especially large damage in the amount of more than 9 million rubles, then its punishment moves from the category of administrative jurisdiction to prosecution under criminal law. Charges in such cases are brought by the prosecutor's office or the police.