How to open an individual entrepreneur? The most common question from new entrepreneurs. Opening an individual entrepreneur is often associated with fears of bureaucracy and hassle, but there is nothing scary in the procedure for registering an individual entrepreneur: filling out the application will take you no more than 10 minutes, and the period for its consideration will not exceed 3 days

Opening an individual entrepreneur is not a difficult matter and will not require a lot of money, time, or nerves from you. Today, the procedure for registering an individual entrepreneur in Russia has become as simple and automated as possible. If you doubt the advisability of opening an individual entrepreneur or have not answered any questions about starting a business, then read on.

What is IP

An individual entrepreneur is an individual entrepreneur. From the point of view of the law, an individual entrepreneur is a duly registered individual who has the right to conduct business without forming a legal entity (LLC, CJSC, etc.). In other words, an individual entrepreneur is the same individual who has legal rights to commercial activities. The logic of the law is as follows: if you are constantly engaged in some kind of commercial activity, receiving income from it, then this is probably entrepreneurship. But in order to do business legally and avoid fines, you need to go through the registration procedure, obtaining the status of an individual entrepreneur or opening a company.

Can an individual entrepreneur provide services to legal entities on a patent?

You have the right to provide services that are named in the list of patent types of activities in Article 346.43 of the Tax Code of the Russian Federation to both the population and legal entities. After all, Chapter 26.5 of the Tax Code of the Russian Federation does not require that individual entrepreneurs provide services only to the public. The list of patent services in the Tax Code of the Russian Federation includes furniture repair, as well as services for the transportation of passengers and goods by road (subclauses 7, 10, 11, clause 2, Article 346.43 of the Tax Code of the Russian Federation). You have the right to provide these services to individuals and legal entities (letter of the Federal Tax Service dated June 10, 2014 No. GD-4-3/11215).

Can an individual entrepreneur registered in Moscow, working under a patent for the provision of motor transport services with a passenger car and under a patent for the provision of furniture assembly and repair services, provide services to legal entities under a service agreement, and can his income exceed that assumed by the state? Or is the amount of income limited? What is the correct limit and is it better to open an individual entrepreneur with a simplified taxation system with a rate of 6%?

Why is it better to open an individual entrepreneur than an LLC to begin with?

Registration of an individual entrepreneur is the simplest option for registering a business for those who want to do something personally or with employees, but without partners. An alternative option for opening an individual entrepreneur is to register an LLC (limited liability company). With this organizational and legal form, you create a legal entity, but as an individual you can act as the sole founder. In practice, about 75% of limited liability companies are LLCs created by just one individual.

As a rule, the LLC format is chosen for larger-scale projects. Registering an LLC is more advisable when you plan to take out large loans from banks or other funds; there is a high risk of going broke and being left with debts. Otherwise, an individual entrepreneur is more suitable. The main benefits of individual entrepreneurs include simple registration and termination procedures, clarity of accounting and less reporting, and more favorable taxation.

At the same time, an individual entrepreneur has one significant drawback compared to an LLC. An individual entrepreneur is liable to his creditors and for all obligations with all his property, even if it is not used in business activities. An exception is the list of property on which it is impossible to levy a foreclosure, for example, on a single dwelling.

For an LLC, compared to an individual entrepreneur, the risk zone is delineated by the amount of funds and property that are listed on the balance sheet of the enterprise. At the same time, if the bankruptcy of the organization was caused by the actions of a participant, then he may be held additionally liable by the court and will be required to repay debts from his personal property.

Who can become an individual entrepreneur

The following can become an individual entrepreneur in Russia:

- Any capable citizen of the Russian Federation who has reached the age of majority can open an individual entrepreneur;

- minor citizens who are 16 years old and who have been declared fully capable by decisions of the guardianship and trusteeship authorities or the court;

- minor citizens over 14 years of age, subject to the consent of their parents or guardians;

- citizens or persons of other countries with temporary or permanent registration in any locality of the country.

Who is prohibited from opening an individual entrepreneur in Russia:

- State and municipal employees are prohibited from opening individual entrepreneurs;

- security and prosecutorial officials;

- lawyers and judges;

- military personnel.

- those who previously had an individual entrepreneur, but did not deregister it;

- citizens who have been deprived of the right to engage in entrepreneurial activity by a court verdict, and the period of this ban has not yet expired;

- citizens who were already engaged in business and were declared bankrupt in connection with this activity, and a year has not yet elapsed from the date of bankruptcy.

What you need to do before opening an individual entrepreneur

Select type of activity

If you decide to open an individual entrepreneur, then you probably have an idea of what kind of entrepreneurial activity you will be engaged in. From the point of view of the law, any commercial activity is recorded with a special code and name. The list of such codes is called the All-Russian Classifier of Types of Economic Activities (OKVED). In 2020, the OKVED-2 classifier is in force in Russia.

You will need an activity code when opening an individual entrepreneur: you will have to indicate what activity you plan to engage in. To do this, one main activity code and an almost unlimited number of additional codes are indicated. If the main code denotes your main type of business, additional areas of business or even proposed activities are indicated as additional ones. Usually, when opening an individual entrepreneur, entrepreneurs are advised to choose as many additional types of activities as possible: there is no demand for this, but if you expand your business, you will not have to contact the tax office again. Remember that indicating several OKVED codes does not oblige you to conduct business in all of them, but the choice of the main direction affects permits, taxes and licenses.

When choosing the appropriate code and searching for an answer about which code is suitable for your type of activity through an Internet search engine, keep in mind that the answers of many lawyers and online consultants still provide codes in the old edition. In this case, use the table of correspondence between old OKVED codes and new ones.

Keep in mind that individual entrepreneurs, by law, cannot engage in all types of activities: some types of business are allowed only to companies.

What types of activities are not suitable for individual entrepreneurs:

- production and circulation of strong alcoholic products;

- space activities;

- organization of tenders;

- clearing activities;

- activities of banks;

- insurance activities.

Also clarify whether your type of activity is licensed.

You can find out this from the federal law “On licensing of certain types of activities” dated May 4, 2011 N 99-FZ. A license is an official permission from the state to engage in a business that requires the creation of special conditions. Examples of licensed activities include the production of medicines, communication services, private security activities, management of apartment buildings, transportation of goods and passengers by sea, air, rail, etc. There are 54 such points in total (Article 12 of Federal Law No. 99-FZ). Keep in mind that Law No. 99-FZ does not directly state that individual entrepreneurs are not allowed to carry out many licensed activities. Often, an individual entrepreneur learns about the impossibility of starting a particular business only after registering and applying for a license.

You can obtain a license from the list of licensed types of activities of an individual entrepreneur only for: pharmaceutical activities, medical activities, educational activities, private detective activities, production of phonograms, computer programs and databases.

If you, as an individual entrepreneur, are engaged in activities subject to licensing without a license, you may be fined under Article 14.1 of the Code of Administrative Offenses of the Russian Federation - in the amount of 4,000 to 5,000 rubles, with possible confiscation of manufactured products, production tools and raw materials.

Decide on the tax system

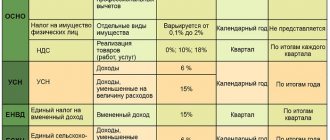

When opening an individual entrepreneur, by default you are assigned a general taxation system (OSNO). The downside is that an individual entrepreneur must pay income tax and VAT, and this system also has more complex accounting, and there are more reasons for inspections. Therefore, a common practice, along with the individual entrepreneur registration procedure, is to submit an application for transition to a special regime.

These tax systems pay one tax or use a reduced rate, and in some cases the amount of taxes may depend on actual income.

What special tax regimes exist when opening an individual entrepreneur:

- STS (simplified taxation system).

Allows you to pay tax on income (6% rate) or on the difference between income and expenses (15% rate). It is not possible to quickly change the object of taxation, so you need to calculate in advance what will be more profitable. Under the simplified tax system, there are restrictions on turnover (no more than 150 million rubles at the end of the tax period), the number of employees (must be less than 100 people) and types of activities. The declaration is submitted once a year.

- UTII (single tax on imputed income).

Allows you to pay tax not on actual income, but on imputed income. This means that the state itself has calculated how much taxes need to be paid from a specific store area, with a certain number of employees or from a certain number of retail outlets. UTII is not valid in all regions of the country; for example, UTII is not valid in Moscow. The declaration is submitted every quarter.

- PSN (patent taxation system).

The essence of this tax system is to purchase a patent for a certain type of activity for several months or a year. With PSN, the tax also does not depend on actual income: the buyer of the patent pays a fixed amount for it in two payments. In this case, the entrepreneur will not be required to pay additionally even in case of excess income. There is no reporting at all for PSN. You can calculate the cost of a patent using the calculator on the Federal Tax Service website.

- Unified Agricultural Tax (Unified Agricultural Tax).

This tax regime is suitable for agricultural industries and agricultural firms and replaces income tax, property tax and VAT. The tax is paid twice a year, and the declaration is submitted at the end of the year.

To choose a taxation system, when opening an individual entrepreneur, you need to carry out financial calculations yourself or seek advice from an accountant if you do not have your own experience.

Keep in mind that when choosing a taxation system when opening an individual entrepreneur, you need to monitor the deadlines for submitting notifications, otherwise you will have to apply not the regime that is beneficial, but the one prescribed on a general basis. For example, the transition to a simplified taxation system is made only before the beginning of the year, and not in the middle of the year or some time after registration. Also, the patent will not be valid if you do not pay for it on time. However, ignorance of the law will not free you from responsibility.

Submitting an application to open an individual entrepreneur

The registration procedure can be completed either independently or with the help of intermediaries. We recommend that you act in the first way, as this will allow you to gain first experience of interacting with the tax authorities, and you do not risk leaving your personal data to an unknown person. Moreover, today registering an individual entrepreneur will not take you much time - filling out the application will not take you more than 10 minutes, and the period for its consideration will not exceed 3 days.

There are four ways to obtain the IP registration service:

- submit an electronic application.

You can submit an application directly via the Internet using the State Services website without visiting the Federal Tax Service;

- visit the department in person.

You can make an appointment with the tax office at a time convenient for you. The Federal Tax Service inspector is obliged to accept your documents no later than 30 minutes from the time you choose;

- send electronic documents.

If you already have a completed application form, you can also submit it via the Internet, although it is much easier to fill it out directly on the portal;

- make a postal shipment.

You can send all documents to the Federal Tax Service by mail.

You can download the application form for state registration of an individual as an individual entrepreneur (Form No. P21001) here.

To fill out an application for opening an individual entrepreneur, you will need a passport of a citizen of the Russian Federation and a TIN certificate. When submitting an electronic application, you will need to select the “Fill out a new application” mode. But in order to sign it, you will need an Enhanced Qualified Electronic Signature of a citizen.

When filling out an application for opening an individual entrepreneur, you will need to indicate:

- E-mail address;

- information about citizenship (citizen of the Russian Federation, foreign citizen or stateless person);

- address of place of residence (stay) in the Russian Federation;

- FULL NAME;

- TIN;

- OKVED (main and additional).

After you fill out the application for opening an individual entrepreneur, you will need to send it to the Federal Tax Service and wait for the result to be sent to the email address you specified and receive the documents. The service period is 3 days.

When submitting documents in electronic format, as well as through the MFC or a notary, registration of an individual entrepreneur is free; in case of personal submission of an application to the Federal Tax Service of Russia, the state duty will be 800 rubles. You can pay the fee on the Federal Tax Service website, at a bank or through an ATM. It is not necessary to present a receipt for payment.

Is it possible for an entrepreneur to work under an employment contract?

Undoubtedly, publicly indicating the full name of a private entrepreneur in some way deprives him of confidentiality. This is inconvenient when an individual does not want to advertise it. But on the other hand, there are services on the Federal Tax Service website that allow you to freely obtain detailed data about the legal entity that interests you. On this site you will find the following information:

You will need to document the fact that there was no business activity for a certain period. This way you can save yourself from insurance premiums, but this does not relieve you of responsibility for business reporting.

What after opening an individual entrepreneur

In three working days you will be able to pick up your documents. This will be an extract from the Unified State Register of Individual Entrepreneurs (USRIP). You can be denied registration only on one of the grounds specified in Article 23 of Federal Law N129-FZ. After official registration, you can legally conduct business, namely enter into contracts, open current accounts and hire employees.

Please note that for some activities, registration alone may not be sufficient: you will need to provide notice of the commencement of certain activities. A list of such types of activities can be found in the appendix to the Decree of the Government of the Russian Federation N584. The notification is submitted to the authority responsible for monitoring such activities. Also, don't forget about the licensing process mentioned above. The law provides for fines for late notification of the start of activities and lack of a license.

After completing the registration of an individual entrepreneur, you can:

- get statistics codes;

- make a seal;

- open a bank account;

- register workers if you need them;

- obtain a license if your type of activity is licensed;

- purchase a cash register (if necessary);

- ensure the maintenance of accounting records for individual entrepreneurs.

Can an individual entrepreneur work with legal entities?

If you have not entered into a supply agreement with a legal entity. persons, then I recommend that you prepare for an audit and insist on the fact that all your sales were retail. To do this, save letters from regulatory authorities. In addition to the letter cited by a colleague, there is also this detailed letter on your topic:

Interesting read: How much child support should a non-working father pay for 2 children?

Today, transferring company employees to individual entrepreneur status allows the company to save on rising contribution rates. However, the biggest challenge is convincing these employees to take the step of becoming a businessman. How can this be done, maximally protecting the company from possible litigation with funds, and what benefits will the company receive? Regarding the latter, the best way to explain it is with the help of numbers.

Opening a current account when opening an individual entrepreneur

According to the law, individual entrepreneurs are not required to open a bank account. However, in practice today it is difficult to imagine a business that pays only in cash. And the point here is not only about convenience and an increase in the number of payment methods. Often, today's consumers do not burden themselves with carrying cash, and if they do not have it, they can pay you with a credit card.

In addition, a current account for an individual entrepreneur will be required if:

- It is planned to conclude contracts with other individual entrepreneurs or organizations in an amount exceeding 100 thousand rubles. Payment under such agreements is carried out only in non-cash form.

- a cash balance limit has been established (since 2014, individual entrepreneurs and small organizations may not set a limit, but for this a special order must be issued). According to the rules of cash discipline, all cash of the enterprise, in excess of the established limit at the end of the working day, must be handed over to the bank for depositing into the current account.

In practice, many individual entrepreneurs use a current account even if they do not need it to conduct business, since using Internet banking services it is more convenient to pay taxes and make insurance contributions.

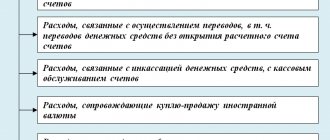

Checking account costs typically consist of the costs of opening and maintaining a checking account. If in the first case zero prices have become common practice among banks, then the commission for maintaining an account may vary depending on the range of bank services. Comparative tables with offers from various banks can be easily found on the Internet today. You can open a current account today even without a personal visit to the bank, provided that you have already been served by it before. To open a current account, an individual entrepreneur may be required to: a passport or other identification document, a card with sample signatures and seal imprints, licenses (if provided by law) and patents (if any), documents confirming the powers of the persons indicated in the card, for the disposal of funds in the current account.

Insurance premiums

Insurance premiums are mandatory fixed payments that every entrepreneur must pay, regardless of whether they are engaged in any activity or not. Such deductions are paid even if the individual entrepreneur does not conduct any activities and does not make a profit. The exception is military service under conscription, caring for a child under 1.5 years of age and caring for a disabled person, group I, a disabled child or a person over 80 years old.

Since 2020, insurance premiums are paid to the Federal Tax Service. The current amount of insurance premiums can be found here. In 2020, this is 32,448 rubles plus 1% on income over 300 thousand for pension insurance and 8,426 rubles for health insurance. These payments must be made once during 2020.

If an entrepreneur wants to receive sick leave and maternity benefits himself, he can voluntarily enter into an agreement with the Social Insurance Fund. Contributions there are paid separately. If there is no contract and contributions, then there will be no benefits for temporary disability.

So how much does it cost to run an individual entrepreneur per year?

We have shown in detail what expenses an entrepreneur will face in the first year of business. As you can see, we can definitely only talk about the amount of fixed insurance premiums of individual entrepreneurs for themselves - 40,874 rubles for a full year. But these costs will not exist if the entrepreneur switches to NAP, where the payment of contributions is voluntary.

All other expenses, including tax payments, directly depend on the factors that we have listed. Therefore, for an entrepreneur using the simplified tax system Income with little revenue and no employees, these costs will be kept to a minimum. And medium and large businesses incur more expenses, but this should be compensated by higher incomes.

If there are employees

Running an individual entrepreneur without employees without outside help is not difficult, and there is no special bureaucracy in it. But when the first employee appears, the situation changes, since the document flow is quite complicated for a person who is not a specialist. In this case, it is most reasonable to hire a specialist who will deal only with these issues or outsource accounting.

An individual entrepreneur can hire employees both under employment and civil law contracts. But when hiring an employee, the individual entrepreneur assumes expenses and responsibilities, namely:

- calculates and withholds personal income tax on the income it pays to its employees. The next day after payment of wages, the individual entrepreneur is obliged to transfer personal income tax at a rate of 13% in favor of the tax inspectorate.

- pays monthly insurance premiums (from 2020, paid according to the details of the Federal Tax Service). In 2020, the tariff for compulsory pension insurance is 22%, for compulsory medical insurance - 5.1%, for the Social Insurance Fund - 2.9% (excluding contributions from accidents).

Tax holidays after opening an individual entrepreneur

In the event that you register as an individual entrepreneur for the first time after the adoption of the regional law on tax holidays, you can qualify for a zero tax rate under the simplified tax system and special taxation system. You can avoid paying taxes for a maximum of two years. Specific types of activities for which tax holidays are established are determined by regional law. You need to find local regulations to understand whether your activity qualifies for this benefit or not, and what other requirements need to be met.

Is it possible for an individual entrepreneur to work with legal entities?

This position has been repeatedly expressed by the Russian Ministry of Finance in its letters (dated 06/23/2020 No. 03-11-11/36156, dated 04/05/2020 No. 03-11-06/3/19246). cases when sales are not subject to UTII from retail sales, when UTII and non-cash payments are compatible, the supply of goods should be distinguished.

The fact is that only a certain type of activity falls under the UTII (in your case, retail trade), and not the individual entrepreneur itself as a whole. The IP itself is either on the main or on the usn (if you submitted the notification in a timely manner). Good afternoon. I am an individual entrepreneur and when registering I chose the usn.