Accounting for bank commissions and interest under the simplified tax system

The costs allowed to reduce the simplified tax base are fixed in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation.

You can familiarize yourself with the list of such expenses and the regulations for their adoption in the article “List of expenses under the simplified tax system “income minus expenses”” .

Costs under the simplified tax system associated with banking interaction include the costs recorded in subparagraph. 9 paragraph 1 of the above article:

- interest paid for loans and credits provided;

- commissions for services provided by credit institutions.

For more information about how interest is included in expenses, read the publication “Loan Interest Accepted for Taxation.”

In this case, expenses for bank services are taken into account in the manner applied by Art. 254, 255, 263, 264, 265 and 269 of the Tax Code of the Russian Federation for calculating income tax. Art. 264 classifies payment for services of credit institutions as other expenses. As for expenses for creditor services, the letter of the Ministry of Finance of the Russian Federation dated July 14, 2009 No. 03-11-06/2/124 provides a clear explanation of what banking operations they should be associated with. These operations are mentioned in Art. 5 of the Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities”.

Typical Accountant Mistakes

- Reflection of revenue at the time of receipt of funds to the current account, and not at the time of transfer of ownership of the goods to the buyer. This distorts reporting, especially when payment by card and transfer of funds occur in different reporting periods.

- Reflecting revenue minus commission to the bank is also a mistake. There is an underestimation of sales revenue and expenses, which leads to distortion of accounting and tax reporting. Under the simplified tax system, such an error underestimates the tax base.

- Violations include the sale of goods without the use of cash registers, failure to reflect revenue from non-cash payments in the cashier-operator's journal or in the certificate report.

Banking transactions expensed

In accordance with the above-mentioned law, the following are related to the costs caused by banking transactions:

In addition to basic banking operations in Art. 5 of Law No. 395-1 provides a list of services of credit institutions, which, according to the same letter from the Ministry of Finance, are allowed to be accepted for expenses:

Accepted costs must be confirmed by the corresponding primary source. They are taken into tax accounting at the time of payment (clause 2 of Article 346.16 of the Tax Code of the Russian Federation).

All other expenses that arise in the course of interaction with banks, not mentioned above, cannot be taken into account for calculating the simplified tax. Let us dwell on individual services of creditors that raise questions when accepted as costs for the simplified tax system.

How to choose the best option

To choose a suitable bank, you need to carefully study the conditions of the banks. Pay attention to:

- Interest rate. For many credit institutions, it decreases or increases depending on revenue. If at the time of concluding the agreement your monthly turnover was higher and then decreased, it is important that the bank does not impose penalties.

- Terminal. Banks often provide machines for temporary use. It is important that the terminal is not used. Please check this point with the manager in advance.

- Current account cost (RS). Since acquiring without a PC is impossible, it is worth finding out in advance about the subscription fee for its service.

- Transferring money to an account. After the transaction, the funds do not arrive to the entrepreneur’s account immediately, but after a few days. Check this point in advance.

- Payment systems. Most banks cooperate with well-known payment systems. Nevertheless, it would be useful to find out in advance which ones.

Also ask your manager about employee training and technical support if you have questions.

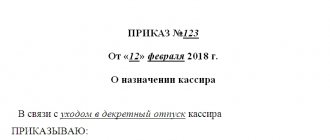

Bank expenses for salary payments on cards

According to the letter of the Ministry of Finance dated July 14, 2009 No. 03-11-06/2/124, the commission for transferring salaries to employee cards is considered a banking transaction and reduces the base for calculating the tax on the simplified tax system. To accept these costs, it is necessary to indicate in the employment contract that the salary is transferred not through the cash register, but by bank transfer.

At the same time, the costs for opening cards for employees, in the opinion of the Ministry of Finance, expressed in this letter, cannot be taken as a credit for tax accounting. But according to the letter of the Moscow Tax Service dated 02.06.2005 No. 20-12/40107, it is possible to take into account in expenses for calculating income tax bank commissions for issuing cards to employees of an organization for the purpose of transferring employer payments to them, but provided that these expenses are under an agreement is taken over by the organization. Since bank commissions for the simplified tax system are accepted as expenses in accordance with the provisions of Art. 264 and 265 of the Tax Code of the Russian Federation, the conclusions of the above letter from the tax service are also applicable for the simplified tax. As we can see, the positions of the Ministry of Finance and the Tax Service of the Russian Federation are different.

Problematics of the issue

Despite the active development of acquiring in Russia, many participants are still not familiar with the nuances of reflecting payments, in particular, calculating income. Indeed, in the case of payment through the terminal, the real amount of the order differs from that received in the account of the individual entrepreneur or LLC, and many people, especially novice entrepreneurs, do not know what exactly needs to be reflected in the KUDIR. We’ll tell you what amount should be recorded as income, but first let’s give an example.

Let's imagine that the buyer pays for the cost of goods with a bank card through a terminal installed in a store or through an online payment at a retail outlet on the Internet. In this case, the procedure for crediting funds to the account of an individual entrepreneur or LLC will be as follows:

- the client makes payment using funds located in his bank account, giving 10,000 rubles for his order. The transaction can take place at a stationary retail outlet or in an online store;

- the acquiring bank that services the terminal installed in the store or the intermediary responsible for the operation of online payments in the online market takes a commission for each payment in the amount of 3%. In this case, the bank takes 300 rubles for servicing the transaction;

- the remaining part, after deducting the bank commission, goes to the entrepreneur’s account and amounts to 9,700 rubles.

As a result, the order amount and the final cost credited to the account are different. Now the entrepreneur is faced with the question: which of the two amounts (10 thousand rubles or 9,700 thousand rubles) must be reflected in the KUDIR and, as a result, recorded in the declaration under the simplified taxation system when calculating the tax?

This is a very pressing problem that arises for most entrepreneurs. The same situation occurs when making payments in an online store using online acquiring. After all, the bank that services the store also charges a commission for each payment. This means that the order amount will differ from the one that will be credited to the company’s bank account.

Please note that the commission of the bank or intermediary company servicing the acquiring company is an expense for the entrepreneur.

Compensation for “Client-Bank”

With the development of information systems, the use of “Client Bank” seems to be a natural process. For operational work, bankers provide similar services. There is no doubt about their economic justification. Art. 346.16 of the Tax Code of the Russian Federation indicates the permissibility of taking banking services into account in the manner specified in Art. 265 Tax Code of the Russian Federation. Subp. 15 paragraph 1 of this article literally indicates the admissibility of accepting bank services as expenses arising from the use of electronic systems for transmitting documents from bankers to the customer and back.

Results

The list of costs that reduce the simplified tax base is set out in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation. Expenses for banking services are given in sub. 9 clause 1 art. 346.16 of the Tax Code of the Russian Federation - they are presented in the form of interest paid for loans and credits, or commissions for the services of credit institutions.

The services of bankers who reduce the simplified tax base are given in Art.

5 of the law of December 2, 1990 No. 395-1. Banking services include them, but in a specific list. Bank commissions under the simplified tax system are included as expenses at the time of actual payment based on the confirming primary receipt. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Like in Elba

You are an agent. Selling goods or services of the principal

You deduct remuneration from the money received from the client. Its size is written in the agency agreement

Take into account the agency fee in the simplified tax system when you receive payment from a client.

Create a receipt from a customer in Elba:

- Money → Receipt “by the bank” → Sales under an agency agreement

- Amount: payment amount from the client

- Take into account in taxes: amount of agency fee

- Receipt date: the day the money was received from the client

The principal transfers the remuneration separately: based on sales results or in advance

Take into account the agency fee in the simplified tax system on the day you receive payment from the principal.

Create a receipt from a customer in Elba:

- Money → Receipt “by the bank” → Sales under an agency agreement

- Amount: payment amount from the client

- Take into account taxes: zero

- Receipt date: the day the money was received from the client

Create a receipt from the principal in Elbe:

- Money → Receipt “by the bank” → Sales under an agency agreement

- Amount: amount of remuneration from the principal

- Take into account in taxes: the same amount of remuneration

- Receipt date: the day the money was received from the principal

You withhold remuneration from the money received from the client, but the amount of remuneration is not fixed in the contract, but is determined by the agent’s report

Take into account the entire amount received from the client in the simplified tax system. When the principal approves the amount of remuneration in the agent's report, adjust the income.

Create a receipt from a customer in Elba:

- Money → Receipt “by the bank” → Sales under an agency agreement

- Amount: payment amount from the client

- Take into account in taxes: the same amount of payment from the client

- Receipt date: the day the money was received from the client

Adjust the income after the agent's report is approved:

- Money → Receipt “other” → Accrual of remuneration under the agency agreement

- Take into account in taxes: the difference between the amount of remuneration and payment from the client with a minus sign

- Date of receipt: the day the principal approves the agent’s report.

This way, a corrective entry will appear in KUDiR - only agency fees will be taken into account in taxes.

Expenses of the simplified tax system: we transfer the proceeds to the principal

On the simplified tax system “Income minus expenses”, it is important to correctly take into account expenses. Transferring proceeds to the principal is not an expense.

Create a write-off for the principal in Elba:

- Money → Bank write-off → Payments under an agency agreement

- Amount: the amount of payment from the client or revenue minus the agent's commission

- Take into account taxes: zero

- Write-off date: day of transfer of proceeds to the principal

Only for LLC: accounting

1. When selling on behalf of the principal

- Commissioned goods: in Elbe it will not be possible to account for such goods - they require a special off-balance sheet accounting account 004. Take into account such goods, incoming invoices from the principal and outgoing invoices for clients in a separate Excel file.

- When selling commission services: before generating financial statements, check that the outgoing and incoming commission acts.

2. When preparing financial statements for the year, accrue agency fees in accounting:

- open the task “Prepare and send financial statements” → step “Reflect the missing transactions using accounting statements” → “Add accounting statements”

- type of transaction: “Sale of goods and services of the principal under an agency agreement”

first entry: Debit 76 Principal - Credit 99, amount: agency fee

second entry: Debit 76 Client - Credit 76 Principal, amount: the entire amount of the client’s payment

- date: when the agent's report was signed

For example, you sell consignment goods on behalf of the principal and retain the commission immediately. The accounting entries will be:

You are an agent. Buying goods or services for the principal

Your client, the principal, hires you to purchase goods or services. You receive a reward for the work done. Look at the transaction diagram in our help.

You keep the reward yourself. Its size is fixed in the contract

Often the principal transfers money for the purchase and the amount of the agent’s commission in one amount - from which you yourself deduct the reward.

The principal instructed you to place an advertisement on Yandex.Direct and transferred 15,000 ₽. Of this amount, you spend 10,000₽ to pay Yandex and retain 5,000₽ - the income in the simplified tax system will be the size of your commission of 5,000₽.

Create a receipt of money from the principal in Elbe:

- Money → Receipt “by the bank” → Sales under an agency agreement

- Amount: the entire amount received from the principal

- Take into account taxes: only the amount of the agency fee

- Receipt date: the day the money was received from the principal

The principal transfers the remuneration separately. Its size is fixed in the contract

Sometimes the principal transfers the remuneration and the amount for the execution of the order in separate payments.

The Principal transferred the Money to execute the order:

- Money → Receipt “by the bank” → Sales under an agency agreement

- Amount: amount to execute the order

- Take into account taxes: zero

- Receipt date: the day the money was received from the principal

The principal transferred the agent's remuneration:

- Money → Receipt “by the bank” → Sales under an agency agreement

- Amount: reward amount

- Take into account in taxes: amount of remuneration

- Receipt date: day of receipt of remuneration from the principal

You do not know the amount of the reward in advance and withhold it from the money received for the execution of the order

When receiving money from the principal, take into account the entire amount in the simplified tax system. When the principal approves the amount of remuneration in the agent's report, adjust the income.

Received money from the principal:

- Money → Receipt “by the bank” → Sales under an agency agreement

- Amount: receipt amount

- Take into account in taxes: the same amount of receipt

- Receipt date: the day the money was received from the principal

Adjust the income after the agent's report is approved:

- Money → Receipt “other” → Accrual of remuneration under the agency agreement

- Take into account in taxes: the difference between the amount of remuneration and receipts from the principal with a minus sign

- Date of receipt: the day the principal approved the report

An adjusting entry will appear in KUDiR; only agency fees will be taken into account in taxes.

Only for LLC: accounting

When preparing financial statements for the year, accrue agency fees in accounting:

— “Prepare and send financial statements” → step “Reflect missing transactions using accounting statements” → “Add accounting statements”

— type of transaction: “Purchase of goods and services for the principal under an agency agreement”

- first entry: Debit 76 Principal - Credit 99, amount: agency fee

- second entry: Debit 76 Client - Credit 60 Supplier, amount: amount of payment to the supplier minus agency fees.

— date: when the agent’s report was signed

You can read about the documents for the buyer and the principal and the agent’s report in the help desk.

You are the principal. Selling goods or services through an agent

You entrust the agent with a task: transfer goods to the buyer, sell your services, receive money for goods, or find clients. Look at the transaction diagram in the article about agency agreements.

In taxes, take into account the entire amount of the client's payment, even if the agent withheld the commission and transferred part of the proceeds to you. The date of receipt of income depends on the terms of the agency agreement.

The agent sells on his own behalf and receives money from the client

Include income in the simplified tax system on the day the money arrives from the agent.

Show in Elba the receipt of money from the agent:

- Money → Receipt “by the bank” → Sales under an agency agreement

- Amount: receipt amount

- Take into account in taxes: the full amount of the client's payment without reduction for the agent's commission

- Date of receipt: the day the money was received from the agent

The agent sells on your behalf and receives money from the client

Take into account the income in the simplified tax system on the day the client paid the agent.

Show the client's payment in the simplified tax system income:

- Money → Receipt “other” → Not specified

- Take into account in taxes: the full amount of the client’s payment

- Receipt date: the day the agent received the money from the client

Create a receipt of money from an agent in Elba:

- Money → Receipt → by Bank → Sales under agency agreement

- Amount: receipt amount

- Take into account taxes: zero

- Date of receipt: the day the money was received from the agent

The agent does not participate in settlements

Take into account the income in the simplified tax system on the day you receive money from the client.

Create a receipt of money from a client in Elba:

- Money → Receipt “by the bank” → Payment for goods and services by clients

- Amount: receipt amount

- Take into account in taxes: the full amount of the client’s payment

- Receipt date: the day the agent received the money from the client

Expenses of the simplified tax system: when to take into account the agent's commission in expenses

If you are using the simplified tax system “Income minus expenses”, write down the amount of the agent’s commission as expenses.

The date depends on the method of payment of remuneration:

The agent withheld a commission from the money received from the buyer

Show the agency fee in the simplified tax system expenses:

- Money → Write-off “other” → Not specified

- Amount: reward amount

- Take into account in taxes: amount of remuneration

- Date: date of approval of the agent’s report or act for agency remuneration

You transferred the reward in a separate amount

Create a write-off in Elba for the payment of agency fees:

- Money → Bank write-off → Payments under an agency agreement

- Amount: reward amount

- Take into account taxes: zero

- Date: date of payment of the agent's remuneration

Additionally, show the agency fee in the expenses of the simplified tax system:

- Money → Write-off “other” → Not specified

- Take into account in taxes: amount of remuneration

- Date: compare the dates of payment of remuneration and approval of the agent’s report or act for agency remuneration and select the latest one

When to take into account the cost of goods in the expenses of the simplified tax system

You have the right to write off the cost of goods sold as expenses based on the sale date specified in the agent’s report.

— Money → Write-off “other” → Write-off of goods sold

— Amount: cost of goods

— Take into account in taxes: cost of goods

— Date: implementation date indicated in the agent’s report

Only for LLC: accounting

The invoice or act is issued by your agent

1. To reflect the transfer of goods to the agent, reflect the write-off act:

— Goods → Select goods → Write off → Used/spoilt → Expense type “Other”, account 45 (Shipped goods)

— The system itself will calculate the amount and construct the wiring 45 - 41

— Date: when the goods were transferred to the agent.

2. When preparing financial statements for the year, write off the cost of goods sold using an accounting statement. Task “Prepare and send financial statements” → step “Reflect missing transactions using accounting statements” → “Add accounting statements”:

— Operation type: “Other”

— Debit 99 Income and expenses — Credit 45, the amount of the cost of goods

— Date: when the agent’s report was signed.

3. When preparing financial statements for the year, accrue agency fees and reflect the transfer of goods or services of the principal in the accounting records. Task “Prepare and send financial statements” → step “Reflect the missing transactions using accounting statements” → “Add an accounting statement”: - Type of operation: “Sale of goods and services to the public through an agent” - First entry: Debit 20 - Credit 76 Agent, amount: agent's fee - Second entry: Debit 76 Agent - Credit 99 amount of client payment - Date: when the agent's report was signed.

You issue the invoice or act yourself

1. Reflect the transfer of goods to the customer in the outgoing invoice for the amount of the sale to the customer. The system itself will construct wiring 99 - 41 and 62 - 99.

2. When preparing financial statements for the year, accrue agency fees and reflect the transfer of goods or services of the principal in the accounting records. Task “Prepare and send financial statements” → step “Reflect the missing transactions using accounting statements” → “Add an accounting statement”: - Operation type: “Sale of goods and services to clients through an agent” - First entry: Debit 20 - Credit 76 Agent, amount: agent's fee - Second entry: Debit 76 Agent - Credit 62 Client, amount: amount of client payment - Date: when the agent's report was signed.

You are the principal. Buying goods or services through an agent

You instruct an agent to buy goods or services: find an intermediary, pay him a fee, and he buys the desired product for you. Look at the transaction diagram in the article about agency agreements.

When to include purchase costs in the simplified tax system expenses

It depends on what exactly you are buying:

1. Product for resale.

On the day the goods are shipped to the final buyer.

2. Services or goods for your own use.

On the last date: when the purchase was paid in full or the agent’s report was signed.

When to take into account agency fees in the expenses of the simplified tax system

On the last date: when the remuneration was transferred or the agent’s report was signed.

1. Reflect in Elba the debiting of money for the execution of the order by the agent:

- Money → Bank write-off → Payments under an agency agreement

- Amount: amount to complete the order

- Take into account taxes: zero

- Date: date of debiting for the execution of the order.

2. Reflect in Elbe the expenses for the agent's remuneration

If you signed the agent's report and then transferred the fee:

- Money → Bank write-off → Payment for goods and services

- Amount: reward amount.

- Take into account in taxes: amount of remuneration

- Date: date of payment of the agent's remuneration

If you transferred the remuneration before approving the agent’s report, first show the write-off for payment of the remuneration, and in taxes reflect the expenses as a write-off under “other”:

- Money → Bank write-off → Payment for goods and services

- Amount: reward amount

- Take into account taxes: zero

- Date: date of payment of the agent's remuneration

+

- Money → Write-off “other” → Not specified

- Take into account in taxes: amount of remuneration

- Date: date of approval of the agent's report

3. Reflect the costs of the product or service in the simplified tax system

Create a write-off in Elba for completing an order:

- Money → Write-off “other” → Not specified

- Take into account in taxes: the amount of purchase costs

- Date: determine the date of consumption according to the rules listed above

4. Reflect the goods in the warehouse

If the supplier has issued an invoice in your name, add it to Documents → Inbox.

If there is no invoice, add the goods to the warehouse based on the acceptance certificate from the agent: Goods → Add → “By acceptance certificate.”

If you purchased a service through an agent, and the service provider issued a deed in your name, add it to Documents → Inbox.

Only for LLC: accounting

When preparing financial statements for the year, write off the agent's debt to you:

— open the task “Prepare and send financial statements” → step “Reflect missing transactions using accounting statements” → “Add accounting statements”

— operation type: “Other”

— posting: Debit 99 Credit 76

— amount: agency fee

— date: when the agent’s report was signed

If you have already added a deed or invoice from the seller, create an accounting certificate:

— operation type: “Other”

— posting: Debit 60 Credit 76

— amount: the cost of the purchased product or service excluding agency fees

— date: when the agent’s report was signed

You can read about documents for an agent in the article about agency agreements.

Acquiring

Take into account the income in the simplified tax system on the day when the money arrives from the bank. The Ministry of Finance allows this.

See when Elba takes into account acquiring automatically.

If it doesn't work automatically, show it like this:

— Money → Receipt “by the bank” → Sales under an agency agreement

— Amount: amount received

— Take into account in taxes: the full amount of customer payments without reduction by bank commission

— Receipt date: the day the money was received from the bank

— Commission: bank commission. Elba will take this amount into account in expenses if you are on the simplified tax system “Income minus expenses”