Individual entrepreneurship is a status, not a position

Let us remember that entrepreneurial activity is the independent activity of individuals aimed at making a profit. Its main features are contained in Art. 2 Civil Code of the Russian Federation:

- business activity is carried out at your own peril and risk;

- persons engaged in it must be registered;

- Profit in the course of business activities can be obtained from the use of property, sale of goods, performance of work or provision of services.

Civil legislation grants a citizen the right to engage in business without forming a legal entity from the moment of his state registration as an individual entrepreneur (Clause 1 of Article 23 of the Civil Code of the Russian Federation).

Tax legislation considers individual entrepreneurs as individuals registered in the prescribed manner and carrying out entrepreneurial activities without forming a legal entity (PBOYUL) - clause 2 of Art. 11 of the Tax Code of the Russian Federation.

Labor legislation provides for the participation of individual entrepreneurs in labor relations exclusively as an employer for their potential employees (Article 20, Chapter 48 of the Labor Code of the Russian Federation).

That is, an individual entrepreneur is a special status of a citizen that allows him to legally engage in business, including through the use of hired labor of other persons.

An individual entrepreneur has all the rights and obligations of an employer established by Art. 22 Labor Code of the Russian Federation.

But at the same time, by definition, there is no “leadership” or “superiorship” over him. And this factor makes it objectively impossible for an individual entrepreneur to create a service, production, etc. characteristics.

Similarities between individual entrepreneurs and legal entities

When carrying out commercial activities, an entrepreneur, on the same basis as a legal entity, can hire personnel under employment contracts and/or attract individuals from outside on the basis of civil law contracts. From the date of registration of a citizen as an individual entrepreneur, he has many responsibilities - to submit reports and pay taxes “for himself” and for his employees; on accounting, but to a lesser extent than in enterprises; on choosing the optimal taxation system; on registration of personnel changes, etc.

In a word, both legal entities and entrepreneurs must fulfill their responsibilities as employers, parties to contractual transactions and as participants in the system of tax relations with the state. But when it comes to responsibility, there are more differences than similarities. In addition to the already mentioned property liability, legal cases of individual entrepreneurs are considered in arbitration, and the amount of penalties, as a rule, for entrepreneurs is “an order of magnitude” lower than for enterprises. In general, there are many more differences than similarities between entrepreneurship in the form of an individual entrepreneur and in the form of an organization. What to choose?

Characteristics - what kind of document?

A production (service) characteristic is an official document containing personal data, which is issued by the employer to the employee (in most cases for presentation to third parties):

- for employment (at the request of the future employer);

- for certification by employees in some state/municipal organizations or law enforcement agencies;

- for rewarding;

- to obtain a visa to enter certain foreign countries;

- when investigating a criminal case to study the identity of the participant;

- in other similar situations.

The purpose of the characteristics is to describe the portrait of the employee, both professional and personal. Therefore, it is usually compiled by the employee’s immediate supervisor, personnel or the employer’s security service.

There are no legal requirements for the preparation of a regular characteristic. According to the general rules, the basic requirements for the publication of outgoing documents by the employer are taken into account.

Characteristics of an entrepreneur

One of the requirements for the content of the characteristic, regardless of the purpose and addressee, is its objectivity.

If a character reference is written for an individual entrepreneur, it is impossible to achieve it: he has neither management nor superiors, since he is not an employee. Even if he has hired employees, writing a character reference for his boss by his subordinates will not be objective. Automotive characteristics are also of little use, except as a resume for employment.

Perhaps the only situation in which the need for an objective characterization of an individual entrepreneur may arise is the rare case of nomination for any state award for outstanding success, support, charity, etc.

In these cases, the characterization of the individual entrepreneur can be given by the authority of the subject in which the entrepreneur operates.

Higher education at Mordovian State University named after. N.P. Ogarev, majoring in Journalism. Studied with the famous Soviet journalist P. N. Kirichek

Total experience as a lawyer is more than 20 years, experience in private legal practice is more than 18 years. He has accumulated extensive experience in handling cases of legal entities and civil persons in courts of general jurisdiction and Arbitration.

Characteristics for an employee, student at a school or institute are written in organizations by people who have these powers. In some cases, employees themselves bring a ready-made testimonial. You can read seven points of correct self-characterization here.

It's not easy to write about yourself. A description of oneself or a description of oneself (if the author is a woman) can easily result in an ode, which, when read, will cause Homeric laughter in the reader. My characterization does not mean that it should be devoid of objectivity. Because objectivity is the main criterion that makes up the value of such a document. To describe yourself impartially, you should avoid general and figurative language and use only facts.

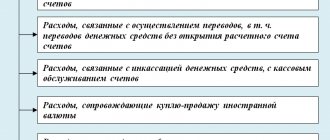

Taxes and fees

Without indicating the use of one or another taxation system when registering an individual entrepreneur, the entrepreneur automatically ends up on the general system. He is required to pay 18% VAT, 13% personal income tax and, of course, property tax.

The advantage of such a system can be considered the absence of restrictions (number of employees, income level), the absence of the need to pay VAT and personal income tax in the event of temporary inactivity of the individual entrepreneur. Among the shortcomings, it is necessary to note a rather complicated reporting and accounting system, as well as high taxes.

If during the registration of an individual entrepreneur you did not indicate that you want to switch to a special taxation regime (for example, the patent system, UNDV, simplified tax system), then taxes will have to be paid in the general regime, on income from your activities, including property tax, personal income tax and VAT. To switch to a simplified tax payment system from the beginning of next year, you need to submit an application before the end of the current year.

When choosing a simplified taxation system, an entrepreneur is exempt from paying VAT, personal income tax and property tax, tax rates are significantly lower, and such tax is also not paid in the absence of activity.

Entrepreneurs who have chosen the optimal simplified option for themselves are exempt from the obligation to pay property tax, including that which they use in their activities as individual entrepreneurs.

By choosing a patent system, an entrepreneur has the right to purchase a patent for a period of 1 month to a year, thereby exempting himself from paying VAT, personal income tax and property tax. The patent tax system is very popular among entrepreneurs whose activities are seasonal.

The rate of such tax is 6% of possible income. Here, reporting is almost completely absent, work terms are flexible, and you can work without purchasing a cash register. Unfortunately, such a system is not suitable for all types of activities and has restrictions on income levels. Disadvantages include the inability to reduce taxes using insurance premiums paid.

Since 2020, individual entrepreneurs who register as an entrepreneur for the first time can establish tax holidays for a period of up to 2 years. This means that individual entrepreneurs have the opportunity to establish preferential tax rates (0%).

In this case, there is no need to pay tax under the simplified taxation system. But such vacations may not be provided to all newly-minted entrepreneurs, but only to those whose activities are related to the production, social or scientific spheres.

If an entrepreneur chooses a single business tax of 15%, he no longer needs to pay property tax, personal income tax and VAT.

Types of characteristics

There are five types of documents to write a reference for yourself: for study, for work, for the traffic police, the military registration and enlistment office, or everyday, not entirely obligatory, things. Additional varieties include external and internal. In two cases, you may need to compile a description yourself in writing. When it is necessary to draw up this, for example, in response to a court demand or other legal cases, you can seek the help of lawyers and legal experts.

External characteristics are needed by banks, military registration and enlistment offices, new employers, and guardianship and trusteeship authorities. Internal - to a specific team, for example, deciding to demote an employee or entrust a difficult project to a newcomer.

Characteristic structure

Of course, you need to describe yourself in a business style, observing the following basic rules on how to draw up a document. The following scheme is common:

- The heading “characteristics” is located in the middle of the sheet. The candidate for the position then provides full name, date of birth, educational and/or work status.

- Describe your educational and work activities, noting in what year, for what position and in what institution you got a job or entered college, or are studying at school. This paragraph also includes an indication of transfer from one position to another within the institution, special achievements, certificates, awards, and implementation of successful projects.

- List business and human qualities: hard work, professionalism, stress resistance, ability to get along with colleagues, punctuality, charisma, and so on.

- In conclusion, you should include recommendations from former managers. For example, the head of the magazine editorial office writes that I. A. Ivanov has the full necessary personal and professional qualities, as well as experience for the position of head of the legal department. An approximate formulation is written by the school director, who indicates that Petrov P.I. can study strictly according to an individual educational program at home, taking into account his state of health and the specifics of his cognitive abilities. The message ends with the phrase that the reference was issued for presentation at the place of request, and the date of registration with a place for the manager’s signature.

Advantages and disadvantages of registration

Advantages:

- The procedure for registering an individual entrepreneur is simplified compared to that which legal entities undergo. An individual entrepreneur does not need to develop a charter, register a legal address, or conduct business activities in strict accordance with legal documents. In addition, the costs of registering an individual entrepreneur are significantly lower than those of a legal entity.

- Accounting is carried out in a more simplified form ; there is no need to maintain a staff of accountants, which allows you to save on costs.

- Since registration of an individual entrepreneur takes place at the place of residence, there is no need to register a legal address.

- No authorized capital required.

- The reporting system is also simplified , reports are submitted once a quarter if you are on a simplified taxation system, and an annual tax return is submitted - on a general one.

- Absence of income tax and other taxes imposed on legal entities.

- The individual entrepreneur has no obligation to conduct annual meetings of participants.

- The closure of an individual entrepreneur , in the event of such a decision by the entrepreneur, is carried out within 5 working days.

- An individual entrepreneur can independently choose the taxation system that suits him.

Flaws:

- An entrepreneur bears full liability with all his property, unlike, for example, an LLC, which is liable to creditors only with its authorized capital.

- The obligation to pay contributions to the pension fund, regardless of whether business activity is carried out.

- When compiling the tax base, a legal entity may indicate losses incurred in previous years; this option is not provided for individual entrepreneurs, and it is almost impossible to reduce the tax base.

Rules for writing characteristics

How to write and on what? Suitable for this document:

- organizational form / form of a school or university, company (take it from the secretary, or it can be sent by letter upon request);

- white sheet of A4 office paper.

It is worth adding that the second option will be needed, for example, when drawing up characteristics from neighbors. This is discussed in detail in the article “How to write a testimonial from your neighbors.”

It is prohibited to leave stains, torn edges, blots, spelling, lexical or punctuation errors on the document. The characteristic acquires legal force after affixing signatures and seals at the institution.

How to write a description correctly? The main qualities of a good characterization are:

- in maximum brevity;

- content;

- objectivity;

- half page capacity.

A character reference is an autobiographical document certified by the signature and/or seal of an authorized person that gives a general professional idea of the person and contains feedback and conclusions from colleagues, the manager’s opinion about the employee’s work, educational or social work and personal qualities that are socially significant in the work. How can you write about yourself believably?

Positive qualities for a resume

Observing the fourth point in filling out an autobiographical document, it is advisable to use a cheat sheet to impress the recipient with your multifaceted personality. Five to seven character traits are enough to describe your own strengths. The correct choice of qualities is determined by an adequate perception of oneself. The selected personality traits should be demonstrated right out of the gate at the interview:

- activity;

- tendency to analyze and predict events;

- self confidence;

- easy perception of change;

- concentration;

- courtesy;

- ability to control one's work;

- openness to people and the world;

- initiative;

- sociability and spoken language;

- reliability;

- setting high goals in the profession;

- excellent mood;

- responsiveness;

- decency;

- sense of time and adherence to schedule;

- independence;

- ability to make quick decisions;

- resistance to stressful situations;

- desire to develop and become better;

- creative solution of business problems;

- ability to function in a work team;

- persuasiveness;

- desire to achieve results;

- honesty.

Negative qualities

No person is without negative qualities, so you need to note some shortcomings in your resume to show your adequate self-esteem. Disadvantages sometimes become an integral part of certain professions and do not interfere with the performance of professional duties. Employers respect employees who are not ashamed of their imperfections. There is no need to describe, say, all 20 or 40 negative traits; 1-2 are enough to earn the reader’s respect.

Choose honestly negative qualities from the fourteen offered:

- consent only with confirmed information;

- excessive gullibility towards others, simplicity;

- excessive demands on other people and self-perfectionism;

- introversion or even social phobia;

- slow pace of work, procrastination;

- lack of perseverance to complete monotonous and painstaking tasks (reports, for example);

- ability to solve problems in a creative and at the same time easy way;

- lack of knowledge and practical experience in the profession;

- pickiness and meticulousness (perfectionism);

- worry about each project, turning into depression;

- straightforwardness;

- self-confidence;

- modesty;

- excessive activity.

Examples of personal qualities in a resume

Employee personal characteristics are divided into 4 categories. Firstly, this is the attitude towards work activity and business qualities. Nine qualities for the first category: conscientious attitude to work, activity, desire, initiative, interest in learning all the secrets of the profession, commitment, creative thinking, perseverance in achieving results, responsible attitude to assignments, hard work, determination. Secondly, these are personal qualities such as respect for other people, sociability, the ability to listen to a person, friendliness, responsiveness and friendliness.

An ideal employee is always active, attentive, collected, focused, cheerful, punctual, self-critical, stress-resistant, self-confident, diligent and honest at work. He is neat, so his desk is always clean and tidy. His shoes and suit are always clean, and he himself is neat and clean.

Depending on the intended job for which the future employee is applying, relevant advantages and disadvantages are noted. An analyst and economist should be pedantic, attentive, assiduous, responsible, neat and diligent, but not a hyperactive amateur artist; at least there is no need to state this at the interview.

What qualities are required from an engineer?

The main qualities that are important for an engineer are attentiveness, concentration, dedication, responsibility, self-organization, independence, discipline, a technical mindset, perseverance, and adequacy.

Advantages of a lawyer

The legal profession is associated with defending human interests and an interest in solving problems; applicants are required to meet strict requirements, therefore the following work qualities are essential:

- serious attention to detail - one inaccurate word changes the entire regulatory act;

- courteous and caring attitude towards people;

- ability to analyze;

- defending the interests of the client;

- the ability to communicate with any people - those accused of a crime are not always in vain;

- conscious dialogue focused on business;

- justice;

- constant study of legislation;

- confidence in success;

- ability to solve legal problems;

- the ability to explain a legal position specifically and clearly;

- stress resistance.

Accountant

What are the positive qualities of an ideal accountant?

An accountant is one of those professions that require complete concentration on routine calculations, which are impossible without perseverance. When submitting your resume, you should make sure that you are attentive and able to tinker with routine calculations throughout the entire working day and even after it. Employers, in addition to education in accounting, need positive personal qualities of the applicant.

First of all, they are looking for a person who knows how to keep his mouth shut, because the trade secrets of an enterprise should not go beyond the workplace. The employer should be told that you do more than you talk; capable of speaking to the point and keeping serious secrets. Another quality that needs to be mentioned in the autobiographical document is high responsibility. Basically, the accountant has to prepare financial statements when everyone else is resting. High responsibility is necessary for an accountant, which is worth mentioning in the resume and self-description, since he bears financial responsibility.

Five main qualities of a professional accountant:

- analytical skills acquired at school and university;

- ability to organize work process;

- concentration;

- perseverance;

- honesty at work.

How to register an individual entrepreneur?

- A prerequisite for registering an individual entrepreneur is the presence of a TIN (taxpayer identification number). If you already have it, all you have to do is make a copy of it. If there is no such number, an application for one can be submitted simultaneously with the entire package of documents required for registration, although it will take a little more time. In general, it takes 5 working days to register an individual entrepreneur, provided that all the necessary documents are available.

- By the time you decide to open an individual entrepreneur , you already need to determine for yourself what type of activity you plan to engage in (OKVED codes), since during their registration you will need to indicate the code. It is on this basis that the size of the insurance tariff of the FSS (social insurance fund) will be determined. You will be required to engage in exactly the type of activity that you indicated when registering as an individual entrepreneur.

- You also need to prepare a photocopy of your passport in advance. All pages of the document are copied and stitched.

- To register an individual entrepreneur, you must pay a state fee ; a receipt for payment is attached to the general package of documents.

- Completed application form for registration as an individual entrepreneur. The form for such an application consists of five pages, where you will need to indicate your data, and it should be filled out legibly, without corrections or errors, in block letters.

- After you have submitted the application along with the rest of the documents, you should be given a receipt indicating the date the documents were issued. On the appointed day, you receive the documents in person or they are sent to you by mail.

- You receive four documents indicating that you are an individual entrepreneur, that you have been registered with the tax authority, entered into the register of individual entrepreneurs (an extract from this register is issued to you) and that you are registered at your place of residence with the Pension Fund .

Now you can fully engage in entrepreneurial activity. The main thing to always remember is your responsibility to pay taxes, maintain records and report.

To make non-cash payments, you must open a current account. To design it you will need your own stamp. It will also be useful for certifying documents.

Here you need to remember that if you have already made a seal, then please certify with it all your documents related to your activities; certification with only one signature will not be enough. In the activities of individual entrepreneurs, payments are made in cash or using bank cards, although depending on the chosen taxation system and some trading conditions, you can do without it.

Why do you need a characteristic?

The characteristic refers to official documentation and is intended for presentation in the following cases:

- future place of work;

- recertification (government institutions and law enforcement agencies);

- receiving an award;

- visa application;

- court hearings;

- other place of requirement.

The reference letter from the place of work of an individual entrepreneur is practically no different from any other issued for an employee.

Who prepares and signs characteristics

Most often, by definition, a character reference is drawn up by the employer for the employee.

And it can be useful for:

- new employment (if management wants to find out additional information about the future employee);

- for certification of employees (for government agencies);

- for submission in some situations to the Ministry of Internal Affairs;

- obtaining a visa to travel abroad;

- award presentations, etc.

A citizen who has a place of work can always turn to management for paper.

In some cases, other employees of the enterprise can characterize it. In this case, an entrepreneur who combines personal business with employment will receive a personal reference at the place of work. An individual entrepreneur is required to have a document drawn up on the organization’s letterhead, sealed and signed by the director or other authorized person. But more often it happens that an entrepreneur does not have a manual that will characterize his work. And subordinates are unlikely to give their boss a truthful and objective assessment. Therefore, in some cases, the individual entrepreneur draws up a description for himself independently. But this is more like a resume.

In some cases, when we are talking about awards from government agencies or gratitude for assistance (charitable activities, etc.) from the authorities, the document can be prepared by representatives of the local municipality or an organization involved in joint work. In this case, the seals and signatures on the paper will be of the structure or company that prepared the document.

This kind of characteristic of an individual entrepreneur contains a list of his personal or professional qualities. The objectivity of such an assessment is often questionable, since the document is a mere formality.

What does the characteristic of an individual entrepreneur include?

The document includes complete information about the person related to the position held. If documentation for hired employees is filled out by the human resources department, where complete data is entered from the moment of entry into service (responsibilities, merits, offenses, promotions), then an example of an individual entrepreneur’s characteristics could be as follows:

- indication of personal data;

- indication of information about individual entrepreneur registration;

- scope of activity from the moment of registration of the status of an individual entrepreneur;

- scope of activity at the time of drawing up the document;

- indication of facts of administrative offenses or their absence;

- participation in charity events and social campaigns;

- awards for the entire period of work.

This is what a general characteristic of an individual entrepreneur may look like, which requires a complete understanding of the person as an entrepreneur.

If controversial or conflict situations arise, the document may have a different form, which includes data only about the last place of business activity. For this purpose, a brief description of the individual entrepreneur is compiled.

12. Characteristics of IPAn individual entrepreneur has the right to act without registering the status of an enterprise or firm, however, subject to state registration of systematic activities, the entrepreneur acts as an individual. If such an enterprise generates income in an amount above the non-taxable minimum, then taxes must be paid on income from individual entrepreneurial activity. A sole proprietor has the right to use the property that belongs to him at his own discretion (for example, renting out housing, growing agricultural products in his garden and selling it). According to the Civil Code of the Russian Federation, an individual entrepreneur is liable for his obligations with all his property. He can start and stop his activities at any time in accordance with his own desire. In some cases, the law provides for the need to obtain paid state licenses that give the right to conduct certain types of individual entrepreneurship (for example, shooting rare game, catching valuable species of fish, certain types of educational services and medical practice). If individual entrepreneurial activity of one type is systematic, the entrepreneur should acquire a patent to carry out such activity. A patent is issued for a certain period, as well as for a certain volume of activity and is subject to payment. Any capable citizen who wishes to create his own economic or commercial organization has the right and opportunity to acquire the status of a legal entity by registering himself as a private enterprise or firm in accordance with current legislation. The owner (founder) of a private company (business entity) has the right to hire any number of employees (hired employees who do not influence the management of the company). Closely related to private entrepreneurship is family entrepreneurship, which, although strictly speaking should be classified as group, i.e., collective forms, in reality, in the presence of normal relations in the family, represents a type of private entrepreneurship. Since an individual owner - an entrepreneur running a sole business - is not bound by any conditions or restrictions dictated by co-owners, and is to a small extent burdened by the need to document his actions, such a business is attractive. However, independence and simplicity are acquired at the cost of unlimited personal responsibility and the need to separate ownership from the owner (the owner dies, the company dies, the heirs will receive not the company, but inherited values).

Who compiles the characteristics of the individual entrepreneur

Since an individual entrepreneur does not have managers, he is his own boss. The businessman also draws up a reference for himself, signing and sealing it.

If there are awards from local authorities, as well as when participating in charity events, the document can be drawn up by representatives of the municipality or the organization that was the founder of the charity. In this case, a general description of the individual entrepreneur is drawn up with an emphasis on excellent performance in providing services or product quality, as well as with a mandatory indication of the fact of participation in a particular promotion.

If a standard document is required, the compiler can be a district police officer, utility services or municipality. A sample description from the individual entrepreneur’s place of work will look like this:

- standard A4 sheet is used;

- upper right corner – name of the organization to which the document is submitted; below - from whom;

- in the middle – the word “Characteristics”;

- indication of the information of the individual entrepreneur and the address of the place of work (point of sale or office providing services);

- the businessman’s field of employment is described and since when he has been engaged in activities at this address;

- offenses, complaints and other negative aspects for the period that the individual entrepreneur occupies at the last address are indicated;

- positive aspects are indicated that may relate to the quality of products and service, as well as the attitude of the entrepreneur towards clients;

- After listing the positive and negative aspects, a general opinion is made about the businessman.

What should a job description contain?

As such, there is no precisely approved form for writing a document, so sample references for an individual entrepreneur basically contain the same information:

- passport details;

- what professional skills a person has, you can list educational institutions completed, courses and positions held;

- what human qualities a person has, for example, how efficient he is or how he can behave in a crisis situation;

- how socially active he is, how he interacts with people, whether he has been noticed in conflicts with the team.

Electronic signature for individual entrepreneurs - why is it needed and how to make it

When a reference for an individual entrepreneur is needed for an award, the sample must include the following data:

- in the upper right corner the name of the organization for which the document is being drawn up and the full name of the individual entrepreneur are indicated;

- at the beginning of the body, the individual entrepreneur’s characteristics must contain the entrepreneur’s data, points of sale or office address;

- the area in which the business activity is carried out must be described, for example, cargo transportation, trade, the date of registration of the individual entrepreneur;

- a brief description of the product, measures to improve the quality of the product or the provision of services are indicated;

- a summary of the general positive and negative aspects of being an entrepreneur.

When rewarding for special services to the city, it is advisable to briefly indicate information about close family members in the characteristics. If an individual entrepreneur has close cooperation with other companies and makes a significant contribution to their development, it is worth mentioning them too.

Important! The characteristic must end with the date, signature and seal of the individual entrepreneur.

Sample of a standard seal of an individual entrepreneur

Characteristics of activities

There is such a thing as characteristics of the activities of an individual entrepreneur. The document is slightly different from a simple description of an entrepreneur, since not only professional merits are assessed, but also the principle of doing business, tax reporting and much more. Outsiders cannot know this, including local authorities, so the reference is issued by representatives of the tax service. To do this, tax reporting is checked based on submitted returns for the past period. If fraud is suspected, an unscheduled inspection of the business and all documentation is carried out, on the basis of which a profile is drawn up.

If you find an error, please select a piece of text and press Ctrl+Enter.

Sep 10, 2019adminlawsexp

Definition of concepts

With the emergence of the private sector in the Russian economy, a need arose to assign legal status to persons engaged in entrepreneurial activities. In this regard, concepts such as “individual” (FZ), “legal entity” (LE), “individual entrepreneur” (IP) and others have become relevant.

When registering with the tax office, a citizen must accurately indicate the desired taxpayer status. To do this, let's look at these concepts in more detail.

Individual

An individual (FZ) in the Civil Code of the Russian Federation means any person living on the territory of our state and falling under the scope of its legislative acts. An individual is a subject of civil law, endowed with the rights and responsibilities enshrined in the Constitution of the Russian Federation and the Code of Codes of the Russian Federation.

Individuals may be the following categories of persons:

- citizens of the state;

- foreign citizens and residents of the Russian Federation;

- stateless people (people without citizenship).

Federal law status is assigned to a person automatically and does not require regular confirmation.

Legal

Legal entity (LE) is an organization carrying out entrepreneurial or non-profit activities. As a rule, a legal entity is registered in the name of an individual, has an official name and documented property.

During trials and proceedings, the interests of a legal entity are represented by one of the leaders of the organization, and the property registered with this organization acts as collateral.

Mandatory features of a legal entity include:

- management hierarchy, enshrined in the constituent documentation, which can be either individual or collegial. In the first case, the company is headed by a director, president, or other managing person. In the second, the company is managed by a board of directors, general meeting, board, or other management team;

- separate property assigned to a given organization. This includes a bank account, authorized capital, or other independent cash balance;

- an official name that allows a legal entity to defend its interests in civil proceedings and litigation.

Commercial and non-profit organizations are recognized as legal entities. The goal of the former is to achieve monetary profit, and the main activity is entrepreneurship. The purpose of the second is to satisfy the non-material needs of citizens.

Legal entity status is assigned when submitting an application to the tax authorities. Data about the new taxpayer is entered into the Unified State Register of Legal Entities. Legal entity status requires annual confirmation. When an enterprise, organization, or firm is closed, management undertakes to deregister the legal entity from the tax office.