About invoices

One of the conditions for a tax deduction is the presence of a correctly executed invoice. If the document contains errors and does not comply with the requirements of the law, then the deduction will not be issued (Clause 2 of Article 169 of the Tax Code of the Russian Federation). One of the required elements is the signatures of authorized persons. In practice, the question often arises: who can sign an invoice for a director?

Current legislation provides for the possibility of issuing invoices on paper or electronically (paragraph 2, paragraph 1, article 169 of the Tax Code of the Russian Federation).

The procedure for issuing, issuing and registering invoices is established by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137. In turn, the procedure for issuing and receiving invoices in electronic form is approved by Order of the Ministry of Finance of Russia dated November 10, 2015 No. 174n.

In the invoice received from the supplier, the details “Head of the organization or other authorized person” and “Chief accountant or other authorized person” are not filled in; instead, the additional indicators “Fuel and lubricants accounting engineer” and “Accountant” are filled in. The number of the order authorizing these persons to sign the invoice is also indicated.

Is this filling in of the invoice correct? If not, could this be a basis for refusing to apply for a VAT tax deduction?

Having considered the issue, we came to the following conclusion:

Filling out an invoice in the manner specified in the text of the question is not a basis for refusing to apply for a VAT tax deduction.

Rationale for the conclusion:

According to paragraph 2 of Art. 169 of the Tax Code of the Russian Federation, invoices are the basis for accepting tax amounts presented to the buyer by the seller for deduction when the requirements established by clauses are met. 5, 5.1 and 6 art. 169 of the Tax Code of the Russian Federation.

Clause 6 of Art. 169 of the Tax Code of the Russian Federation stipulates that an invoice is signed by the head and chief accountant of the organization or other persons authorized to do so by an order (other administrative document) for the organization or a power of attorney on behalf of the organization.

In addition to Art. 169 of the Tax Code of the Russian Federation, the procedure for drawing up invoices is regulated by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137 “On the forms and rules for filling out (maintaining) documents used in calculations for value added tax” (hereinafter referred to as Decree N 1137). The form of the invoice used in calculations of value added tax and the rules for filling it out are established by Appendix 1 to Resolution No. 1137 (hereinafter referred to as the Rules).

The invoice form contains the details (indicators) “Head of the organization or other authorized person” and “Chief accountant or other authorized person.”

The Ministry of Finance of Russia in letters dated 04/10/2013 N 03-07-09/11863, dated 04/23/2012 N 03-07-09/39 explained that in the case when an invoice is signed by an authorized person, the signature of the corresponding person is affixed precisely to these indicators and indicate his last name and initials.

Thus, persons authorized to sign invoices with the corresponding administrative document put their signature instead of the surnames and initials of the head and chief accountant of the organization, and after their signature the surname and initials are indicated.

In this case, it is not required to indicate the position of the persons who signed the invoice and the documents providing the corresponding authority.

At the same time, in the above-mentioned letters, specialists from the Ministry of Finance of Russia note that the norms of the Tax Code of the Russian Federation do not prohibit the indication of additional details (information) in invoices, including the position of the authorized person who signed the corresponding invoice. Representatives of the Federal Tax Service of Russia also agree with the Ministry of Finance of Russia; in the letter dated January 26, 2012 N ED-4-3/1193 it is indicated that the presence in the invoice of additional details (information) not provided for in paragraphs. 5 and 6 tbsp. 169 of the Tax Code of the Russian Federation and Resolution No. 1137, is not a basis for refusing to accept for deduction the tax amounts presented by the seller to the buyer. Let us note that representatives of the tax and financial departments made similar conclusions earlier, before Resolution No. 1137 came into force. See, for example, letters from the Ministry of Finance of Russia dated 02/06/2009 N 03-07-09/04, dated 01/21/2008 N 03-07 -09/06, Federal Tax Service of Russia dated June 18, 2009 N 3-1-11/425, Federal Tax Service of Russia for Moscow dated January 23, 2009 N 19-11/004827.

In the situation under consideration, the details “Head of the organization or other authorized person” and “Chief accountant or other authorized person” of the invoice are not filled in; instead, the additional indicators “Fuel and lubricants accounting engineer” and “Accountant” are filled in. We believe that filling out the invoice this way is not correct. That is, the document received by the organization was drawn up in violation.

At the same time, you should pay attention to the second paragraph of clause 2 of Art. 169 of the Tax Code of the Russian Federation. This norm states that errors in invoices and adjustment invoices that do not prevent tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, when conducting a tax audit, their value, as well as the tax rate and the amount of tax presented to the buyer, are not grounds for refusing to accept tax amounts for deduction.

In our opinion, filling out an invoice in the manner specified in the text of the question does not prevent the tax authorities from identifying the seller, buyer of goods (work, services), property rights, the name of goods (work, services), property rights, their value when conducting a tax audit , as well as the tax rate and tax amount charged to the buyer. Consequently, the considered method of filling out an invoice cannot be a basis for the buyer’s refusal to accept the VAT amounts presented by the seller for deduction.

For your information:

The legislation does not contain requirements that if an invoice is signed by a person who is not a manager or chief accountant, documents confirming the authority of this person must be presented to the buyer along with the invoice. The absence of such documents by a taxpayer cannot entail negative consequences for him. To accept the tax amounts presented to the buyer by the seller for deduction, a properly executed invoice is sufficient (see, for example, resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated April 20, 2010 N 18162/09, FAS Moscow District dated June 3, 2009 N KA-A40/4697-09- 2, Ninth Arbitration Court of Appeal dated September 24, 2008 N 09AP-11535/2008, letter of the Federal Tax Service of Russia dated August 9, 2010 N ShS-37-3/8664).

Prepared answer:

Expert of the Legal Consulting Service GARANT

professional accountant Lazukova Ekaterina

Information legal support GARANT

https://www.garant.ru

About signatures

According to the current rules, a paper invoice is signed by the head and chief accountant of the selling organization. At the same time, the question often arises: who can sign an invoice for the chief accountant or the head of the organization? After all, these employees may not be at the workplace when the need arises to sign a document. Employees, for example, may be on sick leave or on annual leave.

Indeed, an invoice can be signed not only by managers and the chief accountant, but also by other persons authorized to do so by order of the director or by power of attorney on behalf of the organization. Here is an example of such a power of attorney:

Power of attorney

Moscow city March sixth two thousand nineteen

Limited Liability Company “Astra” (OGRN 1127785134567, INN 7722311234) represented by General Director Alexander Ivanovich Pushknin, acting on the basis of the Charter, authorizes Elena Alekseevna Lobanova with this power of attorney, passport 46 06 727511, issued 05/03/1991 OVD “Northern Tushino” Moscow, on behalf of Astra LLC, sign invoices for the manager, as well as primary documents issued to counterparties.

Authorized to sign

In order to give one of the company's employees the authority to sign invoices instead of the manager or chief accountant, it is enough to issue an order or draw up a power of attorney. To avoid tax authorities’ quibbles, it is better to give copies of these documents to buyers along with the invoice.

The rules that must be followed when signing up for management are explained in detail in many letters from the Ministry of Finance and the Federal Tax Service. Thus, quite recently, specialists from the financial department again drew the attention of taxpayers to the fact that authorized persons must sign “in the invoice details “Head of the organization” and “Chief accountant”, after the signature the surname and initials of the authorized persons should be indicated without indicating their positions and details of powers of attorney issued to them" (Letter of the Ministry of Finance of Russia dated January 21, 2008 N 03-07-09/06). At the same time, officials make a reservation: if positions and details are nevertheless written, this is not a violation of the procedure for filling out invoices. The conclusion suggests itself: “you can’t spoil porridge with butter.”

L. Izotova

note

The signature on the invoice must be affixed with your own hand; a facsimile cannot (Letter of the Ministry of Finance dated 04/10/2019 N 03-07-14/25364).

You cannot deduct VAT on an invoice (clause 2 of Article 169 of the Tax Code of the Russian Federation):

- or unsigned;

- or signed by an unauthorized person (the signature transcript indicates the full name of a person who does not have the authority to sign invoices);

- or a signed facsimile (Letter of the Ministry of Finance dated December 8, 2017 N 03-03-06/1/81951, Resolution of the Presidium of the Supreme Arbitration Court dated September 27, 2011 N 4134/11).

If you find an error, please select a piece of text and press Ctrl+Enter.

Attention to squiggles

Let's look at another situation: the director went on vacation or a business trip, or perhaps he was simply absent on business or sick. Who will sign the invoice in his absence? There is a great temptation to simply forge a signature. “Just think, some kind of squiggle! We drew the same one, and there are no problems,” careless employees may think. However, this approach threatens big troubles. As judicial practice shows, inspectors can conduct an examination of signatures, thus proving that the invoice does not comply with the requirements of the Tax Code (Resolution of the Federal Antimonopoly Service of the West Siberian District dated February 13, 2006 N F04-185/2006(19515-A67-25) ). As a result, the right to deduction under such a document will be lost.

Another option is to use a facsimile signature. The Civil Code allows the use of clichés “when making transactions using mechanical or other means of copying in cases and in the manner prescribed by law, other legal acts or agreement of the parties” (Clause 2 of Article 160 of the Civil Code). However, it must be taken into account that “civil legislation does not apply to tax and other financial and administrative relations, unless otherwise provided by law” (clause 3 of article 2 of the Civil Code). And since neither tax nor accounting legislation “provides for the use of facsimile signature reproduction when preparing primary documents and invoices,” officials make an unambiguous conclusion about the illegality of its use (Letter of the Ministry of Finance of Russia dated October 26, 2005 N 03-01- 10/8-404, Letter of the Federal Tax Service of Russia dated February 14, 2005 N 03-1-03/210/11).

Arbitration practice on this issue is very diverse. Thus, in a number of cases, arbitrators side with the tax authorities and refuse to reimburse amounts of value added tax on documents signed by facsimile (Resolution of the Federal Antimonopoly Service of the Volga District dated May 3, 2007 N A57-4249/06, West Siberian District dated 29 January 2007 N Ф04-8449/2006(29482-А46-33)). At the same time, there are court rulings according to which the use of a facsimile signature on an invoice cannot be qualified as a violation. They state that “a facsimile signature reproduces the handwritten signature of the person himself, belongs to a specific individual who can be identified by the personal signature he made on the document” (Resolutions of the Federal Antimonopoly Service of the Ural District dated April 19, 2007 N F09-2754/07-S2, FAS Moscow District dated May 15, 2006 N KA-A40/2894-06).

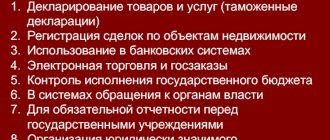

Receiving electronic documents from the Federal Tax Service

Paragraph 3 of Article 80 of the Tax Code of the Russian Federation lists categories of taxpayers who are required to submit tax reports only in electronic form through an electronic document management (EDF) operator. Thus, all VAT payers must submit declarations (calculations) for this tax exclusively in electronic form, regardless of the scale of the business and the number of employees. As for reporting on other types of taxes, it must be submitted electronically using the TKS if the average number of employees of the taxpayer exceeds 100 people. For the named participants in electronic document flow, the Tax Code establishes additional responsibilities (clause 5.1 of Article 23 of the Tax Code of the Russian Federation). Thus, they must ensure the possibility of receiving any documents from the tax authorities in electronic form using the TKS (to do this, you need to enter into an agreement with an electronic document management operator and have a certificate of an electronic signature verification key). In addition, the above taxpayers are required to send receipts to inspectors confirming the acceptance of documents received from them. At the same time, the Tax Code directly allows the delegation of these responsibilities to an authorized person. To do this, it is necessary to provide the inspectorate at the place of registration not only with an agreement with the operator, but also with documents confirming the right of the representative to receive documents from this tax authority. If the representative is an organization, and the taxpayer is an individual, then in general, the inspectorate must also provide papers confirming the taxpayer’s right to receive documents from the Federal Tax Service (Clause 5.1, Article 23 of the Tax Code of the Russian Federation). In this case, it is the authorized person who will be responsible for receiving information from tax authorities and sending them receipts. Article 23 of the Tax Code of the Russian Federation is silent on how to issue a power of attorney for such a delegation. This means that the general rules for drawing up a power of attorney, which we discussed above, apply. At the same time, paragraph 5.1 of Article 23 of the Tax Code of the Russian Federation lists additional actions for notifying inspectors about an authorized person. Thus, a copy of the power of attorney for the person to whom the functions of “electronic communication” with tax authorities have been transferred must be submitted to the tax authority within three working days from the date of its execution.

And if the specified powers are delegated to an organization (for example, an accounting service department), then it is additionally necessary to inform which individual will act on behalf of the authorized organization (if this individual is not its manager). In the case where “electronic correspondence” with tax authorities will be handled not by the manager, but by another employee of the authorized organization, among other things, a document confirming the authority of this employee will be required (that is, it will also be necessary to issue a power of attorney on behalf of the authorized organization for the employee of this organization). A copy of such a power of attorney can be submitted to the inspectorate personally or through a representative, or sent in electronic form through an electronic document management operator. In the latter case, the document is submitted in the form of a scanned copy (clause 5.1 of Article 23 of the Tax Code of the Russian Federation). Also see “Amendments to the Tax Code of the Russian Federation: prohibition on the “sudden” introduction of new reporting forms, exchange of documents with the inspectorate, blocking of accounts.”

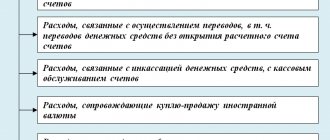

Requirements for issuing an invoice and issuing procedure

- persons who are exempt from paying VAT;

- enterprises and entrepreneurs engaged in retail trade, public catering, performance of work, provision of services to the public when selling products in cash with the seller issuing a strict form;

- banks for tax-free transactions;

- for the sale of securities exempt from tax duties (except for the services of intermediaries and brokers);

- non-state pension funds and insurance companies for tax-free payments.

All accounting factors, including timing, details of filling out, procedure and application of such accounts are outlined in the Tax Code. Moreover, such documentation is the legal basis for the acceptance of the goods by the recipient and the amount of VAT as a deduction. In accounting, documents of this type are used to maintain VAT records.

Universal transfer document - an alternative to an invoice and delivery note

The forms of primary accounting documents are approved by the head of the economic entity on the recommendation of the official who is entrusted with maintaining accounting records (Part 4 of Article 9). The primary accounting document is drawn up on paper or when using EDI in the form of an electronic document signed with an electronic signature (Part 5 of Article 9).

Based on a universal transfer document, you can conduct accounting, write off income tax expenses, and also claim a tax deduction for VAT. This combination of functions is quite logical and natural, since properly executed primary accounting documents are necessary not only for accounting, but also for tax accounting.

Transfer of authority to other persons, sample order for the right to sign invoices

Let's look at an example. The director of Green World LLC, R. A. Patrikeev, often goes on business trips abroad due to official needs. The company's chief accountant is responsible for overseeing accounting in regional divisions, so she is also often away. As a result, the question arose: who signs invoices in their absence?

To resolve the issue, the company issued an order “On granting the right to sign invoices” dated September 21, 2017 No. 167, after which the question “Who signs invoices?” didn't get up again. Thus, the company complied with the requirements of the law and saved itself and its customers from potential claims from controllers.

For more information about what inaccuracies are permissible in an invoice, read the material “What errors in filling out an invoice are not critical for VAT deduction?”

IMPORTANT! Before writing an order about who has the right to sign invoices, it is better to open GOST R 6.30-2003 and familiarize yourself with the requirements for the preparation of organizational and administrative documentation.

You can view and download a sample order on our website.

Results

The issue of who signs invoices must be resolved in a timely manner. If this is done by the manager (IP) or the chief accountant, no additional actions are needed, but if other persons sign, then it is necessary to consolidate their powers by issuing the corresponding local act (order, instruction) or issuing a power of attorney.

These documents will officially identify who signs the invoices, and your counterparty will not have to argue with inspectors and defend a deduction if the invoice is signed by unauthorized persons.

You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

Signing and sending tax reports

The general rules for signing tax reporting are established in paragraph 5 of Article 80 of the Tax Code of the Russian Federation. It states that returns and calculations are signed by the taxpayer or his representative. Here it should be noted that a taxpayer-organization, in principle, cannot act personally. Therefore, a representative always acts on her behalf. The head of the company (and in some types of organizations other persons) has the right to represent the organization without a power of attorney - on the basis of the charter or other documents. In this case, information about persons who have the right to act on behalf of the organization without a power of attorney must be entered into the Unified State Register of Legal Entities. All other persons (including the chief accountant) can sign tax reports only if they have a power of attorney from the organization. A power of attorney is also drawn up in the case when the right to sign statements for a taxpayer is delegated to another company that keeps records. At the same time, paragraph 3 of Article 29 of the Tax Code of the Russian Federation directly stipulates that a power of attorney for a representative is drawn up in accordance with the norms of civil legislation. Let us recall that when drawing up a power of attorney on behalf of an organization, the following rules must be observed (Articles 185 - 187 of the Civil Code of the Russian Federation):

- the power of attorney is executed in writing;

- the power of attorney must indicate the date of its issue;

- the validity period of the power of attorney can be any, but if it is not directly indicated in the text of the power of attorney, then it will be valid for one year from the date of issue;

- a sample signature of an authorized person is not a mandatory requisite of a power of attorney;

- the trustee can be either another company or any individual, including a person who is not an employee of the organization.

the power of attorney is signed by the head of the organization;

As we can see, the law does not require that a power of attorney issued by an organization be notarized. But if the principal is an individual entrepreneur, then he will have to contact a notary (clause 3 of article 29 of the Tax Code of the Russian Federation, clause 4 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57, letter of the Federal Tax Service of Russia dated October 16, 2013 No. ED-4- 3/ [email protected] ). Is it necessary to notify tax authorities that the person who signed the declaration (calculation) acted on the basis of a power of attorney? The already mentioned paragraph 5 of Article 80 of the Tax Code of the Russian Federation states that information about the power of attorney, which gives the right to sign tax reports, is entered in a special field in the declaration itself. In this case, a copy of the power of attorney is attached to the declaration (regular, without a mark of certification, since the Tax Code of the Russian Federation does not require this). If the taxpayer reports electronically via telecommunication channels, then a copy of the power of attorney for signing the reports can also be sent via TKS (clause 5 of Article 80 of the Tax Code of the Russian Federation). In practice, the following algorithm will be used.

The representative submits to the inspection a copy of the taxpayer’s power of attorney for the right to certify the completeness and accuracy of the information specified in the declaration. The document can be submitted either on paper or electronically via telecommunication channels in the form of a scan (however, this option must be previously agreed upon with the inspector). In the future, when sending each declaration, you must attach an information message about the power of attorney.

Please note that in some systems for sending electronic reporting, a message about the power of attorney details is automatically attached to the report. Thus, when submitting reports through Kontur.Extern, the message about the representative office is filled out once and sent automatically along with each declaration.

For more information on this, see “Federal Tax Service: the taxpayer’s representative is required to submit an information message about the power of attorney along with each electronic tax return” and “Federal Tax Service: before sending tax reporting via the Internet, the taxpayer’s representative must submit a copy of the power of attorney to the Federal Tax Service Inspectorate.”

Signature of the authorized person on the invoice: what can be indicated and what cannot be indicated

It is not necessary to mention the power of attorney on the invoice itself. You can indicate the presence of a power of attorney and the position of an authorized person: entering additional details into the invoice is acceptable. Or do not indicate any information at all about the presence of a power of attorney, because at the beginning of the line where the signature is affixed, there is already a mention that “another authorized person” has the right to sign here. It is important not to remove this reference when manually correcting an invoice (where the “manager or other authorized person” line is erased and the signatory’s title is entered instead).

Also, you should not leave the field with your last name and initials empty, adding only your signature. Despite the fact that the Tax Code of the Russian Federation does not require decryption of a signature, Resolution No. 1137 contains a decryption requirement. Such “defective” invoices are more likely to result in legal disputes with inspection authorities.

Signature on the invoice by proxy: a sample filling is given below.

Signing primary and monetary documents

The rules for preparing accounting documents are no longer regulated by tax legislation, but by accounting legislation. Thus, Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ) is devoted to the preparation of the “primary report”. It says that the document is signed by the persons who performed the operation and are responsible for the correctness of its execution. A little more specificity is contained in paragraph 14 of the Regulations on accounting and financial reporting in the Russian Federation (approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n). This norm states that the list of persons authorized to sign primary documents is established by the head of the organization in agreement with the chief accountant. It turns out that in order to grant a person the right to sign a “primary document”, it is enough to include this person in the appropriate list approved by order or directive of the head of the organization. No additional documents (in particular, a power of attorney) are required. The issue of signing monetary and settlement documents is resolved in a similar way - the list of persons authorized to sign such documents is approved by the head of the organization. Typically this list is an annex to the organization's accounting policies. Note that in practice, such simplicity of delegation of the right to sign primary documents can play a cruel joke on organizations. As is known, at present, the forms of most primary documents can be developed independently (clause 4 of Article 9 of Law No. 402-FZ; see “New Law on Accounting: Which primary accounting documents can be used”). But often organizations prefer to use familiar unified forms, having approved them as the used forms of primary accounting documents. At the same time, it is completely ignored that the unified forms already have special fields for affixing signatures of authorized persons. As a result, it turns out that the right to sign the primary document by order of the organization is granted, for example, to the warehouse manager, and the form of the primary document approved for use in the organization contains the requisite “Chief accountant, signature.” Accordingly, the warehouse manager will not be able to fill out such a document. Therefore, in the case of a “primary” document, the main rule is to ensure a correlation between the forms of documents approved by the organization and the list of persons who have the right to sign them. To do this, it is better to make all details associated with the signature neutral. For example, you can use the following phrases: “Signature of an authorized person” or “Manager or other authorized person.” This, by the way, will allow you to avoid problems when signing those primary documents that, according to the procedure established in the organization, require the obligatory autograph of the manager or chief accountant. If these persons are absent from work (vacation, illness, etc.), it will be enough to issue an order or other administrative document for the organization, which will allow, for example, the chief accountant to sign the “primary report” for the manager, or vice versa.

On signing an electronic, legally significant primary document, see “How to sign an electronic primary document: reading the new law on accounting and the law on electronic signatures.”

Do I need to sign the invoice on both sides?

Given the large amount of information that needs to be reflected in this document, it may happen that one page is not enough. The Tax Code of the Russian Federation does not contain a prohibition on issuing an invoice on several sheets.

So that the recipient does not have concerns about the reliability of the data, we recommend transferring part of the tabular form to another sheet so that it looks like a continuation of the previous one. In addition, the document originator may be required to endorse each page of the invoice.

For clarity, all information is reflected on separate sheets, stapled and numbered. You can also display the data on the back, but this is inconvenient for accountants processing documents bound for archiving. Details that determine who signs invoices in the organization (“Head of the organization” and “Chief accountant”) are indicated on the last sheet. This arrangement of signatures is not a violation if the continuous numbering is not broken.

Sample invoice 2020: free download

Line 5 of the invoice contains the number and date of the payment and settlement document. The field is filled in when an advance invoice is issued. These are payment orders, checks, letters of credit, cashier's checks, strict reporting forms - in a word, payment documents according to which the buyer paid for goods shipped (work performed, services rendered). It will be considered an error if the seller in line 5 of the invoice indicates the numbers and dates of other documents (invoices, contracts) that do not relate to payment. The buyer will not be able to deduct input VAT on such an invoice.

During the month, the audit firm advised regular clients under monthly consulting service agreements. In addition, one client was given one-time advice on the application of accounting and tax laws. The consultation lasted one and a half hours.