Products released from main production: at what cost are they valued?

According to PBU 5/01 (approved by order of the Ministry of Finance of Russia dated 06/09/2001 No. 44n), finished products are part of the enterprise’s inventories (clause 2), and they must be reflected in accounting at the actual cost of production (clause 5). However, such a cost price for products produced during the month is not yet formed at the time of release, since the month of production has not ended, and the volume of product costs does not include those expenses that can only get there after the month closes. Moreover, these costs are not always indirect. For example, depreciation of fixed assets directly involved in the production of a certain type of product will also be accrued only after the end of the month.

Meanwhile, the production of products that are the main one for the enterprise is carried out continuously, and not only their release from production, but also shipment to customers can occur several times a month. Both manufactured and shipped products must be taken into account not only in quantitative terms, but also in cost terms (clause 203 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n). At what cost is it assessed if data regarding the actual value of this indicator has not yet been compiled?

In this case, an interim assessment (accounting price) is applied, the possible options of which are cost (clause 204 of the Guidelines):

- normative;

- negotiated;

- any other.

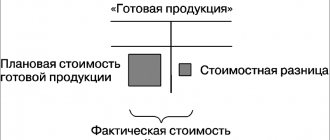

At the end of the month, the result of the interim assessment must be adjusted to the actual values (clause 206 of the Guidelines). At the same time, it is allowed to continue to reflect products in the interim assessment, taking into account the formed deviations in a separate analytical article for this, and not for specific types of product, but for their groups (paragraphs 204-206 of the Guidelines).

Creating a document for product release in 1C

Let's look at the step-by-step instructions for creating the document “Production Report for a Shift”.

To create a new document, you need to go to the “Production” menu, then in the “Product Output” section, click on the “Production reports per shift” link. A window with a list of documents will open.

Let’s create a new document by clicking on the “Create” button:

Next, in 1C you need to fill in the required details of the document header. These include:

- Organization (if there are several of them in the database. If records are kept for one organization, the details will not even be in the form of a new document. I will show this below);

- Stock . It should be taken into account that materials will be written off from this warehouse, and finished products will also be credited to it;

- Cost Account . This account will be used to write off raw materials and supplies;

- Field " Division ". Necessary for analytical accounting.

In the tabular part, in the “Products” tab, we select the finished products that will be our output. Accordingly, we indicate the quantity and price. The price and amount of finished products will be only planned for now, since we have not yet taken into account all costs (for example, workers’ salaries) in its cost price. The final (more precisely, actual) cost will be formed at the end of the month using the “Month Closing” document, after all costs have been posted.

You must select an account. It will be used for the posting of finished products.

Then fill out the “Materials” tab. Here you can use the “Fill” button. The table of materials will be filled in automatically in accordance with the specification for the finished product. A product may have several specifications, so it is indicated in the “Products” tab.

Accounting for manufactured products at standard cost

What kind of wiring should be used to reflect the standard cost of manufactured products? For the posting carried out at the time of release - finished products are released from the main production - there are two options for its correspondence (the choice of these options is reflected in the accounting policy):

- with a direct correlation between the main production cost account (account 20) and account 43, intended for accounting for finished products;

- using an interim account 40, which operates only during the month and must be closed after its completion.

In the first case, the posting will look like Dt 43 Kt 20, and in the second - Dt 43 Kt 40. That is, in the first option, writing off during the month will lead to intermediate red balances on account 20. The second option does not affect account 20.

In any of the options, each type of created product at the standard cost (or other accounting price) and in the actual quantitative assessment will be reflected in account 43. In the case of shipment in the month of production, based on these indicators, the debit of account 90 will show the cost of products sold: Dt 90 Kt 43.

Finished products in warehouse: invoice and accounting rules

Recording of transactions involving finished products is carried out using 43 accounts. Debit balances on it indicate that the enterprise has a certain stock of products released from production. Credit turnover shows the disposal of consignments. Analytics separates accounting data by storage location.

When finished products are delivered to the warehouse, the posting looks like:

D43 – K20 (23, 29).

The entry is made on the basis of the invoice. The transfer of products from the warehouse is formalized by crediting account 43 in correspondence with debiting 45, 80, 44. If shortages are detected, account 94 will be debited for their amount.

For example, Faya LLC produces kefir. In January, 2500 liters of kefir product were produced. At the same time, expenses were incurred by the main production department in the amount of 17,500 rubles, and by the auxiliary unit - 8,000 rubles. At the end of the technological cycle, the finished products were delivered to the warehouse. Reflection of all transactions in accounting:

- D20 – K10 (70, 69) – the amount of basic production expenses is shown in the amount of 17,500 rubles.

- D23 – K 10 (70, 69) – expenses incurred by the auxiliary workshop are reflected: 8,000 rubles.

- D20 - K23 - costs of the auxiliary workshop are included in the production cost estimate of 8,000 rubles.

- Finished products are credited to the warehouse - postings are made between D43 and K20 in the amount of 25,500 rubles. (17,500 + 8,000).

Due to what actions will the products be reflected at actual cost?

Adjustment of the standard cost to the actual cost at the end of the month is carried out by writing off from account 20:

- On account 43 (if the intermediate account 40 is not used) - the magnitude of deviations (positive or negative) from the amounts already written off from account 20, which are divided as a percentage by the products sold during the month (due to their value, the cost of production included in the account is immediately adjusted 90) and for the remainder in the warehouse.

- On account 40 - the entire amount of actual costs incurred in creating products released during the month, which leads to the formation of both standard (credit) and actual (debit) costs on this account. The result of comparing the resulting figures gives the value of the deviations, which are also subject to distribution to the products sold (account 90) and products remaining in the warehouse (account 43).

An increase in actual cost compared to standard costs leads to the need to increase, due to deviations, the amounts shown on accounts 43 and 90, and this is reflected by direct postings to the amount of these deviations:

- Dt 43 Kt 20 and Dt 90 Kt 43 - if account 40 is not used in accounting transactions;

- Dt 43 Kt 40 and Dt 90 Kt 40 - if count 40 is used.

When the actual cost generated is lower than the standard cost, then exactly the same entries are applied to the deviations, but with a negative sign (reversing).

Thus, the posting—reflecting the actual cost of the finished product—regardless of which of the accounting correspondence options is used, is created by two operations:

- on calculating standard costs;

- for accounting for deviations.

The first of them is done at the time of release, and the second - after the close of the month.

What documents accompany the purchase and sale?

All primary documentation that the company uses in its work meets the requirements specified in the accounting law No. 402-FZ. In case of selling products, you will need to fill out:

- Consignment notes in the form TORG-12;

- Invoices;

- Waybills;

- UPD – universal transfer document;

- Certificates, specifications, other documents provided for in the contract.

Documents for products are drawn up in two copies. If a special transfer of ownership rights is provided for the product, then it is more convenient to draw up three copies of shipping documents. On the part of the receiving party, the supplier must receive a mark on acceptance of the products: date, signature, seal of the purchasing company.

Invoices are issued by the seller if he is a VAT payer or tax agent. Invoices serve as confirmation of the transfer of rights to property (goods, products). In accounting, they will serve as the basis for accepting products for accounting and writing off the acquisition cost as expenses when calculating profits. Starting from October 21, 2013, it is allowed to use the universal transfer document UPD for purchase and sale transactions, for registration of services and works provided. The UPD is issued in two copies and serves as an alternative replacement for documents: TORG-12 and invoices. The UTD form for filling has the form of an invoice. The document is certified by the persons responsible for the shipment of products, as well as by the person responsible for the correct registration of the facts of the economic life of the enterprise.

Postings of sold products:

Dt 90.2 Kt 43 – sales of products

Dt 90.3 Kt 68 – VAT payable is charged

Dt 62 Kt 90.1 – accounts receivable formed

Dt 50/51 Kt 62.1 – payment received from the buyer.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Results

To reflect the receipt of finished products at the warehouse and their sale in the month of production (i.e. until data on the actual cost is generated), prices are used that reflect the interim assessment of the created product. After the month is closed, the interim estimate is adjusted to the actual estimate, and the cost of both the products shipped in the month of production and the products remaining in the warehouse are subject to such adjustment.

The formation of intermediate and actual costs in accounting can be carried out in two ways: without using account 40 and with its use.

In the first case, the intermediate cost and deviations from it (both positive and negative) are reflected by the posting Dt 43 Kt 20; at the same time, for deviations arising from shipped products, an additional write-off is made to account 90 (Dt 90 Kt 43). In the second case, the intermediate cost is fixed by posting Dt 43 Kt 40, and the actual cost - by posting Dt 40 Kt 20, i.e. the amount of deviations appears on account 40 and is credited from it to the shipped (Dt 90 Kt 40) and remaining in the warehouse (Dt 43 Kt 40) products. You can find more complete information on the topic in ConsultantPlus. Full and free access to the system for 2 days.

How to reflect sales of products in transactions

Sales volume includes all finished products shipped to customers, regardless of whether they have been paid for or not. Products can be sold either with subsequent payment after shipment or with prepayment.

Postings:

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 1. Sale of finished products before payment by the buyer | ||||

| 90.02 | 43 | Finished products are sent for sale at their actual cost | 5000 | Invoice (TORG-12) |

| 62.01 | 90.01 | Reflected revenue for sold products including VAT | 7080 | Waybill (TORG-12) and invoice |

| 90.03 | 68.02 | VAT on products sold is reflected | 1080 | Sales book, invoice (TORG-12), invoice |

| 51 | 62.01 | The supplier's debt for shipped products has been repaid | 7080 | Payment order, bank statement |

| 2. Sale of finished products on prepayment | ||||

| 51 | 62.02 | Received advance payment from buyer | 7080 | Payment order, bank statement |

| 76 | 68.02 | VAT is charged on the prepayment amount | 1080 | Sales book, invoice (TORG-12), invoice |

| 90.02 | 43 | Shipped products are taken into account at actual cost | 5000 | Waybill (TORG-12), invoice |

| 62.01 | 90.01 | Sales revenue taken into account | 7080 | Waybill (TORG-12), invoice |

| 62.02 | 62.01 | The prepayment received earlier was taken into account as repayment of the debt to the buyer | 7080 | Help-calculation |

| 68.02 | 76 | VAT is credited from the prepayment amount | 1080 | Invoice |

| 90.03 | 68.02 | VAT charged on products sold | 1080 | Waybill (TORG-12), invoice |

Enter the site

RSS Print

Category : Accounting Replies : 43

You can add a topic to your favorites list and subscribe to email notifications.

« First ← Prev.1 Next → Last (5) »

| mari [email protected] Belarus, Minsk Wrote 242 messages Write a private message Reputation: | |

| Hello! Please help me understand the transactions of the entire production cycle, from the purchase of materials to the determination of the financial result. Here's what I got. Where are my mistakes? 1) Dt60 Kt51 - 120 rubles. Paid the supplier for the metal 2) Dt10 Kt60 - 100 rubles. We received the goods from the supplier and the specification for the goods, and entered the goods into the warehouse. 2) Dt18 Kt60 - 20 rub. Input (credit) VAT is allocated. (Account 60 closed) 2) Dt20 Kt10 - 100 rub. We launched metal for the production of metal frames (Account 10 is closed) 2) Dt90.2 Kt20 - 200 (100 materials +100 other monthly costs) rub. Closing of the month. Expenses for the month are written off to cost. (Account 20 is closed taking into account the fact that there were already costs there before purchasing the metal) Then I have a gap in understanding... 2) Dt43 Kt?? — 300 rub. Finished products have been produced, taken into account at price = cost price 100 + profitability 150 + vat 50 2) Dt45 Kt43 - 300 rubles. Products have been shipped to the buyer. (Account 43 closed) 2) Dt62 Kt90.1 - 300 rub. Payment has been received from the buyer, i.e. our proceeds to the current account 2) Dt90.2 Kt45 - 250 rubles. The price without VAT as part of the revenue is included in the cost price??? (account 45???) 2) Dt90.3 Kt68.25 - 50 rub. VAT has been allocated for payment. 2) Dt68. Kt18 - 30 (50-20) rub. VAT credited. 30 rubles payable on the loan account 68.25 According to account 90 I had a loss of 200 rubles. It seems to me that this is incorrect. I understand that on account. 90.2 I took into account 100 rubles of materials twice... But how to do it differently, at a dead end... | |

| I want to draw the moderator's attention to this message because: Notification is being sent... | |

| Who seeks will always find. |

| mari [email protected] Belarus, Minsk Wrote 242 messages Write a private message Reputation: | #2[339009] May 31, 2011, 3:44 pm |

Notification is being sent...

Who seeks will always find.| Tananda// [email hidden] Wrote 13007 messages Write a private message Reputation: 2378 | #3[339031] May 31, 2011, 15:51 |

Notification is being sent...

all women are angels, but when their wings are clipped, they have to fly on a broom| oks_li [email hidden] Belarus, Minsk Wrote 2509 messages Write a private message Reputation: 374 | #4[339039] May 31, 2011, 15:55 |

Notification is being sent...

| Forget-me-not [email protected] Belarus, Minsk Wrote 837 messages Write a private message Reputation: | #5[339075] May 31, 2011, 4:14 pm |

mari wrote:

2) Dt43 Kt?? — 300 rub. Finished products have been produced, taken into account at price = cost price 100 + profitability 150 + vat 50 2) Dt45 Kt43 - 300 rubles. Products have been shipped to the buyer. (Account 43 closed) 2) Dt62 Kt90.1 - 300 rub. Payment has been received from the buyer, i.e. our proceeds to the current account 2) Dt90.2 Kt45 - 250 rubles. The price without VAT as part of the revenue is included in the cost price??? (account 45???) 2) Dt90.3 Kt68.25 - 50 rub. VAT has been allocated for payment. 2) Dt68. Kt18 - 30 (50-20) rub. VAT credited. 30 rubles payable on the loan account 68.25 According to account 90 I had a loss of 200 rubles. It seems to me that this is incorrect. I understand that on account. 90.2 I took into account 100 rubles of materials twice... But how to do it differently, at a dead end...

D43 K20 (or 40, if you use) At 43 you will only have s/s, without profitability and VAT D 62 K 90 here is 300, and for D90 K45 s/s = 200, D90 K68 50 Total 50 rubles profit

I want to draw the moderator's attention to this message because:Notification is being sent...

| mari [email protected] Belarus, Minsk Wrote 242 messages Write a private message Reputation: | #6[339501] June 1, 2011, 10:31 |

Notification is being sent...

Who seeks will always find.| Alenka [email hidden] Belarus, Grodno Wrote 2247 messages Write a private message Reputation: 125 | #7[514992] June 13, 2012, 11:47 |

Notification is being sent...

| Lidochka [email protected] Belarus, Lida Wrote 57 messages Write a private message Reputation: | #8[514996] June 13, 2012, 11:53 |

Notification is being sent...

09081953| Alenka [email hidden] Belarus, Grodno Wrote 2247 messages Write a private message Reputation: 125 | #9[515000] June 13, 2012, 11:56 |

Notification is being sent...

| Lidochka [email protected] Belarus, Lida Wrote 57 messages Write a private message Reputation: | #10[515006] June 13, 2012, 12:06 |

Notification is being sent...

09081953« First ← Prev.1 Next → Last (5) »

In order to reply to this topic, you must log in or register.