In almost all cases, a legal entity and individual entrepreneur are created in order to engage in some kind of business. And where there is business, there are financial transactions in cash and non-cash payments. And all these operations need to be carried out somehow, registered, and then also reported to the tax and other services.

That is why almost all financial transactions of individual entrepreneurs are carried out through a current account. A current account for individual entrepreneurs has a lot of differences from the standard one, and in this article we will tell you who needs it, when and why, as well as how to open this account.

What is this

Probably everyone who is at least superficially familiar with banks knows what a current account is. This is a special bank account that is used to store funds by the client for the purpose of protecting them and increasing them according to the prevailing interest rate.

A current account for entrepreneurs is a completely different bank account. Firstly, this type of account does not increase finances, but, on the contrary, requires money for maintenance. Secondly, its opening is almost always mandatory, while opening a regular current account is voluntary. Thirdly, the current account of an individual entrepreneur or organization is actively used in a variety of operations and serves as a kind of identifier for the entrepreneur, while a regular current account

How is it deciphered?

Let's look at the decoding of bank account numbers:

| Digits 1 - 3 | Decoding the numbering in a bank account |

| 102 — 111 | financial institution capital |

| 202 | cash accounting |

| 203 | precious metals account |

| 204 | operations with precious metals |

| 301 — 329 | various transactions between banks (correspondent accounts, settlements on valuable documents, etc.) |

| 401 — 406 | accounts for budget funds |

| 407 | accounts of non-state entities |

| 408 | accounts for individual entrepreneurs, individuals and legal persons |

| 409 | storage of funds collected in cash |

| 410 — 426 | physical deposits individuals and organizations |

| 427 — 440 | accounting of deposits, deposits of individual entrepreneurs, legal entities. and physical persons |

| 441 — 457 | loans to enterprises of all forms of ownership |

| 458 | loan debts |

| 459 | interest on loans |

| 460 — 473 | money lent from organizations |

| 474 — 479 | other assets and liabilities of companies |

| 501 — 528 | securities transactions |

| 601 — 621 | accounting of fixed assets at the enterprise |

| 706 — 708 | financial results |

| 801 — 855 | power of attorney accounts |

| 909 — 971 | transactions on off-balance sheet accounts |

| Digits 4 - 5 | more detailed description of operations |

Using the first 5 digits, you can find out the purpose of opening, currency, validity period of the account or loan, as well as the owner (individual, individual entrepreneur, LLC, etc.).

Why and when is it needed?

Individual entrepreneurs and other types of legal entities almost always need a current account. However, the law obliges it to be opened in the following cases:

- To pay taxes non-cash via electronic transfer. This rule is not relevant for individual entrepreneurs, so we will not consider it;

- If an individual entrepreneur enters into an agreement with another individual entrepreneur or legal entity, and the amount of the agreement is 100,000 rubles or more. At the same time, a current account is needed even in the case when not one-time, but partial transfers in the amount of 100,000 rubles are made;

- If the individual entrepreneur has a limit on the balance of money. The need is connected with the standard, according to which any funds that an individual entrepreneur has in excess of the limit must be handed over to the bank.

So why do you need a current account for an individual entrepreneur at all? The answer is simple - to carry out all non-cash transactions: from those provided for in various agreements to those required by law. At the same time, this account is very convenient to use; with its help, you can speed up even the smallest financial transactions by conducting them online or through a bank. It is precisely because of the convenience that a current account is usually opened immediately after registering an individual entrepreneur.

How long to wait for a response from the bank

From the moment of submitting the online application to the conclusion of the contract, on average it takes 1-2 days. This is usually the amount of time it takes to verify your documents. Some banks reserve an account immediately after reviewing the application. If such a service is available, you will receive bank details within 15 minutes.

Of course, this will not be a full-fledged cash settlement, and you will not be able to carry out expense transactions, but it will be possible to provide these details to counterparties and accept incoming payments.

How to open

You can open a current account in two ways: yourself, by contacting the bank, or with the help of a third-party organization. If you open a bank account yourself, then you need to do the following:

- Select the appropriate option;

- Get a sample application for opening an account from the bank;

- Fill out the application and take it to the bank along with the documents listed below;

- Open a current account by concluding an agreement with the bank;

- Complete the account registration by depositing any amount into it or performing a transaction through it.

If you do not want to work directly with the bank, but you still need to open a current account, then you can ask for help from any organization that provides legal and financial assistance to individual entrepreneurs and legal entities. It's fast and convenient, but has its drawbacks:

- You will have to pay for the organization’s services;

- Offers will not always be profitable, since such organizations open accounts in banks with which they cooperate;

- There is some chance of running into scammers.

If everything is fine, then when using the services of these services you will only need to do two things - sign a service agreement and pick up documents.

Advantages of opening a current account

Large businesses actively cooperate with companies that have current accounts. Such firms participate in tenders on the State Procurement website and enter into contracts for amounts greater than 100 thousand rubles, when without “responsibility agreement” there is no such possibility.

Other advantages:

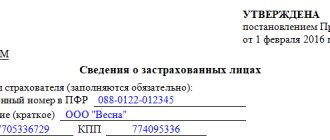

- no need to go to the bank to pay taxes and contributions to the pension fund

- acquiring - payment via bank cards, money is credited to the current account

- all functionality in the Internet banking mobile application: viewing account status, transferring money, analysis, and so on

- you can connect a salary project

- documents are signed with an electronic digital signature - electronic digital signature

- money protection: it cannot be stolen from a bank, only in case of force majeure

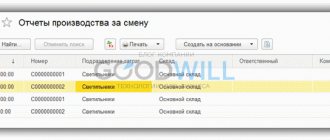

- integration with 1C, Contour, Button, Finguru and My Business

Advantages of Tinkof Bank

A current account is opened at Tinkoff Bank in one day. Money is transferred to the "account account" in the bank around the clock, and to other banks - from 1 am to 8 pm.

Individual entrepreneur at Tinkoff Bank

withdraw money without commission, but from 400 thousand rubles to 1 million rubles. Free online accounting works for them - submitting simplified taxation system and UTII declarations, paying taxes and contributions.

For individuals at Tinkoff

payments are generated automatically. Documents are sent to counterparties from the mobile application. You can check your partners for free through the counterparty verification service - address, director, court cases and OKVEDs.

Documentation

In order to open a current account, you will need to prepare a package of documents. It should include:

- Application for opening a current account on behalf of an individual entrepreneur;

- Passport of a citizen who has registered as an individual entrepreneur;

- Power of attorney and passport of the representative, if the account is not opened personally by the individual entrepreneur;

- Certificate from the tax service that the individual entrepreneur is registered;

- Extract from the Unified State Register of Individual Entrepreneurs;

- Bank card. Issued directly at the bank when opening an account.

This is the minimum basic set of papers. Some banks may ask for additional documents, so check their list with your consultant in advance.

What does decryption give?

Each digital account designation is unique. The ability to decipher it makes it possible to find out:

- Who is the owner of the account - legal entity, individual. person, individual entrepreneur, etc.

- What is it used for?

- In what currency are transactions performed?

- In which branch is the account opened?

Decryption will help the organization avoid incorrect transfer of funds in favor of third parties. Additionally, you can check the reliability of counterparties in the process of concluding agreements and protect yourself from fraudulent activities.

Where is the best place to open?

Beginning entrepreneurs often ask the question “Where to open a current account?” It’s quite difficult to answer this question, so we’ll just give you some advice that will help you navigate the variety of offers:

- Explore all available options. You should not open a current account in the first bank you come across - explore several options, since each offers its own conditions, its own cost and its own rules;

- Pay attention to special offers and promotions. Many banks, trying to attract customers, are ready to offer simplified account opening, service discounts, additional payments and other promotions. They can help you save money or start your business;

- Check out additional services. Almost every bank is ready to offer you assistance in maintaining a current account. So, before opening an account, you should check whether the bank can significantly help you or not;

- Read customer reviews or ask partners for advice. Quite often, the bank's promises diverge from the services actually provided. So before signing an agreement, it is worth talking with those who already have a current account open and operating;

- Read information about possible restrictions. Some banks have restrictions on financial transactions involving a current account. To prevent them from creating unpleasant incidents, it is better to familiarize yourself with them in advance;

- Contact only reliable and time-tested banks. If you contact an unreliable bank, there is a chance that it will close, and you will have big problems with accounts, concluded agreements and financial transfers.

Bank selection

Where is the best place to open a current account for individual entrepreneurs and LLCs? When choosing a bank for settlement and cash services, business owners are advised to pay primary attention to the following parameters:

- reliability of the financial organization, its business reputation;

- functionality and cost of services;

- Availability of mobile and internet banking;

- available methods of replenishing your account.

The table below presents the offers of cash settlement services from leading Russian banks that have proven themselves in the financial services market.

| Bank | Opening | Maintaining |

| Dot | For free | 0 -2500 rub./month. |

| Tinkoff | For free | 490 - 4990 rub./month. |

| Raiffeisenbank | For free | 490 - 7500 rub./month. |

| Modulbank | For free | 0 - 4900 rub./month. |

| UBRD | For free | 0 - 7500 rub./month. |

Find more

Price

The cost of a current account for an individual entrepreneur is also a very complex issue. The fact is that each bank offers its own price, and most of them are ready to provide special discounts and promotions . If we discard everything unnecessary, then the cost of the current account will consist of:

- The cost of registering a bank account;

- The cost of working with documents, issuing certificates and papers;

- Monthly cost of servicing the current account;

- Monthly cost of included additional services.

Why do you need a current account?

Money comes to the current account, taxes are paid from it and non-cash payments are made. For example, an individual entrepreneur or LLC with an account purchases goods and pays for various services.

You can still:

- transfer money to counterparties from other countries, money is converted at the exchange rate.

- withdraw money.

- transfer money to the bank, which will transfer it to employees under the salary project.

- pay to the Social Insurance Fund and the pension fund.

- submit applications for participation in the tender on the Public Procurement website.

- use overdraft, acquiring, leasing and other banking services.

For example, at Tinkoff Bank you can pay from a current account even if you have no money. The bank simply opens an overdraft - you will give the money back later.

Fourth Directorate

Banks serve not only their own corporation, but also clients - individuals and legal entities. The opening of an account is accompanied by a notification about the assignment of a designation group by which the client is identified. For user operations, tools have been created starting with the number “4”:

- 401 – payments to the federal budget;

- 402 – replenishment of local and regional budgets;

- 403 – transactions with other funds of the Ministry of Finance and loans from foreign countries received and issued;

- 404 – sign of social funds – pension, medical, social insurance;

- 405 and 406 – the founders of enterprises are federal or local authorities;

- 407 – a sign of commercial and non-profit organizations whose owners are individuals and companies;

- 408 – other clients;

- 411-425 – for working with deposits of citizens and organizations placed in KFU;

- 430 and further – to account for the internal operations of the KFU.

The MM pair is used as an addition to the NNN and specifies information about the owner.

Code 407 means that the client is a non-governmental institution, and then there is a clarification:

- 40701 – credit organizations;

- 40702 – commercial structures;

- 40703– non-profit structures;

- 40704 – wallet for election campaigns.

Conclusion 1. In the example discussed at the beginning of the article, the current account begins with the combination 40702, which means a commercial structure owned by individuals and companies.

How to find out

If you need to find out your personal PC, you can’t just take the plastic and look at the data, since it is not reflected on the physical medium. The numbers you see are the card number.

There are ways to find out (see) the card account number of a bank card:

- ATMs and terminals;

- mobile app;

- envelope with PIN code and agreement;

- call the contact center or visit the office.

In documents

When issuing a card, the bank entered into a service agreement with you in 2 copies, one of which must be with you. The document contains information about the details that will be required to carry out transactions (your RS, BIC and full name of the organization). If the contract is lost, do not be upset, there are other ways, but they will take a little longer.

In online banking

Information about the card is duplicated in your personal account. To do this, you need to go to your personal account on the bank’s official website, select a card and go to the “Information” section. For convenience, you can send the details to a third party or copy the data to the clipboard. This will prevent you from making mistakes when entering a combination of numbers.

If you do not have access to online banking, register in the system. Usually, to do this, you need to indicate the plastic number on the front side and the mobile phone number specified during registration. Registration takes about 2-3 minutes.

At an ATM or app

When an ATM is in close proximity, you can find out the details. Insert the plastic card into the ATM or terminal, select “Information” or a similar section. Next, order printing of your details. The ATM will issue a receipt with the necessary data.

If there is no ATM nearby, but you have a mobile phone, go to the application. Information about cards is usually published in the “Information” tab.

At the support service or branch

Customers who are not computer and mobile savvy can request data from a contact center or branch. Go to the bank's official website and find the call center phone number. Prepare your passport details and plastic card. The specialist may ask you to confirm your identity with a code word.

To find out the current (personal) account number of a Sberbank credit card at a branch, you do not have to go to the office where you received the plastic card. Any nearest branch will do. You need to have a physical card and passport with you.

Bank and card

To avoid confusion with the map, you should clarify the information:

- 20 characters – the length of the non-cash wallet number.

- 16 characters – length of the bank card number.

These are not matching combinations and concepts. To work with a card with the supposed designation 1234 5678 9012 3456, the bank must open a twenty-digit account.

When filling out, the client should carefully and carefully study the forms that are exactly required (card or account details).

The share of non-cash wallets for one citizen is not standardized. A person can operate several objects in a single bank or have one in the top twenty. These can be ruble, dollar or pound accounts.

Checking account

(

current account, demand account, checking account

) - an account used by a bank or other payment institution to record clients' monetary transactions. The current state of the current account, as a rule, corresponds to the amount of funds belonging to the client.

Typically, these accounts are not used to generate passive income (interest) or for savings. The main purpose of using a current account is reliable and quick access to funds on demand through a variety of channels for transmitting orders. In this case, the client can deposit or withdraw any amount of funds at any time. Because money is available on demand, these accounts are sometimes called demand accounts. The term " current account"

» usually refers to accounts of individuals for settlement transactions not related to business or private practice.