Are individual entrepreneurs and legal entities required to notify the tax authorities about opening a current account in Russia?

Until April 2014, LLCs and individual entrepreneurs had to inform the tax office about opening a current account in the Russian Federation in person within a week after completing the documents at the bank.

An approved form was submitted to the tax office containing the account number, the date of opening or closing the account, the name of the company or data of the individual entrepreneur, KPP and TIN of the company or individual entrepreneur, information about the bank. The completed form was certified by the signature of the director and accountant. If the information was not submitted in time, the company or individual entrepreneur was fined 5,000 rubles, the director or chief accountant - 1,000-2,000 rubles.

In May of that year the law changed. Since then, this task has been handed over to banks, which open and close accounts for taxpayers. That is, in 2020, as in 2020, legal entities and individual entrepreneurs do not inform the Federal Tax Service about opening accounts in Russia.

We recommend reading: Rating of banks for small businesses with profitable cash settlement services for individual entrepreneurs and LLCs.

How does the bank notify the Federal Tax Service?

When opening current accounts, the responsible bank employee enters data about new clients into the account registration book. The entry must contain the name of the organization or individual entrepreneur data, the date of registration and number of the agreement on cash settlement services, and the purpose of opening the account. The information is first sent to the bank’s head office, then to the tax office. As a result, the date of submission of data to the tax office is entered in the registration book.

Information is transmitted to the Federal Tax Service in three ways:

- To the tax office email address. Upon receipt of the information, the responsible tax officer sends a response letter to the bank.

- By written message. The bank sends a registered letter to the tax office at the place of its registration with notification of receipt.

- Through a proxy when contacting the Federal Tax Service in person. The bank issues a power of attorney to a third party to transfer documents to the tax office.

The tax notice contains:

- name, address and details of the bank where the account is opened (KPP, INN, correspondent account, BIC, account number);

- name of the organization or individual entrepreneur data;

- number and date of the contract;

- number and date of opening of the current account;

- legal certificate data persons or individual entrepreneurs about registration with the Federal Tax Service;

- code of the tax office where the letter is sent;

- position and contact information of a bank employee.

The document is generated in 2 copies: for the Federal Tax Service and the bank. If it is filled out by hand, you must follow two rules:

- One cell - one letter.

- Using a pen with blue ink.

Deadlines for submitting an application to the tax office

When opening an account for an LLC or individual entrepreneur, the bank is required to inform the tax office 5 working days in advance.

If deadlines are not met, according to Art. 132. Tax Code of the Russian Federation, fines are imposed on both the responsible bank employee in the amount of 1,000 to 2,000 rubles, and the bank itself in the amount of 20,000 rubles. For untimely sending of information about closing an account or changing details, the bank faces a fine of 40,000 rubles.

Procedure for changing the current account

Legal entities and individual entrepreneurs are not required to inform the Federal Tax Service about a change of account. This responsibility is also transferred to banks: the bank that closes the account reports the closure, and the bank that opens the account reports the opening.

We recommend reading: Rating of banks by cash settlement services for individual entrepreneurs and legal entities with customer reviews.

https://youtu.be/SlG26oBY-aE

Order until 2014

Before the entry into force of Federal Law No. 50, each business owner was required to submit a completed form in the prescribed form (s-09-1) to the tax office, the Pension Fund and the Social Insurance Fund. It included 2 separate sheets and it was necessary to fill it out in 2 copies.

The first sheet contained information about the company itself, and the other displayed bank account details. The form did not need to be certified by a lawyer, and no state fee was imposed. The form must be submitted within 7 days. If these deadlines were violated, a fine was imposed. When opening accounts in several banks at the same time, the fine increased several times. There were as many forms to be submitted as there were accounts opened in different banks.

It was possible to fill out form C-09-1 in one of two options:

- by hand;

- on the computer.

If the form was filled out by hand, then the following requirements must be met:

- fill out the form in printed capital letters, each of which has a separate window;

- You can only write with blue ink, the pen must be a ballpoint pen.

In addition, the form had to be certified with the seal of the organization and signed by the head of the company. The bank also issued a certificate notifying the opening of an account - it had to be attached to the form. It was issued either by a bank (most often) or by the tax office. There was nothing regulating the period for issuing the certificate.

Notification by postal service was allowed. To do this, it was necessary to issue a registered letter with a declared value; an inventory was also attached, which reflected the list of documents enclosed in the letter. A stamp was placed on the mail containing information about the date of departure. If the letter was sent later than 7 days, a fine was imposed.

Return to content

Notification about opening a current account abroad

According to Federal Law No. 173 legal. Individuals and individual entrepreneurs must independently inform the tax authorities about the opening and closing of current accounts in foreign banks, as well as about changes in account details. Foreign banks, i.e. those that have opened a current account outside the Russian Federation, do not deal with such issues. If the notification is not received within the appointed time, legal. a person or individual entrepreneur faces a fine of up to 1 million rubles.

How to notify the tax office about opening a current account abroad

You must inform the tax office within 1 month. from the date of opening an account abroad. To do this, an individual entrepreneur or LLC fills out a notification about opening an account, a sample of which is available for download on the official website of the Federal Tax Service.

You can submit documents in one of the following ways:

- contact the Federal Tax Service in person;

- send a package of documents by mail with notification of receipt;

- online through the free program “Legal Taxpayer”, which is posted on the Federal Tax Service website.

Special shape

On May 2, 2014, changes in legislation came into force, which exempted individual entrepreneurs and legal entities. persons from the obligation to notify the Federal Tax Service and funds (PFR, Social Insurance Fund) about the opening of accounts. Now the banks themselves are doing this.

But it would be useful for an entrepreneur or organization to inform their partners about changes in details. To do this, you need to send each counterparty a notification in free form. This will eliminate delays in the receipt of funds due to the use of incorrect details. Often the obligation to report changes in the current account is enshrined in the terms of various agreements, and should not be neglected.

Previously, the taxpayer had to notify the Federal Tax Service, Pension Fund, etc. about open accounts. To do this, it was necessary to fill out special application forms and submit the completed documents to the branch of the Pension Fund, the Social Insurance Fund and the tax office. Applications could also be sent by mail. Notification to the tax authority was sent strictly within 5 days. Otherwise, organizations and individual entrepreneurs received fines.

In order to make life easier for taxpayers, the Federal Tax Service has provided them with the opportunity to send documents for business registration, as well as all kinds of notifications in several ways.

In electronic form

By going to the official website of the Federal Tax Service, the user can fill out and send all the important documents for registering and servicing his business. Form C-09-1 was no exception. There, on the website, the client can find examples of filling out the form and, if necessary, seek help from an online consultant.

In this case, it was necessary to send a valuable letter about opening a current account to the tax office with a mandatory inventory of all the contents inside. The date of sending the letter was determined by the stamp. One was placed on the option that remained with the account holder, and the second was noted on the copy for the local branch of the Federal Tax Service. Only with the help of this sign could the sender confirm the timing of sending the notification.

The head of an organization, the founder of a company or an individual entrepreneur could submit the form independently by coming to the tax office at the place of registration of the business.

If you have opened a current account, but do not know who to notify and how, or there is simply not enough time for this, then a trusted person can also take care of this issue, but subject to a notarized power of attorney confirming the right to carry out such actions on behalf of the principal.

It does not matter when the business entity registered its business. The important thing is when he opened an account with a credit institution. The fact is that the taxpayer, by law, in any case was obliged to send a message about this to the tax office. The notice period for opening a current account is seven business days from the date the account starts operating. If this requirement was not met, the violator would face sanctions.

The IRS wants to know about your accounts and the income you receive. This way she can check that you have paid all taxes. Maybe you rent out real estate abroad, but don’t pay anything to the Russian budget. Or you have a deposit in a Swiss bank, but there are no taxes. Or maybe you are selling securities or generally performing transactions that are prohibited.

The tax office wants to find out all this in order to charge you something extra. Fines for failure to provide notifications are nothing. Sometimes you will have to pay 100% of the income you received in a foreign bank to the Russian budget.

When preparing a form for a message about opening a current account, the following nuances must be applied:

- Fill out the document using a pen with blue ink only/fill out the document form electronically;

- When filling out a document by hand, each letter corresponds to one separate cell;

- The document is filled out twice. One copy remains with the notifying person, and the other is sent to the government agency;

- The document is sent either by e-mail, regular mail, or in person with the assistance of an authorized representative.

It is important to note that in May 2014, a law was passed stating that an entrepreneur should not engage in notification of extra-budgetary government bodies.

Within 5 days, bank employees are required to send a notification to the appropriate regulatory authority.

There are two types of document that can be sent to government agencies:

- In handwritten form, using personal delivery, transmission by proxy or by mail;

- It is also possible to send a letter electronically.

https://youtu.be/OkM9utGm6lg

In the case when a document is transferred personally or with the involvement of an authorized person, one of the copies of the documents must contain the stamp of a state-owned body, as well as the date of receipt of the document.

If the document is sent by email, upon receipt the tax office must send a notification that the application has been successfully received.

The form for filling out message No. C-09-1 to the People Insurance Fund is the original form for notifying government agencies about the creation of a settlement account.

The law provided for in the tax code provides:

- Sending a document from individual entrepreneurs or legal entities at the place of residence;

- The notification must be submitted no later than seven days after opening the account.

We suggest you read Where to complain if debt collectors call about someone else’s loan

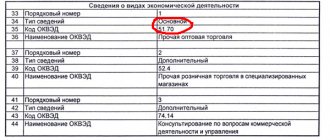

Document form No. S-09-1 includes four sheets of A4 format.

First sheet: Title sheet

- On the top line of the sheet you need to write the TIN and KPP. When writing a message about opening an individual entrepreneur account, only the TIN is indicated.

- At the top right, it is mandatory to indicate the tax office to which the application is sent.

- When filling out the next line, you must indicate either the number “1” if the sender is a representative of an organization, or the number “4” if the sender is an individual entrepreneur.

- After this, enter the name of the company/full name of the entrepreneur.

- The lines of information about the person sending the notification are filled in.

Second sheet (sheet A)

- At the top you need to write the number of the open current account, and then indicate the date.

- After this, information about the bank is written. The name must be taken from the “book of state registration of credit organizations”.

- Then information about the location of the bank is written.

- On the last line you need to indicate your TIN, KPP and BIC details.

- A signature is placed at the very bottom.

- The form is then submitted to the tax authority.

The third sheet is filled out if an account is opened with the federal treasury.

The fourth sheet must be completed if the right to transfer finances electronically has appeared/expired.

Notification of counterparties about the opening of a new current account

When concluding agreements with partners, the payment method and bank details for the transfer are specified. The Bank does not inform its clients' counterparties that they have opened an additional current account. This must be done by the individual entrepreneur or legal entity himself. face. If the counterparty was not notified of the change in details, the money goes to a non-working account or hangs up in intrabank accounts. That is, they do not go to the recipient's account. But despite the fact that the money did not reach the organization, the seller fulfilled his obligations. Disputes in this situation are pointless.

Therefore, in order to avoid difficulties in receiving payment, it is important to notify the counterparty in a timely manner about adding a current account.

To do this, it is enough to send an information letter about opening a current account by e-mail or regular letter with notification of receipt. The latter will help avoid disputes in court.

If, after receiving the notification, the counterparty sent money using the old details, this is considered a violation of the terms of the contract. Then your claims will be justified.

Why does the tax office need this information?

Currently, individual entrepreneurs or owners of an organization do not need to send a notification to the Pension Fund about opening an account, since a law has been adopted that non-budgetary organizations must notify banks.

Bank employees send a notification to the pension fund within five days, so the entrepreneur no longer needs to worry about notifications from other organizations.

The situation is similar with the message about closing a current account.

Previously, failure to submit an application to open a current account was strictly punishable; now, thanks to the 2014 law, an entrepreneur must send a notification only to the tax office.

Despite the fact that notifying the tax service about opening a current account may seem like a sign of mistrust, in fact this action carries many advantages.

The notification process informs government agencies that the new account has been successfully opened and is ready for the turnover process.

At the moment, the entrepreneur does not need to notify the Federal Tax Service about opening an account, as mentioned above.

Until May 1, 2014, citizens - individual entrepreneurs, as well as legal entities, being taxpayers, were obliged to strictly notify the tax authorities about their relationships with the banking sector, namely the opening and closing of current accounts, within seven days working time. The procedure for submitting documents was strictly regulated and looked as follows.

After opening or closing a current account in any bank in the Russian Federation, representatives of the enterprise were required to notify the tax office at the place of their state registration within seven days from the date of concluding an agreement with the bank.

The notification was a written message in a certain form in two copies. It necessarily contained the name of the bank, the name of the taxpayer enterprise with all state registration numbers, as well as the current account number. When personally submitting a notice of opening or closing a bank account, a representative of the organization had to receive a stamp from the tax office about the time and date of reception. This was necessary to avoid all sorts of misunderstandings and disputes regarding the timing of the application.

It could have been by mail

Another option for submitting notice of the opening and closing of bank accounts was permissible through the federal postal service. In this case, a registered letter had to be sent to the tax service. It was necessary to attach a pre-prepared inventory of the attachment to it and ask the postal service for a receipt. Proof of the timely delivery of the notice to the tax inspectorate was the postal receipt and the same inventory of the contents.

Enterprises and organizations had no right to send such notifications in any other way, in particular through electronic means of communication.

We invite you to familiarize yourself with what is not an encumbrance on a land plot

The most important thing in submitting a notice of opening and closing current accounts was meeting the deadlines. Violation of them was punishable by impressive fines of 5,000 rubles. Together with the abolition of the mandatory notification to the tax office about actions with current accounts, fines were also abolished.

But! As the practice of entrepreneurial activity in our country shows, in relation to small and medium-sized businesses, government agencies implement the carrot and stick model. If something was cancelled, someone somewhere was given a relaxation, it means that soon in some part there will certainly be a tightening of laws and rules.

Now tax authorities have the full legal right to demand and receive certificates from banks with information about cash flows at enterprises and organizations, as well as personal accounts of individuals.

Such certificates must contain information about all transfers, transactions and account balances. At the same time, banks cannot delay in providing such information, because, again, they are subject to strict time limits: within three working days, all requested information must be provided, otherwise banks will now be subject to financial and administrative sanctions. And believe me, they will do everything possible to avoid this!

Reference

According to the law, law enforcement agencies, if necessary, have the right to request from tax authorities or the banks themselves information about the existence of certain current accounts with the subject. The Federal Tax Service itself can also request information from a financial institution about the taxpayer’s account. In fact, such a document can be obtained only in two ways:

- submitting an application to the bank;

- sending an application to the local Federal Tax Service.

In the first case, a certificate from the bank about opening a current account will reach the recipient only after he completes an application in any form and sends it to the bank. In the second case, the actions are identical. The preparation of such certificates itself takes relatively little time. It may take five days for the data to be verified and processed properly.

But due to the presence of irrational bureaucracy in the work of state and non-state structures, the entire process can take from 5 to 30 days. At the moment, executive authorities are struggling with such delays, which consume the time of conscientious citizens and business entities.

Fines

For violating the established rules and regulations, the unscrupulous taxpayer faced punishment - an administrative fine, but not account blocking (in full or in part). Such a measure of influence is provided for by law only for those offenders who have not submitted tax returns and other accounting reports to the tax authorities within the established time frame. When opening an account, only a fine could be collected for failure to notify about this event.

Very dangerous for “forgetful” business entities was the fact that the number of notifications to the Federal Tax Service should have been equivalent to the number of active accounts. That is, if a taxpayer opened not one, but three accounts at once in one bank, then there should also have been three notifications to the regulatory authorities.

The same situation applies to fines. If an entrepreneur forgot to notify the tax office about his three accounts, then the fine of 5,000 rubles was multiplied by 3, and the amount was equal to 15,000 rubles. The bank’s notification about opening a current account, in addition to the tax service (since the beginning of 2010), also had to be sent to the Social Insurance Fund, Pension Fund and the Compulsory Medical Insurance Fund. For non-compliance with these rules, a fine of 5,000 rubles was also provided.

Accounts outside the Russian Federation

As for the process of currency regulation, legislation obliges the founders of the company to provide the Federal Tax Service with information related to the opening and closing of accounts and deposits placed in banking institutions located outside of Russia.

In addition, you need to notify about changes in details. And also keep in mind that money transfers to your accounts opened in foreign banks are controlled by the tax authorities. When a company operates outside the borders of the Russian Federation, the entrepreneur himself has to notify the regulatory authorities.

We advise you to read: Where is it profitable to open a current account for individual entrepreneurs and LLCs