Application for a separate division (form 2020)

To register a separate division that does not have the status of a branch or representative office, a message in form S-09-3-1, approved, is submitted to the Federal Tax Service. By order of the Federal Tax Service dated 06/09/2011 N ММВ-7-6/ [email protected] In this message you need to fill out:

- page 1 is information about the organization itself (TIN, KPP, name, OGRN, etc.), the number of separate divisions being created and the person who signs the message in form S-09-3-1;

- page 2 is information about the unit being created. The name of the unit, its address, and the date on which it was created are reflected.

Please keep in mind that the name of the separate division being created is indicated if it exists. There are no special rules regarding this name established by law.

The date of creation of a separate division, as a rule, is indicated in the decision or order on the creation of a separate division. We have provided a sample of such an order.

Step-by-step closing instructions

Step-by-step instructions for closing a separate division are as follows:

- deregistration with the Federal Tax Service;

- dismissal of employees.

So, the first step is deregistration with the tax office. This obligation is provided for in Art. 84 Tax Code of the Russian Federation. To perform these actions, you need to prepare a set of documents. The composition of the data will differ depending on whether the separate division is a branch or representative office or not.

When it has not been assigned a similar status, the process of deregistration is carried out at the place of registration of the main company. From the moment of publication of the official document on the closure of a separate unit, this information must be transmitted within 3 days.

A notice of deregistration is provided in the approved form No. S-09-3-2. You can transfer it in different ways:

- personally or through a proxy;

- by mail;

- in electronic form via the Internet.

Documents for download (free)

- Sample filling S-09-3-2

- Sample order to close a separate division

- Form S-09-3-2

Within 10 days after submitting the message, the tax inspectorate sends a notice of deregistration of the separate division.

A different closure procedure is provided for a branch or representative office. Information about them is included in the company’s constituent documents, as well as in the Unified State Register of Legal Entities. Accordingly, the procedure will involve introducing appropriate changes.

Thus, it consists of two stages:

- sending a message in form No. C-09-3-2 to the tax office;

- making changes to constituent documents.

The first stage of this process is discussed above. As for the process of incorporating changes into the constituent acts, it is necessary to collect certain information for adjustment:

- notification of changes in form No. Р13002;

- the verdict on the changes, as well as the text of the changes itself.

This set of data must be submitted to the tax office, which registers companies. This Federal Tax Service will include transformations into the Unified State Register of Legal Entities and the company’s constituent documents. Information about the liquidation of a separate division is provided to the tax office at the place where the company was founded.

She, in turn, transmits data on the termination of the branch or representative office to the Federal Tax Service at their location.

Documents for making changes to the constituent acts are also provided within 3 days from the date of the verdict on the closure of a separate division.

Responsibility for untimely transfer of information is provided:

- for form No. S-09-3-2 – 200 rubles. (for a company) and 300-500 rubles. (for her leader);

- for application R13002 – 5 thousand rubles.

Important! From January 1, 2020, the obligation to deregister from off-budget funds was abolished.

According to existing regulations, organizations were required to report in writing the liquidation of separate divisions. These actions had to be completed within 1 month. Moreover, a fine of 200 rubles was imposed for late submission of information.

Organizations are currently not required to share such information. The obligation was abolished because legislators considered it unnecessary to repeat information about the deregistration of representative offices submitted to tax authorities and extra-budgetary funds.

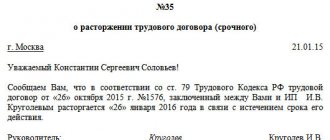

The next step is termination of labor agreements concluded with employees of a separate division. There are two options here:

- if the parent organization is located in the same area as the separate division, then the dismissal is made due to staff reduction;

- if a branch or representative office is located in another area - due to the liquidation of the employer.

The tax authority must submit data on the income of employees in Form 2-NDFL. They should be submitted to the tax office at the place of registration of the branch or representative office. Information is transmitted for the current tax period (beginning of the year - moment of liquidation).

Important! If any payments to employees were made after the closure of a separate division, then they must be reported to the tax office at the location of the main company.

Form C-09-3-1: fill out online

The website of the Federal Tax Service of Russia nalog.ru contains quite a lot of useful services for preparing certain documents and for submitting them to the tax office. But, unfortunately, a service for filling out a message on form S-09-3-1 online has not yet been developed.

Opening of a separate division of the company. Form S-09-3-1.

WHAT IS A SEPARATE DIVISION.

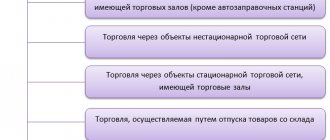

A separate division is, simply put, a branch of a company. According to the Tax Code of the Russian Federation (Article 11, clause 2), a separate division means any branch of a company located at an address other than the legal one, where stationary workplaces (created for a period of more than 1 month) are equipped: for example, a retail outlet, office, pick-up point for online store orders. Moreover, the fact of the presence of jobs does not imply the mandatory regular presence of workers on the territory of a separate unit: for example, a warehouse may be recognized as a separate unit. The Tax Code of the Russian Federation also states that a separate division is considered such regardless of the presence of references to the fact of its creation in the accounting and other documents of the enterprise, i.e. the lack of registration does not deprive a separate unit of its status, however, in this case, the legal entity will be held liable under Art. 117 of the Tax Code of the Russian Federation (evasion of registration with the tax authority). A separate division may have its own seal and its own balance sheet: accordingly, accounting for it is kept separately.

A separate division needs to be opened even if it is just another district of one city. In this case, the opening of a separate unit will also have to wait 5 days.

Individual entrepreneurs (IP) are not required to open separate divisions and are not required by law.

Notice of the creation of a separate unit (C-09-3-1)

Applications

If an organization decides to create a separate division, then the tax office should be notified about this in writing. For these purposes, a standard form for notification of the creation of a separate division has been developed, form No. S-09-3-1 (form according to KND 1111053).

The message should be sent to the Federal Tax Service office at the place where the main organization is registered. From the moment of creation of a separate division, it is necessary to notify the tax office within a month.

messages form C-09-3-1 can be found using the link at the bottom of the article (excel format).

In order for a unit to be considered separate, it must comply with certain rules:

- be located outside the territory of the main organization;

- have stationary equipped workplaces;

- divisions must conduct activities.

If the created division complies with the specified rules, then it must be registered with the tax authorities. Based on the submitted message form S-09-3-1, the tax office registers the unit at its location.

Other sample applications to the tax office:

- on registration of CCP form according to KND 1110021 - sample;

- on registration of individual entrepreneurs, form P21001 - sample.

We will register everything for you!

Our team takes care of all the hassle of registering a separate unit on a turnkey basis. You will need a package of necessary documents and a power of attorney; we will do the rest without your participation.

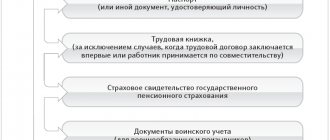

List of documents required for registering a separate division without your participation:

- TIN certificate (copy);

- OGRN certificate (copy);

- Order on the creation of a separate division (copy);

- Lease agreement for a separate subdivision (copy);

- Seal;

- Power of attorney for the right to represent interests in the Federal Tax Service (Article 185 of the Civil Code of the Russian Federation);

- Application Form No. S-09-3-1 (On the creation of a separate division of a Russian organization on the territory of the Russian Federation);

- OKVED statistics codes.

Opening time: 5-8 working days. Cost of service: from 1000 rub.

Documents required for independent opening of a separate division:

For submission via electronic reporting systems:

- only completed application form S-09-3-1

For self-filing at the tax office:

- passport of the person submitting the documents

- power of attorney, in case of registration by an authorized person, and not by the general director of the enterprise

- completed application form S-09-3-1

Documents that may be additionally required by some interdistrict tax offices:

- Notice of registration of a legal entity at the location of a separate division, branch (form S-0-9-3-1)

- A copy of the tax registration certificate of a legal entity certified by a notary

- Documents confirming the creation of a separate division (order, lease agreement)

- Certificate for manager, accountant (in any form).

- Power of attorney (for everyone except the General Director).

- When registering a branch (representative office): - constituent documents of a legal entity indicating information about a separate division; — extract from the Unified State Register of Legal Entities; — regulations on a separate division; — decree (order) on the creation of a separate unit

Documents are usually submitted to the Department of Registration and Accounting of Taxpayers, to the tax office at the place of registration of the legal entity (at the legal address of the enterprise). An application for registration must be submitted no later than 1 month after the opening of a separate unit.

If you use electronic reporting systems, then you do not have to visit the tax office, but you can download the registration form and fill it out and send it to the tax office electronically (in Excel format).

Opening a separate division is necessary, for example, to register a cash register in Crimea at a location other than its legal address.

Confirmation of the opening of a separate subdivision can be collected from the tax office of the district where the separate subdivision was opened. When opening, your branch will also be assigned a checkpoint. An example of a notice of registration of an organization with the tax authority (form No. 1-3-Accounting KND Code 1121029):

TERMS FOR REGISTRATION OF A SEPARATE DIVISION.

A separate division must be registered no later than 1 month from the date of its formation.

A separate enterprise is registered by the tax office within 5-7 working days. Very often the deadlines are delayed, so we advise you to call the tax office of your area (operational control department) and ask whether your application for opening a branch has been processed.

To find out whether a separate subdivision is open, you need to call the tax inspectorate of the district in whose territory you are opening a separate subdivision.

SEPARATE DIVISION - BRANCH - REPRESENTATIVE OFFICE, WHAT IS THE DIFFERENCE?

A separate division may be given the status of a representative office or branch. A representative office can represent the interests of a legal entity, but it is not endowed with its rights, i.e. cannot conduct commercial activities. A branch is considered a separate division of a legal entity that performs the functions or part of the functions of the legal entity itself, i.e. can conduct commercial activities on behalf of a legal entity, as well as represent its interests. Neither a branch nor a representative office are independent legal entities, and they can represent the interests of the company in court only by proxy. They also do not have the status of taxpayers, therefore tax reporting on them is not provided separately, but is included in the reporting of a legal entity. Enterprises located on the simplified tax system can register separate divisions that are not branches or representative offices. Individual entrepreneurs cannot register separate divisions.

FORM C-09-3-1. REGISTRATION OF A SEPARATE DIVISION. SAMPLE COMPLETION.

Form S-09-3-1 (KND code 1111053) is required for registering a separate division of a company, as well as making changes to an already open division, such as: changing information about the director, changing the location, changing the name of a separate division. An example of a completed form is below (click on the image to enlarge):

COMPLETING THE APPLICATION BY POINT:

- TIN

- checkpoint

- Tax authority code

- name of the organization or individual entrepreneur

- OGRN of the organization

- number of registered separate divisions

- type of application

- how many pages are in the application

- number of attachments to the document

- who submits the application

- Full name of the person submitting the notification

- TIN of the person submitting the notification

- contact phone number

- document proving identity and authority

- Type of change

- checkpoint

- Name

- Address of the separate division to be opened

- date of creation

- main OKVED

- Full name of the head of the separate division

- TIN of the head of a separate division, if available.

- telephone

- The TIN of the organization is 10 digits, not to be confused with the OGRN.

- Checkpoint - fill out the checkpoint of the main organization (not a separate division, which does not exist yet)

- Code and number of the tax office (IFTS) to which you are submitting documents. The code and number for the Republic of Crimea and the city of Sevastopol can be taken from the table.

- Name of the organization. Write the full name of the organization, for example: “Limited Liability Company “Zagrebay””.

- OGRN is the main state registration number, taken from the taxpayer’s registration certificate.

- Each department will need to complete a second page of the form.

- Type of application: 1 - if you are reporting the creation of a separate division; 2 - if you make changes to an already created separate division.

- The number of pages in the application, if one division is opening, then 2 pages. If more, then by the number of divisions plus 1.

- Number of application sheets. The application may be accompanied by a copy of a document confirming the authority of the representative (power of attorney or order appointing the head of a separate division)

- Who submits the application:

- head of the organization - put “3”

- representative of the organization - put “4”; if this is a representative of the organization by power of attorney, then you will need to submit a power of attorney for the person submitting the notification.

- Last name, first name, patronymic of the person presenting the documents.

- TIN of the individual presenting the documents - 12 digits.

- Contact phone number at the discretion of the applicant

- The passport details of the applicant are filled in in the following format: series, number. Or the number and date of the power of attorney, if this is not the general director.

- The type of change made to an already created separate division. If you are submitting documents to create a separate division, then you do not need to fill out anything.

- Checkpoint of a previously created separate subdivision, if you are making changes to an already registered subdivision. If you are creating a new one, then you do not need to fill out this item.

- The name of the separate unit is whatever you come up with, only without the obscenities and calls to overthrow the existing Putin regime.

- The address is also an address in Africa)))

- Date of creation of a separate division. Just do not write a date earlier than a month before submitting the application, otherwise you may run into a fine.

- The main OKVED of the organization. It is necessary to indicate the BASIC OKVED - it appears first in your extract from the Unified State Register of Legal Entities (USRLE).

- Last name, first name and patronymic of the head of the separate division; if there is none, then leave the field blank.

- TIN of the head of a separate division, if available.

- telephone number of the head of the detachment, if available.

Notification of the opening of a separate division in the Federal Tax Service

An application for registration must be submitted no later than 1 month after the opening of a separate unit.

Tax authority code – code of the department to which the message is submitted (at the location of the organization).

Based on the submitted message form S-09-3-1, the tax office registers the unit at its location.

After receiving the required set of documents, information about the closure of the unit will be entered into the Unified State Register of Legal Entities within five days. The main company learns about this from the notification received.

In the “Organization” field you need to enter its full name. Empty cells should be crossed out.

The message should be sent to the Federal Tax Service office at the place where the main organization is registered. From the moment of creation of a separate division, it is necessary to notify the tax office within a month.

By force, a separate division must be located at an address different from the address of the main organization, and have stationary jobs, that is, jobs created for a period of more than one month.

In accordance with the letter of the Ministry of Health and Social Development of the Russian Federation numbered 2891-19, dated September 9, 2010, when a division of a company is closed, it is obligatory to notify the FSS and the Pension Fund about this.

By force, a separate division must be located at an address different from the address of the main organization, and have stationary jobs, that is, jobs created for a period of more than one month.

The GARANT system has been produced since 1990. and its partners are members of the Russian Association of Legal Information GARANT.

The Federal Tax Service of Russia approved the corresponding application form in the above-mentioned order and put into effect a general procedure for filling out the application form, and also indicated the basic and mandatory requirements for such an application, but did not develop or publish a sample for filling out form S-09-3-1.

When filling out the form, all fields intended to indicate the TIN and KPP must be filled in on each page of the application. The requirements for each column to be filled out are set out in Appendix No. 13 to the Order of the Federal Tax Service of Russia.

A representative office can represent the interests of a legal entity, but it is not endowed with its rights, i.e. cannot conduct commercial activities.

Downloading a form from other sources does not guarantee compliance with the officially approved form.

In the “Name” field, indicate the name of the department, if available. Then provide the full address of the unit's location. Please note how this item is filled out in the sample application C-09-3-1 presented below. If you are filling out information about the address of a separate division for Moscow and St. Petersburg, then you do not need to fill in the “District” and “City” fields.

Let's understand the concepts

The structure of a legal entity includes numerous representative offices, divisions and branches. All these are separate structural departments that are located outside the organization itself. But a branch, separate department or representative office does not become a new legal entity and is not endowed with property.

A structural branch is created so that a legal entity can carry out its activities in a new territorial location. The separate entity is endowed with the rights and powers to represent the interests of the parent organization, conduct business on its behalf, make payments, enter into agreements and contracts, and so on.

The company independently makes decisions on the creation and closure of separate divisions. The Federal Tax Service should be notified of the decision made in the prescribed manner.

IMPORTANT! Useful: step-by-step instructions on how to properly close a separate division with all samples and forms.

Which units are closed according to form S-09-3-2

The organization has the right at any time to decide to liquidate an unprofitable division, representative office or branch. The verdict is formalized by order or instruction in any form. In addition to the order, the company is obliged to notify the Federal Tax Service. To do this, fill out a special form KND 1111052 - S-09-3-2.

Application form S-09-3-2 is filled out when closing a branch, separate division or representative office. Moreover, it does not matter whether information about structural branches is included in the constituent documents of the company or not. If the information is enshrined in the charter and other constituent documentation of the organization, then you will have to submit an additional form P13001 and pay a state fee of 800 rubles. This is necessary for the Federal Tax Service to make appropriate changes to the Unified State Register of Legal Entities.

Sample filling and blank form of form S-09-3-2

Registration is carried out by the tax authority within 5 days from the date of actual submission of the package of documents or receipt on the server through electronic document management. The corresponding notification serves as a document confirming the registration of the unit.

Separate units mean a unit that is located separately from the organization itself and has its own equipped stationary workplaces. This unit must be registered with the tax authority at its location. For this purpose, message form C-09-3-1 is submitted.

In the second case, when the activities of a branch or representative office, information about which is included in the charter, are terminated, the procedure will be slightly different.

When closing a division, information about which was not initially included in the charter, such an extended list of papers is not required.

Instructions for filling out application C-09-3-2

The procedure for filling out the form is established by Order of the Federal Tax Service of Russia dated 06/09/2011 No. ММВ-7-6/ [email protected] If a company decides to liquidate several OPs at once, then you will have to fill out an application for deregistration of a separate division in 2020 for each one.

The structure of the form requires filling out two pages. This is the title page or sheet 1, which reveals the identifying information about the parent institution. The second sheet reflects information about the closure of a representative office, branch or separate division.

How and when to submit form C-09-3-2

Application C-09-3-2 must be submitted to the Federal Tax Service within 3 working days from the date of closure of the separate branch. Send the documents to the inspection department where the parent organization is registered.

Information is provided in several ways, but each has its own nuances:

| Application method C-09-3-2 | Recommendations |

| Personally | The applicant's passport will be required to confirm the identity of the person applying to the Federal Tax Service. |

| Through a representative | In addition to your passport, you must provide a copy and original of the power of attorney (for verification) that was issued by the parent organization. |

| Via secure communication channels | It is necessary to verify the electronic document with an enhanced digital signature. Otherwise, the documents will not be accepted by the Federal Tax Service, since without an electronic signature they have no legal force. |

| Through the taxpayer’s personal account | Registration on the official website of the Federal Tax Service is required. An enhanced qualified signature will be required. |

If all the paperwork is completed correctly, the Federal Tax Service will send the organization a notice of the closure of the separate branch within 10 working days. If the tax authorities schedule an on-site tax audit of the liquidated branch, the notification will be sent only after the audit is completed.

Main purpose

The form is filled out as a message in which the company notifies the tax office that a separate division has been opened. In this case, such a unit must simultaneously meet several requirements:

- this is not a branch;

- This is not representation;

- it has a different address compared to the head office;

- it has stationary workplaces (starting from one), which are fully equipped for employees to perform the relevant duties;

- The expected duration of work is at least a month (continuously).

In this case, the document is drawn up not only as a notice of opening, but also as a notice:

- about its renaming;

- about a change in his address;

- about the simultaneous change of both the address and the name of the unit.

In all cases, the notification must be sent to the local tax office no later than 30 calendar days from the date of establishment of the unit or change in any of its information (name and/or address).

Branch and separate division: similarities and differences

As a rule, medium-sized enterprises use a developed network of their structural elements: along with the central (head) office, there are also several separate units, which, depending on their characteristics, can be called differently: separate divisions, branches, representative offices. A common feature of all these elements is the territorial distance from the main office. That is, this is not a single complex, and certainly not a single building.

However, there are significant differences between them, which are associated not only with physical, but also with legal characteristics. The essence of the differences can be clearly seen in the table.

| compared characteristic | separate division | branch |

| reflection of information about creation in the constituent documentation | are not reflected | reflected |

| the need to appoint a director | absent | There is |

| order of creation | possible without obtaining the approval of the founders | solely with the approval of the founders |

NOTE. The close location of various components of the company to each other does not entail the need to call them branches or representative offices. In such cases, we are talking about structural units - for example, warehouses, production buildings and an administration building, located within the same complex (on the same site).

Filling procedure

The document can be filled out either handwritten (legibly, in block letters, using a blue or black pen), or printed using computer technology. To maintain a neat appearance, it is recommended to use 16 point Courier New font.

It is important to comply with the following requirements for filling out form C-09-3-1:

- The fields with the organization's TIN and KPP details are filled in on each page without exception, otherwise the document will be declared invalid.

- Each sheet is numbered in chronological order.

- No amendments, corrections, or blots should be allowed - in such cases, another form is drawn up and the old one is deleted.

NOTE. If several departments are opened at the same time, it is permissible to submit one application and attach as many sheets as the number of organizations to open.

Fill out the second sheet

At the very top of the form, we again enter the TIN and KPP number (legal entity only).

In the line “Account number” indicate its number and the date of opening the bank account. It happens that an organization opens several accounts. In this case, it is impossible to indicate all accounts in one message C-09-1; form C-09-1 is submitted for each account.

Next, we indicate the full name of the credit institution (with a fully specified legal form).

Below we enter the bank data: address, TIN, BIC, checkpoint.

Be careful: if you indicate the region code “77” (Moscow), then you do not need to write anything in the “city” line.

In those lines for which there is no data to fill in (the body of a house, for example), dashes are placed.

The data for filling out form S-09-1 can be found both in the organization’s documents (IP) and in the account opening certificate that will be given to you by the bank. So, the OGRN number is in the registration certificate, the OGRNIP number is in the certificate of assignment of the state number of the entrepreneur. INN (both bank and organization), as well as KPP and BIC of the bank, account number are written in the account opening certificate.

Form and sample document

The document form is the same for all organizations, regardless of the nature of the activity (commercial, non-profit), structure, number of staff and other parameters. Form S-09-3-1 looks like this.

An example of filling out form C-09-3-1, which can be used as a sample, is shown below.

We submit a message about the creation of a separate division

An organization can create a separate division, the main features of which are a separate location (separate from the organization itself. In this case, at the location of the division there must be stationary workplaces, the creation period of which exceeds 1 month. Another sign is the fact of conducting activities through it.

When creating a separate division on the basis of an order, the organization should notify the tax service about this event. For this purpose, the tax office has developed a standard form for reporting the creation of form C-09-3-1. We offer you to download the current message form for 2020 using the link at the bottom of the article.

There are certain rules for submitting a message about the opening of a separate division:

- Form C-09-3-1 is submitted to the tax office, which is located at the location of the organization itself;

- The deadline for submitting this document is 1 month from the date of formation of the unit.

Download samples of other notifications:

- on the transition to the simplified tax system form 26.2-1 -;

- about the selected objects of taxation - sample;

- on the use of the right to VAT exemption - sample.

Instructions for filling

Specific filling requirements are also the same for all cases. The following is a detailed description of the current rules.

Front page

Here the filling rules are quite simple - you need to print (or enter in legible handwriting) the following information about the company:

- The TIN and KPP details are exactly those that were received from the tax office.

- OGRN number.

- Code of the tax office - the one that directly controls the company (this message is also sent there).

- The company name in C-09-3-1 must be indicated in full, exactly as it is written in official documents.

- You need to enter a figure for the number of units to be opened - and it is assumed that they are all registered on the same day. If, for example, one structure is opened, you must enter: “1—”.

- Depending on the type of message, marking with numbers is used - since we are talking about the opening of a unit, the number 1 is put. If you just need to make changes to the message that was submitted to the inspection before, the number 2 is put.

- Line “message compiled on” – here you need to indicate the exact number of pages of the document in the format, for example: “5—”.

- The number of pages from which copies of documents confirming the authority of the relevant person are compiled is similarly indicated.

- The company representative must enter “I confirm” in the proof of confirmation of the accuracy of the information and enter the code “3” if he holds the position of director or “4” if he represents the company but holds a different position.

- The last name, first name and patronymic of the manager are written in capital block letters on 3 lines - each initial has its own line.

- Next, you need to register the manager’s TIN (personal, as a private individual).

- The contact information includes a telephone number and e-mail, followed by a signature (in handwriting) and the date of registration.

- Finally, you must also indicate the name of the document that confirms the authority of the person concerned.

Information about the separate division

When filling out this part, you need to pay special attention to those cases when information is submitted about the opening of several separate divisions at the same time. The design rules are as follows:

- For the TIN and KPP details, the relevant data should be provided, duplicating them on each page (if there are several such pages).

- Using the code in the form, you need to indicate the purpose of the notification: number 1 indicates a change in address, number 2 indicates a change in name, and number 3 indicates a change in address and name at the same time.

- Information about the location - here you need to indicate the full postal address, including the postal code, the code that denotes the region, locality and its district (if any), the full designation of the house (including buildings, letters).

NOTE. In the case of the federal cities of Moscow and St. Petersburg, you must leave the “City” and “District” fields empty.

- By date, you must indicate exactly the date when it was created or the date when changes were officially made to its name and/or address.

Thus, timely and correct completion of the form is a guarantee of the absence of claims from the tax inspectorate and corresponding penalties.

Share link:

Step by step: opening a separate division of the organization

Is it necessary to make a decision to create a separate division of the organization?

The obligation to make a decision on the creation of a separate division is not provided for by law. In addition, it does not need to be submitted to the tax office when registering (clause 2.1 of the Federal Tax Service Letter dated September 3, 2010 N MN-37-6/ [email protected] ).

However, we recommend that you make this decision. This will allow:

• coordinate the work of the organization to create it;

• determine the date from which a separate division will be considered created. Determining this date will allow you to avoid a dispute with the tax authority over the moment from which it is necessary to count the period for registering it. The risk of a dispute arises from the fact that the issue of when to create a separate division is not regulated by law.

The director of the organization can make a decision, unless otherwise provided by the company's charter. The decision can be formalized by order of the organization.

2. How to fill out a message on form C-09-3-1 about the creation of a separate division of the organization

The procedure for filling out a message in form S-09-3-1 is approved by Order of the Federal Tax Service of Russia dated 06/09/2011 N ММВ-7-6/ [email protected] In the message, fill out page 1 with information about the legal entity (organization) and page 2 with information about the entity being created a separate division.

If you are creating several separate divisions at once, then fill out a separate page 2 for each of them (clause 13 of Appendix No. 13 to the Order of the Federal Tax Service of Russia dated 06/09/2011 N ММВ-7-6/ [email protected] ).

On page 1, indicate (section II of Appendix No. 13 to the Order of the Federal Tax Service of Russia dated 06/09/2011 N ММВ-7-6/ [email protected] ):

• INN, KPP, name and OGRN of the legal entity (organization) creating a separate division;

• tax authority code at the location of the legal entity (organization);

• number of separate divisions created. For example, when creating one separate division, enter the number “1” as follows: “1—“;

• number of message pages. If one separate division is created, then there will be two pages. This information is indicated as follows: “2—“;

• who signs the message - a director or representative of a legal entity (organization) by proxy;

• FULL NAME. the person signing the message and his TIN, if he has one and the person uses it along with personal data. As well as an email address and telephone number for contact.

If the message will be signed by a representative of a legal entity (organization), indicate a document confirming the authority of the representative.

On page 2, indicate (Section III of Appendix No. 13 to the Order of the Federal Tax Service of Russia dated 06/09/2011 N ММВ-7-6/ [email protected] ):

• TIN and KPP of a legal entity (organization) creating a separate division;

• name of the separate division being created, if any;

• address of the separate division being created. If the separate subdivision is located in Moscow or St. Petersburg, then when filling out information about the address of the separate subdivision, do not fill in the “District” and “City” fields;

• date from which the separate division was created.

3. How to register with the Federal Tax Service the opening (submit a notice of creation) of a separate division of the organization

Registration of the opening of a separate division is carried out by submitting a message in form S-09-3-1 to the tax office (IFTS of Russia) at the location (registration) of the legal entity (clause 3, clause 2, article 23, clause 4, article 83 of the Tax Code of the Russian Federation) ).

Only a power of attorney must be attached to the message if it is submitted by a representative of the organization (Clause 3 of Article 29 of the Tax Code of the Russian Federation).

If several separate divisions are created within the same municipality or in Moscow, St. Petersburg and Sevastopol, subordinate to different inspectorates, then in addition, with a message in form S-09-3-1, you can submit a notification about the selection of a tax authority for registering a Russian organization at the location of one of its divisions (form N 1-6-Accounting). We recommend doing this, since this will allow you to submit reports to one inspection for several separate divisions (clause 4 of Article 83 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of Russia dated September 28, 2011 N PA-4-6/15886).

The deadline for submitting a message about the opening of a separate division is one month from the date of its creation (clause 3, clause 2, article 23 of the Tax Code of the Russian Federation).

Methods for submitting a message (clause 7, article 23 of the Tax Code of the Russian Federation):

1) directly to the tax office at the location of the organization (in person or through a representative);

2) send by registered mail;

3) through telecommunication channels (Internet);

4) through the taxpayer’s personal account.

When submitting a message in electronic form, it must be certified by an enhanced qualified electronic signature of the person who submitted the message in form S-09-3-1, or his representative (clause 7 of Article 23 of the Tax Code of the Russian Federation).

4. How to obtain documents on registration of a separate division

Within five working days, the organization is issued (sent) a notice of registration with the tax authority (clause 6, article 6.1, clause 2, article 84 of the Tax Code of the Russian Federation).

The notification will indicate the assigned checkpoint, which must be used by the separate unit, including for filling out invoices (clause 7 of the Procedure approved by Order of the Federal Tax Service of Russia dated June 29, 2012 N ММВ-7-6/ [email protected] , Letter of the Federal Tax Service of Russia dated 11/16/2016 N SD-4-3/ [email protected] ).

The tax authority cannot refuse to register a separate division, since there are no grounds for refusal in the Tax Code of the Russian Federation.

5. How to register an open separate division with the Pension Fund of Russia

Please note that it is necessary to register a separate division with the Pension Fund of the Russian Federation only if the division pays benefits to employees and has a bank account (clause 3, paragraph 1, article 11 of the Pension Insurance Law).

Submit to the Federal Tax Service at the location of the organization a message about vesting a separate division with the authority to accrue payments and remunerations in favor of individuals. The period is one month from the date the organization issues an order to vest the OP with such powers (Letter of the Ministry of Finance of Russia dated 05.05.2017 N 03-15-06/27777).

The Federal Tax Service itself will transfer the information to the Pension Fund (clause 3, clause 1, article 11 of the Law on Pension Insurance).

6. How to register a created separate division in the FSS of the Russian Federation

Please note that a separate division of an organization needs to be registered with the Federal Social Insurance Fund of the Russian Federation only if the division pays payments to employees and has a bank account (clause 2, part 1, article 2.3 of Law N 255-FZ, subclause 2, clause 1, article 6 of Law N 125-FZ).

To do this, no later than 30 calendar days from the date of creation of the unit, submit to the FSS of the Russian Federation at its location (clauses 6, 9, 10 of the Procedure for registration and deregistration with the FSS of the Russian Federation, approved by Order of the Ministry of Labor of Russia dated April 29, 2016 N 202 n ):

• application for registration in the approved form;

• a certificate from the bank confirming the opening of a branch account;

• a document confirming that the division issues payments to individuals. For example, a copy of the regulations on a separate division, which states that it independently calculates payments to its employees.

For violation of the deadline for registration with the FSS of the Russian Federation at the location of the OP, a fine may be imposed on the policyholder (Article 26.28 of Law No. 125-FZ):

• in case of delay up to 90 days inclusive - 5,000 rubles;

• more than 90 days—RUB 10,000.