Distribution of income tax between budgets

Last updated 06/12/2019 at 10:29 am

If you have questions or need assistance, please call Free Federal Tax Advice.

- Moscow and region

- St. Petersburg and region 8 (812) 467-43-82

- Other regions of Russia ext. 742

Income tax is levied on all citizens who earn income in Russia, and even foreigners cannot avoid this payment if they make a profit within the country. The massive scale of the income tax and the wave of revelations in government agencies make us think - to which budget is the income tax credited and how is the personal income tax distributed in the financial policy of the state? Read about the distribution of personal income tax between budgets in 2020 in our material.

Where do wage taxes go and where to pay personal income tax for employees and other obligations?

Most of the income tax revenues replenish the budgets of the constituent entities of the Russian Federation, the remaining share relates to the income of local budgets (Articles 56 and 61 of the Budget Code of the Russian Federation).

Income tax is paid in a single payment according to the relevant BCC. Further, the Treasury, on the basis of OKTMO, independently sends the amounts of deductions to the appropriate budgets.

KBK for personal income tax payment in 2020:

- 18210102010011000110 - personal income tax on income paid by the tax agent.

- 18210102020011000110 - Personal income tax on income of individual entrepreneurs, notaries, lawyers.

- 18210102030011000110 - Personal income tax on income of persons received under Art. 228 Tax Code of the Russian Federation.

- 18210102040011000110 - Personal income tax of foreign individuals using a patent in their work activities.

About the BCC used when paying other taxes, read the material “Deciphering the BCC in 2020 - 18210102010011000110, etc.”

https://youtu.be/U4zxis4NNSg

What budget does personal income tax go to?

Firstly, according to the Russian Tax Code in Article 13, personal income tax refers to federal payments, does this mean that it is paid to the federal budget? Each tax, and personal income tax, has strict details for being credited to the budget system - to the accounts of the Federal Treasury of Russia. At the same time, payers transfer funds according to the payment details of their inspection and according to a single BCC - it is common throughout the country.

Details of your inspection can be found through the service:

- You need to go to the page class=”aligncenter” width=”1016″ height=”560″[/img]

- The search takes place at your address.

- You can also search by Federal Tax Service number.

- Here is an example of payment details.

All BCCs are in the Federal Tax Service directory.

Please note that there are separate codes for tax, penalties, fines, etc.

Next, you need to rely on the Budget Code of Russia - it establishes to which budget, federal, regional or local, personal income tax is paid by citizens and transferred by employers:

- Article 56 of the Budget Code of the Russian Federation lists tax revenues of regional budgets - 85% of the personal income tax goes to the regional budget according to revenues in this subject of the country;

- Article 61 of the Budget Code of the Russian Federation states that the remaining % of personal income tax is paid to the local budget according to fees in rural and urban settlements, municipal and internal urban areas and urban districts.

To make sure that there are no income tax receipts in the federal treasury, you can look at Article 50 of the Budget Code of the Russian Federation - personal income tax is not included in the list of tax revenues. Regions and local self-education bodies adopt their own budget laws and distribute personal income tax collections depending on the needs of the territory.

You can view the specific amounts of tax revenue through the Federal Tax Service website - in the statistics and analytics section.

You have access to data up to 2006 inclusive.

Personal income tax: where to transfer

Employers need to know where personal income tax is transferred.

If funds are sent using incorrect details, the tax authority will record a tax arrears from the taxpayer (organization or individual entrepreneur). The result may be the accrual of penalties and fines, as well as a lengthy process of searching and returning funds. Taxpayers need to know to which budget personal income tax is paid. Since this is a federal tax, it is subject to transfer in full to the federal budget. At the next stages, all income tax funds received by the state are divided into two parts - 15% and 85%. Most of it is credited to the budgets of the constituent entities of the Russian Federation, the remaining 15% is divided between municipal budgets (Article 56 of the Tax Code of the Russian Federation).

Results

If you have questions or need assistance, please call Free Federal Tax Advice.

- Moscow and region

- St. Petersburg and region 8 (812) 467-43-82

- Other regions of Russia ext. 742

- Personal income tax is a federal payment, i.e. the entire list of its elements is established by the Tax Code of Russia.

- According to the Budget Code of Russia, 85% of income tax goes to the budgets of the constituent entities of Russia.

- The rest of the personal income tax goes to the local treasury.

If you find an error, please select a piece of text and press Ctrl+Enter.

If you have questions or need assistance, please call Free Federal Tax Advice.

- Moscow and region

- St. Petersburg and region 8 (812) 467-43-82

- Other regions of Russia ext. 742

I tried very hard when writing this article, please appreciate my efforts, it is very important to me, thank you!

(2 ratings, average: 5,00)

When paying an advance, we do not transfer personal income tax

The Labor Code establishes that all employers are required to pay wages at least every 15 calendar days. Therefore, in one month the employee must receive at least two payments: an advance payment and a final payment. In this case, the natural question is: when is personal income tax paid from a salary, and when from an advance payment?

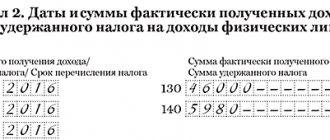

Officials determined that the obligation to pay income tax on the advance portion of wages depends on the date of payment:

- If the advance payment is credited before the last day of the calendar month, then income tax on the advance payment is not paid to the budget.

- If the advance share is transferred on the last calendar day of the month, then income tax from individuals is withheld and paid to the Federal Tax Service in the general manner.

Please note that at the end of the month, all payments transferred in favor of hired specialists must be recognized as income. And income tax must be calculated on income amounts, that is, on both advance and final payment of wages. If the advance is transferred before the last day of the month, then ND from individuals does not need to be withheld from the advance itself.

Personal income tax: which budget is credited to, who makes the deductions

One of the main tax fees levied on citizens of our country is personal income tax. In what budget this payment from the pocket of each Russian is credited is of interest to many, since all of us, of course, would like to see what favorable changes the money spent will contribute to. In addition, which budget to send personal income tax to is a predetermining question for each employing organization that withholds tax from its employees, and other organizations that need to independently pay tax on the income they receive.

Personal income tax: which budget is it included in?

Where to pay personal income tax

If we are talking about an individual entrepreneur paying his own personal income tax within the framework of the general taxation system, then it is also transferred to the place of registration of the individual entrepreneur based on his registration address.

These exceptions are discussed in detail in paragraph 7 of Article 226 of the Tax Code. So, if an organization has a separate division, then it will have to pay personal income tax at the place of registration of this OP. To what budget is personal income tax paid in this case? Everything is also in the federal one. But the tax agent will transfer it in two separate payments, to the Federal Tax Service Inspectorate for the parent organization and the inspectorate with which the separate division is registered. Accordingly, such an organization will have to keep separate records of salaries paid to employees of the main office and the additional one.

We recommend reading: Primorsky Krai Transport Tax 2020

To which budget is personal income tax credited?

The income tax levied on individuals has one interesting feature that distinguishes it from most other levies. Thus, it belongs to the category of federal taxes, that is, relevant for all residents of the country who receive money on its territory. However, contrary to all the usual norms, the money collected from it does not go to the Federation budget, but directly to the treasury:

Even being a payment established at the Federal level, personal income tax subsequently goes to the budgets of regions and cities, as well as other localities

In this case, the appropriate proportions must be observed: 85% to the region, and the remaining amount to the municipality.

By the way, due to such an unconventional distribution, it is always difficult to say what taxpayers' money will be spent on. The funds received from this collection are used universally; they can be used for:

- renovation of educational institutions;

- meeting the needs of the healthcare system;

- restoration of damaged highways, etc.

Pay attention to another interesting fact: when distributing the funds received to the city budget, the payment from a particular Russian will not go to the city where he lives, but to the city where he works, that is, he receives his income.

Personal income tax is the most famous of all payments to the treasury, since it is levied on absolutely every person

Tax on sick leave and vacation pay: before and after 2016

Let us immediately note that the deadline for paying income tax on sick leave and vacation pay and the deadline for paying personal income tax on wages until 2020 were the same.

The main changes in payment terms affected these two categories. Now it is necessary to pay personal income tax from them to the treasury before the end of the month, when payments for sick leave and vacation pay were made. Also see “How sick leave is paid in 2020.”

EXAMPLEIf an employee received vacation pay on August 4, 2020, then income tax on them must be paid until August 31, 2016 inclusive. Also see “Calculating vacation in 2020: examples.”

Another type of income that differs in the timing of tax transfer to the budget is dividends.

Based on the law, the time of transfer of income tax to the budget directly depends on what kind of organizational and legal structure the company has with ownership shares or that has issued shares and paid dividends on them to its shareholders - individuals.

| Company type | Deadline for income tax remittance | |

| From 2020 | Until 2020 | |

| OOO | No later than the day following the day of payment of dividends | The day on which the due dividends are credited to the bank accounts of individual shareholders, or the day on which the responsible person receives money from the bank intended for issuing dividends to shareholders |

| JSC | No later than one month from the date of payment of dividends | Within a month after the transfer of amounts due to shareholders |

When paying personal income tax on dividends for joint-stock companies in 2020, the deadline remained the same: within a month from the date of payment to the accounts of individuals.

As for LLCs, previously they were required to make contributions to the budget on the same day when they paid dividends. This period has now been extended by one day. That is, money can be sent the next day. Also see “Personal income tax on dividends”.

By whom and how is personal income tax transferred to the budget?

According to the Tax Code of our country, income tax payers are citizens who receive funds from a source located on the territory of the Russian Federation. However, they can belong to two different categories:

Tax Code of the Russian Federation Article 207. Taxpayers

A resident is a resident of our country who has a passport of a Russian citizen and permanent registration on the territory of the Russian Federation. At the same time, a resident receives or maintains his status by living in the country for at least 183 days a year. For residents of the Russian Federation, the so-called general rate applies to personal income tax, which is relevant at a given time. This year it is 13% of the income received.

Let's give an example: if a citizen, for example, has a monthly salary of 10 thousand rubles before deducting personal income tax, then he will receive 13% (that is, 1 thousand 300 rubles) less. It turns out that in the end there will be 10,000-1,300 = 8,700 rubles left for his expenses.

The most significant difference between the status of resident and non-resident is that representatives of each category pay completely different amounts to the state treasury from the income they receive in Russia

Based on the definition of a resident, one can easily say who he is – a non-resident. In fact, this is a person who left his homeland too often, and as a result did not accumulate 183 days of stay on its territory. The main difference between these two statuses in practice will be reflected in the amount of personal income tax paid.

If a person, due to a long and frequent absence from the territory of Russia, is recognized as a non-resident, then in this case the amount of income tax for him will be completely different.

Thus, the rate relevant for non-residents is 30% of income. Therefore, if our hero receives the same salary of 10 thousand rubles, even then after income tax he will have 30% (that is, 3 thousand rubles) less. Consequently, he will be able to manage the following amount: 10,000-3,000 = 7 thousand rubles.

Agree, the difference is quite noticeable. At the same time, in our example we consider an initially small amount of income. In those situations where this indicator is large, the citizen will have to give a much larger amount of money to the state treasury.

This tax must be paid only to those citizens who are employees of organizations located on the territory of our country, or who receive income from other sources also located on its territory.

Regardless of who the citizen is (non-resident or resident), in order for tax to be collected from him, it is necessary to have a source of incoming income on the territory of the Russian Federation.

Taxpayers can transfer tax revenue to the country’s treasury in various ways:

- in fact, without taking part in the process, through an intermediary - a tax agent, who is appointed by the employer organization of the individual;

- or independently, if the citizen receives funds systematically or one-time.

Personal income tax from advance

The Labor Code in Article 136 of the Labor Code of the Russian Federation establishes the payment of wages at least once every half month. The first part is known as an advance - salary for half the month worked. The second part is the rest of the salary for the second half. The interval between issues cannot be more than 15 days .

Employee income is subject to personal income tax. At first glance, it seems that income taxes need to be withheld twice a month. The first is from an advance payment, the second is from the remaining salary. But that's not true. There are two reasons.

Firstly, Letter of the Federal Tax Service No. BS-4-11/ [email protected] dated 05/26/14. It directly states: income tax is withheld from the full salary upon final payment once a month. That is, personal income tax is not paid on the advance .

Secondly, Letter of the Ministry of Finance No. 03-04-06/33737 dated July 10, 2014. The ministry shares the position of the tax authorities. Personal income tax can only be deducted from the full salary. Advance payments are not subject to income tax .

For example, an employee’s salary is 50,000 rubles. Advance - half the salary. As a result, he will be given 25,000 rubles in advance. From the second part, 6,500 rubles of tax will be withheld and 18,500 rubles will be handed over.

But there are exceptions to this rule:

- the advance was issued on the last day of the month - income tax is withheld and transferred the next day;

- the employee has a personal income tax debt - the amount must be withheld from the advance payment in favor of repaying the debt, while personal income tax is not charged on the advance itself;

- the employee was given income in kind or he received a benefit - this income is subject to personal income tax, which must be withheld from the next cash payment, even if it is an advance, and personal income tax is not charged on the advance itself.

What income is subject to personal income tax?

Unfortunately, residents of our country have a false understanding of what an individual's income actually constitutes. Therefore, the overwhelming majority of Russian residents actually violate the law by not transferring part of the funds received to them, bypassing the tax agent, to the state budget.

There is a list of income on which you are required to pay this tax fee, which you may not have previously been aware of. We advise you to study it carefully so as not to face legal consequences later.

Income is the total amount of funds received by a person, coming from certain sources. So, we are talking about money earned:

- when selling real estate that was owned by a citizen for less than 5 years from the date of its acquisition from the previous owner;

- on leasing any property, not necessarily real estate;

- from income whose sources are located outside the borders of our country;

- subsequently participating in any drawings (except for those cases when the organization raffling off the funds assumes the responsibilities of a tax agent);

- in the form of payment for work performed (also if the organization that provided the work did not assume the functions of a tax agent);

- Other income.

For the income indicated above, the same rate applies as for wages - 13% for residents and 30% for non-residents.

Of course, many will be outraged when they hear that they must contribute funds to the treasury even from cash prizes won. However, this is the law, and we, as law-abiding citizens, are obliged to follow it. In the end, the funds transferred to the state will subsequently go directly to the improvement of our country.

Tax payments are made in an official manner by entering the correct budget classification codes in the relevant documentation

Where does personal income tax go to what budget?

Municipal budgets are also formed from federal taxes, but classified as local. The most important and significant for local revenues is the personal income tax, known to everyone as personal income tax.

For payments taxed at a rate of 13 percent, the base is reduced by so-called tax deductions. In this case, you need to sum up all taxable income, subtract tax deductions, and multiply the resulting figure by 13%. If it turns out that there is less income than deductions, then the base is taken equal to zero.

Standard personal income tax deductions apply only to income received from one of the employers of the taxpayer's choice. In other words, if a person works two or more jobs, he can only take the standard deduction for one of them.

What regulations regulate personal income tax?

What articles should you study:

| Regulatory acts | Comments |

| Article 207 of the Tax Code of the Russian Federation | Taxpayers |

| Art. 217 Tax Code of the Russian Federation | Income not subject to taxation |

| Article 218 of the Tax Code of the Russian Federation | Standard tax deduction |

| Article 219 of the Tax Code of the Russian Federation | Social tax deduction |

| Article 220 of the Tax Code of the Russian Federation | Property tax deduction |

| Article 224 of the Tax Code of the Russian Federation | Determining the tax rate |

| Art. 226 Tax Code of the Russian Federation | Features of tax calculation, incl. organizations with separate divisions. The procedure and deadlines for paying personal income tax, |

| Art. 56, Article 61 of the Budget Code of the Russian Federation | Distribution of personal income tax by budget |

Which budget to pay personal income tax to: tax transfer procedure

Local taxes include fees introduced by local governments. They are also binding, meaning they must be paid. They are paid to the local tax authorities.

This tax rate can be reduced by local governments for certain categories of taxpayers, but only to 13.5%.

Tax transfer is carried out by enterprises within the established time limits according to budget classification codes depending on the category of income of the taxpayer. After this, the Treasury independently distributes payments to the appropriate budgets according to the classifier of territorial entities.

Your 13% is not distributed between funds; all of it goes entirely to the local budget and is spent on the needs of the municipality and its population. Here are approximate items of expenses that include your 13% income tax.

If income is received on an ongoing basis from one source, which is the employer, then the responsibility for calculating and paying tax falls on this employer-tax agent.

Professional deductions are equal in amount to documented expenses associated with the relevant activity.

So, let’s look at how, according to the Tax Code (hereinafter referred to as the Tax Code of the Russian Federation), all individuals are divided into categories of taxpayers.

Previously, this was done no later than the day on which the money was issued. Employers are required to withhold personal income tax from the earnings of employees and transfer it to the state treasury.

What happens if you don’t pay personal income tax?

The Russian Tax Code clearly establishes sanctions that will be applied to both the tax agent and the individual in the event that personal income tax is paid late or the transfer of funds to the state treasury is completely ignored.

Timely payment of taxes is controlled by law

Thus, tax agents who delay in transferring funds may receive a fine of 20% of the tax amount itself. The state will “charge” the same interest on top if the money is not transferred at all or the calculation is incomplete. Also, arrears and penalties may be withheld from the defaulter. But there is a nuance - if labor income is paid to employees in kind, it is impossible to collect taxes from them, and delay in tax payment, accordingly, cannot happen either. Another point is that the tax agent did not withhold personal income tax from the employees’ income. In this case, he will also face a fine, but without a penalty.

As for individuals, they may also receive a fine of 20% of the tax amount in case of incomplete payment or non-payment. But the law provides for another penalty for deliberate underestimation of taxable income. If an individual specifically indicates a smaller amount in the declaration, he will be subject to a fine of 40% of the actual amount. The law also exempts individuals from fines in case of late payment. But penalties for personal income tax for late payment will be charged.

Didn't manage to submit your declaration on time? Do you want to know what the consequences are for failure to submit reports on time? Read more about the statute of limitations for tax offenses and how to reduce the amount of the fine in our article.

To which budget is personal income tax credited?

Today, the state policy regarding the tax system has changed, many local taxes have been abolished, and the share of collected taxes in the total income of the regions is small.

Not all types of income received by individuals in the Russian Federation (or abroad, as described above) are subject to income tax. According to the current tax legislation of the Russian Federation, tax is calculated in the form of a certain percentage, which is taken from the total aggregate income of a citizen of the Russian Federation, with the exception of expenses that have been documented. So who are the persons who must pay personal income tax to the state budget?

Personal income tax is one of the list of mandatory fees. The main purpose of such taxation is to replenish the state treasury. But to which budget is personal income tax credited in 2018?

According to the law, all income tax collected must go to the budget of your city, and there this amount is already distributed at their discretion for housing needs, for medical needs, and the money also goes to the salaries of those persons who are paid by city departments.

Personal income tax, or personal income tax for short, is a type of direct taxes in the Russian Federation, which is one of the main fees.

The conditions are completely simple, regardless of whether the calculation is made by the payer himself or his tax agent.

Personal income tax, or personal income tax for short, is a type of direct taxes in the Russian Federation, which is one of the main fees.

The state system has legislatively established not only the tax base, but also a graduated system of tax rates. These are five levels of rates, each precisely corresponding to a certain type of income received.

The modern type of development of the tax system is focused on already proven schemes that have successfully shown themselves in other countries. Most of the funds that go to the federal budget are planned.

Budget for personal income tax: regional or federal?

Income tax is a very significant fee for any country, not only Russia. Due to these payments, the state treasury receives very significant cash injections, which can be compared with revenues from income taxes or VAT. Let’s figure out what level the personal income tax in Russia should be assigned to.

The tax system of our country involves three types of taxes: federal, regional and local. Which classification the tax will be assigned to depends on the level of the government agency introducing mandatory payments. According to Article No. 23 of the Tax Code of the Russian Federation, the tax on labor income is federal. The principle of this classification is based on the fact that personal income tax is a fixed tax, the payment of which is carried out in the same and unchanged way in all settlements of the country without exception. This is the difference between taxes classified as federal and regional. The latter are legislatively prescribed very imprecisely, and local authorities can establish specific features and nuances of such payments, based not only on federal laws, but even on their own regulations.

However, personal income tax does not go entirely to the federal budget. According to the law, only 85% of the total tax funds paid goes to the budget of Russian constituent entities. An exception is made for taxes paid by foreigners who work in Russia under a patent - in this case, the money is credited to the subject budget 100%.

The remaining 15%, according to the Budget Code of Russia, must be credited to local budgets; then they will be distributed depending on the administrative structure of this subject. So, if the subjects have rural settlements divided into municipal districts, the former will receive two percent of the amount, the latter – thirteen percent. If the territory of the subject includes urban settlements, then ten percent of personal income tax will be transferred to their budget, the municipal districts within them will receive the remaining five percent.

Income tax rate in 2020

These are those who have switched to UTII, simplified taxation system, unified agricultural tax or those involved in the gambling business, as well as foreign organizations operating through representative offices and receiving income in the Russian Federation.

If, at the end of the calendar year, expenses exceed income, then the tax base is assigned a zero value.

Since 2020, it has been established that tax agents are required to pay personal income tax for their employees no later than the day following the day of actual receipt of income (salary) and no later than the end of the month in which benefits related to disability and vacation pay were issued.

- salary for official employment;

- payment for work performed under GPC contracts;

- dividends;

- insurance payments;

- income received from the disposal of property;

- income from the sale of real estate or other valuable assets;

- other income received from activities in Russia or abroad (for residents).

Now the rules have changed - for salary income it is transferred no later than the next day after the day it was issued, and for vacation pay and disability benefits, which are accrued from the employer’s funds, it is transferred on the last day of the month when they were paid.

Personal income tax, or personal income tax, applies to absolutely all individuals. According to the law, individuals mean Russians and foreigners, adult citizens and minors, women and men, that is, absolutely everyone.

Payment of income tax is carried out at the place of registration of an individual or tax agent.

To calculate personal income tax, you need to determine the tax base (that is, the amount of taxable income) and multiply it by the appropriate tax rate. As a result, you will receive the personal income tax amount. For income subject to different rates, the bases are determined separately. Please note: the tax base for dividends must be determined separately from other income.

In addition, this also includes interest on funds received from members of the agricultural cooperative in the form of a loan, again to the extent that it is proven that the established amounts have been exceeded.

For citizens, the obligation to pay income tax arises when they receive income not related to official employment.

Individuals receiving income (cash) are required to give up part of it in favor of the state budget at a set rate. This alienated part is considered an income tax, which is direct and basic for the entire population of Russia.

- Persons conducting private practice (lawyers, private detectives, notaries).

- Persons who received unearned income from the sale or rental of property.

- Citizens whose income is transferred from sources outside the country.

- IP-schniks.

- People who received remuneration from a source that does not have the status of a tax agent.

- Heirs of the authors of inventions, works of science or art, receiving rewards.

- Citizens who have won money in risk-based games (lotteries).

Individual entrepreneurs and persons engaged in private practice (notaries, lawyers, etc.) themselves account for income from their activities, calculate personal income tax and pay it to the budget.

The tax system is an economic lever that allows you to regulate the state of social production, dynamics and structure, and influence scientific and technological progress.

Procedure for calculating personal income tax 2017

To determine the amount of personal income tax that needs to be transferred to the state treasury, it is necessary to carry out calculations using the following formula:

Personal income tax = Tax base * personal income tax rate

The tax base refers to the following types of income:

- dividends;

- wages;

- prepaid expense;

- vacation pay;

- sick leave payments;

- vacation compensation upon dismissal;

- income from the sale of property or its rental;

- winnings and prizes;

- other types of taxable income approved by the Tax Code of the Russian Federation.

The deadlines for transferring income tax on income vary. They are also approved by the Tax Code of the Russian Federation. Penalties are provided for their violation.

To what budget is personal income tax paid?

He independently calculates the amount to be withheld and transfers it to the budget. The employee already receives a “net” salary.

Thus, in this case, even mutual overpayments or arrears of personal income tax related to one employee, but lasting, say, a couple of months, can cause problems for the employer. Indeed, in this case, he violates the basic rule of the tax agent: withhold tax when paying a specific income to a specific individual.

Therefore, unfortunately, there can be no talk of offsets between personal income tax and other taxes that this employer pays.

A business accountant withholds 13% income tax on your income on payday. The next day, this tax is transferred to the Federal Treasury Department to a single current account.

Where is personal income tax transferred?

As already noted, personal income tax is paid at the place of registration of the legal entity. faces. In the case where a company has a separate division, the pressing question arises, where is personal income tax transferred? Let us answer that those employed in a separate division of an individual pay tax at the actual location of this division.

Legal entities acting as employers are required to make calculations and deductions of personal income tax amounts when calculating and actually transferring wages to the bank accounts of their employees. Accordingly, they are tax agents, and taxpayers are individuals who received income. In our article we will look at whether the actual place of residence of the taxpayer depends on where personal income tax is paid? We will also find out what details are required to transfer personal income tax in 2020?

17 Dec 2020 uristland 209

Share this post

- Related Posts

- Can I, as a single mother, apply for child support if the father is listed in the certificate?

- Judicial practice on alimony 2020 from 16 to 18 when a child is married

- Bailiffs resolve alimony debt

- How a young family can get a housing subsidy

Where do personal income taxes go to what budget?

If your employer forgot to withhold tax or if you do not have a tax agent, you will have to pay the tax and report the income yourself.

It is important to understand that residency and citizenship have nothing in common. A foreigner who lives in Russia for most of the year, works here and receives income can also be a tax resident.

The benefit received in kind by each individual should be personalized. However, if tax authorities, when conducting audits, calculate taxable income for each employee by distributing expenses in proportion to the number of participants in the event, this does not correspond to the current edition of the Tax Code of the Russian Federation [4].

In subjects with territorial division into urban districts, the entire remaining amount is credited to the budgets of these districts.

Personal income tax payment deadline in 2020

In paragraph 9 of Art. 226 of the Tax Code of the Russian Federation states that a tax agent does not have the right to pay tax from his own funds; personal income tax is always paid at the expense of the individual’s income. Therefore, even if an accountant mistakenly transfers the entire amount of dividends without withholding tax, he will be able to pay tax only if the recipient of the dividends returns the corresponding amount. Otherwise, you will either have to withhold the missing tax from the next payment, or at the end of the year, notify the tax authorities of the impossibility of withholding personal income tax.

This paragraph deals with calculated and withheld tax. What does this mean for payroll taxes? This means that there is no need to pay personal income tax on advance payments, since the tax is calculated when income is calculated; for salaries, this means the end of the month; it is the last calendar day of the month that the accrual of salaries is reflected in accounting.