From January 1, 2020, a new tax will appear in Russia to “withdraw their shadow” from self-employed citizens. It is being introduced within the framework of the new special tax regime “Professional Income Tax” (hereinafter referred to as the “NPT”). Who will be required to pay the new tax? What is the amount of the new tax? Is it beneficial for individual entrepreneurs to switch to paying NAP to the simplified tax system or UTII? What kind of receipts into bank accounts are subject to the new tax? How are tax authorities going to control the income of individuals? What happens if you ignore payment? We have studied the package of bills on the new tax and offer a short overview.

Start of the experiment on “coming out of the shadows” on January 1, 2020

On January 1, 2020, an experiment will start in Russia, within the framework of which a new taxation system, “Professional Income Tax,” will be introduced into the tax system. This is done to legalize the income of self-employed citizens who, in fact, are engaged in “shadow business” and do not pay any taxes (in particular, they hide income from renting out apartments).

The draft law is also posted on the State Duma website.

The experiment is planned to be carried out from January 1, 2020 to December 31, 2028 in 4 pilot regions:

- Moscow;

- Moscow region;

- Kaluga region;

- Republic of Tatarstan.

Changes for 2020.

From January 1, 2020, amendments to Law 422 will come into force. The general terms and conditions remain the same. However, the list of experimental subjects has been increased to 23 regions. In turn, to the above were added:

1. Areas:

- Voronezh;

- Volgogradskaya;

- Leningradskaya;

- Nizhny Novgorod;

- Novosibirsk;

- Omsk;

- Rostovskaya;

- Samara;

- Sakhalinskaya;

- Tyumen;

- Sverdlovskaya;

- Chelyabinskaya;

2. Edges:

- Krasnodar;

- Permian;

3. Federal Law cities:

- Saint Petersburg;

4. Autonomous okrugs:

- Nenetsky;

- Khanty-Mansiysk;

- Yamalo-Nenets;

5. Republics:

- Bashkortostan;

According to experts, during 2020 other regions will be included in the composition of taxable entities under the NAP. But by the end of the year, coverage throughout Russia will become one hundred percent.

What income will be subject to NPA?

The new tax system provides that income from professional activities will be taxed.

Such income can be received from the sale of goods (work, services, property rights). Professional income is the income of individuals from activities in which they do not have an employer and do not engage employees under employment contracts.

(Clause 2 of Article 2 of the Law). However, the following are not subject to the new tax:

- income from employment relationships;

- income from the sale of real estate, vehicles;

- income from the transfer of property rights to real estate (except for rental (hiring) of residential premises);

- income from the sale of property that was used for personal, household and (or) other similar needs;

- income of self-employed citizens from individuals for the provision of services to them for personal, household and (or) other similar needs specified in paragraph 20 of Art. 217 of the Tax Code of the Russian Federation (apparently, we are talking about self-employed citizens - tutors, nannies, etc.).

- income from the performance by individuals of services (work) under civil contracts in which the customer of the services (work) is the employer of the specified individual or a person who was his employer less than 2 years ago (most likely, the period of “two years” is introduced for in order to exclude the possibility of dismissing employees for the purpose of concluding agreements with them as NPA payers).

- income in kind.

Non-payment of tax: liability and monetary punishment

The Russian Tax Code reflects provisions containing the responsibilities that taxpayers bear. In case of violation of the rules and deadlines for transmitting to the tax service information about the calculation carried out regarding the receipt of profit from the production or sale of products (provision of services or work performed), which are the object of NPA taxation, it is expected to issue a fine of 20% of the available profit . If this type of violation is repeated within six months, the amount of penalties will be equal to the amount of income received. Minor citizens who carry out professional activities are also obliged to pay tax on the income tax.

I recommend:

- Debit multicard from VTB: conditions, nuances, pitfalls

- Passive income, options: top 26 types and sources of income, schemes, examples

- Small business: ideas for beginners (top 13 startup options)

- VTB mutual funds: profitability, conditions and investment prospects, reviews

- Investments in Sberbank for individuals: personal account + trading platforms + reviews + tips on how to start earning money

Tax rates for the new tax and tax period

The tax period for the new tax is a calendar month. Accordingly, the income received is taken into account as part of the tax base on a monthly basis.

The tax rate for the new tax is provided in the amount of:

- 4% – from income received from the sale of goods (work, services, property rights) to individuals;

- 6% – from income received from sales to individual entrepreneurs and legal entities.

Let’s assume that in 2020 a freelance designer provided design services to another individual in the amount of 3,000 rubles. The tax on professional income will be 120 rubles (3000 rubles x 4%). And if exactly the same service was provided to a legal entity or individual entrepreneur, then the tax would be 180 rubles (3000 rubles x 6%). At the same time, income received within the framework of the NAP will not be subject to personal income tax!

The income threshold at which you can use the new special tax regime is no more than 2.4 million rubles per year. If the annual income exceeds the limit, then the right to it is lost.

Amendments to the Budget Code (BC) clarify that tax revenues from the payment of tax on professional income are subject to distribution to both the federal and regional budgets:

- at a tax rate of 4% - 62.5% will be transferred to the regional budget and 37.5% to the federal budget;

- at a tax rate of 6%, the regions will receive 75%, the federal budget - 25%.

How to generate a financial report in the application

Generating reports is not at all difficult. As soon as you receive the money (it doesn’t matter - in cash or by bank transfer), you generate a check in your electronic application, where you write down the amount and type of service. If the information is incorrect, the check can be corrected or corrected, or canceled if the money had to be returned.

Tax is automatically calculated on the amount written out, which can be seen right there. Money is written off before the 25th of the next month.

If there are no completed payments, no tax will be charged.

Upon termination of self-employed activity, registration can be revoked.

Who can switch to paying the new tax

The following can take part in the experiment on “coming out of the shadows” and paying the NAP:

- ordinary individuals;

- individual entrepreneurs.

An important condition is that in order to join the experiment, the place of activity must be the experimental territory (that is, Moscow, Moscow and Kaluga regions or the Republic of Tatarstan). However, the commented law does not disclose the concept of “place of business”. How can you understand where exactly services are provided if a person is registered with a passport, say, in Yekaterinburg, but periodically stays in Moscow and provides some services in the capital?

What about those who provide their services or sell goods online? (for example, freelancers or Instagram store owners). The law stipulates that in order to participate in the experiment they must be physically located in the experimental regions. That is, in fact, they must sit at the computer, for example, in Moscow, the Moscow or Kaluga region, the Republic of Tatarstan (paragraph 2, paragraph 1, article 2 of the Law). But how can tax authorities check this? There is no clarity on such issues yet.

The transition to the new regime for individual entrepreneurs is voluntary. The main condition for individual entrepreneurs is the absence of employees under employment contracts. At the same time, it is important to understand that when switching to this special regime, businessmen do not lose their “individual entrepreneur” status and are not required to be deregistered as an individual entrepreneur. They retain this status, but simply switch to applying a new special tax regime.

Place of business

The law determined that the new tax on professional income is valid only in 4 regions for those who operate there. What does “doing business” mean?

There are no official explanations for this term yet, but in my opinion this phrase should be taken literally:

- An information businessman (one who teaches online) conducts activities where the place from which he broadcasts is located; or a place where a person is physically located. Here you can tell me: “I travel constantly, broadcast from different countries, and write texts on the plane, so where do I operate?” I will assume that it is better for you to choose as your place of business your place of permanent registration or your place of permanent or temporary residence (place of permanent or temporary registration).

- The needlewoman carries out activities where she knits/embroiders things. By default, we consider the place of registration/registration to be such a place.

- The programmer operates where his computer is located. There is also another opinion that a programmer can be in Thailand and work remotely, and receive money for sold programs to an account in Kaluga. In this case, Kaluga may be considered the place of business. And I rather agree with this position.

- A truck driver operates where he lives or where he works.

You yourself determine the subject where you operate and indicate this place when switching to the special regime. Changing the location is allowed no more than once a year. If you change location, inform the tax authorities by the end of the next month.

You must be prepared to prove that you are operating in this region. Temporarily reside in another region - in some cases you are required to obtain temporary registration (and in some cases this is not necessary). For a temporary stay of up to 90 days, citizens of the Russian Federation do not have to bother with registration.

Do you have doubts and want to know more precisely what will be your place of business and whether you have the right to apply this tax? The best option would be to write a request to the Federal Tax Service Central Office and save an official response on your specific situation. The official answer does not eliminate additional taxes, but it does eliminate fines and penalties.

Who is not entitled to apply the new tax regime

The draft law provides for a number of exceptions. In particular, the following will not be able to switch to the new tax regime:

- persons engaged in the sale of excisable goods and goods subject to mandatory labeling;

- persons engaged in the resale of goods, property rights, with the exception of the sale of property used by them for personal, household and (or) other similar needs;

- persons engaged in the extraction and (or) sale of mineral resources.

- persons carrying out entrepreneurial activities in the interests of another person on the basis of agency agreements, commission agreements or agency agreements, with the exception of persons providing services for the delivery of goods and acceptance (transfer) of payments for the specified goods (works, services) in the interests of other persons.

- Individual entrepreneurs applying other tax regimes. Those. it will not be possible to combine NPD with the simplified tax system, UTII and even OSNO ;

- taxpayers whose income taken into account when determining the tax base exceeded 2.4 million rubles in the calendar year.

Thus, if an individual (IP), for example, purchases goods in China and then resells them in Russia, then they have no right to switch to paying “professional income tax.” In such a scheme, there is the fact of “resale of goods”. And this circumstance prohibits the use of NAP

Types of activities falling under the NAP

The new tax system is not suitable for everyone. Only individual entrepreneurs without employees and individuals providing services and/or selling goods of their own production, registered in the prescribed manner, will be able to apply it.

There are no restrictions on types of activities. It can be anything that is not prohibited by law.

Federal Law 422 specifies only persons who do not have the right to apply NAP. Watch this video for more details:

https://youtu.be/m6HoJYXZ7-k

This special mode has become the most popular among:

- representatives of the beauty industry (hairdressers, cosmetologists, manicurists);

- consumer service workers (shoemakers, window cleaners, seamstresses, household appliance repairmen, photographers);

- tutors;

- translators;

- vehicle repair and maintenance specialists.

Buyers will be required to issue receipts

When making payments using the “My Tax” mobile application, a fiscal receipt will be issued, the data of which will be automatically transmitted to the tax authority.

The check can be transferred to the buyer “on paper” or electronically (for example, sent by mail or offered to scan the OR code).

Please note: the TIN is provided as a mandatory element of the check. This means that each buyer of work or services will need to ask for an INN. If there is no number, then you will not be able to issue a check. Using the TIN, tax authorities will be able, in particular, to understand whether an individual (buyer) is an individual entrepreneur. And determine the tax rate correctly.

The check must be generated and handed over to the buyer at the time of payment in cash and (or) using electronic means of payment. For non-cash payments, the check must be generated and handed over to the buyer no later than the 9th day of the month following the month in which the payments were made.

Please note that failure to issue checks to buyers - legal entities and individual entrepreneurs - will deprive them of the right to reduce tax (for example, simplified tax system) on the purchase of goods, works or services from tax payers.

Also under consideration in the State Duma is another law that, starting in 2020, will introduce liability for violations in the generation and transmission of data through the “My Tax” mobile application. It is proposed to add Article 129.13 to Part One of the Tax Code, which establishes liability for this.

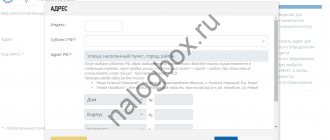

Registration - no, there is registration

Law No. 422-FZ determines that registration of an individual and/or individual entrepreneur as an NPD taxpayer is carried out using the My Tax . Registration is also possible through an authorized credit organization that carries out information exchange with the Federal Tax Service, without a visit to the tax authority.

The My Tax app is the main tool for the self-employed

“My Tax” is the official application of the Federal Tax Service of Russia for tax payers. Designed for mobile devices on the iOS (download: App Store) and Android (download: Google Play) platforms. It helps you register * and work under a preferential special regime - Professional Income Tax , which is often called a tax for the self-employed . After installing the application you can:

- Register as a taxpayer and also deregister

- generate and send a check to the client

- keep track of taxes

- receive notifications about payment deadlines

- generate a certificate to confirm income

For more details, see materials about the “My Tax” application...

See also: How to use the “My Tax” mobile application

* Note: In Federal Law No. 422-FZ, the term “registration” is not used. It is used by the My Tax application.

Foreign citizens on NAP. Features of using the special mode

Foreign citizens from countries that are members of the Eurasian Economic Union have the right to apply the NAP on the same conditions as Russian citizens. Citizens of other states that are not members of the EAEU cannot apply the special regime - Professional Income Tax.

Citizens from Belarus, Armenia, Kazakhstan and Kyrgyzstan can register as an NPA taxpayer through the “My Tax” mobile application or the personal account of a self-employed person. However, you cannot register using your passport. Registration is possible only with an INN and password to access the personal account of an individual taxpayer (LC FL).

Access to your personal account can be obtained at any Federal Tax Service Inspectorate, which is responsible for receiving citizens, simultaneously with tax registration and assignment of a Taxpayer Identification Number (TIN). When applying, you must have an identification document with you.

New tax calculation

The tax authorities themselves will calculate the amount of the tax return based on the data entered into the “My Tax” mobile application. In this case, a tax deduction is provided, which will depend on the tax rate. If income is paid at a rate of 4%, then the deduction will be 1% of income. If a 6% rate is applied, then the deduction is larger - 2% of income. However, in both cases, the deduction cannot be more than 10 thousand rubles per month.

Tax base expenses for NAP will not be reduced.

The new tax regime does not provide for the payment of insurance contributions to extra-budgetary funds. You will only need to pay tax: 4 or 6 percent on income. However, tax payers are given the right to pay insurance contributions for compulsory pension insurance on a voluntary basis with a limitation on the maximum amount of such contributions. So far, such a “maximum” size is unknown.

Benefits for taxpayers

As mentioned earlier, NPD is an additional special regime. What benefits do payers of this tax have? Individuals do not pay personal income tax on those sources of income that fall under the terms of the NAP.

Individual entrepreneurs do not pay:

- Personal income tax on the profit that is subject to personal income tax;

- VAT (except for the tax when importing goods into the territory of the Russian Federation);

- established insurance payments.

Individual entrepreneurs acting on behalf of NAP taxpayers are not payers of fixed insurance payments. Other special tax regimes imply the payment of insurance payments, even if there is no profit. If there is no profit during the tax period, there are no minimum, mandatory or established payments. At the same time, NAP taxpayers are full participants in the compulsory medical insurance system and have the right to count on payment of sick leave.

Under what conditions can I receive a tax deduction?

PERSONS using NAP can count on a reduction in the amount of tax by the amount of the tax deduction, which should be within 10,000 rubles.

How tax authorities will control income

No reporting will be required under the new special regime. Thus, in particular, reporting on income received as part of the application of the NAP is not provided. But a reasonable question arises: how then will tax authorities control the amount of income received? Apparently, tax authorities will rely only on income information that a person himself entered into the “My Tax” application.

However, do not forget that tax authorities have other ways to control the movement of funds through accounts. So, for example, there are increasingly rumors that tax authorities are already monitoring transactions on all bank cards.

Minors and NAPs – are they required to pay tax + types of activities

Minors aged 14-18 years, like adult capable citizens, have the right to become payers of professional income tax.

Let's consider in what cases this is possible:

- Upon provision of written consent from the legal representatives of the teenager: parents, adoptive parents or guardian (clause 1 of article 26 of the Civil Code);

- When concluding a civil marriage (clause 2 of article 21 of the Civil Code of the Russian Federation);

- When a teenager is recognized as legally competent by a decision of the guardianship and trusteeship authority or the court (Article 27 of the Civil Code of the Russian Federation).

These three conditions apply to those types of activities that do not require registration of individual entrepreneurs and fall under the law of self-employed people.

The procedure for calculating and paying tax for self-employed minors is the same as for adults.

What is important for individual entrepreneurs to know: answers to questions

Question about renting out an apartment to an individual entrepreneur

The current individual entrepreneur applies the simplified tax system with the object “income”. At the same time, he rents out his personal apartment to an individual, but does not pay the simplified tax according to the simplified tax system. Can individual entrepreneurs start paying professional income tax on income from renting out an apartment in 2020 in order to “come out of their shadow” on this income?

Answer: You cannot combine NPD with the simplified tax system. Therefore, an individual entrepreneur can begin to pay a “simplified” tax on income from renting out his apartment at a rate of 6 percent. Or another option is to switch to paying NAP and pay a new tax from 2020 at a rate of 4 percent.

Note that NPT payers who rent out their apartments will not lose either the right to a property deduction under subparagraph 4 of paragraph 2 of Article 220 of the Tax Code of the Russian Federation, nor the right not to pay tax at all, if the conditions of paragraph 17.1 of Article 217 of the Tax Code of the Russian Federation are met. However, if the owner of the apartment was previously an entrepreneur and had already rented out the apartment as an individual entrepreneur, then he will not be able to take advantage of either the deduction or the right not to pay tax when selling the rented apartment

Question about insurance premiums for individual entrepreneurs

Individual entrepreneurs pay insurance premiums every year. Since 2020, this amount has increased again. For individual entrepreneurs, this amount is significantly affordable. If you maintain your individual entrepreneur status and switch to paying NAP from 2020, will you still need to continue paying insurance premiums? Also see “ Insurance premiums for individual entrepreneurs from 2020: sizes .”

Answer: Individual entrepreneurs using NAP have the right not to pay pension and medical insurance contributions. That is, if you switch to NAP from 2020, you can save on insurance premiums. However, remember that the income threshold at which you can use the new special tax regime is no more than 2.4 million rubles per year. Also, NAP cannot be applied to all incomes (see above).

How can an individual entrepreneur switch to paying NAP?

How can an individual entrepreneur switch to paying the new tax?

Answer: Individual entrepreneurs using special regimes (for example, simplified tax system or UTII) can switch to NAP at any time after January 1, 2020. If they decide to abandon the NAP, they will be able to return to another special regime immediately after the refusal. You will only need to submit an application (notification) to the Federal Tax Service.

Progress of the experiment. Interest of regional authorities, individual entrepreneurs and self-employed

Pardon the pun, but it’s hard to make a mistake by calling the NAP, a tax for the self-employed, “ the most interesting tax .” After all, the experiment aroused very keen interest not only in regions where a tax on professional income is in effect; it can be applied to citizens and entrepreneurs, but also in other regions of the Federation that are not participating in the experiment. Entrepreneurs often agree that NPD is close to “IP on the simplified tax system” and carefully weigh all the pros and cons. Many immediately see clear benefits in the transition to the application of tax on professional income. Some are even trying to find an opportunity to apply NAPs by conducting activities on the territory of constituent entities of the Russian Federation that are not included in the experiment.

The authorities of regions not participating in the experiment are also showing interest in the special “tax on professional income” regime. In particular (according to unverified data), the Sverdlovsk region submitted an “application” to participate in this experiment. And the authorities of Udmurtia also decided to “seek” the introduction of a special tax regime for the self-employed in the republic.

The list of participants may expand in 2020

about the likely expansion in 2020 of the list of participants in the experiment to establish a special tax regime “ Tax on Professional Income ”. According to him, since the law came into force, several constituent entities of the Russian Federation have already applied to the Chamber of Regions, wishing to join Moscow, the Moscow and Kaluga regions, and Tatarstan.

Progress of the ten-year experiment Tax on professional income - participants of the experiment - those wishing to participate Moscow and the Udmurtia region Kaluga region. Tatarstan Sverdlovsk region

It is expected that by July 1, 2020, the information necessary to make a decision on a possible increase in the list of participants in the experiment will be received. Therefore, the State Duma and the Federation Council may adopt appropriate amendments to Law No. 422-FZ during the spring session. In addition, the Federation Council believes that the NAP is a very successful experiment and should be extended to the entire country in 2020.

“By the autumn session, the Federal Tax Service of Russia will be ready to expand the experiment on introducing a tax on professional income. Requests for expansion are already coming in and are being processed.”

Interim results of the experiment. Who is next?

That is, it’s interesting, and the tax is interesting. We will try to monitor the progress of the experiment and mark on our map the subjects of the Federation whose leadership wants to join the experiment and is making certain efforts to do so.

E. Bushmin also spoke about the results of the first three weeks of the experiment, with reference to incoming data from the tax service. In particular, he said that the most active self-employed are taxi drivers.

“There is nothing surprising in this; we predicted such a turn a year ago, when we first started drafting the bill,” said Evgeniy Bushmin. — In second place are persons renting out their apartments. It must be said that the measure will really help civil servants, who are currently forced to pay 13% of their income from renting out housing. Let me note that we are not talking about managers, but about ordinary workers who cannot boast of large salaries. They are prohibited by law from becoming self-employed in order to minimize their expenses, but they can become self-employed. Third place, according to statistics, is occupied by citizens who earn money by cleaning apartments, followed by tutors.”

"Parliamentary newspaper"

Entrepreneurs are self-employed

During the first four months of the experiment to introduce a tax on professional income, about 35 thousand NAP payers were registered with the Federal Tax Service of Russia. Including about 6 thousand individual entrepreneurs who switched to this special regime. That is, every sixth registered Russian self-employed person previously worked as an individual entrepreneur.

This is a significant share, but far from a massive “exodus of individual entrepreneurs.” The main reason for the transition of individual entrepreneurs to self-employment is quite obvious and predictable. This was stated by the Head of the Federal Tax Service of Russia M. Mishustin at a government hour with the Federation Council.

https://youtu.be/0_yvCiN80Fw

Preferences for self-employed

Self-employed people can receive additional incentives and preferences, in particular access to government procurement. In addition, the Russian Ministry of Finance is preparing proposals for a moratorium on inspections of the self-employed - a five-year supervisory holiday.

According to the head of the Ministry of Finance of the Russian Federation A. Siluanov, quoted by RG with reference to Interfax, the self-employed, including potential ones, need some incentives. One of them could be supervisory holidays.

“I think the period should be at least 5 years, so that during this period we do not carry out control and supervisory activities over the work of these entrepreneurs”