Recalculation of wages may be required due to any changes in the assignment of the salary level, as well as in case of overpayment or underpayment of funds to the employee for work in the organization.

Recalculation of wages can be carried out:

- At the initiative of the employer, if a counting error was identified and the employee was notified accordingly. In this case, the employee of the organization is asked to return part of the funds or deduct them from the next salaries, and also, in case of underpayment, receive the missing amount of earned funds.

- By a court decision, if an employee went to court to recover the missing part of wages from the employer, and the court made an appropriate decision.

- According to the court decision, if the employer went to court to forcefully collect the overpaid amount, and the employee refused to return it for any reason, including through deductions from the next months wages.

An employer can “forgive” an employee’s debt on his own initiative if the amount of the debt is small. Most often, overpaid funds are written off as a bonus, so there are no difficulties with registration. However, providing an employee with the opportunity to dispose of overpaid funds is the employer’s right, and not his obligation, therefore, at any period of time, the organization may demand the return of overpaid funds.

Salary recalculation is required:

- when changing the amount of wages for all employees or a specific employee;

- if a counting error occurs that leads to incorrect results of earned funds;

- when paying an advance or funds to pay expenses on a business trip in an amount that exceeds the employee’s actual expenses.

The legislation limits the possibilities and features of recalculation of wages, so employers cannot take advantage of the far-fetched possibility of recalculation for “savings”.

Salary change

Changing the salary amount is a legally established possibility of registering a recalculation based on new data. Adjustment of the salary level must occur in full compliance with current legislation with the use of information about the financial capabilities of the organization.

At the end of each year, the financial department of the enterprise analyzes the financial viability of the organization and puts forward a proposal to increase wages, based on the indexation data of the minimum wage and the total income of the enterprise. The current financial situation in the country guarantees an increase in the minimum wage, as the cost of products and essentials necessary for human life is systematically increasing.

Wage indexation is not the responsibility of the employer, except in cases of payment according to the minimum wage established in the region. If the salary of employees is above the minimum level, the employer can independently determine whether to increase the income of employees or not. In the case of indexation, wages are recalculated for a specified period, and the amount of funds is paid additionally to each employee.

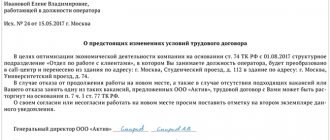

Changes in wage conditions

The amount and procedure for remuneration are essential terms of the employment agreement. And with any adjustment to the agreements, the employer must not only reflect the changes in the contract. A salary recalculation is also required.

Often, changes in earnings are made in connection with an increase in the level of wages in the company, an increase in the minimum wage, or a complete change in the wage system in the organization. In all cases, employees must be notified of upcoming changes and salary recalculation in the prescribed manner.

Wage cuts are carried out much less frequently. But circumstances can turn out this way. If wage conditions worsen, employees must be notified of changes in remuneration at least two calendar months in advance. The same period is provided for reduction. For example, when an employee is transferred from full time to 0.75 or part time.

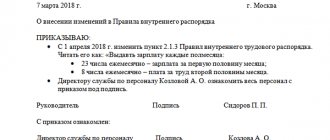

Let us briefly remind you how to formalize the recalculation of wages. Firstly, an order or other order from the manager is required to change the terms of remuneration. Then the new rules and calculation procedure are fixed in the employment contract with the employee. For example, an additional agreement is concluded.

Based on correctly completed personnel documentation, the accountant will recalculate the wages of an employee whose payment conditions have changed.

https://youtu.be/AoiCF1Mh7I8

Calculation error

Calculation errors are understood as arithmetic errors that lead to the formation of incorrect wage amounts, for example, in the case of incorrect addition of hours of work or daily income based on standard hours. The occurrence of an arithmetic error requires a mandatory recalculation of wages with further payment of the missing part or the return of income issued in excess of the norm.

Arithmetic errors include not only manual calculation of data, but also the entry of incorrect information into specialized accounting programs for calculating wages and other income of employees and the enterprise as a whole.

Overpayment of wages in excess of the required income must be returned subject to the following conditions:

- the maximum return time should not exceed one month from the date of the incorrectly accrued amount;

- the employee independently and without any pressure drew up an application for the return of the surplus.

The money can be returned directly to the cash desk in cash or through deductions from the next month's salary. The legislation establishes that the return of funds that were issued due to an incorrect interpretation of labor law norms or due to incorrect calculation of wages without a calculation error is not required.

The court's decision

Controversial issues of recalculation of overpaid amounts are subject to consideration at meetings of the labor dispute commission or in the courtroom.

Making deductions based on court decisions is mandatory for the employer.

Overpaid wages are withheld in the following cases:

- counting error;

- by decision of the Labor Dispute Commission in the case where the employee is found guilty of idle time or failure to comply with production tariffs and standards;

- according to the writ of execution, if a court decision made a determination of the employee’s unlawful action. Deductions from wages are made within the limits determined by the decision of the control authorities, but taking into account the norms of labor legislation. Depending on each specific case, the amount of deductions varies from 20 to 70%.

Erroneous payment of higher wages

Most often, errors in paying higher wages that would be due to an employee are associated with the issuance of an advance or when processing a certain amount of money given to an employee on a business trip.

Recalculation can be carried out automatically using special programs:

- When returning funds from an advance issued in an increased amount. In this case, the employee can write an application to deduct the excess from wages in the future.

- If there is a discrepancy between the amount of travel funds and the actual expenses incurred by the employee while on a business trip.

Funds can be returned to the cash desk or accounting department of the organization after the employee submits an appropriate application and issues an order for recalculation of wages or advance due to the issuance of an increased rate.

The employee was overpaid

Most often, excessive salary payments are caused by one of two reasons. The first is the so-called vacation overexpenditure, when the employee was given vacation for a period not yet worked. He received vacation pay and then quit, while the period for which the vacation was granted remained unworked. In this case, the amount of vacation pay becomes an excessively paid salary, that is, the employee’s debt to the employer. The second reason is an unpaid advance, when the employee received a certain amount in the middle of the month and then quit. Further, during the final calculation, it turned out that the salary actually earned in a given month was less than the advance received. Then the “unclosed” part of the advance will be listed on the debit of account 70, as the employee’s debt.

How to recalculate

Salary recalculation can be done manually or using specialized accounting programs; In each specific case, the features of determining the true salary are individual.

When calculating manually, an accountant or other authorized person must reconcile the data about the employee and his work. For example, if a salary is 18,000 rubles, an employee is entitled to 40% of the advance and 60% of the salary on the 14th and 28th of each month. At the same time, he was given an advance in the amount of 11,000 rubles, which exceeds 40% of the required amount. The schedule establishes a clear number of working days per month for a specific employee, so the salary amount is always stable and does not require any adjustments.

Based on this, the following calculation can be made:

- 18,000/(100%)×40%=7,200 rubles - advance amount every month

- 11,000-7,200 rubles=3,800 rubles - refundable

The employee can return 3,800 rubles to the organization’s cash desk or write an application to deduct the amount issued from the salary that he will receive in the same or next month. Moreover, if the mistake was made due to incorrect application of the law, the return of funds is not the responsibility of the employee.

If the employer uses specialized programs to calculate salaries, then they must include an additional directory, which, depending on the type of recalculation, may be called “Additional accruals” or “Additional deductions”. Additional accruals are used when it is necessary to additionally pay an employee for the performance of his work duties, and deductions for deductions from the income of employees of an amount exceeding the employee’s income in the past.

When entering data into the directory, the following information is indicated:

- Name of the surcharge or deduction.

- The period for making deductions or additional payments.

- The amount of additional payments or deductions as a percentage or as a fixed payment amount.

- Account of expenses for additional payment or withholding of funds.

- A source of financing for payment of funds to the company's cash desk or for additional payment to an employee.

- Economic classification code for expenses.

When using specialized programs, accounting for taxes and surcharges or deductions is formed when filling out the relevant documents. Automatic calculation of data will help in quickly and efficiently processing recalculation by entering corrective information.

Underpayment

After dismissal of an employee, in some cases wages have to be accrued additionally. The reasons may be:

- past mistake;

- bonuses for previous periods.

1. Underpayment by mistake.

In this case you need:

- additionally calculate wages, personal income tax and insurance premiums. Calculate budgets. Record expenses in tax accounting. Accounting (tax and accounting) is similar to accounting for regular salaries;

- calculate and pay the employee compensation for delayed wages in the amount of not less than one three hundredth of the current refinancing rate of the Bank of Russia of the amount unpaid on time for each day of delay (Article 236 of the Labor Code of the Russian Federation). This compensation is not subject to personal income tax and is not included in tax expenses.

Read in the taker

2. Late bonus.

If some company bonuses are awarded after the end of the bonus period (annual, quarterly), the employee can receive the money after dismissal.

The date of receipt of income in the form of wages is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation). This means that a late bonus must be included in the employee’s income for the quarter or year following which it was assigned. This means that if the annual reports have already been submitted, you will have to submit clarifications.

Insurance contributions to extra-budgetary funds in the amount of such a premium can be reflected in the reporting of the current period (letter of the Ministry of Health and Social Development of the Russian Federation dated May 28, 2010 No. 1376-19).

If the bonus is annual, then you will need to recalculate compensation for unused vacation upon dismissal, which is calculated based on average earnings. The belated bonus at the time of dismissal was not included in the average earnings. And remuneration at the end of the year is taken into account in average earnings, regardless of the time of accrual (clause 15 of the Regulations on the specifics of the procedure for calculating average wages, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922).

Note! If the bonus is quarterly, then the resigning employee does not need to recalculate compensation for unused vacation, because bonuses accrued outside the billing period are not included in the average earnings (letter of Rostrud of the Russian Federation dated May 3, 2007 No. 1263-6-1), except, as we have already noted, per annum.

The article was prepared by experts from the “Salaries and Personnel” berator.

Practical encyclopedia of an accountant

All changes for 2020 have already been made to the berator by experts.

In answer to any question, you have everything you need: an exact algorithm of actions, current examples from real accounting practice, postings and samples of filling out documents.

Questions and answers on the topic

Decor

Registration of recalculation occurs in several stages, each of which is mandatory. If an employer finds an error in calculating an employee’s salary, he sends a notification of the discovery of the error to an employee of the organization. If the employee finds errors, then he is sent to the employer.

Salary recalculation occurs in three stages:

- Drawing up an application. The application is drawn up in free form and is not subject to unification; the document indicates the personal information of the director of the organization, the name of the enterprise, the personal data of the applicant, his position, as well as a request for recalculation of the salary amount for any period.

- Issuing an order to recalculate wages to employees. This document is drawn up by the employer and can be used everywhere. When determining the salary amount, the employer must notify the enterprise employee about upcoming changes and obtain his signature on the notification form.

- Notification of order change. This document is provided to employees of the enterprise whose salary will be changed up or down. The document is issued when the order is issued, but before it is signed. Signing of the order is possible only after receipt of the notification by all members of the work collective.

A change in salary, including through recalculation, based on a court decision does not require the preparation of a notice to notify an employee of the organization. The employee receives his own copy of the court order to change the amount of the salary payment.

How to avoid problems when paying staff

Issues related to overpayment of an advance can be resolved as follows: the advance is part of the salary and is paid for the period worked from the 1st to the 15th of the month. Accordingly, if employees are paid a “calculated advance,” there will be no problems with overpayment for the first half of the month, since the employee will receive only his honestly earned money.

Overpayment of vacation pay relates not to accounting, but to the HR service. The HR officer must check the availability of unused vacation days. If a “minus” is identified, the manager should be notified of possible risks. Therefore, unexpected dismissal after a vacation with the formation of debt to the employer indicates problems in this area.

But avoiding purely technical errors when paying dismissed employees can also be difficult. A payroll specialist must not only be a qualified accountant, but also have a good understanding of taxation and employment law.

Therefore, it is quite logical to outsource this important and time-consuming function.

Our employees specialize in payroll calculations. They have thoroughly studied the legislation in this area and always carefully check the results obtained.

Our HR officers track vacation balances for each employee.

To eliminate possible errors, we use a multi-level control system, from the collection of initial data to the moment of transfer of payments.

Deep knowledge and many years of experience allow us to resolve any controversial issues and optimize mandatory payments without violating legal requirements.

Period and statute of limitations

The statute of limitations for recalculation is not established by law, however, funds from an employee’s salary fund can be redistributed within established periods, depending on the status of the organization’s employee.

Depending on the status of the employee in relation to the organization, recalculation is allowed in the following periods:

- For a citizen working at an enterprise, recalculation can be carried out for a period equal to the duration of the employment relationship in accordance with the employment contract.

- For a dismissed employee of an organization, the maximum period for recalculation is three months before the date of dismissal or three months after the employee learned or should have learned about an offense committed against his rights.

Statutes of limitations in labor disputes play a special role, since after the expiration of the period established by law, it is almost impossible to restore your rights, except in cases with a good reason for missing the deadline.

The statute of limitations for filing a claim is three months from the day the employee of the organization learned of the offense committed against him.

The statute of limitations can be restored by filing a corresponding application with the court, but the reasons for missing it must be compelling, for example:

- Serious illness or hospital treatment, which did not allow an employee of the organization to go to court to protect his rights.

- Cataclysms or other acts of force majeure, which significantly worsened the possibility of appealing to the judicial authorities. For example, an earthquake, flood, volcanic eruption, blizzard, severe frost, etc.

- Illness of a close relative, if he required constant care, and leaving him alone could have serious consequences for his health.

If the judicial authority decides on the need to recalculate wages, the employee will be able to count on reimbursement of funds not only for the current few months, but also for the entire period of incorrect calculation of wages.

Salary recalculations based on court decisions

One of the grounds on which the employer will have to recalculate wages for the previous year is a court decision or the conclusion of another authorized body. For example, a decision of the state labor inspectorate or the conclusion of a labor dispute commission.

The decision to recalculate earnings can be made either at the initiative of the employee or at the request of the employer. It all depends on the circumstances. For example, if an employer does not pay wages on time and in full, then a subordinate can seek justice through the court.

We invite you to familiarize yourself with Accounting for on-farm settlements

The employer also has the right to demand the withholding of excessively transferred remuneration through the court. For example, if an employee received an advance, but did not work it out. A similar appeal to the court may be required if the employee took vacation for a year that was not fully worked.

We will answer the most popular questions about recalculating earnings.

1. Is it possible to recalculate the income of a subordinate for previous periods?

Can. Labor legislation does not limit the timing of recalculation. But if there are any disagreements, disputes will have to be resolved in court.

2. Is recalculation allowed after dismissal?

https://www.youtube.com/watch?v=ytadvertiseen-GB

Yes, it is allowed. The employee has the right to apply for a recalculation within three months from the date of dismissal. Or within three months from the day on which the underpayment became known.

3. How to recalculate the salary of a working pensioner?

According to general rules. There are no exceptions, restrictions or privileges for salary recalculation for working pensioners.

4. What about taxation?

Recalculate taxes and contributions in the billing period in which the error was identified or recalculation was made. When the amount is withheld from a subordinate, personal income tax and insurance premiums are subject to reduction. If you have identified an underpayment, recalculate taxes, fees and contributions upward.

5. The employer refuses to pay the underpayment of wages, what should the employee do?

Follow the algorithm:

- submit a written statement to your employer;

- duplicate the application to the trade union committee of the organization;

- if there is no response or action, contact the labor inspectorate (in person, by mail, via the Internet);

- go to court with a claim for violation of labor rights.

The employer bears administrative responsibility for violation of labor legislation. The amount of penalties depends on the severity of the violation and the statute of limitations for the offense.

The mechanism for correcting primary accounting documents and recalculating wages has long existed in standard 1C:Enterprise products that automate payroll calculations: 1C: Salaries and Personnel 7.7, 1C: Salaries and Personnel Management 8 (rev. 2.5) and other programs , which include payroll components. In the program “1C: Salaries and Personnel Management 8” (rev. 3.0) this mechanism has been improved and made more user-friendly.

You can correct documents and accept corrections for accounting in three ways:

- enter a document “retroactively” - this is, for example, a “forgotten document” that was not accepted for accounting in a timely manner;

- correct a document from a previous period;

- reverse the document.

Let's look at how to reflect each of these situations in the 1C: Salaries and Personnel Management 8 program, edition 3.0.

This method allows you to register a document relating to a past period in the database.

Example 1

Let’s assume that at the end of February 2020, the payer received a certificate of incapacity for work for January 2020. The salary for January has already been calculated and paid earlier. The employee was paid a full month's salary.

Let's create a document Sick leave with the month of registration February 2015. We will indicate the period of sick leave - from January 16 to January 31 (Fig. 1).

The total values of accruals and separately the total values of recalculations performed are reflected on the first page of the document. This allows the user to visually monitor the calculation results. Recalculations of accruals from previous periods are separated from accruals and are reflected on a separate tab of the Recalculation of the previous period document.

This method is used if in the current period an adjustment is made to the information contained in a document accepted for accounting in the previous period.

Example 2

In practice, situations arise that require correction: – an incorrect period was entered into the document; – the wrong employee was selected in the document; – the employee, for example, was granted leave from 02/01/2015 to 02/28/2015, vacation pay was paid on 01/29/2015. Then, with the written consent of the employee, he was recalled from leave from 02/15/2015.

Recalculations are recorded when data for payroll calculations changes in periods for which wages have already been paid. The reasons for registering recalculations are changes:

- composition of charges;

- indicator values;

- time worked.

If you cancel the document Accrual of salaries and contributions, information about employees and periods for which recalculations were made is restored and can be corrected again. If the reason for recalculation is registered in the program, an information message appears in the form of the document Accrual of salaries and contributions, informing you of the need to recalculate the document (see Fig. 11). If you click on the More details hyperlink, a form opens with a list of periods and reasons for the occurrence of recalculations.

Rice. 11. Message about the need for recalculation and the “Add up now” button

https://www.youtube.com/watch?v=ytabouten-GB

We suggest you familiarize yourself with what documents you receive after a divorce

When you click on the Additional Accruals button, the Payroll Accrual document for the current period is created, and the tabular section Additional Accruals and Recalculations is filled in in it.

Recalculation of benefits

Similar to the example of salary recalculation, the Recalculation of benefits tab displays the results of recalculation or additional accrual of benefits for past periods (Fig. 12).

Rice. 12. Recalculation of benefits

Benefits are recalculated automatically if corrections are made to existing orders for parental leave. You can also register the need for recalculation manually in the Salary section - {amp}gt; Recalculations.

If there is no need to create a separate salary recalculation document for the next payroll period, the period is not closed and the salary has not been paid, it is possible to recalculate the current document Calculation of salaries and contributions. If there are many employees for whom recalculation is required in the document, you can refill the document using the Fill out menu button in the document header. Available in the drop-down list:

- complete refilling of the document;

- refilling with saving manual changes;

- addition of data from employees not included in the document.

If you need to recalculate the salary of only one employee, this can be done by specifying the accrual line with the desired employee, right-clicking to open the context menu and selecting the Recalculate Employee menu item.

The Additional accrual, recalculation document is a Salary accrual document created in a special mode. If the period is “closed”, i.e. the payment of wages is registered or reflected in accounting, the user has the opportunity to enter the document Additional accrual, recalculation. It contains the details necessary to make an intersettlement payment and is intended for use in cases where it is necessary to pay additional accrued wages before the end of the billing period (Fig. 13).

Rice. 13. Document “Additional accrual, recalculation”

The need to recalculate average earnings documents is determined automatically when registering accrued wages. The program determines a list of documents that use data on average earnings for the period in which changes were made. If information about accruals and hours worked has changed, a recalculation record is recorded.

At the same time, an information inscription is displayed on the average earnings document form, which informs about the need to recalculate the average earnings and the document itself, using the More details hyperlink, just like in the Payroll document, a form with a list of periods and reasons for the occurrence of recalculations opens.

To improve the convenience of work and faster access to data on recalculations, the program has created the Recalculations workplace - a recalculation management tool. The workplace form is available through the Salary menu -{amp}gt; Service —{amp}gt; Recalculations. The workplace is a processing containing two tabular parts Salary and Vacation, sick leave and other inter-account documents.

https://www.youtube.com/watch?v=ytpolicyandsafetyen-GB

In the Salary table, for each registered entry, you can open the employee’s data, the data of the document that is the reason for the recalculation, draw up an Additional accrual document, recalculate, or delete an entry from the list if it does not correspond to reality. If necessary, the user can manually add a recalculation record for any employee for the required period.

In the table Vacations, sick leave and other interpayment documents, similar actions are available with average earnings documents.

It is possible to issue a correction to the document or recalculate the average earnings document itself. If a payment has already been made on this document, the program warns about this and provides the opportunity to cancel refilling the document.

It is also possible to delete outdated recalculation records.

Recalculation of personal income tax

The program “1C: Salary and Personnel Management 8” (revision 3.0) provides the ability to recalculate personal income tax withheld from an employee’s salary in previous periods.

This opportunity is provided by the document Recalculation of personal income tax. The document allows you to automatically fill out the tabular section with a list of employees for whom personal income tax needs to be recalculated, or add an entry manually; introduce standard, property and personal deductions; create a printed form for the tax accounting register for personal income tax (Fig. 14).

Rice. 14. Recalculation of personal income tax

“1C: Salary and Personnel Management 8” (rev. 3.0) provides the ability to recalculate insurance premiums. The document Recalculation of insurance premiums allows you to calculate insurance premiums from the beginning of the tax period to the month of registration. The document contains details that allow the recalculation made to be reflected in the reporting as an independent additional accrual in accordance with Article 7 of the Federal Law of July 24.

2009 No. 212-FZ or reflect the recalculation “retrospectively” to form an updated calculation of the RSV-1 for the previous period. The document has two tabular parts: Calculated contributions and Income information, which, as a result of automatic calculation, reflects changes compared to the previously created calculation of insurance premiums (Fig. 15).

We invite you to find out how much a mother of many children earns per month

What months to correct the accrual of last year's salary

If insurance premiums are calculated incorrectly, the procedure for calculating and paying insurance premiums is established by Federal Law No. 212-FZ of July 24, 2009 “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund” (hereinafter referred to as Law No. 212 -FZ). Preparation of updated calculations As in the case of tax calculations, if an error is discovered that leads to underpayment of insurance premiums, the organization is required to submit an updated calculation.

If the error, on the contrary, led to an overpayment, it is not necessary to submit an updated calculation (Parts 1 and 2 of Article 17 of Law No. 212-FZ). In what period are corrections made? An error in the calculation of insurance premiums should be corrected in the reporting period in which it was made (Art.

17 of Law No. 212-FZ). “Clarification” form. If it is impossible to determine the period of errors (distortions), the tax base and tax amount are recalculated for the tax (reporting) period in which the errors (distortions) were identified (paragraph 3, clause 1, article 54 of the Tax Code of the Russian Federation). The taxpayer has the right (but is not obligated) to recalculate the tax base in cases where errors (distortions) have led to excessive payment of tax.

This is stated in paragraph 3 of paragraph 1 of Article 54 of the Tax Code. Corrections in tax registers. Let us remind you that when calculating income tax and personal income tax, tax accounting registers are used (Art.

313 and 230 of the Tax Code of the Russian Federation, respectively). When correcting errors, changes must also be made to them. For information on how to do this in a tax card for personal income tax accounting, read the article in the electronic magazine “Personal income tax is not withheld. How to correct a mistake” (“Salary”, 2011, No. 3). Current reporting year Month of discovery of the error After the end of the previous financial statements for this year) Previous reporting year December of the previous reporting year In the current period after approval previous reporting year Previous reporting year Month of discovery of the error In the current period of the reporting year Past years Month of discovery of the error Additional accrual or reduction salaries entails the introduction of corrections in the calculation of the so-called salary taxes and fees: - income tax and insurance contribution to the Social Protection Fund of the Ministry of Labor and Social Protection of the Republic of Belarus (hereinafter referred to as the FSZN) (1%), withheld directly from the salaries of employees; — insurance premiums to the Social Security Fund and the Belarusian Republican Unitary Insurance Enterprise “Belgosstrakh” (hereinafter referred to as Belgosstrakh), included in the cost of products (works, services).

Overpayment of wages

Most often, overpayment of wages is caused by:

- vacation overexpenditure;

- unpaid advances.

In the first case, the employee was granted leave for the unworked period. At the time of dismissal, the period for which vacation pay was paid remained unworked, and vacation pay became an excessively issued salary.

The second case is when an employee received money in the middle of the month, after which he quit, and the actual accrued salary for a given month turned out to be less than the advance received.

There are three ways to get out of the situation with overpayment of wages:

- ask the employee to voluntarily repay the debt;

- if you refuse to voluntarily repay the debt, file a lawsuit;

- forgive the debt.

Illness or call to work while on vacation

The employee went on vacation, but was recalled from it. From the same day, his salary is calculated, and vacation pay for days of work must be withheld.

If an employee gets sick while on vacation , he can:

- Extend your vacation for days of incapacity. The accountant will not have to recalculate anything.

- Transfer your rest time to another period. Then you need to accrue disability benefits for sick leave days and withhold vacation pay.