Differences from salary

So what is salary?

Let's try to understand in more detail the concept that interests us. The salary is the so-called base from which one starts when calculating wages.

What is the difference between salary and salary? First, tax deductions are primarily based on salary. Secondly, appropriate increases can be accrued in case of processing. From there, penalties for damage to property or other fines are deducted, and incentives or bonuses are added.

This is interesting! Posadovy salary in Ukrainian is an official salary.

As a result, the salary is what the employee receives in his hands. It can be either less or more than the salary. As a rule, the salary amount is agreed upon in advance for a certain amount of hours of work, but if during the process the employee exceeded the norm at the request of his superiors by working overtime, then he should be compensated for this.

What salary size is clearly regulated by the legislation of the Russian Federation? It is a fixed amount, which must be prescribed when drawing up an employment contract with an employee, and changing the salary is hardly possible. In order for the concept under consideration to change its size, a number of conditions are necessary. One of them is the Order. In this case, the salary, or rather, changing it, would be advisable. But the salary is a calculated amount, so it is not written down anywhere in advance.

An employee should carefully monitor the amount of his salary, because sometimes the employer writes off damage to materials or equipment as a deduction for the employee’s monetary compensation, although the latter is not actually to blame for anything (indirectly or directly).

For such a gross violation of laws, you can sue the employer.

The work of counselors at a summer camp can serve as the most striking example of such a case. Some property damage is deducted from new caregivers' pay when management does not verify that the previous shift was completed.

The employee has every right to be informed of all deductions of his wages.

So, what is salary in an employment contract? After all, everyone knows that for some important reasons and in some cases, drawing up this type of agreement is simply necessary. Whether the concept itself and the size and other characteristics are indicated in it, we will consider further.

The employment contract must specify the salary of an employee of the enterprise, the procedure for calculating it and increasing it.

As a rule, the salary is calculated based on the remuneration system, which is:

- tariff-free – wages are calculated based on the company’s final profit;

- tariff - the employer evaluates the employee’s work results based on the agreed norm and production time;

- mixed - the employer takes into account the total profit of the company and the contribution of a specific employee to it.

What salary calculation formula can be used?

The simplest salary calculation formula includes only 3 points:

- salary size;

- number of days worked;

- income tax.

If we assume that the employee does not have to make any payments and no additional payments are made to him, then the salary is calculated as follows:

1. The salary is divided by the number of working days of the month, then multiplied by the number of days worked.

2. Income tax is subtracted from the amount received (in Russia, personal income tax is 13%).

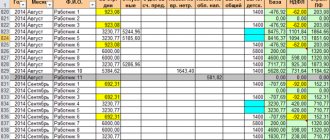

Let's look at an example. The employee's salary is 30,000 rubles. There are 23 working days in a worked month. The employee took 3 days without pay to resolve personal issues, therefore, he worked 20 days in a month. The salary calculation looks like this:

30,000 / 23 × 20 = 26,086.96 rubles (salary before personal income tax);

26,086.96 - 13% = 22,695.65 rubles (take-home salary).

But in practice, such simple calculations almost never happen. Employees are paid bonuses, allowances and compensation. Let’s assume that, in addition to a salary of 30,000 rubles, an employee is paid a bonus of 25% of the salary every month. And he worked only 20 days instead of the required 23 working days per month. Then the calculation will look like this:

Salary + bonus (30,000 + 7,500) = 37,500 rubles (monthly salary);

Don't know your rights?

37,500 / 23 × 20 = 32,608.70 rubles (wages for hours worked excluding personal income tax);

32,608.70 - 13% = 28,369.57 rubles (take-home salary).

In cases where an employee has the right to a tax deduction, the tax amount is first calculated, and then it is deducted from the salary. For example, the salary is 30,000 rubles. The employee worked all days. He has the right to a tax deduction in the amount of 1,400 rubles. The calculation will look like this:

30,000 - 1,400 = 28,600 × 13% = 3,718 rubles (personal income tax after applying the tax deduction);

30,000 - 3,718 = 26,282 rubles (salary in hand).

Calculating payroll can seem like a daunting task. But once you understand its algorithm, there will be no more problems with the next calculation.

https://youtu.be/81sPQ0KkDx8

Coefficients for calculating official salaries

According to labor legislation, an official salary is a fixed amount of payment for labor activities for the performance of one’s own official duties. The official salary cannot include social, incentive or compensation payments.

The Labor Code of the Russian Federation defines the basic salary as the wage rate of an employee of a state or municipal organization carrying out the professional activities of a worker or employee without taking into account additional payments.

Thus, the minimum wage established at the state level serves as the basis for establishing the official salaries of employees.

The salary of any employee directly depends on many factors, including:

- work load;

- specialized education;

- qualification;

- work experience.

Attention! The official salary is a fixed amount of remuneration, established depending on the position held by the employee, qualifications, specialized education and length of service at the given enterprise. The amount of remuneration for the work activities of employees is established based on salary schemes that are developed at the level of an organization or an entire industry:

The amount of remuneration for the work activities of employees is established based on salary schemes that are developed at the level of an organization or an entire industry:

- Industry schemes are used to determine the salaries of employees of organizations financed from budgetary sources.

- Salary schemes approved at the level of firms financed from their own funds take the form of a staffing table indicating the range of specialist positions and the corresponding salary amounts.

The salary schedules for both groups may indicate a salary range, called a salary range.

Establishing minimum and maximum wages makes it possible to determine employee salaries individually, based on their qualifications, work experience, volume of work performed and business qualities.

The level of professionalism of both specialists and workers is determined by gradation into categories, due to which employee salaries are differentiated. Most organizations are characterized by a three-stage gradation.

According to labor legislation, the wage regulations may provide for the establishment of a personal increasing coefficient:

- by position;

- for length of service (more on this).

If an increasing coefficient is established, the amount of upcoming payments is determined by mathematically multiplying the salary by the coefficient.

A personal increasing coefficient can be assigned taking into account:

- vocational training;

- complexity of the work performed;

- employee's degree of responsibility.

The decision on the bonus is made by the head of the enterprise in relation to each employee individually. The length of service coefficient can be established for employees depending on the total professional experience at the given enterprise.

Components of salary and its types

The first part is remuneration for work.

This is the part of the salary that the employee has earned for a certain period of time. It can be accrued for a certain amount of work, for one hour or other time period, or be fixed for a month. Compensation payments may be assessed for various reasons. For example, for work in particularly difficult climatic conditions, in conditions that deviate from the norm (at night), for business trips or work above the norm. Incentive payments include premiums, bonuses, additional payments, allowances and other incentive payments.

According to the law, there are the following types of wages: tariff rate, official salary, basic salary. The tariff rate is set for fulfilling a standard of work of a certain complexity per unit of time. Compensation, incentives and social payments are not taken into account.

Job responsibilities apply to employees who perform job duties for one calendar month. Basic is the minimum salary for an employee of a state or municipal institution.

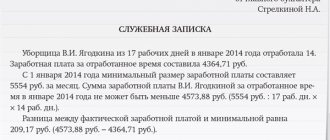

The Labor Code of the Russian Federation (Part 3, Article 133) establishes that the monthly salary of an employee who has worked fully for a given period and complied with labor standards cannot be lower than the minimum wage. From January 1, 2014, the minimum wage was set at 5,554 rubles.

Calculation procedure

How are official salaries determined?

Even taking into account the factors listed above, establishing specific salary ranges is quite labor-intensive and complex. Especially in organizations that have a multi-stage management system. Typically, in order to distribute salaries by rank, some preparatory steps are required.

First you need to determine the general level of the wage fund that the company allocates to its employees. From this fund, you then need (usually this is done by calculation) to allocate an amount of money on an average monthly basis, which will need to be paid to employees as official salaries.

To do this, the availability of compensation and incentive payments is calculated using the existing remuneration system. You will also need to calculate the average salary level.

Next, you should determine the number of ranks at which different official salaries will apply (usually from 3 to 10, depending on the company).

At the next stage, it is necessary to “decompose” the available number of employees at various levels according to their ranks, starting with the first manager in the form of a pyramid, which will grow downwards.

Using simple calculations, you can calculate the amount of money for each rank, and then simply divide it by the number of required employees at each rank and, thus, set the average salary level.

We must not forget that the company’s salary fund usually ranges from 20 to 90% of the total cash turnover. Therefore, the calculation of official salaries should be approached with the utmost seriousness, so as not to become bankrupt after the first working month.

In this case, the salary is calculated without taking into account the need to pay taxes. They will have to be paid either from the body of the salary (if nothing else is planned to be calculated), or from the general level of wages received by the employee.

When making accruals, the employer has to:

- operate with the size of the salary;

- do not forget about the advance payment;

- take into account sick leave and vacation pay;

- make contributions to state extra-budgetary funds;

- withhold personal income tax;

- take into account the availability of writs of execution, alimony, etc.;

- apply bonuses, allowances, coefficients, etc.

The formula is used: ZP = (O / DR) x DO.

When paying hourly, the tariff rate is multiplied by the hours worked per month. The formula is applied: ZP = TSCH x KOCH.

Piece workers can be paid:

- proportional to production;

- using a progressive scale.

Calculation of earnings during a business trip takes into account the average daily payment and takes into account work on weekends.

Taxes

Whatever salary you receive, the following taxes must be deducted from it.

First of all, the personal income tax, which is 13%. For example, your salary is 20,000 rubles. You will receive 17,400 rubles in your hands. All other payments to the state are the burden of the employer, who pays the following contributions: - to the pension fund - 26%, - to the compulsory health insurance fund - 5.1%, - to the social insurance fund - 2.9%, - for injuries - 0, 2%. The employer pays for injuries even if you are an office employee. Otherwise, other payments will be accrued. In total, taxes amount to 34.2%.

If you paid all the above transfers yourself, then instead of 20,000 rubles in your hands, you would immediately receive 26,840 rubles.

Every able-bodied person looking for work should know their rights and responsibilities. This is necessary to ensure that employers do not take advantage of the legal illiteracy of their employees, and this will avoid injustice in the work process. You should study the Labor Code well to know what minimum wage should be paid to employees, how much maximum time they can work per week, and what kind of vacation and how many days off they should be given. Additionally, it is important to understand what salary and wages are, what is their difference, and also what white and gray wages are. In this case, non-payment of earnings by the employer can be avoided.

Salary is considered the most important element for every job seeker. It can attract or repel with its size, however, many employers take advantage of the fact that they indicate only the salary, and the real salary may differ significantly from it. In this case, you need to know how to calculate salary based on salary in order to accurately determine what the employee’s monthly earnings will be.

It should be remembered that for each officially employed employee, companies pay tax and insurance premiums, and they are calculated depending on the employee’s earnings. Therefore, every person should know what contributions are made for him, as well as what his real salary is.

Remuneration: informal and according to an employment agreement

Quite often, a large part of the population does not have the desire or opportunity to find official employment, for various reasons. Therefore, they agree to an informal agreement between the two parties. Working officially was not always profitable and everyone tried to earn the maximum amount of money in any way. With the advent of taxes, people came up with ways to evade paying them. This is where the term “black wages” comes from.

This is an informal payment, without an employment agreement, negotiated with the employer in advance, accepting the agreements of the two parties.

The provision of services under a contract (contract) is the highest income. It specifies the working conditions, deadlines and consequences for violation. The employer in such an agreement is the customer.

There are many reasons why a person agrees to work under a contract:

- High wages.

- Lack of any documents.

- Deviation from alimony payments, credit debts.

- Maintaining social benefits and periodic increases in pensions for older people and people with disabilities.

Amount and form of payments

The amount of remuneration depends on the form of payment accepted at the enterprise. There can be two of them:

Piecework

The amount of remuneration depends on the volume of work performed. Divided into:

- direct, proportional to production;

- piecework-bonus, with additional payment of bonuses;

- piecework-progressive, when the prices for performing work are within the norm are one, above the norm are others;

- collective piecework, which is established if the amount of output cannot be calculated individually.

Allows the enterprise to stimulate the work of workers and increase production, but with its growth, a decrease in quality is possible.

What is an official salary and how it differs from a tariff rate?

This payment system is applied to engineering, economics, legal, and most technical specialties. At the same time, in order to correctly establish gaps between various professional groups of highly qualified specialists, to establish “forks” and gaps between official salaries, the following are taken into account:

- complexity of the actions performed;

- requirements for the quality of the final result;

- the volume of obligations assigned to a particular employee;

- the required (usually minimum) qualification level of a potential employee.

To assess the complexity of the work, the employer will have to take into account the availability of high-tech equipment, tools, the complexity of existing technological processes, the multiplicity of actions performed, the level of independence of the specialist during decision-making, as well as the degree of responsibility for the final

Conclusions TheDifference.ru

- The salary amount is indicated in the documents when a person is hired; the salary is calculated after he has worked for a month at the enterprise or upon his dismissal from his position.

- Salary is a fixed figure in the staffing table of employees, which is used to calculate wages, and the salary indicator in no way affects the amount of salary.

- Salary is a basic, constant unit, and the salary consists of the salary and those percentages, bonuses and deductions that are provided for by law and the terms of the employee’s employment contract.

Surely, every employee would like his salary to meet his needs, the salary to provide his family with everything necessary. When setting wages, the employer takes into account production costs, the prevailing wage level in the industry, and also expects to make a profit.

Therefore, the interests of the employer and employee regarding the sphere of remuneration come into conflict? What is salary? How are wages calculated?

Not every employee fully understands the meaning of such concepts. We invite you to look into these issues together.

What functions does wages perform?

Salary has the following functions:

- motivational;

This function is the main one for the employee, since the salary allows him to satisfy his needs. Without material reward, a person would not waste his time on some kind of work activity.

reproductive;

The reproductive function is closely related to the motivational one, but serves for the benefit of the enterprise: the employee must eat well and be in good physical shape. His family also should not need anything, so that the employee could fully concentrate on his duties.

Sufficient monetary remuneration can increase employee productivity and ensure smooth operation of the company.

stimulating;

This function comes down to the fact that the employee must go to work with the understanding that wages primarily depend on the performance of his work. To do this, the employer must provide the person with work instructions, identify specific achievements and motivate the employee for exceeding them, for example, with a bonus.

status;

Provides salary in accordance with the employee’s qualification level, knowledge and experience. The amount of monetary reward is an indicator of his place in a particular social group. For example, it is for this reason that electricians of different categories will have differences in salaries even with equal hourly output.

production-share;

Requires the contribution of each employee to be taken into account in the final production costs.

regulating.

Helps employees and subordinates interact effectively.

How to check if your salary is calculated correctly

Labor legislation requires that the employee be informed of all bonuses he receives and all deductions made. The most common way of conveying information is by issuing a “settlement”. This document contains a summary of all the basic operations done to calculate payroll. For a sample payslip, see.

From the “calculation” you can understand how the employer calculates the salary based on the salary. Then you need to do your calculations and compare the results. If the amounts do not add up, you should ask the company accountant to go through all the steps of the calculation with you to understand at what stage the discrepancy in the figures occurred.

Thus, the salary and the amount received in hand may not match. They don't have to match. Before paying wages, the employer must withhold 13% of income tax from it. And if the amounts are still equal, this means that the employee is given additional payments - for example, a bonus is paid. To calculate your salary yourself, you need to know about all deductions and allowances in each specific case. Otherwise, the results will be approximate.

“Money doesn’t buy happiness,” says popular wisdom. In the modern edition, it may well have a continuation: “... and in work that brings money and gives pleasure.” But for this pleasure to be as complete as possible, the salary must, at a minimum, correspond to the market level. How to calculate the salary level you can qualify for?

What are the dangers of large requests? Already at the first interview, the recruiter, as a rule, is interested in what salary you are expecting. It is customary to indicate the approximate amount of remuneration in the resume. At the same time, each applicant is faced with the question: what salary should be negotiated in order to ensure financial interest and at the same time not scare off the employer with a high price? It is worth saying that recruiters are scared off by both too low and too high levels of requests: in the first case, they are afraid of insufficient work experience and unprofessionalism, in the second - the candidate’s excessive ambition and inflated self-esteem.

In other words, for successful employment you need to calculate in advance an adequate level of earnings that is suitable for you as a specialist with certain experience and skills.

Where and who gets paid more The starting point of calculations is determined by your specialty. It is well known that in the labor market some professions are valued higher than others: the general market law of supply and demand applies. So, if there are not enough competent IT specialists today, then their work will be better paid. On the contrary, if there are much more resumes for a journalist position than there are vacancies, the sharks of the pen, especially beginners, cannot count on a high salary.

The second important factor for calculating an adequate salary is the city or town in which you are looking for work. Everyone knows that in the capital and large cities they pay more than in small towns, but how to calculate an acceptable salary level in your region? You can conduct a mini-market research yourself: look at job advertisements and resumes of fellow competitors in your specialty in your city.

Adjusted for experience So, the average wage level in your specialty and in your city has been determined. However, do not rush to write the resulting figure on your resume - this is just “the average temperature in the hospital.” Adjust the resulting average value taking into account your experience: lower the bar if you are a beginner, and, on the contrary, raise it if you have already become a pro. There is no single methodology here - the calculation highly depends on the specific specialty, so we recommend that you rely on common sense and the results of relevant research on the site.

For example, according to our data, the average salary of a purchasing manager in Moscow is 60,000 rubles. At the same time, the salary of a beginning specialist in this field with 1 year of experience will start at 40,000 rubles, and the maximum income of a professional with 5 years of experience can reach 130,000 rubles.

Experience in a specific industry or with specific issues is also important for calculating salary levels. For example, a PR manager with experience in the construction industry who is employed by a construction company will cost significantly more than his competitor who previously worked in show business.

Does a second degree affect salary? What else is important when calculating the salary level that is adequate for you? Education influences to a certain extent: according to the portal’s Research Center website, a prestigious university in your specialty or an MBA degree for managers (especially in foreign companies), although they are not decisive for employment, can still add some points to you when calculating your salary.

However, it is worth considering that the employer pays for the work, and not for “Courtes” and diplomas. When working as an accountant, be prepared for the fact that a second higher education in psychology will not affect your income in any way. It is unlikely that your salary and academic degree will increase if you do not work in the field of science or higher education.

Certificates, certificates, diplomas... Paradoxical as it may seem, a much greater impact on your salary can be made not by a labor-intensive and expensive second higher education, but by completed short-term courses on the most pressing issues of your specialty - those that are not yet in the university curriculum.

Thus, for a marketing manager today, a certificate of participation in a seminar on promoting goods and services on social networks can be extremely useful (and significant in terms of salary calculation). For an engineer - a certificate of completion of training in design in modern automated systems. For a specialist in personnel records management – a diploma from a participant in a seminar on innovations in labor legislation.

How much does it cost to know English? According to generally accepted opinion, it increases salary and knowledge of a foreign language. However, this is not entirely true: an employer will pay extra for excellent language skills only when it is really needed in daily work, for example, in a foreign company.

What else has a positive effect on salary? Knowledge of special computer programs, the presence of relevant connections for work, knowledge of related fields and much more. Having assessed your place in the existing coordinate system, determine the final level of your aspirations.

Please note that in the process of negotiations with the employer, you may have to show loyalty and somewhat reduce your demands. That is why some applicants indicate in their resume a figure that is 5-10% higher than what they expect to receive. Whether to use this experience is up to you, taking into account all the circumstances of your employment.

Russia is distinguished not only by its large territory, but also by its very high wages.

What is the average salary in Russia?

If we compare the level of average monthly income in 2020 with salaries in Russia in 2020, we can note that the average salary in Russia has increased by 12% over the past year. But it is worth considering that the increase in wages in Russia in 2020 occurred exclusively in the national currency.

In foreign currency terms, salaries in Russia decreased in 2020 due to the appreciation of foreign currency.

Thus, the average salary in Russia in dollar terms in 2020 is significantly lower than in more developed countries, such as the Baltic states and.

According to statistics, the highest salaries in Russia are observed in two cities of this country: Moscow and the cultural capital of the Russian Federation, St. Petersburg.

There has always been a large gap between average wages in Russia among regions. But in recent years (2017-2019), the trend of widening the gap between indicators has only intensified. This is primarily due to the onset of the economic crisis, as a result of which the foreign exchange rate sharply increased.

Due to the increase, the income of the population living in provincial areas decreased. Against this background, the unemployment rate has increased significantly. Therefore, many people from provincial regions moved to large cities for the purpose of employment.

The average salary in Russia in 2018-2019 is equal to 36 thousand rubles.

Table: statistics comparing average salaries in Russia by region

| Region, district, republic | Average salary level (expressed in rubles) |

| Belgorod | 27 280 |

| Bryansk | 20 790 |

| Vladimir | 22 770 |

| Voronezh | 26 070 |

| Ivanovo | 21 120 |

| Kaluga | 27 060 |

| Kostroma | 22 550 |

| Kursk | 22 770 |

| Lipetsk | 24 640 |

| Moscow region | 42 460 |

| Eagle | 16 830 |

| Ryazan | 21 340 |

| Smolensk | 20 020 |

| Tambov | 21 450 |

| Tver | 20 130 |

| Tula | 25 520 |

| Yaroslavl | 26 620 |

| Moscow | 66 880 |

| Karelia | 32 450 |

| Komi | 39 380 |

| Arkhangelsk | 36 850 |

| Vologda | 28 820 |

| Kaliningrad | 28 820 |

| Leningrad region | 28 050 |

| Murmansk | 43 670 |

| Novgorod | 27 390 |

| Pskov | 24 310 |

| Saint Petersburg | 45 430 |

| Adygea | 20 680 |

| Kalmykia | 20 130 |

| Krasnodar | 25 850 |

| Astrakhan | 27 390 |

| Volgograd | 23 650 |

| Rostov | 23 320 |

| Dagestan | 25 160 |

| Ingushetia | 20 790 |

| Kabardino-Balkarian | 18 920 |

| Karachay-Cherkessia | 18 040 |

| North Ossetia | 18 590 |

| Chechen | 21 010 |

| Stavropol | 22 000 |

| Bashkortostan | 28 160 |

| Mari El | 21 230 |

| Mordovia | 20 900 |

| Tatarstan | 27 060 |

| Udmurt | 23 430 |

| Chuvash | 22 990 |

| Permian | 27 280 |

| Kirov | 22 880 |

| Nizhny Novgorod | 26 840 |

| Orenburg | 26 070 |

| Penza | 22 990 |

| Samara | 27 060 |

| Saratov | 23 430 |

| Ulyanovsk | 22 880 |

| Mound | 22 770 |

| Sverdlovsk | 32 780 |

| Tyumen | 50 160 |

| Khanty-Mansiysk Autonomous Okrug | 61 930 |

| 70 620 | |

| Chelyabinsk | 26 620 |

| Altai | 24 860 |

| Buryatia | 27 720 |

| Tyva | 30 580 |

| Khakassia | 32 010 |

| Transbaikalia | 25 300 |

| Krasnoyarsk region | 29 260 |

| Irkutsk | 32 450 |

| Kemerovo | 17 490 |

| Novosibirsk | 17 600 |

| Omsk | 28 820 |

| Tomsk | 32 230 |

| Sakha | 53 460 |

| Kamchatka | 50 600 |

| Primorsk | 33 990 |

| Khabarovsk | 35 200 |

| Amur | 34 540 |

| Magadan | 55 880 |

| Sakhalin | 51 260 |

| Chukotka | 56 100 |

The highest salaries in Russia are in Moscow and St. Petersburg. In dollar terms, the average salary in these cities ranges from $700 to $1,000, while the average salary in all regions is only $570.

This salary level significantly exceeded the average monthly income of residents of Ukraine ($320), Tajikistan ($140), Azerbaijan ($300) and Kyrgyzstan ($220).

Payment types

Not all employers can clearly explain what exactly an employee’s salary will consist of. Of course, it may seem that it makes no difference what the salary consists of. The more you get, the better. But in some cases it will be useful to know what affects the amount of income.

In fact, there are not many types of remuneration:

- Tariff. This type can be divided into piecework and time-based payment. The piecework form will help to objectively assess the labor factor by establishing production norms, for example. There are various calculation schemes based on factors and functionality. Moreover, the salary may depend on the performance of not only one employee, but also the entire team. The time-based form takes into account the employee’s qualifications and the time spent on work.

- Tariff free.

- Mixed.

The latter types of payment do not imply clear indicators, but the employee’s participation in the production process is assessed in terms of performance.

Regardless of what type of payment is used by the employer, the calculation scheme should be as clear and transparent as possible.

Analysis of public sector wage arrears

Wage arrears in 2020 in the Russian Federation amounted to 3.8 billion rubles. Over the past month it has decreased by 5%. Due to the current situation, the Russian government intends to freeze the payment of wages to index pension payments in 2019.

The state owes the largest amount of money to employees who work in areas such as:

- Manufacturing industry.

- Construction.

- Transport sector.

- Mining.

- Agriculture.

- Research and development.

- Production of gas, water and electricity.

- Educational sphere.

Tariff-free wage system

Tariffing is regulated by law for many industries. For example, for employees in the education sector, an individual tariff SOT has been established in accordance with Government Decree No. 583 dated 05.08.2008.

The tariff-free SOP is similar to the option system in startups. There is a payroll and employees. Let’s assume 100 thousand rubles and 10 people. The employer establishes that:

- The payroll can be increased if the company’s profits rise,

- The share of each employee’s salary is 10%.

The share can rank employees by the amount of participation in work or be the same for everyone.

In the employment contract, of course, they will write down 10 thousand rubles - salary per month. It is impossible to mention % according to the Labor Code, and it is not very profitable for the company.

After the announcement of working conditions, there is no need to establish additional incentives; employees themselves will strive to increase the company’s income. This model is applicable to small, start-up companies that will not go public, but want to interest employees without having money for bonuses.

Salaries of public sector employees

Since January 1, 2019, salaries for public sector employees have increased by an average of 5%.

The salaries of teachers, medical personnel, military personnel and representatives of the judicial system were mainly increased. In 2020, the average salary of a public sector employee was 31,200 rubles. After the increase, this amount increased to 33,000 rubles.

In 2020, salaries of public sector employees are expected to increase at least twice. According to the presidential decree, such an increase in salaries for public sector employees should occur through the introduction of new reforms, for which funds in the amount of 4.6 trillion rubles have been allocated.

But despite this, there is a tendency in Russia to delay wages. The delay in salaries affected primarily law enforcement officers and employees of the educational sector (teachers, pedagogues, university professors).

Employees of the Accounts Chamber receive approximately 171 thousand rubles per month. Members of the Federation Council receive 151 thousand rubles monthly. State Duma deputies earn 123 thousand rubles. Compared to last year, their salaries increased by 29%. In 2020, Kremlin employees were awarded a 5% salary increase, so in 2020 their salary is 206 thousand rubles.

Winner of the All-Russian competition “Teacher of the Year”

The salaries of preschool teachers increased by 5%. In Moscow and St. Petersburg, the salary of a teacher ranges from 30 thousand to 35 thousand rubles per month. In Yekaterinburg, the salary of a kindergarten worker ranges from 16 thousand to 17 thousand rubles. In Perm, for a similar position they pay from 11 thousand to 13 thousand rubles. In the Altai Territory, the salary of employees of preschool institutions ranges from 13 thousand to 15 thousand rubles per month. Teachers working in the Altai Republic receive monthly from 17 thousand to 19 thousand rubles.

In Crimea this year there is almost no debt on salaries for public sector employees. The level of average monthly wages is actively growing in this region. So in 2020, the average salary was 15 thousand rubles, in 2020 this figure increased to 29 thousand. Social workers receive the lowest salaries in the public sector. Their salary does not exceed 20 thousand per month.

The salary of doctors in this region is 21 thousand rubles, and university teachers and teachers receive approximately 28 thousand - 29 thousand rubles. Teachers of preschool institutions in Crimea earn from 10 thousand to 12 thousand rubles per month. Employees of preschool educational institutions in Sevastopol receive an average of 19 thousand rubles.

The salary of a state pilot directly depends on the number of flight hours:

- If the number of hours is 85 per month, then the pilot will receive at least 290 thousand rubles per month.

- If the number of hours is more than 90 per month, then the pilot’s salary will be about 340 thousand rubles per month.

The salary of a janitor working in a utility company directly depends on the region. So a janitor in Moscow receives from 22 thousand to 23 thousand rubles. In Chelyabinsk, a similar position pays 15 thousand rubles. In the cultural capital of the Russian Federation, the salary of a janitor is about 20 thousand rubles. In Tula and Yekaterinburg, janitors earn from 15 thousand to 16 thousand rubles.

How is salary different from salary?

This indicator is reflected in the employee’s employment contract and is indicated in the order upon admission to work. Salary is the basic characteristic for the subsequent calculation of other indicators. Salary is the amount of money that an employee receives after calculating the necessary allowances and withholding personal income tax.

To calculate it, the salary amount is used, to which interest stipulated by the contract, bonuses and compensation, for example, for hazardous production, are added, and personal income tax is withheld. Why do they share? The most significant difference between them is that one indicator is calculated based on the other. In other words, there is an established base salary for a certain position according to the staffing table, to which all interest and bonuses for quality work done are added and from which personal income tax, deductions for property damage or compensation for material damage caused are deducted.

Holds

Deductions from employee earnings are divided into 2 groups:

- Mandatory by law.

- Related to the employer's initiative.

The first group includes the following types:

- personal income tax - in accordance with the Tax Code of the Russian Federation, all Russians are required to pay it, with some exceptions;

- child support for a minor child;

- funds for compensation of harm;

- deductions from the income of convicted persons by court decision, used for their maintenance.

The second group includes deductions:

- the amount of the advance that was issued to the employee, but was not worked out by the latter;

- the amount of the advance that was issued for business trip expenses, but was not spent;

- excessively paid wages due to an error in calculations;

- the amount of money issued for unworked vacation days, if the vacation was provided to the employee.

Features for the military man

The salaries of these categories of persons include the official part and the amount in accordance with the rank to the salaries by position and by rank. For military personnel on a contract basis, the income tax is the same as for civilians and is equal to 13%.

- The salary for the position is added to the salary according to rank.

- They add payments related to length of service, place of service, and others.

- Qualifying tax deductions are given to certain military personnel.

So, an employee’s salary may differ in monetary terms every month. But all changes in wages must be supported by an order or an additional agreement to the employment contract. Otherwise, the employer, changing the salary portion, will act illegally.

What is better - a stable salary or work for interest? The answer to the question is in this video.

Areas of application

Official salary is a concept that is directly associated with the state, so much so does this phrase resemble clericalism. And that’s right, first of all, a similar remuneration scheme is used by state employees. This category includes doctors, teachers, civil servants, military personnel, etc. In this case, this form of payment between employer and employee is extremely convenient and predictable.

In addition, part of the salary scheme can be applied in sales. In addition to a small but constant part of the salary, the employee receives bonuses depending on the performance of his activities. For example, the employer pays him a percentage of completed transactions and concluded contracts.

It is also worth remembering that salary is the amount of earnings before taxes are withheld. So, when signing an employment contract, it is necessary to take into account that the figure written in it in any case does not reflect the amount of money that can be received as a result of the work.

About compensation payments

Compensation payments as part of wages

These payments also relate to wages and represent a variable component of the employee’s salary. It depends on working conditions and employer guarantees. These are payments that do not depend on additional remuneration if the work is performed in fact, as well as on production tasks completed in full.

Payments for work under special conditions of the labor process, namely when working with harmful or dangerous factors, as well as when working in the Northern regions, that is, under climatic conditions that do not correspond to normal ones.

Performing work duties in areas where radioactive, chemical or nuclear contamination of the environment has occurred.

Compensation for labor is calculated on the basis of local regulatory documents of the enterprise, these can be standards, collective agreements or other provisions, and labor agreements also stipulate the amount of these payments to the employee. Moreover, increased wages are paid to employees who work in the Northern regions, as well as in areas close to them.

To correctly understand what compensation is, you need to understand that for work in hazardous conditions, based on a special assessment of working conditions, an additional percentage of wages is paid. It may also be a bonus to the official salary for possession of information related to state secrets, the percentage of which is determined by employees of the security-secret department.

This component of wages is not constant, its indicator is a variable value, that is, it may or may not be paid by the employer. It all depends on how the employee completed the production task, what efforts he put in to get the perfect result.

This part of the payments is in no way subject to regulation by law. That is, it depends on the decision of the management of the enterprise, and if the organization has a wage fund and bonuses, then the latter can always be distributed at the discretion of the employer.

It can be understood that payments stimulating the employee’s work also fall under the motives characterizing the qualifications of labor. This is also an incentive to achieve exactly the kind of results that are aimed at productivity and improving the quality of the work process, while calculating the official salary is not enough.

The purpose of these payments is to stimulate the work of employees, which is aimed at improving qualifications and reducing the turnover of the enterprise’s personnel.

Criteria for which incentive payments are awarded:

- for skill and professionalism in performing production tasks;

- for achieving a high qualification level of workers;

- for working for a long time at the enterprise as a labor incentive so that the employee does not move to another organization;

- for knowledge of other languages, the knowledge of which is in demand at this job.

What does it consist of?

Both in the case of civil servants and in commercial organizations, salary means approximately the same thing. And this part of the earnings includes only the amount established by the employer. Just a few years ago, the salary could not be lower than the minimum wage, but current legislation allows this - if the monthly salary still exceeds this value. In order to achieve this, various allowances, coefficients, bonuses, etc. are applied.

If we are talking about public sector employees, then qualifications, length of service, region, special conditions and many other factors are taken into account, and not just position. And then the seemingly miniscule amount of earnings can increase several times. The salary itself may also in some cases not be paid in full, for example, if the employee went on vacation or sick leave. But in any case, the amount of accrued earnings at the end of the month must, by law, be higher than the minimum wage.

The same applies to commercial structures. Percentages on sales and transactions, bonuses at the end of the month and other allowances are designed to make the work actually more highly paid. Initially, the salary does not include all this.

Unique order to change (increase) official salary

A change in an employee's salary can be initiated by a memo indicating the reasons for the change in salary. If the salary is subsequently reduced, the wishes of the line manager will not be taken into account.

Reasons for increasing the salary may be:

- systematic overfulfillment of the plan;

- training;

- successfully completed certification;

- extensive work experience.

In addition, salary increases may be initiated as a result of changes in job responsibilities.

To raise the issue of a salary increase:

- The employee's manager must provide his superiors with a memo containing information about the reasons for increasing the salary of his subordinate.

- Subsequently, the document must be agreed upon with an authorized person or director of the organization.

- After the salary increase is approved, the HR department employee must prepare a unique order to adjust the salary portion of the employee’s salary, as well as to make adjustments to the staffing table.

- In addition, all changes must be reflected in the employment contract. To do this, it is necessary to prepare an additional agreement, which will subsequently be signed by both parties.

- If an agreement of any kind is reached, a unique order is drawn up to change the official salary and an additional agreement to the employment contract.

Since this order does not have a form approved at the legislative level, any institution has the right to draw it up in a free format on the company’s letterhead

It is extremely important that the order reflects the following data:

- information about the enterprise;

- order details;

- the city or town where the order was drawn up;

- date of document preparation;

- changes in working conditions;

- argumentation of the need to change the official salary;

- signatures of the parties.

Thus, the final version of the order to change the salary of an official will look something like this:

Changes in the terms of payment for professional activities will come into force immediately after the documents are signed by both parties.

The main thing to remember is that no matter how the terms of payment for work change, if any agreement is reached, an order and an additional agreement to the employment contract on changing working conditions must be drawn up between the parties. Without this documentation, the change to the salary portion will be considered invalid.

Functions

Wages have many functions, they are all closely interrelated, contain elements of each other, and at the same time, one is opposite to the other and reduces its effect and even excludes it.

Some of them lead to differentiation of the level of earnings, others to its equalization.

The main functions are:

- reproduction function. Compensates workers for labor expended in production. Here the most important feature of implementation is;

- stimulating or motivational function. Increases the interest of workers in increasing production, directs their interest to increasing their labor contribution and, consequently, the level of income received;

- social function. Helps to implement the principle of social justice;

- accounting and production function. The ability to characterize the degree of labor participation in the pricing process and its share in total production costs;

- regulatory function. It regulates the relationship between supply and demand in the labor market and forms the level of employment.

Time-based form of remuneration

There are two forms of remuneration: time-based and piece-rate, which in turn are divided into several forms.

- Time-based form of remuneration.

- Simple time payment. This type of payment is made for a certain amount of unworked time and does not depend on the quantitative characteristics of the work. It is calculated by multiplying the hourly or daily rate by the number of hours or days worked. If the employee has a salary, then wages are calculated based on the time worked based on the monthly salary.

- Time-based bonus wages. This form of payment implies that the bonus specified in the employment agreement with the employee or enshrined in other internal documents of the organization is added to the time payment calculations.

- Piece wages.

- Direct piecework wages. Carried out on the basis of established piece rates per unit of products or work produced by the employee. This form of remuneration also takes into account the qualifications of the employee.

- Piece-bonus form of remuneration. Provides for the accrual of bonuses for exceeding the production plan or achieving certain quality indicators of the work performed

- Piece-progressive form of remuneration. The essence of this form of remuneration is to increase payment for the production of products or work in excess of the established norm.

- Indirect piecework form of remuneration.

Produced for workers in auxiliary production as a percentage of the wages of workers in main production (adjusters, assemblers, assistant foremen, etc.). In practice, mixed forms of remuneration are often used. This applies, first of all, to workers combining several positions at one enterprise. - Accordal payment. It is used to calculate payment for a set of works or the production of a certain volume of products or work, and not for a specific production operation.

Do not confuse the concepts of “payment system” and “form of payment” - they are not identical, although in the literature they replace each other.

A system is a set of rules for remuneration. Form is one of these rules.

Art. 131 of the Labor Code of the Russian Federation establishes two forms in which labor can be paid:

- Cash – made in rubles.

- Non-monetary - in kind - paid in any material or immaterial form not prohibited by law. The size of the natural part is no more than 15% of the person’s entire salary.

With a simple time-based wage, the time worked in the period is paid. Periods can be recognized as: hours, days, months and variations of these periods.

With a bonus, a bonus for the quality of work is added to the salary for time, calculated as a percentage of the salary at the rate. The bonus may be one-time or applied on an ongoing basis.

With a salary, the employee has the right to count on a monthly salary in the amount as established in the employment contract. Upon achieving a certain qualification (determined subjectively by the employer), the salary may be increased.

The organization of remuneration represents all activities that should reward an employee for his work.

This takes into account the number of hours spent or the final result, as well as the quality of work. The organization of wages in Russia is influenced by:

- wage system;

- form of payment;

- labor rationing.

The payment system has already been mentioned above: the company chooses what is closer to its structure and type of production. It is beneficial for small enterprises to make calculations based on a tariff-free system in order to motivate all employees to effectively carry out their work activities. Large companies more often resort to a tariff system.

In this case, it is important to take into account the conditions, including logistical ones, of a particular enterprise. If we are talking about office work, then the calculation is made for the result of intellectual activity, which must also be measurable

The form of payment can be time-based, piece-rate, or mixed.

Time-based is payments calculated in accordance with the employee’s time spent. The salary is based on special tariff scales, which take into account the level of qualifications of individual employees and the amount of salary depending on the position and profession.

Piece payment is based on the specific result of the work. This form of salary is often found in the field of trade and in various sales at the corporate level, when the employer needs to encourage the employee to perform his duties as efficiently as possible.

The mixed remuneration system includes characteristics of two other types simultaneously.

The influence of the regional coefficient on wages

In regions where working conditions are considered special due to climatic conditions, terrain or increased radiation levels, a regional coefficient is added to employee salaries. It should not be confused with northern allowances for employees of the Extreme Server. The area of application of the regional coefficient is much wider.

The size of the coefficient is established by the Government of the Russian Federation specifically for each region. There is no single regulatory act; a separate resolution is issued for each district. The lowest coefficient - 1.15 - is in the Vologda region, as well as in most regions of the Ural Federal District: Perm, Sverdlovsk, Orenburg, Chelyabinsk, Kurgan regions. A similar coefficient applies in Bashkortostan and Udmurtia.

The regional coefficient is applied not to the salary, but to the actual amount of the salary before personal income tax is deducted from it. To calculate, you need to sum up the salary with all allowances and bonuses, with the exception of one-time payments (such as sick leave and financial assistance), and multiply the resulting total by a coefficient. For example, in one of the cities of the Chelyabinsk region, with an employee’s salary of 30,000 and a bonus of 7,500 rubles, the salary calculation will look like this:

(30,000 + 7,500) × 1.15 = 43,125 rubles (salary before personal income tax);

43,125 -13% = 37,518.75 rubles (salary in hand).

What is the difference between salary and salary? – website about

When you are looking for a job or getting a new position, you have to figure out what kind of salary it can provide.

Every worker should know what determines the amount of money that will be transferred to the card. You need to clearly understand what the salary offered by the employer is - is it a salary or not.

Then you won’t have to be disappointed when you receive what you earn in an amount that is less than expected.

Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your specific problem, please contact the online consultant form on the right →

It's fast and free!

Or call us by phone (24/7):

If you want to find out how to solve your particular problem, call us by phone. It's fast and free!

How does a salary differ from a salary: in detail

Salary and wages... Concepts related to one economic category - employee remuneration. Are there differences between them or are they identical to each other? It is necessary to understand this issue in more detail.

Definition

The salary represents the amount of money that the employer initially offers to calculate the final amount. This indicator is reflected in the employee’s employment contract and is indicated in the order upon admission to work. Salary is the basic characteristic for the subsequent calculation of other indicators.

Salary is the amount of money that an employee receives after calculating the necessary allowances and withholding personal income tax. To calculate it, the salary amount is used, to which interest stipulated by the contract, bonuses and compensation, for example, for hazardous production, are added, and personal income tax is withheld.

: Where is the best place to open an Ethereum wallet?

Salary and wages - what is the difference in accordance with the Labor Code of the Russian Federation and legislation

Before you begin to consider how a salary differs from a salary, it is worth determining what these concepts mean and how exactly their legal regulation is ensured in Russian legislation.

Thus, these concepts and the aspects that regulate them are disclosed mainly in Article 129 of the Labor Code of the Russian Federation, but in practice they are used and regulated in a much larger number of articles of the Labor Code, as well as in other all-Russian and regional normative documents and acts.

At the same time, differences in the concepts of salary and wages are directly fixed in labor legislation, and despite the fact that in practice they can be interchanged with each other by both employers and workers themselves, in all official documentation it is necessary to adhere to the terminology enshrined in the Labor Code of the Russian Federation. Otherwise, confusion in these terms may lead to possible recognition of it as a violation of labor laws.

For example, if an employee’s salary is actually set below the minimum wage for a full-time job, this is not a violation. But if the employment contract stipulates the payment of wages below the minimum, then for the very fact of such a mention in the text of the employment contract, the employer can already be brought to administrative responsibility under Article 5.27 of the Code of Administrative Offenses of the Russian Federation.

Legislative definitions

The classification of the components of the wage fund is presented in Article 129 of the Labor Code of the Russian Federation. According to the definition:

- According to labor law, an official salary is a fixed amount accrued to an employee for performing a job function of a certain degree of complexity for a fully worked calendar month, without taking into account additional compensation and bonus payments.

- Salary or wages is a material reward for invested intellectual or physical potential, depending on the professional qualification level, the degree of complexity of the volume of work performed, taking into account the quantitative and qualitative characteristics of the labor process, including:

- compensation payments - allowances for irregular hours and harmfulness, overtime, additional payments for differences in conditions from established standards; incentive payments - bonuses and incentives for achieved indicators.

If an employee’s basic salary is set below the minimum wage, then the phenomenon is considered the norm, and up to the established minimum amount, an additional compensation or incentive component is paid. However, fixing a salary in an employment contract below the minimum wage for full-time employment is a direct violation of labor law, punishable by fines in accordance with Article 5.27 of the Administrative Code.

Motivation system

The company's revenue directly depends on how interested employees are in their work.

In total, there are two formats for motivating employees – material and non-material.

Material. A successful manager is a stingy manager. According to statistics, an employee who works for a percentage of sales shows better results than someone else who works for a fixed salary. Therefore, it is advisable to divide his income into three components: fixed salary (30%), soft salary (10%) and bonuses (60%).

A fixed salary is the minimum acceptable remuneration to meet the basic needs of employees. Receiving a soft salary presupposes 100% fulfillment of KPIs. The lion's share of the salary should be bonuses. They are the key motivator for the implementation of a given plan.

Non-material motivation. It is a set of social events aimed at increasing employee loyalty, improving working conditions, creating a healthy atmosphere in the team, and building team spirit.

The components of non-material motivation include: information boards with sales indicators for each manager, competitions, public praise, provision of additional days for vacation, gifts, time off.

The leader must work according to the “do as I do” principle and be an example for the team. The final result depends on it, so specialists at this level should be especially interested in their work. There are several ways to motivate.

- The frames are hard and soft. The first should be from 40 to 50% of the total earnings of the ROP. The soft salary is conditional on 100% achievement of key performance indicators.

- Bonuses. The additional reward system depends on how the entire department performed as a whole. If the plan is completed 80% or lower, the manager receives nothing. At 80-100% - coefficient 1, 100-120% - coefficient 2, over 120% - coefficient 3. Coefficient 1 is equal to one salary. In this case, the maximum size of bonuses should be limited to a specific figure or percentage. And as the company grows, the size of bonuses should decrease so that the owner does not lose his profit.

The ROP motivation system must be reviewed at least once a year and take into account the interests of managers at different levels.

There are two types of employee motivation in companies: material (monetary) and intangible (career and personal growth).

Soft salary (30%)

Fixed salary (10%)

Bonus (60%)

The bonus payment system directly depends on what sales KPIs the manager shows at the end of the month. It is by performance indicators in sales that employees are evaluated.

Therefore, knowing these indicators, the employee will make every effort to improve the material result. Both the company and the employee himself are interested in this result.

We looked at the main sales KPIs by which your company employees should be assessed. Review your standards for assessing the quality of work and your employee motivation system. Make the necessary changes in your business.

Reporting system

How well the sales department worked can be judged by the reporting. It allows you to predict income, allocate resources and identify problems in a timely manner. There are three types of reporting.

- Daily report. It contains information about the number of calls, meetings, and emails sent.

- Weekly report. Allows you to see how many calls resulted in meetings and how many commercial proposals led to a discussion of the terms of purchase.

- Monthly report. Includes the most important indicators: the number of attracted clients, average bill, revenue and profit.

The productivity of managers is reflected in the reports:

- by task;

- by request;

- by the amount of concluded transactions;

- by the number of calls;

- by the number of new contacts over a certain period;

- on winning trades;

- on the distribution of transactions across the sales funnel;

- by distribution of leads by status;

- by income and expenses;

- income and expense report by line of business;

- on debts to creditors;

- by lead source.

Reports for the day, week and month cover the entire work of the sales department and allow you to detect “weak” areas in time.

Conclusions website

- The salary amount is indicated in the documents when a person is hired; the salary is calculated after he has worked for a month at the enterprise or upon his dismissal from his position.

- Salary is a fixed figure in the staffing table of employees, which is used to calculate wages, and the salary indicator in no way affects the amount of salary.

- Salary is a basic, constant unit, and the salary consists of the salary and those percentages, bonuses and deductions that are provided for by law and the terms of the employee’s employment contract.