Source documents

Each fact of economic life must be confirmed by a primary document. It is impossible to take into account documents that document facts of economic life that did not take place (including imaginary and feigned transactions). This is stated in Part 1 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

The forms of primary documents are determined by the head of the organization upon the recommendation of the person entrusted with accounting (Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

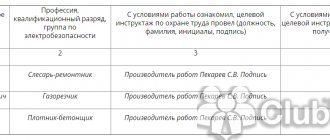

The primary document must contain the following mandatory details:

- Title of the document;

- date of document preparation;

- name of the economic entity (organization) that compiled the document;

- content of the fact of economic life;

- the value of the natural and (or) monetary measurement of a fact of economic life, indicating the units of measurement;

- the names of the positions of the persons who completed the transaction, operation, and those responsible for its execution, or the names of the positions of the persons responsible for the execution of the accomplished event;

- signatures of these persons with transcripts and other information necessary to identify these persons.

Such a list is established by Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

The primary document must be drawn up when a fact of economic life is committed, and if this is not possible, immediately after its completion (Part 3 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

Primary documents are drawn up on paper and (or) in the form of an electronic document signed with an electronic signature (Part 5 of Article 9 of the Law of December 6, 2011 No. 402-FZ).

The law is good, but there is a nuance

And now a little about the procedure for imposing a fine and the sad things.

Protocol on offense under Art. 15.11 Code of Administrative Offenses of the Russian Federation is compiled by tax authorities. But the court imposes an administrative fine on the chief accountant. It is to him that all your arguments in self-defense will ultimately come to him for consideration. Get ready.

In practice, controllers most often apply this article to one of the six violations listed in the note to paragraph 1. Namely, to understatement of taxes and fees. Errors in accounting and accounting are less of a concern to them. And here it’s time to remember one famous expression: we wanted the best, but it turned out as always. Let's look carefully at the new clause 1.1:

“The administrative liability provided for by this article for distortion of accounting (financial) reporting indicators does not apply to the person entrusted with accounting, and the person with whom an agreement has been concluded for the provision of accounting services, if such a distortion was made as a result of inconsistency of primary accounting documents compiled by other persons with accomplished facts of economic life and (or) non-transfer or untimely transfer of primary accounting documents for registration of the data contained in them in accounting registers.”

Where is the mention of understatement of taxes? Does this mean that the innovation making life easier for accountants applies only to distortion of financial statements, and does not apply to the other five offenses from the list of gross violations? We do not have an answer to this question. Knowing the tax authorities, we risk assuming that they can take advantage of this clue. Therefore, everything will depend on which path the judicial practice will take: whether judges will interpret clause 1.1 to cover the entire art. 15.11 or take a formal approach. We hope they choose the first option.

Standard forms

Unified forms of documents from albums of unified forms approved by the resolutions of the State Statistics Committee of Russia are not mandatory for use. At the same time, the forms established by authorized bodies on the basis of federal laws remain mandatory for use. Thus, the organization is obliged to use standard forms of documents approved by the Government of the Russian Federation, the Bank of Russia (for example, payment orders, expenditure and cash receipt orders) and other authorized bodies in pursuance of federal laws. Such clarifications are contained in the information of the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012, letter of the Federal Tax Service of Russia dated June 23, 2014 No. ED-4-2/11941.

If for any fact of economic life a unified form of the primary document is established by a resolution of the State Statistics Committee of Russia, then the organization has the right, at its own choice:

- or develop the document form yourself;

- or use a unified form.

According to the general rule, the forms of primary documents are determined by the head of the organization upon the recommendation of the person entrusted with accounting (Part 4 of Article 9 of the Law of December 6, 2011 No. 402-FZ). That is, the manager must approve either the form independently developed by the organization, or the fact that the organization uses unified forms.

In any case, the primary document must contain all the mandatory details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. The information included in this list is identical in composition and content to the details of documents compiled according to forms from albums of unified forms. That is, the current unified forms comply with the requirements of Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

If necessary, you can add details to unified forms (additional rows, columns, etc.) or exclude them. Approve the corrected unified form by order (instruction) of the manager as the primary document.

Such conclusions follow from the provisions of Article 9 of the Law of December 6, 2011 No. 402-FZ and are confirmed by information from the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012. The correctness of this approach was confirmed by the Federal Tax Service of Russia in a letter dated February 12, 2020 No. GD-4-3/ [email protected] , having sent a letter from the Ministry of Finance of Russia dated February 4, 2020 No. 03-03-10/4547 to lower inspections. This letter from the tax service is posted on the official website of the Federal Tax Service of Russia in the section “Explanations that are mandatory for use.”

An example of how to add additional information to a unified form

At Alpha LLC, repayment of debts to accountable persons sometimes occurs in non-cash form. In order to display this operation in the unified form of the advance report, it was decided to add an additional line to it: “Overexpenditure in the amount of___ was transferred to the employee’s salary card according to the payment order dated “__” ________ 200__. No. ___.” This form was approved by order of the head of the organization.

How to approve forms

Approve the forms of primary documents in the accounting policy (clause 4 of PBU 1/2008).

In this case, standard forms without changes do not need to be attached to the accounting policies. The fact of using unified forms can be reflected in the accounting policies in the following ways:

- write: “The unified forms contained in the albums of unified forms approved by the State Statistics Committee of Russia are used as forms of primary accounting documents, without changes.” In this case, you will need to use uniform forms for each operation for which a form exists;

- prescribe for different accounting objects which unified forms the organization will use, something like this: “...use the unified form _____, approved by the resolution of the State Statistics Committee of Russia dated _____ No. _______.” For example, when using the unified form No. TORG-12, you can make the following entry: “Use the unified form No. TORG-12, approved by Decree of the State Statistics Committee of Russia dated December 25, 1998 No. 132, to register the sale (release) of inventory items to a third party organization.” .

Include samples of independently developed forms approved by the manager in the appendix to the order approving the accounting policy.

Forms of primary accounting documents

Starting from 2013, the forms of primary accounting documents used (with the exception of state organizations) are determined by the head of the economic entity (clause 4 of article 9 of the Accounting Law). These can be unified forms or your own, developed in compliance with the mandatory details of the primary documents. Before this date, when using unified forms, it was impossible to delete the existing details of such documents (letter of the Ministry of Finance of Russia dated 07/08/2011 No. 03-03-06/1/414); it was only possible to supplement the form with new lines or columns.

When developing your own forms of primary accounting documentation, it should be taken into account that the forms of primary accounting documents established by authorized bodies in accordance with other federal laws and on their basis remain mandatory for use (Information of the Ministry of Finance of Russia dated December 4, 2012 No. PZ-10/2012). Examples of such forms are:

— cash documents provided for by the Directive of the Bank of the Russian Federation dated March 11, 2014 No. 3210-U (receipt and expense cash orders, cash book and book of accounting for funds accepted and issued by the cashier, settlement and payment and payroll statements);

— primary documents for accounting for cash payments when carrying out trade operations using cash registers, developed on the basis of Federal Law No. 54-FZ dated May 22, 2003 “On the use of cash register equipment when making cash payments and (or) settlements using payment cards” and approved by Resolution of the State Statistics Committee of the Russian Federation dated December 25, 1998 No. 132 (see letter of the Federal Tax Service of Russia dated June 23, 2014 No. ED-4-2/11941). That is, in this case, it is still necessary to use unified forms of primary accounting documentation for recording monetary settlements with the population when carrying out trade operations using cash register machines (forms No. KM-1 - No. KM-9);

— a waybill approved by Decree of the Government of the Russian Federation dated April 15, 2011 No. 272, which confirms the conclusion of a transportation agreement (letters from the Ministry of Finance of Russia dated January 28, 2013 No. 03-03-06/1/36, dated April 23, 2013 No. 03-03-06/ 1/14014).

At the same time, as practice shows, few economic entities have abandoned the use of the usual unified forms for which most accounting software products are designed.

Many organizations operating vehicles must draw up a waybill to confirm expenses for fuel and lubricants. This raises the question: can an organization independently develop a form of waybill, guided only by the mandatory details contained in paragraph 2 of Art. 9 of the Accounting Law?

Let us remind you that the mandatory details and procedure for filling out waybills are established by Order of the Ministry of Transport of Russia dated September 18, 2008 No. 152 (hereinafter referred to as Order of the Ministry of Transport of Russia No. 152). Letter of the Ministry of Finance of Russia dated August 25, 2009 No. 03-03-06/2/161 states that a waybill independently developed by an organization can be one of the documents confirming the costs of purchasing fuel and lubricants, if it contains mandatory details approved by order of the Ministry of Transport of Russia No. 152. But are Ministry of Transport details required for all enterprises?

As noted in the Decision of the Arbitration Court of the Samara Region dated April 15, 2014 No. A55-31301/2012, the use of Form No. 3 “Passenger Car Waybill” is mandatory only for motor transport organizations. Other organizations can either use the unified form No. 3 “Passenger car waybill”, or develop their own form of waybill or other document that confirms the validity of the expenses incurred for the purchase of fuels and lubricants, which must reflect all the details provided for in paragraph 2 Art. 9 of the Accounting Law. At the same time, primary documents must be drawn up in such a way and with such regularity that on their basis it is possible to judge the validity of the expenses incurred (letter of the Ministry of Finance of Russia dated 04/07/2006 No. 03-03-04/1/327).

In a number of cases, tax authorities, based on shortcomings in waybills (non-compliance with the form approved by Order of the Ministry of Transport of Russia No. 152), conclude that business transactions are unrealistic. When resolving such disputes in court, judges also note that the taxpayer is not a transport organization, and therefore the amount of information indicated in the waybills is sufficient to carry out tax control (resolution of the Fourth Arbitration Court of Appeal dated April 1, 2015 No. A78-6705/2014).

However, the situation is different for motor transport enterprises. In accordance with paragraph 2 of Art. 6 of the Transport Charter prohibits the transportation of passengers and luggage, cargo by buses, trams, trolleybuses, cars, trucks without issuing a waybill for the corresponding vehicle. In this regard, improper execution of a waybill (in forms that do not comply with Order of the Ministry of Transport of Russia No. 152) leads to fines (Decision of the Arbitration Court of the Sakhalin Region dated April 16, 2015 No. A59-570/2015).

Registers

The data contained in the primary documents is reflected in the accounting registers. Accounting registers are lists of transactions in chronological order, grouped by accounting accounts (for example, statements, reports in tabular form).

The register forms are approved by the head of the organization. The required details of the accounting register are:

- register name;

- name of the organization (economic entity) that compiled the register;

- the start and end dates of maintaining the register and (or) the period for which it was compiled;

- chronological and (or) systematic grouping of accounting objects;

- unit of measurement;

- names of positions of persons responsible for maintaining the register and their signatures with a transcript.

Registers are compiled on paper and (or) in the form of an electronic document signed with an electronic signature.

When making corrections to the registers, you must indicate the date of the correction, as well as the signatures of the persons responsible for maintaining this register (with a transcript).

When registering accounting objects in registers, the following are not allowed:

– omissions or withdrawals;

– reflection of imaginary and feigned accounting objects.

Such rules are defined by Article 10 of the Law of December 6, 2011 No. 402-FZ.

The employee responsible for preparing the primary document must ensure its timely transfer for inclusion in the accounting registers. In this case, this employee is responsible for the accuracy of the data recorded in the primary document. This is stated in Part 3 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

Entrepreneur on OSNO

Documentation of business transactions carried out by an individual entrepreneur applying the general taxation system is regulated by the Procedure approved by order of the Ministry of Finance of Russia No. 86n dated August 13, 2002 and the Ministry of Taxes of Russia No. BG-3-04/430.

The requirements for primary accounting documents are contained in paragraph 9 of this procedure. They almost completely coincide with the requirements for primary accounting documents used by organizations. The only addition is that individual entrepreneurs must attach to the primary document that documents the sale of goods or their purchase, a primary document confirming payment for this product.

Separate division

Situation: can a separate division reflect business transactions on the basis of primary documents issued on behalf of the head office of the organization? A separate division is allocated to a separate balance sheet and conducts accounting independently.

Yes maybe.

At the same time, the accounting policy must reflect the condition that all primary documents are drawn up on behalf of the head office.

The organization establishes the methods of accounting independently and prescribes them in the accounting policy for accounting purposes (Article 8 of the Law of December 6, 2011 No. 402-FZ). The provisions specified in the accounting policy apply to all separate divisions of the organization (clause 9 of PBU 1/2008). Therefore, if the organization’s accounting policy states that all primary documents are drawn up on behalf of the head office, then a separate division has the right to conduct accounting on the basis of such registers.

In addition, one of the mandatory details of any primary document is the name of the economic entity that compiled the document (subclause 3, part 2, article 9 of the Law of December 6, 2011 No. 402-FZ). Economic entities are considered, in particular, commercial and non-profit organizations (subparagraph 1, part 1, article 2 of the Law of December 6, 2011 No. 402-FZ). An organization is recognized as a legal entity registered in accordance with the legislation of the Russian Federation (Clause 1, Article 48, Article 51 of the Civil Code of the Russian Federation). A separate division is not an independent legal entity; it is part of it (Article 55 of the Civil Code of the Russian Federation). Consequently, a separate division, conducting accounting independently on the basis of documents drawn up on behalf of the head office of the organization, does not violate accounting legislation.

Accounting information

Situation: in what cases is it necessary to prepare an accounting certificate?

An accounting certificate must be prepared in any cases where an accountant needs to justify transactions or calculations. For example:

- when submitting updated declarations to justify the calculations reflected in them (letter of the Federal Tax Service of Russia dated December 14, 2006 No. 02-6-10/233);

- to confirm the amounts reflected in accounting, for example, when calculating dividends;

- to justify reversal entries, etc.

This primary document must contain the mandatory details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

Not all details are filled in

As arbitration practice shows, in such cases the courts often take the side of taxpayers.

PRIMEROO transferred funds to the foreign partner to pay for consulting services. However, the act confirming the provision of services did not contain all the necessary details. During the on-site inspection, tax inspectors regarded this as a violation of the Federal Law “On Accounting” and excluded the amount paid to the foreign partner from the cost price. As a result, it was decided to charge additional tax, as well as collect penalties and fines from the enterprise. did not agree with the inspection's decision and appealed to the arbitration court. Having studied the case materials, the court sided with the enterprise. He, in particular, pointed out that “minor deficiencies in the preparation of primary documents ... do not indicate the absence of a business transaction, as well as the absence of expenses for the company to pay for consulting services.”

Due to the abolition of the mandatory use of unified forms of primary documents, companies should reduce the number of disputes with inspectors. Controllers will no longer be able to “remove” expenses due to improperly executed documents, since the requirement to use standard forms of documents does not exist from January 1, 2013 (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ).

Signatures in documents

Draw up all primary documents when performing a transaction (transaction, event). And if this is not possible - immediately after the end of the operation (transaction, event). Responsibility for registration lies with the employees who signed the primary document.

Such rules are established by Article 9 of the Law of December 6, 2011 No. 402-FZ.

The list of employees who have the right to sign primary documents can be approved by the head of the organization by his order.

At the same time, the procedure for signing documents used to formalize transactions with funds is regulated, in particular, by Bank of Russia Directive No. 3210-U dated March 11, 2014 and Bank of Russia Regulation No. 383-P dated June 19, 2012.

In any case, the primary document must be signed in such a way that it is possible to identify those who signed it (the persons responsible for processing the transaction). That is, the signatures in the document must be decrypted.

This follows from Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ and is confirmed by the letter of the Ministry of Finance of Russia dated September 10, 2013 No. 07-01-06/37273.

Let’s say an organization that is not a small (medium) enterprise has entered into an agreement with a third-party contractor for the provision of accounting services. Who should sign the primary documents for the chief accountant in this case?

The manager himself must appoint a list of people who have the right to sign primary accounting documents (clause 14 of the Regulations approved by order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n, information of the Ministry of Finance of Russia No. PZ-10/2012). These can be employees of the organization (cashier, manager, etc.), as well as representatives of a third-party organization that does accounting.

The right to sign bank documents can be transferred to full-time employees, as well as to persons providing accounting services (clause 7.5 of Bank of Russia Instruction No. 153-I dated May 30, 2014). Thus, in addition to the head of the organization, bank documents can be signed by an employee of the organization or the head of a third-party organization that keeps records.

At the same time, the head of the organization himself cannot sign for the chief accountant. The fact is that, since the organization is not a small (medium) enterprise, the manager cannot take over the accounting. This conclusion follows from Part 3 of Article 7 of the Law of December 6, 2011 No. 402-FZ.

Unlike organizations, an individual entrepreneur cannot transfer the right to sign primary documents to third parties. This is directly indicated in paragraph 10 of the Procedure, approved by order of August 13, 2002 of the Ministry of Finance of Russia No. 86n and the Ministry of Taxes of Russia No. BG-3-04/430.

Situation: can the chief accountant sign contracts if he is the founder of the organization?

Yes, it can, but only if he has a power of attorney for the right to sign, issued by the head of the organization (Clause 4 of Article 185.1 of the Civil Code of the Russian Federation).

In other cases, the right to sign contracts on behalf of the organization belongs to the head (unless otherwise provided by the organization’s charter) (Clause 1, Article 53 of the Civil Code of the Russian Federation).

Situation: what color of ink should be used to sign primary documents, as well as invoices?

As a general rule, any color, but there are special requirements for bank documents.

The legislation does not impose requirements on the color of ink that must be used to sign primary documents, as well as invoices. Clause 2.8 of the Regulations approved by the USSR Ministry of Finance dated July 29, 1983 No. 105 (applied to the extent that does not contradict current legislation) states that entries in primary documents must be made in ink, crayon or ballpoint pen paste. Do not use a pencil for writing.

An exception is provided only for bank documents. Clause 1.7.2 of the Rules approved by Bank of Russia Regulation No. 385-P dated July 16, 2012 states that each document submitted to a credit institution on paper must have the signatures of authorized officials and a seal imprint and correspond to the declared samples. In this case, signatures on all documents must be made with a pen with black, blue or purple ink.

Tip: Sign source documents as well as invoices using traditional ink colors (black, blue or purple).

The fact is that when copying primary documents and invoices filled out using red or green ink, the data specified in this way may not appear on the copies of the documents. This may lead to negative consequences when submitting copies of documents for a tax audit (see, for example, Resolution of the Federal Antimonopoly Service of the East Siberian District dated February 14, 2006 No. A19-13900/05-43-F02-290/06-S1).

Take care of your bills from a young age

Unfortunately, no one is immune from encountering emergency situations. Sometimes, as a result of thefts, fires, floods or other similar incidents, taxpayers, for one reason or another, lose primary accounting documents. Moreover, the loss of documentation can be even more costly for the injured party than the loss of other property. The whole point is that not only organizations are interested in the availability of primary documentation, but also tax authorities that check the correctness of calculation and payment of taxes.

Often, tax authorities, having discovered the absence of primary documentation, assess taxes based on paragraphs. 7 clause 1 art. 31 of the Tax Code of the Russian Federation, in unreasonable amounts. But even in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 25, 2004 N 668/04, it was stated that the calculation of the amount of tax to be paid into the budget is made on the basis of data on income and expenses. And if it is impossible to establish one of the components necessary for calculating tax, one should be guided by the corresponding rule provided for in paragraphs. 7 clause 1 art. 31 of the Tax Code of the Russian Federation, which creates additional guarantees of taxpayer rights and ensures a balance of public and private interests.

There are quite a lot of similar cases in arbitration practice.

So, for example, this is the resolution of the Federal Antimonopoly Service of the Central District dated 09/05/07 in case No. A48-4470/06-06.

In addition to errors and contradictions in the collection of evidence, the fact that they directly violated the requirements of paragraph 7 of paragraph 1 of Article 31 of the Tax Code of the Russian Federation did not work in favor of the tax inspectorate. According to this norm, tax authorities have the right to determine the amount of taxes payable by taxpayers to the budget system of the Russian Federation by calculation based on the information they have about the taxpayer, as well as data about other similar taxpayers.

As the court pointed out, tax authorities are required to prove the absence of similar taxpayers.

Since this was not done, the entire tax calculation of the tax office was called into question.

As practice shows, most often the courts refuse to consider tax authorities in such cases due to the fact that the latter either cannot prove the absence of similar taxpayers, or calculate taxes based only on the possible income of the taxpayer, without taking into account his possible expenses.

In particular, decisions in favor of taxpayers were made in the following resolutions:

- FAS Volga-Vyatka District dated March 30, 2007 in case No. A79-14488/2005;

- FAS Volga District dated 05/08/07 in case No. A49-7268/06-2A/11;

— Federal Antimonopoly Service of the North-Western District dated October 25, 2006 in case No. A42-12194/2005;

- FAS East Siberian District dated March 20, 2007 in case No. A33-3654/05-F02-1360/07.

However, if the tax authorities act fairly correctly, justifying all their calculations or actually finding a similar taxpayer - who will have a similar industry affiliation, type of activity, average monthly revenue, average number of employees, total cost of fixed assets, etc., - then they may well succeed in court.

However, the most unpleasant situation when documents are lost occurs when an organization needs to confirm the right to tax deductions for VAT.

There are judicial precedents when the courts sided with taxpayers in this matter.

However, the Supreme Arbitration Court of the Russian Federation expressed a completely different point of view. And if in the ruling of the Supreme Arbitration Court of the Russian Federation dated 10.18.07 N 13416/07 one can still detect some hesitation of the judges, then in the resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated 30.01.07 N 10963/06, the ruling of the Supreme Arbitration Court of the Russian Federation dated 31.08.07 N 8686/07 and In the decision of the Supreme Arbitration Court of the Russian Federation dated October 30, 2007 N 8686/07, the position of the court is completely clear. According to the Supreme Arbitration Court, in the issue of applying VAT deductions, the calculation method described in paragraphs. 7 clause 1 art. 31 of the Tax Code of the Russian Federation, not applicable.

Everything is very simple. According to Art. 166 of the Tax Code of the Russian Federation, the amount of VAT is calculated as the share of the tax base corresponding to the tax rate. This same article provides for the right of tax authorities, in the event that the taxpayer does not have credentials, to determine the amount of tax by calculation. However, the right to apply tax deductions is provided for in other articles, namely Art. 171 and art. 172 of the Tax Code of the Russian Federation. In accordance with them, it is the taxpayer, and not the tax authorities, who has the responsibility to confirm the legality of tax deductions with primary documentation.

The Russian Ministry of Finance reflected the favorable position of the Supreme Arbitration Court of the Russian Federation in a letter dated 09.20.07 N 03-02-08-12.

Thus, it is the organization that should be vitally interested in the restoration of lost documentation.

What do I need to do?

Firstly, if it is discovered that documents have been lost, a commission must be created to investigate the reasons for this. It is highly desirable that the commission include a third-party, disinterested person. Ideally, this should be a representative of a government agency.

Based on the results of the investigation, it is necessary to draw up an appropriate report.

Secondly, an inventory of the property should be immediately carried out.

Thirdly, it is necessary to apply for official confirmation of the emergency events that have occurred - from the regional department of the Russian Ministry of Emergency Situations, from law enforcement agencies or from the housing and communal services department - depending on what exactly happened.

Fourthly, when the above documents are compiled and received, the tax office should be notified in writing about the loss of primary tax and accounting documentation. It is advisable to attach copies of all documents related to this case to this notice.

Fifthly, we immediately need to begin restoring lost primary documentation.

With regard to invoices required to confirm VAT tax deductions, there is only one way - obtaining copies of them from counterparties. Documents regarding the delivery of property can be restored with the help of the carrier. And documents evidencing the receipt of received property can be restored independently.

www.palata-nk.ru

Electronic documents

Primary documents can be prepared both in paper and electronic form (Part 5 of Article 9 of the Law of December 6, 2011 No. 402-FZ). The last option is possible if an electronic signature is placed on the documents (Article 6 of the Law of April 6, 2011 No. 63-FZ).

The requirements for an electronic signature are provided for by the Law of April 6, 2011 No. 63-FZ.

There are the following types of electronic signature: simple unqualified, enhanced unqualified and enhanced qualified (Article 5 of the Law of April 6, 2011 No. 63-FZ). The legal force of the document will depend on what signature the organization uses.

Thus, primary documents certified with a simple or enhanced non-qualified electronic signature cannot be accepted for accounting and tax purposes. They are not recognized as equivalent to paper documents certified by a handwritten signature.

On the contrary, documents certified by an enhanced qualified electronic signature are equated to those signed personally and are accepted for accounting and tax purposes.

Similar conclusions follow from paragraphs 1 and 2 of Article 6 of the Law of April 6, 2011 No. 63-FZ and confirmed by letters of the Ministry of Finance of Russia dated April 12, 2013 No. 03-03-07/12250, dated December 25, 2012 No. 03- 03-06/2/139, dated May 28, 2012 No. 03-03-06/2/67, dated July 7, 2011 No. 03-03-06/1/409.

The format for submitting a document on the transfer of goods during trade operations in electronic form was approved by Order of the Federal Tax Service of Russia dated November 30, 2020 No. ММВ-7-10/551. The format for presenting the document on the transfer of work results (document on the provision of services) in electronic form was approved by Order of the Federal Tax Service of Russia dated November 30, 2015 No. ММВ-7-10/552. These formats are relevant both in business activities and when submitting documents at the request of the inspection in electronic form.

The Federal Tax Service of Russia does not plan to develop formats for standard forms.

If the legislation of Russia or an agreement provides for the submission of a primary document to a counterparty or to a government agency (for example, a tax office) on paper, the organization is obliged to make a paper copy of the electronic document at its own expense (Part 6, Article 9 of Law of December 6, 2011 No. 402 -FZ).

What if an organization draws up documents not according to the format approved by the Federal Tax Service of Russia? Then submit the forms to the inspectors on paper - certify the copies with a note that the documents are signed with an electronic signature.

Similar clarifications are provided in the letter of the Federal Tax Service of Russia dated November 10, 2020 No. ED-4-15/19671.

For details on how to submit documents to tax inspectors, see:

- How to submit documents at the request of inspectors during a desk tax audit;

- How to submit documents at the request of inspectors during an on-site tax audit.

If an organization decides to process primary documents in electronic form, this method of maintaining documentation must be reflected in the accounting policy. In particular, the accounting policy needs to record:

- list of documents participating in electronic document flow;

- list of employees authorized to sign electronic documents;

- method of electronic exchange of documents (with or without the involvement of an electronic document management operator);

- procedure for storing electronic documents;

- method of submitting documents at the request of the tax office (electronically or on paper).

This follows from Article 8 of the Law of December 6, 2011 No. 402-FZ.

But the formats of electronic documents that the organization uses do not need to be reflected in the accounting policies. This was confirmed by the Federal Tax Service of Russia in a letter dated November 10, 2020 No. ED-4-15/19671. Although this letter deals with accounting policies for tax purposes, the conclusion of the Federal Tax Service of Russia is also relevant for accounting policies for accounting purposes.

Printing on documents

The seal is not listed among the mandatory details of the primary documents listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ.

Therefore, put a stamp on the document:

- if the organization, at its own choice, uses an independently developed form approved by the head, which includes a seal;

- if the organization, of its own choice, uses a unified form contained in the album of unified forms, which includes a seal. At the same time, the manager approved that the form is used without changes (or the changes do not affect the seal);

- when applying standard mandatory forms established by authorized bodies (the Government of the Russian Federation, the Bank of Russia, etc.) on the basis of federal laws, if the standard forms require a seal.

Such conclusions follow from the provisions of Article 9 of the Law of December 6, 2011 No. 402-FZ.

The list of documents on which the organization’s seal is required (optional) is given in the table.

In agreements that an organization usually concludes (purchase and sale, provision of services, etc.), a seal also does not need to be affixed. A seal must be affixed only if this is expressly provided for in the contract (Clause 1, Article 160 of the Civil Code of the Russian Federation).

One more thing. From April 7, 2020, LLCs and joint stock companies may not have seals at all. This is provided for in Articles 2 and 6 of Law No. 82-FZ of April 6, 2020.

Documents in a foreign language

Documents written in a foreign language must have a line-by-line translation into Russian. This is necessary both for accounting and tax purposes (clause 9 of the Regulations on Accounting and Reporting, Article 313 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated February 28, 2012 No. 03-03-06/1/106).

There is no need to add anything to the documents themselves. Attach separate translations signed by the translators. A document can be translated into Russian by either a professional translator or an employee of an organization who speaks a foreign language (letters of the Ministry of Finance of Russia dated April 20, 2012 No. 03-03-06/1/202, dated March 26, 2010 No. 03-08- 05/1).

However, the organization may retain some words in a foreign language if they are a registered trademark, for example, the name of the airline on an airline ticket (Article 6 of the Convention for the Protection of Industrial Property of March 20, 1883) or are not essential for confirming the expenses incurred, for example, in an air ticket in a foreign language - the terms of application of the fare, rules of air transportation, rules for the transportation of baggage and other similar information (letters of the Ministry of Finance of Russia dated March 24, 2010 No. 03-03-07/6, dated September 14, 2009 No. 03- 03-05/170).

If documents in a foreign language are compiled according to a standard form (identical in the number of columns, their names, decoding of works, etc. and differ only in the amount), then with regard to their constant indicators, a one-time translation into Russian is sufficient. Subsequently, only the changing indicators of this primary document need to be translated. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated November 3, 2009 No. 03-03-06/1/725.

Error correction

Corrections in primary documents are allowed (Part 7, Article 9 of the Law of December 6, 2011 No. 402-FZ).

The procedure for correcting errors in primary documents should be established in the accounting policy for accounting purposes or in an appendix to it. The organization independently develops ways to make corrections to the primary document (both on paper and in the form of an electronic document). Focus on the requirements of the Law of December 6, 2011 No. 402-FZ, accounting regulations and take into account the peculiarities of document flow. When developing such methods, you can focus on current regulations governing similar issues (for example, Rules for filling out invoices, approved by Decree of the Government of the Russian Federation of December 26, 2011 No. 1137). This was stated in the letter of the Ministry of Finance of Russia dated January 22, 2020 No. 07-01-09/2235.

Correct errors in primary documents as follows: cross out the incorrect text and write the corrected text above the crossed out text. Crossing out is done with one line so that the correction can be read. Certify corrections in documents with the signatures of the persons who compiled the document (indicating their last names and initials or other details necessary to identify these persons), and indicate the date the correction was made.

You cannot make corrections to cash and bank documents. Such rules are established by paragraph 7 of Article 9 of the Law of December 6, 2011 No. 402-FZ, section 4 of the Regulations approved by the Ministry of Finance of the USSR on July 29, 1983 No. 105, and paragraph 4.7 of the Bank of Russia directive of March 11, 2014 No. 3210-U .

An error in the accounting register can be corrected on the basis of an accounting certificate. This document must provide a rationale for the correction.

Corrections not authorized by the persons responsible for maintaining the relevant register are not allowed in accounting registers (Part 8, Article 10 of Law No. 402-FZ of December 6, 2011). If the correction in the register is authorized by the responsible persons, then certify it with the signatures of these persons (indicating their surnames and initials or other details necessary to identify these persons), and indicate the date the correction was made. Such rules are established by paragraph 8 of Article 10 of the Law of December 6, 2011 No. 402-FZ.

Corrections in primary accounting documents

According to paragraph 7 of Art. 9 of the Law on Accounting, corrections are allowed in the primary accounting document, unless otherwise established by federal laws or regulatory legal acts of state accounting regulatory bodies.

Thus, corrections in cash and banking documents are not allowed (paragraph 2, clause 4.7 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

It is possible to make corrections in other primary accounting documents.

The correction in the primary accounting document must contain the date of the correction, as well as the signatures of the persons who compiled the document in which the correction was made, indicating their surnames and initials or other details necessary to identify these persons.

Thus, corrections in the primary document must be certified by representatives of the parties involved in the preparation of this document in accordance with the provisions of the Accounting Law.

The procedure for correcting errors in primary accounting documents is regulated by clause 4.2 of the Regulations on Documents and Document Flow in Accounting (approved by the USSR Ministry of Finance dated July 29, 1983 No. 105). The error correction algorithm is as follows:

— the erroneous entry is crossed out;

— the correct entry is made;

- the inscription “corrected to believe” is affixed;

— the date for making the correction is set;

— the position of the person and the full name of the person who makes the correction are indicated;

- a personal signature is placed.

Timely and high-quality execution of primary accounting documents, their transfer within the established time limits, as well as the reliability of the data contained in them are ensured by the persons who compiled and signed these documents.

It should be noted that when considering legal disputes, documents drawn up in violation of the above requirements are not considered as proper evidence of a business transaction.

For example, in one of the court decisions (Decision of the Arbitration Court of the Nizhny Novgorod Region dated March 17, 2015 No. A43-27322/2014), corrected invoices were not regarded as evidence indicating the delivery of goods, since “...corrected invoices do not contain the signatures of the persons who compiled the document with a correction indicating identifying features, as well as the signature of the defendant’s authorized person.”

As a general rule, if facts are revealed in subsequent billing periods indicating that the primary accounting documents (acts) for previous billing periods contain unreliable information, the parties are obliged to make corrections to the previously signed primary documents in order to ensure their accuracy.

However, making corrections to primary accounting documents drawn up unilaterally and containing corrections to meter readings to justify the declared volume of transferred electricity cannot be considered sufficient and reliable evidence of consumption of electrical energy in a larger volume. As noted in the resolution of the Tenth Arbitration Court of Appeal dated January 16, 2015 No. A41-53651/2014, “... a unilateral change in information about the amount of energy resources consumed by the defendant in the account and the energy acceptance certificate, without the mutual will of the parties, contradicts the above rules of law and does not entail legal consequences."

Internal control

The organization is obliged to organize and carry out internal control of the facts of economic life. And if its reporting is subject to mandatory audit, then it is obliged to maintain internal control over accounting and reporting (except for cases where the manager has assumed the responsibility for accounting). Such requirements are established by Article 19 of the Law of December 6, 2011 No. 402-FZ.

In addition, one of the tasks of the chief accountant is to organize and control the creation (reception), processing and storage of documents (clause 6.6 of the Regulations approved by the USSR Ministry of Finance on July 29, 1983 No. 105 (valid to the extent that does not contradict the law)). The following tools can be used to perform this task:

- document flow schedule;

- nomenclature of cases.

The procedure for generating and processing documents must be fixed in the document flow schedule (clause 5.1 of the Regulations approved by the USSR Ministry of Finance on July 29, 1983 No. 105). The development of the schedule is organized by the chief accountant. The schedule is approved by order of the head of the organization (clause 5.2 of the Regulations approved by the USSR Ministry of Finance on July 29, 1983 No. 105).

The document flow schedule should describe:

- stages of creating (receiving), checking and transferring a document for storage;

- timing of each stage;

- a list of employees performing business operations and preparing documents;

- list of employees checking documents;

- relationship between responsible persons.

The schedule can be drawn up in the form of a diagram or a list of works indicating the operations and relationships of the performers. An approximate form of this document is given in the appendix to the Regulations approved by the USSR Ministry of Finance on July 29, 1983 No. 105. However, you can develop your own schedule structure. Such rules are established by paragraph 5.4 of the Regulations approved by the USSR Ministry of Finance on July 29, 1983 No. 105.

An example of a document flow schedule in tabular form

The chief accountant of Alpha LLC has developed a document flow schedule in tabular form (see, for example, the part of the document flow schedule dedicated to bank documents).

An example of a document flow schedule in the form of a diagram

Alpha LLC has decided to continue issuing travel certificates for employees going on business trips. The chief accountant of Alpha has developed a document flow schedule in the form of a diagram (see, for example, the scheme for processing a travel certificate).

In organizations with a small document flow, everything can be reduced to drawing up separate memos for employees. The employee should describe in detail what documents he must fill out so that there are no claims against him from the accounting department. For example, an employee goes to pick up paid goods from a supplier. The memo should state what documents he must bring, as well as the period within which they must be submitted to the accounting department. You can also attach samples of the required documents to the memo.

An example of a memo to the contractor on the procedure for completing documents

Document flow at Alpha LLC is organized by drawing up separate memos for employees (see, for example, the memo for a posted employee).

Control over the execution of the document flow schedule is assigned to the chief accountant (clause 5.7 of the Regulations approved by the USSR Ministry of Finance on July 29, 1983 No. 105). Employees of the organization must be familiar with this document or an extract from it. The chief accountant's requirements for document preparation are mandatory for all employees of the organization. For failure to comply with the requirements of the chief accountant, disciplinary action may be taken against employees. Some organizations prescribe compliance with paperwork requirements as one of the bonus conditions.

After processing the document, it is necessary to ensure its safety and subsequent transfer to the archive.

One way to organize the storage of documents is to compile a list of cases. It contains information about which documents should be kept in which department and for how long they should be stored. Form the nomenclature of affairs in the accounting department similarly to the nomenclature of affairs in the personnel department.

Rules for storing primary accounting documents, transferring them to archival storage, withdrawal (removal)

When storing primary accounting documents, organizations are also guided by the Regulations on Documents and Document Flow in Accounting, approved by the USSR Ministry of Finance on July 29, 1983 N 105 (hereinafter referred to as the Regulations on Document Flow), GOST R 51141-98 “Office work and archiving. Terms and definitions”, approved by Resolution of the State Standard of Russia dated February 27, 1998 N 28.

In all cases, the chief accountant of the organization bears responsibility for the safety of primary accounting documents.

In accordance with Section 6 of the Regulations on Document Flow, before being transferred for archival storage in the organization itself or in the relevant archives, primary documents must be stored in the organization's accounting department in special rooms or in locked cabinets under the responsibility of persons authorized by the chief accountant. Strict reporting forms are stored in safes or metal cabinets.

Before the formation of cases, it is recommended to store primary accounting documents for the purpose of preserving them, filed in special thematic folders. Processed (registered) documents related to a specific accounting register must be compiled in chronological order and bound. Certain types of documents (work orders, shift reports) can be stored not bound, but filed in folders.

Every month, based on the results of registration of accounting registers, it is recommended to sew documents into thematic files stored in the above order.

The issuance of primary documents from accounting and archives to employees of other structural divisions, as a rule, is not allowed, and in some cases can only be done by order of the head of the organization or the chief accountant.

In some cases, primary accounting documents may be seized by authorized bodies. Thus, in accordance with paragraph 8 of Article 9 of the Law on Accounting, primary documents can be seized by the bodies of inquiry, preliminary investigation and prosecutor's office, courts, tax inspectorates and tax police on the basis of their decisions in accordance with the legislation of the Russian Federation.

When seizing primary documents, tax officials, in particular, are guided by Articles 93 - 94 of the Tax Code of the Russian Federation and Instruction of the Ministry of Finance of the RSFSR dated July 26, 1991 N 16/176 “On the procedure for the seizure by an official of the state tax inspectorate of documents evidencing on concealment (understatement) of profit (income) or concealment of other objects from taxation for enterprises, institutions, organizations and citizens.”

When carrying out a seizure (seizure), the chief accountant or other official has the right, with the permission and in the presence of representatives of the authorities conducting the seizure of documents, to make copies of them indicating the reason and date of seizure. If unfinished volumes of documents are seized (not filed, not numbered, etc.), then with the permission and in the presence of representatives of the authorities making the seizure, the relevant officials of the organization can complete these volumes (make an inventory, number the sheets, lace, seal, certify with your signature and seal).

In all cases, the seizure (seizure) of documents must be documented in a protocol, a copy of which is handed over to the relevant authorized official of the organization against receipt.

Responsibility for the absence of primary documents

Attention: the absence (failure to submit) of primary documents is an offense (Article 106 of the Tax Code of the Russian Federation, Article 2.1 of the Code of Administrative Offenses of the Russian Federation), for which tax and administrative liability is provided.

The absence of primary documents, invoices, as well as accounting and tax registers is recognized as a gross violation of the rules for keeping records of income and expenses. Responsibility for it is provided for in Article 120 of the Tax Code of the Russian Federation.

If such a violation was committed during one tax period, the inspectorate has the right to fine the organization in the amount of 10,000 rubles. If a violation is detected in different tax periods, the fine will increase to RUB 30,000.

A violation that led to an understatement of the tax base will entail a fine of 20 percent of the amount of each unpaid tax, but not less than RUB 40,000.

In addition, at the request of the tax inspectorate, the court may impose administrative liability on officials of the organization (for example, its head) in the form of a fine in the amount of:

- from 300 to 500 rub. for failure to submit primary documents necessary for tax control (part 1 of article 23.1, part 1 of article 15.6 of the Code of Administrative Offenses of the Russian Federation);

- from 2000 to 3000 rub. for failure to comply with the procedure and terms of storage of primary documents (part 1 of article 23.1, article 15.11 of the Code of Administrative Offenses of the Russian Federation).

In each specific case, the perpetrator of the offense is identified individually. In this case, the courts proceed from the fact that the manager is responsible for organizing accounting, and the chief accountant is responsible for its correct maintenance and timely preparation of reports (clause 24 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18). Therefore, the subject of such an offense is usually recognized as the chief accountant (an accountant with the rights of the chief). The head of an organization may be found guilty of:

- if the organization did not have a chief accountant at all (resolution of the Supreme Court of the Russian Federation dated June 9, 2005 No. 77-ad06-2);

- if accounting and tax calculation were transferred to a specialized organization (clause 26 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18);

- if the reason for the violation was a written order from the manager, with which the chief accountant did not agree (clause 25 of the resolution of the Plenum of the Supreme Court of the Russian Federation of October 24, 2006 No. 18).

Consequences of improper execution of primary documents

First of all, violations in the preparation of primary documents may become the basis for liability under Art. 120 Tax Code of the Russian Federation.

The following are subject to this responsibility:

- taxpayers are organizations, and from January 1, 2014 also individual entrepreneurs (paragraph 1, paragraph 1, article 120 of the Tax Code of the Russian Federation; subparagraph “a”, paragraph 34, article 1, part 3, article 6 of the law of July 23, 2013 No. 248-FZ);

- tax agents (subparagraph “b”, paragraph 34, article 1, part 3, article 6 of Law No. 248-FZ; paragraph 3, paragraph 3, article 120 of the Tax Code of the Russian Federation). Note that until 2014, the wording of Art. 120 of the Tax Code of the Russian Federation directly indicated only the taxpayer, which raised doubts about its applicability in relation to tax agents. There was an opinion that they could not be the subject of this offense. At the same time, the Federal Tax Service insisted on the opposite (letter dated December 29, 2012 No. AS-4-2/22690).

In addition, the lack of properly executed primary documents may lead to a recalculation of the tax base and additional tax charges.

More details about the liability arising from Art. 120 of the Tax Code of the Russian Federation, read the material “Fine for gross violation of the rules for accounting for income and expenses” .

Primary documents are lost

Situation: what to do if the primary documents are lost?

If documents confirming recorded transactions are lost, the organization must take action to investigate the causes and restore the loss. To do this, the employee who discovered the loss must write a memo, on the basis of which an order is issued from the manager to appoint a commission to investigate the loss. Document the results of the commission’s work in an act.

If during the work of the commission the tax inspectorate requests documents that were lost, the organization will be able to ask to increase the deadline for submitting documents (clause 3 of article 93 of the Tax Code of the Russian Federation). In this case, the order to create a commission will be a documentary substantiation of such a request.

If, based on the results of the commission’s work, the documents are not discovered (restored), the organization will not be able to confirm the accounting and tax accounting data. In addition, the organization may face liability for the lack of documents.