Design features

The task of drawing up a bank order lies with the organization issuing credit funds.

Once completed, the document itself can be in either printed or electronic format. If the document is drawn up and filled out in writing, then you should pay attention to the fields. The rules for filling out details in the fields are described in the 3rd appendix to the bank order. When it comes to document execution in electronic form, its format should not exceed A4 format. If the text of the document exceeds these boundaries in volume, then the document must be converted into a multi-page form. The credit institution retains the right to establish a certain order in the numbering of pages, the order of signing the document, as well as other details regarding the design.

https://www.youtube.com/watch?v=cJNqrBWxKIw{amp}amp;lc

This document may use additional fields, the purpose of which can be determined by the organization itself for issuing credit funds. She is also responsible for their quantity, purpose and design, depending on needs. Only authorized persons who have the right to sign documents on behalf of this organization, that is, have the right of first or second signature, participate in the signing of the order.

In addition, the organization is responsible for confirming the authenticity of the order. Each branch has the right to personally establish the procedure in accordance with which the procedure for establishing the authenticity of the document will take place. The branch is responsible for the integrity of the document itself, as well as for the accuracy of its contents.

A document such as a bank order is widely applicable for conducting settlement transactions when customer accounts interact with the accounts of a branch of an organization for issuing credit funds.

All changes and results must be accurately reflected in the bank order. The document is subject to certain changes specifically for these purposes. Additional fields or lines are added to it, in which all the necessary data is entered.

The bank order contains another important information. An extract from your personal account must be attached to it. This document contains data on all transactions carried out specifically with this personal account of the client of the bank branch.

There are cases when there is not enough funds in the account of a bank client acting as a payer. In this case, the bank order will be moved to documents for unpaid or overdue payments. A payment order can pay a bank order. This operation can only take place in the order prescribed by the regulations of the Bank of the Russian Federation.

Work related to the movement of a bank order or its payment, if this document is in electronic form, occurs in agreement with the management of the organization for coordinating this process. Also, one should take into account the standards established by the Bank of the Russian Federation and state laws. These measures apply mainly to those bank orders whose owners have problems with their personal account or do not have enough funds on it.

Bank order sample filling

https://youtu.be/XSXHfhHdGFA

Information about the form

The paper is drawn up in the established format, which is assigned the number 0401066 according to the all-Russian classifier of management documentation. It is signed by bank employees and certified by the seal of this financial institution. The size, format and numbering of points is regulated by the regulation of the Central Bank of the Russian Federation No. 383-P on the rules of money transfers, adopted in 2020.

We invite you to familiarize yourself with the Road Accident Notice. Sample filling, diagram, form

The fact that an incomplete payment has been made is recorded by a special mark in the field to indicate the purpose of the payment. In addition, the employee performing the transfer indicates on the reverse side the transaction parameters, information about the document itself and puts his visa.

The form must be filled out in two copies. One of them refers to the documents of the financial institution’s operating day, the second is attached to an extract from the payer’s personal account.

Using bank orders

How is a bank order used? An order from a bank can be used for payment transactions in which the payer credit institution interacts with several other accounts in credit institutions. In this case, the corresponding amounts for the payer number are indicated on separate lines. A bank transfer reflecting transactions made on the personal account is attached to the client’s account statement.

If it is a question that the payer of the client's account does not have funds or their quantity is insufficient, the document written on paper is placed in the files that were not paid on time. The information is then transmitted in the “Payment” payment order. The bank establishes the transfer procedure to the credit institution.

Forgery of cash receipt order

Now let's laugh at cash receipts.

Expense cash order No. 1

The contents of this cash debit order do not comply with the requirements established by Bank of Russia Directive No. 318-P dated April 24, 2008 “On the forms of documents used by credit institutions on the territory of the Russian Federation when carrying out cash transactions with banknotes and coins of the Bank of Russia, banknotes and coins of foreign countries (groups of foreign states), transactions with bullion of precious metals, and the procedure for their filling and registration,” namely, the following are missing:

- signature of the recipient of funds in the column “Received the amount indicated in the cash receipt order”;

- job title, signature, surname, initials of the accounting employee of the credit institution who checked and issued the cash order;

- job title, signature, surname, initials of the supervisory employee of the accounting department of the credit institution, who is entrusted with the responsibility of exercising control over accounting;

- job title, signature, surname, initials of the cashier of the credit institution who issued cash;

- information about the additional office of the branch in which the transaction for issuing funds was allegedly carried out;

- stamp of the cash desk of an additional office (branch) of the bank.

In addition, this 2013 order indicates the BIC of 2020 (for obvious reasons, the BIC is obscured).

And of course, our favorite PJSC in 2013)))

Expense cash order No. 2

The signature of the recipient of funds and the seal of the bank office cash register are missing.

Expense cash order No. 3

With the exception of the document execution time and BIC, the comments are similar to No. 1.

What does it look like

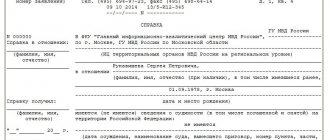

The order filling sample contains almost all the same data as the payment order, with the exception of the note about partial transfer. The information provided in the document looks like this:

- Order number and date, type of payment.

- Amount of incomplete transfer. It is entered in numbers and in words.

- Details of the payer and his bank.

- Details of the recipient and his bank.

- Type of payment, number and date of payment order.

- Contents of the transaction with VAT allocation.

- Purpose of payment, where partial payment is indicated.

On the back page, in addition to the seal and signature, the employee indicates the amount remaining until payment is made in full.

The difference between a bank order and a payment order

Although both of these documents have widespread use in banking system workflows, they have several distinctive features. To do this, it is important to understand the essence of the meaning of the term “payment order”. Unlike a bank order, this document means a certain instrument with the help of which a partial transfer of funds occurs according to a receipt, invoice or other type of obligation on the part of the organization for issuing loans.

When a partial payment is made using this document, then the order allows you to record the changes made. This happens due to the fact that a special mark will be placed on the document. A specialist in the field of providing banking services must have a sufficient level of qualifications.

His job in this process is that he must put information on the back of the receipt regarding the partial payment that was made. The information should display the following data: serial number, information about the transferred amount of money, as well as about the order. It is important to certify all this with the personal signature of a bank employee.

Each existing order must have at least one more copy, which can be left for safekeeping at a specific bank branch. Some people have a question about why one copy should remain in the bank’s file cabinet. In addition to the fact that in case of loss of one document, it will be possible to obtain a copy of it, this document can be used for information extracts.

We invite you to familiarize yourself with the Statement of Claim for the protection of consumer rights, a claim under the PPP for a refund of money, where to file a claim for the protection of consumer rights

A document of this type is also used for a full transfer of funds, for example, for the supply of goods, products, services received, or for the payment of taxes.

In short, a bank order has many differences with a payment order and a payment order. These concepts should be clearly distinguished from each other and the essence of the impact they have on the conduct of banking operations on personal accounts should be understood. However, what these types of documents have in common is that on their basis, credit institutions and bank branches can receive accurate and up-to-date information about clients, their details, as well as about bank transfers made.

The concept of a bank order was brought up for discussion eight years ago, and after two years from the start of consideration, it was introduced into the legislation of the Russian Federation. If we note some features of the document’s design, it is important to mention that when drawing up a printed document, paper is used that both Sberbank of Russia and other banks actively work with.

https://www.youtube.com/watch?v=upload

Most often, this document is widely used to carry out settlement operations. An organization in which the payer has his own personal account can freely operate simultaneously with several other accounts provided by bank branches. It is important to note that all such interactions must be clearly reflected in the bank order.

Having understood the meaning of a bank order, it is important to understand what is behind the term “memorial order”. A memorial order is a document with which you can make a transfer without using cash. This is its significant difference from a bank order, because the latter acts as an extract for the deposit or withdrawal of money in the form of cash, from the personal card of a bank client.

The memorial order, in turn, is a very popular form for accounting. With its help, accounting departments and individual specialists can very quickly and reliably carry out calculations and bring together the necessary amounts, both in working with loans and in debit operations. The main advantage of this order is that with its help you can very easily settle all the necessary accounts.

Another important difference is that the bank order may contain the necessary auxiliary details. There is even a special place for them in the document, usually at the end of all mandatory information.

Bank order and payment order are basically used for the same purpose but are different from each other. A bank order is a payment method that is carried out directly at the bank where it was issued. A payment order is a payment method that is processed at any bank branch.

On the other hand, a bank order is an instrument used to transfer money to a specific location. A payment order is issued by a bank and collected by one branch of the bank at another branch of the same bank.

There is a certain payment amount in case of application. It is not possible to stop payment of a bank order once it has been sent, as it is always paid for a specific purpose.

A payment order is an international banking term that refers to an instruction from a bank account holder to a bank or other financial institution indicating that the bank is making a payment or series of payments to a third party.

We invite you to familiarize yourself with the effect of the date of payment of sick leave on personal income tax reporting || An employee brought sick leave after payment of wages

... an indication by the sender to the receiving bank, transmitted orally, electronically or in writing, for payment or for payment to another bank of a fixed or determinable amount of money to the beneficiary..

Payment orders are post-contract instruments that are often used to pay for agreements with agents and usually contain payment conditions that must be met, such as successful completion of contract requirements.

Payment orders with “conditions” should not be confused with “conditional payment orders”. Contingent payment orders are pre-contract documents consisting of a documented agreement between the beneficiary and the payer confirming the payer's ability to pay, which is often issued to the recipient's bank, and may sometimes include bank instructions for establishing a payment order after execution of the contract.

Conditional payment orders may be established after a contract is signed and a letter of credit or other financial instrument is posted with the paying bank, but are never executed before the contract is executed due to the risk that the contract will not be implemented.

What is a memorial order?

Many enterprises are introducing the so-called memorial-warrant accounting system. This is an accounting system that involves drawing up separate entries for each of the transactions performed .

Such postings are called memorial orders. The main purpose is to reflect operating amounts, broken down into credit and debit parts.

Why is a memorial warrant needed?

Typically, the memorial order reflects the first accounting entries based on the financial and economic activities of enterprises.

This is the simplest form of accounting of all.

That’s why it is often used by novice workers. They learn to solve simple problems using wiring, so that they can then move on to more complex operations.

To conduct bookmaking activities, you must obtain a special permit. For information on obtaining a bookmaker license, please follow the link.

Off-balance sheet memorial order.

The difference between a bank order and a payment order

https://www.youtube.com/watch?v=ytpressru

In financial transactions, an order is a written order from a first person that directs a second person to pay a specified recipient a specified amount of money at a specified time.

In public finance, a bank order is a written order to pay on demand or after the maturity date. These orders look like checks, but they cannot be deposited into a demand deposit account. Instead, they can be drawn on existing funds so that the issuer can collect interest.

If the order is conditional on the availability of funds, it is not a negotiable debt instrument. Issued by government agencies to pay wages to individual employees, accounts payable to suppliers, local governments, taxpayers receiving tax refunds, recipients of unemployment benefits, and owners of unclaimed money.

Memorial

A memorial order is a document with the help of which transactions are carried out without the use of cash.

Bank warrants can be used as sweeteners by companies issuing debt securities or preferred stock to attract potential lenders and investors. A warrant gives its owner the right to buy a certain number of shares of a company at a certain price within a certain period of time.

Memorial orders are widely used in accounting. With their help, settlements for creditor and debit transactions are carried out. A distinctive feature of this document is that it can reliably summarize all the necessary accounts and write down the necessary details in a specially designated section (usually at the end of all completed fields).

Guarantees deposited at the bank are routed to the collection bank, which processes them as collection items and issues warrants to the government agency's treasury for payment to the bank each business day.

Regular order

https://www.youtube.com/watch?v=http:belvebbank

Regular warrants are redeemed by the State Treasurer upon issue. “Registered Warrants” bear interest and must not be redeemed by the Treasurer until the date the Warrant is redeemed. If they cannot be immediately redeemed by the issuing entity, the collecting bank may accept them as short-term debt instruments and charge interest on redemption in accordance with the prior agreement with the issuer. The collecting bank may refuse to accept the issue of the order, in which case other banks may also refuse to accept them.

Payment order: filling procedure, purpose | Accounting on IDdeiforbiz.ru

The payment order is discussed in Central Bank Regulation No. 383-P of 2012. This payment document is created at a banking institution to make a partial transfer of funds. Let us next consider the features of the payment order.

To generate a payment order, partial acceptance by the payer and the absence of the required amount of funds in the account are required. In banking practice, this document is designated as an order that has not been executed until a certain time.

The procedure for filling out a payment order is similar to the procedure provided for filling out settlement papers.

All copies of the document must contain the bank’s stamp, the signature of the responsible employee and the date. The first copy is certified by the signature of a bank employee. The payment order form has code 0401066.

Nuances

On the front part of the payment order there is an o. On the reverse side, the responsible bank employee makes a note about the partial transfer. In particular, the payment number, order number and date, amount and balance are indicated. This data is certified by the signature of the employee.

Document storage

When transferring funds by order, the first copy of the order through which the payment was made remains part of the bank documents. The last copy is used as an attachment to the payer’s personal statement.

When making the last payment on an order, the first copy of the order, together with the first copy of this order, is stored in bank documents. The remaining copies are issued to the payer along with the last copy of the cash order, which is attached to the extract from the personal account.

Document for write-off

It is worth saying that a cash order for debiting funds is used quite rarely in banking practice. In the automated system of a financial organization, a document is created and a specific type of operation is selected:

- Payment to the supplier.

- Calculation of credit/loan.

- Transfer of tax payment.

- Refund to the buyer.

- Other settlements with counterparties.

- Transfer to the account of another company.

- Transfer of salary.

- Transfer of funds to an accountable person.

- Other non-cash write-offs.

Filling out a payment order for debiting is carried out on the basis of a bank statement. When registering, it is considered that the transfer has already been made and is confirmed by relevant documents.

Order for receipt of funds

It is drawn up using papers that differ from the incoming order. It should be noted that payment orders for the receipt of money and instructions are used with almost the same frequency.

As in the previous case, when creating a document, select the appropriate type of operation:

- Payment from the buyer.

- Calculation of credit/loan.

- Refund by supplier.

- Other settlements with counterparties.

- Proceeds from sales of bank loans and payment cards.

- Collection of funds.

- Purchasing foreign currency.

- Proceeds from the sale of foreign currency.

- Other non-cash transfers.

Important: How the Ruble is denoted

Example

Let's consider the features of the order used for collection of funds. This document does not contain payment details. Funds are transferred between cash accounts. When specifying the corresponding item, you can select one of the subaccounts 57 of the “Transfers in transit” account.

During the collection operation, the following posting is generated:

— Db sch. 51 CD count. 57 - by the amount deposited into the bank account.

Money goes to account 57 when the collection transaction is reflected with a cash order (expenditure) of the appropriate type. In this case, when selecting it and indicating the corresponding subaccount 57 of the account, the following posting is made:

— Db sch. 57 CD count. 50 - for the amount of funds collected.

Design features

In case of partial payment, all copies of the order are marked with:

- Bank details.

- The number of transactions that were performed.

- Signature of the responsible employee.

The first copy must be certified by the employee of the banking organization who controlled the execution of the order. The inscription about partial payment must be indicated at the top, on the right side of the front side.

Payment order

It is a settlement document expressing a written order from the account owner sent to a banking organization to transfer a certain amount to the recipient's account. The latter can be opened in this or another bank.

The execution of the order is carried out within the period established by law, or in another, shorter period, if this is provided for in the account service agreement or determined by customs.

Using this payment document, funds are transferred:

- For the supply of goods, provision of services, performance of work.

- To the budget of any level, extra-budgetary funds.

- For the purpose of returning/placing a loan/loan, paying interest on borrowed funds.

- For other purposes provided for in the agreement or law.

In accordance with the main agreement, the order can be used to transfer an advance (prepayment) for services, work, goods, or to perform periodic settlement transactions. The document can be presented within 10 days (calendar). The period starts counting from the next day after the date of discharge.

Payment order and payment order: differences

These two documents have one thing in common. Both instructions and warrants are used as a way to carry out operations related to partial payments. However, the documents have significant differences.

The first is that a payment order cannot be used to pay a bill or receipt in full. A payment order, on the contrary, usually performs just such a function.

A payment order is a direct transfer of money. In this case, it is not expected that the client of the banking organization will issue an order to carry out a settlement transaction. The payment order, in turn, provides for the transfer to the banking structure of the right to transfer money from the client’s account to another account.

Note!

The payment order can be used, for example, by judicial authorities. The authorities contact the banking organization with a request to write off a certain amount from the debtor’s account in favor of another person or some structure.

At the same time, the account owner is not notified in advance about the operations that will be performed with his money. He can learn about the transfer after the funds have been transferred, that is, upon execution of the order. For example, this could be an SMS notification.

He may not find out about the operation until he visits the banking structure (if, for example, a mobile bank is not installed).

Accordingly, a payment order and an instruction are documents that are different in content. They can be executed independently of each other or be interconnected settlement securities.

Source: https://IDeiforbiz.ru/platejnyi-order-poriadok-zapolneniia-naznachenie.html