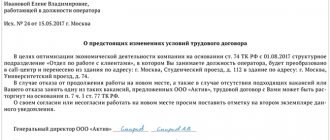

No matter how strange it may sound, it is possible to create a separate division of a legal entity unintentionally. Such cases occur quite often in practice. Often this “unintentional” action entails a number of negative consequences. Let us further consider what a separate division of a legal entity is.

Definition

A separate structural unit of a legal entity is an enterprise opened by the main organization and meeting a number of requirements established by law. In order for a company to be recognized in this status, a number of conditions must be met. First of all, such an enterprise must have stationary workplaces, properly equipped. They will be considered created if they are formed for a period exceeding a month. Another requirement is territorial isolation from the main organization.

What is a separate division

The concepts of “branch” and “representative office” are given in Art. 55 Civil Code of the Russian Federation. The concept of a separate unit is specified in Article 11 of the Tax Code of the Russian Federation - “... any territorially separate unit from it, at the location of which stationary workplaces are equipped. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in the specified division. At the same time, a workplace is considered stationary if it is created for a period of more than one month...”

A separate unit is characterized by two characteristics - territorial isolation and the presence of a stationary workplace created for a period of more than a month.

Workplace

Its concept is revealed in Article 209 of the Labor Code. A worker is a place where a citizen arrives to carry out his production activities. Moreover, it must be indirectly or directly controlled by the employer. Recently, so-called “remote (virtual) offices” have become very common. Employees of many enterprises work at home, using their own technical equipment (computers, in particular).

The living space of these citizens, of course, cannot be controlled by the employer, either directly or even indirectly. Accordingly, in this case, a separate division of a legal entity is not created. One more very important fact should be taken into account. The workplace must be created by the legal entity itself. It does not matter whether the premises in which it will be formed will be rented or owned. For example, a cleaning company sends an employee to a client’s office to carry out daily cleaning for two months. In this case, there will be no creation of a subdivision, since the premises or even a separate part of it do not belong to the tenant. In this situation, the employee is considered a business traveler.

Ministry of Finance's opinion

The Ministry believes that consideration of each case of potential creation of a unit must be made taking into account specific circumstances and factors. Experts explain that the decision on the absence or presence of signs of such an enterprise should be carried out taking into account the essential terms of contracts (provision of services, contracts, leases, etc.) that were concluded between the organization and the counterparty. All factual circumstances related to the activities carried out by Russian legal entities should be taken into account. An organization can have many separate divisions. Legislative norms do not contain any restrictions in this regard.

Classification

What kind of separate divisions can there be? Branches and representative offices of legal entities are the two main types of enterprises opened by the main organization. Each of them has a number of features. A representative office is a separate division of a legal entity that operates in a territory different from that specified in the constituent documents of the parent organization, expresses its interests and ensures their protection. The concept is explained in Article 55 of the Civil Code (clause 1). A branch is a separate division of a legal entity that operates in a territory different from the one that, again, is indicated in the constituent documents of the parent organization and implements all of its tasks or any specific part of them. The definition is present in the above article in paragraph 2. Thus, a branch is a separate division of a legal entity that performs a fairly large volume of tasks.

Branches and representative offices

The branch is geographically remote from the parent enterprise and is not an independent legal entity, but performs all or part of its functions. The representative office of the organization is also not an independent legal entity and is located at a different address - remote from the “head”. At the same time, the representative office of the enterprise conducts production activities, representing the interests of the legal entity and protecting them.

Moreover, according to Article 55 of the Civil Code of the Russian Federation, both representative offices and branches must appear in the constituent documents of the legal entity that created them. Consequently, registration of a branch of a legal entity or its representative office becomes possible only when appropriate changes are made to the organization’s Charter and their state registration.

At the same time, to make any changes to the Charter of the organization, a decision of the founders of the legal entity or its authorized body is required. Thus, amendments to the Charter of an enterprise related to the opening of branches and representative offices, as well as their liquidation, are carried out on the basis of a decision of the general meeting of participants for an LLC or the general meeting of shareholders for a JSC.

Further, about changes in the Charter of an LLC or JSC, information about its representative offices or branches must be reported to the body carrying out state registration. Therefore, it should be recalled that the authorized federal executive body responsible for state registration of legal entities is the Federal Tax Service of Russia.

Requirements

The legislation does not prescribe the mandatory development of provisions on the basis of which separate divisions of a legal entity will operate. The form of this normative act, accordingly, is not included in the unified ones. However, in practice, standard provisions have been developed that an organization can follow. It should also be noted that information about the created separate divisions must be present in the constituent documentation of the parent enterprise. The corresponding requirement is established in paragraph 3 of Article 55 of the Civil Code. The norms allow the activities of departments without a manager.

Registration process

Initially, the management of the company must make an appropriate decision on the basis of which it is necessary to open a branch or representative office. The step-by-step instructions for registering a separate division involve performing successive steps. Each of them is important and is therefore recorded in official documents. These stages include:

- a meeting of the founders of the enterprise is formed, at which the need to open a division is considered;

- an appropriate decision is made, documented in the minutes of the meeting;

- an order is issued;

- the form of registration of a separate division is selected, since it can be a branch or representative office of an enterprise;

- the optimal place for work is determined, which is equipped with all the necessary means so that workers can cope with their main responsibilities;

- within 30 days after the division starts operating, it is required to submit a notification to the Federal Tax Service, for which the standard form C-09-3-1 is used, and the tax office at the location of the branch is selected for this purpose;

- further, it is required to register the division with the Social Insurance Fund and the Pension Fund, but this is required if the branch has its own bank account, it draws up its own balance sheet, and there are also employees for whom funds must be transferred to the funds;

- If, during the operation of a structural unit, the name of the unit or its address changes, then the Federal Tax Service must also be notified about this.

The process is not considered too complicated if you understand it well. Registration with a separate tax division is required. If this is not completed in a timely manner, the company will be subject to administrative liability.

Registration

The law provides for a procedure, the implementation of which ensures recognition of the legality of the activities carried out by a separate division of a legal entity. Registration is carried out with the tax authority at the location of the established enterprise. In this case, registration must be carried out within a month from the date of formation of the enterprise. The corresponding prescription is contained in Article 83 of the Tax Code (clause 4).

CREATION OF A BRANCH, REPRESENTATIVE OFFICE OF A LEGAL ENTITY

The creation of a separate structural unit of a legal entity is regulated by Article 51 of the Civil Code of the Republic of Belarus.

A representative office is a separate division of a legal entity, located outside its location, protecting and representing the interests of the legal entity, performing transactions and other legal actions on its behalf. A branch is a separate division of a legal entity located outside its location and performing all or part of its functions, including the functions of a representative office.

From the above definitions it is clear that a branch has broader powers compared to a representative office, because the branch not only represents the legal entity, but also performs all or part of the functions of the legal entity.

Branches and representative offices are not legal entities; they are endowed with the property of the legal entity that created them; the head of a separate division is appointed by the parent company and acts on the basis of his power of attorney.

- The first stage of opening a structural unit is the decision to create a separate structural unit . This decision is made by the body that is authorized to make such a decision. For business companies (LLC, ALC, JSC), such a decision can be made by a general meeting of participants, a board of directors (supervisory board), etc. The decision to create a branch is documented in the minutes of the general meeting of participants. If the decision to create a branch or representative office is made in relation to a unitary enterprise (UE), then such a decision is formalized by the decision of the founder, unless otherwise provided by the charter of the unitary enterprise.

- After making a decision to create a separate division, it is necessary to make changes to the constituent documents of the legal entity that created them. This is due to the fact that branches and representative offices must be indicated in the charter of the legal entity that decided to create it. The procedure for amending the charter is established by Decree of the President of the Republic of Belarus dated January 16, 2009 No. 1 “On state registration and liquidation (termination of activities) of business entities.

- Next, it is necessary for the legal entity to approve the regulations on a separate division . The regulation is the main document regulating the activities of a separate structural unit, it indicates the following information: type of separate unit (branch or representative office), name and location, list of powers of the structural unit, goals and subject of activity, disposal of property and profit, etc. .

It is worth noting that the division being created can have a separate account, an independent balance sheet and conduct commercial activities independently, but if the branch or representative office does not maintain a separate balance sheet, then the proceeds go to the parent company.

- After creating a separate division, the legal entity that created the separate division must contact the tax authority at the location of such a separate division with a message about the creation of a separate division no later than ten working days from the date of its creation. If a division has a separate balance sheet and bank account, it will be assigned a UNP. If the created structural unit does not have a separate balance sheet and bank account, such a unit is recognized as separate for control purposes, but is not subject to registration.

- Registration of units with the Federal Social Security Service bodies of the Ministry of Labor and Social Protection of the Republic of Belarus is carried out on the basis of an application for registration. The form of such an application was approved by Resolution of the Federal Social Security Service of the Ministry of Labor and Social Protection dated August 21, 2009 No. 12.

- If divisions operate on the territory of the Republic of Belarus and are entitled to pay insurance premiums for compulsory insurance against industrial accidents and occupational diseases, they are subject to compulsory insurance against industrial accidents and occupational diseases . To register, you must submit the appropriate package of documents.

- Due to the fact that information about separate divisions, indicating the work and (or) services that constitute the licensed type of activity for each separate division, is indicated in the license, and in connection with the creation of structural divisions, it is necessary to include this information in the licenses. To make changes and (or) additions to the license, you must contact the licensing authority within one month.

- The heads of representative offices and branches act on the basis of a power of attorney; a power of attorney on behalf of the parent enterprise is issued by its head or another person authorized to do so by the constituent documents . Such a power of attorney should provide the maximum number of rights to the manager that are necessary for the effective operation of the structural unit. The appointment of the head of a branch or representative office is carried out according to the procedure established in the constituent documents of the legal entity that created such a division. The validity period of the power of attorney cannot exceed three years.

Creating a separate structural unit of an enterprise is a complex process that requires care when drawing up documents. A business lawyer will provide you with legal assistance related to the creation of a branch or representative office of a legal entity.

OTHER MATERIALS:

Articles and practice of lawyer for administrative cases Bychek T.A. you can read it on the website.

Current texts of regulatory legal acts can be read on the National Legal Internet Portal pravo.by.

Tags: Lawyer / Lawyer in Minsk / Assistance of a lawyer / Representation of a legal entity / Creation of a separate division / Creation of a representative office / Creation of a branch / Branch of a legal entity / Economic / Business law / Legal assistance / Legal entities

Features of the procedure

In practice, it happens that a separate division of a legal entity, located outside the place of activity of the parent organization, did not begin work within the first month from the moment of its creation. In this case, there is no need to submit an application to the Federal Tax Service. If, after 2 months, the company still starts operating, then it is mandatory to register. At the same time, it will not be possible to do this without violating the instructions of the Tax Code. Experts recommend that you still register the unit within the period established by law, even if it does not work in the first month. Formally following the procedure will avoid many problems in the future.

A separate division in the Tax Code of the Russian Federation

In accordance with paragraph 2 of Article 11 of the Tax Code of the Russian Federation, a separate division of an organization is recognized

Based on the definition given in the Tax Code of the Russian Federation, taking into account the requirements of paragraph 4 of Article 83 of the Code, the essential features of a separate division can be identified:

As a matter of priority, when deciding on the creation of a separate division, it is necessary to establish the true meaning of isolation and its essential features. |

Notification

In addition to registering the unit at its location, the parent organization is obliged to notify the tax office at its location about the creation of the enterprise. A similar notification is required in case of closure of the company. In the latter case, the notice must be sent within a month. The message is issued by f. S-09-3.

Why are additional divisions being opened?

The need for this process may be due to various reasons. Most often, registration of separate units is required in the following situations:

- the company plans to expand its territorial scope of activity, so it needs to reach as many people as possible within its target audience;

- the company is pursuing an aggressive policy, so it is necessary to cover a completely specific territorial region;

- regions are selected where it is most profitable to carry out activities in a particular direction;

- it is necessary to satisfy the demand of customers living in other cities;

- widespread promotion of the brand in different cities of Russia;

- reducing the risk of bankruptcy, since production facilities can be moved in different cities, and if one of the divisions is unprofitable, it can be supported in times of crisis by funds coming from other regions.

The registration process of any representative office should be carried out only taking into account the basic provisions of the law. If an individual address is assigned to a production structure, and work is planned for a month or a longer period of time, then registration with the tax office of a separate unit is absolutely necessary. This requirement is contained in Art. 23 NK.

Compliance with requirements when opening multiple businesses

If an organization creates several divisions within the municipality in which it operates, then there is no need to re-register. The corresponding provision is enshrined in Article 83 in paragraph 1. In such a situation, the parent enterprise is only obliged to send a message to the Federal Tax Service about the creation of a unit. Notification is carried out according to the rules of Article 23 (clause 3).

If several divisions are located in the same municipality, but in territories under the jurisdiction of different inspections, registration can be carried out by the control body at the address of one of them. It is determined by the parent company. Having made a decision, the organization sends a letter to the inspectorate. Accordingly, it is sent to the inspectorate located at the address of the selected enterprise. The notification is issued by f. KND No. 1111051.

Actual and legal address

Quite often in practice these two concepts are identified. Legal address means the location of the organization. Its definition is regulated by the Civil Code, Article 54 (clause 2): it is established that the address of the enterprise’s location corresponds to the registration address. This procedure is carried out on the territory where the permanent executive body of the company is located. If it is absent, the registration address coincides with that of another person or structure that has the right to act on behalf of the enterprise without a power of attorney.

The actual address is the one at which the company conducts its business. Some territorial tax inspectorates express the following opinion on this issue. They believe that the division operates at the actual address, and the parent organization is located at the legal address.

Many experts consider this approach to be incorrect. As the legislation indicates, one of the key characteristics of a unit is its territorial isolation. If the company operates at an address that differs from that recorded in the constituent documentation, it does not meet this criterion. The fact is that in this case there is no one at the legal address, therefore, there is no parent organization. And its presence is a prerequisite by default.

Location of the organization and its divisions

In accordance with the provisions of the Tax Code of the Russian Federation, the concept of the location of an organization is not disclosed, as a result of which, taking into account the norms of Article 11 of the Tax Code of the Russian Federation, the conceptual apparatus of civil legislation can be fully used. In accordance with paragraph 2 of Article 54 of the Civil Code of the Russian Federation, the location of a legal entity is determined by the place of its state registration. State registration of a legal entity is carried out at the location of its permanent executive body, and in the absence of one - another body or person entitled to act on behalf of the legal entity without a power of attorney. Since the relevant norms of the Civil Code of the Russian Federation, as well as the Resolution of the Plenum of the Armed Forces of Russia and the Plenum of the Supreme Arbitration Court of Russia dated 01.07.1996 No. 6/8 “On some issues related to the application of part one of the Civil Code of the Russian Federation” use a reference norm to the provisions of the legislative act regulating issues of state registration of legal entities, let us turn to the text of the latter. Based on the meaning of subparagraph “c” of paragraph 1 of Article 5 of the Federal Law of 08.08.2001 No. 129-FZ “On State Registration of Legal Entities and Individual Entrepreneurs”, the location of the permanent executive body of a legal entity is its address. Additional information regarding the concept of “address” is contained in subparagraph “d” of paragraph 2 of the same article, in which the address is understood as a set of details that determine the location of an object in space:

- name of the subject of the Russian Federation;

- name of the district, city, other populated area;

- street name;

- house and apartment number.

Thus, the creation of a separate division as a legal fact can be stated when the latter (that is, stationary workplaces) is created at a different address than the state registration address (and, therefore, location) of the organization.

Responsibility

If a separate division of a legal entity, located at an address different from the one at which the parent company operates, is not registered in the prescribed manner, the Tax Code provides for different types of sanctions. First of all, for violation of deadlines, those responsible face a fine of up to 5 thousand rubles. (Art. 116). The penalty will be doubled if the delay is more than 90 days. It is worth saying that there are no sanctions for failure to notify the Federal Tax Service of the closure or creation of a tax division.

Article 117 establishes liability for work without registration. The amount of monetary penalties under this standard is significantly higher. Thus, Article 117 establishes that for conducting activities in violation of registration rules, a fine of 10% of the profit received in the course of such work is imposed. In this case, the amount of recovery cannot be less than 20 thousand rubles. If the activity was carried out for more than 3 months, the fine is doubled. Article 116 applies if the parent organization has not submitted an application for registration within the prescribed period, and norm 117 applies if the control body has revealed the fact of carrying out activities without registration.

Pension Fund

Subdivisions that have a dedicated balance, settlement account and pay salaries to employees are subject to registration in the fund. Registration is carried out on the basis of data from the Unified State Register of Legal Entities. The tax inspectorate, within five days from the date of receipt of the notification of the formation of the unit, sends them to the Pension Fund of the Russian Federation at the address of the OP location. The Fund, in turn, provides the policyholder with 2 copies of the notice. One of them must be transferred to the Pension Fund of the Russian Federation at the address of the parent organization within ten days.

FSS

To register in this fund, the unit must also have an independent balance sheet, employees to whom it pays salaries, as well as a current account. Registration is carried out at the territorial branch of the Social Insurance Fund at the address where the OP operates. From the date of creation of the division, the parent company, within thirty days, submits an application and copies of:

- State registration certificates.

- Notifications about registration with the Federal Tax Service (separately for the OP and the parent organization).

- Documents confirming the creation of the unit. This may be a charter, which contains the relevant information, or a power of attorney granted to the head of the OP.

- Information letter from the statistics agency.

- Notifications about registration with the Social Insurance Fund of the main organization.

- Certificates from the bank about the account, if they were opened at the time of contacting the fund.

Nuances of the FSS notification

You should contact this state fund after receiving a notification from the Federal Tax Service. Registration of a separate unit with the Social Insurance Fund is a simple process that is required under the following conditions:

- the representative office has its own separate balance sheet;

- its employees conduct their own accounting, which is certainly written down in the company’s accounting documentation;

- salaries are calculated for all employees of the branch, and they are also paid various bonuses or other payments;

- There is a separate current account.

To carry out registration, you must submit a corresponding application and other documents from the company to the FSS. It is often necessary to obtain a preliminary certificate from the bank where the current account is opened in order to provide the details of this account. Documentation can be transmitted during a personal visit to the institution, through electronic communication channels or by sending them by mail.

Personal income tax

The tax is calculated based on the amounts paid to the employees of the relevant departments. Personal income tax is paid to the address of the location of each enterprise opened by the parent organization. Reports must be submitted to the inspectorate at the registration address of the OP. In some cases, the employee enters into an agreement with the parent organization, and works in the division. In such situations, personal income tax is paid to the Federal Tax Service at the address of the OP location. If the division was registered with the tax authority not at the beginning of the month, the tax is transferred in proportion to the share of the salary paid to the employee during his working life. It is necessary to take into account that payment of personal income tax, as well as submission of reports, is carried out only when the OP has an independent balance sheet and bank account. Otherwise, this responsibility falls on the parent company. It deducts personal income tax and submits tax reports to the inspectorate with which it is registered.

Registration of a separate division - step-by-step instructions

An organization that decides to create a separate division within its structure is obliged to inform the tax office about this. This should be done within a month from the date of its opening. At the same time, the new structure itself must go through the registration procedure. To register an OP, you must contact the Federal Tax Service at its location .

To complete the registration procedure, you will need to carry out a number of actions. For ease of description, they will be presented below in the form of separate steps.

Step 1. Preparing a package of documents

To register branches and representative offices, you will need to prepare copies of documents that document its creation. They were described in detail in the previous paragraph. You will also need copies of:

- certificate confirming state registration of the parent organization;

- orders that appointed the manager, as well as the chief accountant of the created structural unit;

- a payment document confirming the fact of depositing funds to pay the state duty;

- if the unit is located in premises that are not owned by the organization, a copy of the lease agreement.

All prepared copies of documents must be notarized.

In addition, it is necessary to prepare an extract from the Unified State Register of Legal Entities of the parent organization, as well as two completed applications (forms P13001 and P13002).

If another division is registered (not a branch or representative office), it is enough to submit to the tax office a notification completed in form C-09-3-1.

Step 2. Sending documents

There are three ways to send documents to the tax office:

- personally by a person who has the right to act on behalf of the organization;

- by registered mail via mail - you will need to prepare a list of attachments in two copies;

- electronically through secure communication channels.

Step 3. Completing the registration procedure

Registration of an OP is carried out by the Federal Tax Service within five days. The countdown begins from the day the documents are submitted if they are sent through a representative, or from the day they are received by the Federal Tax Service when sent electronically or by mail. The document confirming the fact of registration is a notification.

During the registration of an EP, it is assigned only its own reason for registration - KPP. The TIN used in the activities of the structural unit is the same as that of the parent company .