Did you know? that the founders are not parasites or that the founders can become unable to travel abroad due to debt?

AB now, about the main thing. In society, questions often arise as to whether all enterprises, regardless of their organizational and legal form, should, when creating an enterprise, include a constituent agreement and charter in the list of constituent documents. To clarify this issue, let's look at it in more detail.

Author of the document

| Contract-Yurist.Ru offline Status: Legal company rating460 84 / 6 Private message Order a consultation | number of consultations: |

| noted as the best: | 5 |

| answers to documents: | |

| documents posted: | 927 |

| positive feedback: | |

| negative reviews: |

Agreement on the establishment of a limited liability company

«_____________»

G. ________________

2009

Agreement on the establishment of a limited liability company

«____________»

_________ "___" _______ 2009

1. _________________, residing at:______________, passport____________, series______, issued by ___________________________________________;

2. _________________, residing at:______________, passport____________, series______, issued by ___________________________________________;

3. ___________________, represented by _________, acting on the basis of ______________;

hereinafter referred to as the Founders (Participants) , on the basis of the Civil Code of the Russian Federation, Federal Law dated 02/08/98 N 14-FZ “On Limited Liability Companies”, entered into this Agreement as follows:

Subject of the Agreement

1.1. The founders undertake to create a Limited Liability Company “_____________” (hereinafter referred to as the “Company”), the authorized capital of which is divided into shares.

1.2. The founders undertake to pay for shares in the authorized capital in accordance with the terms of this Agreement. The parties bear the costs of creating the Company in proportion to their shares in the authorized capital.

1.3. This Agreement regulates the relations of the Participants in the process of their joint activities to establish a commercial organization in the form of a Limited Liability Company, as well as the procedure and conditions for their participation in the activities of this Company.

1.4. In accordance with this Agreement, the composition of the Founders (Participants) of the created Company, the size of the authorized capital of the Company, the size and nominal value of the share of each of the Founders of the Company, the size, procedure and terms of payment for such shares in the authorized capital of the Company are determined.

1.5. Members of the Company are not liable for its obligations and bear the risk of losses associated with the activities of the Company, within the value of their shares in the authorized capital of the Company.

Name and location of the Company

2.1. Full corporate name of the Company: Limited Liability Company “____________”.

2.2. Abbreviated corporate name: LLC "____________".

2.3. Name of the Company in ___________ language: “_____________________”.

2.4. Location of the Company: ____________________.

The executive body represented by the director is located at this address.

2.5. The company is a legal entity, owns separate property, accounted for on its independent balance sheet, and is liable for its obligations with this property, can acquire and exercise property and personal non-property rights in its own name, bear responsibilities, and be a plaintiff and defendant in court.

2.6. The company is considered created as a legal entity from the moment of its state registration.

2.7. The company is created without a term limit.

Purpose of creation and types of activities

3.1. The main purpose of creating the Company is to carry out commercial activities to make a profit.

3.2. The types of activities of the Company are determined by the Charter of the Company.

3.3. The Company has the right to engage in any other types of activities not prohibited by the current legislation of the Russian Federation. The Company may engage in certain types of activities, the list of which is determined by the current legislation of the Russian Federation, only on the basis of a special permit (license) and in accordance with the conditions for granting such licenses.

Authorized capital of the Company Shares of participants in the authorized capital

4.1. The authorized capital of the Company is made up of the nominal value of the shares of its Participants.

4.2. The authorized capital determines the minimum amount of its property, which guarantees the interests of its creditors.

4.3. The size of the authorized capital of the Company is _________________ rubles.

4.4. The authorized capital of the Company consists of the nominal value of the following shares of the Participants:

4.4.1. ___________________ nominal value ___________ rubles, which is ___% of the authorized capital.

4.4.2 _____________________ nominal value ____________ rubles, which is __% of the authorized capital.

4.4.3. _____________________ nominal value ____________ rubles, which is __% of the authorized capital.

4.5. The actual value of the share of the Company Participants corresponds to part of the value of the Company's net assets, proportional to the size of its share.

4.6. The founders of the Company must pay at least 50% of the authorized capital at the time of registration of the Company; within a year (a shorter period can be set) from the moment of state registration of the Company, 100% of the authorized capital must be paid.

4.7. In case of incomplete payment of a share in the authorized capital of the Company within one year from the date of state registration of the Company, the unpaid part of the share passes to the Company. Such part of the share must be sold by the Company in the manner and within the time limits established by the Law on Limited Liability Companies.

4.8. Payment for shares in the authorized capital of the Company may be made in money, securities, other things or property rights or other rights with a monetary value.

4.9. The monetary value of the property contributed to pay for shares in the authorized capital of the Company is approved by a decision of the general meeting of the Company's participants, adopted unanimously by all the Company's Participants.

4.10. If the Company's right to use property is terminated before the expiration of the period for which such property was transferred for use to the Company to pay for the share, the Company Member who transferred the property is obliged to provide the Company, upon its request, with monetary compensation equal to the payment for the use of the same property on similar terms. during the remaining period of use of the property. Monetary compensation must be provided at a time within a reasonable time from the moment the Company submits a request for its provision (other methods and a different procedure for providing compensation may be provided).

In case of failure to provide compensation within the prescribed period, a share or part of a share in the authorized capital of the Company, proportional to the unpaid amount (cost) of compensation, passes to the Company. Such part of the share must be sold by the Company in the manner and within the time limits established by the Law on Limited Liability Companies.

4.11. The property transferred by a Company Member for use to the Company to pay for his share, in the event of such Member leaving or expelled from the Company, remains in the use of the Company for the period for which this property was transferred (otherwise may be provided).

4.12. It is not permitted to release the Founder of the Company from the obligation to pay for a share in the authorized capital of the Company, including by offsetting his claims to the Company.

4.1.3. In case of failure to fulfill or untimely fulfillment of obligations by each Founder to pay for shares in the authorized capital of the Company, the founder shall pay for the period of delay __% of the unpaid amount for each month of delay. For the authorized capital not paid within the agreed period, interest is accrued in favor of the Company (liability may not be established) .

Company management procedure

5.1. The supreme body of the Company is the general meeting of the Company's participants, which manages the activities of the Society in accordance with the current legislation and this Charter.

The competence, procedure and procedure for making decisions at the general meeting are determined by the Charter of the Company.

5.2. Management of the current activities of the Company is carried out by the sole executive body of the Company - the director of the Company, who is elected by the general meeting of participants and acts on the basis of the Charter of the Company.

The competence of the director is determined by the Company's Charter.

Notifications

6.1. All notices to the Company or the participant related to this Agreement are sent in writing to the address of the recipient.

6.2. A notice sent is considered received and brought to the attention of the recipient on the day of its receipt. For telegrams and fax messages, the day of receipt of the Notification is considered to be the day the telegram or fax message was sent.

6.3. In the event of a change of address for any Participant, that Participant must notify the other Participants.

Responsibility of the parties

7.1. If any Participant does not fulfill or improperly fulfills its obligations defined in this Agreement, then this Participant is obliged to compensate other participants for losses caused by non-fulfillment or improper fulfillment of their obligations.

7.2. Losses are understood as direct actual damage. Reimbursement of lost income is not made.

Final provisions

8.1. The legal status of the Company, the rights and obligations of its Participants are determined by the current legislation of the Russian Federation and are enshrined in the Charter of the Company.

8.2. The procedure for reorganization and liquidation of the Company is determined by the Charter of the Company.

8.3. The Agreement may be terminated by mutual consent of the Participants in the manner agreed upon by them.

In the event of liquidation of the Company, this Agreement is terminated simultaneously with the liquidation.

8.4. Changes and additions to this Agreement must be made in writing and duly signed.

8.5. If any of the provisions of the Agreement is or becomes invalid, this does not invalidate the other provisions.

Signatures

- ______________ / _____________

- ______________ / _____________

- ______________ / _____________

Download the document “Agreement on the establishment of a Limited Liability Company (option 2)”

Changes in the LLC law after July 1, 2009.

Until recently, Limited Liability Companies consisting of two or more participants had two constituent documents that were registered with the tax authorities: the Charter and the Memorandum of Association. From July 1, 2009 in accordance with the Federal Law of December 30. No. 312-FZ amended the Law on LLCs - Federal Law of February 8, 1998 No. 14-FZ “On Limited Liability Companies” (hereinafter referred to as the “Law on LLCs”). In particular, the concept of “founding agreement” was abolished and instead the founders must enter into a written agreement on the establishment of the Company (clause 5 of article 11). Let's try to figure out how the foundation agreement concluded by the founders when creating a company after July 1, 2009 differs from the previous foundation agreement. And also what should organizations that were created before the Federal Law of December 30, 2008 No. 312-FZ come into force with their constituent agreements, which are now not a constituent document?

The foundation agreement is an agreement concluded between the founders of a legal entity upon its creation. In the Memorandum of Association, the founders undertake to create a legal entity, determine the procedure for joint activities for its creation, the conditions for transferring their property to it and participation in its activities. The agreement also determines the conditions and procedure for distributing profits and losses between participants, managing the activities of a legal entity, and the withdrawal of founders (participants) from its composition.

Until July 1, 2009, the constituent agreements in their status related to constituent documents, as evidenced by Art. 89, 122 Civil Code of the Russian Federation. The articles of association must meet the following requirements:

“The constituent documents of a legal entity must determine the name of the legal entity, its location, the procedure for managing the activities of the legal entity, and also contain other information provided by law for legal entities of the corresponding type. The constituent documents of non-profit organizations and unitary enterprises, and in cases provided for by law and other commercial organizations, must define the subject and goals of the activities of a legal entity. The subject and certain goals of the activities of a commercial organization may be provided for by the constituent documents even in cases where this is not mandatory by law.”

The constituent agreement, when any data contained in it was changed, was subject to mandatory registration with the tax authorities, as well as the second constituent document of Companies with several participants - the Charter of the Companies.

After July 1, 2009, the constituent agreements of the Companies registered earlier ceased to be valid, and the founders of Limited Liability Companies stopped concluding constituent agreements when creating a legal entity. However, the founding agreement upon creation was replaced by another document defining the procedure for the founders to carry out joint activities to establish a company and some other issues - an agreement on establishment . Based on the decisions made by the founders, reflected, among other things, in the agreement on the establishment of the Company, and the documents prepared in accordance with them, the person authorized by the founders submits documentation for the state registration of the company as a legal entity.

Leave a comment on the document

Do you think the document is incorrect? Leave a comment and we will correct the shortcomings. Without a comment, the rating will not be taken into account!

Thank you, your rating has been taken into account. The quality of documents will increase from your activity.

| Here you can leave a comment on the document “Agreement on the establishment of a Limited Liability Company (option 2)”, as well as ask questions associated with it. If you would like to leave a comment with a rating , then you need to rate the document at the top of the page Reply for |

Amendments to the charter and constituent documents

As already mentioned, the described agreement - along with the protocol of the decision to create an LLC - confirms the intention of the founders to create an LLC;

discussed and adopted at the general meeting. Both individuals and legal entities can act as founders. Commercial organizations are created to make a profit, non-profit organizations (educational, physical education, health, social, political, religious and others) - for purposes not related to making a profit (although sometimes this is not so easy to understand). limited liability company; closed and open joint stock companies; state and municipal unitary enterprises based on the right of economic management and operational management.

A legal entity is considered created from the moment of its state registration, which in practice directly means the moment of registration of its constituent documents. Charter of a legal entity There is no legal definition of the concept “charter of a legal entity”.

The charter has a special status; it regulates the “internal life” of the organization and occupies the highest place in the hierarchy of other local acts of a legal entity.

The internal documents of the organization must not contradict the charter, and if there are conflicts, the norms of the charter are always applied. The concept of a constituent agreement The constituent agreement, which by its legal nature is a civil multilateral agreement that establishes the mutual obligations of the founders to create a legal entity, the conditions for transferring their property to it and participation in its activities, as well as the conditions and procedure for distribution, is of great importance for a legal entity. between participants in income and losses, management of the activities of a legal entity, withdrawal of founders (participants) from its composition.

Contradictions between the constituent agreement and the charter In case of contradictions between the constituent agreement and the charter of one legal entity, the following conditions must apply: the constituent agreement, if they relate to the internal relations of the founders;

What constituent documents must a legal entity have? Current legislation contains requirements for the list and form of constituent documents mandatory for legal entities.

the company must undergo state re-registration.

However, if there is a discrepancy between the criteria of the founding contract and the provisions of the charter, the charter of the legal entity should be governed. A similar approach is justified by the fact that the document is the constituent document for the vast majority of legal entities, including all legal entities created by one founder.

It also becomes the only constituent document in the case when the constituent contract is terminated due to the fact that for any reason the only participant remains in the legal entity (company).

There is no concept of “statutory documents”

Article 52. Civil Code of the Russian Federation.

Based on the systematic interpretation of the legislation, we can conclude that the charter of a legal entity is a local regulatory legal act approved in the manner prescribed by law and registered. determining the legal status of a legal entity, its structure, structure, types of activities and regulating the relationship between participants and the legal entity itself. The requirements for the content of any constituent documents boil down to the fact that they must indicate the name and address of the organization, the size of the authorized capital, the procedure for managing the organization and the powers of each management body and some other issues.

Constituent documents must contain the name and location of the legal entity.

Depending on the legal status of the organization, the legal basis for its activities is the charter (regulations) and the constituent agreement, or only the charter (regulations).

Mandatory presence of a charter and constituent agreement The mandatory presence of a charter and constituent agreement is provided for the following organizations: Commercial organizations: Limited liability partnership;

Note:

but must be registered in the Unified State Register of Legal Entities, i.e. changes are required in the Unified State Register of Legal Entities: change of the director of the enterprise or his passport data; replacement of the holder of the register of shareholders in a joint-stock company; changing the passport details of the participants (founders) of the LLC, if they were not specified in the charter; changing the size of shares or composition of participants (founders) of the LLC, if they were not specified in the charter; pledge of a share in the authorized capital of the company and its withdrawal; the beginning of the process of reducing the size of the authorized capital. Changing information in the Unified State Register of Legal Entities is a mandatory legal procedure for such transformations in a company.

We invite you to familiarize yourself with: Selecting a 7 and 11 mm glue stick for a hot-melt glue gun: parameters and specifics of operation

Found documents on the topic “agreement for simultaneous payment for the activities of two LLCs”

- Tripartite contract agreement for the construction of real estate ( with the participation of two customers and one contractor) Construction contract, construction contract → Tripartite contract agreement for the construction of real estate (with the participation of two customers and one contractor)

tripartite agreement for the construction of real estate ( with the participation of two customers and one contractor) g... - Trilateral agreement contract for the construction of real estate (at participation two customers and one contractor)

Construction contract, construction contract → Tripartite contract contract for the construction of real estate (with the participation of two customers and one contractor)contract agreement for the construction of a real estate property in the city of ""20. ...

- Check at registration payment for the reservation, accommodation and additional paid services at no special coupons. Form No. 3-gm

Accounting statements, accounting → Invoice when making payment for reservation, accommodation and additional paid services in the absence of special coupons. Form No. 3-gmapproved by order of the Ministry of Finance of the Russian Federation dated December 13, 1993 no. 121 form no. 3-gm hotel (address...

- Check at registration payment for the reservation, accommodation and additional paid services at no special coupons. Form No. 3-g

Accounting statements, accounting → Invoice when making payment for reservation, accommodation and additional paid services in the absence of special coupons. Form No. 3-gapproved by order of the Ministry of Finance of the Russian Federation dated December 13, 1993 no. 121 form no. 3rd hotel city…

- Agreement financial lease (leasing) with direct participation seller and committing with the last simultaneously purchase transactionssales property, provided for leasing (3-party agreement)

Leasing agreement, agreement → Financial lease (leasing) agreement with the direct participation of the seller and the latter simultaneously completing a purchase and sale transaction of the property provided for leasing (3-party agreement)a financial lease (leasing) agreement the direct participation of the seller and the completion of and sale transaction at the same time ...

- Agreement loan (interest the loan amount is paid simultaneously with the principal amount of the loan upon expiration of the period for which provided loan)

Money loan agreement → Loan agreement (interest on the loan amount is paid simultaneously with the principal amount of the loan upon expiration of the period for which the loan is provided)loan agreement of the agreement ), hereinafter referred to as...

- Qualification characteristics of the cashier used at drawing up a contract of employment and payment labor

Employment agreement, contract → Qualification characteristics of a cashier used in drawing up a contract for hiring and remunerationqualification characteristics of the cashier carries out operations for receiving , accounting, issuing cash and securities with mandatory compliance with the rules ensuring their safety; semi...

- Qualification characteristics of the collector used at drawing up a contract of employment and payment labor

Employment agreement, contract → Qualification characteristics of the collector used when drawing up a contract for hiring and remunerationqualification characteristics of the collector receives, in accordance with the established procedure, cash and securities of the enterprise

- Qualification characteristics of a legal consultant used at drawing up a contract of employment and payment labor

Employment agreement, contract → Qualification characteristics of a legal consultant used in drawing up a contract for hiring and remuneration...state and completed execution of judicial and arbitration cases; participates in the development and implementation of measures to strengthen contractual , financial and labor discipline; analyzes and summarizes the results of consideration of claims in court and arbitration cases, ...

- Qualification characteristics of an accountant used at drawing up a contract of employment and payment labor

Employment agreement, contract → Qualification characteristics of an accountant used in drawing up a contract for hiring and remuneration... carries out work in various areas of accounting (accounting for fixed assets, inventory, production , sales of products , results of economic and financial activities, settlements with suppliers and customers, and ...

- Qualification characteristics of a warehouse manager used at drawing up a contract of employment and payment labor

Employment agreement, contract → Qualification characteristics of a warehouse manager used in drawing up a contract for hiring and remunerationqualification characteristics of the warehouse manager supervise the work of receiving , storing and issuing inventory items in the warehouse, their placement taking into account the most rational use...

- Qualification characteristics of an accountant-auditor used at drawing up a contract of employment and payment labor

Employment agreement, contract → Qualification characteristics of an accountant-auditor used in drawing up a contract for hiring and remuneration...and by instructions and regulations, planned and on special assignments, documentary audits of the economic and financial activities of enterprises , as well as their divisions that are on an independent balance sheet; timely prepares the results of the audit and pre ...

- Qualification characteristics of the central warehouse manager used at drawing up a contract of employment and payment labor

Employment agreement, contract → Qualification characteristics of the manager of the central warehouse, used when drawing up a contract for hiring and remunerationqualification characteristics of the manager of the central warehouse manages the production and economic activities of the warehouse; heads the work of receiving , storing and issuing goods...

- Qualification characteristics of an economist for financial work used at drawing up a contract of employment and payment labor

Employment agreement, contract → Qualification characteristics of an economist for financial work, used in drawing up a contract for hiring and remunerationThe qualification characteristics of an economist in financial work determine the size of income and expenses, receipts and deductions of funds, credit relationships and relationships of the enterprise ...

- Agreement purchase-sales goods with condition payment in installments

Agreement for the purchase and sale of property → Agreement for the purchase and sale of goods with the condition of payment in installmentscontract for the purchase and sale of goods with the condition of payment in installments “” 20 (local area), referred to as ...

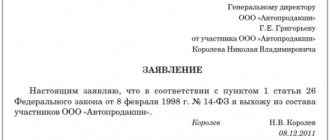

Features of the memorandum of association

The memorandum of association is an agreement concluded between the founders of a legal entity upon its creation. The text of the document states the obligation of the participants to create a legal entity, defines the nuances of subsequent joint activities and participation in management.

The agreement consists of several sections, each of which contains certain information:

- The introductory part, which indicates the purpose of drawing up the contract.

- The name of the document and the legal form of the organization (in this case LLC). This information is not mandatory from the state's point of view, but it helps to clarify the subject of the agreement.

- Subject of activity and location of the organization. In this paragraph you should indicate at what address the created legal entity will be registered.

- Obligations of the founders for the formation of an LLC. According to clause 1 of Article 432 of the Civil Code of the Russian Federation, the document must contain all information that allows its parties to be identified. Therefore, this paragraph begins with a preamble, which indicates the personal data of the parties to the agreement (full name, name of legal entities, contact details, etc.).

- The procedure for forming the authorized capital and information on payment of equity contributions. Without fail, the text of the agreement must contain information on the timing of payment of shares (clause 5 of Article 11 of the LLC Law), the amount of the authorized capital (clause 1 of Article 89 of the Civil Code of the Russian Federation). When creating an LLC, you need to remember that the legislator requires that the minimum amount of authorized capital be more than 10 thousand rubles (Clause 1 of Article 14 of the LLC Law).

- Responsibility for the obligations of the created legal entity. Often, liability is established in direct proportion to the share contribution of each founder. If the authorized capital is created on the principle of equality, the size of the shares is identical, then responsibility will be distributed equally.

- The procedure for distribution of profits and repayment of losses. The law regarding this point provides complete freedom of action to the parties to the agreement. They must determine how the profit will be divided and how loan obligations will be fulfilled on their own.

- LLC management procedure. Clause 5 of Article 11 of the LLC Law states that information of this type is included in the text of the agreement without fail. Here you need to indicate how the board of the LLC will be formed, what rules apply when identifying candidates for management positions. The date for holding the general meeting of founders and the procedure for notifying the upcoming meeting are also additionally indicated.

- Rights and obligations of founders, including liability for violation of the agreement, issues related to the exit or entry of founders into the LLC.

- The procedure for considering controversial issues, amending and terminating an agreement, reorganizing and liquidating an LLC.

- Other information included at the discretion of the parties to the contractual process. These include provisions on the responsibility of the founders in case of non-payment of their share in the LLC, the provision of compensation to the company by the founder, and the procedure for regulating disagreements that arise during the work process.

Related documents

- Agreement on the establishment of a limited liability company by legal entities

- Information about the actual participants of the Limited Liability Company. List of participants of the Limited Liability Company.

- Order on the appointment of the General Director.

- Example (sample) of a power of attorney to receive documents on reducing the authorized capital of an LLC

- Example (sample) of a completed protocol on reducing the authorized capital of an LLC

- Example (sample) of a completed decision to reduce the authorized capital of an LLC

- Example (sample) of a letter about the absence of creditors of a Limited Liability Company

- Example (sample) of notification to creditors about reducing the authorized capital of an LLC

- Protocol on the establishment of a Limited Liability Company (first meeting of founders)

- Protocol on the establishment of a Limited Liability Company

- Minutes of the general meeting when distributing the share owned by the Limited Liability Company

- Minutes of the general meeting of participants of a limited liability company on the distribution of the share in the authorized capital of the Company belonging to the Company in connection with the withdrawal of a Company participant from the Company

- Minutes of the general meeting of the Founders on the creation of a Limited Liability Company

- Minutes of the general meeting of the founders of the limited liability company (payment of the authorized capital is made in cash)

- Decision of the owner of a Limited Liability Company to change the director (general director)

- Decision to create a Limited Liability Company 1

- Decision to create a Limited Liability Company 2

- The decision to create a Limited Liability Company with a single participant

- Participant's decision to change the director

- The Founder's decision to sell a share in the LLC

What does a proper memorandum of association look like?

The activities of the LLC are regulated by Law No. 14-FZ of February 8, 1998, as subsequently amended on July 3, 2020. The changes came into force on January 1, 2020. In accordance with this law, the UD is not a constituent document: a constituent agreement is not needed to register an LLC. It is considered as the main constituent document only for non-profit organizations. This document is strictly confidential. Therefore, you are not obliged to present it to anyone, except to a representative of the investigative department, with a sanction or with your consent.

Why is the memorandum of association so important? From the point of view of the company structure, nothing. Usually, the UD briefly states the same provisions as in the charter. But in a legal sense, it is more difficult to challenge the UD in civil law relations, because:

- this document is signed by each founder on equal rights with the other participants, and the charter is approved by the first director by decision of the general meeting;

- the constituent agreement is certified by a notary in the presence of all interested parties, and the charter of the LLC is submitted for registration by one representative.

The UD can be drawn up at any time: both before signing the charter and after that. At its core, a memorandum of association is an agreement between the founders of a company about the financial system of the company. It states:

- the percentage of the founders' funds in the authorized capital at the time of opening the company;

- equity participation in the company structure;

- the procedure for redistributing shares, selling shares to parties to the agreement and transferring them to third parties;

- issues of resolving disputes and conflict situations;

- terms and procedure for the founders to contribute their share;

- distribution of income from LLC activities.

The last two paragraphs contain confidential information and may be a trade secret.

Comment on the rating

Thank you, your rating has been taken into account. You can also leave a comment on your rating.

Is the sample document useful?

If the document “Agreement on the Establishment of a Limited Liability Company (Option 2)” was useful to you, we ask you to leave a review about it.

Remember just 2 words:

Contract-Lawyer

And add Contract-Yurist.Ru to your bookmarks (Ctrl+D).

You will still need it!