Benefits of outsourcing accounting services

Small companies and enterprises (including those owned by individual entrepreneurs) are not always interested in hiring a permanent employee to provide accounting services, since they simply do not have enough work for him. In this case, outsourcing, that is, turning to third-party competent specialists to provide one-time or periodic services, is a rational solution to the issue.

- receiving quality services at the right time and in the required volume;

- possibility of reducing the company's staff. Accordingly, wages and other necessary deductions are reduced;

- the organization can concentrate all its efforts on its core activities;

- a third-party organization brings in professionals who specialize in a specific area.

In this case, a written contract for accounting services must be concluded. Only in this case will both parties have guarantees of fulfillment of obligations, because the agreement describes its subject in detail and regulates the responsibilities of each counterparty (including the implementation of clearly defined work and their payment at the specified rate and on time). In case of violation of obligations, only with a written document can you protect your rights in court.

Item

Under this agreement, one party (customer) instructs the other (contractor) to perform certain work within a specified time frame for payment. According to the law, only this condition is essential. However, this does not prevent the parties from describing in detail the responsibilities and procedure for performing the work.

The subject of such an agreement may be:

- drawing up reports;

- organization and maintenance of accounting at the enterprise;

- formation of principles and methods of accounting policies;

- restoration of lost reporting for previous periods;

- optimization of payments to employees and tax services;

- carrying out inventory.

The sample agreement for the provision of accounting services, given at the end of the article, contains an indication of the subject of the standard agreement.

Accounting services and outsourcing

Accounting services are a complex of services, which include: submission of reports, restoration and establishment of accounting records, support and maintenance.

A professional accountant selects the optimal option for an organization to maintain accounting and tax records, ensuring control over the movement of funds. Accounting outsourcing is one of the options for maintaining an organization's accounting. When using this option, a standard contract for the provision of accounting services (services) is drawn up with a specialized company. Cooperation with such a company can be carried out daily or several times a month.

In modern economic conditions, more and more managers are choosing accounting outsourcing.

The nature of the relationship that arises as a result of concluding an agreement for accounting services with a specialized company (agreement for subscription accounting services or support) is quite specific and requires a more detailed approach due to issues that arise during the provision of such consulting services.

Duties of the parties

The main responsibility of the contractor is to complete the work, the customer is to pay for it. However, to ensure that no disagreements arise when accepting work, it is worth making a list of required services, deadlines for their completion, and indicating other important points for the customer. Typically, the customer includes in the agreement such items as:

- warning about possible negative consequences of any actions or decisions;

- providing consultations and explanations in the event of a request from the customer or its employees;

- obligation to non-disclose information that became available to the accountant during the execution of the assignment;

- ensuring the safety of documents;

- compliance with mandatory customer instructions;

- provision of services personally (or the ability to attract other qualified workers);

- warning about deadlines for submitting reports and making payments.

The customer, for his part, must pay for the work on time, as well as provide all the necessary information: documents, powers of attorney.

What to pay attention to

A sample accounting agreement is presented below. It is concluded in writing and each party is given a signed copy. The agreement may also provide for other obligations and rules of liability for their violation, however, if such clauses are not included, the general rules of the Civil Code apply. Particular attention should be paid to the list of works, the order of its implementation, the amount and timing of payment, penalties for violation of duties. Be sure to provide valid details and check them.

Contract for accounting (outsourcing)

AGREEMENT FOR ACCOUNTING (OUTSOURCING)

06.04.2015 № 112

Moscow

Limited Liability Company "Beta", hereinafter referred to as the "Customer", represented by General Director Alexander Ivanovich Petrov, acting on the basis of the charter, on the one hand, and Limited Liability Company "Gamma" represented by General Director Kirill Vasilyevich Uvarov, acting on on the basis of the charter, hereinafter referred to as the “Contractor”, on the other hand, hereinafter collectively referred to as the “Parties”, have entered into this agreement (hereinafter referred to as the Agreement) as follows:

1. THE SUBJECT OF THE AGREEMENT

1.1. The Customer instructs, and the Contractor, during the term of this Agreement, provides accounting services (hereinafter referred to as services) to the Customer, which he undertakes to pay. 1.2. The list of services provided by the Contractor under this Agreement includes: – formation of the Customer’s accounting policy in accordance with accounting legislation; – preparation and adoption of a working chart of accounts, forms of primary accounting documents used to formalize business transactions for which standard forms are not provided; – ensuring the procedure for conducting inventories; – control of business transactions; – compliance with the technology for processing accounting information and document flow procedures; – organization of accounting and reporting in the head office and in separate divisions of the Customer; – generation and presentation of accounting information about the Customer’s activities, his property status, income and expenses quarterly within 30 days from the end of the corresponding quarter of the reporting period; – accounting of property, liabilities and business transactions, incoming fixed assets, intangible assets, inventory and cash; – reflection in the accounting accounts of transactions related to the movement of property, liabilities, fixed assets, intangible assets, inventory and cash; – accounting for production and distribution costs, execution of cost estimates, sales of products, performance of work (services), results of the Customer’s economic and financial activities, as well as financial, settlement and credit transactions; – drawing up economically sound calculations of the cost of products, work (services) performed, cost estimates; – carrying out payroll calculations and other obligations of the Customer to employees; – accrual and transfer of taxes (fees) to budgets of all levels, insurance contributions to state extra-budgetary funds, payments to banking institutions; – repayment of debts on received credits (loans) within the terms established by the relevant lending agreements; – participation in conducting an economic analysis of the Customer’s economic and financial activities based on accounting and reporting data in order to identify on-farm reserves, eliminate losses and non-production costs.1.3. The services specified in clause 1.2 of this Agreement are provided by the Contractor for all business transactions of the Customer during the term of this Agreement. Requirements for individual services (operations) provided can be determined on the basis of the Customer’s assignments (requests), submitted in writing in the form specified in Appendix No. 1 to this Agreement. 1.4. Place of provision of services: 127083, Moscow, st. Mishina, 56.

2. RIGHTS AND OBLIGATIONS OF THE PARTIES

2.1. Responsibilities of the Contractor: 2.1.1. Provide services to the Customer in accordance with the requirements of this Agreement and the current legislation of the Russian Federation. 2.1.2. At the written request of the Customer, provide written explanations on issues and actions related to the provision by the Contractor of services under this Agreement within 5 (five) business days from the date of receipt of such a request. 2.1.3. Ensure the confidentiality of information and information about the Customer’s activities. 2.1.4. Ensure the safety of received primary documents; 2.1.5. No later than the 25th day of the last month of each quarter, provide the Customer with two copies of the certificate of services rendered, signed on their part. 2.1.6. The Contractor has no right to involve third parties to perform work under this Agreement. 2.1.7. Inform the Customer no later than 3 (three) working days in advance about the need to sign documents.

2.2. Contractor's rights: 2.2.1. Request from the Customer documents, clarifications and additional information related to the provision of services specified in clause 1.2 of this Agreement. 2.2.2. Independently determine the forms and methods of providing services under this Agreement, based on the requirements of the current legislation of the Russian Federation. 2.2.3. Independently determine the composition of specialists providing services and, at its own discretion, distribute among them the work provided for in the Agreement. 2.2.4. Make copies of any documents for use in fulfilling obligations under this Agreement. 2.2.5. The Contractor has the right not to begin work or suspend the provision of services in cases where the Customer’s violation of its obligations under this Agreement, in particular the failure to provide documents or information, prevents the Contractor from fulfilling this Agreement. 2.2.6. Refuse to fulfill obligations under this Agreement, subject to full compensation to the customer for losses.

2.3. Responsibilities of the Customer: 2.3.1. Promptly transfer to the Contractor the documents and information necessary for him to fulfill his obligations under this Agreement. 2.3.2. Sign the documents prepared by the Contractor within 3 (three) working days from the moment the Contractor informs about their readiness. 2.3.3. Accept the results of services provided from the Contractor by signing an act of services provided or declare a reasoned refusal to sign it, indicating the reason for the refusal. 2.3.4. Make timely payment for services provided under this Agreement in the manner and within the time limits provided for in clause 3 of this Agreement.

2.4. Rights of the Customer: 2.4.1. Require the Contractor to properly provide services in accordance with the terms of this Agreement. 2.4.2. Require the Contractor to submit certificates of services rendered. 2.4.3. Check the progress and quality of work performed by the Contractor without interfering with his activities. 2.4.4. At your own discretion, contact (not contact) the Contractor for the provision of services provided for in the Agreement. 2.4.5. Upon written or oral request, without additional payment, receive from the Contractor information about the regulatory legal acts on which the Contractor’s activities to fulfill the obligations provided for in this Agreement are based, as well as the texts of these acts. 2.4.6. Refuse to execute this Agreement subject to payment to the Contractor of the expenses actually incurred by him.

3. COST OF SERVICES AND PAYMENT PROCEDURE

3.1. For services properly provided under this Agreement, the Customer undertakes to pay the Contractor a remuneration in the amount determined in accordance with Appendix No. 2 to this Agreement. 3.2. Payment for services provided under this Agreement is carried out by transferring remuneration to the Contractor's bank account, the details of which are specified in section. 10 of this Agreement. 3.3. Payment for services provided under this Agreement is made within 10 (ten) days after receipt of the invoice for payment for services provided.

4. PROCEDURE FOR DELIVERY AND ACCEPTANCE OF SERVICES

4.1. No later than the 25th day of the last month of each quarter, the Contractor provides the Customer with two copies of the certificate of services rendered, signed on its part. 4.2. The Customer is obliged, within 5 (five) working days after the date of receipt of the certificate of services rendered, to return to the Contractor one copy of the certificate, signed on its part, or to provide the Contractor with a reasoned refusal to accept services. 4.3. If the Customer fails to provide a signed certificate of services rendered or a reasoned refusal to accept services within the period specified in clause 4.2 of this Agreement, the services are considered accepted by the Customer in full and with proper quality. 4.4. If the Customer submits a reasoned refusal to accept services, the Parties draw up a bilateral act with the terms and conditions for eliminating comments. 4.5. Upon completion of the elimination by the Contractor of all comments reflected in the report, the Customer is obliged to accept the services and sign the acceptance certificate for the services provided, taking into account the addressed comments. 4.6. Services are considered accepted by the Customer from the moment the Parties sign the certificate of services rendered or in the case specified in clause 4.3 of this Agreement.

5. RESPONSIBILITY OF THE PARTIES

5.1. A Party that fails to fulfill or improperly fulfills its obligations under this Agreement is obliged to compensate the other Party for losses caused by such failure or improper fulfillment. 5.2. For failure to fulfill or improper fulfillment of obligations under the Contract, the Contractor is liable to the Customer to the extent of the cost of the services provided, which resulted in damages to the Customer, and if there is fault. 5.3. For late payment for services provided for in this Agreement, the Customer is obliged to pay the Contractor a penalty in the amount of 0.2% of the cost of services under this Agreement for each day of delay.

6. FORCE MAJEURE (FORCE MAJEURE)

6.1. The Parties are released from liability for partial or complete failure to fulfill obligations under this Agreement if the failure was a consequence of natural phenomena, external objective factors and other force majeure circumstances for which the Parties are not responsible and the adverse effects of which they are unable to prevent. 6.2. The parties are liable for partial or complete failure to fulfill obligations under this Agreement in the presence of fault only in cases provided for by law or this Agreement.

7. TERM OF THE AGREEMENT

7.1. This Agreement comes into force from the date of signing. 7.2. This Agreement is concluded for a period of one calendar year. 7.3. This Agreement may be terminated early: – by written agreement of the Parties; – unilaterally if one of the Parties refuses this Agreement in cases where the possibility of such refusal is provided for by law or this Agreement; – in other cases provided for by law or agreement of the Parties.

8. DISPUTE RESOLUTION

8.1. All disputes and disagreements that may arise between the Parties will be resolved through negotiations based on the current legislation of the Russian Federation. 8.2. If controversial issues are not resolved during negotiations, the disputes are resolved in court in the manner established by the current legislation of the Russian Federation.

9. FINAL PROVISIONS

9.1. In all other respects that are not provided for in this Agreement, the Parties are guided by the current legislation of the Russian Federation. 9.2. Any changes and additions to this Agreement are valid provided that they are made in writing and signed by duly authorized representatives of the Parties. 9.3. All notices and communications must be given in writing. Messages will be considered properly sent if they are sent by registered mail, by fax or delivered in person to the legal (postal) addresses of the Parties with receipt by the relevant officials. 9.4. This Agreement is drawn up in two copies having equal legal force, one copy for each of the Parties.

10. ADDRESSES AND PAYMENT DETAILS OF THE PARTIES

| Customer: Limited Liability Company "Beta" Legal address: 127083, Moscow, st. Mishina, 56 INN/KPP 7736046991/775001001R/s 30232810200000000003 in JSCB "Trust" K/s 30101810600000000957BIK 044525957 Tel.: 8 (495) 123 45 67F AX: 8 (495) 123 45 67 e-mail: [ email protected] | Contractor: Limited Liability Company "Gamma" Legal address: 127083, Moscow, st. Mishina, 56 OGRN 1236547890123 INN/KPP7714345896 / 771401001R/s 40702810900010000087 JSC KB "Union of Solidarity" K/s 30101810400000000223BIK 04467983 5Tel.: 8 (795) 1234567Fax: 8 (795) 1234567e-mail: [email protected] уail.ru | ||||||

| Signatures of the parties: | |||||||

| Customer: | Executor: | ||||||

| CEO | _____________ | A.I. Petrov | CEO | ______________ | K.V. Uvarov | ||

| M.P. | M.P. | ||||||

Outsourcing agreement for accounting services: sample

Articles on the topic

An agreement to outsource accounting services is a paramount necessity if you want to outsource your accounting to third parties. What should the contract include and what points should be given special attention to? Biznes.ru figured out the nuances of the agreement to outsource accounting.

A company’s agreement with an outsourcing company must contain a detailed description of the subject of the agreement, the conditions for fulfilling obligations and responsibilities. It is worth checking the agreement for compliance with current legislation. New regulations are adopted quite quickly and you may not have time to keep track of all changes in the law. Before drawing up an agreement, we advise you to consult with a lawyer or take a specialist with you to the transaction.

Important.

An accounting outsourcing agreement is also concluded if you need to restore your accounting.

Applications and related documents

The standard accounting services agreement form uses the following appendices:

- List of services provided under the contract;

- Exercise;

- Payment schedule.

The sample contract for the provision of accounting services uses the following supporting documents:

- Certificate of acceptance of works (services);

- Performer's report;

- Contractor expense report;

- Additional agreement;

- Protocol of disagreements;

- Protocol for reconciliation of disagreements.

Often used with this pattern:

- Agreement for the provision of information services

- Agreement for the provision of consulting services

- Agreement for the provision of marketing services

- Agreement for the provision of security services

- Contract for the provision of advertising services

Popular documents and procedures:

- Taxi car rental agreement

- Power of attorney to represent interests in the pension fund

- Application with a request to provide information in the form of an extract

- Rules of contracts for securing the fulfillment of obligations

- Power of attorney to represent the interests of the victim

What documents need to be prepared for the contract?

To draw up an outsourcing agreement for the provision of accounting services, you will need the following list of documents:

Certificate of state registration and tax registration.

Documents on the appointment of management persons.

Extract from the Unified State Register of Legal Entities.

Notices from social funds.

Tax and accounting reporting for the current and earlier periods, as well as accounting registers.

Bank agreement on opening an account.

The company's accounting policy.

You can prepare the documents yourself, but a responsible outsourcing company will definitely advise you on all issues and help with preparation.

Note:

Some outsourcing companies offer additional free services in addition to accounting. Make sure that they are specified in the contract. For example, here the standard tariff includes free personnel records, legal support and tax optimization.

Termination of an agreement

The reasons for terminating an accounting outsourcing agreement can be very different. This fact applies to both bilateral and unilateral termination.

The last type of breakdown in the working relationship can only occur when the outsourcing company fails to fulfill its responsibilities.

The contractor may terminate the contract unilaterally when the customer tries to change financial information or fail to pay for the work performed.

Accounting services for individual entrepreneurs

There are no particular differences between the accounting services of an individual entrepreneur and a legal entity. The list of services still includes a number of responsibilities:

- maintaining primary documentation in accounting;

- inclusion of business operations in the accounting program;

- creation of accounting registers;

- accrual and transfer of salary funds;

- tax transactions;

- control over extrabudgetary contributions and much more.

The only significant feature of accounting services for individual entrepreneurs is the ability to conduct accounting without using registers, that is, in a simple form, or use registers when accounting for property.

Agreement for the provision of accounting services with individual entrepreneurs.

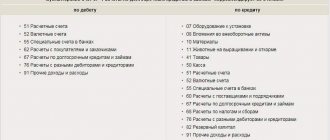

This applies to those enterprises that are on a simplified taxation system. In this case, the chart of accounts contains a minimum number of synthetic accounts.

Can an individual entrepreneur conduct accounting independently and in what cases is this possible? Find out here.

https://youtu.be/eT_0YUT8Ecg

What should be in an accounting outsourcing agreement?

An accounting outsourcing agreement must include the following sections:

Subject of the agreement. If accounting is transferred to a company, it is necessary to specify each function that will be its responsibility: reporting, full bookkeeping, etc. Examples of functions.

Procedure for provision of services. Specify the payment scheme, the procedure for delivery and acceptance of services, settlements, etc.

Responsibility of the parties. They indicate what the contractor faces for violating deadlines and poor quality performance. Penalties are prescribed in specific amounts.

Conditions for the execution of the contract by both the customer and the contractor.

Contract time. Experts advise making the contract urgent.

What is important to include in an agreement for outsourcing accounting services?

Maintaining trade secrets.

When drawing up an agreement for accounting outsourcing, pay attention to the clause on maintaining trade secrets. It is important to state that each of the parties agrees to consider the information transferred to each other when drawing up the contract and during the performance of obligations as confidential. You also need to specify the period during which this agreement will be valid. The best option is if the information is considered confidential not only for the duration of the agreement, but also for several years after termination of the agreement.

Risk insurance.

Do not forget to register financial risk insurance. The insurance itself looks like this.

Conflict resolution.

The agreement also needs to specify the procedure for resolving possible conflicts. The customer and the contractor must resolve conflicts pre-trial. It is worth clarifying how, where and in the presence of whom the parties will deal with difficult situations.

Three months of accounting, HR and legal support FREE. Hurry up to apply, the offer is limited.

Agreement conditions

- The subject of the agreement is accounting services. They do not produce a material result (but can be recorded on a material medium) and are consumed in the process of carrying out any activity. Since accounting and tax accounting services differ in the specification of the customer’s conditions, information about them must be clearly and fully reflected in the subject of the contract. To specify accounting services, you can use an application (task).

- the deadline for execution themselves (by agreement), which makes it possible to classify the deadline as an essential condition.

- Price is considered as an essential and differentiated condition that requires agreement. Lack of agreement between the parties in determining the price may be grounds for refusal to conclude an agreement.

These are the basic conditions of a standard sample contract for the provision of accounting services, which allow you to resolve issues that arise during the execution of the contract. In addition, in the text of the document, by agreement of the parties, it is possible to indicate the possibility of the contractor engaging co-executors.

Legal regulation

The Civil Code of the Russian Federation has outlined, basically, general approaches to regulating relations within the framework of the form of an agreement for the provision of accounting services. Legal regulation of a standard sample contract for accounting services is carried out by the Federal Law of November 21, 1996 N 129-FZ “On Accounting” (which establishes uniform legal and methodological foundations for organizing and maintaining accounting in the Russian Federation) and some other federal laws, decrees of the President of the Russian Federation and resolutions Government of the Russian Federation.

The contract form is simple, written. The legislation does not impose any special requirements on it.

Parties to the agreement

The parties are the customer and the contractor. Parties may be individuals, legal entities and individual entrepreneurs.

GPC agreement and legal framework

The specifics of concluding civil contracts are regulated by the provisions of the Civil Code. These types of contractual obligations have the following types of contracts:

- Paid provision of services;

- Contract;

- Commissions;

- Instructions;

- Property rental;

- Agency contract;

- Transport delivery.

Unlike labor contracts, when drawing up civil contracts, the parties are the customer and the contractor. The names of the parties to the concluded agreement in no way interfere with the current staffing schedule in the organization.

When drawing up a civil contract, it is necessary to clearly state its subject, which is to perform certain work or achieve a certain result. As for the duration of the contract, it is not regulated by law and is established on the basis of a mutual agreement between the parties.

All the features of employment contracts have absolutely no meaning when drawing up a civil contract. The contractor does not have the right to count on vacation or receiving benefits guaranteed by law. Likewise, the customer should not require the citizen to comply with working hours or the company’s internal labor regulations. Also, the customer does not have the opportunity to send the contractor on a business trip.

Legislative regulation

The contract for maintaining accounting records in a company is determined by Article 779 of the Civil Code of the Russian Federation. According to this agreement, responsibilities are distributed as follows:

- the contractor is obliged to provide services according to the customer’s requirements;

- in turn, the customer is obliged to pay for the work performed.

Civil Code of the Russian Federation Article 779. Contract for paid services

1. Under a contract for the provision of services for a fee, the contractor undertakes, on the instructions of the customer, to provide services (perform certain actions or carry out certain activities), and the customer undertakes to pay for these services. 2. The rules of this chapter apply to contracts for the provision of communication services, medical, veterinary, auditing, consulting, information services, training services, tourism services and others, with the exception of services provided under contracts provided for in Chapters 37, 38, 40, 41, 44, 45, 46, 47, 49, 51, 53 of this Code.

There are also a number of rules that must be followed:

- according to general rules, services must be provided by the contractor personally, unless other conditions are specified in the contract;

- the period for the provision of services and the procedure for payment must be specified in the contract;

- if the terms of the contract are not observed due to the fault of the customer, then the contractor receives payment in full;

- if force majeure circumstances arise without the fault of both parties, then the customer reimburses the contractor for his actual expenses, unless otherwise specified in the contract;

- the contractor and the customer may refuse to comply with all clauses of the contract unilaterally if one party pays the other for expenses or losses incurred;

- in all other cases, the clauses of the agreement are observed according to the general rules.

With whom you can enter into an agreement for the provision of accounting services and how to take it into account, you can see here:

https://youtu.be/f2ksuJ9p8Vc

Pros and cons of accounting outsourcing

Many large and not so large companies have already tasted all the benefits of providing accounting services under a contract.

In legal terminology, this is called accounting outsourcing. There are many advantages. Eg:

- the customer company saves significantly on costs, since there is no need to pay salaries to a large staff of accountants;

- There is no need to pay payroll tax contributions to the budget. These deductions amount to more than 30%;

- there is no need to organize workplaces for accounting employees, there is no need to equip them with office equipment, software, buy a huge amount of office supplies, or train new employees;

- the ability to avoid many problems that are associated with human factors;

- According to the contract, accountants will not go on vacation, will not take time off or sick leave.

Also, cooperation with an external accounting company allows you to significantly save on some types of taxes, since the amount of payment to the outsourcer under the contract is included in the costs of the customer company.

There are also disadvantages to outsourcing. The main ones are the following:

- some types of company activities depend on the speed of reaction to equipment failure, therefore it is much more profitable and convenient to have a full-time accountant among the staff;

- Unlike an outsourced accountant, an in-house specialist can perform a number of other tasks that do not relate to his type of activity. For example, he can replace the secretary, buy equipment, take over correspondence, or fix a faulty switch in the office. The outsourcer will not do all this, since he works according to the contract.