What is account 90 used for in accounting?

To generate income, business entities incur expenses that must be taken into account in accounting in accordance with the current standards of PBU. To account for income and expenses from main activities, account 90 is used.

Here, information is summarized separately for each type of income and expense in chronological order. The main income is considered to be the revenue that comes to the company from the sale of products, goods, works, and services.

This account should reflect information about expenses that have already generated income for the company. It also takes into account indirect taxes, which are included in the price of products, works, and services. For example, VAT, excise taxes, etc.

At the end of each month, by comparing account turnover, the financial result is determined. If the excess on this account goes to the loan, then the company has received a positive result in the form of profit.

Attention! If the debit is negative, it is a loss. At the end of the year, these indicators form the main financial result for the year. Since at the end of the reporting period the financial result is written off from this account, it should not have any balances.

https://youtu.be/bOktS8UkPYQ

Reflection of revenue on account 90

What is revenue? This is the amount of funds due to the organization from buyers or customers of its work (services) for products sold or services (work) performed. When funds of this kind are received, they should be reflected in the credit of subaccount 90.01. It should be remembered that this account collects information about income only from the main activity. If receipts occurred as a result of other transactions, they are recorded in account 91.01. How to determine the main activity? Typically, these items are indicated in the accounting policy of the enterprise in the appropriate section.

If the organization’s charter states that a legal entity carries out any activity not prohibited by current legislation, then the main income is recognized as those amounts that are received regularly and their amount exceeds 5% of the total revenue received during the reporting period.

What subaccounts are used 90 accounts

The chart of accounts assumes the opening of the following 90 subaccounts on the account:

- 90/1 “Revenue” - it takes into account the main income of the company, which can be represented either by sales proceeds, rent, interest, if these types of activities are recognized as main ones.

- 90/2 “Expenses” - expenses incurred, as a result of which the company received income, are reflected. For example, the cost of finished products, works, services.

- 90/3 “VAT” – information is reflected on accrued (outgoing) VAT, which is included in the cost of goods, works, and services sold according to issued invoices.

- 90/4 “Excise taxes” – information on accrued excise taxes on products is reflected in accordance with current legislation. These amounts are also included as a surcharge in the price of the goods.

- 90/5 “Export duties” - used in foreign economic activity to reflect the duties included in the price.

- 90/6 “General business expenses” - applies when the organization’s accounting policy determines the method of writing off these expenses directly to cost, without first distributing them by type of activity. Here, management costs for services provided, work performed, and products sold are recorded.

- 90/7 “Commercial expenses” - used to summarize information on sales expenses for goods sold, works of services. This subaccount is used in trade organizations.

- 90/9 “Profit (loss) from the main activity” – is intended to reflect information on the formation of interim financial results for the type of activity being carried out. The turnover of account 90 is compared monthly or quarterly in order to determine interim financial results.

In accordance with the specifics of the activity being carried out, other sub-accounts may be opened for this account. This point is recorded in the accounting policy of the organization.

You might be interested in:

Fixed assets in accounting and tax accounting, main changes in 2020

In addition, analytical accounting is opened on these sub-accounts for each type of product produced, services provided, and work performed.

Analytics can also be organized by sales regions or other areas that are required to manage the organization and make timely decisions.

Important! At the end of the year, account 90 is closed, which involves writing off the accumulated amounts of turnover in the subaccounts of the account to account 90/9. Thus, the balance of account 90 at the end of the year will be zero.

Calculation of enterprise performance results

At the end of each month, it is necessary to calculate the result of the enterprise's activities.

This is done extremely simply: credit turnover on the account. 90.01 is compared with the amount of debit turnover of the account. 90.02–90.07. If the difference is positive, a profit is generated; if it is negative, a loss is generated. An example of account assignments when determining the financial result is shown in the table: Account 90: entries compiled at the end of the month

| Dt | CT | Characteristics of a business transaction |

| 90.01 | 90.09 | Revenue for the reporting month is written off |

| 90.09 | 90.02 | Closed amount of cost of goods sold |

| 90.09 | 90.03 | VAT amounts are written off to the financial result |

| 90.09 | 90.04 | The amount of excise taxes is closed |

| 90.09 | 99 | The profit of the enterprise for the reporting month is reflected |

| 99 | 90.09 | The sales loss for the reporting month is reflected |

It turns out that each of the sub-accounts (except 90.09) is sequentially closed by writing off the amounts to account 90.09. After which the final value formed on it is attributed to account 99 (to debit - loss, to credit - profit).

All subaccounts of the synthetic account 90 have a balance during the year, which increases every month. But the formation of a balance of 90 accounts is impossible and incorrect according to the PBU and the standard chart of accounts.

Account characteristics

To generate data on income received, as well as expenses incurred for the normal activities of a business entity, account 90 is used.

This account differs from many others in that it has no balance at the beginning or end of the reporting period. In addition, the account is active-passive, since during interim summing up it can contain both a debit and a credit balance.

Account 90 records income and expenses for the following types of activities:

- For the sale of any finished product;

- For work and services performed in various areas;

- For purchased products that are included in the packaging of finished products;

- To account for work related to construction or installation;

- For transportation services;

- For loading and unloading services;

- When renting out your property, if this is the main source of income;

- When transferring rights to patents on a paid basis.

The debit of account 90 reflects the entire range of costs incurred for core activities. The amounts of cost, accrued taxes, etc. are indicated here. Credit 90 of the account reflects the entire volume of revenue received from the main activity.

Attention! Account 90 is closed by generating the amount of profit or loss using account 90 09, and then writing it off to account 99. Since this account should not have a balance at the end of the period, it is not reflected in the balance sheet.

Formation of financial results

To account for the current profit of the organization, account 99 “Profits and losses” is used.

It is intended to identify the final financial result of the organization’s activities for the current period (reporting year). Records are kept on it monthly throughout the year. There should be no balance on this account on the first day of the new year. To generate information about the financial result during the month, a system of synthetic accounts provided for in the chart of accounts is used to record income and expenses:

- Account 90 “Sales” (income and expenses for the main activity)

- Account 91 “Other income and expenses” (other operating and non-operating income and expenses)

- Account 99 “Profits and losses” (to determine the total profit or loss for the organization)

Account 90 “Sales” is intended to generate information on income and expenses for conducting normal activities of the organization during the month. Account 90 “Sales” generates the financial result from economic activities, which constitute the main purpose of creating the organization. It represents the difference between sales revenue and the cost of products (works, services) sold.

Account 91 “Other income and expenses” is intended to generate information about other income and expenses that are not the main activity. For example, expenses and income from the sale of fixed assets or materials, exchange rate differences, etc. Account 91 “Other income and expenses” reflects all operating and non-operating income and expenses (except for extraordinary income and expenses and income tax expenses, which are reflected in account 99 “Profits and losses”).

At the end of each month, the balance (difference) of income and expenses from accounts 90 “Sales” and 91 “Other income and expenses” is transferred to account 99 “Profits and losses”.

Account 99 “Profits and Losses” reflects: profit or loss written off from accounts 90 and 91, income and expenses associated with emergency situations, and the amount of accrued income tax. As a result, account 99 “Profits and losses” reveals the organization’s net profit.

When reforming the balance sheet on December 31 of the calendar year, the amount of net profit of the reporting year, formed in the debit of account 99 “Profits and losses,” is transferred to the credit of account 84 “Retained earnings (uncovered loss).” This entry is made by the final posting of December of the reporting year in such a way that as of January 1 of the year following the reporting year, account 99 “Profits and losses” has no balance. Account 84 “Retained earnings (uncovered loss)” is included in the “Capital” section. The economic content of this account lies in the accumulation of profits not yet paid in the form of dividends (income) or retained earnings, which remain with the organization as an internal source of long-term financing.

The formation of profit or loss can be schematically represented as follows:

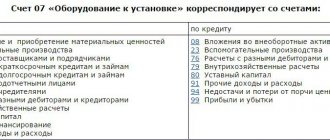

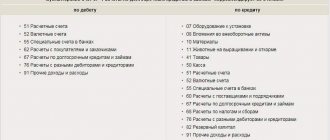

Account correspondence

From the debit of account 90, entries can be made to the credit of the following accounts:

- Account 11 - for the cost of sold animals that were fattened;

- Account 20 - for the cost of work and services sold;

- Account 21 - for the cost of semi-finished products sold externally;

- Account 23 - for the cost of work and services provided by auxiliary production;

- Account 26 - for accumulated general business expenses in their conditionally constant part (without distribution by type of main production);

- Account 29 - for the cost of work and services provided by service industries;

- Account 40 - for the deviation of the actual cost of production over the planned one;

- Account 41 - for the cost of purchased goods sold;

- Account 42 - for the amount of trade margin;

- Account 43 - for the cost of sold own products;

- Account 44 - for the accumulated amount of expenses associated with the sale of goods;

- Account 45 - for the amount of the cost of goods for which revenue was recognized;

- Account 58 - for the amount of redeemed or sold securities;

- Account 68 - for the amount of accrued taxes and fees;

- Account 79 - for the amount of costs for on-farm settlements;

- Account 99 - for the amount of profit received when closing account 90.

You might be interested in:

Account 10 in accounting: what it is used for, characteristics, subaccounts, postings

From the credit of account 90, entries can be made to the debit of the following accounts:

- Invoice 45 - for the cost of the stages of work accepted by the customer;

- Account 50 - for the amount of cash revenue received for the reporting period;

- Account 51 – for the amount of revenue received to the current account for the reporting period;

- Account 52 – for the amount of revenue received in foreign currency for the reporting period;

- Account 57 – for the amount of revenue received from receipts, transfers, etc. during the reporting period;

- Account 62 - for the amount of goods shipped to the buyer;

- Account 76 - for the amount of work and services provided to other creditors;

- Account 79 – for the amount of revenue from on-farm settlements;

- Account 98 - upon the arrival of the moment of recognition of income previously allocated to future periods;

- Account 99 – for the amount of loss received when closing account 90.

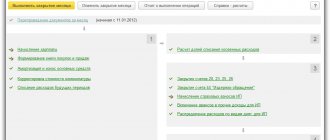

Closing account 90

The synthetic account 90 should not have a balance at the end of the month. Therefore, at the end of the month, entries are made to close this account. To do this, the debit and credit turnover to account 90 is compared. If the credit turnover is greater than the debit turnover, we can say that at the end of the month the organization has a profit based on normal activities:

Debit account 90-9 – Credit account 99 “Profits and losses”

If the ratio is the opposite, then the organization ended the month with a loss, and account 90 is closed as follows:

Debit account 99 – Credit account 90-9

At the end of the year (December 31), not only the financial result for December is revealed, but all sub-accounts to account 90 are closed. The so-called balance sheet reformation is carried out.

Please note that when using accounting programs, the monthly closure of account 90, as well as the reformation of the balance at the end of the year, are usually carried out automatically.

Account 90 in accounting has several functions, and most importantly, it serves to generate profit or loss for the organization. Read about the features of its use in this article.

Accounting entries

Let's look at what transactions the sales account 90 takes part in.

Sale of products, works, services:

| Debit | Credit | Description |

| 62/1 | 90/1 | The goods have been shipped to the buyer |

| 76 | 90/1 | Sales to other debtors reflected |

| 90/2 | 41, 43 | The cost of goods sold was written off |

| 90/3 | 68 | VAT on sales has been calculated |

| 50, 51 | 62/1 | Money for the goods is transferred by the buyer |

How to close account 90 at the end of the year:

| Debit | Credit | Description |

| 90/1 | 90/9 | Write-off of revenue from core activities |

| 90/9 | 90/2 | Write-off of costs for core activities |

| 90/9 | 90/3 | Write-off of accrued VAT amounts |

| 90/9 | 90/4 | Write-off of accrued excise taxes |

| 90/9 | 99 | The profit received was written off when closing the account 90 |

| 99 | 90/9 | The resulting loss was written off when closing the account 90 |

Analytical accounting for account 90

Analytics is carried out on sub-accounts, which are closed at the end of the month and their balances are transferred to the profit and loss account. The score card 90 can have the following turns:

- 90.1 in relation to revenue;

- 90.2, showing the cost of production with operating expenses;

- 90.3 for VAT amounts;

- 90.4, intended for accounting for excise taxes;

- 90.5, allocated for export duties;

- account 90 “Sales” for summing up its subaccounts has a subaccount 90.9.

Amounts accumulated during the month on accounts 90.1 – 90.4 are subject to write-off to 90.9. Next, account 90 is reset by posting with account 99. For the purposes of analytical accounting, a separate reflection of each type of commodity item is typical.

How to determine the financial result of a company's activities

The interim financial result must be determined at the end of each month or other period specified in the accounting policy. For example, small businesses are allowed to perform this operation once per quarter, or even once per year.

At this moment, a comparison of turnovers in the subaccounts of account 90 should be made. The financial result is determined as the difference between debit and credit turnover for the selected period and is written off to profit and loss account 99, while such an operation will only affect account 90/9. The balances on the remaining subaccounts will be retained until the end of the year, when the final determination of the result will be made.

Attention! That is, the financial result is determined by subtracting from the amount of revenue in account 90/1 the amounts accumulated in cost subaccounts 90/2-90/5.

If the results of the calculations result in a positive value, it will indicate a profit for the reporting month. If the result is negative, this indicates a loss from the activity. After this, the determination of the intermediate result is made using postings - D 90/9 K 99 in case of profit, and D 99 K 90/9 in case of loss.

Subaccounts 90 of account, with the exception of 90/9, accumulate the amounts of revenue and expenses incurred, as well as the amount of taxes, throughout the year. At the end of the year, the final result for each of them is written off to subaccount 90/9 in one amount. Since during the year the amounts of the financial result were written off from it, if the account is closed correctly, there should not be a balance of 90.

Closing 90 accounts at the end of the year

During the month, all sales are reflected in this way. At the end of the month, the balance is calculated for each subaccount and the financial result for the month is displayed. How does this happen?

1. The amounts for each subaccount are added up, that is, the turnover for credit is 90/1, for debit 90/2, for debit 90/3.

2. From the total debit turnover (subaccount 2 + subaccount 3), the credit turnover (subaccount 1) is subtracted.

3. If you receive a positive number, it means there is a loss for the month, that is, expenses exceeded income. The loss is reflected by posting D99 K90/9, where account 99 “Profits and losses” is used to generate the final financial result.

4. If we receive a negative number, it means that we have a profit for the month; we reflect it by posting D90/9 K99.

With the beginning of a new month, account 90 is re-opened, the balance of each sub-account is transferred to the corresponding sub-accounts of the new 90 account.

We continue to take into account all sales transactions throughout the month, and at the end of the month we again calculate the financial result for the month.

And this continues from month to month until the end of the year.

Closing account 90 at the end of the year (postings):

At the end of the year, account 90 must be closed so that the balance of each subaccount becomes zero. In this case, each subaccount is closed to subaccount 90/9:

- 90/1: we consider the final balance, it is a credit balance, in order for the balance on this subaccount to become zero, you need to post D90/1 K90/9.

- 90/2: we calculate the final balance, it is a debit, in order for the balance to become equal to zero, we carry out the posting D90/9 K90/2.

- 90/3: similar to subaccount 2, we carry out posting D90/9 K90/3.

- 90/9: now, if you calculate the final balance on this subaccount after completing all previous entries, it will be equal to 0.

Account 90 is closed.

At the beginning of the new year, we will re-open account 90 with a zero balance on all sub-accounts and begin recording sales transactions anew.