The “Equipment for Installation” account is intended for various equipment that requires installation. Installation is the assembly of equipment from forming parts, spare parts for this equipment, attachment to supporting structures, etc. The account is used mainly in construction organizations.

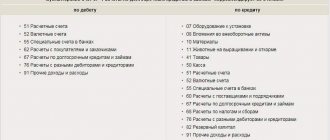

Main account correspondence:

Installation work

Installation work includes:

- assembly and installation of equipment at the site of permanent operation;

- technological supply (water, air, installation of cables and electrical wires, etc.);

- equipment check;

- insulation and painting;

- etc.

The equipment can be of a production, or energy, technological nature, etc. The main feature of such equipment is the impossibility of putting it into operation without assembly (connection, configuration). All costs for delivery, storage, setup, etc. are also taken into account in the account to determine the actual cost of the equipment.

Equipment that does not require assembly cannot be included in the account.

Explanations

For the company to switch to a scheme for reflecting expenses for receiving units through an account. 15, the feasibility of its use should be analyzed. Accounting for the costs of purchasing equipment intended for installation is carried out according to its specific types. This is necessary to determine the initial cost of fixed assets. Application of account 15 assumes that all expenses are divided by:

- The amount of costs at accounting prices.

- The difference between them and actual costs.

Acceptance of accounting from suppliers

Example

Alliance-Stroy LLC purchased equipment worth 2,006,000 rubles, including VAT of 306,000 rubles. For the installation of equipment, a contract was concluded with AlfaProekt LLC, the cost of the work was 318,000 rubles, including VAT 48,000 rubles.

Postings

The accountant of Alliance-Stroy LLC made the following entries:

| Dt | CT | Operation description | Sum | Document |

| 60 | Equipment requiring installation has arrived | 1700000 | Invoice | |

| 19 | 60 | The amount of VAT claimed is reflected | 306000 | Invoice |

| 68 | 19 | VAT is accepted for deduction | 306000 | Book of purchases |

| 08 | The equipment has been handed over for installation | 1700000 | Acceptance and transfer certificate OS-15 | |

| 08 | 60 | Installation work included in the price | 270000 | Accounting information |

| 19 | 60 | Amount of VAT claimed by the contractor | 48000 | Invoice |

| 68 | 19 | VAT is accepted for deduction | 48000 | Book of purchases |

| 60 | Payment under the contract and with the equipment supplier (2006000+318000) | 2324000 | Payment order | |

| 01 | 08 | The equipment is accepted for accounting as OS (1700000+270000) | 1970000 | Accounting information |

Write-off

The classification of accounts provides for special items for recording the cost of units commissioned for installation. In particular, it applies to DB sch. 08, summarizing information on investments in non-current assets. At the same time, units delivered to the construction site that require installation are accepted by the contractor as off-balance sheet item 005. The cost of the equipment or its parts is deducted from it accordingly. If the installation of equipment transferred to the contractor at its permanent place of use has not actually begun, then its cost is not written off. In case of gratuitous transfer, sale and other similar operations of units to be installed, their price is transferred to DB. Account 91, reflecting other expenses and income. Analytical accounting by account. 07 is carried out by storage areas of objects and their individual names (brands, types, etc.).

Retirement of equipment

Sometimes it happens that equipment is discarded even before it is handed over for installation. For example, due to its theft, damage, transfer, etc.

Disposal due to technical unsuitability

Alliance-Stroy LLC credited a technical device worth 10,000 (excluding VAT) to the account. The device was stolen from a warehouse, about which a report was drawn up. In this case, the following transactions are created:

| Dt | CT | Operation description | Sum | Document |

| The cost of equipment is written off as a shortage | 10000 | Write-off act |

Disposal due to sale

Alliance-Stroy LLC, after recording a technical device worth 15,000 rubles (excluding VAT) on the account, decides to sell it before handing it over for installation. Postings in this case:

| Dt | CT | Operation description | Sum | Document |

| 91.1 | The cost of equipment is written off as expenses | 15000 | Implementation Act |

Deviations

They must be recorded separately on the account. 16 with further debiting of articles that reflect the corresponding objects. It becomes obvious that deviations in the price of equipment requiring installation under this scheme should also be recorded by type of material assets and transferred to the account. 08 at the time of transfer of units for installation. Restrictions on the formation of an assessment of equipment intended for installation, depending on the moment at which it was accepted, similar to the assessment of OS and intangible assets, it is permissible to determine not the average, but the actual cost.

VAT accounting

The procedure for VAT reimbursement when accounting for equipment differs little from the procedure for accounting for fixed assets. An organization can show VAT for reimbursement immediately after the equipment is accepted for accounting.

Of course, tax refunds are only possible for equipment used in activities subject to VAT. That is, if an organization combines activities under the main taxation system with UTII, VAT can be reimbursed only on equipment purchased for OSNO.

When to use the Hardware to Install folder

If you look into an accounting textbook, you can read there that account 07 takes into account fixed assets that, before being put into operation, require installation, assembly or some other additional operations to bring them to a state suitable for use. Account 07 is also used by various construction and similar organizations.

Equipment for installation

used in cases where the purchased fixed asset requires installation.

Thus, if your OS cannot be put into operation immediately after purchase and some additional costs are expected to “bring it to mind,” then such a fixed asset must definitely be entered into the “Equipment for installation” folder.

A typical example is an air conditioner. Once purchased, you cannot simply turn it on and use it. First, it still needs to be installed, and the costs of this installation in some cases may well be comparable to the price of the air conditioner itself. Consequently, the initial cost of the air conditioner when taking it into account will not be equal to the purchase price at all - you also need to take into account installation costs. That is why such a future main tool must be entered into the “Equipment for installation” folder.

If the fixed asset can be used immediately after purchase and does not require any additional investments, then such OS is entered into the “Equipment (fixed asset objects)” folder.

Accounting for fixed assets at an enterprise in 2017–2018: what has changed

First of all, accounting specialists at an enterprise should clearly understand the differences and similarities in approaches to reflecting fixed assets and transactions with them in the accounting and tax accounting of fixed assets.

In both accounting and tax accounting, in order for a company to consider certain equipment as its fixed asset, the object must meet the following criteria:

- the estimated period of use of the object exceeds 12 months;

- the object was acquired for use in the business of the enterprise, and not for resale;

- the asset is capable of bringing economic benefits to the enterprise;

- the initial cost exceeds 40,000 rubles. for accounting and 100,000 rubles. for tax accounting purposes.

Until 01/01/2016, the criterion for the initial cost of fixed assets in accounting coincided with that in tax accounting: fixed assets were considered equipment worth more than 40,000 rubles. But from 01/01/2017 in paragraph 1 of Art. 256 and paragraph 1 of Art. 257 of the Tax Code of the Russian Federation, amendments were made, according to which OS began to be recognized for tax purposes only for property exceeding the value of 100,000 rubles. Moreover, this increase in the limit applies only to OS accepted from 01/01/2016. In accounting, the value of the limit has not yet changed: depreciable property is an asset worth more than 40,000 rubles. In this connection, taxable temporary differences are formed between tax and accounting.

See here for details.

Each fixed asset belongs to a specific depreciation group, and its cost is written off as expenses over a certain time period.

The main change in accounting for fixed assets that 2020 brought was a change in the codes of the All-Russian Classifier of Fixed Assets (OKOF), due to which the depreciation periods for some fixed assets changed, and some types of fixed assets were transferred to another depreciation group. The new standards apply to OS facilities put into operation after 01/01/2017.

Use of borrowed funds

The units can be purchased using a loan. In this case, the interest on it should form the assessment of the equipment until it is transferred for installation. Operations for accruing interest on bank loans that were received for the purchase of such objects should be reflected depending on the period of provision of borrowed funds. The wiring looks like this:

— Db 07 Kd 66 (67).

In case of sale of units, the following entries are made before installation:

— for write-off: Db 91.2 Kd 07.

— for the amount of the buyer’s debt: Db 62 Kd 91.1.

As a result, according to 91, reflecting other expenses and income, the financial result from the sale of equipment will be revealed. This is due to the fact that the debit determines the cost of sold material assets, and the credit determines the amount received from the sale. In such cases, however, a loss may also arise.

Depreciation and revaluation of fixed assets in accounting

The company depreciates the OS over the course of its operation, i.e., gradually transfers its value to account 02.

NOTE! Depreciation in accounting for the operating system used should not be interrupted. An exception exists only for OS preserved for more than 3 months, as well as for OS, the restoration of which should last longer than 12 months (clauses 17, 23 of PBU 6/01).

However, accounting specialists should remember that some categories of fixed assets do not need to be depreciated. These include, for example, land plots.

For information on how to calculate depreciation and display it in accounting, read the material “Methods of calculating depreciation in accounting.”

The company also has the right to revaluate its fixed assets, that is, recalculate both the cost of fixed assets and the amounts of previously accrued depreciation. This follows from clause 15 of PBU 6/01. Such revaluation must be carried out at the end of each year. In this case, the results of revaluation (the value of revaluation or discount) can both influence the financial results of the company and increase/decrease the company’s additional capital.

Fixed assets in tax accounting

An indication of what types of property can be classified as fixed assets for the purpose of calculating income tax is contained in clause 1 of Art. 257 Tax Code of the Russian Federation.

Thus, fixed assets are part of the property that simultaneously satisfies the following conditions:

- used as means of labor in the production and sale of goods (performing work, providing services) or for the management needs of the organization;

- the initial cost of the object exceeds 100,000 rubles.

Fixed assets in accounting represent an important and in some aspects complex area of accounting. After all, any movement of fixed assets (acquisition by a company or disposal from production) requires the organization’s accountants to have a clear understanding of the rules and regulations of accounting relating specifically to fixed assets. What specialists should know first of all will be discussed in this article.

Nuances of accounting for the transfer of fixed assets to the authorized capital of an LLC

If a company decides to transfer its former OS to the authorized capital of another organization, it should be remembered that such a transfer must also be formalized by an appropriate act. It can be compiled either in free form or using a template in the OS-1 form. At the same time, it is important that such an act reflects the residual value of the fixed assets, as well as the amount of VAT that the company will have to recover in connection with the transfer of the fixed assets as a contribution to the capital of another company.

Further. The transferred OS is assessed by the participants of the receiving organization to determine the size of the contribution made by such OS. Therefore, it is important for the company to understand that if participants evaluate the fixed assets at a cost exceeding its book value, then the company will attribute the difference to its income (credit to account 91 in correspondence with the debit of account 76, intended to account for the company’s debt on a contribution to the capital of a third-party company). In the opposite case, if the shareholders valued the operating system at a smaller amount than what was indicated in the company’s accounting documents, it turns out that in fact the debt on the contribution to the capital company was not fully repaid. Therefore, the difference should be included in other expenses and written off as a debit to account 91.

Whether to charge depreciation on fixed assets received as a contribution to the management company, read here.

Liquidation of fixed assets in accounting

Liquidation of fixed assets has some peculiarities in terms of accounting.

Firstly, since the company did not receive income for the disposed fixed assets, the company will only have to show expenses in its accounting. In this case, expenses (recorded in the debit of account 91) will include the following:

- residual value of the liquidated asset;

- the amount of costs for work (both own and performed by third parties) that directly accompanied the liquidation of the OS;

- the amount of VAT that the company had to restore in connection with the liquidation of the operating system.

What transactions are made when disposing an asset , see . in the material “Disposal of fixed assets in accounting (nuances).”

Secondly, specialists responsible for fixed assets accounting should not forget that as a result of liquidation, the company receives some new inventory. They must be taken into account on account 10 (debit) in correspondence with the increase in the company’s other income (credit 91).

Read about how to take into account costs when liquidating an OS here.

Additionally

During the inventory, a shortage of units that were accounted for in account 07 may be revealed. In such situations, the item is credited. In this case, the account is debited. 94, reflecting losses and shortages from damage to material assets. The accountant can immediately use the account. 99 showing losses and profits. This is advisable in case of loss of units intended for installation due to emergency circumstances of economic activity. The latter, for example, include nationalization, accident, fire, natural disaster, and so on.

OS in accounting

In the accounting of an organization, in order to recognize an asset as an item of fixed assets, it is necessary that the following conditions be met in relation to such an item:

- the object is intended to be used for any of the following purposes (clause 4 of PBU 6/01):

- production of products;

- execution of work;

- provision of services;

- management needs of the organization;

- provision for a fee for temporary possession or use.

- the object is intended for use for a period of time exceeding 12 months;

- the organization does not intend to subsequently resell the asset;

- the object is capable of bringing future economic benefits to the organization.