Sample donation agreement

Related publications

Any transaction is a contract, an agreement between two parties. If such relations are not formalized, then the agreement is considered to be concluded orally. In some situations, the law requires the mandatory conclusion of a written agreement. The agreement for the donation of funds, which will be discussed in our article, depending on the conditions, may remain only an oral agreement, but in a number of cases it must certainly be drawn up on paper.

https://youtu.be/ngDOIMjEQoA

Oral and written gift agreement

The procedure for concluding a gift agreement is prescribed in Article 574 of the Civil Code. It regulates general cases of donation, both property and cash.

In general, according to the provisions of the mentioned article, a gift agreement can be concluded orally, that is, the donor simply transfers money, title documents to the object or some other key to ownership of the object to the donee. At the moment of this transfer, the transaction is considered completed. But the agreement must be drawn up in writing if there is a donation of real estate that is subject to state registration, or if the parties agree to transfer the object in the future. A contract of donation of funds or property in an amount exceeding 3,000 rubles is subject to mandatory written execution if the donor is a legal entity.

The latter is especially true for those employer companies that practice giving gifts to their employees for various holidays. On the one hand, such an approach should certainly increase the loyalty of employees towards the employer and strengthen the corporate spirit within the team, but at the same time it requires the organization to provide additional paperwork for such transactions. And here it is worth adding that the donor-legal entity can be recommended to draw up a written agreement even in cases where its amount does not exceed the established limit. Firstly, this will clearly record the amount of the gift in accounting. In addition, in this situation, the problem of paying personal income tax arises, for which its own limits are established. Thus, gifts made by an employer in the amount of up to 4,000 rubles per year are not subject to personal income tax. In other words, there can be several gifts (and this will be easiest to track if you sign a corresponding agreement with the employee each time), but their total amount should not exceed the non-taxable limit. The employer must withhold the excess and transfer personal income tax to the budget, just as he does in the role of a tax agent for a regular salary.

If the donor and recipient are individuals, then in cases of transfer of ordinary gifts or sums of money, tax consequences do not arise (Article 217 of the Tax Code of the Russian Federation). So in such a situation, the parties may well exercise their right not to enter into a written agreement for the donation of funds or property. Conversely, a written agreement should be drawn up when transferring, for example, a car. On the one hand, the Civil Code does not prohibit leaving such a transaction oral: after all, although the ownership of such an object requires state registration, we are not talking about real estate, and, therefore, this agreement does not fall under the requirement of Article 574 of the Civil Code of the Russian Federation for written execution. However, this kind of transaction is still subject to the same personal income tax, unless the gift is transferred between close relatives. And again, it would be easier and more reliable to spell out this situation in a written contract.

Is it possible to give vouchers to employees?

Another fairly common gift for employees at enterprises in 2020 is various vouchers for vacations in sanatoriums and resorts, which are issued to employees and members of their families to improve the health of the body. At the same time, as with the types of gifts described above, the process of registering this type of incentive affects such features as:

- payment of personal income tax by an employee;

- payment of insurance premiums, etc.

Important : In the event that vouchers to health care institutions are presented, according to the conditions described in Article 572 of the Civil Code, the cost of this gift should not be included in the base for calculating insurance premiums, because these payments, according to the law, do not apply to objects which are subject to mandatory insurance contributions (more information can be found in Article 7 of Federal Law No. 212, which was adopted on July 24, 2009). However, the described rule does not apply if the employer compensates for the cost of the voucher.

We remind you that the agreement for donating a trip to an employee, the cost of which exceeds 3,000 Russian rubles, is subject to mandatory written execution (according to the standards described in paragraph 2 of Article 574 of the Civil Code of the Russian Federation), and ignoring this condition leads to the nullity of the agreement and cancellation of the transaction.

Having decided to receive a voucher worth more than 4,000 Russian rubles as a gift from the employer, the employee must pay 13% of its total cost (clause 28, article 217 of the Tax Code of the Russian Federation).

In cases where the employer compensates for the voucher at the expense of money that is not included in the expenses taken into account when calculating income tax, rather than donating it, this income, according to paragraph 9 of Article 217 of the Tax Code, is exempt from personal income tax.

Simply put, it is much more profitable for employees to receive compensation for the trip rather than the trip itself. It is worth noting the fact that this exception in 2020 still does not apply to tourist packages.

An equally important point is that the transfer of vouchers to employees must be carried out according to a transfer deed, and if the obligation to pay personal income tax arises, the obligation to pay tax falls on the employer not only in relation to his employee, but also to his family members. At the same time, the employer cannot withhold tax, which, in accordance with the standards described in paragraph 5, paragraph 226 of Article 226 of the Tax Code of the Russian Federation, must be reported to the tax authorities.

Instead of an afterword

As you can see, to encourage employees, there is a separate procedure for drawing up a gift agreement for employees from the employer, which is based on the standards established by the “three pillars” - the Labor, Tax and Civil Codes.

Also, it is worth adding that tax specialists today are showing special interest in such transactions, and therefore any deviation from the letter of the law can cause not only fines, but also litigation.

If you have questions related to the legal sphere or you want to get advice based on your situation, our lawyers are ready to share their considerable experience with you free of charge! Write to us!

Previous

Deed of GiftAgreement of donation of a land plot between relatives - sample 2020. for MFC

Next

Deed of GiftA gift agreement from a legal entity to an individual

Form of gift agreement

But let’s return to the question of how to draw up a donation agreement. The model of such an agreement is not strictly established by law.

The contract form must contain the usual details and elements that reveal the essence of the transaction and identify its participants. These are the full names and passport details of individuals participating in the transaction, or the names and basic registration data of legal entities participating. The amount of the gift must also be stated, or, if we are talking about an agreement for the transfer of property, a description of this object and its approximate value is given. It would not be amiss to prescribe the procedure for transferring money or property, and other conditions that the parties consider important.

Donation agreement, sample:

Prohibition on donation

In conclusion, a few words need to be said about situations in which giving money or property is prohibited. All of them are spelled out in Article 575 of the Civil Code.

Thus, a gift transaction on behalf of minors or incapacitated persons is impossible. It is prohibited to accept gifts to employees of medical, educational and social organizations if the donor or his close relative receives services from these organizations. State or municipal employees and other persons in state or municipal positions cannot accept gifts as part of their official duties. Gifts between legal entities are completely prohibited. In this case, the very concept of a gift loses its essence, giving way to the definition of income, which, regardless of the tax system applied, will entail certain tax obligations.

The concept of a gift in labor law

According to the provisions of the Labor Code of the Russian Federation, a gift means an object of a tangible or intangible form given to an employee on behalf of the company on a free basis. The following criteria for the act of donation are considered essential:

- The procedure is not an incentive for the employee’s labor achievements (fulfilling the sales plan, improving the quality of manufactured products, etc.). The reason for presenting a gift to an employee can be a memorable date (professional holiday, anniversary), the employee’s retirement, a “round date” of length of service at the company, etc.

- The cost of the gift and the procedure for its delivery are not elements of remuneration. In other words, a bonus, additional payment, bonus or other reward (both in monetary terms and in the form of a material object) issued/delivered in accordance with the internal remuneration procedure is not considered a gift.

- The transfer of a gift does not entail any obligations for the employee to the company.

Calculation of income tax, features of the simplified tax system

Again, the main parameters in this case are the reason for giving such gifts along with the purpose:

- If there is no connection with direct job responsibilities. Such gifts are not included in the group of expenses. This also applies to organizations where a decision has been made to switch to the simplified tax system. There are no references to payments in the contents of the closed list associated with expenses.

- When gifts are incentives for successful performance in the main position. In this case, the manager can take into account the amount for the tax base of profit charges, if desired. The same applies to organizations that use the simplified tax system.

Procedure for taxation of the value of a gift to an employee

The procedure for calculating taxes and insurance premiums on the value of a gift given to an employee on behalf of the company is regulated by the current provisions of the Tax Code.

According to the Tax Code of the Russian Federation, a gift to an employee is the basis for personal income tax. In this case, when calculating tax, the company has the right to apply a tax deduction in the amount of 4,000 rubles. Thus, a gift whose value is equal to or less than 4,000 rubles is not subject to personal income tax.

If the value of the gift exceeds 4,000 rubles, then tax is charged on the difference between the value of the gift according to the agreement and the amount of the deduction (4,000 rubles).

Let's look at an example . The educational institution presented its employees with memorable gifts for Teacher's Day. The cost of the gift for each employee is 7,305 rubles.

According to the Tax Code of the Russian Federation, personal income tax is assessed on the cost of gifts, the amount of which is calculated as follows:

(7,305 rubles – 4,000 rubles) * 13% = 429.65 rubles.

The procedure for calculating insurance contributions for gifts to employees is approved by the Tax Code of the Russian Federation. In addition, the specifics of taxation of gifts with contributions are described in clarifications and letters from the Ministry of Finance and the Federal Tax Service. In accordance with current legislation and clarifications of regulatory authorities, the object of accrual of insurance premiums is the amount of remuneration that is paid (transferred) to the employee as a reward for work performance.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Gifts and their types

In order to correctly classify gifts, it is necessary to determine its main characteristics, in accordance with the requirements of the Legislation in the field of Labor and Civil Relations.

- Those who have no connection with work activity.

Gift in kind

The Civil Code defines gifts as things that are transferred from one party to another, free of charge. Employers are assigned the function of donors. Employees become recipients. This or that thing is transferred only after a special donation agreement has been drawn up.

Gift agreements are almost always in writing. This is also true for gifts with an amount greater than three thousand rubles, and when the donor is a legal entity. But the written form always outperforms the oral form in terms of safety, regardless of its value.

There is no need to formalize a separate agreement with each person when distributing gifts on a massive scale, for example, on the occasion of a holiday. An advisable solution would be to draw up a gift agreement, where there are many parties. Each recipient's signature appears at the end of the documents.

- A gift as a reward for performing work activities.

Any employer can reward employees for doing their job well. Then the cost of the gift becomes part of the payment for the work. The basis for the transfer is not a gift agreement, but a regular labor agreement. In fact, such incentives belong to the group of production bonuses.

Employee gift agreement

The transfer of a gift to an employee on behalf of the company is carried out on the basis of a gift agreement and an acceptance certificate. The listed documents are the basis for the delivery of a gift and must be drawn up in accordance with the provisions of the Civil Code of the Russian Federation.

In what cases is it compiled?

A gift agreement for an employee must be drawn up for each occasion when a gift is given to an employee on behalf of the company. In order to distinguish the concept of a gift from elements of remuneration, the gift agreement must be drawn up in the form of a separate document signed by the employer (donor) and the employee (donee).

If the procedure for giving gifts to employees is regulated by the company’s internal regulations (for example, the Regulations on Incentives and Motivational Activities), then the gifts given are recognized as an element of remuneration and are subject to personal income tax and insurance contributions in the general manner.

Let's look at an example . At the end of the half-year, an employee of Gamma LLC was given a gift - a mobile phone worth 12,330 rubles. The transfer of the gift was carried out in accordance with the Regulations on Incentives, with the execution of an order from the manager.

In this case, the gift is recognized as an element of remuneration and is subject to taxes and contributions in the following order:

- Personal income tax – 13% at the expense of the employee (RUB 12,330 * 13% = RUB 1,602.90);

- Pension Fund - 22% at the expense of the company (RUB 12,330 * 22% = RUB 712.60);

- Social Insurance Fund - 2.9% at the expense of the company (RUB 12,330 * 2.9% = RUB 356.70);

- Compulsory medical insurance – 5.1% at the company’s expense (RUB 12,330 * 5.1% = RUB 628.83).

Required details

The form in accordance with which a gift agreement for an employee must be drawn up is not approved by law. The document is drawn up in free form, indicating the required details:

- Title of the document;

- date and place of compilation;

- information about the donor in the preamble (full name of the company, full name, position of the manager or other person on whose behalf the company acts under the donation agreement);

- information about the donee in the preamble (full name, TIN, position, structural unit);

- company details (legal address, USR code, bank account number);

- address, passport details of the employee;

- signatures of the parties;

- seal of the organization that acts as the donor.

According to the Civil Code of the Russian Federation, drawing up a written agreement is a mandatory condition for transferring a gift to an employee on behalf of the company. In addition, a written form of the contract is required to exempt the value of the gift from taxation by insurance premiums.

Basic provisions

When drawing up a contract, the employer should include the following provisions in the document:

- Subject of the agreement . In this paragraph, you should describe the subject of the donation - a gift in material form, in the form of money or transfer of ownership of an object. The item should also include the cost of the gift in accordance with the purchase/production price.

- The procedure for transferring ownership. According to the gift agreement, the gift is transferred into the ownership of the recipient at the time of transfer (the date of signing the acceptance certificate), or at another time (the date is specified in the agreement).

- Rights and obligations of the parties . The basic principle of the gift agreement is that the transfer of a gift does not entail the employee’s obligations to the employer. After transferring the gift, the donor loses all rights to the object of the gift.

- Contract time . This clause is mandatory when drawing up an agreement in writing. According to the general rule, the validity of a gift agreement terminates at the moment of transfer of ownership of the object of donation from the donor to the donee (the date of the transfer and acceptance act).

- Special provisions . At the request of the parties, the agreement can be supplemented with special provisions (for example, requirements for maintaining the confidentiality of the act of donation, etc.).

The form of the agreement for giving a gift to an employee can be downloaded here ⇒ Agreement for giving a gift to an employee.

Transfer and Acceptance Certificate

Confirmation of the transfer of a gift to an employee on behalf of the company is an act drawn up in writing in accordance with legal requirements. The gift acceptance certificate must contain the following information:

- Title of the document;

- date and place of compilation;

- information about the donor and donee (according to the agreement);

- item of donation (full name), its value;

- date of gift transfer;

- signatures of the parties.

Making a gift to an employee in 2020 – what the law says

According to the current legislation, namely Article 191 of the Labor Code of the Russian Federation, the norms of which determine the list of possible incentives for employees, the employer has the right to encourage the conscientious work of employees. In addition, the law provides for other forms of incentives (even the issuance of state awards), which can be applied as a result of the signing of a collective agreement or in accordance with the internal regulations of the work organization.

Important : At the same time, based on the information presented in Article 129 of the Labor Code, each of the possible incentives, as well as various stimulating presentations to an employee, must be considered part of the salary of this employee, which, in addition to benefits, entails appropriate registration, as well as payment of established mandatory contributions and taxes.

Thus, having decided to give a gift to his employee, the employer is obliged to formalize this with a deed of gift or a gift agreement, the content of which should not indicate a connection between the employee’s labor successes and the fact of the gift.

Let us immediately note that this gift agreement between an individual and a legal entity, according to paragraph 2 of Article 574 of the Civil Code of the Russian Federation, must be drawn up exclusively in writing, and violation of this rule leads to the nullity of the gift deed. It costs 3,000 Russian rubles to complete the document today.

In addition, in order to formalize a legal act, according to Article 432 of the Civil Code, when drawing up a contract, it is necessary to describe the gift, its qualities and characteristics in as much detail as possible. If the employer gifts not one, but several employees, the best option would be to conclude a so-called multilateral gift agreement, which considers all recipients as one party, and the employer as the second (as the donor).

Since the transaction in question also relates to financial transactions, which themselves require accounting, all expenses when concluding a transaction must be recorded and confirmed by relevant documents. At the same time, in addition to the gift agreement itself, the head of the organization is obliged to issue a special order or instruction on the purchase of gifts and their distribution to his employees.

That is, in fact, the targeted nature of all expenses incurred for the purchase of gifts will be subsequently confirmed by providing receipts, invoices, invoices or contracts for the supply of transaction objects acting as gifts.

Important : When giving a gift to an employee, the employer must fill out a statement, which can be drawn up in free written form. In this mandatory document, it is recommended to record both information about the gift being given and information about the employee receiving it, who signs for the receipt of the gift. This statement is similar to the transfer act and performs the same functions.

On the part of the work organization, the deed of gift in favor of the employee is signed, as a rule, by the manager. However, the act can also be certified by an employee who has such powers and has a power of attorney. At the same time, according to paragraph 5 of Article 576 of the Civil Code, a gift agreement without indicating the recipient or the gift transferred to it is considered void.

Sample collective agreement for gift giving to employees

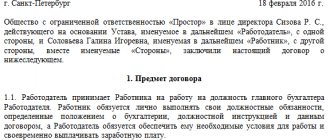

Employee gift agreement N ___ (multilateral)

g. __________ “___”________ ____ g.

_______________________________, hereinafter referred to as "Employer", (name) represented by _________________________________________________________, acting___ (position, full name of the authorized representative) on the basis of _____________________________________________________, on the one hand, (document confirming authority) and ____________________________________, hereinafter referred to as " The donees (full name of the employees), on the other hand, have entered into this Agreement as follows:

1. THE SUBJECT OF THE AGREEMENT

1.1. In accordance with this Agreement, the Employer undertakes to transfer free of charge the ownership of each of the Donees ________________________________, hereinafter referred to as the “thing” (if the gifts are the same) (if each employee or some of the employees is given a separate gift, different from the others, then this must be stated separately) . 1.2. The cost of each donated item is _______ (___________) rubles (the cost of each type of gift donated must be indicated separately). 1.3. The ownership of the thing passes to each Donee after signing this Agreement and transferring the title documents for the thing (option: and the actual transfer of the thing). 1.4. The specified thing is not the subject of a pledge, is not encumbered by other rights of third parties, is not the subject of a dispute about the right, and is not under arrest. 1.5. The gift is transferred by the Employer to each Donee as an incentive in connection with _____________________________________. 1.6. The item was purchased by the Employer at his own expense. 1.7. The transfer of a thing is carried out through its delivery (or: symbolic transfer (handing over keys, etc.)).

2. RIGHTS AND OBLIGATIONS OF THE PARTIES

2.1. The recipient has the right to refuse it at any time before the gift is transferred to him. Refusal of a gift must be made in writing. The refusal of one or more of the Donees from the item does not entail the termination of this Agreement; for other Donees, this Agreement continues to be valid on the same terms. If all Donees refuse the items, this Agreement is considered terminated. 2.2. The employer has the right to cancel the donation or demand the cancellation of the donation in court to one, several or all Donees in the cases specified in Art. 578 of the Civil Code of the Russian Federation. 2.3. In case of cancellation of the donation, the Donee has no right to demand compensation for losses. 2.4. The employer has the right to demand from the Done(s), who refused to accept the item, compensation for actual damage caused by the refusal to accept the gift. 2.5. In case of cancellation of the donation, the Donee is obliged to return the donated item if it was preserved in kind at the time of cancellation of the donation.

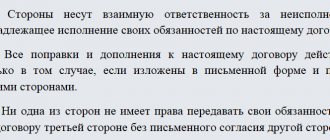

3.1. The terms of this Agreement and additional agreements to it are confidential and are not subject to disclosure. 3.2. The person who made the disclosure compensates the Party for losses as a result of such disclosure (Article 15 of the Civil Code of the Russian Federation).

4. DISPUTE RESOLUTION

4.1. All disputes and disagreements that may arise between the Parties on issues that are not resolved in the text of this Agreement will be resolved through negotiations. 4.2. Disputes not resolved during the negotiation process are resolved in court in the manner established by the current legislation of the Russian Federation.

5. TERM AND TERMINATION OF THE AGREEMENT

5.1. This Agreement comes into force from the moment it is signed by all Parties and terminates after the Parties fulfill their obligations in accordance with the terms of the Agreement. 5.2. This Agreement is terminated early: - by agreement of the Parties; — other grounds provided for by the legislation of the Russian Federation and this Agreement.

6. SPECIAL CONDITIONS AND FINAL PROVISIONS

6.1. In everything that is not provided for in this Agreement, the Parties are guided by the current legislation of the Russian Federation. 6.2. Any changes and additions to this Agreement are valid provided that they are made in writing and signed by duly authorized representatives of the Parties. 6.3. All notices and communications must be given in writing. 6.4. The transfer of an item into the ownership of the Donee under this Agreement is not a form of remuneration for the employee. 6.5. The Agreement is drawn up in ___ (______________) copies having equal legal force, one for the Employer and each of the Donees.

7.1. List of gifted employees (Appendix No. 1).

8. ADDRESSES AND DETAILS OF THE PARTIES

Employer: ________________________________________________________. (name, details) Employee 1: __________________________________________________________. (Full name, passport details) Employee 2: _________________________________________________________. (Full name, passport details) Employee ___: _______________________________________________________. (Full name, passport details) Employee ___: _______________________________________________________. (Full name, passport details)

Employer: ________________/_________________________ (signature) (full name)

Employee 1: ________________/_________________________ (signature) (full name) Employee 2: ________________/_________________________ (signature) (full name) Employee __: ________________/_________________________ (signature) (full name) ) Employee __: ________________/_________________________ (signature) (full name)

——————————— Information for information: According to the Federal Law of 04/06/2015 N 82-FZ “On amendments to certain legislative acts of the Russian Federation regarding the abolition of the mandatory seal of business companies” from 04/07/2015 business companies are not required to have a seal.

Important terms of contracts

The parties can agree that if the recipient puts his signature, it means that the gift was received in kind. It does not matter what exact deadlines are indicated in the original document.

Drawing up a transfer deed is not necessary in every situation. It doesn't matter what condition the property is in. In fact, the donee receives it free of charge.

The donor has the primary meaningful obligation. He cannot claim to provide the thing in return. Under certain circumstances, donors have the right to:

- compensation at the expense of the donee in connection with the preparation of the item for transfer and unnecessary expenses incurred

- failure to fulfill a gift promise

- return of the gift

The recipient may refuse the gift in writing after the transaction has been completed. Or claim this or that thing from the donor.

Form 2-NDFL – online

The obligation to submit a certificate in form 2-NDFL applies to all employers, including those who give gifts to their employees at least once a year. Depending on the value of the gift and the reason why it is given to the worker, this income may be fully or partially exempt from income taxation. And if the employer gives gifts infrequently, then such a one-time transaction may raise questions when reflecting it in personal income tax reports. Therefore, to avoid problems, it is recommended to generate all personal income tax reports automatically - in the BukhSoft program.

Fill out form 2-NDFL in the BukhSoft program. She uses the current Certificate form, taking into account the latest changes in legislation. The document can be prepared either electronically or in paper form for printing. Before sending to the Federal Tax Service, the calculations are tested by all tax service verification programs.

What is important to know about giving

An agreement on the delivery of a monetary or non-monetary gift is a civil law transaction, the rules of execution of which are regulated, first of all, by the Russian Civil Code. The parties to such a transaction can be both legal entities and entrepreneurs or ordinary individuals who do not have the status of entrepreneurs.

In accordance with the current rules, gifting may involve one of two options.

- Transfer of assets to the donee party:

- property, including money;

property rights.

or release from property obligations;

or a promise to release the recipient of the gift from property obligations.

When making a gift, a written agreement is required under the following circumstances.

- The giving party is a legal entity.

- The gift costs more than 3000 rubles.

Specifics of gift giving to employees

When drawing up a gift agreement for an employee, the sample, as a rule, involves the gift of some assets - money or property in material form. In addition, due to the existence of labor relations between the employer and his employees, they influence the execution of the gift transaction, which is regulated primarily by civil law. Here are some features of preparing a gift agreement for this year's sample that are important to note.

- Gifts to employees worth more than 3,000 rubles. is issued in writing.

- When drawing up a gift agreement for an employee, a sample of this document mentions the parties to the transaction not as the donor and the donee, but as the employer and the employee.

- The addresses and details of the parties to the transaction include information about the employer and employee.

In addition, the drafting of a gift agreement, a sample of which is used by employers in relation to their employees, is influenced by the form of the gift - money, material property, rights, etc., as well as the large number of recipients.

- One employee may receive a gift from a company or entrepreneur for a personal event.

- A group of employees can be given gifts in connection with a national or professional holiday.

It is customary to congratulate women in the office on International Women's Day, and men on Defender of the Fatherland Day. It is also considered good form to give employees souvenirs for the New Year.

Depending on the number of recipients of free benefits, either a standard or multilateral sample is chosen for the gift agreement. A sample multilateral employee gift agreement is given below.

Gifts for employees' children

Sometimes gifts can also be given to children of employees. Usually these are toys, candy, tickets to some events, etc. The procedure for providing gifts to the children of employees can also be established in the local act of the organization (Article 8, paragraph 4, 7 of the first article 22 of the Labor Code of the Russian Federation). Here you need to determine the age category of the children of employees to whom the salon gives gifts, as well as the condition on the minimum length of service of employees in this beauty industry enterprise. For example, you can indicate that a salon employee has the right to receive a gift for his young child if he has worked here for at least three months.

In this situation, it is enough for the salon director to issue an order for the purchase of gifts, set deadlines for their delivery and appoint responsible persons for drawing up the statement. There is also no unified form for such an order, so it can be drawn up in any form.

IMPORTANT!

If the owner of the salon did not withhold personal income tax from the amount of the gift, then the employee will have to pay the tax himself (subclause 4, clause 1, article 228 of the Tax Code of the Russian Federation). There is no need to draw up a gift agreement, because the cost of children's gifts usually does not exceed 3,000 rubles.

Some employers, in order to increase the incentive for their employees to work, resort to the method of incentives.

And let’s say frankly that if the team is satisfied with the work and treats the employer with respect, then at this enterprise the work is done efficiently, there is no staff turnover, and in general, labor relations are built on the principle of mutual benefit.

Reward methods can include various activities: from providing time off and cash payments to giving gifts to employees.

Most often, the question of gifts arises before certain holidays or significant dates for this enterprise.

When giving gifts to employees, the employer sometimes resorts to a gift agreement, and thus documents this transaction.

Donation agreement

The agreement, the subject of which is a gift, is drawn up in writing. At the same time, it must meet the general requirements for contracts. There are no distinctive requirements for it.

Mandatory clauses of the gift agreement for an employee:

- The place of drawing up and date are mandatory attributes of the contract.

- Parties who take part. Namely, the employer and the employee accepting the gift.

- Description of the gift itself, which will be the subject of this document.

- Rights and obligations. As a rule, there is not a lot of information in this agreement. The main responsibility of the employer is to deliver the agreed gift on time, and for the employee to accept it. The rights can indicate that the employee has the right to refuse the gift.

- How are controversial situations resolved?

- Conclusion.

- Signatures of the parties.

Of course, other information that is necessary in a particular situation can be added to the points we have listed.

For example, if the subject is real estate, then it is worth noting which party will be involved in registering the agreement.

After all, as we know, if an agreement involving real estate is not registered, then it is invalid. Unless otherwise provided by law.

Gift to an employee under a contract

It is also worth noting that if an employee refuses a gift before receiving it, the contract will be declared invalid. Moreover, the refusal must be issued in writing.

And of course, we should not forget that, like any legal document, an agreement to give a gift to an employee must be drawn up voluntarily, and in the absence of various coercive factors.

And also should not contain in its text various corrections and other blots that were made over the original text.

Below is a standard form and sample agreement for donating a gift to an employee, a version of which can be downloaded for free.

Basic consumer rights

03.03.2020

Special criminological measures to prevent crime among minors and youth

03.03.2020

Composition of a crime as a legal basis for qualifying crimes

03.03.2020

Gift agreement: sample for employers

A company or entrepreneur can give gifts to only one employee in connection with an important personal or professional event for him. Here are just a few reasons - depending on the person’s age and type of activity.

- Birthday.

- Marriage.

- Victory in a professional competition.

Symbol LLC held a competition among its employees for the title of best seller. The choice of the winner was influenced by test results, the presence or absence of labor discipline violations, and reviews from store managers. As a result of the competition, the seller recognized as the best received a gift from Symbol.

In such cases, for a gift agreement, the sample mentions only two parties to the transaction - the employer and the employee. An example of such an agreement can be downloaded from the following links:

Sample multilateral employee gift agreement

The differences between a sample multilateral gift agreement and an agreement with a single employee are as follows.

- An annex is prepared for the sample multilateral gift agreement, which lists the recipients, indicating the type and amount of the transferred benefits.

- Each recipient signs for receipt of the gift.

- With employees who do not sign, the agreement is considered not concluded.

A legally correct sample of a multilateral agreement for the gift of gifts to employees in cash can be downloaded from the following links:

Transfer of gifts and VAT

If the ownership of goods has been transferred free of charge, this is a type of sale, according to current legislation. Therefore, the fact of donation is subject to VAT. Taxes of this type are not charged only on gifts for which a monetary form was introduced upon transfer.

Tax calculation becomes an obligation for individual entrepreneurs and enterprises that have been transferred to UTII or operate on the basis of the general taxation system. The procedure for transferring gifts itself does not become part of the activity that has been transferred to the simplified tax system. Therefore, general tax rules apply for this operation.

A gift agreement is a standard business transaction if accounting is applied to it. Correct reflection in the documentation is important for her. You can’t do without calculating contributions and taxes.

Noticed a mistake? Select it and press Ctrl Enter to let us know.