Registering a cash register has now become much easier. Why? The fact is that now you can do this without leaving your home. If previously the cash register had to be taken to the Federal Tax Inspectorate, and certainly at the place of registration of the individual entrepreneur or legal entity, now it is enough to register it via the Internet.

The old registration procedure, which required a personal visit to the tax office, has also been significantly simplified. Now you can register a cash register in any of its branches - regardless of the address of business and the place of registration of the organization or individual entrepreneur.

All this is the consequences of Federal Law No. 54 FZ, which provides for the transition of business to online cash registers. At least we can thank our state for this - in this way the state has slightly sweetened the pill of working under the new rules. But first things first. We will tell you about registering an online cash register with the Federal Tax Service - the procedure, deadlines, and necessary documents.

Introduction. What is an online cash register and what is it used for?

A cash register connected to the Internet is needed to send data to the tax service. Now tax officers see information about each purchase directly on the monitor screen. This procedure is provided for by Federal Law No. 54 FZ. In addition, the online cash register can:

- independently close a shift and generate a cash report;

- print fiscal documents in a new format - with a QR code, a link to the tax website, product name and other important information;

- send a copy of the receipt electronically to the buyer - via SMS or email;

- store information on internal memory - fiscal storage.

This leads to the following advantages of using online cash register:

- reducing the number of inspections by inspectors - why go or travel somewhere if all the information is available on the computer in real time;

- facilitating the work of the salesperson-cashier - the cash desk generates many reporting documents independently, without human intervention;

- reducing the number of gray schemes, double and triple bookkeeping - everything that dishonest entrepreneurs used.

Common mistakes when registering an online cash register

Errors that do not lead to failure of the fiscal drive are even more common. They won't let you complete your registration. Fortunately, they can be corrected in your personal account of the Federal Tax Service.

1. An electronic digital signature does not allow authentication on the Federal Tax Service server - the solution is discussed above.

2. The Federal Tax Service website contains incorrect data:

- There is an error in the registration check number - you need to fill out the form again on the Federal Tax Service website in the cash register card;

- The date and time of the registration check were entered incorrectly - the form must be filled out again on the Federal Tax Service website in the cash register card;

- An error in the FPD of the registration check - it is necessary to fill out the form again on the Federal Tax Service website in the cash register card.

3. In the personal account of the Federal Tax Service, one OFD was selected, then you decided to change it, and another one was entered into the cash register driver.

In this case, you also need to fill out the registration form again:

- enter fiscal characteristics from the fiscal document issued by the CCP;

- they will not fit, a window will appear with a “Resubmit Application” button;

- you should agree with everything proposed in the pop-up window, and ultimately wait for the application editing form;

- select the correct fiscal data operator from the list.

Important! The installation address and other online cash register data will need to be entered again.

After changes to the form in the personal account of the Federal Tax Service, you should sign it again with your personal signature. Next, you should immediately enter the data of the fiscal attribute, and the cash register will update the status to “Registered”.

Online cash register registration

Method one - classic

The classic way is to register the old fashioned way. You need to take the cash register, all the documents for it, the constituent documents of an individual entrepreneur or legal entity and visit the nearest tax office. The method still works, but information appears that in some branches of the Federal Tax Service they may refuse to register cash registers.

So, to register you will need the following documents:

- receipts and contracts confirming the purchase of a cash register;

- online cash register passport with serial number;

- documents of individual entrepreneurs or organizations. There is no need to present them to the inspector - they will be needed to fill out applications;

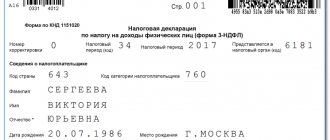

- application on form KND 1110061. You can fill out the form at home or ask the tax inspector and do everything on the spot;

- agreement with the fiscal data operator;

- personal passport.

There is no state fee for registering a cash register. You can entrust the work to a legal representative - then a notarized power of attorney will be added to the list of documents.

When registering, you must fill out all fields of the application correctly, carefully check that the data is correct and submit it to the inspector. Most tax offices operate a one-window system. You need to take a ticket from the terminal and wait for the call.

This method of registering an online cash register is suitable for those who are not very internet savvy. If the words “personal account”, “login”, “password” don’t mean anything to you, then this is your path.

The advantage of this method is that a qualified electronic signature is not required.

The downside is that registration can take up to 5 business days. Many entrepreneurs know that they often need to start working “yesterday,” so not everyone can afford an extra few days.

After all the procedures, you need to come back to the tax office and get a registration card. It will contain the individual registration number of the device and other information.

Method two - registration via the Internet

A much more convenient, and most importantly, faster method. This is also free, but you will have to fork out money to purchase an electronic signature. You can get it at the departments of the Ministry of Telecom and Mass Communications - both in person and via the Internet. The cost of the service in 2020 is 1,500 rubles.

First, register your personal account on the official website of the Federal Tax Service. The procedure is no different from registering on any Internet site - you need to come up with a login and password to log in, using the TIN and full name of the individual entrepreneur and email address. You will receive an email with a link to activate your account - follow it and you will be in your account.

In the personal account menu, select “Accounting for cash register equipment” and then “register cash register equipment”. All information must be entered manually into the appropriate menu fields. Have the following information ready:

- address for installing the online cash register. This will be the direct address of the retail outlet where the device will be used;

- online cash register model - you need to select it from the proposed list;

- name of the store or outlet;

- serial number of the cash register - it is indicated in the device passport;

- data about the fiscal drive - its model and number;

- information about the fiscal data operator with whom the data transfer agreement has been concluded.

Here you can fill out an online application form using KND form 1110061, or download a ready-made document. After entering all the information, the system will prompt you to sign and send the data. Check again that everything is filled out correctly and sign the documents with an electronic signature. A link will be sent to your email address, following which you can find out the status of your application. You can also find it in the section of your personal account “Information on the passage of documents sent to the tax authority.”

Based on the results of the procedure, the online cash register is also assigned a registration number. You can save the registration report as a PDF file. The cash register itself generates and prints a report on the completion of registration - it must be saved.

After assigning a registration number, you need to go to your personal account on the website of your OFD. There, the cash register is already registered; you just need to enter the number issued by the tax office. After this, the online cash register is ready to go and sales can begin.

Critical errors during self-registration of an online cash register

During the process of registering a cash register for individual entrepreneurs, inexperienced entrepreneurs can make critical mistakes that will disable the fiscal drive. It will stop functioning and you will have to buy a new one.

The most popular mistakes:

- incorrect registration date for the online cash register;

- incorrectly specified taxation system;

- purchase of a tax fund with a validity period that is not compatible with the taxation system.

Incorrect CCP registration date

Incorrectly recording the date of registration of the cash register is a common mistake of inattentive users.

The reason is that the date in many cash registers is entered automatically and incorrectly. For example, this is the case with Evotor smart terminals.

It is necessary to check the date, since if there is an error, the fiscal drive will not work.

The fiscal drive was purchased without regard to the tax regime

There are two types of fiscal accumulator: for 15 and 36 months. When working in special modes, you can purchase FN for 36 months. However, under the general taxation system, it is necessary to use the Federal Tax Fund for 15 months.

If you, working for OSNO, buy and install a FN with a validity period of 36 months on your online cash register, then it will not work.

All rules for choosing a fiscal drive>>>

Electronic signature - why is it needed and how to get it

To register an online cash register and its subsequent operation, you need another device - an electronic digital signature, or EDS. This is a special file recorded on external media. In essence, this is an ordinary flash card, only fiercely protected from hacking and data copying. For encoding, methods developed and approved by the Federal Security Service are used. Cool methods, you need to understand.

There are several types of electronic signatures - they all differ in the degree of protection. To register an online cash register, you need the most advanced - enhanced qualified digital signature. It is a combination of login and password, protected by special encryption using cryptographic methods.

The bottom line is that to register an online cash register you need a signature, which is a complete replacement for a handwritten one. Only a strengthened qualified digital signature will be such - all others do not provide the required degree of data protection. According to the legislation of the Russian Federation, an enhanced digital signature has the same legal force as a personal visa on any document .

EDS is needed not only when registering online cash registers. This device may be useful to you in the future when maintaining electronic document management. For example, when submitting financial statements to the tax service. By the way, ask your accountant: perhaps he already has an electronic digital signature and will not have to buy anything additional. A signature will be needed not only at the tax office, but also when concluding an agreement with the fiscal data operator. In general, if you have an online cash register, you can’t do it without an electronic signature .

Where to get an electronic signature

This issue is dealt with by special companies - certification centers . All organizations that have the right to issue signatures are accredited by the Ministry of Communications and have the appropriate licenses and permits. The idea is something like this: you come to one of these centers, show your documents and specialists will identify you. After this, an digital signature is personally issued to you - this is a guarantee that no one else will be able to use it. If someone signed the documents, then it was only you.

When choosing a center, you should study the list of organizations posted on the State Services website. Only centers included in this list have the right to issue enhanced digital signatures.

You can use the services of any certification center. It is clear that it is most convenient to find the one closest to you geographically. Unfortunately, to receive the device you only need a personal visit - it won’t be possible to do everything remotely. But if there is still a choice, then you should be guided by the following criteria:

1. Deadline for producing an electronic signature. Usually everything takes 3-5 business days. If your partner promises to produce the media in a month, it might be worth looking for someone else.

2. Reputation of the center. Unfortunately, not all organizations operate flawlessly. Some of them openly screw up: they confuse personal data, delay deadlines, or use low-quality storage media. You should not contact such people - you will waste your time, money and nerves. Study reviews on the Internet, ask colleagues and partners - perhaps they will recommend a good center or dissuade you from contacting a dubious company.

3. Price of the service. If you are opening your first business, learn to save right away. You can start with an electronic signature. The minimum cost of manufacturing the device is about 1000 rubles . But you can easily pay 5 thousand if you don’t study the market thoroughly and contact the first center you come across. Take your time and thoroughly review the offers of all certification authorities. If, other things being equal, one of them offers to make the service cheaper than others, contact him. Exceptions are cases when digital signature is needed urgently. If you are put at the front of the queue, you will have to pay an order of magnitude more, but there is nowhere to go.

4. Level of technical support. Unfortunately, equipment sometimes breaks down and electronic signatures are no exception. It happens that the device needs to be urgently repaired or replaced with a new one. Some centers do this quickly and efficiently, and some - not so much. It is clear that it is better to choose from the first.

How to get an electronic digital signature

So, you have chosen a certification center and are ready to go for a signature. To do this, you need to prepare a package of documents. It will differ for individual entrepreneurs and legal entities.

For IP you will need:

- Personal passport of an individual entrepreneur. At the center they will ask for the original document and copies of pages - the main page and the one with registration.

- Pension certificate - SNILS. You will also need a copy and an original.

- Certificate or notification of state registration as an individual entrepreneur - copy and original.

- An extract from the Unified State Register of Individual Entrepreneurs issued no more than six months ago.

- TIN - copy and original.

List of documents for organizations:

- Passport of the person who receives the digital signature and will be its owner. This could be the director, his deputy or an accountant. You need the original and a copy of the document.

- Certificate of registration of a legal entity - original and copy.

- TIN.

- Extract from the Unified State Register of Legal Entities for a period of no more than six months from the date of issue.

- Original and copy of the pension certificate of the owner of the digital signature - SNILS.

Then everything is the same for individual entrepreneurs and organizations. You need to write an application to obtain a signature and pay a receipt for the service. After production, you will be informed that the device is ready and invited to pick it up.

In the case when the signature is received not by its future owner, but by his legal representative, you will need another document - a notarized power of attorney . You can order one at any notary office. The cost starts at 1800 rubles. The office employee must present the passports of the owner of the signature and his legal representative. The representative himself does not participate in the procedure and his personal presence is not necessary.

According to the law, there is a slight relaxation for individual entrepreneurs. They can submit documents for the issuance of an electronic signature through Russian Post, multifunctional centers - MFC, or any branch of the tax service. You can bring papers, or take scans and send them by email. But in order to pick up your digital signature you will still have to go to a certification center.

Legal entities submit an application and receive the device only at certification centers.

Important! An electronic signature does not work forever - its validity period is limited. Usually this is 12 months, after which the digital signature must be replaced with a new one. Some centers now offer signatures that last 15 months or even longer. They cost a little more, but in the end it turns out to be more profitable: the cost of the month is less.

Do not leave the signature replacement until the last day and do it at least a month before the old one expires. This way, you will leave yourself room to maneuver in unforeseen cases and will not have to run around the city in search of a certification center, as well as overpay for urgency.

Methodology for completing the KKM registration procedure

To correctly complete the equipment registration, you need to log in again in your personal account. In it, click on the menu item Cash Register Accounting. The product registration number will be displayed here, which you should also click on. In the window that appears, click on the Complete registration button. The following form opens, where information is entered from the registration reporting file printed by the machine in step 2. The key to completing the form correctly is to enter the correct date and time as indicated on the report. The procedure must also be completed correctly.

Expert opinion

Kirill

Cashier specialist

Ask a Question

To complete the registration procedure, you need to click the Sign and Submit button. The system will automatically check the information and save it to a special cash register registration card, which can be viewed in the list of documents sent to the Federal Tax Service. The cabinet interface is very convenient and well thought out. Navigation can be handled by a person who has never encountered such tasks before. Thanks to this, all actions are performed as quickly as possible.

https://youtu.be/GmEK-1UxqHg

What is better: do everything yourself or seek help from specialists

Imagine this: an aspiring individual entrepreneur opens the first store in his life. He independently makes repairs there, negotiates with suppliers of goods, goes to banks in search of a loan and does a million other things. Among other things, he also needs to deal with cash register equipment - do everything that we wrote about above.

Often there is simply not enough time for all this. It is almost impossible to sit down at the computer and understand the intricacies of registration while the first coat of paint dries before applying the next.

Therefore, many businessmen are ready to give a certain amount of money to have the work done for them. There are plenty of offers of this service on the market - you just need to find and choose a reliable company.

The average cost of the service is 3,000 rubles. This includes concluding an agreement with the OFD and registering the cash register with the tax office. If you pay about the same amount, they will connect and set up your equipment and provide staff training. In general, the best solution is to order all the work on a turnkey basis.

This method allows you to do nothing at all - you just need to call and agree on the service. You will receive a commercial offer by email, which will indicate the prices for all work performed by the technician. Typically, the package offer includes the cash register itself, all work on connecting equipment and settings, registration and conclusion of contracts and obtaining an electronic signature, and staff training.

If things go well and there are no deadlines, you can get the job done in one working day. A specialist will come to your location, bring equipment with him, set everything up and connect it. Additionally, you can order technical support for a certain period of time - a very useful thing. At first, when working with equipment, questions will arise that need to be resolved promptly. In addition, the equipment tends to break down: either the cash register does not see the barcode scanner, or does not recognize the terminal for accepting bank cards.

Registration of cash registers with the Federal Tax Service “manually”

There are two ways to get your cash register equipment legalized by the tax authority:

- offline , by directly visiting the territorial office of the Federal Tax Service and submitting documents in traditional, paper form;

- online , submitting all data via the Internet.

You should not think that the first option is an anachronism, since tax authorities often simply do not have a feedback mechanism, and you may simply not know how the registration of your equipment is progressing, since such an algorithm is simply not provided. Therefore, special attention should be paid to this roadmap. Here are the step-by-step instructions:

- It is recommended to immediately conclude an agreement with a local technical service center (TSC). For minimal money, this will reduce you a lot of unnecessary “running around” and incorrect actions.

- Preparation and submission of a registration application for a cash register (qualified employees of the central service center will help prepare it).

- Fiscalization of cash register equipment is a procedure for technical examination of the correctness of the control equipment. Tax authorities need to obtain an expert opinion that your cash register will correctly reflect and transmit all transaction data. And CTO specialists act as experts.

- Based on the results of fiscalization of the cash register, as well as after submitting an application to assign a registration number to it, a cash register registration card is generated.

- Next, we enter into an agreement with the OFD and register the cash register with them.

In this case, you will have to visit all departments on your own, albeit with the assistance and assistance of specialists from the Central Technical Service (or perhaps the same organization-OFD) in preparing the documents.

Deregistration of an online cash register

Re-registration of a cash register

There are times when a cash register needs to be deregistered. For example, the device failed, was stolen or sold to another user. The procedure will be the same as when registering the cash register. This can also be done in two ways - in person or remotely, via the Internet.

In both cases, you need to download and fill out an application using the KND form 1110062 - it is designed specifically for deregistering cash register equipment. The document must indicate:

- corporate name of the LLC or last name, first name and patronymic of the individual entrepreneur; TIN;

- brand and serial number of the cash register;

- circumstances of loss or theft, if any;

- report on the closure of the FN, if the equipment is sold to a new owner.

The legislation provides for strict deadlines for deregistering a cash register. This must be done no later than one business day from the date of sale.

You can also deregister the cash register through your personal account on the tax office website. It’s much simpler, faster and more convenient, and most importantly, no extra paperwork is needed. Just go to the cash register equipment accounting section, select the online cash register that needs to be deregistered - and that’s it. You just need to fill in the data about closing the fiscal drive - date and time.

After entering the information, the application is signed with an electronic signature and sent for processing. The procedure usually takes a few minutes. You can check your application status through your account.

The new owner must register the cash register. The procedure is no different from registering a new device - everything is absolutely the same. Just remember to correctly draw up and sign the purchase and sale agreement - it will be required during registration. When re-registering, the fiscal drive will have to be replaced with a new one. Also, the new owner must enter into an agreement with the fiscal data operator.

Your legal representative can also withdraw money from the tax office. To do this, you need a notarized power of attorney confirming his authority.

When deregistering, a deregistration card is generated - you can download and print it. You can do this by visiting the tax office and picking up the document in person.

Forced cancellation of registration

In some cases, tax authorities themselves deregister cash registers . This occurs when the user violates the law or when the period for using the FN has expired.

If this happens, the cash register must be registered again. In the first case, this is done after eliminating all violations, in the second - after purchasing a new fiscal drive.

How to register an online cash register with the tax office yourself

An entrepreneur can register his cash register in person (that is, on his own). No one officially has the right to demand any payment from him for this procedure. However, this procedure can also be carried out through consultants - you will have to pay for their services.

The operating scheme of the online cash register is designed in such a way that information about the transaction is first sent via the Internet to a technical intermediary - the fiscal data operator (FDO). The tasks of this organization include bringing the gross information array into a structured numerical series (so that you can immediately tell which numbers are related to which tax). And the already processed data is then transmitted to the Federal Tax Service. Therefore, the registration of a cash register must begin with its registration with the OFD company.