What is 0.5 rate

There is no concept of “part-time” in Russian legislation. This word is popularly used to refer to half of the normal working time, which, according to Art. 91 of the Labor Code of the Russian Federation, is no more than 40 hours per week. That is, for example, an employee hired at 0.5 rate will work during a five-day shift not 8 hours a day, like other employees, but only 4.

The work of such an employee will be paid in proportion to the time worked (or based on the amount of work performed).

It is worth noting that according to Art. 93 of the Labor Code of the Russian Federation, work under the conditions in question will not entail for employees any restrictions on the length of the annual basic paid rest, calculation of work experience and other labor rights.

Purpose and form

The staffing table is a mandatory document that has several purposes :

- It contains lists of the company’s structural divisions, the employees employed in them and their positions.

- On its basis, the titles of employee positions are established, which are indicated in personnel documentation and employment agreements.

- Guided by this document, the director issues orders for the appointment of employees to approved positions.

- It reflects salaries, bonuses and other allowances for each employee, that is, the structure of his salary is formed.

At the same time, personal information about employees does not appear in the staffing table . That is, only job titles are listed there, not the full names of employees.

For the document in question, there is a T-3 form , approved by Decree of the State Statistics Committee of Russia dated January 5, 2004 No. 1. However, the legislation does not establish strict rules for the formation of this document. According to letters of Rostrud dated 01/09/2013 No. 2-TZ, dated 01/23/2013 No. PG/409-6-1, dated 05/15/2014 No. PG/4653-6-1, commercial organizations and entrepreneurs-employers You are not required to use Form T-3. If necessary, you can supplement it with lines and columns or develop your own form based on it. But it is impossible to remove any details from the approved form (Resolution of the State Statistics Committee of Russia dated March 24, 1999 No. 20).

An independently developed staffing form must necessarily include the following information :

- about the structural divisions of the organization;

- about all positions and specialties;

- about the number of staff units;

- on salaries, tariff rates, and bonuses, if any;

- on the total salary for each position and for the entire staff.

In practice, many organizations draw up staffing schedules according to the approved form, since it is developed taking into account all the requirements of the law “On Accounting”.

How to indicate this condition in an employment contract

When drawing up a work contract for 0.5 wages, it is necessary to include all mandatory conditions, including: place of work, position, working conditions at the workplace, information about remuneration, validity period. Also, in order to avoid violation of labor laws, it should be stated that the employee will be employed only half of the usual time. If the part-time day is not reflected in the document, the employer will have to make the required deductions in full. He may also be fined during inspection by the labor inspectorate. Therefore, the contract must indicate the following points:

- establishing part-time work;

- working hours (indicate the number of hours or days per week, hours per day);

- break time.

The contract also sets out the work schedule of such an employee. We offer for your review a part-time employment contract: sample.

The agreement is drawn up in two copies. They must be signed by the employee and the employer. One copy must be given to the employee. The second one remains with the boss. Upon receipt of his copy, the employee must put a special mark on the employer’s copy.

The information specified in the contract is also recorded in the employment order.

Required documents

ConsultantPlus FREE for 3 days

Get access

A sample order to transfer 0.5 rates may be required in various situations. As a rule, this type of administrative documentation is drawn up when there is a need to change the workload.

A sample order for a transfer to 0.5 wages at the initiative of the employee must be developed in the organization, since the legislator does not prohibit changing the work regime on this basis.

But so that the personnel inspection does not find violations in the registration of such a change in the working regime, all documentation must be completed correctly. This will be discussed further.

Any person may have circumstances that do not allow him to devote 8 hours a day to work.

If simply dismissal is too radical a decision, the Labor Code suggests a softer option: the opportunity to work part-time (Article 93 of the Labor Code of the Russian Federation). The transition to such a regime must occur by agreement of the parties.

Step 1. After the HR department has received the employee’s application and the director has expressed his consent to transfer the employee to part-time work, an order is drawn up.

The HR department can develop a single document (the legislator has not developed a standard form) and leave blank lines to fill out the basis of the administrative act.

The order must be in writing and signed by the manager performing the functions of the company’s sole executive body or a person specially authorized to perform these functions.

Form structure:

- a header that does not need to be filled out if the order is printed on a form. It includes: the name of the legal form and the organization itself, address and TIN;

- name of the administrative act;

- text indicating the reason and basis for its publication. As a rule, the employer refers to production needs or other reasons (or the employee’s statement) that prompted him to make such a decision. The basis is an additional agreement on changing the labor regime and the employment contract itself;

- the text of the order with specific instructions regarding the new work and rest regime;

- signature;

- place where the employee signs to familiarize himself with the order.

The employee's signature on familiarization must be obtained.

Step 2. An additional agreement to the employment contract is drawn up and signed.

Such a transfer can be either permanent or temporary. This condition must be indicated in the documents.

This is also possible, and this is a fairly common measure given the deteriorating financial situation of many companies and the threat of mass layoffs. In this case, a shortened working day (Article 74 of the Labor Code of the Russian Federation) is introduced for a period of up to 6 months.

If the regime is changed by the administration of the enterprise, it is very important to adhere to the rules established in Art. 74 of the Labor Code of the Russian Federation, since such decisions cause many conflicts and must be carefully documented.

Each employee must be notified in writing about changes to the terms of interaction separately two months before the start date of their application, also stating in the notice the reason for such a decision.

If the specialist's consent is not obtained, he must be offered another position in accordance with his qualifications and state of health (all suitable available vacancies must be offered). In the absence of such a vacancy or in case of refusal, the employee must be dismissed on appropriate grounds. All documents must be in writing and filed on file.

Thus, the list of required documents is as follows:

- written notification (in accordance with Article 74 of the Labor Code of the Russian Federation, if the initiative to change the terms of interaction comes from the administration of the enterprise);

- additional agreement;

- order.

We invite you to read the Complaint against the management company ZHILFOND

Every person wants to have additional income, especially if there is a need for it.

We will explain in detail what it is and how it is processed in this article.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Show content

This can be absolutely any period of time, for example, from morning to lunch, or from lunch to evening. The employee and employer can agree on any schedule.

Due to the fact that the work time has been halved, the level of remuneration will be corresponding. In most cases, an organization hires part-time employees when an employee cannot be fully loaded with work responsibilities. In order not to overpay him for working full time, he is employed part-time.

Anyone, including already employed citizens, has every right to find a second part-time job.

When accepting, you need to consider the following factors:

- A part-time employed citizen has the right to annual paid leave.

- The employee has an unlimited length of service, equal to those who work full time (Article 93 of the Labor Code of the Russian Federation).

- The employee has the right to a shortened working day according to the calendar.

- All hours worked above the norm specified in the contract are overtime and are paid separately, based on the norms of the Labor Code of the Russian Federation, Article 99.

The main feature of this mode of work is the amount of wages, which is calculated based on the time worked or the number of days. Another distinctive feature is that a person has a wonderful opportunity to earn extra money, which means additional income, by combining the main workplace and part-time work (Article 284 of the Labor Code of the Russian Federation).

Article 284 of the Labor Code of the Russian Federation. Duration of working hours when working part-time

The duration of working hours when working part-time should not exceed four hours a day. On days when the employee is free from performing work duties at his main place of work, he can work part-time full time (shift).

During one month (another accounting period), the duration of working time when working part-time should not exceed half of the monthly standard working time (standard working time for another accounting period) established for the corresponding category of employees.

The restrictions on the duration of working hours when working part-time, established by part one of this article, do not apply in cases where the employee has suspended work at his main place of work in accordance with part two of Article 142 of this Code or has been suspended from work in accordance with parts two or four of Article 73 of this Code.

The employee also has additional privileges: the right to vacation, preservation of seniority, a short day according to the production calendar, as well as overtime pay.

Next, we will talk about the documents required when applying for a job.

Employment contract

https://youtu.be/rjO_sKtwCcI

The most important document is an employment contract drawn up and signed by both parties. This document must contain the following information:

- Rights and obligations of the parties.

- Details of the parties (personal data of the employee and information of the employer organization).

- Salary amount.

- Subject of the contract (employee position).

- Working hours (work time and rest periods).

- Working conditions.

- Job responsibilities.

- Validity.

When drawing up an employment contract, special attention should be paid to the following points:

- Temporary regime (information must be clearly stated, that is, it must be indicated that the employee is hired on a part-time basis).

- Work schedule (clear distribution of work and rest time).

- The subject of the agreement is the direct job responsibilities of the employee.

Order

The order has no special features and is drawn up according to a standard scheme. An order to accept 0.5 bets must contain the following data:

- the name of the enterprise indicating the legal form - LLC, individual entrepreneur, OJSC (read about the specifics of hiring an individual entrepreneur here);

- document number, title and date;

- reasons for transfer;

- type of transfer (temporary or permanent);

- Full name of the employee and position;

- amount of wages (salary);

- employee personnel number (if available);

- a document serving as a basis (for example, an employee’s statement);

- after reading the order, the employee must affix his signature;

- signature of the head of the company and other authorized persons.

The only difference is that the “conditions of admission” section contains a notice about the conditions of admission for part-time work. The salary data column records the amount of the part-time rate.

An order for part-time employment must be signed within three working days. The counting of days begins from the moment the employee starts work.

An employment contract establishes work obligations between the employee and his employer.

We transfer the employee to 0.5 rates

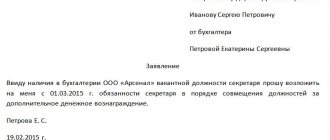

If an existing employee approaches the boss with a request to transfer to 0.5 pay rates, and he does not mind, the procedure for completing the documents is as follows:

- The employee must submit a written statement indicating the reason for the change in work hours. A document confirming this need is attached to it (for example, a conclusion from a medical commission if you have to care for a sick relative).

- Next, an additional agreement to the contract is drawn up. In it, the clause on the work and rest regime is stated in an updated version.

Legal basis for part-time work

By virtue of Part 1 of Art. 91 of the Labor Code of the Russian Federation, working time is the time period during which a worker must directly work, and other periods that are classified by law as working hours.

Its normal duration is 40 hours per week (Part 2 of Article 91 of the Labor Code of the Russian Federation). It should be understood that the legislation does not contain the term “part-time employment contract” - this is a purely everyday concept. This phrase in common usage means that the employee should not work the normal amount of time, but only half, that is, 20 hours a week. Accordingly, he will receive not his full salary, but a 2-fold cut.

According to Part 1 of Art. 93 of the Labor Code of the Russian Federation, by agreement of the parties - both when hiring an employee and subsequently - it can be established that the worker must work less than 40 hours.

The following types of part-time work can be distinguished:

- with part-time work (or part-time shift);

- part-time work week;

- mixed, i.e. with part-time and part-time work week.

In some cases, establishing such a work regime is not a right, but an obligation of the employer. In particular, it should be established at the request of a woman in a situation, the parents of a child under 14 years of age or a disabled child under 18 years of age, as well as an employee who is forced to care for a sick family member. In addition, it must be remembered that for some categories of employees, Art. 94 of the Labor Code of the Russian Federation establishes a reduced duration of the work shift - accordingly, such workers, by virtue of the law, simply do not have the opportunity to work 40 hours.

How to correctly fill out the staffing table for LLCs and individual entrepreneurs

Requisites

- the full name of the organization must be indicated in full accordance with the constituent documents;

- OKPO is an 8-digit organization code. These data are contained in the information letter of the statistical authorities, which should be available at every enterprise;

- staffing number. There are no clear requirements here. You can use continuous numbering, you can start each year with the number 1 and indicate the year through a fraction, you can use any other numbering method.

- Date of preparation. The actual date of compilation is indicated; it may differ from the date of entry into force of the staffing table (for example, a staffing table drawn up in December of the current year comes into force on January 1 of the next year);

- the period of validity of the staffing table is indicated, most often 1 year, and from what date it comes into force;

- in the upper right corner the stamp “Approved” is placed and the details of the approval order and the implementation of the staffing table are indicated. As a rule, the stamp of the organization is placed on top of the “Approved” stamp, although this is not enshrined in law.

Staffing form 2020

The form can be downloaded from any legal system, such as Consultant or Guarantor. As a rule, the format offered for download is Word or Excel; there is no fundamental difference here, but it is more convenient to maintain in a tabular form, since formulas can be entered into the appropriate cells and the document itself will calculate the number of staff units and the wage fund.