Estimate

| Reviews: | 2 | Views: | 35946 |

| Votes: | 0 | Updated: | 20.01.2015 |

File type .doc (Microsoft Word 97)

Document type: Act

?

Ask a question Remember: Contract-Yurist.Ru - there are a bunch of sample documents here

| __________________________________ (organization) | I affirm: ____________________________ ____________________________ "____"___________ 20__ |

What laws set limits on the write-off of building materials?

There is no firm rule in accounting laws according to which materials must be written off for production. However, paragraph 92 of the Order of the Ministry of Finance dated December 28, 2001 No. 119n states that materials must be released from the warehouse in accordance with the standards of the production program. This rule assumes that write-offs cannot be uncontrolled.

The volumes during the operation must comply with approved standards. There is also Article 252 of the Tax Code of the Russian Federation, according to which all expenses of an enterprise must be supported by documents. Spending must also be reasonable from an economic point of view.

The company independently approves consumption standards based on the following documents:

- SNiP 82-01-95. Here are the general rules. RDS 82-201-96. Here you can find answers to specific questions, as well as examples of calculations.

When approving standards, specific papers may also be used:

- GESN. The document specifies standards for specific types of construction. MDS. Here you can find recommendations for using GESN.

The basic volumes for write-off will depend on the construction project.

For example, the concrete used in the construction of a residential or industrial building will vary. The standards regarding this aspect are given by GOST and SanPiN. Expert opinions may also apply.

The limits approved by the enterprise must be fixed in estimates and various internal documents.

Documents are compiled by the department responsible for the technological process. After the papers are developed, the director of the company must approve them. Write-offs must be made in accordance with established standards.

It is possible that the approved limit may be exceeded, but this situation should alert the manager. In particular, he will need to establish the reasons for exceeding the standards. For example, this could be defective materials or technological losses.

IMPORTANT! Write-off of materials in excess of approved standards can only be done with the permission of the manager.

On the primary documentation (invoice, act), a note is placed on the supply of building materials in excess of the limit and the reasons for such an operation. If the write-off is carried out without complying with these rules, it will be unlawful. Such actions can lead to distortion of costs and the entry of incorrect data in tax reporting and accounting.

When is the material released for production?

As soon as the material reaches the consumer, it is taken into account. Only after accounting can it be sent to production. What is release of building materials? This is the moment when they are transferred to the construction site where construction is underway or construction, repair or finishing work is planned. There is a strict general rule that governs all production standards. It concerns the write-off of materials and does not imply double interpretation. It says the following: all construction materials are subject to mandatory write-off.

Any organization has the right to develop and approve its own write-off standards, but they must be based on the standards developed by the State Construction Committee of Russia. There are special standard collections that indicate production consumption rates. They are the guidelines for action by the personnel of firms, companies, enterprises, and institutions for the write-off of materials. How to correctly calculate the limit for their spending? For this purpose, the norms for their consumption in construction, indicated in these collections, are taken.

Return to contents

Standardization procedure

Standardization includes the following stages:

Analysis of the circumstances of construction work. Includes the selection of building materials, establishing a unit of work, planning the construction execution process. Setting limits for each material per unit of work.

The types of standards are specified in RDS 82-201-96. Control over the implementation of limits. If limits are violated every now and then, it makes sense to adjust them. Norms must correspond to objective reality.

NOTE! When rationing, the concept of normal is often used. There are standards for standard forms of work that can be used to set limits.

The procedure and content of the process of rationing building materials

The process of standardization in construction consists of regulating the use of building materials during the execution of work. The main stages of standardization are:

- Analysis of the conditions under which construction work will take place. At this stage the following is carried out:

- final selection of materials (taking into account the requirements of technical design documentation, GOST and SNiP);

- organization of the work process;

- definition of a unit of work;

- determination of consumables to complete a unit of work.

IMPORTANT! A unit of construction product is a component of the construction flow. Construction flow - uniform, continuous execution of construction work (progress). When standardizing, the following can be taken as a unit:

- separate area of work;

- part of an object under construction (for example, a foundation or a wall);

- one entire object or a group of homogeneous objects (for example, the construction phase of a cottage community of 20 standard houses);

- takeover is a private flow that covers several elements of the main one (for example, custom finishing of part of the apartments in a new building).

- Determination of the standard consumption of each building material per unit of work. According to RDS 82-201-96, cost standards can be:

- Enlarged - by complex of works. They are used at the design stage to select technological solutions.

IMPORTANT! Integrated standards cannot be used to write off building materials.

- Averaged - according to estimate documentation. Needed to determine the total amount of resources required for construction.

IMPORTANT! Average standards cannot be used to control the actual write-off of materials, as well as for payments for construction work (between customers and contractors).

- Elemental - consumption for the selected unit of construction work. They are the ones that should be used when calculating and approving standards for write-off of materials during construction work (as well as for settlements between customers and contractors).

- Monitoring compliance with consumption standards when performing work and adjusting standards if necessary. Here we should mention another specific thing in the construction process - normal.

Normal is an indicator or characteristic that most fully corresponds to the technical process. Determined taking into account a set of parameters. For standard work, there are usually already developed standards that can be relied upon when developing write-off standards.

The main principle of rationing is the unity of the normal and the standard. If the consumption according to the established standard leads to a deviation from the norm, the standard needs to be revised.

Methods for establishing elementary norms

The limit per unit of building material is calculated based on consumption rates per unit of work process. The following formula is used for calculations:

N = ni1Ki1 + ni2Ki2 +… + niiKii

It uses the following notations:

- N is the write-off limit per unit of building material. ni is the limit of spending on a work process. Ki is a coefficient that establishes a unit of work process in the total volume of building materials. It is found according to the following formula: elementary unit of an object/enlarged unit of building materials.

All the nuances of calculations are set out in paragraph 5 of RDS 82-201-96.

When approving basic standards per unit of work, the following methods are used:

Production.

Similar work is being observed at the construction site. The ratio of the volumes of operations performed with the materials consumed is measured. The production technique is usually used for building materials for which losses that are difficult to eliminate are possible. Laboratory.

It is assumed that measurements will be carried out under special circumstances. The technique is usually used when it is necessary to calculate the influence on the work of a certain factor. Calculation and analytical. The essence of the methodology is the implementation of theoretical calculations based on existing statistical data.

IMPORTANT! When taking measurements, you need to take several approaches. Their minimum number is 5.

Documentation of write-offs

All operations performed must be confirmed by primary documentation. The write-off of building materials is also accompanied by paperwork.

The head of the enterprise has the right to independently determine the list of primary documentation drawn up upon disposal. However, in any case, all details must be indicated in the document. The list of necessary details is contained in Article 9 of Law No. 402 “On Accounting”.

Let's consider the documents that are usually drawn up when writing off building materials, as well as their standard forms:

Requirement - invoice. Relevant if the enterprise has no restrictions on obtaining building materials.

Compiled according to form No. M-11. The document can be used to record the movement of valuables within an enterprise. Limit-fence card. Used when there are limits.

It is drawn up according to form No. M-8. Invoice for the release of building materials to the outside. It is used if the material is sent to a separate division of the enterprise. Compiled according to form No. M-15.

The list of details used can be modified in accordance with the needs of a particular enterprise.

The invoice is issued in two copies. The financially responsible person is engaged in this. One copy of the document is used when writing off building materials, the second - when registering.

After the material (or raw materials) has been received by the consumer and has been accepted for accounting, it can be released for production. The release of building material involves its transfer directly to the construction site.

All construction materials are subject to mandatory write-off. At the same time, the organization independently approves the standards for write-off of materials in construction on the basis of standard collections of production consumption standards developed by the State Construction Committee of Russia. As a consumption limit, the norms for the consumption of materials in construction, included in the estimates, can be used.

The basis for writing off construction materials are the following documents:

- log book of work performed in form KS-6a for each construction project; production standards for the consumption of basic building materials, developed by the construction organization itself and approved annually by its head; site and local estimates for objects under construction, which provide for the estimated consumption of materials by type of work and structural ;material report in form M-19 for the materially responsible person: the head of the construction site or the work contractor; monthly report on the consumption of basic materials in construction in comparison with the consumption determined according to production standards in form M-29.

Note that until recently, a report on form M-29 was classified as a mandatory document.

But in the latest album of Rosstroi of unified forms of primary documentation for accounting for construction work, such a form is missing. Now a construction organization can independently develop its own report form. It must indicate the following:

- name of the document; date of preparation; name of the construction organization; content of the work; its measure in monetary and physical terms;

Approval of standards for write-off of building materials

Write-off standards are approved by the persons responsible for their development and application:

- head of the production and technical department (PTO);

- chief construction engineer (or a person with similar responsibility and authority);

- head of the enterprise.

In the future, the normalized costs of building materials are included in separate columns in the act for writing off materials. Next to them, information about the materials actually written off is entered. The act completed in this way is approved again by the responsible persons and the manager. It is also possible that the manager, on the basis of an act, issues an order to write off the building materials specified in the act.

For the unified form of the act of writing off building materials, see the article “Unified form No. M-29 - form and sample.”

IMPORTANT! The accounting department of an enterprise has a rather indirect relationship to the very approval of norms for writing off building materials, although it actively uses the norms in the future to solve problems of accounting and control of construction costs.

Read more about accounting methods for creating the cost of written-off materials in the publication “Procedure for writing off materials at average cost”.

Estimation at cost of each unit

This method is used in cases:

- when a construction organization has a relatively small range of materials in stock. This allows you to track which specific purchase batch materials are written off from; when materials that are specially accounted for are subject to write-off; if materials were purchased in single quantities for the construction of a specific facility.

Despite the complexity of estimating the cost of each unit, this method is good in that materials are written off at actual cost. However, it requires clear accounting of each purchase. When using this method, you need to know which batch the material is taken from and write it off at the price of this particular purchase.

Average cost estimate

This method contains two options for calculating the cost of material.

Option 1 – weighted assessment:

To determine the weighted score, do the following:

- the cost of a group of materials at the beginning of the month and those purchased before the end of this month is calculated; the quantity of materials of the same group for the reporting period is calculated (the sum of the balance at the beginning of the month and the quantity purchased during the month); the resulting cost is divided by the number of materials.

Option 2 – sliding assessment:

The rolling estimate is the actual cost of the material. It differs from a weighted assessment in that when calculating, instead of the quantity of materials purchased during the reporting period, only their receipt at the time of write-off is taken into account (taking into account balances at the beginning of the month).

FIFO method

According to the FIFO method, materials are written off to production in the order in which they were purchased. The batches purchased earlier are written off first. Moreover, written-off (issued) materials are written off at their actual cost, and the balances are valued at the cost of the last purchase. Write-off of materials using the FIFO method can be performed in two ways:

Option 1:

- First of all, the materials of the first batch of materials are written off at their actual cost. If the quantity in this batch does not cover the needs for write-off, then the second batch is written off at its actual cost, etc. To determine the balance, the cost of written-off materials is subtracted from the total cost of materials received for the month (taking into account the balance at the beginning of the month).

Option 2:

- first, the total cost of materials received for the month is determined (taking into account the balance at the beginning of the month); then the balance of materials at the end of the month is determined at the price of the last purchased batch; the difference between these values will be equal to the cost of materials written off for this period.

Write-off of open storage materials

Sand, gravel, blocks, crushed stone and other open storage materials are located in open areas.

They are spent during the reporting period without documentation. To determine their consumption, a monthly inventory of balances is carried out (at the end of the reporting period). The assessment of inventories spent on production is determined by the formula:

P = N + P – K, where

P – cost of materials spent on production;

N – cost of the initial balance of materials (at the beginning of the month);

P – cost of materials received during the reporting period;

K – the cost of the final balance (at the time of inventory).

Document flow for accounting of material consumption

The following workflow scheme for accounting for material consumption is proposed:

- at the beginning of the month, the work performer (financially responsible person) receives a material report with the resulting balances (in quantitative and cost terms) of materials at the beginning of the month;

- during the month (this is theoretically, but practically at the end), the work producer reflects the movement of materials in his material report in quantitative terms and displays the balance of materials at the end of the month (also in quantitative terms);

- within the period established by the head of the organization, the financially responsible person submits a report in form N M-29 to the VET;

- a report approved by the head of the technical department in form N M-29 and a material report are submitted to the chief engineer (or a person authorized by him);

- a material report approved by the chief engineer, together with receipts and expenditure documents, as well as a report in Form N M-29 are submitted to the accounting department;

- The accounting department reviews the material report - determines the value of the receipt of materials, their use and the balance at the end of the month;

- a material report with the remaining materials at the beginning of the new month is transferred to the work contractor;

- data from processed material reports is transferred to the summary statement of the movement of material assets.

S.A.Vereshchagin

Expert

by methodology

accounting

and taxation

Writing off hard-to-recover losses

The consumption of materials in construction includes losses that are almost impossible to eliminate. Hard-to-recover losses can occur when transporting materials from a warehouse or during construction and installation work.

The write-off of these losses is carried out taking into account the standard norms for difficult to eliminate losses given in RDS 82-202-96. If this kind of loss of material resources is not covered by this document, then they should be developed in accordance with SNiP 82-01-85 and the above-mentioned RDS.

Regulatory framework for developing write-off standards

The development and approval of standards for the write-off of building materials for a specific enterprise should be based on basic rules and regulations. The main working documents are:

- SNiP 82-01-95 “Development and application of norms and standards for the consumption of material resources in construction”;

- RDS 82-201-96 “Rules for the development of standards for material consumption in construction.”

SNiP 82-01-95 establishes more general provisions for rationing materials in construction, RDS 82-201-96 complements and specifies most of the aspects, and also contains examples of calculations.

The basic quantities of consumption and type of materials are determined by the requirements for the construction project. For example, the composition of the concrete used may differ for an industrial workshop building and for a residential building. In this aspect, one should be guided by GOST and SanPiN standards for construction, as well as the opinions of technical experts.

There are other types of specific documents involved in standardization:

- GESN - state elemental estimate standards. They indicate the permissible estimated values of material consumption for specific types of construction work;

- MDS - methodological documents in construction. They contain instructions for the use of GESN.

The main body issuing the regulatory documents listed above is the State Construction Committee of Russia. Although other executive bodies (for example, the Ministry of Health), research institutions and even enterprises in the construction industry are usually involved in the development.

Write-off of materials

Based on the approved data of the report form No. M-29, the accountant writes off the consumed materials monthly using one of the above methods, having previously checked them with the actual availability, for the cost of construction (construction and installation work).

As a rule, the write-off of materials is carried out under a specific act of form No. KS-2. However, there is no unified form for the act of writing off materials in construction, so many organizations create it on their own, taking into account the presence of the details provided for in paragraph 2 of Article 9 of Law No. 129-FZ, namely the form code, the names of the materials being written off, the unit of measurement, the actual consumption of materials, the object, to which the materials are written off, the date of compilation, the positions of the persons responsible for carrying out business transactions. As additional details, you can indicate the direction of expenditure, accounting accounts, direction of expenditure and other data necessary for the organization to detail accounting.

←Return

- Date: 02/17/2015 Comments: Rating: 26

Issues regarding the write-off of building materials are faced mainly in the construction and repair industry.

It is believed that understanding the rules for writing off building materials is difficult. In fact, everything is quite simple if you know the consumption rates of certain materials used in construction and repair. Knowing this, it will be much easier to understand the act where their expenses are reflected.

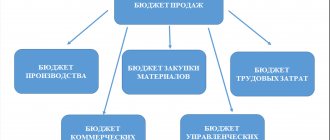

Scheme of write-off of building materials.

Write-off of materials in construction - procedure

Not a single construction of a real estate project is complete without the use of a large amount of building material.

The total cost of the work directly depends on the amount of special material used and, accordingly, on its cost.

Therefore, competent accounting of inventory items (TMV) is extremely important during the construction of even small-scale projects.

The write-off of materials in construction plays an important role.

In words this seems quite simple, but in reality many companies face difficulties that may arise through no fault of the company.

Let's consider the procedure for writing off materials in construction.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your specific problem, please contact the online consultant form on the right. It's fast and free!

Control over the write-off of materials at the enterprise

To calculate the volume of special materials required for the construction of any facility, norms and rules approved by the production and technical department (PTO) are used.

The director of the company approves the list of employees involved in writing off inventory items. As a rule, an engineer and an accounting employee are appointed to be responsible for preparing the relevant documentation - heads of production sites who are responsible for approving the indicators indicated in the reports.

Moreover, the responsibility for signing the processed documents of the chief engineer and the head of the technical department should also be stated in the same order.

The accounting department is assigned the following functions:

- preventing the write-off of building materials in quantities exceeding the standards;

- preventing the groundless write-off of construction material due to loss;

- eliminating fraud based on the write-off of special material of a higher level than was actually used.

Any construction company striving for correct and accurate accounting of building materials must build a clear document flow system.

Methods for assessing materials when they are written off

To correctly write off building materials, it is necessary to correctly analyze their cost. According to legislative acts on accounting, special materials are taken into account based on their actual price.

The actual cost is the amount of costs, including:

- initial cost;

- transport expenses;

- cost of consultations;

- customs state duty;

- cost of intermediary services.

In case of write-off of special materials sent for construction or any other disposal, the determination of the actual cost must be carried out individually for each type of building material during the reporting period using one of the proposed methods:

- Determination of the cost of each unit of supplied building materials. The most suitable option for accounting for particularly valuable inventory items.

- Determination of the average cost value. It is a mathematical division of the total cost of the entire complex of materials by the number of accounting units.

- Using the First In, First Out principle - first in, first out. – special materials received last are removed from the balance sheet first.

- Using the Last In, First Out method is the opposite principle - building materials put on the balance sheet at the very beginning are written off.

Documentary support for writing off materials

Act on write-off of materials in construction - sample

The preparation of documents for the write-off of special materials in construction is directly dependent on several factors, but first of all it is influenced by the relationship with material suppliers and how they comply with disciplinary requirements.

The main goals of building document flow in a construction company are:

- relevance of data on the movement of construction materials;

- control of the safety of special materials;

- monitoring compliance with standards for the consumption of building materials;

- efficient use of special materials.

The write-off of building materials for production needs can be made on the basis of a package of documents consisting of:

- standards for the consumption of material for a certain production, approved by the head of the organization;

- estimated estimate;

- journal of work performed;

- report on the actual consumption of building materials, comparison with approved planned indicators.

To maintain regular reporting, a company can develop and approve its own standards for the write-off of materials in construction, the main condition is that they meet the requirements of the State Register, but experts recommend using the standardized form M-29 and the Instructions used by the heads of production sites to control the consumption of building materials in comparison with established standards.

But it is necessary to understand that the form must be finalized for each construction enterprise individually.

The document must contain the following two chapters:

- planned need for building materials and the volume of work performed;

- reconciliation of actual supply of building materials with planned consumption limited by production standards.

The first part is drawn up by responsible employees of the technical department, and the second - by site managers or foremen.

The write-off of building materials occurs in several stages:

- At the beginning of each month, the work manager receives a regular material report with the actual balances of inventory items in his personal warehouse.

- The person bearing financial responsibility, at the end of the reporting month or in parallel with the work, draws up document M-29 on the delivery and balance of construction materials; submits reports to the PTO for verification within the period established by the order of the head of the company.

- The technical department specialist checks, and the chief approves the M-29 report and the material report, the documentation is transferred to the chief engineer for confirmation.

- The chief engineer, after confirming the package of documents, transfers it to the accounting department.

- The accountant determines the cost of arrived and consumed special materials and calculates the cost of the actual balance based on the documentation provided.

- The accountant enters information into the summary table of the movement of material throughout the enterprise and performs a write-off.

Accounting for inventory items begins from the moment of drawing up design and estimate documents containing established standards for their expenditure.

Consequences of overexpenditure

During the analysis of reporting in the M-29 format, inconsistencies in indicators may be identified.

In this case, the head of the construction site will need to write an explanatory note corresponding to the M-29 form, in which he must indicate the reason for the overuse of special materials.

Along with the explanatory note, an act of write-off of building materials, drawn up and approved by the commission, must be attached.

If the overexpenditure of building materials resulted from theft or damage, then in order to write off inventory items within the framework of the law, the management of the enterprise is obliged to contact the relevant authorities to obtain documentary evidence of what happened.

If the reason for the waste of special material is recognized as valid, and the overspending is confirmed by calculations, then the head of the enterprise has the right to order the write-off of the excessively spent special material.

Also, the production manager is required to provide an explanatory note if savings were made on materials used in construction.

Due to the fact that the write-off of building materials is provided for in the estimate documents, which are not subject to adjustments during the work, the development company is responsible for all actual overuse of material.

Since the total cost of the ongoing construction cannot be increased, the basic principle of writing off special materials implies that the head of the construction company must make every effort to find the culprits and take measures to recover from them the amount covering the costs incurred.

But in situations where the waste occurred due to unforeseen circumstances - such as a fire or theft - then the materials are written off by the accounting department as non-operating expenses

Dear readers, the information in the article may be out of date, please take advantage of a free consultation by calling: Moscow, St. Petersburg or using the feedback form below.

lawyer-guide.ru