Purpose and use

Account 16 is used to summarize information about the differences that have arisen between the values of acquired material assets. They are calculated within the framework of the actual cost of procurement or purchase, as well as accounting prices.

It is used by enterprises that account for materials on account 10, and also use low-value items with immediate wear and tear by reflecting them on account 12 at accounting values.

The amounts of differences in the costs of acquired assets, calculated in the actual costs of purchase and procurement, as well as accounting prices, are subject to write-off to the Debit or Credit of account 16 from account 15 “Procurement and acquisition of materials”. Such valuables may include the following product items and units

:

- fuel resources;

- mineral fertilizers;

- stern;

- seeds;

- planting materials;

- construction equipment, etc.

The differences accumulated in the account relating to the cost of acquired assets are written off to the debit of accounts related to the accounting of production costs, as well as other areas in proportion to the values at the accounting prices of materials used in the production process.

Analytical accounting activities within the framework of this account are carried out for groups of material resources with approximately the same degree of deviations.

Thus, it turns out that account 16 is traditionally used to account for the difference between the accounting value and the actual cost of inventories. This direction is often used by organizations that reflect the value of inventories within the framework of accounting values. Traditionally, they take into account the purchase of material and production assets using account 15.

Complete correspondence with examples

During accounting transactions, account 16 is large-scale

, therefore it is widely used along with the following areas.

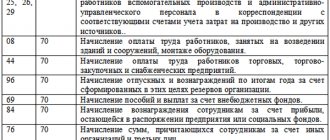

By debit

By loan

- 08

– investments in long-term assets; - 15

– procurement and purchase of materials; - 20

,

23

– basic and auxiliary production, respectively; - 25

– costly areas of general production nature; - 28

- marriage; - 29

– service farms; - 44

– costs of the implementation plan; - 60

– settlement transactions with suppliers; - 76

– carrying out settlements on accounts receivable and payable; - 79

– on-farm operations; - 90

,

91

– receipts and expenses for current and other activities; - 97

– upcoming expenditure areas.

Key transactions and business transactions

If we consider the basic transactions within account 16, they look like this.

- Dt 16 Kt 15

- a reflection of the fact of deviation between the cost of materials and the actual cost. - Dt 16 Kt 15

- a reflection of the deviation in the cost of materials. - Dt 15 Kt 16

- reflects the fact of deviation between the cost indicator of materials and the actual cost parameter. - Dt 20 Kt 16

- direct accrual of deviations occurred.

Write-off of deviations, calculation and other operations

Write-off measures are displayed within the following entries.

- Dt 08 Kt 16

– write-off at the end of the monthly period of deviation of the actual cost indicator. - Dt 20 Kt 16

– write-off of deviations in the value of tangible assets. - Dt 23 Kt 16

– write-off due to deviation of the actual cost norm. - Dt 29 Kt 16

- the same as in the previous case. - Dt 44 Kt 16

is an operation in which identified deviations in the cost indicator of materials are written off at the expense of sales costs. - Dt 91 Kt 16

– write-off of deviation amounts for materials sold. - Dt 26 Kt 16

- a write-off occurred at the end of the month in relation to the deviation of the actual cost of materials from accounting prices. - Dt 25 Kt 16

– write-off based on deviation of actual cost.

Vacation arrangements in relation to production resources must be documented through documentation accepted by the company in accordance with the specifics of the production process. For example, this could be a waybill associated with the internal movement of goods, a fence sheet, a route map, etc.

The number of materials that were transferred must be reflected in the unit in which operational accounting is carried out. It can be pcs., kg., m., l., sq. m.

In the process of releasing materials into the production process, their assessment is carried out using one of the following methods:

- at the cost of each product unit;

- according to the average cost parameter;

- at the price of the first stocks (by time of purchase).

These standards are defined within the framework of the Inventory Accounting Instructions. It is approved by the Ministry of Finance and allows you to significantly simplify accounting activities

.

The company must apply one of the specified methods for a group of inventory items during the reporting period. The chosen method should be fixed within the framework of the company's accounting policy

.

As for settlement actions, they are carried out quite simply. Grouping of costs reflecting the cost occurs by elements:

- expenses of a material nature;

- staff remuneration;

- contributions for social needs;

- depreciation on fixed assets;

- other expenses.

These costs make up the cost.

The deviation is calculated as the difference between the actual cost, which includes markup, taxes and other additions, and the received amount.

simplified tax system

If an organization applies a simplification, income from the sale of materials increases the tax base for the single tax (Clause 1 of Article 346.15, Article 249 of the Tax Code of the Russian Federation). Recognize income in the period in which it is paid. The date of receipt of income is the day the debt to the organization is repaid (the day money is received in a bank account or cash register, receipt of property, etc.). If a bill of exchange is received as payment, recognize income at the time it is paid or transferred by endorsement to a third party. This is stated in paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation.

If an organization pays a single tax on the difference between income and expenses, it can take into account the cost of materials as expenses immediately after actual payment (subclause 1, clause 2, article 346.17, clause 2, article 346.16, clause 1, article 252 of the Tax Code of the Russian Federation ). After the organization has decided to sell the materials, they acquire the status of goods (Clause 3 of Article 38 of the Tax Code of the Russian Federation). Therefore, include the proceeds from the sale of materials in the calculation of the tax base (clause 1 of Article 346.15 and clause 1 of Article 249 of the Tax Code of the Russian Federation). How revenue is determined, see What income is subject to a single tax under the simplified tax system.

An example of how sales of materials are reflected in accounting and taxation. The organization applies a simplification and calculates tax on the difference between income and expenses

In January, Alpha LLC purchased 1,000 packs of A4 paper for printing brochures. The cost of one pack is 59 rubles. (including VAT – 9 rubles). In the same month, payment was made to the supplier in full.

In February, Alpha used 500 reams of paper to print brochures.

In March, Alpha sells 100 packs of purchased paper. The actual cost of these materials is 59 rubles. per pack (including VAT - 9 rubles). The sales price for 100 packs under the contract is 9,440 rubles. "Alpha" evaluates materials in accounting at the actual cost of a unit of inventory. The organization maintains accounting for the cost of materials without using accounts 15 and 16.

Alpha's accountant made the following entries in the accounting.

In January:

Debit 10 Credit 60 – 59,000 rub. (1000 packs × 59 rubles) – paper is capitalized;

Debit 60 Credit 51 – 59,000 rub. – payment is transferred to the supplier for the purchased paper.

In February:

Debit 20 Credit 10 – 29,500 rub. (59 rubles × 500 pcs.) – paper is written off as an expense based on the materials consumption report.

In March:

Debit 62 Credit 91-1 – 9440 rub. – sales of 100 packs of A4 paper are reflected;

Debit 91-2 Credit 10 – 5900 rub. (59 rubles/piece × 100 pieces) – the cost of the issued paper is written off;

Debit 91-9 Credit 99 – 3540 rub. (9440 rubles – 5900 rubles) – profit from the sale of paper is reflected;

Debit 51 Credit 62 – 9440 rub. – payment has been received from the buyer for the sold paper.

When calculating the single tax, the Alpha accountant: - included 59,000 rubles in expenses in January. (including 50,000 rubles - the cost of 1000 reams of paper, 9000 rubles - VAT paid to the supplier when purchasing 1000 reams of paper); – in March, included in income the proceeds from the sale of 100 packs of paper in the amount of 9,440 rubles.

Regulatory framework

Accounting for material and production values is carried out on the basis of various documents. For ease of understanding, they are divided into several levels.

- First level

. Legislative acts, administrative documents and decrees adopted by the President. - Second level

. Generally accepted accounting standards for record keeping. - Third level

. Various methodological recommendations. - Fourth level

. Documents adopted within the enterprise itself.

Thus, account 16 plays an important role in accounting and is used in reflecting a large number of transactions.

Medium and large manufacturing enterprises that use the services of a large number of suppliers often face a problem: incoming materials and goods, which are homogeneous in nature, vary significantly in price. In addition, situations may arise in production in which it is necessary to capitalize materials before receiving documentation reflecting their actual cost.

In such cases, enterprises use accounting prices, which can be:

- the price fixed in the supply contract;

- planned price based on actual cost;

- approved fixed price;

- the average price of a group of homogeneous materials combined with each other, accounted for as one object;

- the cost actually established in the previous period (month, year).

In the first four cases, deviations are included in the composition (TZR).

Actual cost arises from:

- amounts for settlements with suppliers;

- settlements with intermediaries;

- costs for delivery, procurement, storage of valuables;

- other costs not included in the previous groups.

To account for deviations of planned prices from actual prices, account 16 “Deviation in the cost of material assets” is used in correspondence with account 15 “Procurement and acquisition of material assets”.

Attention!

The chosen method of accounting for inventory items must be recorded in the accounting policy. It is necessary to prescribe in detail the use of certain accounts, the methodology for calculating and assigning to costs the amounts of deviations in the cost of inventory items, if the enterprise uses planned prices.

We apply count 16: postings

Let's agree that goods and materials have arrived at our enterprise. Let it be water-based paint, its volume is 1 ton. The book value of 1 liter is 70 rubles, the actual price from the supplier is 75 rubles per 1 liter.

Don't know your rights?

It turns out that:

- We receive paint worth 75,000 rubles from the supplier and reflect the fact of purchase of goods and materials in accounting by posting: Dt 15 Kt 60 (75,000).

- We credit the paint at the accounting price - 70,000 rubles - to account 10 “Materials”: Dt 10 Kt 15 (70,000).

- At the end of the month, we credit the difference between the actual and accounting prices for purchased paint to account 16: Dt 16 Kt 15 (5000).

The difference can also be negative. In this case, reverse wiring is used: Dt 15 Kt 16.

The release of paint into production is reflected:

- Posting indicating the fact of paint consumption at the discount price: Dt 20 Kt 10.

- Related wiring according to the difference: Dt 20 Kt 16.

If there is a negative difference in the cost reflected on the credit of account 16, in paragraph 2 the posting Dt 20 Kt 16 REVERSE will be applied.

The amounts for the indicated two entries in account 16 are proportional to the ratio of actual and accounting costs. For example, if 100 liters of paint were supplied to the workshop, then the amount for the first transaction will be 7,500 rubles, and for the second - 500 rubles.

Account 16 reflects the difference (positive for debit, negative for credit) between the actual and book value of inventory items accepted from the supplier for the billing period. This difference, along with the accounting value, is written off to the debit of account 20 when goods and materials are released into production.

It is allowed to use discount prices upon receipt of goods and materials. But under such conditions, it is necessary to apply account 16 “Deviation in the cost of material assets.” It records the resulting difference in cost.

Often, organizations whose activities require a large amount of materials of various kinds use the services of different suppliers. Depending on the terms of purchase, transportation costs and other factors, prices for the same homogeneous product may vary. Sometimes inventories (goods) need to arrive before documents containing information about the actual cost arrive.

In such cases, organizations may resort to discount prices. Their size is approved periodically and remains unchanged for a certain time (for example, during the year). For these purposes, account 16 is used in accounting.

The economic department, if necessary, revises the value of accounting prices, based on one or more conditions:

- Established negotiated prices.

- Actual cost of materials.

- The amount of the planned price approved by the organization. Used for internal movement of materials.

- Average prices are set when there are many goods of the same group.

The actually formed cost of goods cannot be changed, with rare exceptions. The actual cost includes the following costs:

- amounts paid directly to the supplier;

- customs duties and related non-refundable taxes;

- accrued remuneration to intermediary organizations;

- costs for delivery of goods, procurement, storage;

- other expenses.

If it is impossible to immediately determine the correct price, organizations use accounting ones. This provision should be stated in the accounting policy.

The capitalization of materials occurs on account 15 “Procurement and acquisition of material assets” by analogy with the usual receipt of goods and materials. Next, the resulting difference between the real and accounting prices is formed using account 16. The capitalization itself is reflected in 41 or 10.

The resulting difference in cost is then written off to production costs, selling costs, and other expenses.

The resulting deviations are taken into account monthly in the appropriate accounts. The write-off is carried out in proportion to the accepted accounting value. For this purpose, the total value of deviations obtained at the beginning of the month and those formed during the month is divided by the sum of received inventory items and the balance at the end of the month. The identified percentage (after multiplying the resulting result by 100) is subject to write-off.

Simplified options for writing off deviations directly to cost accounts are also allowed if their value does not exceed 10%. Deviations can be fully taken into account in the cost of materials if the specific weight of their value is up to 5%.

Characteristics of accounts 15, 16 and their features

Account 15 is active-passive, but in its economic essence it has all the signs of an active account, since it reflects information about the material assets of the enterprise. The actual value of the MC is accumulated on the account. Then, in correspondence with the account. 16 the differences between actual and accounting prices are revealed. The debit balance of the account reflects inventory items in transit that belong to the enterprise, but have not yet arrived at the warehouse.

Count 16 is active-passive, similar to count. 15, showing signs of being active. Reflects the deviation of the actual cost from the planned cost, recorded on accounts 10, 41, 07.

Typical entries for accounting for cost deviations of inventory items

Let's look at account correspondence using examples.

Boards were purchased for the construction workshop: 400 linear meters of edged material at a price of 200 rubles per meter, including. The planned price of the MC is 150 rubles per meter, lower than the actual one.

Postings:

- D 10 K15

— 60,000.00 rub. (150*400) – boards were capitalized to the warehouse at discount prices. - D 15 K60

- D 19 K60

– 12203.00 rub. – VAT. —————————————————————— RUB 80,000.00 (400*200). - D 16 K15

- 7797.00 rubles (67797-60000) - reflects the excess of the actual price of the boards over the accounting price (overexpenditure).

Let the planned price of boards under the same conditions be 250 rubles per meter, that is, higher than the actual one.

- D 10 K15

– 100,000.00 (250*400) - boards are accepted at discount prices for the warehouse. - D 15 K60

— 67797.00 rub. – actual cost of received boards. - D 19 K60

– 12203.00 rub. – VAT. —————————————————————— RUB 80,000.00 (400*200). - D15 K16

– 32203.00 rubles (100000-67797) - reflects the excess of the accounting price of the boards over the actual one (savings).

At the end of the month, in proportion to the cost of materials, their increase in price is written off to the debit of those accounts to which the materials themselves were written off:

- D 20 (23,29,25,26, etc.) K 16.

- The increase in price of sold MC is written off to account 91/2.

- D 91/2 K 16.

- The increase in the price of goods sold is written off to account 90/2.

- D 90/2 K 16.

If the accounting price exceeds the actual price (a credit balance appears on account 16), deviations are also calculated. Reversal entries are made similar to those given above. Amounts are most often written off in proportion to the cost of materials.

Example

Let it be at 1.01. of the current month on account 16 there is a loan balance of 3,800 rubles, a debit turnover of 5,700.00 rubles, and a credit turnover of 1,100.00 rubles. At the end of the month, a debit balance is formed in the amount of 800 rubles, subject to distribution. On account 10, the balance as of January 1 of the current month is 2000.00 rubles, receipt of materials in the amount of 78,000.00 rubles, write-off to production - 40,000.00 rubles. Wiring - D 20 K10

— 40,000.00 rubles – materials are written off for production at discount prices.

We will calculate the amount of deviations to be written off. Cost of materials 2000+78000 = 80000.00 rubles. 800/80000= 0.01. 0.01 *40000= 400 rubles. Wiring - D 20 K 16

— 400.00 rubles.

Analytics for account 16 is organized by inventory groups with a similar level of deviations of accounting prices from actual indicators. It is advisable to combine it with a grouping of materials of the same type in purpose and use in the production process.

How to take into account the write-off of illiquid inventory items in tax accounting

Material costs include losses from shortages or damage to goods and materials during their storage and transportation within the limits of natural loss norms established by law (clause 2, clause 7, article 254 of the Tax Code of the Russian Federation).

However, expenses associated with shortages or damage to inventory items for other reasons can also be included in income tax expenses if they meet the requirements of paragraph 1 of Art. 252 of the Tax Code of the Russian Federation on economic feasibility and documentary evidence.

Such costs can be written off by inclusion in one of the following categories: non-operating expenses (clause 20, clause 1, article 265 of the Tax Code of the Russian Federation), other expenses associated with production and sales (clause 49, clause 1, article 264 of the Tax Code of the Russian Federation) ). The lists are open. It should be noted that including the cost of damaged valuables in expenses may entail claims from the tax authorities (Letter of the Ministry of Finance of Russia dated 06/07/2011 N 03-03-06/1/332).

However, with proper documentation, a positive outcome of the dispute with the tax authorities is very likely for the organization.

The Resolution of the Federal Antimonopoly Service of the North-Western District dated September 11, 2008 in case No. A56-3652/2007 considered a situation where a company wrote off physically worn-out and obsolete materials as illiquid property and included their cost in expenses. The court found that the materials were recognized as illiquid due to their long-term storage (the materials were purchased in 1980 - 1995 for production purposes), lack of movement (income - expenditure), loss of marketability, and unsuitability for use. The court came to the conclusion that the company was not able to use the decommissioned materials for their intended purpose due to the loss of their original properties, and indicated that the decommissioned materials were purchased by the company directly for production activities, their use was supposed to generate income, which is justified, in accordance with Art. 252 of the Tax Code of the Russian Federation.

The cost of physically worn out and obsolete materials at the time of their write-off as illiquid property can be attributed to the reduction of taxable profit.

Regarding the restoration of the VAT amount.

According to the position of the Supreme Arbitration Court of the Russian Federation, set out in Decisions dated May 19, 2011 N 3943/11, dated October 23, 2006 N 10652/06, the obligation to pay to the budget VAT amounts previously legally accepted for deduction must be directly provided for by law, and the Tax Code of the Russian Federation does not provide for restoration VAT previously accepted for deduction when writing off expired goods.

The Federal Tax Service of Russia has a similar opinion (Letter dated 05/21/2015 N ГД-4-3/ [email protected] ).

But at the same time, there are explanations from regulatory authorities in which they insist on the restoration of VAT in such cases (see, for example, Letter of the Ministry of Finance of Russia dated January 21, 2016 N 03-03-06/1/1997). And although the decisions of the highest courts have priority over the explanations of the Ministry of Finance of Russia, the possibility of claims from regulatory authorities cannot be excluded (Letter of the Ministry of Finance of Russia dated November 7, 2013 N 03-01-13/01/47571 (sent for information and use in the work of the Letter of the Federal Tax Service Russia dated November 26, 2013 N GD-4-3/21097)).

Methods for writing off deviations

The company has the right to choose its own methodology. Guidelines for accounting of MPZ (Order of the Ministry of Finance No. 119-n, clause 88) offer a number of options:

- Write-off of deviations in general to the accounts of production costs or distribution costs, similar to those used to write off the materials themselves. Applies when the share of costs does not exceed 10% of the accounting value of the MC.

- Write-off based on their share as a percentage of the cost of certain MCs at discount prices at the beginning of the month. If this method significantly reduces the accuracy of the indicators, the data is adjusted in the next month by the amount of the resulting write-off differences. At the same time, the maximum materiality standard is set at 5%.

- Write-off according to the standard for the proportion of deviations to the accounting value of the MC. If the actual data reveal a strong difference from the standards, adjustments are made to the distributed deviation indicators.

- Write-off of deviations in full on a monthly basis to the cost of consumed inventory items. This method is possible if their share in the cost of materials at discount prices is not higher than 5%.

Deviations from the actual cost occur when accounting for material assets at planned prices. Deviations are reflected in accounts 15 and 16 of accounting. The enterprise independently chooses the method of distribution of deviations and enshrines it in its accounting policies. In this case, it is advisable to be guided by the “Methodological guidelines for accounting for inventories” approved by the Ministry of Finance.

That accounting for the purchase of materials, goods or equipment for installation is not always carried out directly in accounts 10 “Materials”, 41 “Goods” and 07 “Equipment for installation”, respectively. For accounting purposes, an organization may provide that all actual costs for the acquisition of these assets are preliminarily collected on account 15 “Procurement and acquisition of material assets.” Typically, when using account 15, it is assumed that the organization reflects the acquisition of property at accounting prices on accounts 10, 41 or 07. Accordingly, a separate account is required to account for the difference between the actual acquisition cost and the book value. The chart of accounts and the Instructions for its use for these purposes provide for active account 16 “Deviation in the value of material assets” (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Write-off at cost of each unit

This write-off method is convenient for organizations that have a small list of items. In this case, it is not too difficult to track the cost of a specific batch of inventories and determine the write-off value. If this method is used, accounting is carried out for each batch of inventories, their prices change little, and the write-off occurs at the purchase price.

Example

At Parma LLC, at the beginning of the period, there were 100 kg of paint left in the warehouse for 3,000 rubles. at actual cost. Then, within a month, two more batches of paint were purchased:

- 150 kg in fact. cost 3,200 rubles, transportation and procurement costs - 1,000 rubles.

- 200 kg, cost 5,200 rubles, TZR amounted to 1,000 rubles.

Inventory and equipment are included in the actual cost. For convenience, all calculations are taken without VAT.

Let's calculate the actual cost of paint:

- At the beginning of the month - 3,000/100 = 30 rubles/kg;

- 1st batch - (3,200 +1,000) /150 = 28 rubles/kg;

- 2nd batch - (5,200 + 1,000)/200 = 31 rubles/kg.

During the period spent:

- 90 kg of paint from the remainder;

- 100 kg from the first batch;

- 110 kg from the second batch.

The cost of paint written off for production will be:

- 90*30 + 100*28 + 110*31 = 8,910 rub.

Materials released from warehouse to production: wiring:

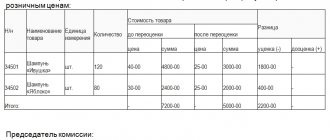

| Dt | CT | Operation description | Amount, rub. | Document |

| 20 | 10 | Write-off of materials reflected | 8 910 | M-11 |