Payroll (Unified form No. T-51)

Excerpt from Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1 “On approval of unified forms of primary accounting documentation for recording labor and its payment”:

When using a payroll slip in Form N T-49, other settlement and payment documents in Forms N T-51 and T-53 are not drawn up.

For employees receiving wages using payment cards, only a payslip is drawn up, and payroll and payslips are not drawn up.

The statements are compiled in one copy in the accounting department.

Payroll (forms N T-49 and N T-51) is made on the basis of data from primary documents recording production, hours actually worked and other documents.

https://youtu.be/GKocaFVOb7c

In the “Accrued” columns, amounts are entered by type of payment from the payroll fund, as well as other income in the form of various social and material benefits provided to the employee, paid for from the organization’s profits and subject to inclusion in the tax base. At the same time, all deductions from the salary amount are calculated and the amount to be paid to the employee is determined.

On the title page of the payroll slip (Form N T-49) and the payroll slip (Form N T-53) the total amount to be paid is indicated. The permission to pay wages is signed by the head of the organization or a person authorized by him to do so. At the end of the statement, the amounts of paid and deposited wages are indicated.

In the payroll (form N T-49) and payroll (form N T-53), upon expiration of the payment period, an o is made against the names of employees who did not receive wages, respectively in columns 23 and 5. If necessary, the number of the presented document is indicated in the “Note” column of Form N T-53.

At the end of the payroll, after the last entry, a final line is drawn to indicate the total amount of the payroll. For the amount of wages issued, an expense cash order is drawn up (Form N KO-2), the number and date of which are indicated on the last page of the payroll.

In pay slips compiled on computer storage media, the composition of the details and their location are determined depending on the adopted information processing technology. In this case, the document form must contain all the details of the unified form.

Set of accruals and deductions of wages sample

Current as of: September 22, 2020 The calculation of wages to employees can be reflected both in the payroll, which is also intended to record the payment of wages, and in a separate document - the payroll.

We will tell you about the features of using and filling out the pay slip (form No. T-51).

The payroll is used to calculate wages for employees of the organization (incl.

advance – salaries for the first half of the month). An organization can use both an independently developed payroll form and form No. T-51, approved by Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1.

Let us describe some features of compiling a payroll statement using the example of form No. T-51.

Types of statements

In accounting, there are the following types of statements:

- Form t 49 – payroll statement

- Form t 51 - payroll

- Form t 53 – payroll

The payroll statement is prepared by the company's accountant, and he also signs it .

https://youtu.be/J-WYSIlLYkI

Such a document is drawn up in a single copy, according to those primary documents that take into account the employees’ working hours.

Frequency of filling

In most cases, employees are paid twice a month. Such conditions are specified in the Labor Code of the Russian Federation; for violating it, the company risks incurring administrative liability. Moreover, the first payment is considered an advance payment (usually a percentage of the salary), and the second payment is considered the main payment (the remaining part of the amount). Thus, a simple payslip will be issued for the advance (it indicates the amount that was paid in the first half of the month).

https://youtu.be/y7hubjGaty4

Form T-51 serves to illustrate and document the main part of the payment of wages to employees of the institution.

The column “Retained and credited” in the tabular part of the document must also take into account the advance part - data from the first paper.

Contents of the statement

The statement form has a title page and a table on the back . in a large organization, the form consists of several sheets. The title page of the statement must indicate:

- Name of the organization

- date

- Organization code

- Amount to be paid

- Billing period, in organizations. As a rule, this is one month for which wages are calculated

According to current legislation, payroll records must be kept for five years . For verification, a turnover sheet can be drawn up, which serves to summarize the data entered in the primary document in order to check the opening balance, turnover for the billing period, and the ending balance.

Signed by

The printed document must indicate the position, signature and transcript of the signature of the official who compiled the document. This could be the chief accountant or HR accountant.

https://youtu.be/P_QDkDogw1g

ATTENTION! The statement will not be valid without the organization's seal on the last page.

By the way, according to the rules, it is permissible to fill out as many lines of the statement as necessary. It may have two, three, four or more sheets, compiled according to the sample tabular part of the paper.

Before receiving wages, the employee has the right to review the generated document at any time.

What is a payroll summary?

Such a statement is used in agricultural enterprises in order to control the flow of funds for wages and reporting . Such a statement is drawn up for a billing period of one year; every month, for all categories of employees, data on earnings, bonuses, compensation, and any other payments that are included in the wage fund are entered. A separate line indicates the amounts that were paid in kind for wages, as well as payments that are not part of the wage fund.

Payroll form for payment of wages

We will tell you in this article what form and how to fill out the wage statement. In addition, we will talk about the purposes for which various forms of salary statements are used and whether approved standardized forms are required to be used.

We invite you to familiarize yourself with Changes in the Ministry of Internal Affairs system

Sample payroll statement in form T-53.xls

Sample pay slip - form T-51.xls

Sample summary salary statement.doc

The salary slip (form T-53), registered in OKUD under No. 03010111, is recommended by the fiscal authorities for registration when issuing wages to employees. The payroll statement, filled out by the accountant and signed by the director, is handed over to the cashier to issue cash to the employees of the enterprise according to the list specified in it.

Salary reports when checking the Social Insurance Fund

Hello dear forum users. Help is needed. From the Social Insurance Fund, the auditors requested salary records

for the year, broken down by month, to verify the correctness of the calculated NSiPZ. We have 1C Accounting 7.7. As far as I know, in ZiK it is possible to form some kind of vaults, but in 1C Bukh. Looks like this isn't possible? Maybe someone has a processing for 1C, or at least tell me what they look like, these vaults!

So print out “payroll statements for __ month” for them, which are generated monthly, in 1C they are called “Accrued taxes from payroll”. What do you doubt?

Reports=Specialized=accrued taxes from payroll

For example, in 1C I have this

Yes indeed, I have one too. Why didn't I see him before? Thanks a lot. For now, I decided to take them the table made in Ixelles, in which the lines indicate the total amounts for wages, compensation, sick leave at the expense of the employee and for the account. Wed in FSS, vacation pay, and in the month columns. Those. the same SALT according to the count. 70, but all months are on one sheet. And then we’ll see if it suits them or not.

Thank you all for your answers, they helped a lot.

they have now come to check my colleague according to the new rules, the pension is jointly with the Social Insurance Fund, and they also requested a set of statements. We work in Parus, and we don’t make records, only statements, as I understand it, they ask for the same as it is derived from 1C. And they ask for a code broken down into payments, in order to probably exclude payments that are not taxed. Tell me, based on what documents, they generally work and conduct these checks, which they have the right to demand. There is no set of wages in the Instructions for Budget Accounting (and as far as I remember, in commercial accounting too), this is not a mandatory form, but an analytical piece of paper “for yourself.” And the payroll sheet does not suit the inspectors, you have to calculate everything yourself

I speak for a long time and unconvincingly, as if I were talking about the friendship of peoples.

Everything I said is IMHO, if there are no references to legislation

We will create a summary of accruals

For the T-51 payroll sheet, we provide a sample of filling in with conventional digital data.

They will not look specifically at people in the submitted report

for September 2011

for September 2011

https://www.youtube.com/watch?v=ytdevru

No. Employee Accrued personal income tax To be paid by the Social Insurance Fund of the Russian Federation FFOMS TFOMS Contributions to the Pension Fund of the Russian Federation “for the insurance

part of the pension" "for the funded part of the pension"

Then really just print out the turns

For now, I decided to take them the table made in Ixelles, in which the lines indicate the total amounts for wages, compensation, sick leave at the expense of the employee and for the account. Wed in FSS, vacation pay, and in the month columns. Those. the same SALT according to the count. 70, but all months are on one sheet. And then we’ll see if it suits them or not.

We work in Parus, and we don’t make records, only statements, as I understand it, they ask for the same as it is derived from 1C.

And they ask for the code to be broken down into payments, in order to probably exclude payments that are not taxed

Tell me, on the basis of what documents they generally work and carry out these checks, what they have the right to demand.

There is no salary code in the Budget Accounting Instructions (and, as far as I remember, in commercial accounting too), this is not a mandatory form, but an analytical piece of paper “for yourself”

But the payroll statement does not suit the inspectors; they have to calculate everything themselves

They submitted documents for reimbursement of benefits under the BiR, they requested all pay slips, timesheets, orders for hiring employees for the year of work for all employees, DAM, Pers.accounting, 4-FSS, 2-NDFL for 2011, labor agreement, labor. book for the benefit recipient.

https://www.youtube.com/watch?v=ytpressru

We have an error in payroll calculation, i.e. in October, November, December 2011, a larger amount was accrued for all employees than it should be, because It was calculated in Excel, there was an error in the formula. I wanted to add hours according to the timesheet, but then each person has too many hours. employee.

Do you think they can find fault with this and do they recount it at all?

2. Did you understand what you wanted to ask? Then press the button.

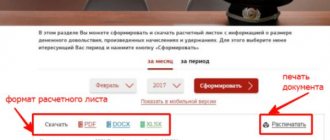

To view accruals and deductions for the organization for January, we will generate a special report “Set of accruals” for the “Automation” organization. To do this, go to the “Reports” menu item and select the “Accruals Summary” menu item.

Figure 5.225 Interface Calculation of salaries of employees of organizations. Summary of charges

An empty report “Summary of accruals and deductions for the organization” will open.

Let's set the period - January 2008. Let’s fill out the report using the “Generate” button.

Figure 5.226 Formation of a set of charges and deductions

If you need to print the report, click on the “Send form to printer” button.

The report “Set of accruals and deductions for the organization” reflects the amounts accrued and withheld from employees for the organization as a whole for any specified period. Using the report settings form, you can change the grouping of report data presentation and the list of fields displayed.

This type of documentation is used to control the flow of funds from wages and is convenient for preparing financial statements.

A unified form of the summary statement has not been approved, so each organization draws it up independently, taking into account the purposes of use.

Typically, the information reflected in the summary statement includes:

- monthly accruals for each employee (including bonus, advance payment and other accruals);

- deductions for the same period in relation to each employee;

- amounts of contributions to extra-budgetary funds, etc.

Also, depending on the purpose of compiling the summary statement, the following parameters can be recorded in it:

- form of employment;

- names of employees' positions;

- number of hours worked;

- stage of work execution;

- amount of payment per unit of working time, etc.

Thus, the summary statement demonstrates beginning and ending balances, turnover with detail by employees, account cards, posting reports and primary documentation.

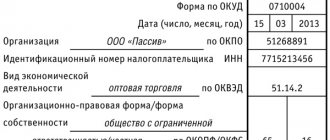

The title page of the payroll slip contains the following details:

- name and OKPO code of the company;

- debit account;

- validity period of the document;

- the total amount intended for payment under this statement;

- signatures of the head of the enterprise and the chief accountant with the date of signature;

- name of the document, its number and date;

- duration of the billing period.

The salary slip (a sample of which we are considering) can be drawn up on several pages, and their total number must be indicated in the corresponding line. These pages, which follow the title page, contain a table that shows:

- serial number of the record;

- employee’s personnel number and full name;

- amount, and in the next column the employee puts a mark on receipt (his personal signature) or, if the money was not received, the cashier puts down “deposited”.

The “Note” column usually indicates the number of the identification document that is presented by the recipient of the money. This is practiced if there is a very large staff and the cashier does not know everyone by sight.

At the very bottom of the document, the cashier indicates how much money was paid and how much was deposited. The signature of the person responsible for issuing money (usually the cashier) is affixed, and the number and date of the cash receipt order are affixed. The accountant who checked the statement handed over by the cashier along with the cash reports puts his signature and indicates the date of the check.

Corrections can be made to the payroll, but they greatly attract the attention of inspectors when checking compliance with cash discipline at the enterprise. So, if there are corrections and it is not possible to replace the form with a new one (the issuance of money according to the document has already begun and there are signatures confirming their receipt), then it is necessary to fill them out correctly.

https://www.youtube.com/watch?v=ytcopyrightru

The detected error is carefully crossed out, and a new one is made on top of this entry. Corrections must be signed by the manager, chief accountant and cashier. It would be useful to prepare an accounting certificate explaining the reason for the correction.

A payslip is a document that is used by an organization to pay employees. It lists all payments, deductions, etc. which ultimately allows you to receive exactly the amount to be paid that is due to the employee. Process payment of wages. An accountant can work on the payroll, payroll, and payroll.

Such a statement is used in agricultural enterprises in order to control the flow of funds for wages and reporting. Such a statement is drawn up for a billing period of one year; every month, for all categories of employees, data on earnings, bonuses, compensation, and any other payments that are included in the wage fund are entered. A separate line indicates the amounts that were paid in kind for wages, as well as payments that are not part of the wage fund.

Hello dear forum users. Help is needed. From the Social Insurance Fund, the auditors requested reports on salary calculations for the year, broken down by month, to verify the correctness of the calculated NSiPZ. We have 1C Accounting 7.7. As far as I know, in ZiK it is possible to form some kind of vaults, but in 1C Bukh. Looks like this isn't possible? Maybe someone has a processing for 1C, or at least tell me what they look like, these vaults!

So print out “payroll statements for __ month” for them, which are generated monthly, in 1C they are called “Accrued taxes from payroll”. What do you doubt?

Reports=Specialized=accrued taxes from payroll

For example, in 1C I have this

Yes indeed, I have one too. Why didn't I see him before? Thanks a lot. For now, I decided to take them the table made in Ixelles, in which the lines indicate the total amounts for wages, compensation, sick leave at the expense of the employee and for the account. Wed in FSS, vacation pay, and in the month columns. Those. the same SALT according to the count. 70, but all months are on one sheet. And then we’ll see if it suits them or not.

Thank you all for your answers, they helped a lot.

they have now come to check my colleague according to the new rules, she is a pensioner jointly with the Social Insurance Fund, and they also asked for statements of statements. We work in Parus, and we don’t make records, only statements, they ask, as I understand it, it’s like it comes out of 1C. And they ask for a statement broken down into payments, in order to probably exclude payments that are not taxed. Tell me, on the basis of what documents, they generally work and conduct these checks, what they have the right to demand.

https://www.youtube.com/watch?v=ytpolicyandsafetyru

I speak for a long time and unconvincingly, as if I were talking about the friendship of peoples.

Everything I said is IMHO, if there are no references to legislation

WHAT DOCUMENTS TO PREPARE

The company must provide inspectors with the opportunity to familiarize themselves with documents related to the calculation and payment of insurance premiums (Part 21, Article 35 of Law No. 212-FZ).*

Inspectors may request almost all documents related to wages, constituent documents, as well as calculations of insurance premiums in the forms RSV-1 and 4-FSS of the Russian Federation. Inspectors will look for violations of the law, discrepancies between the indicators reflected in the calculations of accrued and paid insurance premiums and accounting data. They will also check the completeness and correctness of the accounting transactions that affect the formation of the base for calculating contributions.*

The list of documents that will most likely have to be submitted is given in the table below. 1 and 2. Note that the FSS of Russia requires a larger number of documents than the Pension Fund. The fact is that, in addition to general information, FSS inspectors of Russia also analyze documents related to the payment of compulsory social insurance benefits.*

We invite you to familiarize yourself with the Commercial Concession Agreement (Franchising) option 2, 2020, 2020 - Franchising and Transfer of Rights Agreement - Samples and forms of agreements

Table 1. List of documents that employees of the Pension Fund of Russia and the Federal Social Insurance Fund of Russia will require

Constituent documents (charter and (or) constituent agreement)

The auditors will verify the name of the company, its address, preferential activities, and the procedure for paying dividends

Instructions: how to maintain a salary sheet in a budget organization

Not a day without instructions × Not a day without instructions

- Services:

Payroll statements are special forms of documents that reflect information about the amounts of accrued wages and other remuneration for the work of employees of the organization. We will tell you in the article what forms public sector employees should use.

September 3, 2020 Author: Natalya Evdokimova Public sector institutions are required to maintain accounting records according to special standards that differ significantly from generally established requirements. Accounting data in such government institutions is reflected in special forms of primary and accounting documentation.

Documents for reflecting wage calculations are no exception. Let us determine which forms of payroll statements should be used by public sector employees.

Instructions: how to correctly prepare a salary slip

Not a day without instructions × Not a day without instructions

- Services:

A payroll statement is a document that records all accruals and payments to employees.

We recommend reading: Are grandchildren entitled to inherit as disabled dependents?

The payroll is filled out for all employees, regardless of how they receive their wages (in cash or by transfer to bank cards).

It is mandatory for any institution. We’ll tell you what a salary slip is, you can download the form in the article. December 14, 2020 Author: Alexandra Zadorozhneva The payment of wages in an institution must be timely and transparent, regardless of whether the amount of remuneration is paid in cash or by bank transfer.

A document confirming the correctness of accruals and payments for each employee in the case of mutual settlements with employees in cash is a salary slip; you can download the form for free below.

The accrual and payment of wages is reflected in the corresponding accounting records, and the document that serves as the basis for such entries is the salary slip (SW).

Payroll T-51: in what case is it applied, sample filling in 2020

/ / , 4, When a business entity uses hired labor in its activities, attracted under labor contracts, it must accrue and pay its employees, according to established rules, wages for their work.

To calculate remuneration and register it in 2020, payroll sheet T-51 can be used. In the current business conditions, it is one of the main forms for calculating wages. Table of contents

The responsibility lies with the accounting department accountant.

If it is missing, then any other accountant, economist, director, etc. can calculate remuneration. It is these specialists who, when calculating remuneration, draw up the primary documents for calculating salaries, including the payroll.

Director's visa on form T-53

Without the signature of the head of the company, the T-53 payroll will not be considered valid, therefore, after filling out all its points and before transferring it to the cashier for issuing wages, the company’s accountant is obliged to submit it to the director for signature.

https://youtu.be/cgizVnqAb1o

And one more signature will need to be placed after all funds have been paid to employees. The chief accountant of the enterprise will have to check the payroll and, if there are no violations, also sign it.

Pay slip: form + sample filling

→ → Current as of: September 22, 2020

The calculation of wages to employees can be reflected both in a document that is also intended to record the payment of wages, and in a separate document - a payslip.

We will tell you about the features of using and filling out the pay slip (form No. T-51). The payroll is used to calculate wages for employees of the organization (incl.

advance – salaries for the first half of the month).

An organization can use both an independently developed payroll form and a form approved by Decree of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1. Let us describe some of the features of compiling a payroll using the example of form No. T-51.

If an organization uses a payroll (for example, according to form No. T-49), a separate payroll is no longer compiled.