According to current legislation, under certain working conditions (for example, dangerous, “dirty”), the company must provide workers with special clothing and footwear free of charge. This should not just be clothing - workers should be provided with workwear and safety footwear that have passed mandatory certification and confirmed their compliance with these purposes. So, for example, overalls and insulated jackets may be classified as workwear, and felt boots, rubber boots, boots and other special footwear may be classified as special footwear.

It is worth noting that uniforms and shoes do not belong to special clothing. A uniform is a distinctive feature that indicates that an employee works in a certain organization, indicates his status, and acts as an identification sign, while special clothing should protect the employee from factors that could harm his health. Uniforms include, for example, uniforms for bank employees and airline employees. Certain government departments and their employees are required to issue and wear uniforms while on duty. It is worth noting that the issuance of uniforms remains at the discretion of the employer, while providing the employee with special clothing is his responsibility.

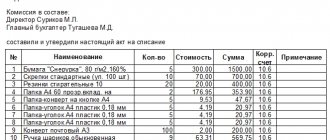

The issuance of special clothing to employees must be confirmed by primary accounting documents. The company has the right to use forms developed independently for this purpose, or use standardized forms, if approved. To record the issued protective clothing, a unified form MB-7 is provided. The form approved by law can also be taken as a basis for developing your own form; it is not forbidden to supplement the form with the necessary details or, conversely, remove unnecessary ones.

What is included in the concept of “working clothes”

“Working clothing” means clothing, shoes, hats, gloves, mittens and various devices that are issued for individual use and help protect workers of enterprises and organizations from the effects of harmful, dangerous and aggressive factors, including fire, environmental, radiation, electrical etc.

The presence of such workwear in a number of companies is enshrined at the legislative level, i.e. is mandatory.

The purchase of workwear occurs at the expense of the employer, it is his property and is subject to mandatory accounting.

Further dry cleaning and repair of these special protective products is also carried out at the employer’s expense. This is especially true for clothing that has specific characteristics: low electrical conductivity, special fire-fighting and heat-insulating properties, etc. – with frequent use, processing and cleaning of such products, these parameters should not be violated.

It must be said that the term “working clothing” can also be applied to other items that are not related to protective equipment.

In particular, workwear can be called the standard official uniform of employees, which is intended to demonstrate their affiliation with a particular company. In such cases, workwear is usually used in direct contact with consumers of products or services - for example, sellers, managers and other similar categories of personnel.

Here, workwear is not an integral attribute of employees (i.e., you can easily do without it), but is also purchased with the employer’s money, taken onto the balance sheet and taken into account.

Use of Form N MB-7 in an organization

A statement in form N MB-7 is necessary to correctly reflect in accounting the movement of these items in the enterprise through their issuance for individual use by employees.

Due to the fact that at the regulatory level it is mandatory and necessary to provide specialized protective equipment to employees, which are provided by the employer depending on the harmfulness and danger of the organization’s activity (there are free standards for issuing), it is necessary to ensure correct accounting of their movement.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Why do you need a record sheet for issuing special clothing?

A statement is an accounting document that allows you to track the movement of workwear within the company, monitor its use and safety.

Working clothes are classified as fixed assets and are included in the group of low-value and wearable items.

Each employee of the enterprise, before starting a shift, signs for the receipt of workwear, and after the end of the working day returns it. In this case, one or another set of workwear can be assigned to a specific employee.

Answers to common questions

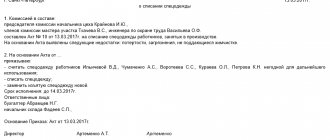

Question No. 1 : How to formalize the issuance of special clothing that was rendered unusable by an employee through his own fault?

Answer : If an employee, who is obliged to treat his workwear with care, as well as all the property of the organization, has intentionally rendered it unusable, then it is necessary to contact the manager, and a commission is appointed that decides to write off the cost to the employee, but during the investigation it is necessary provide an available spare kit. If the investigation does not establish intentional damage, but poor quality, then the cost of PPE is not written off to the employee.

Question No. 2 : Is it possible to issue workwear to an employee for the summer and winter periods without taking it into storage?

Answer : Working clothes, as a rule, require special storage conditions. Therefore, some types of clothing cannot be given to employees for storage at home, as well as for washing or cleaning. Features of storage and care of special devices are regulated by GOSTs for protective equipment. And the movement of clothing is reflected in the MB-7 form and the personal card of the employee for issuing special equipment

Who fills out the document

Maintaining the list is the responsibility of the warehouse employee where the workwear is stored. This employee is required to control the number of items issued and the number taken back - these positions must match at the end of the shift.

If any product is damaged or lost due to the fault of the employee who accepted it, financial responsibility passes from the storekeeper to him. If the damage to the workwear was caused as a result of the performance of official duties, the object is subject to write-off without imposing material sanctions on anyone.

What applies to PPE?

PPE includes:

- special shoes;

- workwear;

- rinsing agents;

- neutralizing agents;

- other means of protection (hands, face, respiratory organs, hearing organs, head, protective suits, safety devices).

All special equipment must undergo a declaration of conformity or certification, and special equipment must comply with standard standards.

Certification of PPE is carried out according to the Rules approved by Decree of the State Standard of Russia dated June 19, 2000 N 34.

Management has the right to establish standards for the provision of PPE that would provide better protection from any negative factors at work compared to standard standards. Such standards are established taking into account the economic and financial situation of the company. In addition, it is necessary to agree on such standards with the representative body of workers.

Features of filling out the form, general information

In 2013, the unified forms of primary accounting documents were abolished, so today employees of enterprises and organizations can make a choice either in favor of freely compiling a statement, or in favor of the previously mandatory unified form in the MB-7 form. It must be said that the second option is still in demand, since the form contains all the necessary data and frees company employees from unnecessary work on developing and approving the document template. In any case, regardless of which method of accounting for workwear is chosen, information about this must be included in the company’s accounting policy.

The statement can be maintained in a “live” form or electronically (with monthly printing) - at the end of the accounting period.

The document is filled out regularly and signed by the recipient of the workwear, as well as by responsible employees (materially responsible person - warehouse employee and head of a structural unit).

However, it is not necessary to certify it with the organization’s seal.

The statement, as a rule, consists of many sheets. To properly maintain a document, they must be numbered and fastened together using a thick, harsh thread. On the last page you need to put the stamp of the company and the signature of the person responsible for maintaining the document.

The statement is compiled in two identical copies , one of which remains with the storekeeper, the second is transferred to the specialists of the accounting department.

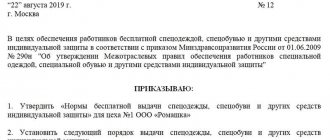

Regulatory regulation of the issuance of personal protective equipment

| Normative act | Scope of regulation |

| Labor Code of the Russian Federation Art. 221 | Providing workers with PPE |

| Order of the Ministry of Health and Social Development of Russia dated June 1, 2009 N 290n | Defines the rules for issuing PPE |

| Resolution of the State Statistics Committee of the Russian Federation dated October 30, 1997 N 71a | Approves form MB-7 |

| Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 N 135n | Approves accounting maintenance |

From 01/01/2013, primary documentation forms do not have to be used directly in the form established by law , that is, organizations have the right to independently develop and apply forms that are convenient for themselves, but they must be approved in the organization’s local documents.

Sample document

At the beginning of the statement it is written:

- assigned number;

- full name of the organization and its address;

- the structural unit in which special clothing is issued;

- date of document preparation.

The main block of the statement looks like a table, where the following data is entered in order:

- employee number (according to the chronology of this document);

- last name, first name and patronymic of the employee, his personnel number;

- identification characteristics of workwear: its name and item number;

- code and name of the unit of measurement (usually pieces);

- number of items issued for each line;

- date of entry into service;

- life time;

- signature of the person who received/handed over this or that product.

Example for writing off personal protective equipment

To perform a labor function during the summer period, employee A.A. Andreev. issued 04/01/2020:

- light jacket - 1 piece, service life 18 months, cost 5,000 rubles.

- gloves - 1 pc., service life 6 months, cost 300 rubles.

And accepted for storage at the winter workwear warehouse on 04/01/2020:

- insulated jacket - 1 pc., service life 18 months (used for 4 months: December-March), cost 9,000 rubles.

- fur gloves - 1 pc., service life 6 months, cost 300 rubles.

Due to the specialization of the organization, subaccounts were opened on account 10: Special clothing in warehouse and Special clothing in use. The following transactions will be made in the organization:

| Debit | Credit | Operation | Amount, rub. |

| 10 / “Special clothing in use” | 10 / "Special clothing in stock" | Special clothing issued | 5300 |

| 10 / "Special clothing in stock" | 10 / “Special clothing in use” | Workwear put into storage | 9300 |

| 25 | 10 / “Special clothing in use” | The cost of the insulated jacket was partially written off | 2000 |

The LDPR candidate is leading in the elections for governor of the Vladimir region

From this article you will learn: • what the MB-7 form looks like and when it is used (registration sheet for the issuance of workwear); • how to correctly fill out the form for the issuance of special clothing; • what information is contained in the standard sample for filling out the form for issuing special clothing. How is the statement form used for issuing workwear in 2015?

The standard interindustry form No. MB-7 (“Registration of the issuance of protective clothing, safety footwear and safety equipment”), approved by Decree of the State Statistics Committee of Russia dated No. 71a, is widely used by employers in the warehouse accounting of protective clothing and special equipment transferred to employees for individual use. © 2011–2016 Aktion-MCFER LLC The website trudohrana.ru is an information portal for managers and occupational safety specialists.

All rights reserved. Full or partial copying of any site materials is possible only with the written permission of the site editors. Violation of copyright entails liability in accordance with the legislation of the Russian Federation.

Registered by the Federal Service for Supervision of Communications, Information Technologies and Mass Communications (Roskomnadzor). Certificate of registration of the mass media PI No. FS77-64191.

Applications for workwear. The procedure for filing applications for personal protective equipment

Its specific types and provision standards are determined on the basis of federal and regional legislative acts that apply in this area.

The employer has the right to establish in the Regulations the number of kits issued not only strictly in accordance with the requirements of the law, but also in a larger amount. Additionally, the standard periods of its use can be reduced, and the use of more expensive and wear-resistant models can be established. All this depends only on the financial capabilities of the company.

Reducing the standards is not permitted, since this will be considered a worsening of the employee’s situation.

For greater security, it is better to approve and agree on all conditions with the employees’ trade union committee, if such a body exists at the enterprise.

The presence of this document in the company where the workwear is to be issued is a mandatory requirement. Since it will contain all the necessary data regarding the rules and conditions for its provision, all employees must be familiar with it.

Another factor that speaks in favor of drawing up the Regulations is the possibility of saving on tax payments.

All quantitative norms specified in the document can be taken into account when calculating profit for taxation.

The implementation of the Regulations in the company must be approved by order of the manager. There is no prescribed form for the Regulations.

This document may consist of several points:

Normative references

This paragraph indicates the main legislative acts on the basis of which the Regulations are developed.

Terms and Definitions

If this clause is present, it can contain explanations of all terms that will be used further in the document.

General provisions

Here is basic information regarding the issuance of protective clothing, for example:

- reasons for this;

- the employer’s obligation to familiarize new employees with the approved standards for issuing it;

- availability against the manager if he does not comply with the established requirements;

- the employee’s obligation to use the funds issued to him correctly and carefully.

The procedure for drawing up standards for issuing workwear

This paragraph may indicate exactly how its required number for personnel is determined, as well as which types of it are interchangeable. The timing of its intended use (a specific period or until wear) may also be indicated.

Rules for submitting applications for workwear

These applications can be issued either annually or unscheduled, in case of changes in the staffing table or the hiring of new employees.

Procedure for issuance, delivery and accounting

The following information is noted here:

- on the basis of what documents can an employee receive special clothing;

- which service of the enterprise he needs to contact;

- how clothing can be marked when issued;

- for how long it is issued;

- features of the issuance of clothing for certain categories of persons (for example, temporary employees, trainees or students).

The period when a particular type of clothing is issued (for example, winter and summer) can also be determined. If it is damaged due to the fault of the employee, management may force him to compensate the cost of the damage in the manner prescribed by Art. 39 Labor Code of the Russian Federation.

Disposal of workwear

Most often it is established that this occurs after its service life has expired or if it has been severely damaged. This procedure is formalized by a special act.

Reception and storage

The main part of the clothing is most often stored in the enterprise warehouse (or in other special premises), where they are issued to the employee. For the latter, specially equipped rooms can also be provided. All features of the arrangement of these premises at a particular enterprise can be displayed in this paragraph.

Care measures

These activities may vary and include:

- clothing labeling;

- rules for washing or cleaning it;

- the need for sanitization, etc.

Specific activities may depend on the characteristics of a particular field of activity.

Responsibility and organization of control over compliance with rules and requirements

This paragraph establishes which ones are responsible for various actions related to workwear (for its storage, issuance, write-off, etc.).

This structure is not mandatory or exhaustive; when drawing up a document for a specific enterprise, some points may be crossed out or replaced.

The main thing is that its content does not contradict the rules adopted by law and does not violate the interests of employees.

Drawing up and approval of the document

The document must be drawn up in accordance with the requirements established by law. All norms and rules introduced into it must be the same or even better than those in the regulations. When establishing standards, the employer should take into account that it is in this quantity and for such a period that in the future he will have to issue special clothing to his subordinates.

It must be noted that its provision is free for subordinates and is carried out entirely at the expense of the employer. It is also worth indicating the duty of workers to carefully store clothing and their responsibility in case of damage, which will make it easier to recover its cost from them.

The development of the Regulations can be carried out by the person responsible for labor protection. Depending on the scope of activity and the scale of the enterprise, this may be:

- Technical Director;

- labor safety inspector;

- production manager, etc.

After drawing up, the document is agreed upon with other specialists: a trade union representative, heads of departments and the head of the enterprise. As for its shelf life, in normal cases it is five years (as for any documents that regulate the procedure for issuing workwear at an enterprise).

The established security standards are subject to permanent storage.

Thus, the Regulations on the issuance of workwear perform the function of protecting the rights of workers to receive this type of personal protective equipment at the enterprise.

The development of this document must occur in accordance with the rules and regulations established by law.

In case of failure to comply with the requirements to provide subordinates with clothing, the employer may be subject to administrative liability.

Despite significant improvements in working methods and the emergence of new technologies, there are still many professions where workers inevitably risk their health and even life.

How dangerous his work is is determined during the conduct of the test.

To reduce risks and protect employees from dangers arising in the workplace, personal protective equipment (PPE) is designed, which, according to GOST 12.4.011-89, is designed to protect:

- respiratory, visual and hearing organs;

- arms, legs, head, face and skin.

In addition, there are safety and insulating means, as well as complex ones.