Categories of citizens who are entitled to compensation for travel on vacation

Russian legislation provides for the possibility of free travel on vacation for a number of Russian citizens. This procedure is carried out by receiving monetary compensation from the employer. This right is assigned to employees by the Labor Code (Article 325). The document establishes that the following categories of citizens can use it:

- Persons working in the Far North or in regions equivalent to it. It must be taken into account that this right applies only to employees of state-owned enterprises. Private companies are not required to pay for travel on vacation.

- Students of correspondence departments of technical universities with state accreditation.

- Citizens who retired early, as having worked in the conditions of the Far North for the period established by the Government.

- Police officers are also entitled to free travel to and from their rest area. Persons performing professional military service under a contract.

FSIN employees are guaranteed free travel only to the place of treatment or rehabilitation (FSIN Order No. 207). The above categories lose the right to pay for travel if the following factors are present:

- The leave application specifies two or more destinations. For example, St. Petersburg and Sochi. In this case, the employer compensates for the cost of tickets only to St. Petersburg.

- Carrying out an overseas tour.

In the second, a citizen can only count on compensation for travel within Russia. For example, he goes to Moscow, from where he flies to Turkey. The employer will reimburse the cost of tickets to Moscow. If an employee flies directly from his city to Turkey, then compensation is not provided for him.

These categories of beneficiaries have the right to travel compensation for members of their families, but only within the limits established for each group of standards. In case of non-compliance, no compensation is provided. Also, family members of the beneficiary lose the right to free travel if they are already pensioners.

https://youtu.be/TCZoIWYXRwE

Components of compensation payments

Expenses included in the reimbursement include the cost of the entire journey to and from the holiday. In this case, all expenses must be documented. Reimbursement for travel expenses applies to all modes of transport (air, rail, water and road). However, departmental regulations may establish their own compensation rules. The cost of the entire journey to the vacation spot and back should not exceed the following price categories:

- For railway transport – no higher than prices in a compartment;

- In water transport - no higher than the prices of group 5 vessels, no higher than prices of category 2 river vessels, and no higher than prices of category 1 ferries;

- For air transport – no higher than economy class prices;

- By land transport - any public transport or personal transport, except taxis.

Compensation for travel to and from the holiday destination occurs upon provision of documents confirming travel expenses. Tickets are such evidence. If suddenly the fare exceeds the permitted prices, then it is necessary to provide additional data on the fare; however, the costs for obtaining certificates will not be reimbursed.

In force majeure circumstances, when it is impossible to provide travel documents to cover travel costs, you can provide documentary evidence for the presence of a government employee and his family in a vacation spot. It is also necessary to provide receipts from the transport company for the price of travel for the holiday along the shortest route.

For residents of the Far North

The state guarantees northerners the opportunity to travel free of charge to their holiday destination and back. But only subject to a number of conditions:

- Compensation is paid once every two years.

- Travel costs are paid only within the territory of Russia.

Baggage transportation is also paid by the employer, provided that its weight does not exceed 30 kg. To receive compensation, it does not matter what type of transport is used when moving.

An employee can also claim payment for the travel of his child, provided that the latter has not reached the age of majority. The child's luggage will also be paid for. To receive the appropriate amount of money, the applicant must submit a written application to his employer. Travel tickets must be attached to it. Those. First, the employee buys them with his own funds and only then receives monetary compensation. If the vacation takes place with a child, the application indicates his data and attaches the set of documents intended for him.

Reimbursement of travel expenses by force of law

Cases when the employer is obliged to pay for the travel of employees are established by the Labor Code of the Russian Federation.

In accordance with Art. 168 of the Labor Code of the Russian Federation, the employer reimburses employees for travel expenses when sent on a business trip. And in accordance with Art. 168.1 of the Labor Code of the Russian Federation, transportation costs associated with business trips are reimbursed to employees whose permanent work is carried out on the road or is traveling in nature. Moreover, employees who, due to official needs, are forced to move within the locality, are also entitled to compensation for travel on public transport. You need to be especially careful when traveling by taxi. Such travel expenses on a business trip are subject to compensation only if their need can be justified. For example, an employee had to get from the airport to the hotel at a late time. Or it was impossible to get to the destination by other public transport.

When an employee moves, by prior agreement with the employer, to work in another area in accordance with Art. 169 of the Labor Code of the Russian Federation, an employee is entitled to compensation for travel to his place of work and new place of residence not only for himself, but also for his family members. And on the basis of Art. 325 of the Labor Code of the Russian Federation, some of our fellow citizens can even go on vacation for free. Such compensation for travel to a place of rest and back within the Russian Federation is provided once every two years to persons working in organizations located in the regions of the Far North and equivalent areas, and annually to employees of federal government bodies and institutions. To receive such compensation, the employee must submit an application to the employer. The application must reflect the duration of the vacation, the amount of expenses to the place of vacation and back, and attach documents confirming travel expenses (tickets).

Payment for travel for military personnel

If a citizen serves in the Armed Forces of the Russian Federation, he has the right to receive regular annual leave lasting from 30 days to one and a half months. This provision applies only to professional military personnel who have entered into a contract with the Ministry of Defense. It also applies to persons undergoing training in military educational institutions (higher and secondary). Only students are entitled to leave twice a year after successfully passing their examinations. For them, the vacation period is up to 30 days.

According to Federal Law of the Russian Federation No. 76, this category has the right to compensation for travel to the place of vacation and the return journey.

The procedure for receiving a cash subsidy is as follows:

- The serviceman purchases travel tickets to and from the destination.

- Then a report is drawn up requesting monetary compensation. The addressee is the commander of the unit in which the military man serves.

- Round-trip travel documents are attached to the report.

Payment of compensation for employees in the RF Armed Forces has the following features:

- The state, which is actually the employer in this case, compensates the cost of tickets for any land, water or air transport. If a serviceman travels by train, they will only pay for a reserved seat, and by plane - only a seat in economy class.

- There will be no payment for travel to the boarding point for the main transport.

- The state also compensates for the travel of one of the family members (husband or wife and minor child).

This procedure for travel compensation also applies to FSB employees. Provided that they serve in the Far East or Siberia.

Northern vacation: travel payment rules

"New Accounting", 2008, N 8

Northern vacation: travel payment rules

Organizations located in the Far North must pay the employee’s travel to and from the vacation spot. Article 255 of the Tax Code of the Russian Federation allows these costs to be included in labor costs, but provided that these costs are incurred in accordance with the provisions of labor legislation.

Minimum guarantee

Persons working in organizations of the Far North and equivalent areas are entitled to a number of benefits, guarantees and compensation. In particular, they have the right to compensation for the cost of travel and baggage transportation to and from the vacation destination.

In fact, the procedure for paying expenses depends on whether the employee is employed in a budgetary institution or in an organization not related to the budgetary sector.

In particular, in federal budgetary institutions this compensation is paid in the manner established by Art. 325 Labor Code of the Russian Federation and Art. 33 of the Law of the Russian Federation of February 19, 1993 N 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas.”

A more specific procedure for payment of compensation in institutions financed from the federal budget is determined by the Rules for compensation of expenses for payment of the cost of travel and baggage to the place of use of vacation and back for persons working in organizations financed from the federal budget located in the regions of the Far North and equivalent to localities, and members of their families, approved by Decree of the Government of the Russian Federation of June 12, 2008 N 455 (hereinafter referred to as the Rules).

For regional and local budgetary organizations, the size, conditions and procedure for compensation of such expenses are determined by state authorities and local governments, respectively. Commercial organizations provide for the rules for payment of compensation in collective and (or) employment agreements.

According to the author, the amounts, conditions and procedure for paying this compensation, established by labor legislation for federal budgetary organizations, should be considered by all employers without exception as minimally guaranteed.

That is, in fact, state authorities of the constituent entities of the Russian Federation, local authorities, as well as relevant employers can establish the same rules as those adopted at the federal level, or provide for a more preferential procedure for compensation. Otherwise, employees have the right to appeal the adopted rules for paying expenses in the courts.

Thus, the provisions of the Rules should be considered by all employers without exception as the basis for calculating and paying compensation.

Not only the employee himself has the right to pay expenses

Persons working in organizations located in the Far North and equivalent areas have the right to compensation from the employer's funds for the cost of travel and baggage transportation to and from the vacation destination (Article 325 of the Labor Code of the Russian Federation). It does not matter whether the employee works in a budgetary institution, a commercial or non-profit organization. All employers without exception must pay compensation.

Those persons who have entered into employment contracts have the right to compensation for expenses. After all, a civil contract does not provide for the provision of paid leave to the employee. This means there is no need to talk about compensation for travel to the venue.

In federal budgetary institutions, travel expenses are reimbursed exclusively at the main place of work (Article 325 of the Labor Code of the Russian Federation). External part-time workers are not compensated for such costs. Internal part-time workers can also exercise the right to compensation only at their main place of work. In other organizations, in this regard, it is necessary to take into account the provisions of the relevant regulatory legal acts, collective agreements, and local regulations.

For your information. Compensation for the cost of travel and baggage must be paid not only by organizations located in the Far North and (or) equivalent areas. Enterprises located in areas where the payment of a regional coefficient to employees’ wages, as well as a percentage increase to wages, is also required to pay this compensation. This follows from paragraph 3 of the Resolution of the Supreme Council of the Russian Federation dated February 19, 1993 N 4521-1 “On the procedure for enacting the Law of the Russian Federation “On State Guarantees and Compensations for Persons Working and Living in the Far North and Equivalent Areas”” .

The employer pays for baggage transportation and travel to and from vacation not only for the employee himself, but also for his family members. At the same time, family members of the employee who have the right to compensation for expenses include a non-working husband (wife), as well as minor children (including adopted children) who actually live with the employee.

The employee must document the relevant relationship and cohabitation. In particular, the following data must be confirmed:

- the fact that the other spouse does not work. As supporting documents, you can use a copy of your work book, a certificate from your place of residence;

- children's age. He will be identified by his birth certificate. Where appropriate, proof of adoption will be required;

- actual residence of the other spouse and children with the employee. This will be confirmed by a certificate from your place of residence.

If the other spouse works, he has the right to pay for travel to his place of work. In this case, each employer must make sure that family members have the right to pay for travel only to one of the parents’ places of work. To do this, it is necessary to request a certificate from the other spouse’s place of work stating that the travel of family members on vacation has not been paid for and (or) will not be paid for by the relevant employer for a certain period of time.

It should be noted that the employer must pay for vacation travel for non-working family members of an employee only if certain conditions are met. From January 1, 2005, compensation for expenses of family members was made on the condition that they go on vacation with the employee or go on vacation to the same locality and when the employee himself is already there.

The corresponding explanations were given in Letter of the Ministry of Health and Social Development of Russia dated August 24, 2006 N 1010-13. In particular, this Letter states that the employer must pay the expenses of non-working family members of the employee, subject to:

- different times of arrival at the vacation destination or different times of departure in the opposite direction;

- that recreation is carried out in various sanatorium-resort institutions, which are nevertheless located in the same administrative-territorial entity.

Payment of expenses is not made if:

- the trip is carried out without the participation of the employee (for example, when sending children on vacation to a children's health camp located outside the location of the budget institution);

- family members go on vacation to a place that does not coincide geographically with the employee’s vacation spot, and the time spent on vacation does not coincide.

This order has now been clarified. The Rules approved in 2008 define: payment of the cost of travel and baggage to family members of an organization’s employee is made subject to their departure to the place where the employee’s vacation is used (to one locality according to the existing administrative-territorial division) and return (both with the employee and and separately from it) while the employee is on vacation (clause 3 of the Rules).

The employer pays for travel once every two years

Compensation for the cost of travel and luggage transportation to the place of use of the vacation and back, provided for in Art. 325 of the Labor Code of the Russian Federation, is a targeted payment. This means that it is impossible to summarize and (or) transfer the right to use vacation to another period if the employee and (or) members of his family did not take advantage of their right to compensation for travel costs within the prescribed period.

In federal budgetary institutions, reimbursement of expenses is carried out once every two years. Let's say a person gets a job. After six months, he has the right to go on paid leave. At the same time, he acquires the right to compensation for travel expenses to the vacation destination and back, as well as for luggage transportation. If the employee does not exercise his right to travel compensation this time, he can do so before the end of the second year of work in the same organization. If two years pass from the date of employment, during which the employee does not exercise his right to reimbursement of expenses, then this amount disappears, but only for the first two years of work.

Consequently, in the future, the right to compensation for expenses for the third and fourth years of continuous work in a given organization arises starting from the third year of work, for the fifth and sixth years - starting from the fifth year of work, etc. (Clause 4 of the Rules).

The right to pay the cost of travel and baggage in relation to family members arises simultaneously with the emergence of the right to pay the corresponding expenses for an employee of the organization. However, in this case, payments are targeted, and therefore are not cumulative if the employee and his family members do not take advantage of the right granted to them in a timely manner.

Composition of reimbursable expenses

As part of the compensation under consideration, the employer must pay for the travel of the employee and his family members within the territory of the Russian Federation to the place of use of the vacation and back by any type of transport (except for taxis), including personal ones, and the cost of luggage weighing up to 30 kg is also subject to payment.

For federal budgetary institutions, the composition of reimbursable expenses is specified in clause 5 of the Rules. In particular, the following expenses are subject to compensation.

Firstly, it is payment of the cost of travel to the place where the employee of the organization uses his vacation and back to his place of permanent residence. These costs are reimbursed in the amount of actual expenses confirmed by travel documents (including insurance premium for compulsory personal insurance of passengers on transport, payment for services for issuing travel documents, provision of bedding on trains), but not higher than the cost of travel:

- by rail - in a compartment carriage of a fast branded train;

- by water transport - in the cabin of the V group of a sea vessel of regular transport lines and lines with comprehensive passenger services, in the cabin of the II category of a river vessel of all lines of communication, in the cabin of the I category of a ferry vessel;

— by air — in the economy class cabin;

- by road - in public road transport (except for taxis), in its absence - in buses with soft folding seats.

Note! If the documents submitted by the employee confirm the costs of travel for a higher category of travel than provided for by the established standards, the corresponding costs can be compensated to him only in accordance with the established category of travel (clause 6 of the Rules).

That is, if an employee of a federal budgetary institution pays for his travel and the travel of family members in a sleeping car of a railway train, compensation is paid to him in the amount of actual expenses incurred, but not higher than the cost of travel in a compartment car of a fast branded train.

In this case, actual expenses are determined according to the submitted travel documents, and the standard cost of payment for travel in a compartment car of a fast branded train is based on a certificate from the transport organization or its authorized agency. Such a certificate must necessarily indicate the route, category of travel and the date for which the cost of travel is determined. The costs of obtaining this certificate are not reimbursed by the employer.

Secondly, the organization pays the employee the cost of travel by public road transport (except taxis) to the railway station, pier, airport and bus station, provided there are documents (tickets) confirming the costs.

Thirdly, payment for the cost of baggage transportation weighing no more than 30 kg per employee and 30 kg for each family member is compensated, regardless of the amount of baggage allowed for free transportation on a ticket for the type of transport followed by the employee and members of his family, in the amount documented expenses.

In all cases, payment must be made for travel to the place where the vacation is used and back by the shortest route.

If documents are lost

If travel documents are lost and (or) cannot be presented for other reasons, the employee of a federal budgetary institution retains the right to receive compensation, but subject to documentary evidence of the stay of him and (or) family members at the place where the vacation was taken (clause 7 of the Rules) . The following may be considered as supporting documents:

- any documents confirming your stay in a hotel, sanatorium, holiday home, boarding house, campsite, tourist base and (or) in another similar institution;

— documents certifying registration at the place of stay.

In this case, travel expenses can only be paid in the amount of the minimum cost, determined based on the following categories of travel documents:

a) if there is a railway connection - at the fare of a reserved seat carriage of a passenger train;

b) if there is only air service - at the tariff for air transportation in an economy class cabin;

c) if there is only sea or river communication - at the rate of cabins of the X group of a sea vessel of regular transport lines and lines with comprehensive passenger services, cabins of the III category of a river vessel of all lines of communication;

d) if there is only road transport - at the fare of a general bus.

In this case, travel to the place of use of the vacation and back only by the shortest route is taken into account.

The fare in the cases under consideration must be confirmed by a certificate from the transport organization or its authorized agent. Such a certificate must necessarily indicate:

— the date on which information about the cost of travel is provided; travel category according to which the fare is determined;

- route, which is estimated in cost terms.

The costs of obtaining a certificate are not reimbursed by the employer.

Travel by personal transport

If an employee goes on vacation in a personal car, the amount of compensation is determined based on the actual expenses incurred to pay for the cost of the fuel consumed, the fuel consumption standards established for the corresponding vehicle, and the shortest route to the place where the vacation was used and back.

The amount of compensation for gasoline expenses is determined on the basis of gas station receipts submitted by the employee, which, according to the date of issue, must correspond to the dates the employee and (or) his family members go on vacation or back (clause 8 of the Rules).

Consumption rates for fuels and lubricants must be determined in accordance with the Methodological Recommendations “Consumption rates for fuels and lubricants in road transport,” approved by Order of the Ministry of Transport of Russia dated March 14, 2008 N AM-23-r.

The distance that is taken into account when calculating fuel consumption rates is determined using existing vehicle routes. In this case, only the shortest route is taken into account.

When determining the standard value, it is recommended to calculate the cost of fuel based on the arithmetic average value of the cost of 1 liter of gasoline, determined on the basis of gas station receipts submitted by the employee.

Example. The employee and his family traveled to the place of vacation use and back by personal vehicle from city A to city B, the distance between which, according to existing road traffic, is 1,470 km. In this case, the employee’s route ran through city B, which is located outside the route from city A to city B.

In total, upon arrival from vacation, the employee presented gas station receipts for 290 liters in the amount of 7,492 rubles, including 170 liters for 26 rubles. and 120 l for 25.6 rubles. The fuel consumption rate for an employee's car is 8.6 liters per 100 km.

Let's determine the standard fuel consumption. It will be 252.84 l ((1470 km x 2) : 100 l x 8.6 l).

Let's calculate the average cost of 1 liter of fuel according to the gas station receipts presented by the employee. It will be 25.83 rubles. ((170 l x 26 rub. + 120 l x 25.60 rub.) : 290 l).

Let's determine the standard cost of fuel. It will be 6530.86 rubles. (252.84 l x 25.83 rub.).

The amount of compensation should be determined in the amount of actual expenses incurred to pay for fuel and lubricants (RUB 7,492), but not more than the standard value (RUB 6,530.86), determined based on established fuel consumption standards. Therefore, the amount of compensation will be 6530.86 rubles.

The current legislation does not establish the need to carry out calculations based only on a specific brand of fuel. In this regard, it is necessary to proceed from the actual expenses incurred by the employee.

On vacation abroad

An employee can also spend his vacation abroad. In this case, the amount of compensation paid is determined based on travel by rail, air, sea, river, and road transport to the nearest railway station, airport, sea (river) port, or bus station to the place of crossing the border of the Russian Federation (clause 10 of the Rules).

The amount of compensation should be determined based on data from the certificate of the transport organization and (or) its authorized agent. However, along with such a certificate, the employee must present a copy of a foreign passport with a mark from the border control authority (checkpoint) about the place of crossing the state border of the Russian Federation. Officials of the organization must check the copy with the original passport.

There are no corresponding marks in the passport if the employee was traveling to CIS countries with which they are not provided for when crossing the border (in particular, with Belarus). In this case, compensation must be paid without presenting a foreign passport.

If an employee and (or) members of his family traveled by plane on vacation abroad, the cost of transportation within the territory of the Russian Federation is also confirmed by a certificate from the relevant transport organization.

The Rules given in full also apply to cases when a family goes on vacation abroad on a tourist package.

Note! If an employee of an organization spends his vacation in several places, then the cost of travel to only one of these places at the employee’s choice is reimbursed. Consequently, the cost of return travel will be paid from the chosen place to the place of permanent residence (clause 9 of the Rules).

Compensation is paid in advance

Based on the provisions of Art. 325 of the Labor Code of the Russian Federation, federal budgetary institutions are required to provide employees with an advance payment to pay for upcoming expenses for travel to and from the vacation destination, as well as for luggage transportation.

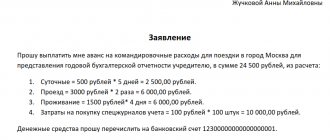

The advance is issued on the basis of a written application from the employee, which he must submit no later than two weeks before the start of the vacation. In accordance with clause 11 of the Rules, it states:

- surname, name, patronymic of the employee’s family members entitled to compensation for expenses, with copies of documents confirming the degree of relationship (marriage certificate, birth certificate, adoption certificate, paternity certificate or change of surname), certificates of cohabitation, copies of the work book of a non-working family member;

— dates of birth of the employee’s minor children;

— place of use of vacation of the employee and members of his family;

— types of vehicles that are expected to be used;

- itinerary;

— approximate cost of travel.

The advance amount is determined based on the approximate cost of travel indicated in the employee’s application. The employer must issue an advance no later than three working days before the employee leaves for vacation (clause 12 of the Rules).

Upon arrival from vacation, the employee is required to submit a report on expenses incurred within three working days from the date of return to work. Attached to this report are originals of travel and transportation documents (tickets, baggage receipts, other transport documents), relevant certificates from transport organizations, gas station receipts and other documents confirming expenses incurred for travel to and from the place of vacation use, as well as for luggage transportation ( clause 12 of the Rules).

If the employee does not submit an advance report within the prescribed period, the employer has the right, within a month, to issue an order (instruction) to withhold unreturned amounts from his wages. However, if the employee does not agree with the basis and (or) amount of the withholding, the employer will have to go to court for forced collection of the debt. These are the provisions of Art. 137 Labor Code of the Russian Federation.

It can be assumed that the need for an advance payment scheme for payment of compensation should be used not only by federal budgetary institutions, but also by other organizations. According to the author, this is the calculation procedure that should be used by commercial and other organizations.

Taxation: expenses are recognized taking into account the Rules

Budgetary institutions pay for the travel of employees and (or) members of their family from the regions of the Far North and equivalent areas to the place of vacation and back, as well as transportation of luggage, at the expense of budgetary allocations.

Other organizations, when determining the source of payment for expenses, must take into account the provisions of paragraph 7 of Art. 255 Tax Code of the Russian Federation. According to this norm, as part of labor costs, you can also take into account the costs of paying for the travel of employees and persons dependent on these workers to the place of use of vacation on the territory of the Russian Federation and back, including the costs of paying for the luggage of employees of organizations located in the regions The Far North and similar areas.

In this case, the corresponding expenses are recognized for profit tax purposes, provided that they are carried out in the manner established by the current labor legislation.

As stated in the Letter of the Ministry of Finance of Russia dated 02/07/2006 N 03-03-04/1/95, dependents according to Art. 179 of the Labor Code of the Russian Federation should be considered disabled family members who are fully supported by the employee or receive assistance from him, which is for them a permanent and main source of livelihood. Expenses for travel on vacation for non-working family members who do not meet the criteria provided for dependents are not taken into account to reduce the tax base for income tax.

When paying for the cost of travel on vacation abroad, only the costs of travel to the place of use of the vacation in that part that falls on the territory of Russia can be accepted for tax purposes. When departing by plane, as part of labor costs, travel expenses documented by travel documents to the airport where the flight to a holiday destination located outside the Russian Federation is carried out (Letter of the Ministry of Finance of Russia dated August 19, 2005 N 03-05-02-04 /159).

Note! In order for the corresponding compensation to reduce the tax base for income tax, it is necessary that the amount, conditions and procedure for payment of compensation are provided for by a collective agreement, local regulations and (or) direct employment contracts with employees. If the relevant provisions are not determined by employment contracts, they must in any case contain references to the provisions of the collective agreement and (or) local regulations governing the payment of compensation.

Compensation amounts paid in accordance with the established procedure are not subject to personal income tax (clause 3 of article 217 of the Tax Code of the Russian Federation), as well as the unified social tax (clause 9 of clause 1 of article 238 of the Tax Code of the Russian Federation).

Consequently, compensation amounts are not included in the calculation base for insurance contributions for compulsory pension insurance.

S. Savelyeva

Independent expert

Signed for seal

29.08.2008

payment for travel on vacation in the regions of the far northpayment of preferential travel registration of travel expenses 325 tk rf vacation in the regions of the far north

Compensation for Police Officers

Employees of the Ministry of Internal Affairs are entitled to regular paid leave once a year. Each employee has the right to compensation for the train to the place of rest. If an employee travels by train, the state will only pay him for a seat in a reserved seat carriage. When traveling by air - a seat in economy class.

An employee may qualify for compensation for travel on vacation for one of his relatives (wife or husband and minor child).

The rules for drawing up a report on receiving a sum of money are similar to those that apply to military personnel. Those. first, the applicant purchases travel tickets at his own expense, then draws up a document asking for compensation in the name of the head of the department in which he is serving.

The money is credited to the employee upon return from vacation. To receive them in full, the employee must follow one rule. Upon arrival at the destination, he must contact the nearest police station within three days and put a mark on his travel documents.

Who is entitled to compensation for travel to and from the holiday destination?

Who has the right to count on a refund of the cost of travel in Russia to the area where the vacation will take place is reflected in the table below. The only condition for all applicants for such a payment is that they live in the regions of the Far North or in equivalent areas (KSiPM), defined by law. Additional leave is provided for residents of the Far North; read about this in the article: → “Providing additional annual paid leave.”

| category of persons | who reimburses the expenses | in what form and amount is compensation provided? | frequency of payments made |

| pensioners due to age or disability who have no income | local authority of the Pension Fund of Russia | documents for travel are provided or a refund is made of actual expenses incurred | 1 time every 2 years |

| workers of commercial firms located in the Far North region and equivalent areas | employer at his own expense | in accordance with the provisions of the agreement between the members of the labor collective and the employer or other internal document of the commercial structure | |

| working in government agencies and federal institutions | federal government agencies and institutions, state extra-budgetary funds | payment for travel by any transport within the territory of Russia, excluding taxis, transportation of luggage weighing ≤ 30 kg. | 1 time every 2 years |

Required documents to receive travel compensation

In order to compensate for monetary losses incurred when purchasing tickets, first of all, the employee is required to draw up a report or statement depending on his place of work or service. It is submitted to the Personnel Department no later than three days before departure.

The document must contain the following information:

- Name.

- Addressee of the application. Here you should indicate the structure in which the employee works or serves, as well as the full name of the head of the organization.

- Information about the applicant (full name, position held).

- The period during which the employee is granted the next vacation.

- Date of departure for vacation, arrival at destination. Date of departure from vacation and arrival home.

- Resting-place.

- An indication of the type of transport that the employee intends to use to get to the place of vacation and return to the place of departure. Indicating the category of transport.

- Which person accompanies the employee on the trip, indicating the place in the transport.

- Date of document creation.

- Signature with transcript.

The following documents are attached to the application (report):

- Train tickets or plane boarding passes.

- Payment documents.

- Certificate of family composition.

- Birth certificate or passport of a minor child if he is going on vacation with his parent (copy).

- Marriage certificate, if the spouse is going on vacation with the applicant, plus his general passport (copies of documents are needed).

- If the trip is carried out by personal vehicle, you will need a copy of the driver's license and vehicle title. Plus, you should take payment receipts at each gas station; they are also attached to the application.

What expenses are reimbursed?

Depending on the place of work or service, compensation for vacation expenses is made before or after it begins. Most often, the calculation takes place in two stages. Before the trip, an advance is issued, and after its completion, the final payment is made based on all submitted documents.

If the trip takes place by train, in addition to the cost of tickets, the employer is obliged to compensate:

- Rent of bedding.

- Insurance tolls.

- Services provided in a reserved seat carriage.

- Increase in cost due to the purchase of a ticket for a luxury carriage.

If the shortest route is chosen from the available routes to your destination, then the trip can be paid for with a transfer. Provided that a long route is chosen, payment will be made only for a trip on a direct flight. If in this case there is a transfer, then you are required to pay for the ticket only to the transfer point.

If the trip is carried out by military personnel or employees of the Ministry of Internal Affairs, payment is graded depending on the rank and position held. The composition is divided into the following categories:

- Supreme Commander.

- Senior Commander.

- Average and ordinary.

Representatives of senior command staff are an exception when paying for tickets. They will be compensated for the purchase of a business class ticket on an airplane or boat. And also a trip in a two-seater compartment in a soft carriage. All other employees can only count on reserved seat and economy class.

When compensating expenses for traveling on personal vehicles, no differences are assumed between employees.

What do employers and employees most often argue about?

Most often, conflicts regarding compensation arise regarding the legality of its provision in the following cases, reflected in the table below.

| Subject of dispute | Decision on the issue (court position) |

| payment of compensation for the train to the holiday destination and back only to family members who do not have work | Travel costs will not be reimbursed for a child or spouse traveling separately |

| Compensation for travel expenses in case of departure to the place of rest of the employee and other family members on different days | in these circumstances, travel is compensated, since it is a simultaneous vacation |

| reimbursement by employers of travel to a place of rest for non-workers in the Far North region and adjacent territories | The legislation stipulates the right to compensation only for employees of enterprises located in the KSiPM zone |

| another place recognized along with the regions of the Far North and adjacent territories for travel payments | A region not related to the KSiPM region, but with the current regional coefficient and a bonus as a percentage of earnings, is considered different for making payments. |

Important! The location address of an economic entity is not the reason for compensation payments. To make these payments, the actual location of the company’s workplaces in the Far North and similar regions is important.

Changes in legislation in 2020

In April 2020, a law was passed amending the Tax Code (Articles 250 and 270). According to the new orders, each employee of any state-owned enterprise acquires the right to receive compensation for travel to a vacation spot from his employer. A compensation of 50 thousand rubles is provided, but only on the condition that the employee travels within the Russian Federation. The following expenses may be reimbursed:

- Cost of travel tickets.

- Expenses associated with accommodation in a holiday home, hotel, etc.

- Expenses for receiving sanatorium-resort treatment.

- Cost of excursion programs.

In practice, the application of the law depends on the wishes and capabilities of the employer. Only those companies will carry out this practice for which it is profitable to classify the amounts spent in this way as expenses when calculating the tax base. This means we are talking about large organizations. Because It is simply unprofitable for medium and small businesses to withdraw such amounts from production.

Features of providing travel compensation

We recommend that commercial companies describe in as much detail as possible the methodology for calculating compensation for travel on vacation. This is their prerogative, and the company’s costs for these activities, which are prescribed by law for institutions located in the KSiPM districts as mandatory, will depend on how much, to whom, and within what time frame these payments are provided.

Travel compensation has a number of nuances that accountants of government agencies need to take into account:

- payment is made there and back, taking into account the minimum cost and the shortest route;

- payment is made no less than 3 days before the date of departure for leave, and the compensated advance amount is approximate;

- the amount of final compensation is established based on the vacationer’s travel expenses upon completion of the vacation and return from it;

- travel costs to and from the vacation destination are compensated for during a specific vacation period, which are not carried forward to the future;

- representatives of government agencies and bodies, as well as non-state employees, payments are made at the workplace that is regarded as the main one.

Collective agreements concluded between workers and employers of enterprises located in the Far North and adjacent territories establish their own conditions for compensation for travel to a place of rest, but their amount must not be lower than the amount provided for similar payments for workers in other federal subjects .

Is travel reimbursement subject to insurance premiums and personal income tax?

Let's take a closer look at whether it is necessary to charge insurance premiums to the funds and withhold personal income tax when reimbursing travel expenses to the vacation destination in the table below.

| Personal income tax | Insurance contributions to the Pension Fund | Health insurance premiums | Insurance contributions to the Social Insurance Fund | |

| for social insurance benefits | for accidents at work | |||

| No | not taxed if the weight of the luggage carried is more than 30 kg; When traveling abroad, only the amount of travel across Russia to the border control point is compensated | |||

Similarly, insurance contributions to extra-budgetary funds are not imposed on compensation for travel to and from a vacation spot in the event of reimbursement of expenses incurred upon dismissal.

As can be seen from the table below, only compensating amounts for travel documents are not subject to contributions within the limits adopted for workers in federal government agencies, restrictions on the amounts of such payments:

- the cost of carried luggage is limited to thirty kg;

- Travel expenses for the employee and his family are only incurred when traveling within Russia. For holidays abroad, amounts for travel through the territory of foreign countries are not compensated.

- family members traveling on vacation with the employee, who are entitled to reimbursement of the cost of their travel, are persons who:

- They live in the same place as an employee of a company located in the Far North and adjacent territories.

- Does not work.

- They are in a marital relationship with him.

- They are his minor children.

What travel expenses are reimbursed to employees?

In Russia, according to the law, there are several types of compensation to employees for expenses incurred in the performance of their official duties. Article 165 of the Labor Code of the Russian Federation explains in what cases the expenses for travel of employees to and from work are compensated, and contains an exhaustive list of compensation payments, among which transportation costs are separately highlighted.

What compensation is provided for transportation costs:

- reimbursement of expenses for operating an employee’s personal car;

- compensation for travel to and from work, including by public transport and taxi;

- payment of travel expenses in terms of purchasing tickets (air, railway, land, water and other types of transport);

- payment for tickets to and from the employee’s place of rest;

- reimbursement of travel expenses to the place of work when moving to another area.

There are no restrictions on amounts for each type of compensatory additional payments, and employers independently set standards for employees. These norms should not contradict the current provisions of labor legislation and are fixed by local orders for the organization.

We will analyze the features of providing each type of compensation payments and the procedure for how to apply for compensation for travel to and from work correctly.

Under what conditions is compensation paid for travel to the place of vacation?

The amount of compensation payments for travel to the place of vacation, although they are determined by the collective agreement, cannot be lower than those established at the federal level.

In commercial companies, management has the right to fully prescribe the procedure for reimbursement of travel expenses to a vacation spot, listing the conditions for making payments, recipients of compensation, amounts of compensation, and so on. As for compensation for employees of budgetary organizations, there are a number of features:

- government employees organizations and extra-budgetary funds located in the Far North, compensation is paid only at the main place of work;

- expenses can be compensated only if the employee applied for payment on time - the right to compensation is not transferred to a future period if the employee has not taken advantage of the opportunity to receive compensation even once in 2 years;

- the final amount of the compensation amount will be determined upon completion of the vacation and the employee presents documents confirming travel expenses;

- the compensation payment is issued to the employee a maximum of three days before the day of departure, but it should be remembered that the advance is only an approximate amount - the balance of the compensation will be paid upon return;

- compensation is paid for travel to and from the vacation destination, taking into account the minimum cost of travel and the shortest route to the vacation destination.